Key Insights

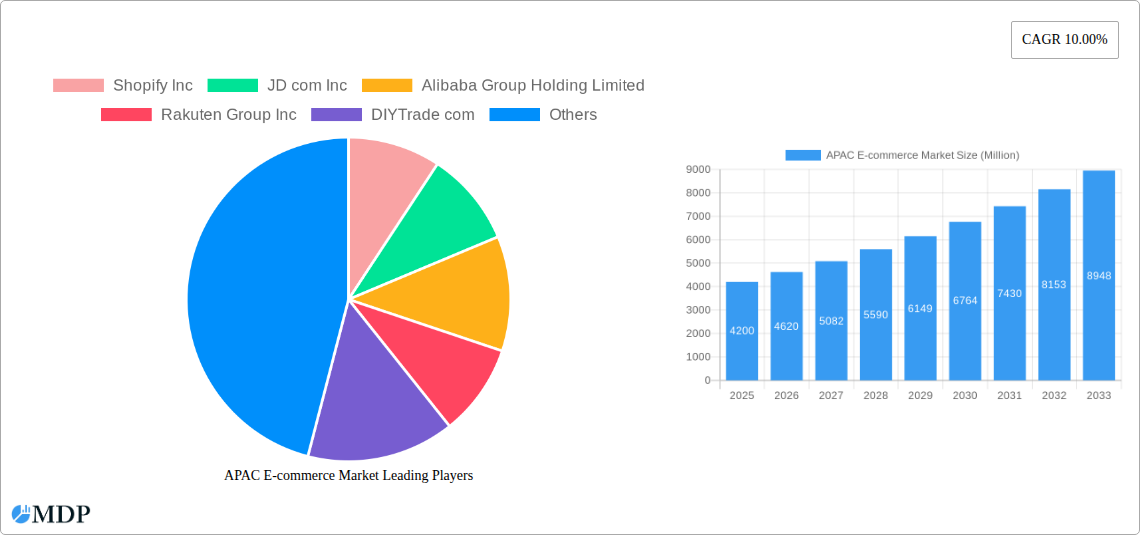

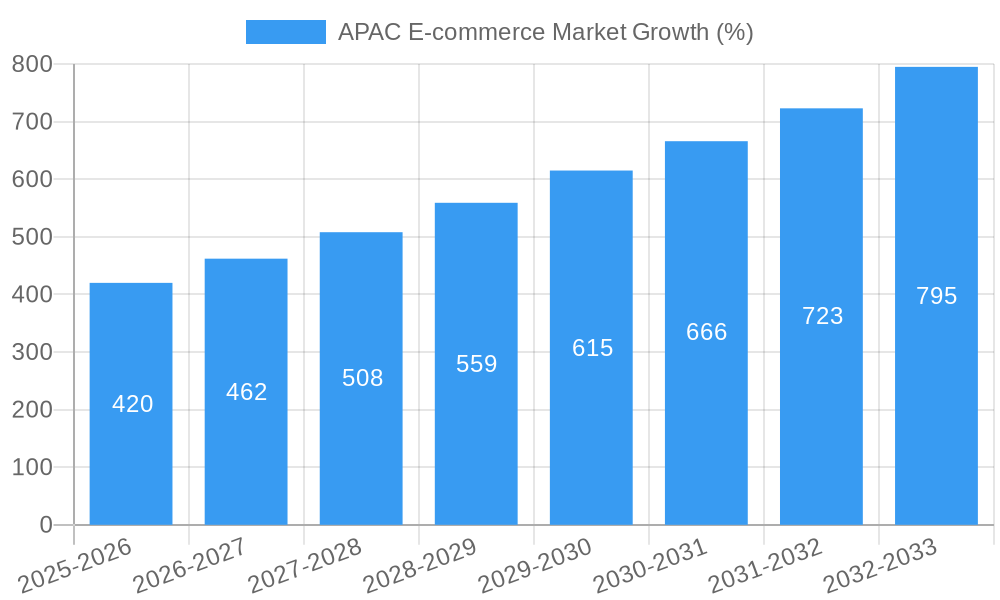

The Asia-Pacific (APAC) e-commerce market, valued at $4.20 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10% from 2025 to 2033. This expansion is fueled by several key drivers. Rising smartphone penetration and internet access across the region, particularly in emerging economies like India and Southeast Asia, are significantly broadening the consumer base for online shopping. Increasing disposable incomes and a burgeoning middle class are further fueling demand for diverse goods and services online. The preference for convenience and competitive pricing offered by e-commerce platforms, coupled with advancements in logistics and payment infrastructure, are also contributing factors. Furthermore, the rise of social commerce and the increasing adoption of mobile payment systems are accelerating the market's growth trajectory. However, challenges remain, including concerns regarding cybersecurity and data privacy, along with the need for enhanced logistics in remote areas to ensure efficient delivery.

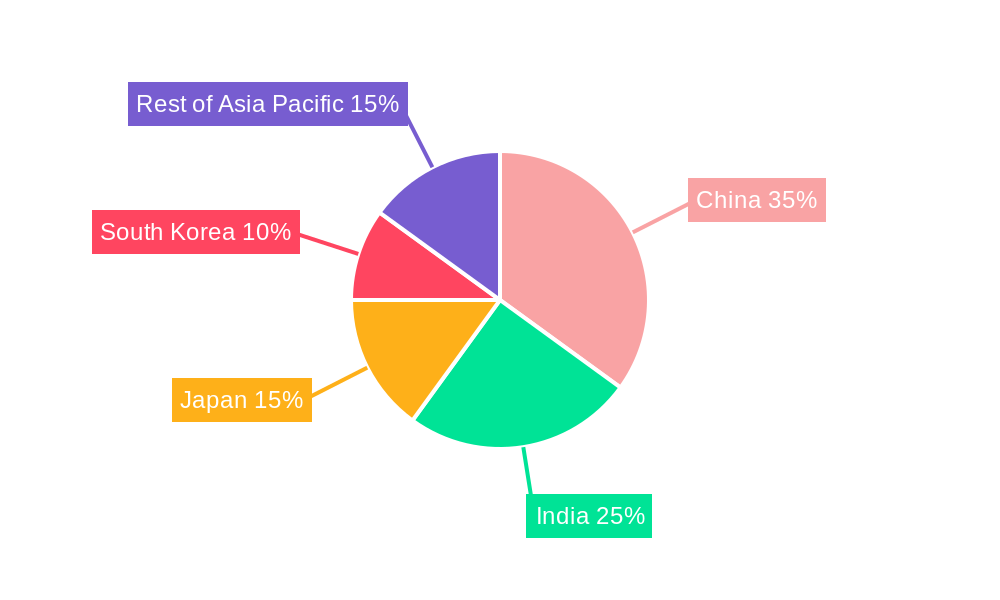

The market segmentation by application reveals diverse growth opportunities. For example, the fashion and apparel sector benefits from the region's fashion-conscious population and accessibility of online platforms. Electronics and consumer goods also experience strong growth due to increasing demand for tech products and household appliances. While precise figures for each segment aren't provided, the overall market dynamism suggests a balanced growth across various applications. Major players like Shopify, JD.com, Alibaba, Rakuten, Amazon, and eBay are fiercely competing for market share, while regional players are emerging to cater to specific local preferences. China, India, and Japan represent the largest market segments within APAC, reflecting their significant populations and relatively developed e-commerce infrastructure. However, the "Rest of Asia Pacific" region is exhibiting rapid growth, creating opportunities for expansion and investment.

APAC E-commerce Market Report: 2019-2033 - Unlocking Explosive Growth in Asia-Pacific

Dive deep into the dynamic APAC e-commerce landscape with this comprehensive market report, covering the period 2019-2033. This in-depth analysis provides invaluable insights for businesses looking to capitalize on the region's booming digital economy. From market size and segmentation to key players and future trends, this report is your essential guide to navigating the complexities of the APAC e-commerce market. Expect detailed data, actionable strategies, and a clear roadmap for success in one of the world's fastest-growing online retail sectors. The report forecasts a market valued at xx Million by 2033.

APAC E-commerce Market Market Dynamics & Concentration

The APAC e-commerce market exhibits a highly dynamic landscape, driven by rapid technological advancements, evolving consumer preferences, and increasing smartphone penetration. Market concentration is relatively high, with a few dominant players commanding significant market share. However, the market also presents opportunities for smaller, specialized players to carve out niches.

- Market Concentration: Alibaba Group Holding Limited and JD.com Inc. currently hold the largest market share, estimated at xx% and xx% respectively in 2025. Other significant players include Amazon.com Inc., Rakuten Group Inc., and Shopify Inc., contributing a combined xx% market share. The remaining share is distributed among numerous smaller players and regional e-commerce platforms.

- Innovation Drivers: The market is fueled by innovations in areas such as mobile commerce, AI-powered personalization, and the rise of social commerce. The increasing adoption of omnichannel strategies and the integration of augmented reality/virtual reality technologies further contribute to market dynamism.

- Regulatory Frameworks: Varying regulatory environments across different APAC nations impact market growth and player strategies. Governments are actively shaping the e-commerce landscape through policies related to data privacy, cross-border trade, and consumer protection. These regulations create both challenges and opportunities for businesses operating in the region.

- Product Substitutes: The market faces indirect competition from traditional retail channels and emerging alternative platforms. However, the convenience and accessibility offered by e-commerce are solidifying its position as the preferred shopping method for many consumers.

- End-User Trends: The APAC e-commerce market is predominantly driven by millennial and Gen Z consumers who are digitally native and highly engaged with online platforms. These demographics exhibit strong preferences for personalized experiences, mobile-first interfaces, and fast and reliable delivery services.

- M&A Activities: The APAC e-commerce sector witnesses significant mergers and acquisitions (M&A) activity. The number of deals in the last five years is estimated to be approximately xx, largely driven by players aiming to expand their market reach, enhance their technological capabilities, and diversify their product offerings. This consolidation trend is expected to continue.

APAC E-commerce Market Industry Trends & Analysis

The APAC e-commerce market exhibits robust growth, propelled by a multitude of factors. The Compound Annual Growth Rate (CAGR) from 2025-2033 is projected to be xx%. This significant growth stems from several key trends:

- Market Growth Drivers: Rising disposable incomes, increasing internet and smartphone penetration, and a growing preference for online shopping are the primary drivers. The expansion of logistics infrastructure and the improvement of payment gateways also contribute significantly to market expansion. Government initiatives to promote digitalization in several APAC countries are adding further momentum.

- Technological Disruptions: Advancements in technologies such as artificial intelligence (AI), big data analytics, and blockchain are revolutionizing the e-commerce landscape. AI-powered personalization, enhanced customer service chatbots, and improved fraud detection mechanisms are transforming the customer experience.

- Consumer Preferences: Consumers in APAC exhibit a growing preference for convenience, personalization, and seamless cross-border shopping. The demand for same-day or next-day delivery, mobile-first experiences, and personalized recommendations is driving innovation and shaping business strategies.

- Competitive Dynamics: The APAC e-commerce market is characterized by intense competition among established players and emerging startups. This rivalry drives innovation, promotes price competitiveness, and results in a wide array of choices for consumers. Market penetration for e-commerce is estimated at xx% in 2025, and it is expected to increase rapidly in the forecast period.

Leading Markets & Segments in APAC E-commerce Market

China currently dominates the APAC e-commerce market, accounting for the largest share of revenue and transaction volume. India is experiencing rapid growth and is projected to become a major market in the coming years. Other key markets include Japan, South Korea, and Australia. The dominance of these markets is due to several factors:

Key Drivers (China):

- Robust economic growth and increasing disposable incomes.

- High internet and smartphone penetration.

- Favorable government policies supporting digital commerce.

- Highly developed logistics infrastructure.

Key Drivers (India):

- A large and growing young population.

- Rapid growth in internet and smartphone usage.

- Increasing adoption of digital payments.

- Government initiatives promoting digital India.

Dominance Analysis: China's dominance stems from its massive population, extensive e-commerce infrastructure, and the presence of major players such as Alibaba and JD.com. India's rapid growth is fueled by its young demographic and expanding digital economy. The dominance of specific segments within applications (e.g., fashion, electronics) varies across markets depending on consumer preferences and economic development levels. Detailed segmentation analysis will be provided within the full report.

APAC E-commerce Market Product Developments

The APAC e-commerce market is witnessing rapid product innovation, driven by technological advancements and evolving consumer demands. Key developments include the integration of AI-powered recommendation engines, the rise of social commerce platforms, and the increasing adoption of omnichannel strategies. The focus is on enhancing personalization, improving customer experience, and optimizing logistics. These innovations are aimed at improving market fit and creating a competitive advantage in a crowded marketplace.

Key Drivers of APAC E-commerce Market Growth

Several factors contribute to the robust growth of the APAC e-commerce market. Firstly, the region's burgeoning middle class fuels increased consumer spending and adoption of online shopping. Secondly, improving digital infrastructure, including internet connectivity and mobile penetration, broadens access. Lastly, supportive government policies that encourage digitalization and e-commerce further accelerate growth. The interplay of these factors creates a synergistic effect, driving the sector's expansion.

Challenges in the APAC E-commerce Market Market

Despite its significant potential, the APAC e-commerce market faces several challenges. Cybersecurity concerns, particularly data breaches and fraud, remain a significant issue. Logistical hurdles, including last-mile delivery in rural areas, pose complexities. Lastly, intense competition and price wars pressure profit margins for many players. These factors influence market dynamics and necessitate proactive mitigation strategies by businesses.

Emerging Opportunities in APAP E-commerce Market

The future of the APAC e-commerce market is bright, presenting substantial opportunities for growth. The expansion of cross-border e-commerce opens new markets and enhances revenue streams. The adoption of innovative technologies such as blockchain for supply chain management and AI for personalized marketing will unlock further efficiencies. The development of robust payment systems and logistical infrastructure will cater to the rapidly expanding consumer base. Strategic alliances and partnerships also offer the potential for significant market expansion.

Leading Players in the APAC E-commerce Market Sector

- Shopify Inc

- JD.com Inc

- Alibaba Group Holding Limited

- Rakuten Group Inc

- DIYTrade com

- ChinaAseanTrade com

- Amazon.com Inc

- eBay Inc

- Apple Inc

- AliExpress

Key Milestones in APAC E-commerce Market Industry

- February 2023: JD.com, Inc. launched "ChatJD," an AI-powered chatbot for retail and finance, signifying a significant advancement in customer service and operational efficiency.

- April 2023: TMON launched a "Sports & Leisure Special Hall," indicating a shift towards specialized product categories and leveraging promotions to attract niche customer segments.

Strategic Outlook for APAC E-commerce Market Market

The APAC e-commerce market presents a compelling investment opportunity, characterized by its substantial growth potential and dynamic innovation. Strategic partnerships, focusing on technological advancements, enhanced logistics, and market expansion into less penetrated regions, will be crucial for success. Companies adept at navigating regulatory complexities and adapting to evolving consumer preferences will be well-positioned to thrive in this competitive yet lucrative market.

APAC E-commerce Market Segmentation

-

1. Product Type

- 1.1. Corn

- 1.2. rice

- 1.3. wheat

- 1.4. soybean

- 1.5. vegetables

-

2. Application

- 2.1. Commercial farming

- 2.2. small-scale farming

-

3. Distribution Channel

- 3.1. Online

- 3.2. offline

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. South Korea

- 4.5. Other APAC countries

APAC E-commerce Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

APAC E-commerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Disposable Income of Consumers; Increasing Consumer Interest towards Convenient Shopping solutions; Extensive Internet Accessibility

- 3.3. Market Restrains

- 3.3.1. High Cost of Content Creation

- 3.4. Market Trends

- 3.4.1. Fashion and Apparel to Witness the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC E-commerce Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Corn

- 5.1.2. rice

- 5.1.3. wheat

- 5.1.4. soybean

- 5.1.5. vegetables

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial farming

- 5.2.2. small-scale farming

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. offline

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Other APAC countries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China APAC E-commerce Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Corn

- 6.1.2. rice

- 6.1.3. wheat

- 6.1.4. soybean

- 6.1.5. vegetables

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial farming

- 6.2.2. small-scale farming

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Online

- 6.3.2. offline

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. South Korea

- 6.4.5. Other APAC countries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. India APAC E-commerce Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Corn

- 7.1.2. rice

- 7.1.3. wheat

- 7.1.4. soybean

- 7.1.5. vegetables

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial farming

- 7.2.2. small-scale farming

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Online

- 7.3.2. offline

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. South Korea

- 7.4.5. Other APAC countries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Japan APAC E-commerce Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Corn

- 8.1.2. rice

- 8.1.3. wheat

- 8.1.4. soybean

- 8.1.5. vegetables

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial farming

- 8.2.2. small-scale farming

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Online

- 8.3.2. offline

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. South Korea

- 8.4.5. Other APAC countries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South Korea APAC E-commerce Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Corn

- 9.1.2. rice

- 9.1.3. wheat

- 9.1.4. soybean

- 9.1.5. vegetables

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Commercial farming

- 9.2.2. small-scale farming

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Online

- 9.3.2. offline

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. South Korea

- 9.4.5. Other APAC countries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. China APAC E-commerce Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. India APAC E-commerce Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Japan APAC E-commerce Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. South Korea APAC E-commerce Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Rest of Asia Pacific APAC E-commerce Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Shopify Inc

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 JD com Inc

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Alibaba Group Holding Limited

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Rakuten Group Inc

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 DIYTrade com

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 ChinaAseanTrade com

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Amazon com Inc

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 eBay Inc

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Apple Inc

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Ali Express

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 Shopify Inc

List of Figures

- Figure 1: APAC E-commerce Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: APAC E-commerce Market Share (%) by Company 2024

List of Tables

- Table 1: APAC E-commerce Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: APAC E-commerce Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: APAC E-commerce Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: APAC E-commerce Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 5: APAC E-commerce Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: APAC E-commerce Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: APAC E-commerce Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: APAC E-commerce Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 9: APAC E-commerce Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 10: APAC E-commerce Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 11: APAC E-commerce Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: APAC E-commerce Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: APAC E-commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: APAC E-commerce Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: APAC E-commerce Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: APAC E-commerce Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: APAC E-commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: APAC E-commerce Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: APAC E-commerce Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: APAC E-commerce Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: APAC E-commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: APAC E-commerce Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 23: APAC E-commerce Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: APAC E-commerce Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: APAC E-commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: APAC E-commerce Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: APAC E-commerce Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: APAC E-commerce Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: APAC E-commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: APAC E-commerce Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: APAC E-commerce Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: APAC E-commerce Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: APAC E-commerce Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 34: APAC E-commerce Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 35: APAC E-commerce Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: APAC E-commerce Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 37: APAC E-commerce Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 38: APAC E-commerce Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 39: APAC E-commerce Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: APAC E-commerce Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 41: APAC E-commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: APAC E-commerce Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: APAC E-commerce Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 44: APAC E-commerce Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 45: APAC E-commerce Market Revenue Million Forecast, by Application 2019 & 2032

- Table 46: APAC E-commerce Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 47: APAC E-commerce Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 48: APAC E-commerce Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 49: APAC E-commerce Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 50: APAC E-commerce Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 51: APAC E-commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: APAC E-commerce Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 53: APAC E-commerce Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 54: APAC E-commerce Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 55: APAC E-commerce Market Revenue Million Forecast, by Application 2019 & 2032

- Table 56: APAC E-commerce Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 57: APAC E-commerce Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 58: APAC E-commerce Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 59: APAC E-commerce Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 60: APAC E-commerce Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 61: APAC E-commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: APAC E-commerce Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 63: APAC E-commerce Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 64: APAC E-commerce Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 65: APAC E-commerce Market Revenue Million Forecast, by Application 2019 & 2032

- Table 66: APAC E-commerce Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 67: APAC E-commerce Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 68: APAC E-commerce Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 69: APAC E-commerce Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 70: APAC E-commerce Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 71: APAC E-commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 72: APAC E-commerce Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC E-commerce Market?

The projected CAGR is approximately 10.00%.

2. Which companies are prominent players in the APAC E-commerce Market?

Key companies in the market include Shopify Inc, JD com Inc, Alibaba Group Holding Limited, Rakuten Group Inc, DIYTrade com, ChinaAseanTrade com, Amazon com Inc, eBay Inc, Apple Inc, Ali Express.

3. What are the main segments of the APAC E-commerce Market?

The market segments include Product Type, Application, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Disposable Income of Consumers; Increasing Consumer Interest towards Convenient Shopping solutions; Extensive Internet Accessibility.

6. What are the notable trends driving market growth?

Fashion and Apparel to Witness the Growth.

7. Are there any restraints impacting market growth?

High Cost of Content Creation.

8. Can you provide examples of recent developments in the market?

April 2023: TMON announced that the company would open a 'Sports & Leisure Special Hall" and introduce popular sports and outdoor items at exceptional prices. An additional 8% discount was also available when paying with Kakao Pay. This is expected to help athletic people stretch in warm spring weather.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC E-commerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC E-commerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC E-commerce Market?

To stay informed about further developments, trends, and reports in the APAC E-commerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence