Key Insights

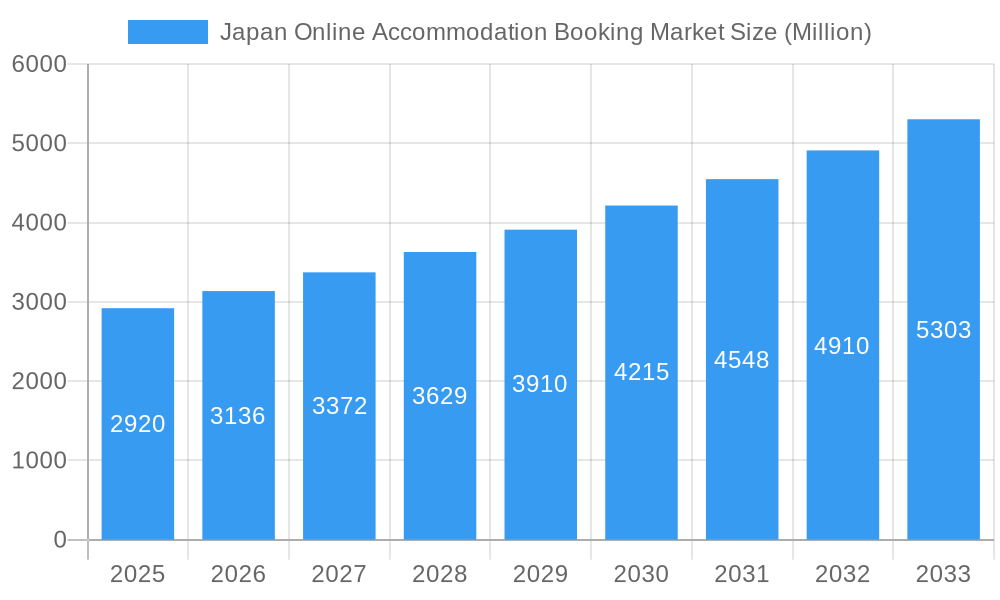

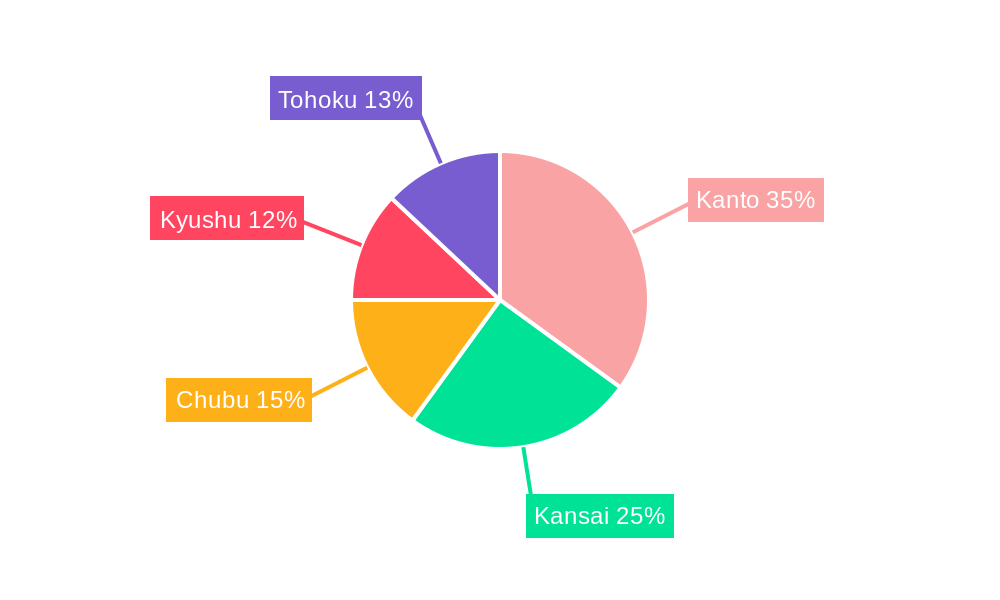

The Japan online accommodation booking market, valued at $2.92 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.5% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing penetration of smartphones and high-speed internet access across Japan significantly boosts online bookings. A burgeoning tourism sector, particularly inbound tourism, further fuels market demand. The preference for convenience and price comparison offered by online platforms, coupled with the growing popularity of mobile booking apps, contributes to this upward trajectory. Furthermore, the strategic investments and innovative offerings by major players like Rakuten Travel, Agoda, and Expedia are driving competition and market expansion. The market segmentation reveals a strong preference for both mobile applications and third-party online portals, highlighting the importance of a multi-channel approach for businesses in this sector. Regional variations exist, with Kanto and Kansai regions likely leading in market share due to their higher population density and tourist attractions.

Japan Online Accommodation Booking Market Market Size (In Billion)

However, certain restraints could temper growth. Fluctuations in currency exchange rates and global economic uncertainty can impact international tourism and consequently, online booking volume. Furthermore, increasing competition among established and emerging players necessitates continuous innovation and customer-centric strategies. Maintaining consumer trust and addressing concerns regarding data privacy and security are also crucial factors for sustainable growth. The market's future growth depends on effectively navigating these challenges and capitalizing on emerging trends such as personalized travel experiences, sustainable tourism initiatives, and the integration of Artificial Intelligence (AI) in booking platforms. The diverse range of accommodation options, from traditional Ryokans to modern hotels, presents opportunities for platforms specializing in niche offerings, further fragmenting the market and driving growth in specific segments.

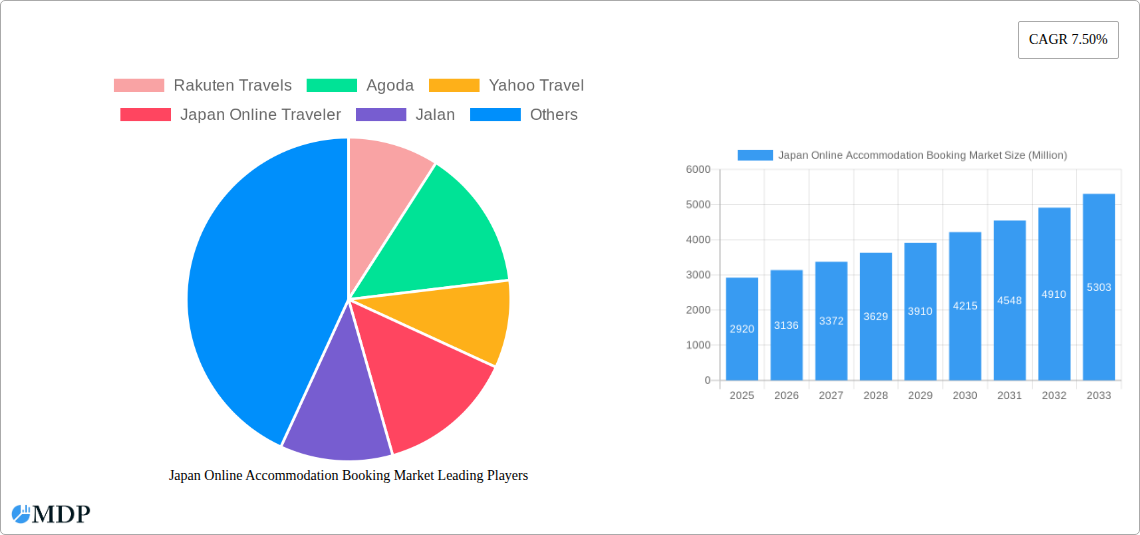

Japan Online Accommodation Booking Market Company Market Share

Japan Online Accommodation Booking Market: A Comprehensive Report (2019-2033)

This comprehensive report offers a deep dive into the dynamic Japan online accommodation booking market, providing invaluable insights for industry stakeholders, investors, and strategic planners. With a detailed analysis spanning the period 2019-2033 (historical period: 2019-2024; base year: 2025; forecast period: 2025-2033), this report unveils the market's size, growth trajectory, key players, and emerging trends. The market is projected to reach xx Million by 2033, demonstrating significant potential for growth. The report incorporates detailed analysis of key players like Rakuten Travels, Agoda, Yahoo Travel, Japan Online Traveler, Jalan, Booking.com, Hotels.com, Expedia, JTB Group, JAPANiCAN, and others, providing a 360-degree view of the competitive landscape. This report is crucial for understanding the market's complexities and formulating effective strategies.

Japan Online Accommodation Booking Market Market Dynamics & Concentration

The Japan online accommodation booking market exhibits a high level of concentration, with a few major players commanding significant market share. Rakuten Travels, Agoda, and Booking.com, for example, hold a combined xx% of the market share in 2025 (estimated), reflecting the dominance of established global and domestic brands. However, the market is also witnessing an increase in innovative startups and niche players, introducing new services and technologies.

Market dynamics are shaped by several factors:

- Innovation Drivers: The integration of AI-powered recommendation systems, personalized travel packages, and virtual reality tours is driving market expansion. The adoption of blockchain technology for secure transactions is also gaining traction.

- Regulatory Frameworks: Government regulations concerning data privacy, consumer protection, and taxation influence market operations. Compliance with these regulations is crucial for businesses to operate smoothly.

- Product Substitutes: Alternative accommodation options like Airbnb and vacation rentals pose competitive pressure on traditional hotels and online booking platforms. This pressure is mitigated by the growing popularity of hybrid models integrating hotels and other accommodations into one platform.

- End-User Trends: Rising disposable incomes, increased domestic and international tourism, and a preference for online booking convenience are key drivers for market growth. Younger generations are especially inclined to use mobile applications for booking.

- M&A Activities: The market has witnessed a significant number of mergers and acquisitions (M&A) in recent years, with xx deals recorded between 2019 and 2024. These activities aim to expand market reach, enhance service offerings, and consolidate market share. This trend is projected to continue, with an estimated xx M&A deals anticipated by 2033.

Japan Online Accommodation Booking Market Industry Trends & Analysis

The Japan online accommodation booking market is experiencing robust growth, driven by a confluence of factors. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). This growth is largely attributed to the increasing penetration of smartphones and internet access across Japan, coupled with shifting consumer preferences towards online travel booking.

Technological disruptions, such as the introduction of sophisticated booking engines, personalized travel recommendations, and improved payment gateways, enhance customer experience and drive market expansion. Consumer preferences are also evolving, with a strong preference towards mobile app bookings and a demand for transparent pricing and seamless user interfaces. Competitive dynamics are characterized by both intense rivalry among established players and the emergence of new market entrants, who leverage innovative business models. Market penetration of online booking platforms is approximately xx% in 2025 (estimated) and is anticipated to reach xx% by 2033, highlighting significant growth opportunities. The market also sees a shift toward sustainable travel, with eco-friendly accommodations gaining prominence.

Leading Markets & Segments in Japan Online Accommodation Booking Market

The Japanese online accommodation booking market is dominated by major metropolitan areas like Tokyo, Osaka, Kyoto, and Hokkaido, due to high tourist traffic and robust infrastructure. These regions also see higher adoption of online booking platforms.

- By Platform:

- Mobile Applications: Mobile applications are experiencing rapid growth, accounting for xx% of total bookings in 2025 (estimated), owing to increased smartphone penetration and user convenience. Key drivers include ease of access, personalized features, and the ability to make reservations on the go.

- Websites: Websites still maintain a significant share (xx% in 2025, estimated), particularly among older demographics who are more comfortable with desktop computers.

- By Mode of Booking:

- Third-Party Online Portals: These platforms, such as Booking.com, Agoda, and Expedia, hold a significant market share (xx% in 2025, estimated) due to their wide selection of properties and competitive pricing. However, direct booking is growing steadily.

- Direct/Captive Portals: Hotels' own booking platforms and websites are growing in popularity, gaining xx% market share in 2025 (estimated) as hotels aim to bypass commission fees and build stronger customer relationships. This trend is facilitated by improved user experience on these portals.

Japan Online Accommodation Booking Market Product Developments

Recent product innovations focus on enhancing user experience and providing personalized services. AI-powered chatbots offer instant customer support, while personalized recommendations increase booking conversions. Integration with loyalty programs and reward systems enhances customer engagement. The increasing use of VR technology allows users to virtually tour accommodations before booking, thereby reducing uncertainty and increasing confidence. This aligns with the growing trend towards seamless and transparent online travel experiences.

Key Drivers of Japan Online Accommodation Booking Market Growth

Several factors contribute to the market's growth:

- Technological Advancements: The continuous development of user-friendly mobile apps, advanced booking engines, and AI-driven personalized recommendations are fueling market expansion.

- Economic Growth: Rising disposable incomes and increased tourism spending boost demand for online accommodation booking services.

- Favorable Government Policies: Government initiatives promoting tourism and improving infrastructure facilitate the growth of the online booking sector.

Challenges in the Japan Online Accommodation Booking Market Market

The market faces several challenges:

- Intense Competition: The presence of numerous established and emerging players intensifies competition, impacting profitability.

- Data Security Concerns: Ensuring the security of sensitive customer data is critical and requires substantial investments in cybersecurity measures.

- Fluctuating Exchange Rates: Currency fluctuations impact pricing and profitability, especially for international travelers.

Emerging Opportunities in Japan Online Accommodation Booking Market

Emerging opportunities lie in leveraging technological innovations such as blockchain technology for secure transactions, AI for personalized recommendations, and VR for immersive experiences. Strategic partnerships between online platforms and local businesses can enhance offerings and broaden market reach. Expansion into niche markets like eco-tourism and luxury travel opens doors to new revenue streams.

Leading Players in the Japan Online Accommodation Booking Market Sector

- Rakuten Travels

- Agoda

- Yahoo Travel

- Japan Online Traveler

- Jalan

- Booking.com

- Hotels.com

- Expedia

- JTB Group

- JAPANiCAN

Key Milestones in Japan Online Accommodation Booking Market Industry

- March 2022: RateGain Technologies partnered with Rakuten Travel Xchange, expanding Rakuten's global hotel supply and enhancing customer choice. This significantly impacted Rakuten's competitive positioning.

- April 2022: Bear Luxe partnered with Sabre, integrating Sabre's corporate booking tools and expanding Sabre's presence in the Japanese market. This improved Bear Luxe's access to corporate clients and enhanced its booking capabilities.

Strategic Outlook for Japan Online Accommodation Booking Market Market

The future of the Japan online accommodation booking market is bright, with continued growth fueled by technological innovation, increasing smartphone penetration, and the ever-growing demand for convenient and personalized travel experiences. Strategic partnerships, expansion into niche markets, and a focus on providing exceptional customer service will be crucial for success. Companies that leverage data analytics to understand customer preferences and adapt their offerings accordingly will gain a significant competitive advantage.

Japan Online Accommodation Booking Market Segmentation

-

1. Platform

- 1.1. Mobile application

- 1.2. Website

-

2. Mode of Booking

- 2.1. Third party online portals

- 2.2. Direct / captive portals

Japan Online Accommodation Booking Market Segmentation By Geography

- 1. Japan

Japan Online Accommodation Booking Market Regional Market Share

Geographic Coverage of Japan Online Accommodation Booking Market

Japan Online Accommodation Booking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Social Media and Celebrity Influence; Increasing Disposable Income

- 3.3. Market Restrains

- 3.3.1. Cost of Services is a Restraining Factor for the Market; Limited Insurance Coverage is Restraining the Market

- 3.4. Market Trends

- 3.4.1. Advancement in Technology has led to Growth in the Online Accommodation Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Online Accommodation Booking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Mobile application

- 5.1.2. Website

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 5.2.1. Third party online portals

- 5.2.2. Direct / captive portals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rakuten Travels

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Agoda

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yahoo Travel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Japan Online Traveler

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jalan

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Booking

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hotels com

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Expedia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JTB Group**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 JAPANiCAN

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rakuten Travels

List of Figures

- Figure 1: Japan Online Accommodation Booking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Online Accommodation Booking Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Online Accommodation Booking Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: Japan Online Accommodation Booking Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 3: Japan Online Accommodation Booking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Japan Online Accommodation Booking Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 5: Japan Online Accommodation Booking Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 6: Japan Online Accommodation Booking Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Online Accommodation Booking Market?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the Japan Online Accommodation Booking Market?

Key companies in the market include Rakuten Travels, Agoda, Yahoo Travel, Japan Online Traveler, Jalan, Booking, Hotels com, Expedia, JTB Group**List Not Exhaustive, JAPANiCAN.

3. What are the main segments of the Japan Online Accommodation Booking Market?

The market segments include Platform, Mode of Booking.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Social Media and Celebrity Influence; Increasing Disposable Income.

6. What are the notable trends driving market growth?

Advancement in Technology has led to Growth in the Online Accommodation Market.

7. Are there any restraints impacting market growth?

Cost of Services is a Restraining Factor for the Market; Limited Insurance Coverage is Restraining the Market.

8. Can you provide examples of recent developments in the market?

April 2022: Bear Luxe and a B2B membership portal signed a distribution agreement with Sabre to expand Sabre’s footprint in Japan. Sabre’s corporate booking tools will allow the Japanese company to connect with corporate travel buyers. This partnership will also enable the Bear Luxe platform to drive direct bookings, increase engagement, and trigger conversions through the deep retail focus of the Sabre SynXis Booking Engine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Online Accommodation Booking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Online Accommodation Booking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Online Accommodation Booking Market?

To stay informed about further developments, trends, and reports in the Japan Online Accommodation Booking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence