Key Insights

The Israeli commercial real estate market is poised for significant expansion, projected to reach $25 billion by 2025, with a compound annual growth rate (CAGR) of 6.5% from 2025 to 2033. This growth is underpinned by a dynamic technology sector, robust foreign investment, and expanding tourism. Demand for office space in key cities such as Tel Aviv and Jerusalem is on the rise, while the retail and hospitality sectors are benefiting from increasing consumer spending. Government-led infrastructure development and urban regeneration projects are also key growth drivers. Despite potential headwinds from construction costs and interest rate volatility, the office and retail segments are expected to lead market expansion.

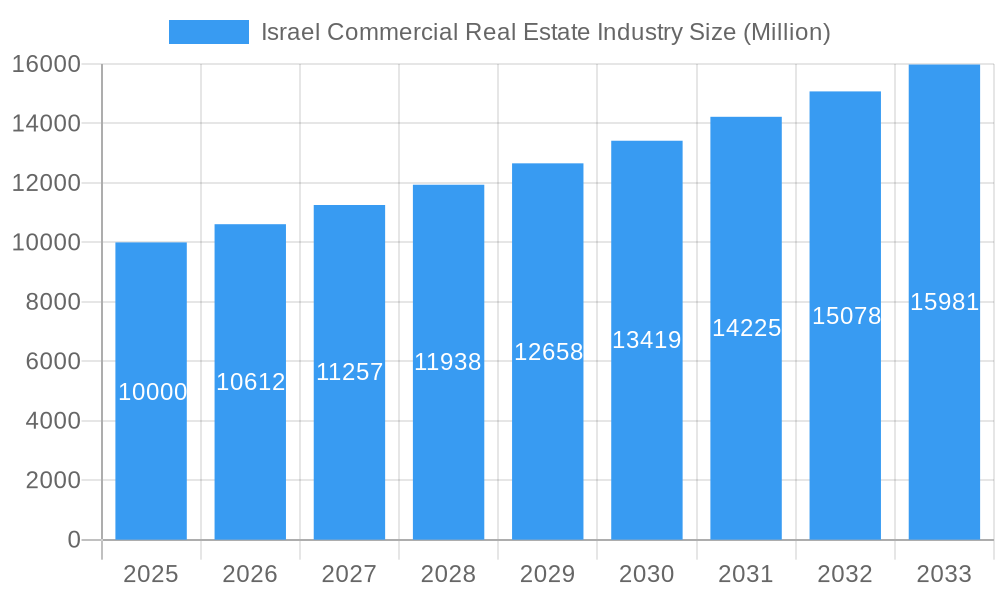

Israel Commercial Real Estate Industry Market Size (In Billion)

The market exhibits distinct segmentation by end-user. The "Businesses" segment currently leads, driven by technological advancements and corporate expansion. The "Government" segment provides consistent demand for public infrastructure and buildings. The "Individuals" segment, comprising smaller investors, presents a substantial growth opportunity. Significant regional variations exist, with major urban centers like Tel Aviv demonstrating the strongest growth. Leading entities such as Azrieli Group, Gazit-Globe, and Melisron are strategically positioned to leverage market trends, though competitive pressures are anticipated to increase.

Israel Commercial Real Estate Industry Company Market Share

Israel Commercial Real Estate Industry: 2019-2033 Market Report

Unlocking the potential of Israel's dynamic commercial real estate market with this comprehensive report, providing in-depth analysis and future forecasts (2019-2033). This report offers actionable insights for investors, developers, and industry stakeholders navigating the complexities of this thriving sector. From analyzing market concentration and identifying leading players to exploring emerging opportunities and challenges, this report equips you with the knowledge to make informed decisions and capitalize on future growth.

Israel Commercial Real Estate Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of the Israeli commercial real estate market from 2019-2033. We delve into market concentration, assessing the market share held by key players like Azrieli Group Ltd, Gazit-Globe Ltd, and Melisron Ltd. The report examines the influence of regulatory frameworks, technological innovation, and substitution effects on market dynamics. Furthermore, we analyze M&A activity, quantifying deal counts and their impact on market consolidation. The study period (2019-2024) provides a historical context, while the forecast period (2025-2033) offers predictions, using 2025 as the base and estimated year.

- Market Concentration: Analysis of market share distribution across major players (e.g., top 5 players hold XX% of the market in 2025).

- Innovation Drivers: Examination of technological advancements impacting construction, management, and leasing strategies.

- Regulatory Framework: Assessment of government policies and regulations influencing market activity (e.g., building permits, zoning laws).

- Product Substitutes: Analysis of alternative investment options and their impact on market demand.

- End-User Trends: Exploration of shifting preferences and needs of businesses and individuals influencing property demand.

- M&A Activity: Detailed analysis of M&A deal counts and values from 2019 to 2024 and projections for 2025-2033 (e.g., XX deals totaling $XX Million in 2024).

Israel Commercial Real Estate Industry Industry Trends & Analysis

This section provides a detailed examination of market trends shaping the Israeli commercial real estate landscape. We analyze growth drivers such as population growth, economic expansion, and urbanization. The report also explores the impact of technological disruptions, including PropTech innovations and their influence on market efficiency and consumer preferences. Competitive dynamics, including strategies employed by leading players, are scrutinized. The Compound Annual Growth Rate (CAGR) and market penetration rates are provided for key segments across the forecast period (2025-2033).

Leading Markets & Segments in Israel Commercial Real Estate Industry

This section identifies the dominant regions, product types (Office, Retail, Industrial, Residential), and end-users (Businesses, Government, Individuals) within the Israeli commercial real estate market. A detailed analysis explains the factors driving this dominance, incorporating both qualitative and quantitative data. Key drivers are highlighted using bullet points.

- Dominant Segment: (e.g., The Office segment is projected to dominate the market, with a XX% market share in 2025, driven by…)

- Key Drivers for Dominant Segment:

- Strong economic growth in Tel Aviv and other major cities.

- Increased demand from technology companies and multinational corporations.

- Government initiatives promoting economic development in specific regions.

- Robust infrastructure development supporting efficient connectivity.

Israel Commercial Real Estate Industry Product Developments

This section summarizes key product innovations, applications, and the competitive advantages they offer. It focuses on the technological advancements driving product development and their alignment with market demands. We analyze how these innovations influence market competitiveness and provide a competitive edge for developers and businesses.

Key Drivers of Israel Commercial Real Estate Industry Growth

This section outlines the primary factors fueling the growth of the Israeli commercial real estate market. We discuss the synergistic effect of technological advancements, economic expansion, and supportive government policies. Specific examples are provided to illustrate the impact of these drivers.

Challenges in the Israel Commercial Real Estate Industry Market

This section highlights the major hurdles impeding the growth of the Israeli commercial real estate market. These challenges include regulatory constraints, supply chain disruptions, and intense competition. The report quantifies the impact of these restraints on market growth.

Emerging Opportunities in Israel Commercial Real Estate Industry

This section explores promising opportunities for long-term growth within the Israeli commercial real estate sector. We highlight strategic partnerships, technological breakthroughs, and market expansion strategies that promise significant returns for investors and developers.

Leading Players in the Israel Commercial Real Estate Industry Sector

- Azrieli Group Ltd

- Gazit-Globe Ltd

- Melisron Ltd

- Arko Holdings Ltd

- Ashtrom Group Ltd

- Elbit Imaging Ltd

Key Milestones in Israel Commercial Real Estate Industry Industry

- 2020-Q2: Completion of the XX project, adding xx Million square feet of office space in Tel Aviv.

- 2022-Q4: Merger between Company A and Company B, creating a leading player in the residential market.

- 2023-Q1: Launch of a new PropTech platform streamlining property management.

Strategic Outlook for Israel Commercial Real Estate Industry Market

The Israeli commercial real estate market presents significant long-term growth potential. Strategic opportunities exist for investors and developers who leverage technological advancements, tap into emerging sectors, and adapt to changing consumer preferences. The market's resilience and capacity for innovation suggest a positive outlook for the forecast period.

Israel Commercial Real Estate Industry Segmentation

- 1. Offices

- 2. Industrial

- 3. Retail

- 4. Hotels

- 5. Other Property Types

Israel Commercial Real Estate Industry Segmentation By Geography

- 1. Israel

Israel Commercial Real Estate Industry Regional Market Share

Geographic Coverage of Israel Commercial Real Estate Industry

Israel Commercial Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing need for contemporary office spaces; Urban and semi-urban lodging are acting as other significant growth-inducing factors

- 3.3. Market Restrains

- 3.3.1. Availability of Financing

- 3.4. Market Trends

- 3.4.1. Shortage of Building Land and Labor Availability

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Israel Commercial Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offices

- 5.2. Market Analysis, Insights and Forecast - by Industrial

- 5.3. Market Analysis, Insights and Forecast - by Retail

- 5.4. Market Analysis, Insights and Forecast - by Hotels

- 5.5. Market Analysis, Insights and Forecast - by Other Property Types

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Israel

- 5.1. Market Analysis, Insights and Forecast - by Offices

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 8 COMPANY PROFILES

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Azrieli Group Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gazit-Globe Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Melisron Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arko Holdings Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ashtrom Group Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Elbit Imaging Lt

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 8 COMPANY PROFILES

List of Figures

- Figure 1: Israel Commercial Real Estate Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Israel Commercial Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Israel Commercial Real Estate Industry Revenue billion Forecast, by Offices 2020 & 2033

- Table 2: Israel Commercial Real Estate Industry Revenue billion Forecast, by Industrial 2020 & 2033

- Table 3: Israel Commercial Real Estate Industry Revenue billion Forecast, by Retail 2020 & 2033

- Table 4: Israel Commercial Real Estate Industry Revenue billion Forecast, by Hotels 2020 & 2033

- Table 5: Israel Commercial Real Estate Industry Revenue billion Forecast, by Other Property Types 2020 & 2033

- Table 6: Israel Commercial Real Estate Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Israel Commercial Real Estate Industry Revenue billion Forecast, by Offices 2020 & 2033

- Table 8: Israel Commercial Real Estate Industry Revenue billion Forecast, by Industrial 2020 & 2033

- Table 9: Israel Commercial Real Estate Industry Revenue billion Forecast, by Retail 2020 & 2033

- Table 10: Israel Commercial Real Estate Industry Revenue billion Forecast, by Hotels 2020 & 2033

- Table 11: Israel Commercial Real Estate Industry Revenue billion Forecast, by Other Property Types 2020 & 2033

- Table 12: Israel Commercial Real Estate Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Israel Commercial Real Estate Industry?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Israel Commercial Real Estate Industry?

Key companies in the market include 8 COMPANY PROFILES, Azrieli Group Ltd, Gazit-Globe Ltd, Melisron Ltd, Arko Holdings Ltd, Ashtrom Group Ltd, Elbit Imaging Lt.

3. What are the main segments of the Israel Commercial Real Estate Industry?

The market segments include Offices, Industrial, Retail, Hotels, Other Property Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 25 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing need for contemporary office spaces; Urban and semi-urban lodging are acting as other significant growth-inducing factors.

6. What are the notable trends driving market growth?

Shortage of Building Land and Labor Availability.

7. Are there any restraints impacting market growth?

Availability of Financing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Israel Commercial Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Israel Commercial Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Israel Commercial Real Estate Industry?

To stay informed about further developments, trends, and reports in the Israel Commercial Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence