Key Insights

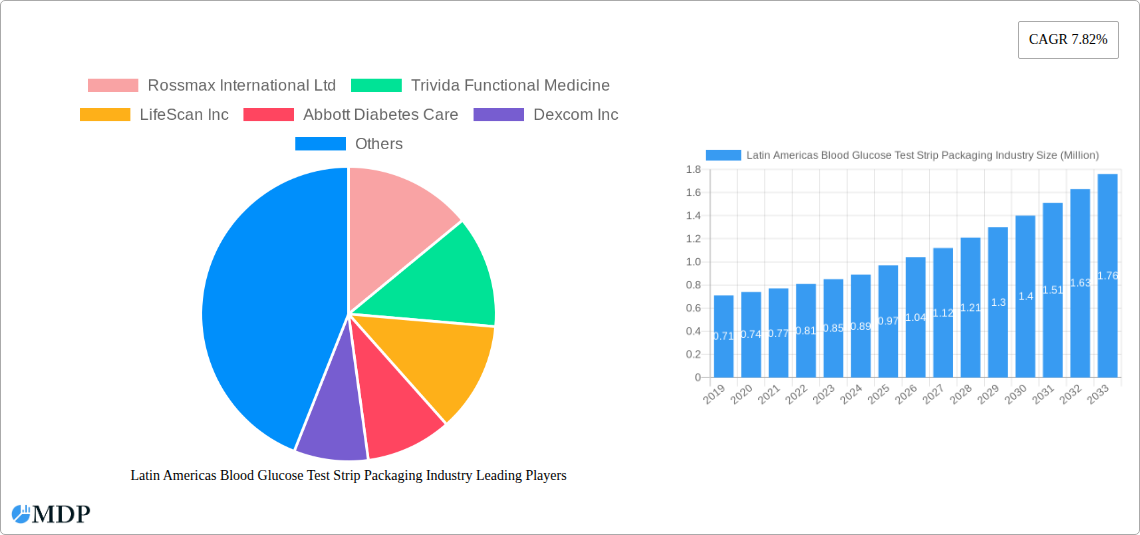

The Latin American blood glucose test strip packaging market is poised for significant expansion, projected to reach USD 0.97 Million by 2025. This growth is fueled by an anticipated Compound Annual Growth Rate (CAGR) of 7.82% over the forecast period of 2025-2033. The increasing prevalence of diabetes across the region, driven by lifestyle changes, sedentary habits, and aging populations, is the primary catalyst for this market's ascent. As more individuals require regular blood glucose monitoring, the demand for effective and reliable packaging solutions for test strips escalates. The market encompasses two key segments: self-monitoring blood glucose devices, which include glucometer devices, test strips, and lancets, and continuous blood glucose monitoring devices, comprising sensors and durables. Both segments contribute to the overall packaging demand, with a particular emphasis on sterile, protective, and user-friendly packaging to maintain the integrity and accuracy of the test strips.

Latin Americas Blood Glucose Test Strip Packaging Industry Market Size (In Million)

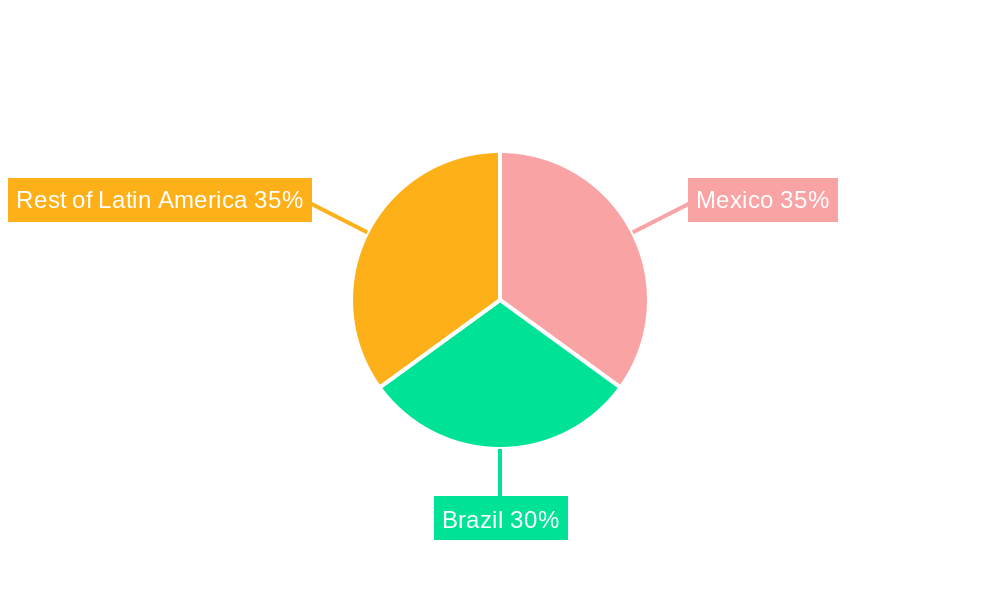

The market dynamics are further shaped by evolving technological advancements in packaging materials and designs, aiming to enhance shelf life, prevent contamination, and improve patient convenience. Key geographical markets within Latin America, including Mexico and Brazil, are expected to lead the demand due to their large populations and substantial diabetic patient bases. The "Rest of Latin America" segment also presents considerable growth opportunities as healthcare infrastructure develops and awareness surrounding diabetes management increases. While the market is largely driven by the escalating diabetes burden, potential restraints could include stringent regulatory approvals for packaging materials and a higher initial investment cost for advanced packaging technologies. However, the overarching trend of increasing diabetes diagnoses and proactive health management strategies among the population strongly supports a positive trajectory for the Latin American blood glucose test strip packaging market.

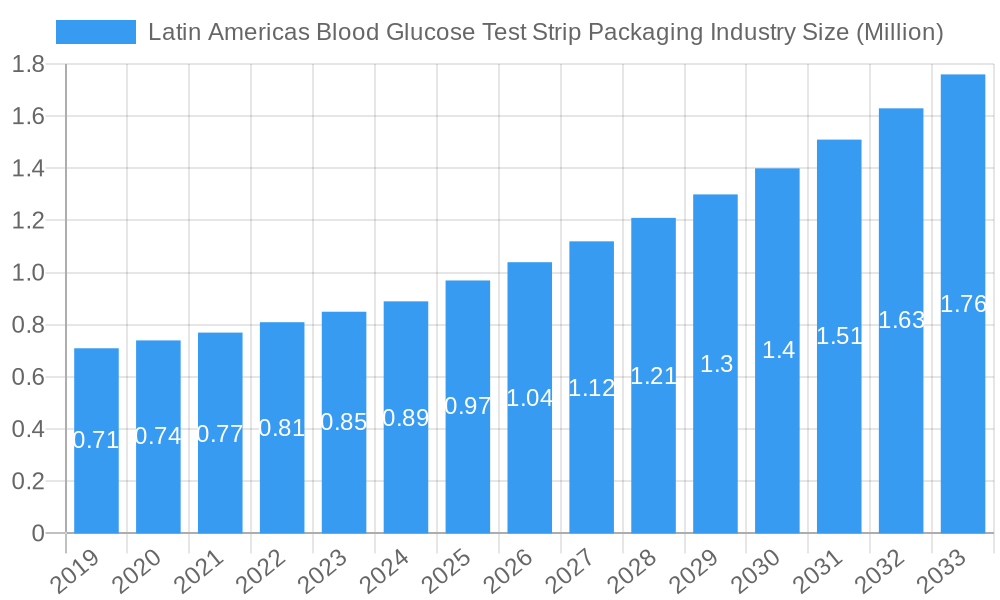

Latin Americas Blood Glucose Test Strip Packaging Industry Company Market Share

Unlock critical insights into the burgeoning Latin American blood glucose test strip packaging market. This comprehensive report, covering the historical period 2019–2024 and forecasting to 2033 with a base year of 2025, delivers actionable intelligence for industry stakeholders. Dive deep into market dynamics, key players, technological advancements, and growth drivers shaping the future of diabetes management packaging in Mexico, Brazil, and the wider Latin American region.

Latin Americas Blood Glucose Test Strip Packaging Industry Market Dynamics & Concentration

The Latin American blood glucose test strip packaging industry is characterized by moderate concentration, with a few key players holding significant market share. Innovation in packaging materials, such as sustainable and user-friendly designs, is a primary driver. Regulatory frameworks, though evolving, are increasingly focused on patient safety and product integrity, influencing packaging requirements. Product substitutes, particularly advancements in continuous glucose monitoring (CGM) systems that reduce the reliance on traditional test strips, present a notable challenge. End-user trends lean towards convenience, accuracy, and affordability, driving demand for cost-effective and easy-to-use packaging solutions. Mergers and acquisitions (M&A) are anticipated to play a role in market consolidation, with an estimated XX M&A deals expected during the forecast period, further shaping the competitive landscape. The market share of leading packaging providers is projected to reach approximately XX% by 2025, highlighting the influence of established entities.

- Market Concentration: Moderate, with leading companies holding substantial market share.

- Innovation Drivers: Sustainable materials, improved user experience, enhanced shelf-life, and tamper-evident features.

- Regulatory Frameworks: Focus on patient safety, child-resistance, and environmental standards.

- Product Substitutes: Growing adoption of Continuous Glucose Monitoring (CGM) devices impacting traditional test strip demand.

- End-User Trends: Demand for convenience, affordability, accuracy, and smaller, portable packaging.

- M&A Activities: Expected to drive market consolidation and strategic alliances.

Latin Americas Blood Glucose Test Strip Packaging Industry Industry Trends & Analysis

The Latin American blood glucose test strip packaging industry is experiencing robust growth, propelled by a rising prevalence of diabetes across the region, increasing healthcare expenditure, and a growing awareness of diabetes management. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is estimated at XX%, indicating a significant expansion. Technological disruptions are primarily centered around advanced packaging materials offering superior protection against environmental factors like humidity and light, which can degrade test strip accuracy. Innovations in smart packaging, including features for lot tracking and expiry date management, are also gaining traction. Consumer preferences are increasingly influenced by factors such as ease of use, portability, and the sustainability of packaging materials. This shift is driving demand for lighter, smaller, and more environmentally friendly packaging solutions. The competitive dynamics are marked by a mix of global manufacturers and localized players, all vying for market share through product differentiation and strategic pricing. Market penetration of advanced packaging solutions is expected to rise from XX% in the base year 2025 to XX% by 2033, driven by technological advancements and increasing consumer demand for sophisticated packaging.

Leading Markets & Segments in Latin Americas Blood Glucose Test Strip Packaging Industry

Brazil is poised to emerge as the dominant market within the Latin American blood glucose test strip packaging industry during the forecast period, driven by its large population, increasing diabetes incidence, and a growing healthcare infrastructure. Mexico also presents a significant market, with a substantial patient base and a proactive approach to diabetes management. The Rest of Latin America, encompassing countries like Colombia, Argentina, and Chile, collectively represents a growing segment with considerable untapped potential.

Within the segmentation, Self-monitoring blood glucose devices (SMBG) are anticipated to remain the larger segment, with Test Strips as the most significant sub-segment. This dominance is attributed to the established user base and the continued reliance on traditional blood glucose meters for routine monitoring. However, the Continuous blood glucose monitoring devices (CGM) segment, comprising Sensors and Durables (Receivers and Transmitters), is projected to witness the highest growth rate. This surge is fueled by technological advancements in CGM accuracy and user-friendliness, coupled with a shift towards integrated diabetes management solutions.

Dominant Geography:

- Brazil:

- Key Drivers: Large, aging population; high diabetes prevalence; government initiatives for diabetes care; expanding private healthcare sector.

- Dominance Analysis: Brazil's sheer population size and the increasing adoption of diabetes management technologies make it a crucial market for test strip packaging. The country's economic growth, albeit subject to fluctuations, generally supports increased healthcare spending.

- Mexico:

- Key Drivers: High rates of obesity and type 2 diabetes; increasing disposable incomes; growing awareness of chronic disease management; strategic location for distribution.

- Dominance Analysis: Mexico's robust healthcare system and a growing demand for accessible and affordable diabetes monitoring solutions position it as a key player. The country's proximity to North American markets also facilitates the adoption of new technologies and packaging innovations.

- Rest of Latin America:

- Key Drivers: Growing middle class; increasing access to healthcare; rising adoption of digital health solutions; unmet medical needs in certain areas.

- Dominance Analysis: This broad segment offers diversified growth opportunities. As economies mature and healthcare access improves, countries within this region are expected to see a significant increase in demand for diabetes management products and their associated packaging.

- Brazil:

Leading Segment:

- Self-monitoring Blood Glucose Devices:

- Test Strips: Continues to be the largest sub-segment due to widespread use of glucometers. Packaging needs to ensure strip integrity and shelf-life.

- Glucometer Devices: Packaging for meters requires durability and protection during transit and storage.

- Lancets: Smaller packaging requirements, focus on sterility and safety.

- Continuous Blood Glucose Monitoring Devices:

- Sensors: Advanced, sterile packaging critical for disposable sensors, often with specialized materials to maintain sensor functionality.

- Durables (Receivers and Transmitters): Packaging for electronic components requires protection from physical damage and electrostatic discharge.

- Self-monitoring Blood Glucose Devices:

Latin Americas Blood Glucose Test Strip Packaging Industry Product Developments

Innovations in Latin American blood glucose test strip packaging are increasingly focusing on enhancing product stability, user convenience, and environmental sustainability. Developments include advanced moisture-barrier films and desiccant integration within pouches to protect test strips from degradation, thereby ensuring accurate readings. Tamper-evident seals and child-resistant closures are becoming standard, addressing regulatory and safety concerns. Furthermore, the trend towards miniaturization is driving the development of compact and lightweight packaging solutions for both traditional test strips and CGM components, catering to the demand for portable diabetes management devices. Eco-friendly materials, such as recyclable plastics and biodegradable options, are also being explored to align with growing environmental consciousness.

Key Drivers of Latin Americas Blood Glucose Test Strip Packaging Industry Growth

The growth of the Latin American blood glucose test strip packaging industry is propelled by several key factors. Firstly, the escalating prevalence of diabetes and pre-diabetes across the region, largely driven by lifestyle changes and an aging population, creates a sustained demand for blood glucose monitoring products. Secondly, increasing government initiatives and healthcare policies aimed at improving diabetes management and patient outcomes are further stimulating market growth. Technological advancements in both diagnostic devices and their packaging, leading to improved accuracy, usability, and shelf-life of test strips, also act as significant growth accelerators. Finally, the expanding middle class and rising disposable incomes in several Latin American countries are enhancing access to advanced healthcare solutions, including sophisticated diabetes management tools and their associated packaging.

Challenges in the Latin Americas Blood Glucose Test Strip Packaging Industry Market

Despite the promising growth, the Latin American blood glucose test strip packaging industry faces several challenges. Economic volatility and currency fluctuations in some countries can impact manufacturers' costs and consumers' purchasing power, leading to price sensitivity. Complex and varied regulatory landscapes across different nations can create hurdles for market entry and product standardization. Supply chain disruptions, including logistics and raw material availability, can affect production timelines and costs. Furthermore, the increasing adoption of continuous glucose monitoring (CGM) systems that bypass traditional test strips poses a long-term threat to the market for test strip packaging. Intense price competition among manufacturers and the presence of counterfeit products also present significant challenges.

Emerging Opportunities in Latin Americas Blood Glucose Test Strip Packaging Industry

Several emerging opportunities are poised to drive long-term growth in the Latin American blood glucose test strip packaging industry. The increasing focus on digital health and connected devices presents an opportunity for smart packaging solutions that integrate with mobile applications for data tracking and analysis. Strategic partnerships between packaging manufacturers and device makers, as well as with healthcare providers and pharmaceutical companies, can lead to customized and innovative packaging solutions. Market expansion into underserved rural areas through cost-effective and accessible packaging designs can tap into significant unmet demand. Furthermore, the growing emphasis on personalized medicine may lead to specialized packaging tailored for specific patient demographics or treatment regimens, creating niche market opportunities.

Leading Players in the Latin Americas Blood Glucose Test Strip Packaging Industry Sector

- Rossmax International Ltd

- Trivida Functional Medicine

- LifeScan Inc

- Abbott Diabetes Care

- Dexcom Inc

- Medtronic PLC

- Acon Laboratories Inc

- Agamatrix Inc

- Senseonics

- Medisana AG

- Bionime Corporation

- Roche Holding AG

- Arkray Inc

- Ascensia Diabetes Care

Key Milestones in Latin Americas Blood Glucose Test Strip Packaging Industry Industry

- January 2024: Medtronic plc announced CE (Conformité Européenne) Mark approval for the MiniMed™ 780G system with Simplera Sync, a disposable, all-in-one continuous glucose monitor (CGM) requiring no fingersticks or overtape. Simplera Sync features an improved user experience with a simple, two-step insertion process and is half the size of previous Medtronic sensors. This milestone signifies advancements in CGM technology, impacting the demand for packaging for these next-generation devices.

- August 2022: Abbott and WW International, Inc. (WeightWatchers) announced a strategic partnership to help people with diabetes better understand and manage their diabetes and weight. The companies are working to integrate WeightWatchers' diabetes-tailored weight management program with Abbott's portfolio of FreeStyle Libre products. It is to create a seamless mobile experience that will give people living with diabetes the information and insights needed to make healthy adjustments to their diet, improve their glucose levels, and, ultimately, gain more control of their health. This collaboration highlights the growing trend of integrated diabetes care and the importance of packaging that supports holistic health management.

Strategic Outlook for Latin Americas Blood Glucose Test Strip Packaging Industry Market

The strategic outlook for the Latin American blood glucose test strip packaging industry is one of sustained growth and evolving innovation. Key growth accelerators will include the continued rise in diabetes prevalence, increasing healthcare investments, and a growing demand for user-centric and sustainable packaging solutions. Companies that focus on developing advanced barrier properties, tamper-evident features, and eco-friendly materials will be well-positioned for success. The expansion of CGM technology will necessitate specialized packaging, creating new avenues for innovation. Strategic partnerships, market penetration into emerging economies within the region, and a keen understanding of diverse consumer needs will be crucial for navigating the competitive landscape and capitalizing on future market potential. The emphasis on affordability and accessibility will remain paramount, driving the need for cost-effective yet high-quality packaging solutions.

Latin Americas Blood Glucose Test Strip Packaging Industry Segmentation

-

1. Self-monitoring blood glucose devices

- 1.1. Glucometer Devices

- 1.2. Test Strips

- 1.3. Lancets

-

2. Continuous blood glucose monitoring devices

- 2.1. Sensors

- 2.2. Durables (Receivers and Transmitters)

-

3. Geography

- 3.1. Mexico

- 3.2. Brazil

- 3.3. Rest of Latin America

Latin Americas Blood Glucose Test Strip Packaging Industry Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Rest of Latin America

Latin Americas Blood Glucose Test Strip Packaging Industry Regional Market Share

Geographic Coverage of Latin Americas Blood Glucose Test Strip Packaging Industry

Latin Americas Blood Glucose Test Strip Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Self-Monitoring Blood Glucose Devices hold the highest market share in the Latin America Blood Glucose Monitoring Market in the current year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin Americas Blood Glucose Test Strip Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Self-monitoring blood glucose devices

- 5.1.1. Glucometer Devices

- 5.1.2. Test Strips

- 5.1.3. Lancets

- 5.2. Market Analysis, Insights and Forecast - by Continuous blood glucose monitoring devices

- 5.2.1. Sensors

- 5.2.2. Durables (Receivers and Transmitters)

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Mexico

- 5.3.2. Brazil

- 5.3.3. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.4.2. Brazil

- 5.4.3. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Self-monitoring blood glucose devices

- 6. Mexico Latin Americas Blood Glucose Test Strip Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Self-monitoring blood glucose devices

- 6.1.1. Glucometer Devices

- 6.1.2. Test Strips

- 6.1.3. Lancets

- 6.2. Market Analysis, Insights and Forecast - by Continuous blood glucose monitoring devices

- 6.2.1. Sensors

- 6.2.2. Durables (Receivers and Transmitters)

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Mexico

- 6.3.2. Brazil

- 6.3.3. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Self-monitoring blood glucose devices

- 7. Brazil Latin Americas Blood Glucose Test Strip Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Self-monitoring blood glucose devices

- 7.1.1. Glucometer Devices

- 7.1.2. Test Strips

- 7.1.3. Lancets

- 7.2. Market Analysis, Insights and Forecast - by Continuous blood glucose monitoring devices

- 7.2.1. Sensors

- 7.2.2. Durables (Receivers and Transmitters)

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Mexico

- 7.3.2. Brazil

- 7.3.3. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Self-monitoring blood glucose devices

- 8. Rest of Latin America Latin Americas Blood Glucose Test Strip Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Self-monitoring blood glucose devices

- 8.1.1. Glucometer Devices

- 8.1.2. Test Strips

- 8.1.3. Lancets

- 8.2. Market Analysis, Insights and Forecast - by Continuous blood glucose monitoring devices

- 8.2.1. Sensors

- 8.2.2. Durables (Receivers and Transmitters)

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Mexico

- 8.3.2. Brazil

- 8.3.3. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Self-monitoring blood glucose devices

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Rossmax International Ltd

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Trivida Functional Medicine

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 LifeScan Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Abbott Diabetes Care

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Dexcom Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Continuous Glucose Monitoring Devices

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 4 Others

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Acon Laboratories Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Medtronic PLC

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Agamatrix Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Senseonics

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Medisana AG

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Self-monitoring Blood Glucose Devices

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.14 Bionime Corporation

- 9.2.14.1. Overview

- 9.2.14.2. Products

- 9.2.14.3. SWOT Analysis

- 9.2.14.4. Recent Developments

- 9.2.14.5. Financials (Based on Availability)

- 9.2.15 Roche Holding AG

- 9.2.15.1. Overview

- 9.2.15.2. Products

- 9.2.15.3. SWOT Analysis

- 9.2.15.4. Recent Developments

- 9.2.15.5. Financials (Based on Availability)

- 9.2.16 Arkray Inc

- 9.2.16.1. Overview

- 9.2.16.2. Products

- 9.2.16.3. SWOT Analysis

- 9.2.16.4. Recent Developments

- 9.2.16.5. Financials (Based on Availability)

- 9.2.17 Ascensia Diabetes Care

- 9.2.17.1. Overview

- 9.2.17.2. Products

- 9.2.17.3. SWOT Analysis

- 9.2.17.4. Recent Developments

- 9.2.17.5. Financials (Based on Availability)

- 9.2.1 Rossmax International Ltd

List of Figures

- Figure 1: Latin Americas Blood Glucose Test Strip Packaging Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin Americas Blood Glucose Test Strip Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin Americas Blood Glucose Test Strip Packaging Industry Revenue Million Forecast, by Self-monitoring blood glucose devices 2020 & 2033

- Table 2: Latin Americas Blood Glucose Test Strip Packaging Industry Volume K Unit Forecast, by Self-monitoring blood glucose devices 2020 & 2033

- Table 3: Latin Americas Blood Glucose Test Strip Packaging Industry Revenue Million Forecast, by Continuous blood glucose monitoring devices 2020 & 2033

- Table 4: Latin Americas Blood Glucose Test Strip Packaging Industry Volume K Unit Forecast, by Continuous blood glucose monitoring devices 2020 & 2033

- Table 5: Latin Americas Blood Glucose Test Strip Packaging Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Latin Americas Blood Glucose Test Strip Packaging Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: Latin Americas Blood Glucose Test Strip Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Latin Americas Blood Glucose Test Strip Packaging Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Latin Americas Blood Glucose Test Strip Packaging Industry Revenue Million Forecast, by Self-monitoring blood glucose devices 2020 & 2033

- Table 10: Latin Americas Blood Glucose Test Strip Packaging Industry Volume K Unit Forecast, by Self-monitoring blood glucose devices 2020 & 2033

- Table 11: Latin Americas Blood Glucose Test Strip Packaging Industry Revenue Million Forecast, by Continuous blood glucose monitoring devices 2020 & 2033

- Table 12: Latin Americas Blood Glucose Test Strip Packaging Industry Volume K Unit Forecast, by Continuous blood glucose monitoring devices 2020 & 2033

- Table 13: Latin Americas Blood Glucose Test Strip Packaging Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Latin Americas Blood Glucose Test Strip Packaging Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: Latin Americas Blood Glucose Test Strip Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Latin Americas Blood Glucose Test Strip Packaging Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Latin Americas Blood Glucose Test Strip Packaging Industry Revenue Million Forecast, by Self-monitoring blood glucose devices 2020 & 2033

- Table 18: Latin Americas Blood Glucose Test Strip Packaging Industry Volume K Unit Forecast, by Self-monitoring blood glucose devices 2020 & 2033

- Table 19: Latin Americas Blood Glucose Test Strip Packaging Industry Revenue Million Forecast, by Continuous blood glucose monitoring devices 2020 & 2033

- Table 20: Latin Americas Blood Glucose Test Strip Packaging Industry Volume K Unit Forecast, by Continuous blood glucose monitoring devices 2020 & 2033

- Table 21: Latin Americas Blood Glucose Test Strip Packaging Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Latin Americas Blood Glucose Test Strip Packaging Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Latin Americas Blood Glucose Test Strip Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Latin Americas Blood Glucose Test Strip Packaging Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Latin Americas Blood Glucose Test Strip Packaging Industry Revenue Million Forecast, by Self-monitoring blood glucose devices 2020 & 2033

- Table 26: Latin Americas Blood Glucose Test Strip Packaging Industry Volume K Unit Forecast, by Self-monitoring blood glucose devices 2020 & 2033

- Table 27: Latin Americas Blood Glucose Test Strip Packaging Industry Revenue Million Forecast, by Continuous blood glucose monitoring devices 2020 & 2033

- Table 28: Latin Americas Blood Glucose Test Strip Packaging Industry Volume K Unit Forecast, by Continuous blood glucose monitoring devices 2020 & 2033

- Table 29: Latin Americas Blood Glucose Test Strip Packaging Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Latin Americas Blood Glucose Test Strip Packaging Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: Latin Americas Blood Glucose Test Strip Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Latin Americas Blood Glucose Test Strip Packaging Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin Americas Blood Glucose Test Strip Packaging Industry?

The projected CAGR is approximately 7.82%.

2. Which companies are prominent players in the Latin Americas Blood Glucose Test Strip Packaging Industry?

Key companies in the market include Rossmax International Ltd, Trivida Functional Medicine, LifeScan Inc, Abbott Diabetes Care, Dexcom Inc, Continuous Glucose Monitoring Devices, 4 Others, Acon Laboratories Inc, Medtronic PLC, Agamatrix Inc, Senseonics, Medisana AG, Self-monitoring Blood Glucose Devices, Bionime Corporation, Roche Holding AG, Arkray Inc, Ascensia Diabetes Care.

3. What are the main segments of the Latin Americas Blood Glucose Test Strip Packaging Industry?

The market segments include Self-monitoring blood glucose devices, Continuous blood glucose monitoring devices, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

Self-Monitoring Blood Glucose Devices hold the highest market share in the Latin America Blood Glucose Monitoring Market in the current year.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

January 2024: Medtronic plc announced CE (Conformité Européenne) Mark approval for the MiniMed™ 780G system with Simplera Sync, a disposable, all-in-one continuous glucose monitor (CGM) requiring no fingersticks or overtape. Simplera Sync features an improved user experience with a simple, two-step insertion process and is half the size of previous Medtronic sensors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin Americas Blood Glucose Test Strip Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin Americas Blood Glucose Test Strip Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin Americas Blood Glucose Test Strip Packaging Industry?

To stay informed about further developments, trends, and reports in the Latin Americas Blood Glucose Test Strip Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence