Key Insights

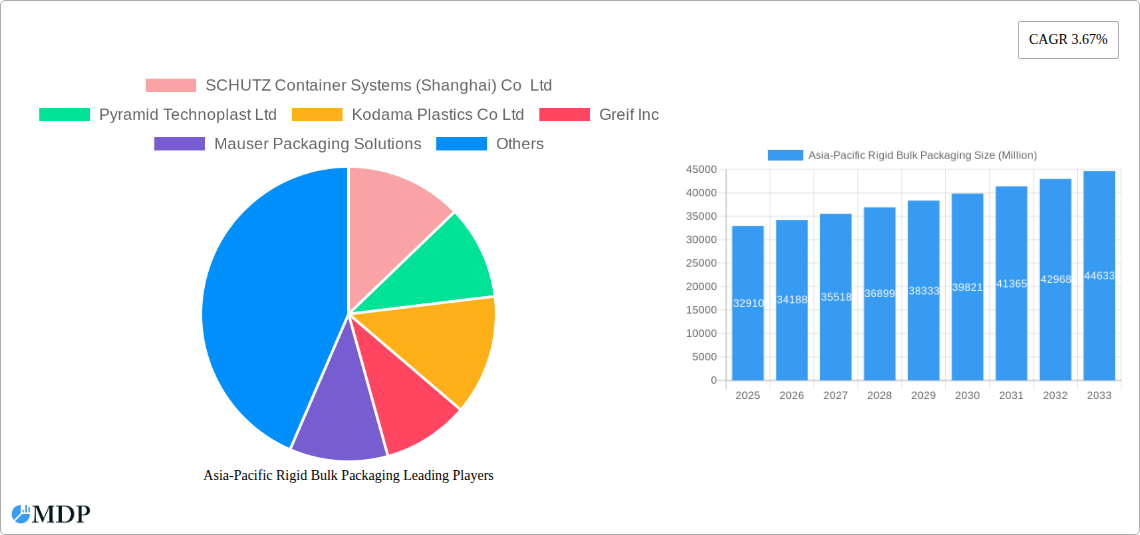

The Asia-Pacific rigid bulk packaging market, valued at $32.91 billion in 2025, is projected to experience robust growth, driven by the region's expanding industrial sector, particularly in manufacturing and logistics. The consistent rise in e-commerce and the increasing demand for safe and efficient transportation of goods are key contributing factors to this market expansion. A compound annual growth rate (CAGR) of 3.67% from 2025 to 2033 indicates a steady, albeit moderate, growth trajectory. This growth is further fueled by the rising adoption of sustainable and lightweight packaging materials, alongside advancements in packaging technologies to enhance product protection and shelf life. However, fluctuating raw material prices and stringent environmental regulations present challenges to market expansion. The market is segmented based on material type (plastic, metal, etc.), packaging type (drums, IBCs, etc.), and end-use industry (chemicals, food & beverages, etc.). Leading players like Schutz, Greif, and Mauser are strategically investing in capacity expansion and innovation to maintain their market share amidst growing competition.

Asia-Pacific Rigid Bulk Packaging Market Size (In Billion)

The market's future trajectory is influenced by several factors. Increased investments in infrastructure and the growth of manufacturing hubs within the Asia-Pacific region are expected to significantly boost demand. Furthermore, the ongoing shift towards automation in logistics and supply chain management will create opportunities for innovative and efficient packaging solutions. Companies are likely to focus on developing eco-friendly alternatives and implementing circular economy models to meet growing sustainability concerns. Nevertheless, economic volatility and potential disruptions to global supply chains could pose risks to sustained growth. The competitive landscape is characterized by a mix of established multinational corporations and regional players, resulting in a dynamic market dynamic that will favor companies that can successfully adapt to evolving customer needs and regulatory changes.

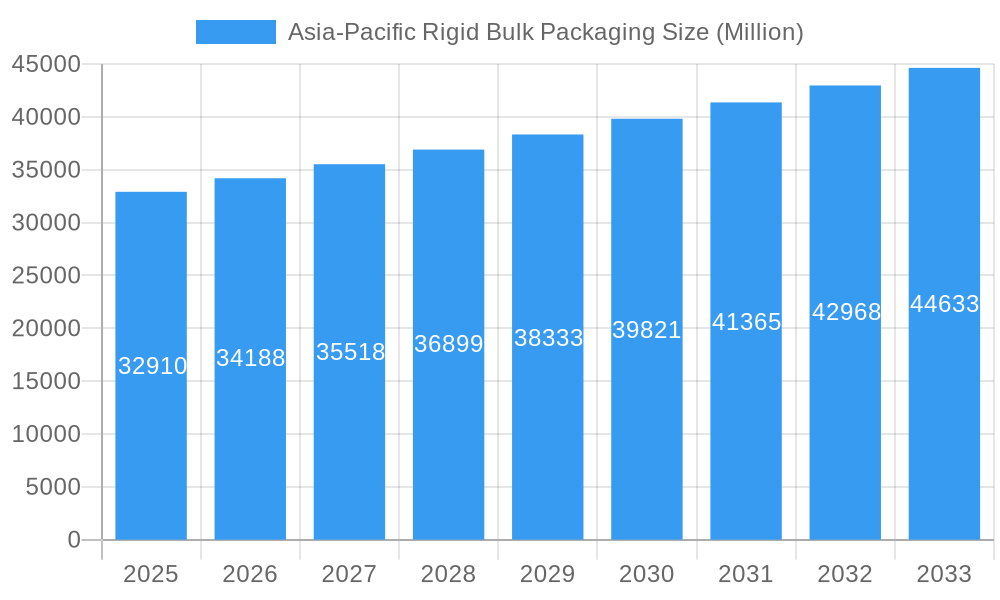

Asia-Pacific Rigid Bulk Packaging Company Market Share

Asia-Pacific Rigid Bulk Packaging Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific rigid bulk packaging market, offering invaluable insights for industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's dynamics, trends, and future potential. The report covers key players like SCHUTZ Container Systems (Shanghai) Co Ltd, Pyramid Technoplast Ltd, and Greif Inc, among others, offering a detailed competitive landscape and growth projections. Discover actionable strategies and informed decision-making opportunities within this burgeoning market. The market size is estimated to be xx Million in 2025 and projected to grow at a CAGR of xx% during the forecast period.

Asia-Pacific Rigid Bulk Packaging Market Dynamics & Concentration

The Asia-Pacific rigid bulk packaging market is characterized by a moderately concentrated landscape with several key players holding significant market share. The market is driven by innovations in materials, sustainable packaging solutions, and increasing demand from diverse end-use industries. Stringent regulatory frameworks concerning material composition and waste management are reshaping the market. Product substitution is a notable factor, with companies actively exploring eco-friendly alternatives. End-user trends towards sustainable and efficient packaging solutions are influencing industry dynamics. M&A activity remains relatively robust, with an estimated xx number of deals recorded between 2019 and 2024, primarily focused on expanding market reach and technological capabilities. Market share distribution is as follows (2024 estimates):

- Top 5 players: xx%

- Next 10 players: xx%

- Remaining players: xx%

Asia-Pacific Rigid Bulk Packaging Industry Trends & Analysis

The Asia-Pacific rigid bulk packaging market is experiencing robust growth, driven by factors such as increasing industrialization, rising e-commerce activities, and the growing food and beverage sector. Technological disruptions, particularly in automation and sustainable packaging materials, are reshaping production processes and consumer preferences. The market is witnessing a shift towards lightweight, durable, and reusable packaging options. Competitive dynamics are intense, with players focusing on product differentiation, cost optimization, and strategic partnerships. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% from 2025 to 2033. Market penetration rates are consistently increasing, especially in emerging economies where industrialization is rapidly progressing.

Leading Markets & Segments in Asia-Pacific Rigid Bulk Packaging

China and India are the dominant markets in the Asia-Pacific region, driven by robust economic growth, expanding industrial bases, and a burgeoning consumer market. Other significant markets include Japan, South Korea, and Australia. Key drivers for this dominance include:

- China: Robust industrial growth, government initiatives supporting manufacturing, large consumer base.

- India: Rapid economic expansion, increasing foreign direct investment, growth in the food and beverage and pharmaceutical sectors.

The detailed dominance analysis indicates a strong correlation between economic growth and the demand for rigid bulk packaging. The increasing urbanization and changing lifestyles also significantly contribute to market expansion. Within segments, the food and beverage industry represents the largest share, followed by chemicals and pharmaceuticals.

Asia-Pacific Rigid Bulk Packaging Product Developments

Recent product developments focus on enhancing sustainability and functionality. This includes lightweight designs using recycled materials, improved barrier properties for enhanced product protection, and incorporation of smart packaging technologies for improved traceability and inventory management. The adoption of advanced materials like bioplastics and recycled polymers is gaining traction, driven by growing environmental concerns and regulatory pressures. This aligns with the market’s increasing demand for eco-friendly solutions.

Key Drivers of Asia-Pacific Rigid Bulk Packaging Growth

Several factors are driving the growth of the Asia-Pacific rigid bulk packaging market. These include:

- Technological advancements: Automation in manufacturing, innovative materials, and smart packaging solutions.

- Economic growth: Rising disposable incomes and increased industrial activity across the region.

- Government regulations: Policies promoting sustainable packaging and waste management. The ISCC Plus accreditation initiatives further solidify the market's sustainable focus.

Challenges in the Asia-Pacific Rigid Bulk Packaging Market

The market faces challenges, including:

- Fluctuating raw material prices: Impacting production costs and profitability.

- Stringent environmental regulations: Requiring compliance with increasingly complex standards.

- Intense competition: Leading to price pressures and margin erosion. The estimated impact of these challenges on market growth is approximately xx%.

Emerging Opportunities in Asia-Pacific Rigid Bulk Packaging

Emerging opportunities include:

- Growth of e-commerce: Driving demand for robust and protective packaging solutions.

- Focus on sustainability: Creating opportunities for eco-friendly and recyclable packaging.

- Expansion into new markets: Untapped potential in developing economies. The market expansion into Southeast Asia offers substantial growth potential.

Leading Players in the Asia-Pacific Rigid Bulk Packaging Sector

- SCHUTZ Container Systems (Shanghai) Co Ltd

- Pyramid Technoplast Ltd

- Kodama Plastics Co Ltd

- Greif Inc [Greif Inc]

- Mauser Packaging Solutions [Mauser Packaging Solutions]

- Manock Industry Co LTD

- Multipac Pty Ltd

- ABCD Drums & Barrels Industries

- Industrial Engineering Corporation

- Yangzhou United Packaging Co Ltd

- Exel Plastech Co Ltd

- Time Technoplast Ltd

- TPL Plastech Limited

- List Not Exhaustive

Key Milestones in Asia-Pacific Rigid Bulk Packaging Industry

- May 2023: Berry Global initiates construction of a new manufacturing facility and Global Centre of Excellence (COPE) in India, emphasizing sustainable practices and ISCC Plus accreditation. This signifies a major step towards promoting circular economy principles within the industry.

- May 2023: Lyondell Basell and Shakti Plastic Industries partner to establish India's largest mechanical rigid plastic recycling plant, with an annual capacity of 55,000 tons. This landmark project showcases the industry's commitment to sustainability and waste management.

Strategic Outlook for Asia-Pacific Rigid Bulk Packaging Market

The Asia-Pacific rigid bulk packaging market is poised for significant growth, driven by expanding industrialization, rising consumer demand, and a growing focus on sustainable packaging solutions. Strategic opportunities include investments in advanced technologies, partnerships to enhance sustainability efforts, and expansion into high-growth markets. The market's future potential is substantial, particularly with ongoing innovation in materials and manufacturing processes.

Asia-Pacific Rigid Bulk Packaging Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Metal

- 1.3. Wood

- 1.4. Other Materials

-

2. Product

- 2.1. Industrial Bulk Containers

- 2.2. Drums

- 2.3. Pails

- 2.4. Bulk Boxes

- 2.5. Other Bulk Containers

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Industrial

- 3.4. Pharmaceutical and Chemical

- 3.5. Other End-user Industries

Asia-Pacific Rigid Bulk Packaging Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

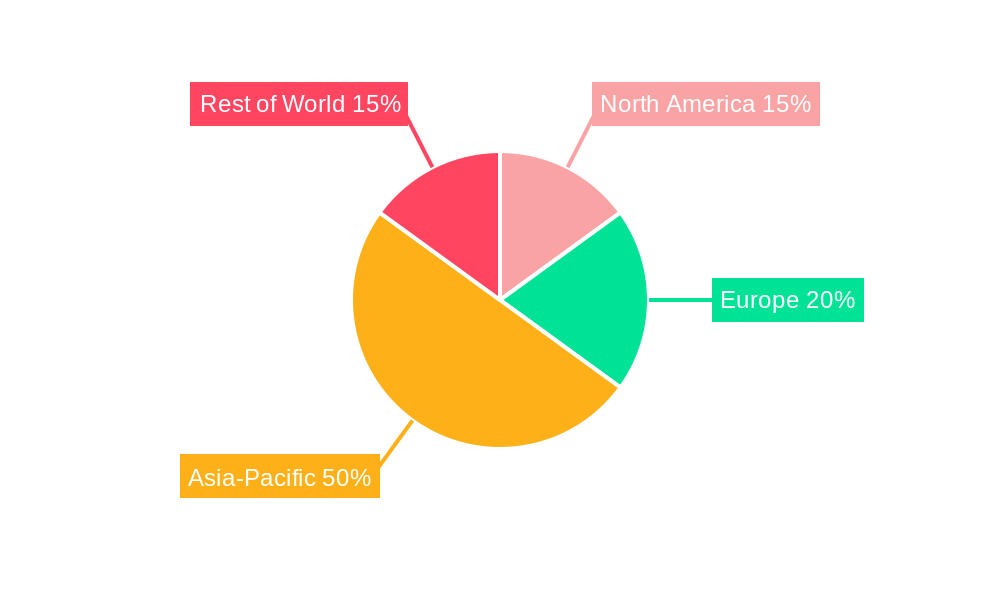

Asia-Pacific Rigid Bulk Packaging Regional Market Share

Geographic Coverage of Asia-Pacific Rigid Bulk Packaging

Asia-Pacific Rigid Bulk Packaging REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Consisting Rise in the Construction Activities in the Asia Pacific Region4.; Robust Demand from the Pharmaceutical

- 3.2.2 Food and Beverage Sector

- 3.3. Market Restrains

- 3.3.1 4.; Consisting Rise in the Construction Activities in the Asia Pacific Region4.; Robust Demand from the Pharmaceutical

- 3.3.2 Food and Beverage Sector

- 3.4. Market Trends

- 3.4.1. Demand From the Pharmaceutical and Chemical Industry is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Rigid Bulk Packaging Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Metal

- 5.1.3. Wood

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Industrial Bulk Containers

- 5.2.2. Drums

- 5.2.3. Pails

- 5.2.4. Bulk Boxes

- 5.2.5. Other Bulk Containers

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Industrial

- 5.3.4. Pharmaceutical and Chemical

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SCHUTZ Container Systems (Shanghai) Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pyramid Technoplast Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kodama Plastics Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Greif Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mauser Packaging Solutions

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Manock Industry Co LTD

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Multipac Pty Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ABCD Drums & Barrels Industries

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Industrial Engineering Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Yangzhou United Packaging Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Exel Plastech Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Time Technoplast Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 TPL Plastech Limited*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 SCHUTZ Container Systems (Shanghai) Co Ltd

List of Figures

- Figure 1: Asia-Pacific Rigid Bulk Packaging Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Rigid Bulk Packaging Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Rigid Bulk Packaging Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Asia-Pacific Rigid Bulk Packaging Volume Billion Forecast, by Material 2020 & 2033

- Table 3: Asia-Pacific Rigid Bulk Packaging Revenue Million Forecast, by Product 2020 & 2033

- Table 4: Asia-Pacific Rigid Bulk Packaging Volume Billion Forecast, by Product 2020 & 2033

- Table 5: Asia-Pacific Rigid Bulk Packaging Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Asia-Pacific Rigid Bulk Packaging Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 7: Asia-Pacific Rigid Bulk Packaging Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Rigid Bulk Packaging Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Rigid Bulk Packaging Revenue Million Forecast, by Material 2020 & 2033

- Table 10: Asia-Pacific Rigid Bulk Packaging Volume Billion Forecast, by Material 2020 & 2033

- Table 11: Asia-Pacific Rigid Bulk Packaging Revenue Million Forecast, by Product 2020 & 2033

- Table 12: Asia-Pacific Rigid Bulk Packaging Volume Billion Forecast, by Product 2020 & 2033

- Table 13: Asia-Pacific Rigid Bulk Packaging Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Asia-Pacific Rigid Bulk Packaging Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Asia-Pacific Rigid Bulk Packaging Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Rigid Bulk Packaging Volume Billion Forecast, by Country 2020 & 2033

- Table 17: China Asia-Pacific Rigid Bulk Packaging Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: China Asia-Pacific Rigid Bulk Packaging Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Japan Asia-Pacific Rigid Bulk Packaging Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Asia-Pacific Rigid Bulk Packaging Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: South Korea Asia-Pacific Rigid Bulk Packaging Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia-Pacific Rigid Bulk Packaging Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: India Asia-Pacific Rigid Bulk Packaging Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Asia-Pacific Rigid Bulk Packaging Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Asia-Pacific Rigid Bulk Packaging Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia Asia-Pacific Rigid Bulk Packaging Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: New Zealand Asia-Pacific Rigid Bulk Packaging Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: New Zealand Asia-Pacific Rigid Bulk Packaging Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Asia-Pacific Rigid Bulk Packaging Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Asia-Pacific Rigid Bulk Packaging Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Asia-Pacific Rigid Bulk Packaging Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Malaysia Asia-Pacific Rigid Bulk Packaging Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Singapore Asia-Pacific Rigid Bulk Packaging Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Singapore Asia-Pacific Rigid Bulk Packaging Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Thailand Asia-Pacific Rigid Bulk Packaging Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Thailand Asia-Pacific Rigid Bulk Packaging Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Vietnam Asia-Pacific Rigid Bulk Packaging Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Vietnam Asia-Pacific Rigid Bulk Packaging Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Philippines Asia-Pacific Rigid Bulk Packaging Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Philippines Asia-Pacific Rigid Bulk Packaging Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Rigid Bulk Packaging?

The projected CAGR is approximately 3.67%.

2. Which companies are prominent players in the Asia-Pacific Rigid Bulk Packaging?

Key companies in the market include SCHUTZ Container Systems (Shanghai) Co Ltd, Pyramid Technoplast Ltd, Kodama Plastics Co Ltd, Greif Inc, Mauser Packaging Solutions, Manock Industry Co LTD, Multipac Pty Ltd, ABCD Drums & Barrels Industries, Industrial Engineering Corporation, Yangzhou United Packaging Co Ltd, Exel Plastech Co Ltd, Time Technoplast Ltd, TPL Plastech Limited*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Rigid Bulk Packaging?

The market segments include Material, Product, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.91 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Consisting Rise in the Construction Activities in the Asia Pacific Region4.; Robust Demand from the Pharmaceutical. Food and Beverage Sector.

6. What are the notable trends driving market growth?

Demand From the Pharmaceutical and Chemical Industry is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Consisting Rise in the Construction Activities in the Asia Pacific Region4.; Robust Demand from the Pharmaceutical. Food and Beverage Sector.

8. Can you provide examples of recent developments in the market?

May 2023: Berry Global launched the construction of a new manufacturing facility and Global Centre of Excellence (COPE) in India. The new facility was to receive accreditation for the ISCC (International Sustainability & Carbon Certificate) Plus, which was expected to enable Berry Global to market healthcare clients’ approved packaging and rigid plastic components and to support a circular economy approach based on improved recycling and mass balancing.May 2023: Lyondell Basell and Shakti Plastic Industries entered a strategic partnership to create an automatic plastic recycling facility in India. The plant is expected to be able to handle rigid packaging waste from post-consumer use and will be able to produce around 55,000 tons/year of recycled polyester and polypropylene. This would make the facility India's biggest mechanical rigid plastic recycling plant when it starts up around the end of 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Rigid Bulk Packaging," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Rigid Bulk Packaging report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Rigid Bulk Packaging?

To stay informed about further developments, trends, and reports in the Asia-Pacific Rigid Bulk Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence