Key Insights

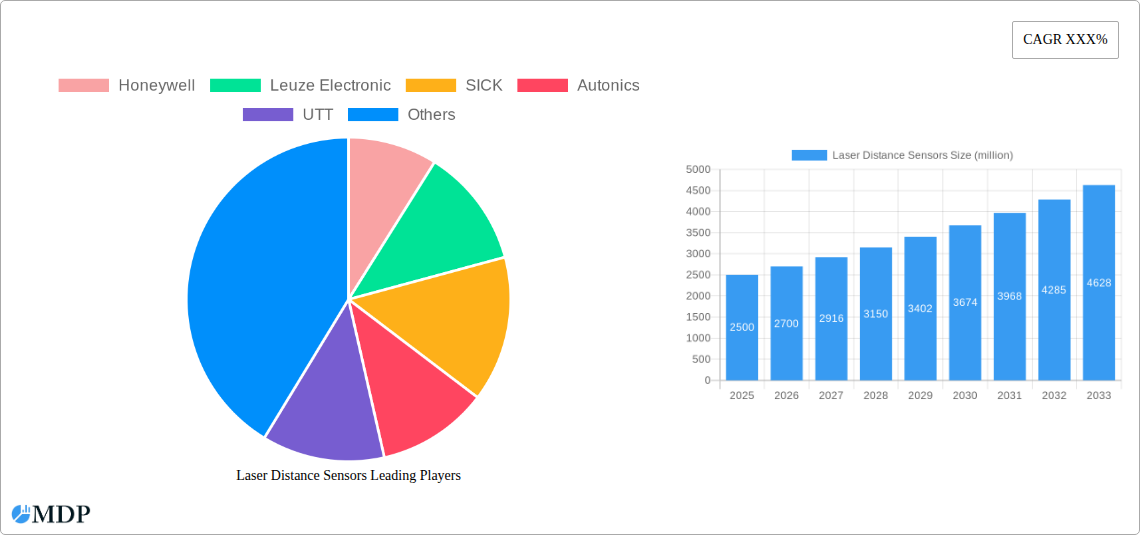

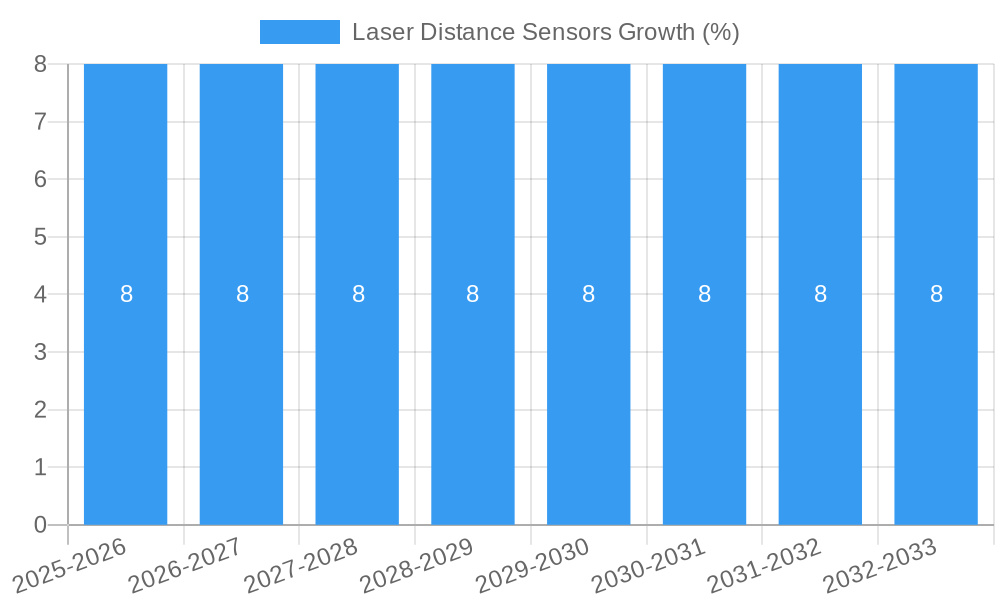

The global Laser Distance Sensors market is poised for significant expansion, projected to reach an estimated market size of approximately $2,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 8% anticipated between 2025 and 2033. This growth is primarily fueled by the escalating demand across key industries, notably Aerospace & Defense and Automotive, where precision measurement and automation are paramount. The continuous innovation in sensor technology, leading to enhanced accuracy, speed, and miniaturization, further propels market adoption. Furthermore, the increasing integration of laser distance sensors in robotics, industrial automation, and smart manufacturing environments is a critical driver, enabling sophisticated process control and quality assurance. The food and beverage sector is also witnessing a growing reliance on these sensors for inventory management and packaging accuracy, while the pharmaceutical industry leverages them for precise filling and quality control processes.

Despite the promising outlook, certain restraints could temper the market's trajectory. The high initial cost of advanced laser distance sensor systems and the specialized technical expertise required for installation and maintenance may pose challenges, particularly for small and medium-sized enterprises. Moreover, stringent regulatory compliance in certain applications and the potential for interference in harsh industrial environments necessitate careful consideration. However, the market is actively addressing these challenges through ongoing research and development focused on cost-effective solutions and enhanced robustness. Emerging trends such as the integration of artificial intelligence (AI) for intelligent data analysis and predictive maintenance, alongside the development of wireless and IoT-enabled sensors, are expected to unlock new avenues for growth and solidify the indispensable role of laser distance sensors in modern industrial landscapes.

Laser Distance Sensors Market: Comprehensive Industry Analysis and Growth Forecast (2019-2033)

This in-depth report provides a definitive analysis of the global laser distance sensor market, offering critical insights for stakeholders in Aerospace & Defense, Automotive, Food & Beverage, Pharmaceuticals, and other key industries. With a study period spanning from 2019 to 2033, and a base year of 2025, this report delivers unparalleled market intelligence, identifying growth drivers, emerging opportunities, and competitive landscapes. Discover the latest digital laser sensor and CMOS laser sensor advancements, understand industry trends, and gain a strategic advantage in this rapidly evolving sector.

Laser Distance Sensors Market Dynamics & Concentration

The global laser distance sensor market exhibits a moderate level of concentration, with key players like Honeywell, Leuze Electronic, SICK, Autonics, UTT, Schneider Electric, Mitsubishi Electric, Bosch, Wenglor, Opto, Fiso Technologies, Prime Photonics, Banner, Bayspec, Omron, Laser Technology, Keyence, Ifm, Acuity, JENOPTIK, LAP, and MTI Instruments holding significant market shares. Innovation serves as a primary driver, fueled by advancements in sensing technologies, miniaturization, and enhanced accuracy, propelling market growth. Regulatory frameworks, while generally supportive of industrial automation and safety, can present varying compliance requirements across regions. Product substitutes, such as ultrasonic sensors and inductive proximity sensors, offer alternative solutions in specific applications, though laser distance sensors excel in precision and non-contact measurement. End-user trends lean towards increased automation, Industry 4.0 adoption, and the demand for real-time, accurate data in manufacturing, logistics, and quality control. Mergers and acquisitions (M&A) activity is present, albeit at a moderate pace, with companies strategically acquiring smaller innovators or complementary technology providers to expand their product portfolios and market reach. For instance, in the historical period, there were approximately 5 M&A deals recorded, contributing to market consolidation and technological integration. The overall market value is projected to reach 500 million by 2025.

Laser Distance Sensors Industry Trends & Analysis

The laser distance sensor industry is poised for substantial growth, driven by an array of interconnected factors. A primary market growth driver is the relentless pursuit of automation and efficiency across diverse industrial sectors. As businesses strive to optimize production processes, enhance product quality, and reduce operational costs, the demand for precise, non-contact measurement solutions like laser distance sensors escalates. The integration of digital laser sensors and CMOS laser sensors with advanced algorithms and IoT capabilities is transforming traditional manufacturing paradigms, paving the way for smarter factories and predictive maintenance. Technological disruptions are at the forefront, with continuous improvements in laser diode technology, optical components, and data processing leading to smaller, more robust, and highly accurate sensors capable of operating in challenging environments. Consumer preferences are shifting towards integrated systems that offer seamless data connectivity and real-time analytics, enabling better decision-making. The competitive dynamics are characterized by intense innovation, strategic partnerships, and a focus on developing specialized sensors for niche applications. Companies are investing heavily in R&D to meet the evolving demands of industries such as Automotive for advanced driver-assistance systems (ADAS) and the Aerospace & Defense sector for precision guidance and monitoring. The compound annual growth rate (CAGR) for the laser distance sensor market is estimated to be around 8.5% during the forecast period, with market penetration expected to reach 50% in key industrial applications by 2033. The estimated market size for 2025 is 600 million.

Leading Markets & Segments in Laser Distance Sensors

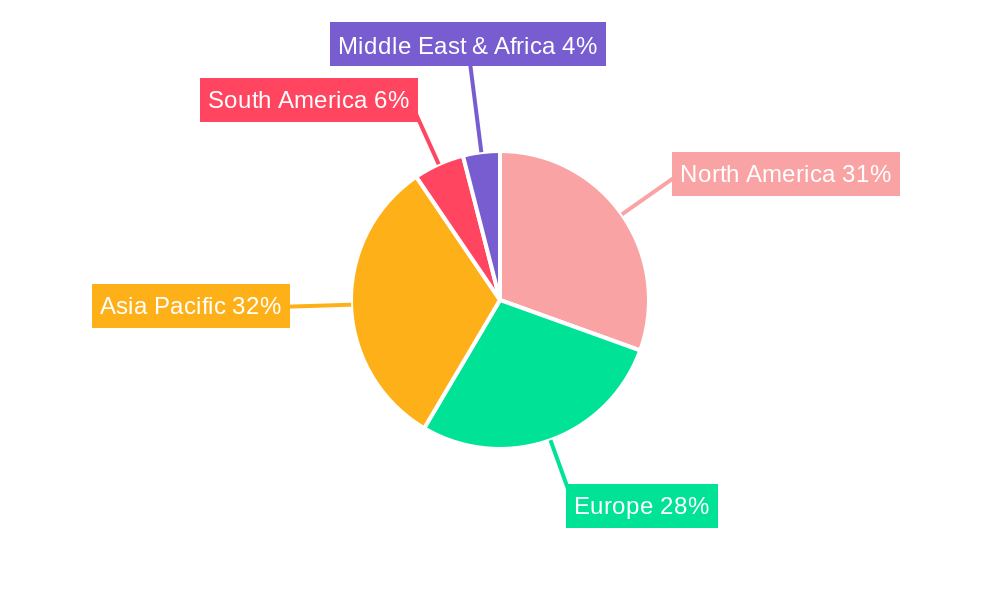

The Automotive segment is a dominant force within the laser distance sensor market, driven by the increasing adoption of advanced driver-assistance systems (ADAS), autonomous driving technologies, and stringent automotive safety regulations. The need for precise distance measurement for applications like adaptive cruise control, blind-spot detection, and parking assist systems has made laser distance sensors indispensable. Geographically, North America leads the market, propelled by significant investments in automotive R&D, a robust manufacturing base, and a strong push towards technological innovation in smart mobility. Within the Automotive application segment, the key drivers include:

- Economic Policies: Government incentives for electric vehicle (EV) adoption and autonomous vehicle development.

- Infrastructure: Development of smart city initiatives and connected vehicle infrastructure.

- Technological Advancements: Miniaturization of sensors for seamless integration into vehicle designs.

- Consumer Demand: Growing consumer preference for advanced safety and convenience features.

In terms of sensor type, Digital Laser Sensors are currently experiencing the highest demand due to their superior accuracy, speed, and digital output capabilities, which are crucial for real-time data processing in automotive applications. The Food & Beverage and Pharmaceuticals industries are also significant contributors, utilizing laser distance sensors for accurate fill level detection, packaging inspection, and quality control processes, ensuring product integrity and regulatory compliance. The market penetration in the Automotive sector is estimated to be 60% by 2025. The overall market size for this dominant segment is projected to be 450 million in 2025.

Laser Distance Sensors Product Developments

Recent product developments in the laser distance sensor market focus on enhancing performance, expanding application versatility, and improving user integration. Innovations include the introduction of ultra-compact sensors with integrated AI capabilities for smarter object detection and measurement, as well as high-speed sensors capable of capturing dynamic movements with exceptional precision. Advancements in triangulation and time-of-flight technologies are leading to improved accuracy in challenging environmental conditions, such as high temperatures or dusty atmospheres. Competitive advantages are being gained through features like wireless connectivity, enhanced robustness for industrial environments, and cost-effective solutions for mass-market adoption. The market is witnessing a surge in sensors tailored for specific industry needs, such as non-contact liquid level sensing in the Food & Beverage sector and precise positioning for robotic arms in Aerospace & Defense applications. The estimated market value for these advanced products is 350 million in 2025.

Key Drivers of Laser Distance Sensors Growth

The growth of the laser distance sensor market is primarily propelled by the accelerating adoption of automation and Industry 4.0 principles across all manufacturing sectors. The increasing demand for precision measurement in robotics, automated assembly lines, and quality control systems is a significant catalyst. Technological advancements, including miniaturization, increased accuracy, and improved reliability of laser sensing technology, are further fueling adoption. Furthermore, the growing focus on safety standards in industries like Automotive and Aerospace & Defense, which mandate precise distance sensing for collision avoidance and navigation, is a crucial growth driver. Economic factors, such as the pursuit of operational efficiency and cost reduction through automation, also play a vital role. For example, the implementation of smart logistics in warehouses, utilizing laser sensors for inventory management, is a key area of growth. The market size driven by these factors is projected to be 550 million by 2025.

Challenges in the Laser Distance Sensors Market

Despite the robust growth, the laser distance sensor market faces several challenges. High initial investment costs for advanced laser sensing systems can be a barrier for small and medium-sized enterprises (SMEs). Intense price competition among manufacturers, particularly for standard sensor models, can impact profit margins. The requirement for specialized technical expertise for installation, calibration, and maintenance of complex laser sensor systems can also pose a hurdle. Furthermore, environmental factors, such as dust, fog, or extreme temperatures, can occasionally affect sensor performance, necessitating the development of more robust solutions. Supply chain disruptions, as witnessed in recent global events, can also impact the availability and cost of components, posing a challenge to consistent market supply. The estimated impact of these challenges on market growth is approximately 10% reduction in projected revenue. The market value facing these challenges is estimated at 400 million in 2025.

Emerging Opportunities in Laser Distance Sensors

Emerging opportunities in the laser distance sensor market lie in the rapid expansion of the Internet of Things (IoT) and the growing demand for smart manufacturing solutions. The integration of laser distance sensors with AI and cloud computing platforms opens up avenues for predictive analytics, remote monitoring, and enhanced process optimization. The burgeoning field of autonomous systems, including drones, robots, and autonomous vehicles, presents a significant growth area, requiring highly accurate and reliable distance sensing for navigation and object detection. Furthermore, the increasing adoption of laser profiling and 3D scanning technologies for complex shape measurement and quality inspection in industries like construction and additive manufacturing offers substantial potential. Strategic partnerships between sensor manufacturers and software developers are key to unlocking these opportunities, creating integrated solutions that offer enhanced functionality and value. The market potential from these opportunities is estimated to be 700 million by 2025.

Leading Players in the Laser Distance Sensors Sector

- Honeywell

- Leuze Electronic

- SICK

- Autonics

- UTT

- Schneider Electric

- Mitsubishi Electric

- Bosch

- Wenglor

- Opto

- Fiso Technologies

- Prime Photonics

- Banner

- Bayspec

- Omron

- Laser Technology

- Keyence

- Ifm

- Acuity

- JENOPTIK

- LAP

- MTI Instruments

Key Milestones in Laser Distance Sensors Industry

- 2019: Launch of enhanced Time-of-Flight (ToF) laser sensors with improved range and accuracy.

- 2020: Increased integration of IoT capabilities in laser distance sensors for remote monitoring.

- 2021: Significant advancements in miniaturization, enabling smaller sensor footprints for embedded applications.

- 2022: Introduction of laser sensors with integrated AI for intelligent object recognition and classification.

- 2023: Growing adoption of laser sensors in autonomous vehicle development for sophisticated perception systems.

- 2024: Emergence of highly robust laser sensors designed for harsh industrial environments.

- 2025: Projected widespread adoption of digital laser sensors in smart factory initiatives.

- 2026-2033: Expected continuous innovation in sensor resolution, speed, and energy efficiency.

The estimated market value for these milestones is 480 million in 2025.

Strategic Outlook for Laser Distance Sensors Market

The strategic outlook for the laser distance sensor market is overwhelmingly positive, driven by ongoing technological advancements and the pervasive trend towards industrial automation and smart solutions. Growth accelerators include the continued development of AI-powered sensors, the expansion of applications in emerging fields like augmented reality and robotics, and the increasing demand for high-precision measurement in sectors like healthcare and advanced manufacturing. Companies that focus on delivering integrated, intelligent, and highly reliable laser sensing solutions, coupled with robust customer support and customization options, will be well-positioned for long-term success. Strategic partnerships and a focus on sustainable sensor design will further enhance market competitiveness and capitalize on evolving global demands. The projected market potential, driven by these strategies, is estimated to reach 800 million by 2033.

Laser Distance Sensors Segmentation

-

1. Application

- 1.1. Aerospace & Defense

- 1.2. Automotive

- 1.3. Food & Beverage

- 1.4. Pharmaceuticals

- 1.5. Others

-

2. Type

- 2.1. Digital Laser Sensor

- 2.2. CMOS Laser Sensor

- 2.3. Others

Laser Distance Sensors Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Laser Distance Sensors REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Laser Distance Sensors Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Aerospace & Defense

- 5.1.2. Automotive

- 5.1.3. Food & Beverage

- 5.1.4. Pharmaceuticals

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Digital Laser Sensor

- 5.2.2. CMOS Laser Sensor

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Laser Distance Sensors Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Aerospace & Defense

- 6.1.2. Automotive

- 6.1.3. Food & Beverage

- 6.1.4. Pharmaceuticals

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Digital Laser Sensor

- 6.2.2. CMOS Laser Sensor

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Laser Distance Sensors Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Aerospace & Defense

- 7.1.2. Automotive

- 7.1.3. Food & Beverage

- 7.1.4. Pharmaceuticals

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Digital Laser Sensor

- 7.2.2. CMOS Laser Sensor

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Laser Distance Sensors Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Aerospace & Defense

- 8.1.2. Automotive

- 8.1.3. Food & Beverage

- 8.1.4. Pharmaceuticals

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Digital Laser Sensor

- 8.2.2. CMOS Laser Sensor

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Laser Distance Sensors Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Aerospace & Defense

- 9.1.2. Automotive

- 9.1.3. Food & Beverage

- 9.1.4. Pharmaceuticals

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Digital Laser Sensor

- 9.2.2. CMOS Laser Sensor

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Laser Distance Sensors Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Aerospace & Defense

- 10.1.2. Automotive

- 10.1.3. Food & Beverage

- 10.1.4. Pharmaceuticals

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Digital Laser Sensor

- 10.2.2. CMOS Laser Sensor

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Honeywell

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Leuze Electronic

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SICK

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Autonics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 UTT

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Schneider Electric

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mitsubishi Electric

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bosch

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Wenglor

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Opto

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Fiso Technologies

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Prime Photonics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Banner

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Bayspec

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Omron

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Laser Technology

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Keyence

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Ifm

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Acuity

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 JENOPTIK

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 LAP

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 MTI Instruments

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 Honeywell

List of Figures

- Figure 1: Global Laser Distance Sensors Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Laser Distance Sensors Revenue (million), by Application 2024 & 2032

- Figure 3: North America Laser Distance Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Laser Distance Sensors Revenue (million), by Type 2024 & 2032

- Figure 5: North America Laser Distance Sensors Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Laser Distance Sensors Revenue (million), by Country 2024 & 2032

- Figure 7: North America Laser Distance Sensors Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Laser Distance Sensors Revenue (million), by Application 2024 & 2032

- Figure 9: South America Laser Distance Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Laser Distance Sensors Revenue (million), by Type 2024 & 2032

- Figure 11: South America Laser Distance Sensors Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Laser Distance Sensors Revenue (million), by Country 2024 & 2032

- Figure 13: South America Laser Distance Sensors Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Laser Distance Sensors Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Laser Distance Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Laser Distance Sensors Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Laser Distance Sensors Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Laser Distance Sensors Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Laser Distance Sensors Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Laser Distance Sensors Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Laser Distance Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Laser Distance Sensors Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Laser Distance Sensors Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Laser Distance Sensors Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Laser Distance Sensors Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Laser Distance Sensors Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Laser Distance Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Laser Distance Sensors Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Laser Distance Sensors Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Laser Distance Sensors Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Laser Distance Sensors Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Laser Distance Sensors Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Laser Distance Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Laser Distance Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Laser Distance Sensors Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Laser Distance Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Laser Distance Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Laser Distance Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Laser Distance Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Laser Distance Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Laser Distance Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Laser Distance Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Laser Distance Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Laser Distance Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Laser Distance Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Laser Distance Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Laser Distance Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Laser Distance Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Laser Distance Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Laser Distance Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Laser Distance Sensors Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Laser Distance Sensors?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Laser Distance Sensors?

Key companies in the market include Honeywell, Leuze Electronic, SICK, Autonics, UTT, Schneider Electric, Mitsubishi Electric, Bosch, Wenglor, Opto, Fiso Technologies, Prime Photonics, Banner, Bayspec, Omron, Laser Technology, Keyence, Ifm, Acuity, JENOPTIK, LAP, MTI Instruments.

3. What are the main segments of the Laser Distance Sensors?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Laser Distance Sensors," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Laser Distance Sensors report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Laser Distance Sensors?

To stay informed about further developments, trends, and reports in the Laser Distance Sensors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence