Key Insights

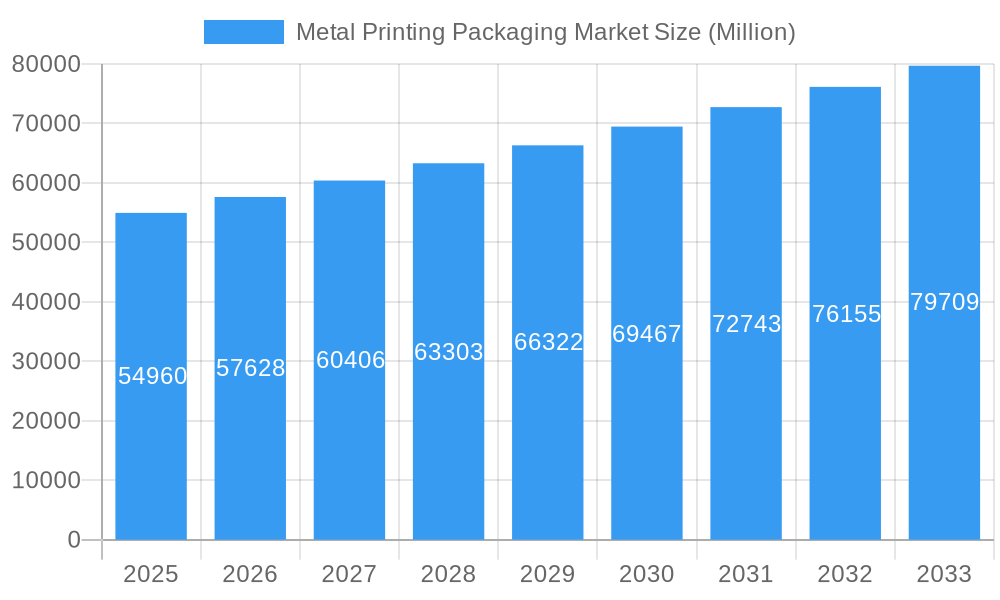

The Metal Printing Packaging Market is experiencing robust growth, projected to reach a market size of $54.96 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 4.84% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for aesthetically appealing and durable packaging across various industries, including food and beverages, cosmetics, and pharmaceuticals, is a major catalyst. Consumer preference for sustainable and recyclable packaging solutions is also fueling market growth, prompting manufacturers to explore eco-friendly metal printing techniques. Technological advancements in printing processes, such as the rise of digital printing for personalized packaging and improved efficiency in offset lithography, are further enhancing market dynamics. The shift towards premiumization and branding in the consumer goods sector further contributes to the market's upward trajectory. Competition is fierce, with major players like Ball Corporation and Crown Holdings Inc. vying for market share through innovation and strategic acquisitions.

Metal Printing Packaging Market Market Size (In Billion)

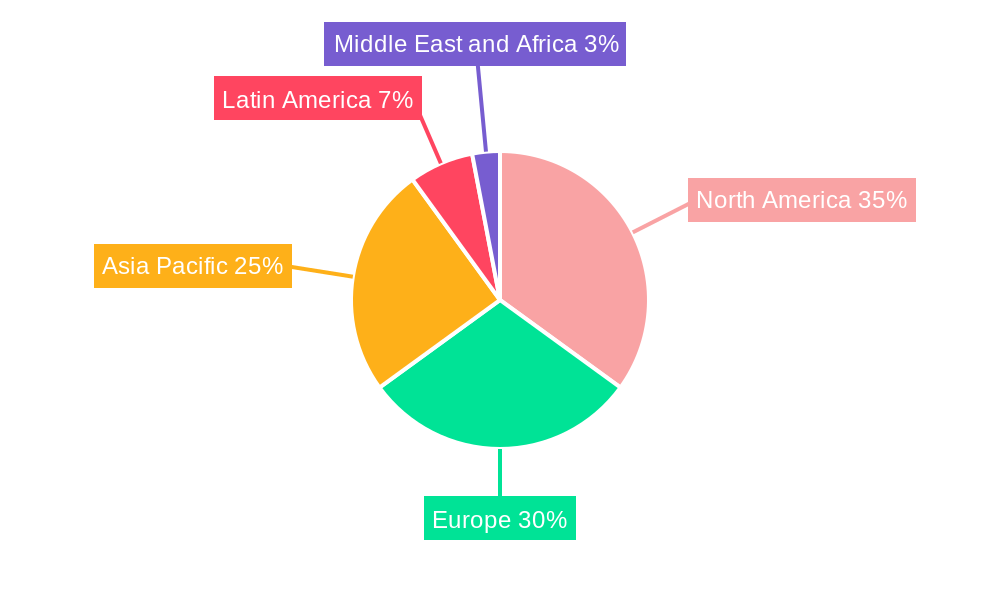

Geographic distribution reveals a dynamic landscape. While North America and Europe currently hold significant market share, the Asia-Pacific region is anticipated to witness the fastest growth due to rising disposable incomes and expanding manufacturing sectors. However, fluctuating raw material prices and environmental regulations pose challenges to market expansion. Furthermore, the increasing adoption of alternative packaging materials, such as plastics and paper-based options, presents a restraint. Despite these hurdles, the continuous innovation in metal printing technologies and the growing preference for sustainable metal packaging solutions suggest a positive outlook for the Metal Printing Packaging Market in the coming years. Segmentation by printing process showcases offset lithography as currently dominant, though flexography and digital printing are rapidly gaining traction due to their cost-effectiveness and customization capabilities.

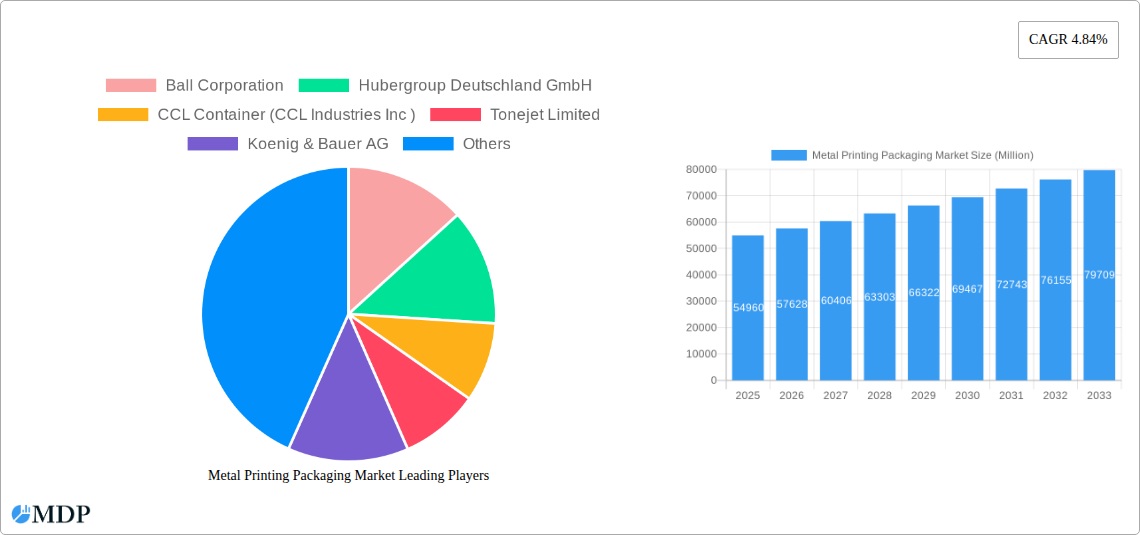

Metal Printing Packaging Market Company Market Share

Metal Printing Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Metal Printing Packaging Market, offering invaluable insights for stakeholders seeking to navigate this dynamic industry. Covering the period 2019-2033, with a focus on 2025, this report delves into market dynamics, trends, leading players, and future opportunities, equipping you with the knowledge to make informed strategic decisions.

Metal Printing Packaging Market Market Dynamics & Concentration

The Metal Printing Packaging Market exhibits a moderately concentrated landscape, with key players like Ball Corporation, Crown Holdings Inc., and CCL Industries Inc. holding significant market share. However, smaller, specialized companies are also contributing to innovation and growth. Market concentration is influenced by factors such as economies of scale in manufacturing, brand recognition, and access to advanced printing technologies. The market is driven by innovation in printing processes, particularly the rise of digital printing, and the increasing demand for sustainable packaging solutions. Stringent regulatory frameworks regarding material recyclability and food safety are also shaping the market. Product substitutes, such as plastic and paper-based packaging, present a competitive challenge. However, the inherent advantages of metal packaging—durability, recyclability, and barrier properties—continue to drive its adoption. Mergers and acquisitions (M&A) activity is moderate, reflecting efforts by established players to expand their market reach and product portfolios. Over the study period (2019-2024), approximately xx M&A deals were recorded, resulting in a xx% increase in market concentration.

Metal Printing Packaging Market Industry Trends & Analysis

The Metal Printing Packaging Market is witnessing robust growth, projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: the rising consumer preference for convenient and aesthetically appealing packaging, technological advancements in printing techniques, particularly the increasing adoption of digital printing for customization and shorter print runs, and the growing demand for sustainable and recyclable packaging solutions. The market penetration of metal packaging in various end-use sectors like food & beverages, personal care, and pharmaceuticals is also on the rise. However, fluctuating raw material prices and economic uncertainties could pose challenges to sustained growth. The competitive landscape is characterized by both established multinational corporations and smaller, specialized companies, leading to intense competition and continuous innovation.

Leading Markets & Segments in Metal Printing Packaging Market

The Metal Printing Packaging Market shows strong regional dominance in North America and Europe, primarily driven by high consumer spending, established infrastructure, and stringent environmental regulations promoting sustainable packaging. Within printing processes, offset lithography remains the dominant segment, holding approximately xx% market share in 2025. However, digital printing is experiencing rapid growth due to its flexibility and customization capabilities, projecting a CAGR of xx% during the forecast period.

Key Drivers of Regional Dominance:

- North America: Strong demand from the food & beverage sector, high disposable incomes, and advanced infrastructure.

- Europe: Stringent environmental regulations favoring recyclable packaging, advanced printing technology, and a well-established supply chain.

Segment-Specific Analysis:

- Offset Lithography: High volume printing capabilities, cost-effectiveness for large-scale production.

- Gravure: Suitable for high-quality printing on metallic surfaces, commonly used for high-volume packaging.

- Flexography: Versatility in substrate printing, suitable for short-run and customized packaging.

- Digital Printing: High customization possibilities, short lead times, cost-effective for smaller runs.

Metal Printing Packaging Market Product Developments

Recent advancements in metal printing packaging encompass enhanced printing technologies offering improved resolution, vibrant colors, and tactile effects. The integration of sustainable materials and recyclable inks is gaining traction, aligning with the growing emphasis on environmental responsibility. New applications are emerging in specialized sectors, such as personalized medicine packaging and e-commerce logistics. These developments improve brand differentiation, product appeal, and align with consumer expectations for both sustainability and high-quality packaging.

Key Drivers of Metal Printing Packaging Market Growth

Technological advancements in printing processes, including the adoption of digital printing, are key growth drivers. The increasing demand for sustainable and recyclable packaging options, spurred by environmental concerns and stricter regulations, is another significant factor. Economic growth in developing countries also fuels demand. For instance, Ball Corporation’s launch of aluminum cups exemplifies the market's focus on sustainable alternatives to plastic.

Challenges in the Metal Printing Packaging Market Market

Fluctuations in raw material prices, especially aluminum, pose a significant challenge. Supply chain disruptions can impact production and lead times. Intense competition among established players and new entrants creates pressure on pricing and margins. The cost of implementing sustainable packaging solutions can also be a barrier for some manufacturers. These challenges collectively restrict the market’s growth and profitability.

Emerging Opportunities in Metal Printing Packaging Market

The rise of e-commerce and the growing demand for personalized packaging present significant opportunities. Strategic partnerships and collaborations between packaging manufacturers and brand owners can drive innovation and expand market penetration. Technological advancements in sustainable materials and printing methods, such as using recycled aluminum and plant-based inks, will propel market growth.

Leading Players in the Metal Printing Packaging Market Sector

- Ball Corporation

- Hubergroup Deutschland GmbH

- CCL Container (CCL Industries Inc)

- Tonejet Limited

- Koenig & Bauer AG

- Crown Holdings Inc

- Envases Metalurgicos de Alava SA

- Toyo Seihan Co Ltd (Toyo Seikan Group Holdings Ltd)

Key Milestones in Metal Printing Packaging Market Industry

- May 2021: Ball Corporation launched its Ball Aluminum Cup, emphasizing sustainability and reducing plastic waste. This launch significantly impacted market dynamics by showcasing a viable alternative to plastic cups.

- March 2020: Bierland's partnership with Crown Holdings Inc. for metal can packaging highlighted the shift towards sustainable and premium packaging solutions within the craft beer industry.

Strategic Outlook for Metal Printing Packaging Market Market

The Metal Printing Packaging Market is poised for continued growth, driven by technological innovation, sustainability trends, and increasing consumer demand for high-quality, customized packaging. Strategic partnerships, expansion into new markets, and development of innovative, sustainable solutions are key strategies for companies to capture a larger market share and thrive in this dynamic sector. The market shows significant potential for future expansion, particularly in emerging economies and specialized packaging applications.

Metal Printing Packaging Market Segmentation

-

1. Printing Process

- 1.1. Offset Lithography

- 1.2. Gravure

- 1.3. Flexography

- 1.4. Digital

- 1.5. Other Printing Technologies

Metal Printing Packaging Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Metal Printing Packaging Market Regional Market Share

Geographic Coverage of Metal Printing Packaging Market

Metal Printing Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Evolution of Digital Print Technology

- 3.3. Market Restrains

- 3.3.1. Monitoring issues and lack of standardization

- 3.4. Market Trends

- 3.4.1. Offset Lithography is Expected to Hold a Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Metal Printing Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Printing Process

- 5.1.1. Offset Lithography

- 5.1.2. Gravure

- 5.1.3. Flexography

- 5.1.4. Digital

- 5.1.5. Other Printing Technologies

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Printing Process

- 6. North America Metal Printing Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Printing Process

- 6.1.1. Offset Lithography

- 6.1.2. Gravure

- 6.1.3. Flexography

- 6.1.4. Digital

- 6.1.5. Other Printing Technologies

- 6.1. Market Analysis, Insights and Forecast - by Printing Process

- 7. Europe Metal Printing Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Printing Process

- 7.1.1. Offset Lithography

- 7.1.2. Gravure

- 7.1.3. Flexography

- 7.1.4. Digital

- 7.1.5. Other Printing Technologies

- 7.1. Market Analysis, Insights and Forecast - by Printing Process

- 8. Asia Pacific Metal Printing Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Printing Process

- 8.1.1. Offset Lithography

- 8.1.2. Gravure

- 8.1.3. Flexography

- 8.1.4. Digital

- 8.1.5. Other Printing Technologies

- 8.1. Market Analysis, Insights and Forecast - by Printing Process

- 9. Latin America Metal Printing Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Printing Process

- 9.1.1. Offset Lithography

- 9.1.2. Gravure

- 9.1.3. Flexography

- 9.1.4. Digital

- 9.1.5. Other Printing Technologies

- 9.1. Market Analysis, Insights and Forecast - by Printing Process

- 10. Middle East and Africa Metal Printing Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Printing Process

- 10.1.1. Offset Lithography

- 10.1.2. Gravure

- 10.1.3. Flexography

- 10.1.4. Digital

- 10.1.5. Other Printing Technologies

- 10.1. Market Analysis, Insights and Forecast - by Printing Process

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ball Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hubergroup Deutschland GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CCL Container (CCL Industries Inc )

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tonejet Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Koenig & Bauer AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Crown Holdings Inc *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Envases Metalurgicos de Alava SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Toyo Seihan Co Ltd (Toyo Seikan Group Holdings Ltd)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Ball Corporation

List of Figures

- Figure 1: Global Metal Printing Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Metal Printing Packaging Market Revenue (Million), by Printing Process 2025 & 2033

- Figure 3: North America Metal Printing Packaging Market Revenue Share (%), by Printing Process 2025 & 2033

- Figure 4: North America Metal Printing Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Metal Printing Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Metal Printing Packaging Market Revenue (Million), by Printing Process 2025 & 2033

- Figure 7: Europe Metal Printing Packaging Market Revenue Share (%), by Printing Process 2025 & 2033

- Figure 8: Europe Metal Printing Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Metal Printing Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Metal Printing Packaging Market Revenue (Million), by Printing Process 2025 & 2033

- Figure 11: Asia Pacific Metal Printing Packaging Market Revenue Share (%), by Printing Process 2025 & 2033

- Figure 12: Asia Pacific Metal Printing Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Metal Printing Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Metal Printing Packaging Market Revenue (Million), by Printing Process 2025 & 2033

- Figure 15: Latin America Metal Printing Packaging Market Revenue Share (%), by Printing Process 2025 & 2033

- Figure 16: Latin America Metal Printing Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Metal Printing Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Metal Printing Packaging Market Revenue (Million), by Printing Process 2025 & 2033

- Figure 19: Middle East and Africa Metal Printing Packaging Market Revenue Share (%), by Printing Process 2025 & 2033

- Figure 20: Middle East and Africa Metal Printing Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Metal Printing Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Metal Printing Packaging Market Revenue Million Forecast, by Printing Process 2020 & 2033

- Table 2: Global Metal Printing Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Metal Printing Packaging Market Revenue Million Forecast, by Printing Process 2020 & 2033

- Table 4: Global Metal Printing Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Metal Printing Packaging Market Revenue Million Forecast, by Printing Process 2020 & 2033

- Table 6: Global Metal Printing Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Metal Printing Packaging Market Revenue Million Forecast, by Printing Process 2020 & 2033

- Table 8: Global Metal Printing Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Metal Printing Packaging Market Revenue Million Forecast, by Printing Process 2020 & 2033

- Table 10: Global Metal Printing Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Metal Printing Packaging Market Revenue Million Forecast, by Printing Process 2020 & 2033

- Table 12: Global Metal Printing Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Metal Printing Packaging Market?

The projected CAGR is approximately 4.84%.

2. Which companies are prominent players in the Metal Printing Packaging Market?

Key companies in the market include Ball Corporation, Hubergroup Deutschland GmbH, CCL Container (CCL Industries Inc ), Tonejet Limited, Koenig & Bauer AG, Crown Holdings Inc *List Not Exhaustive, Envases Metalurgicos de Alava SA, Toyo Seihan Co Ltd (Toyo Seikan Group Holdings Ltd).

3. What are the main segments of the Metal Printing Packaging Market?

The market segments include Printing Process.

4. Can you provide details about the market size?

The market size is estimated to be USD 54.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Evolution of Digital Print Technology.

6. What are the notable trends driving market growth?

Offset Lithography is Expected to Hold a Significant Market Growth.

7. Are there any restraints impacting market growth?

Monitoring issues and lack of standardization.

8. Can you provide examples of recent developments in the market?

May 2021 - Ball Corporation launched a first-of-its-kind Ball Aluminum Cup that has the potential to advance sustainability and reduce plastic waste at gatherings irrespective of big and small. It will be available for purchase at major retailers in all 50 states across the U.S. Between May and June; the cups will be available for the first time in more than 18,000 food, drug, and mass retailers, including Kroger, Target, Albertsons, CVS, etc.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Metal Printing Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Metal Printing Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Metal Printing Packaging Market?

To stay informed about further developments, trends, and reports in the Metal Printing Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence