Key Insights

The Asia-Pacific office real estate market is projected to expand significantly, driven by rapid urbanization, economic growth, and escalating foreign direct investment. Key economies such as China, Japan, India, and Australia are spearheading this expansion, propelled by the dynamism of their technology sectors, the widespread adoption of flexible workspaces, and a heightened demand for contemporary, sustainable office environments. Following a temporary market correction, a robust recovery is evident through heightened leasing activities and sustained investor confidence in prime metropolitan assets. The market is estimated to reach a size of $2198.1 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 6.6% from the base year of 2024.

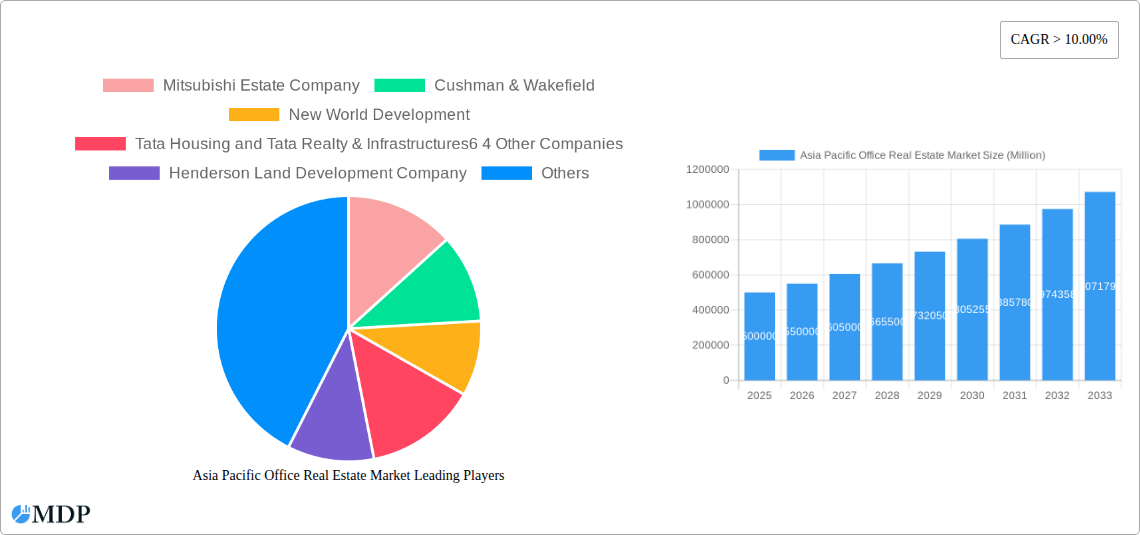

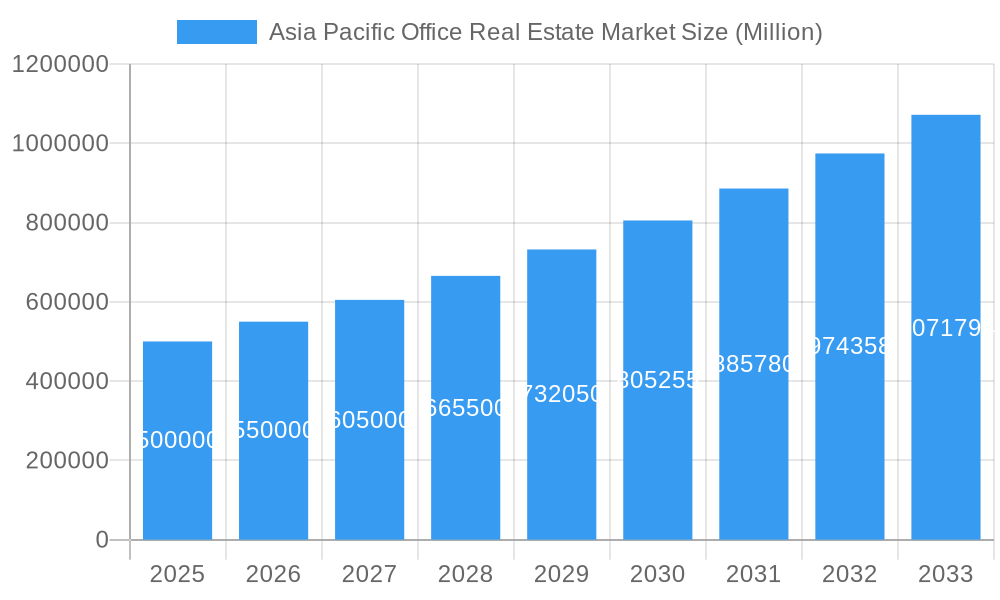

Asia Pacific Office Real Estate Market Market Size (In Million)

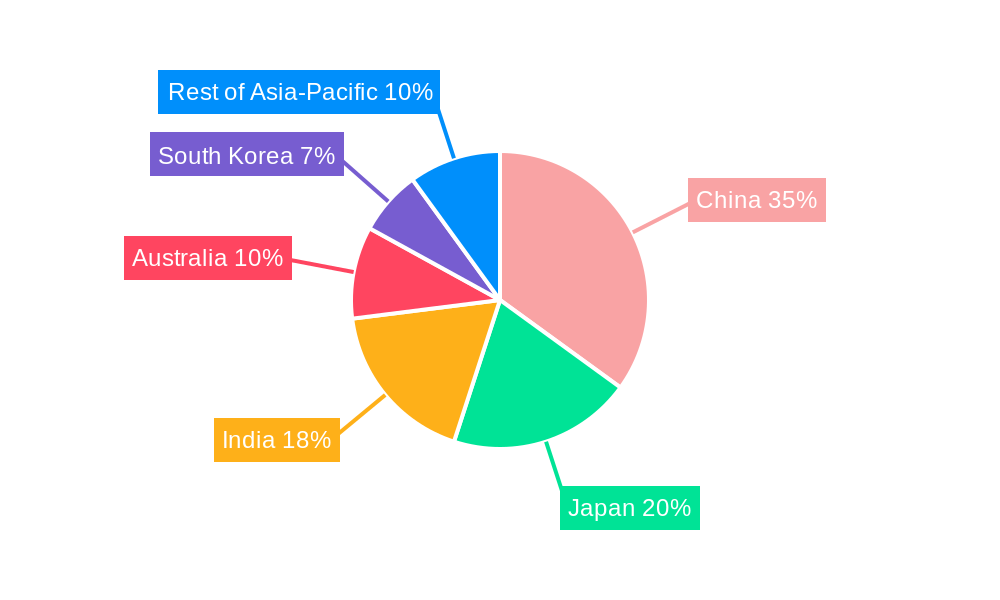

Geographic segmentation highlights China's buoyant technology sector and substantial foreign capital inflows as primary drivers, while Japan's established financial and corporate landscape offers steady growth. India's accelerated economic development is generating considerable demand, contrasting with Australia's consistent, though more gradual, growth trajectory. Other notable contributors include South Korea and various emerging Asian markets. Major industry participants, including Mitsubishi Estate and Cushman & Wakefield, are actively engaged in strategic consolidations and the development of innovative office solutions within this competitive arena. Potential market restraints encompass fluctuating interest rates, evolving regulatory frameworks, and the risk of economic slowdowns, necessitating careful strategic planning.

Asia Pacific Office Real Estate Market Company Market Share

Asia Pacific Office Real Estate Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Asia Pacific office real estate market, covering the period from 2019 to 2033. It offers actionable insights for investors, developers, and industry stakeholders seeking to navigate this dynamic market. The report leverages extensive data and analysis to forecast market trends, identify key players, and highlight both opportunities and challenges. With a focus on key markets like China, Japan, India, Australia, and South Korea, this report is an essential resource for understanding the current state and future trajectory of the Asia Pacific office real estate sector. The report includes a detailed examination of market dynamics, industry trends, leading players, and crucial milestones.

Asia Pacific Office Real Estate Market Dynamics & Concentration

The Asia Pacific office real estate market exhibits a complex interplay of factors influencing its concentration and dynamics. Market share is largely determined by a few major players, but smaller firms play a crucial role in specific segments and geographies. The market is witnessing significant innovation driven by technological advancements like smart building technologies and sustainable design. Regulatory frameworks vary widely across countries, creating both challenges and opportunities for investors. Product substitutes, such as co-working spaces and flexible office solutions, are impacting traditional office demand. End-user trends, including the increasing adoption of hybrid work models, are significantly shaping space requirements. Mergers and acquisitions (M&A) activity is considerable, with a notable increase in cross-border deals in recent years.

- Market Concentration: The top five players (Mitsubishi Estate Company, Cushman & Wakefield, New World Development, Tata Housing and Tata Realty & Infrastructures, and Henderson Land Development Company) hold approximately xx% of the market share in 2024, with the remaining share distributed across numerous smaller players.

- M&A Activity: The number of M&A deals in the Asia Pacific office real estate market increased by xx% from 2023 to 2024, totaling approximately xx deals. The average deal size was approximately USD xx Million.

- Innovation Drivers: Technological advancements in building management systems, sustainable design, and flexible workspace solutions are driving innovation.

- Regulatory Frameworks: Varying regulations across countries impact development timelines and investment decisions.

- Product Substitutes: The rise of co-working spaces and flexible office solutions challenges traditional office models.

- End-User Trends: The increasing prevalence of hybrid work models is influencing office space demand.

Asia Pacific Office Real Estate Market Industry Trends & Analysis

The Asia Pacific office real estate market is characterized by robust growth, driven by factors such as rapid urbanization, economic expansion in several key markets, and increasing foreign direct investment. Technological disruptions, including the widespread adoption of smart building technologies and digital workplace solutions, are reshaping the industry landscape. Consumer preferences are shifting towards sustainable, technologically advanced, and flexible workspaces. Competitive dynamics are intense, with both established players and new entrants vying for market share. The market is expected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with significant market penetration in key growth markets.

Leading Markets & Segments in Asia Pacific Office Real Estate Market

China remains the dominant market within the Asia Pacific region, followed by Japan, India, and Australia. South Korea and the rest of Asia-Pacific also contribute significantly to the overall market size.

China:

- Key Drivers: Rapid urbanization, robust economic growth, and significant foreign direct investment.

- Dominance Analysis: China’s large and growing population, coupled with its expanding economy, drives substantial demand for office space.

Japan:

- Key Drivers: A well-established corporate sector, strong infrastructure, and a stable political environment.

- Dominance Analysis: Japan's established business landscape and focus on technology continue to drive office space demand, though growth might be comparatively slower than other markets.

India:

- Key Drivers: A burgeoning IT sector, increasing foreign investment, and a young, growing workforce.

- Dominance Analysis: India’s rapidly growing IT and services sector fuels significant office space demand, particularly in major metropolitan areas.

Australia:

- Key Drivers: A relatively stable economy, strong infrastructure, and attractive investment environment.

- Dominance Analysis: Australia’s comparatively smaller market size compared to China or India limits its overall dominance but strong growth is still observed in key cities.

South Korea & Rest of Asia-Pacific: These markets contribute significant but more fragmented shares to the overall regional market size.

Asia Pacific Office Real Estate Market Product Developments

Recent product innovations focus on integrating smart building technologies, improving energy efficiency, and creating more flexible and adaptable workspace solutions. These innovations aim to cater to evolving tenant preferences and optimize operational efficiency. The market is witnessing the growing adoption of sustainable design principles and the implementation of technologies aimed at enhancing tenant experience and improving building performance. These advancements provide a competitive advantage to developers who prioritize innovation and offer technologically advanced, environmentally friendly office spaces.

Key Drivers of Asia Pacific Office Real Estate Market Growth

Several factors drive the growth of the Asia Pacific office real estate market:

- Technological advancements: Smart building technologies, sustainable design, and flexible workspace solutions enhance efficiency and appeal.

- Economic expansion: Strong economic growth in several key markets fuels demand for office space.

- Government policies: Supportive government policies and infrastructure investments stimulate development.

Challenges in the Asia Pacific Office Real Estate Market Market

The Asia Pacific office real estate market faces challenges including:

- Regulatory hurdles: Varying and complex regulations across countries create obstacles.

- Supply chain issues: Disruptions in global supply chains impact construction timelines and costs.

- Geopolitical uncertainties: Regional political instability and economic fluctuations pose risks to the market.

Emerging Opportunities in Asia Pacific Office Real Estate Market

Several opportunities exist for long-term growth:

- Technological breakthroughs: The adoption of innovative technologies offers opportunities to improve building performance and tenant experience.

- Strategic partnerships: Collaborations between developers and technology providers can create cutting-edge solutions.

- Market expansion: Growth in secondary and tertiary cities presents substantial expansion possibilities.

Leading Players in the Asia Pacific Office Real Estate Market Sector

- Mitsubishi Estate Company

- Cushman & Wakefield

- New World Development

- Tata Housing and Tata Realty & Infrastructures

- Henderson Land Development Company

- Frasers Property

- JLL

- CDL

- Colliers

- CBRE

Key Milestones in Asia Pacific Office Real Estate Market Industry

- February 2022: Hulic and Japan Excellent executed a purchase agreement for the Shintomicho Building (JPY 3.1 Billion/USD 25.4 Million). This highlights ongoing investment in prime Tokyo office properties.

- July 2022: Google leased 1.3 Million sq. ft. of office space in Bengaluru, India. This signifies the significant demand from tech companies in India’s growing market.

Strategic Outlook for Asia Pacific Office Real Estate Market Market

The Asia Pacific office real estate market holds immense future potential, driven by technological innovation, economic growth, and urbanization trends. Strategic opportunities exist for companies to capitalize on the increasing demand for flexible, sustainable, and technologically advanced workspaces. Focusing on these key trends will be essential for success in this dynamic and rapidly evolving market.

Asia Pacific Office Real Estate Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia Pacific Office Real Estate Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Office Real Estate Market Regional Market Share

Geographic Coverage of Asia Pacific Office Real Estate Market

Asia Pacific Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing geriatric population; Growing cases of chronic disease among senior citizens

- 3.3. Market Restrains

- 3.3.1. High cost of elderly care services; Lack of skilled staff

- 3.4. Market Trends

- 3.4.1. Rise in Demand for Coworking Spaces

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mitsubishi Estate Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cushman & Wakefield

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 New World Development

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tata Housing and Tata Realty & Infrastructures6 4 Other Companies

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Henderson Land Development Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Frasers Property

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JLL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CDL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Colliers

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CBRE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mitsubishi Estate Company

List of Figures

- Figure 1: Asia Pacific Office Real Estate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Office Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: China Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Japan Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: South Korea Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: India Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Australia Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: New Zealand Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Indonesia Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Malaysia Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Singapore Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Thailand Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Vietnam Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Philippines Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Office Real Estate Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the Asia Pacific Office Real Estate Market?

Key companies in the market include Mitsubishi Estate Company, Cushman & Wakefield, New World Development, Tata Housing and Tata Realty & Infrastructures6 4 Other Companies, Henderson Land Development Company, Frasers Property, JLL, CDL, Colliers, CBRE.

3. What are the main segments of the Asia Pacific Office Real Estate Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 2198.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing geriatric population; Growing cases of chronic disease among senior citizens.

6. What are the notable trends driving market growth?

Rise in Demand for Coworking Spaces.

7. Are there any restraints impacting market growth?

High cost of elderly care services; Lack of skilled staff.

8. Can you provide examples of recent developments in the market?

February 2022 - Real estate firm Hulic and Japan Excellent executed a purchase agreement to exchange trust beneficiary rights in the Shintomicho Building for JPY 3.1 billion (USD 25.4 million). Japan Excellent mostly invests in office buildings in Tokyo. Two phases will be involved in the transfer of the Trust Beneficiary Rights in the Shintomicho Building: the first phase will involve the transfer of 40% ownership for JPY 1,24 billion (USD 10.1 million), and the second phase will involve the transfer of the remaining 60% ownership for JPY 1.86 billion (USD 15.3 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Office Real Estate Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence