Key Insights

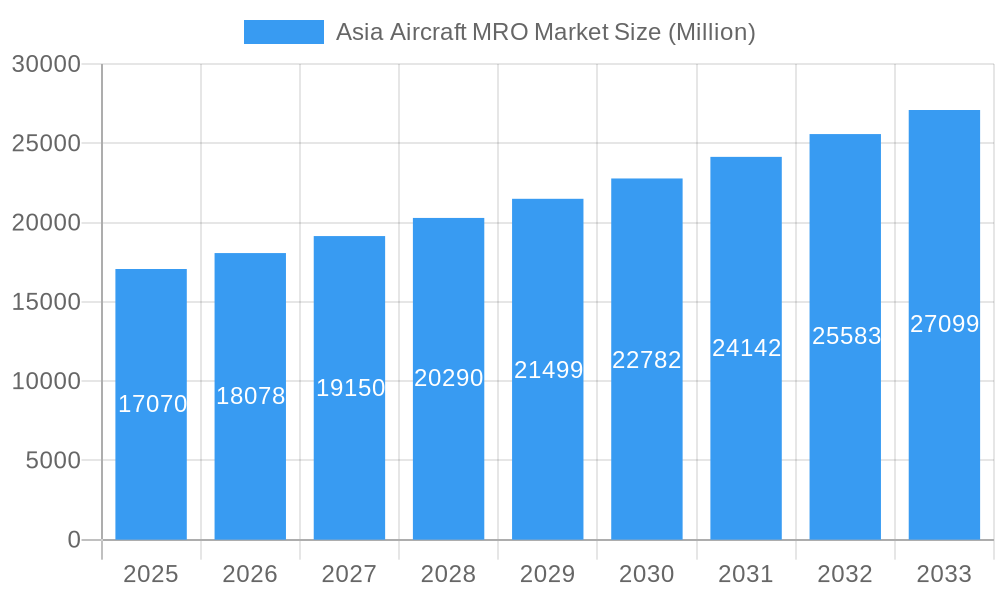

The Asia Aircraft Maintenance, Repair, and Overhaul (MRO) market is poised for substantial growth, projected to reach \$17.07 billion in 2025 and experience a Compound Annual Growth Rate (CAGR) of 5.74% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning air travel sector within the Asia-Pacific region, particularly in countries like China, India, and Japan, significantly boosts demand for aircraft maintenance services. Furthermore, the increasing age of aircraft fleets necessitates more frequent and extensive MRO activities. Government initiatives promoting aviation infrastructure development and supportive regulatory frameworks also contribute to market growth. The rising adoption of advanced technologies like predictive maintenance and digital solutions further enhances operational efficiency and reduces downtime, stimulating market expansion. The segment breakdown shows a strong demand across all MRO types (Airframe, Engine, Component, and Line Maintenance) and application areas (Commercial, Military, and General Aviation). Leading players like Boeing, Airbus, Rolls Royce, and several regional MRO providers are capitalizing on these opportunities, driving competition and innovation within the market.

Asia Aircraft MRO Market Market Size (In Billion)

However, market growth is not without its challenges. Economic fluctuations, geopolitical uncertainties, and potential disruptions to global supply chains can impact MRO activity. Skill shortages in specialized technical roles within the aviation maintenance industry represent a significant constraint, requiring substantial investment in training and development programs. Stringent safety regulations and environmental concerns necessitate substantial capital expenditure on compliant technologies and infrastructure, posing further challenges to market players. Despite these restraints, the long-term outlook for the Asia Aircraft MRO market remains positive, fueled by continuous growth in air passenger traffic and the sustained need for efficient and reliable aircraft maintenance. The market's growth will be driven by investments in new technologies and infrastructure, and the strong presence of both established and emerging players in the region. The continued expansion of low-cost carriers further contributes to the overall demand for MRO services in Asia.

Asia Aircraft MRO Market Company Market Share

Asia Aircraft MRO Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Aircraft Maintenance, Repair, and Overhaul (MRO) market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, leading players, emerging trends, and future growth prospects. The study encompasses key segments including Airframe MRO, Engine MRO, Component MRO, and Line Maintenance across Commercial Aviation, Military Aviation, and General Aviation sectors.

High-traffic Keywords: Asia Aircraft MRO Market, Aircraft Maintenance, Repair, Overhaul, MRO Market Analysis, Asia Aviation Industry, Commercial Aviation MRO, Military Aviation MRO, General Aviation MRO, Airframe MRO, Engine MRO, Component MRO, Line Maintenance, Market Growth, Market Forecast, Market Size, Market Share, Competitive Landscape, Industry Trends, Investment Opportunities, Asia Pacific MRO

Asia Aircraft MRO Market Dynamics & Concentration

The Asia Aircraft MRO market is characterized by a dynamic interplay of factors driving both growth and consolidation. Market concentration is moderate, with a few large players dominating specific segments while numerous smaller players cater to niche needs. Innovation, driven by advancements in technology and increasing demand for efficiency, plays a crucial role. Stringent regulatory frameworks, particularly concerning safety and environmental compliance, shape operational strategies. The market witnesses ongoing M&A activities, reflecting the quest for economies of scale and enhanced service portfolios. Substitute products, such as leasing arrangements, exert some influence, but the core market remains robust. End-user trends toward larger, more fuel-efficient aircraft contribute to higher MRO demand.

- Market Share: The top 5 players collectively hold approximately XX% of the market share in 2025, with a projected increase to XX% by 2033.

- M&A Activity: An average of XX M&A deals were recorded annually during the historical period (2019-2024), with projections suggesting a rise to XX deals annually during the forecast period (2025-2033).

- Innovation Drivers: Advancements in predictive maintenance technologies, digitalization of MRO processes, and the adoption of sustainable practices are key innovation drivers.

Asia Aircraft MRO Market Industry Trends & Analysis

The Asia Aircraft MRO market is experiencing robust growth, fueled by a burgeoning aviation industry and increasing air travel demand within the region. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated to be XX%, driven primarily by factors like the expansion of low-cost carriers, increasing fleet size of major airlines, and governmental support for infrastructure development. Technological disruptions, such as the rise of digital maintenance platforms and the application of artificial intelligence (AI) for predictive analytics, are significantly improving efficiency and reducing downtime. Consumer preferences for seamless travel experiences indirectly drive the demand for efficient and reliable MRO services. Intense competition among established players and new entrants fosters innovation and drives down prices. Market penetration of advanced technologies like AI and Big Data analytics within the MRO sector is projected to reach XX% by 2033.

Leading Markets & Segments in Asia Aircraft MRO Market

The Commercial Aviation segment is the powerhouse of the Asia Aircraft MRO market, projected to capture approximately 70-75% of the total market value by 2025. Within the diverse MRO types, Engine MRO commands a substantial share due to the inherent high cost and intricate nature of engine upkeep. Spearheading this growth are the burgeoning aviation sectors of China and India, solidifying their positions as the leading national markets.

-

Key Drivers for Commercial Aviation Dominance:

- The aggressive expansion and growing popularity of low-cost carriers (LCCs) are significantly boosting air travel demand.

- Major airlines are continuously increasing their fleet sizes to cater to rising passenger numbers and expand route networks.

- Substantial government investments in airport infrastructure, including new terminals and runway expansions, are crucial enablers of aviation growth.

- A consistent upward trend in air passenger traffic, fueled by economic development and a growing middle class, directly translates to higher demand for MRO services.

-

Key Drivers for Engine MRO Segment Leadership:

- The intrinsically high complexity, technological sophistication, and significant cost associated with engine maintenance make it a naturally dominant MRO segment.

- Stringent and evolving global regulatory requirements for engine safety, performance, and emissions necessitate regular and thorough maintenance.

- Continuous technological advancements in engine design and manufacturing are leading to more complex and powerful engines, requiring specialized MRO expertise.

-

China & India Market Dominance:

- Robust economic growth coupled with an expanding middle class in both countries is driving a significant surge in domestic and international air travel.

- Proactive government initiatives aimed at fostering and promoting domestic aviation industries, including MRO capabilities, are creating a favorable ecosystem.

- There are substantial and ongoing investments in modernizing and expanding airport infrastructure and related aviation facilities.

Asia Aircraft MRO Market Product Developments

Recent product developments in the Asia Aircraft MRO market center around the adoption of advanced technologies such as predictive maintenance, digital twin technologies, and AI-powered diagnostics. These innovations aim to enhance operational efficiency, reduce maintenance costs, and minimize aircraft downtime. The market is witnessing a shift towards integrated MRO solutions, providing clients with comprehensive services covering various aspects of aircraft maintenance. These integrated solutions leverage data analytics to optimize maintenance schedules, predict potential failures, and improve overall fleet management.

Key Drivers of Asia Aircraft MRO Market Growth

The Asia Aircraft MRO market's growth is primarily propelled by several factors: a surge in air passenger traffic fueled by economic growth and rising disposable incomes; increasing airline fleet sizes; significant government investments in aviation infrastructure development across the region; and the burgeoning adoption of advanced technologies like AI and predictive maintenance within the MRO sector. Relaxation of certain regulations also contributes to the expansion of the market.

Challenges in the Asia Aircraft MRO Market

The Asia Aircraft MRO market faces a multifaceted landscape of challenges. The increasing complexity and technological sophistication of modern aircraft necessitate continuous upskilling and specialization of the workforce, leading to a persistent demand for highly skilled labor. Intense competition from well-established international MRO providers adds pressure on margins. Furthermore, the potential for supply chain disruptions, whether due to geopolitical factors, natural disasters, or logistical bottlenecks, can significantly impact turnaround times and operational costs. Regulatory hurdles, particularly concerning stringent safety compliance and evolving environmental standards, require constant adaptation and investment. These combined constraints are projected to lead to increased operational costs, with smaller players potentially experiencing an estimated 15-20% reduction in profitability by 2033 due to fierce competition and the inability to leverage economies of scale.

Emerging Opportunities in Asia Aircraft MRO Market

The Asia Aircraft MRO market is ripe with significant opportunities for sustained long-term growth, primarily driven by the adoption of digitalization, a growing emphasis on sustainability, and the forging of strategic partnerships. The integration of disruptive technologies like AI-driven predictive maintenance holds immense potential for optimizing maintenance schedules, reducing downtime, and significantly improving operational efficiency. Strategic collaborations between MRO providers and airlines are becoming crucial for streamlining service delivery, sharing expertise, and optimizing resource allocation. Furthermore, there is considerable opportunity in expanding service offerings to underserved emerging markets within Asia and developing specialized maintenance capabilities for the next generation of aircraft technologies, such as electric and hybrid-electric propulsion systems. The growing demand for environmentally friendly MRO practices also presents a unique avenue for innovation and market differentiation.

Leading Players in the Asia Aircraft MRO Market Sector

- Dassault Aviation

- Rolls Royce PLC

- General Electric

- GMF AeroAsia

- Lockheed Martin Corporation

- Guangzhou Aircraft Maintenance Engineering Company Limited

- Sepang Aircraft Engineering Sdn Bh

- Avia Solutions Group PLC

- AAR Corporation

- Safran SA

- Lufthansa Technik

- Hong Kong Aircraft Engineering Company Limited (HAECO)

- SIA Engineering Company

- Air Works India (Engineering) Private Limited

- ST Engineering

- ExecuJet MRO Services

- The Boeing Company

Key Milestones in Asia Aircraft MRO Market Industry

- 2020: Introduction of a new predictive maintenance software by a leading MRO provider.

- 2021: Merger of two regional MRO companies in Southeast Asia.

- 2022: Launch of a new engine overhaul facility in China.

- 2023: Significant investment in digital infrastructure by a major airline.

- 2024: Government regulations mandating the adoption of eco-friendly maintenance practices.

Strategic Outlook for Asia Aircraft MRO Market

The Asia Aircraft MRO market is poised for robust growth, underpinned by the persistent rise in demand for air travel, continuous fleet expansion by regional and global airlines, and the rapid pace of technological advancements. Companies that proactively embrace digital transformation, integrate sustainable practices into their operations, and cultivate strong strategic partnerships will be optimally positioned to capture emerging opportunities. A relentless focus on enhancing operational efficiency through lean methodologies and advanced technologies, the ability to offer integrated, end-to-end MRO solutions, and a keen understanding of and responsiveness to the evolving operational and regulatory needs of airlines will be paramount for achieving sustained success and market leadership in this dynamic region.

Asia Aircraft MRO Market Segmentation

-

1. MRO Type

- 1.1. Airframe MRO

- 1.2. Engine MRO

- 1.3. Component MRO

- 1.4. Line Maintenance

-

2. Application

- 2.1. Commercial Aviation

- 2.2. Military Aviation

- 2.3. General Aviation

-

3. Geography

-

3.1. Asia-Pacific

- 3.1.1. China

- 3.1.2. India

- 3.1.3. Japan

- 3.1.4. South Korea

- 3.1.5. Australia

- 3.1.6. Thailand

- 3.1.7. Singapore

- 3.1.8. Rest of Asia-Pacific

-

3.1. Asia-Pacific

Asia Aircraft MRO Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Australia

- 1.6. Thailand

- 1.7. Singapore

- 1.8. Rest of Asia Pacific

Asia Aircraft MRO Market Regional Market Share

Geographic Coverage of Asia Aircraft MRO Market

Asia Aircraft MRO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Aviation Segment Projected to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Aircraft MRO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 5.1.1. Airframe MRO

- 5.1.2. Engine MRO

- 5.1.3. Component MRO

- 5.1.4. Line Maintenance

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial Aviation

- 5.2.2. Military Aviation

- 5.2.3. General Aviation

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia-Pacific

- 5.3.1.1. China

- 5.3.1.2. India

- 5.3.1.3. Japan

- 5.3.1.4. South Korea

- 5.3.1.5. Australia

- 5.3.1.6. Thailand

- 5.3.1.7. Singapore

- 5.3.1.8. Rest of Asia-Pacific

- 5.3.1. Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dassault Aviation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rolls Royce PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Electric

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GMF AeroAsia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lockheed Martin Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Guangzhou Aircraft Maintenance Engineering Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sepang Aircraft Engineering Sdn Bh

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Avia Solutions Group PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AAR Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Safran SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Lufthansa Technik

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hong Kong Aircraft Engineering Company Limited (HAECO)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 SIA Engineering Company

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Air Works India (Engineering) Private Limited

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 ST Engineering

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 ExecuJet MRO Services

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 The Boeing Company

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Dassault Aviation

List of Figures

- Figure 1: Asia Aircraft MRO Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Aircraft MRO Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Aircraft MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 2: Asia Aircraft MRO Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Asia Aircraft MRO Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Asia Aircraft MRO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia Aircraft MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 6: Asia Aircraft MRO Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Asia Aircraft MRO Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Asia Aircraft MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Thailand Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Asia Pacific Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Aircraft MRO Market?

The projected CAGR is approximately 5.74%.

2. Which companies are prominent players in the Asia Aircraft MRO Market?

Key companies in the market include Dassault Aviation, Rolls Royce PLC, General Electric, GMF AeroAsia, Lockheed Martin Corporation, Guangzhou Aircraft Maintenance Engineering Company Limited, Sepang Aircraft Engineering Sdn Bh, Avia Solutions Group PLC, AAR Corporation, Safran SA, Lufthansa Technik, Hong Kong Aircraft Engineering Company Limited (HAECO), SIA Engineering Company, Air Works India (Engineering) Private Limited, ST Engineering, ExecuJet MRO Services, The Boeing Company.

3. What are the main segments of the Asia Aircraft MRO Market?

The market segments include MRO Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.07 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Aviation Segment Projected to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Aircraft MRO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Aircraft MRO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Aircraft MRO Market?

To stay informed about further developments, trends, and reports in the Asia Aircraft MRO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence