Key Insights

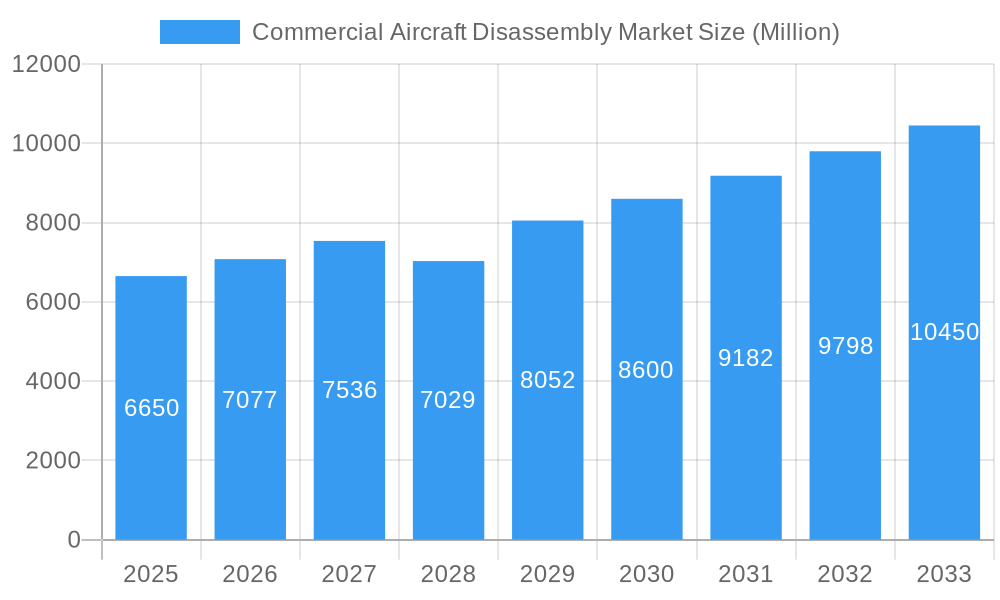

The commercial aircraft disassembly market is experiencing robust growth, projected to reach a market size of $6.65 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 6.39% from 2025 to 2033. This expansion is fueled by several key factors. The increasing age of the global aircraft fleet necessitates more frequent disassembly and dismantling operations, driving demand for efficient and cost-effective solutions. Furthermore, stringent environmental regulations regarding aircraft waste disposal are pushing airlines and leasing companies to prioritize responsible recycling and material recovery initiatives. The growing demand for reusable serviceable materials and rotable parts from disassembled aircraft, coupled with advancements in disassembly technologies that optimize resource recovery, further contribute to market growth. The market is segmented by application (disassembly & dismantling, recycling & storage, used serviceable material, rotable parts) and aircraft type (narrow-body, wide-body, regional jets). North America, particularly the United States, is expected to maintain a significant market share due to its large fleet size and well-established aerospace industry. However, regions like Asia-Pacific are demonstrating rapid growth potential given the expansion of air travel and the increasing number of aircraft reaching the end of their operational lifespan in this area. Competitive landscape analysis reveals key players including A J Walter Aviation Limited, Magellan Aerospace, and others, constantly striving for innovation and strategic partnerships to capture market share.

Commercial Aircraft Disassembly Market Market Size (In Billion)

The continued growth trajectory is expected to be influenced by several ongoing trends. The increasing adoption of sustainable aviation practices will enhance demand for recycling and efficient material recovery services. Technological advancements in disassembly processes, leading to higher efficiency and reduced environmental impact, will also play a significant role. However, potential restraints include the high initial investment required for advanced disassembly technologies and the need for skilled labor. Nevertheless, the long-term outlook remains positive, with the market poised for consistent growth driven by the continued expansion of the global commercial airline industry and an emphasis on responsible aircraft lifecycle management. The market is segmented geographically, with North America, Europe, and Asia-Pacific representing the key regions. Competitive dynamics will continue to shape market evolution, with companies focusing on service innovation, technological advancements, and strategic acquisitions to enhance their market positions.

Commercial Aircraft Disassembly Market Company Market Share

Commercial Aircraft Disassembly Market: A Comprehensive Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the Commercial Aircraft Disassembly Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with 2025 as the base year and a forecast period extending to 2033. The report delves into market dynamics, industry trends, leading segments, key players, and emerging opportunities, providing a 360-degree view of this rapidly evolving market projected to reach xx Million by 2033.

Commercial Aircraft Disassembly Market Market Dynamics & Concentration

The Commercial Aircraft Disassembly Market is characterized by a moderately concentrated landscape, with several key players vying for market share. Market concentration is influenced by factors such as the availability of specialized expertise, technological capabilities, and global reach. The market exhibits considerable innovation, driven by advancements in materials recycling, automation technologies, and the development of environmentally friendly disassembly techniques. Stringent environmental regulations concerning aircraft waste disposal play a crucial role, while the rising cost of new aircraft and increasing focus on sustainability further drive market expansion. Product substitutes are limited, primarily focusing on alternative material sourcing, but their current impact is minimal. End-user trends reflect an increasing demand for sustainable and cost-effective solutions, propelling the market forward.

Significant M&A activity has shaped the market's competitive dynamics, evidenced by acquisitions like AAR's acquisition of AELS. This consolidation trend continues to create larger and more powerful industry players. The following illustrate market concentration and M&A activity.

- Market Share: The top 5 players currently hold approximately 60% of the market share, with the remaining share distributed among smaller, regional players.

- M&A Deal Counts: An average of xx M&A deals per year have been observed during the historical period (2019-2024), indicating significant consolidation.

Commercial Aircraft Disassembly Market Industry Trends & Analysis

The global Commercial Aircraft Disassembly Market is undergoing a robust expansion, propelled by a confluence of critical factors. With an aging global aircraft fleet, the demand for specialized disassembly and comprehensive recycling services is on a significant upward trajectory. Projections indicate a notable Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033, largely fueled by the aviation industry's escalating commitment to sustainable practices and the imperative of resource recovery. Groundbreaking advancements in technology, particularly in the recycling of advanced composite materials, are fundamentally reshaping market dynamics. These innovations are paving the way for more efficient, cost-effective, and environmentally responsible recycling solutions. Furthermore, a growing consumer and regulatory preference for eco-conscious practices is exerting increasing pressure on airlines and other industry stakeholders to adopt sustainable end-of-life strategies for their aircraft. The competitive intensity among market participants is fostering a climate of continuous innovation and driving down costs, ultimately benefiting end-users. Market penetration rates are steadily climbing, reflecting a heightened awareness and broader adoption of sophisticated aircraft disassembly and recycling processes.

Leading Markets & Segments in Commercial Aircraft Disassembly Market

North America currently dominates the Commercial Aircraft Disassembly Market, driven by robust regulatory frameworks, a large fleet of aging aircraft, and the presence of several major players. Europe and Asia-Pacific are also significant markets, showing promising growth potential.

By Application:

- Disassembly and Dismantling: This segment holds the largest market share, driven by the fundamental need for safe and efficient aircraft decommissioning.

- Recycling and Storage: Growing emphasis on sustainability and resource recovery drives substantial growth in this segment.

- Used Serviceable Material: The reuse of aircraft components presents a significant cost-saving opportunity.

- Rotable Parts: The high value of reusable parts fuels significant demand within this segment.

By Aircraft Type:

- Narrow-body Aircraft: The large number of narrow-body aircraft in operation contributes to high volumes in this segment.

- Wide-body Aircraft: Wide-body aircraft disassembly presents unique challenges and opportunities related to size and material composition.

- Regional Jets: This segment exhibits steady growth, mirroring the expansion of regional air travel.

Key Drivers for Dominant Regions:

- North America: Stringent environmental regulations, advanced recycling technologies, and the presence of major players.

- Europe: Strong environmental consciousness and supportive government policies.

- Asia-Pacific: Rapid growth of the aviation industry and increasing fleet size.

Commercial Aircraft Disassembly Market Product Developments

Significant strides are being made in aircraft disassembly technologies, consistently enhancing both the efficiency and economic viability of the process. Paramount among these developments are novel techniques for the recycling of composite materials, which are instrumental in minimizing the environmental footprint of aircraft end-of-life management and unlocking greater value from reusable components. The integration of automated systems and robotic solutions is dramatically accelerating disassembly speeds and improving precision, leading to reduced waste generation and heightened operational safety. This continuous technological evolution directly contributes to a more competitive market landscape, benefiting both large-scale operators and specialized niche service providers.

Key Drivers of Commercial Aircraft Disassembly Market Growth

The expansion of the Commercial Aircraft Disassembly Market is being vigorously driven by a combination of powerful forces. A primary catalyst is the increasing volume of end-of-life aircraft reaching their operational limits. Simultaneously, stringent environmental regulations worldwide are mandating more sustainable disposal methods. Technological innovations in material recycling and automation are streamlining disassembly operations, making them more efficient and cost-effective. Heightened global awareness of environmental concerns and the critical need to minimize landfill waste are also significant contributors. Economically, the substantial cost savings realized through the recovery and reuse of serviceable aircraft materials and rotable parts represent a compelling driver for market growth.

Challenges in the Commercial Aircraft Disassembly Market Market

The Commercial Aircraft Disassembly Market encounters several inherent challenges. The inherent complexity of modern aircraft structures, particularly those incorporating advanced composite materials, requires specialized expertise and sophisticated equipment. This complexity can act as a barrier to entry for smaller market participants. Furthermore, fluctuations in the prices of raw materials and the availability of a skilled workforce introduce further volatility into market dynamics. The regulatory environment, often characterized by its complexity and significant cross-border variations, adds another layer of difficulty. These combined factors can impede market growth, especially for smaller firms lacking the extensive resources required to navigate these intricacies. Ultimately, these challenges can impact the profitability of market players in specific regions.

Emerging Opportunities in Commercial Aircraft Disassembly Market

The long-term growth potential is considerable. The development of advanced recycling techniques for composite materials presents a significant opportunity to enhance the economic and environmental benefits of aircraft disassembly. Strategic partnerships between airlines, aircraft manufacturers, and disassembly companies can unlock synergies and drive innovation. Expanding into emerging markets with rapidly growing aircraft fleets represents another significant opportunity for market expansion and profitability.

Leading Players in the Commercial Aircraft Disassembly Market Sector

- A J Walter Aviation Limited

- Magellan Aerospace

- CAVU Aerospace Inc

- AerSale Inc

- AAR

- Air Salvage International Ltd

- Aircraft End-of-Life Solutions AELS

- China Aircraft Leasing Group Holdings Lt

- AerCap Holdings N V

- Ascent Aviation Services

Key Milestones in Commercial Aircraft Disassembly Market Industry

- June 2023: Ascent Aviation Services opens a new aircraft disassembly and dismantling facility in Arizona, boosting capacity to meet growing U.S. demand.

- April 2023: AAR acquires Aircraft End-of-Life Solutions (AELS), expanding its global footprint and expertise in composite recycling.

Strategic Outlook for Commercial Aircraft Disassembly Market Market

The Commercial Aircraft Disassembly Market is strategically positioned for substantial future growth, underpinned by the escalating demand for sustainable end-of-life solutions, continuous technological advancements, and evolving regulatory frameworks. To capitalize on this considerable market potential, strategic alliances and targeted investments in pioneering recycling technologies will be paramount. Companies are encouraged to prioritize the development of environmentally sound processes, optimize operational efficiencies, and strategically expand their global presence to secure and maintain a competitive advantage. The opportunity for significant value creation through the implementation of innovative recycling techniques and the formation of strategic partnerships will undoubtedly shape the future success of key market players.

Commercial Aircraft Disassembly Market Segmentation

-

1. Application

- 1.1. Disassembly and Dismantling

- 1.2. Recycling and Storage

- 1.3. Used Serviceable Material

- 1.4. Rotable Parts

Commercial Aircraft Disassembly Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Israel

- 5.4. Rest of Middle East and Africa

Commercial Aircraft Disassembly Market Regional Market Share

Geographic Coverage of Commercial Aircraft Disassembly Market

Commercial Aircraft Disassembly Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Narrow Body Segment to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Aircraft Disassembly Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Disassembly and Dismantling

- 5.1.2. Recycling and Storage

- 5.1.3. Used Serviceable Material

- 5.1.4. Rotable Parts

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Commercial Aircraft Disassembly Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Disassembly and Dismantling

- 6.1.2. Recycling and Storage

- 6.1.3. Used Serviceable Material

- 6.1.4. Rotable Parts

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Commercial Aircraft Disassembly Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Disassembly and Dismantling

- 7.1.2. Recycling and Storage

- 7.1.3. Used Serviceable Material

- 7.1.4. Rotable Parts

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Commercial Aircraft Disassembly Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Disassembly and Dismantling

- 8.1.2. Recycling and Storage

- 8.1.3. Used Serviceable Material

- 8.1.4. Rotable Parts

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Commercial Aircraft Disassembly Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Disassembly and Dismantling

- 9.1.2. Recycling and Storage

- 9.1.3. Used Serviceable Material

- 9.1.4. Rotable Parts

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Commercial Aircraft Disassembly Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Disassembly and Dismantling

- 10.1.2. Recycling and Storage

- 10.1.3. Used Serviceable Material

- 10.1.4. Rotable Parts

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 A J Walter Aviation Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Magellan Aerospace

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CAVU Aerospace Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AerSale Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AAR

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Air Salvage International Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Aircraft End-of-Life Solutions AELS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 China Aircraft Leasing Group Holdings Lt

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AerCap Holdings N V

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ascent Aviation Services

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 A J Walter Aviation Limited

List of Figures

- Figure 1: Global Commercial Aircraft Disassembly Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Commercial Aircraft Disassembly Market Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Commercial Aircraft Disassembly Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Commercial Aircraft Disassembly Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Commercial Aircraft Disassembly Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Commercial Aircraft Disassembly Market Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe Commercial Aircraft Disassembly Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Commercial Aircraft Disassembly Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Commercial Aircraft Disassembly Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Commercial Aircraft Disassembly Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Pacific Commercial Aircraft Disassembly Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Commercial Aircraft Disassembly Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Commercial Aircraft Disassembly Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Commercial Aircraft Disassembly Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Latin America Commercial Aircraft Disassembly Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Latin America Commercial Aircraft Disassembly Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Commercial Aircraft Disassembly Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Commercial Aircraft Disassembly Market Revenue (Million), by Application 2025 & 2033

- Figure 19: Middle East and Africa Commercial Aircraft Disassembly Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Commercial Aircraft Disassembly Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Commercial Aircraft Disassembly Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Commercial Aircraft Disassembly Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Commercial Aircraft Disassembly Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Commercial Aircraft Disassembly Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Commercial Aircraft Disassembly Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Commercial Aircraft Disassembly Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Commercial Aircraft Disassembly Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Commercial Aircraft Disassembly Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Commercial Aircraft Disassembly Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Germany Commercial Aircraft Disassembly Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Commercial Aircraft Disassembly Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Commercial Aircraft Disassembly Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Commercial Aircraft Disassembly Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Commercial Aircraft Disassembly Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Commercial Aircraft Disassembly Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: India Commercial Aircraft Disassembly Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: China Commercial Aircraft Disassembly Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Japan Commercial Aircraft Disassembly Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: South Korea Commercial Aircraft Disassembly Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Asia Pacific Commercial Aircraft Disassembly Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Commercial Aircraft Disassembly Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Commercial Aircraft Disassembly Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Commercial Aircraft Disassembly Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Latin America Commercial Aircraft Disassembly Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Commercial Aircraft Disassembly Market Revenue Million Forecast, by Application 2020 & 2033

- Table 25: Global Commercial Aircraft Disassembly Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: United Arab Emirates Commercial Aircraft Disassembly Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Saudi Arabia Commercial Aircraft Disassembly Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Israel Commercial Aircraft Disassembly Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Middle East and Africa Commercial Aircraft Disassembly Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Aircraft Disassembly Market?

The projected CAGR is approximately 6.39%.

2. Which companies are prominent players in the Commercial Aircraft Disassembly Market?

Key companies in the market include A J Walter Aviation Limited, Magellan Aerospace, CAVU Aerospace Inc, AerSale Inc, AAR, Air Salvage International Ltd, Aircraft End-of-Life Solutions AELS, China Aircraft Leasing Group Holdings Lt, AerCap Holdings N V, Ascent Aviation Services.

3. What are the main segments of the Commercial Aircraft Disassembly Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.65 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Narrow Body Segment to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2023: Ascent Aviation Services opened a new aircraft disassembly and dismantling facility in Arizona. This facility will help to meet the growing demand for aircraft recycling services in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Aircraft Disassembly Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Aircraft Disassembly Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Aircraft Disassembly Market?

To stay informed about further developments, trends, and reports in the Commercial Aircraft Disassembly Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence