Key Insights

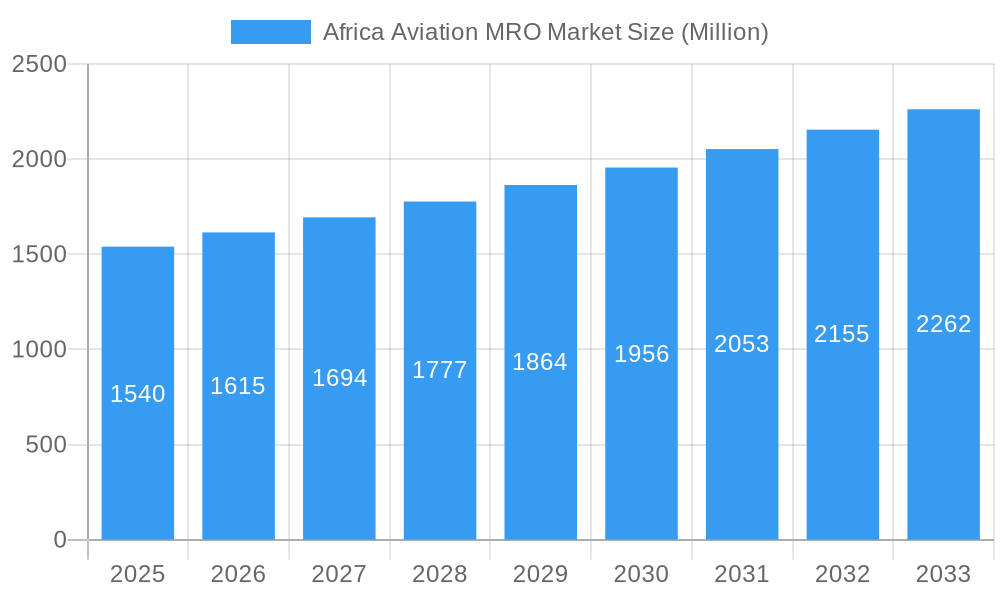

The Africa Aviation Maintenance, Repair, and Overhaul (MRO) market presents a compelling investment opportunity, projected to reach $1.54 billion in 2025 and maintain a robust Compound Annual Growth Rate (CAGR) of 4.79% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the burgeoning African aviation sector, driven by increasing passenger traffic and the expansion of low-cost carriers, creates a significant demand for MRO services. Secondly, the continent's aging aircraft fleet necessitates regular maintenance and upgrades, further bolstering the market. The rise of government initiatives promoting aviation infrastructure development and partnerships with international MRO providers are also crucial catalysts. Segmentation analysis reveals that fixed-wing aircraft currently dominate the market, followed by rotorcraft, with commercial aviation contributing the largest share of MRO activity. Engine MRO, airframe MRO and component MRO are the leading service categories. Growth will be significantly influenced by the expansion of air travel, which creates demand for more efficient MRO services to support a growing fleet.

Africa Aviation MRO Market Market Size (In Billion)

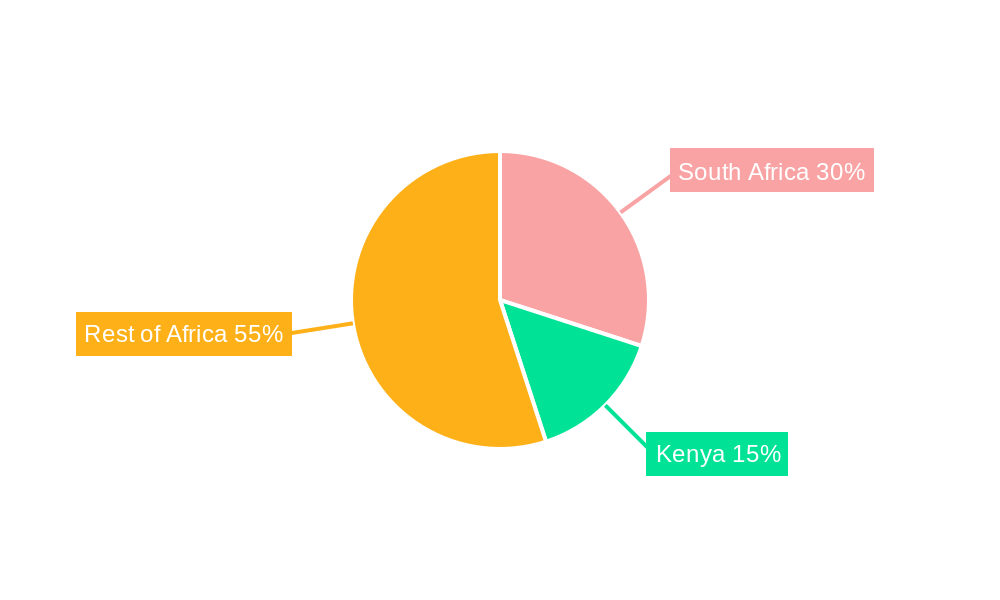

The market's regional distribution shows South Africa, Kenya, and other key economies leading the way in MRO activity. However, untapped potential exists across the continent, particularly in rapidly developing aviation hubs. While challenges remain, such as limited skilled labor and infrastructural limitations in some regions, the overall outlook remains positive. Strategic investments in training programs and infrastructure development are key to unlocking the full potential of the African MRO market. Increased competition amongst established players and the entry of new international providers will further stimulate innovation and price competitiveness, ultimately benefitting the entire aviation ecosystem. Key players like Ethiopian Airlines, Airbus SE, and Lufthansa Technik AG are strategically positioned to capitalize on these opportunities and shape the future trajectory of the African aviation MRO landscape. The market’s growth will likely be influenced by economic conditions in the region and global geopolitical events.

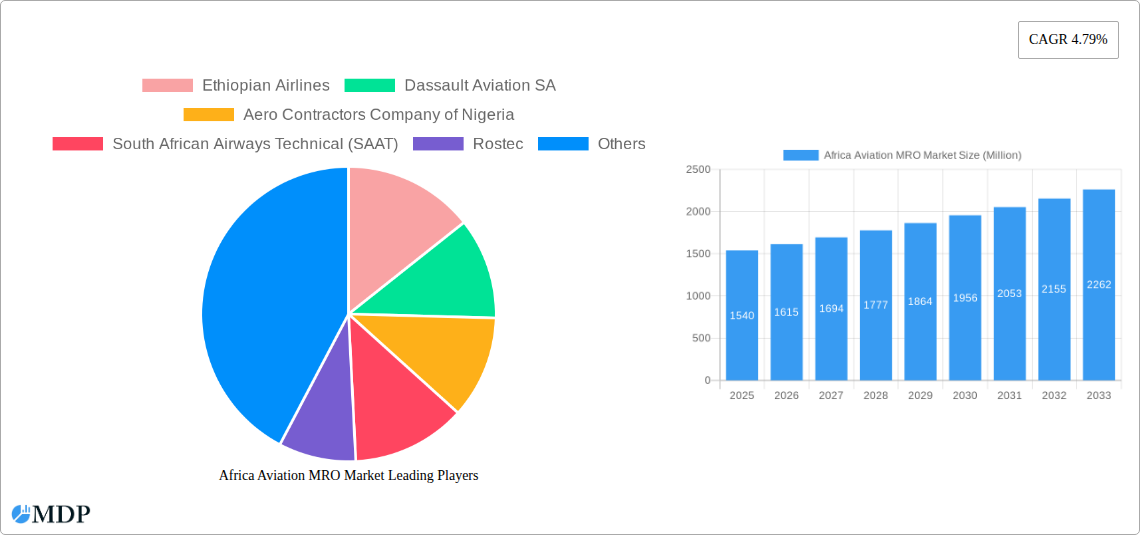

Africa Aviation MRO Market Company Market Share

Africa Aviation MRO Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Africa Aviation MRO Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period spanning 2025-2033. The report meticulously analyzes market dynamics, trends, leading players, and future opportunities, providing a clear picture of this rapidly evolving sector. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

Africa Aviation MRO Market Dynamics & Concentration

The African aviation MRO market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is currently moderate, with a few large players like Ethiopian Airlines, Dassault Aviation SA, and Airbus SE holding significant market share, but a multitude of smaller, regional players also contribute substantially. This leads to a competitive landscape marked by both collaboration and competition.

- Market Share: The top 5 players collectively account for approximately xx% of the market share in 2025, while the remaining xx% is dispersed among numerous smaller players.

- Innovation Drivers: Technological advancements in aircraft maintenance, the adoption of predictive maintenance technologies, and the rise of digital MRO solutions are key drivers of market growth.

- Regulatory Frameworks: The regulatory landscape is diverse across African nations, posing both challenges and opportunities. Harmonization of regulations could significantly boost market growth.

- Product Substitutes: The market faces limited direct substitutes, but indirect competition exists from leasing companies and airlines outsourcing maintenance internationally.

- End-User Trends: The increasing demand for air travel across Africa, coupled with growing airline fleets and rising government investments in aviation infrastructure, drives growth in the MRO sector.

- M&A Activities: An estimated xx M&A deals were recorded between 2019 and 2024, signaling consolidation within the market. This trend is expected to continue as larger players seek to expand their reach and service capabilities.

Africa Aviation MRO Market Industry Trends & Analysis

The African aviation MRO market is witnessing substantial growth fueled by a confluence of factors. The rising number of aircraft in operation, particularly in the commercial aviation segment, is a major driver. Government initiatives aimed at improving aviation infrastructure and expanding air connectivity across the continent further stimulate market expansion. Technological advancements, including the adoption of predictive maintenance and digitalization, are revolutionizing maintenance practices, improving efficiency, and reducing operational costs.

The market is also influenced by consumer preferences for enhanced safety standards, leading to increased demand for high-quality MRO services. The competitive dynamics are intensifying as both established international players and local MRO providers vie for market share. This leads to an environment of price competitiveness and continuous innovation. The market is expected to grow at a CAGR of xx% during the forecast period (2025-2033), driven by increased air travel and investments in fleet modernization. Market penetration of advanced MRO technologies is also expected to increase significantly during this time.

Leading Markets & Segments in Africa Aviation MRO Market

The African aviation MRO market exhibits substantial regional variation, with significant differences in market size and growth rates. North Africa currently dominates the market due to its higher air traffic volume, more established aviation infrastructure, and the presence of several large airlines and MRO providers. However, other regions are witnessing rapid growth, propelled by economic development and investment in aviation infrastructure.

- Dominant Regions/Countries: North Africa, South Africa, and East Africa are currently the leading markets.

- Aircraft Type: Fixed-wing aircraft constitutes the largest segment, driven by the high volume of commercial and cargo flights.

- Aviation Type: Commercial aviation is the largest segment, with Military and General Aviation segments experiencing moderate but steady growth.

- MRO Type: Engine MRO and Airframe MRO are currently the largest segments due to higher maintenance needs and complexity.

Key Drivers:

- Economic Policies: Government policies supporting aviation development and infrastructure investment drive growth.

- Infrastructure: Improvements in airport infrastructure and air navigation systems enhance MRO service accessibility.

- Airline Growth: Expansion of airline operations and fleet sizes directly boosts demand for MRO services.

Africa Aviation MRO Market Product Developments

Recent product innovations focus on leveraging digital technologies to improve efficiency, reduce downtime, and enhance safety. This includes predictive maintenance solutions, advanced diagnostic tools, and data analytics platforms. These innovations are enhancing MRO service offerings, enabling better inventory management and resource allocation. The integration of augmented reality (AR) and virtual reality (VR) technologies in maintenance training and troubleshooting represents another significant advancement. The market fit for these new products is strong, given the industry's increasing focus on optimizing operational performance and cutting costs.

Key Drivers of Africa Aviation MRO Market Growth

Several factors fuel the growth of the African aviation MRO market:

- Technological Advancements: The adoption of advanced technologies like predictive maintenance and digital MRO solutions improves efficiency and reduces costs.

- Economic Growth: Increased economic activity and rising disposable incomes drive passenger growth and consequently, demand for MRO services.

- Regulatory Support: Government initiatives to improve aviation infrastructure and streamline regulations foster market expansion. The example of supportive policies in countries like Rwanda and Ethiopia shows the potential for substantial growth.

Challenges in the Africa Aviation MRO Market

Despite the growth potential, the African aviation MRO market faces challenges:

- Regulatory Hurdles: Inconsistencies and complexities in regulatory frameworks across different African nations hinder efficient operations.

- Supply Chain Issues: Reliable access to parts and components can be challenging, leading to delays and increased costs. The impact is estimated at xx Million annually on the market.

- Competitive Pressures: Intense competition from both established international players and local providers puts downward pressure on prices.

Emerging Opportunities in Africa Aviation MRO Market

Several factors present promising opportunities for growth:

- Technological Breakthroughs: Further adoption of AI-driven maintenance solutions, drone technology for inspections, and other technological advancements will boost efficiency and open new service offerings.

- Strategic Partnerships: Collaborations between international and local MRO providers can bridge technology gaps and enhance service capabilities.

- Market Expansion: The growth of low-cost carriers and expansion into underserved regions offer opportunities for new market penetration.

Leading Players in the Africa Aviation MRO Market Sector

- Ethiopian Airlines

- Dassault Aviation SA

- Aero Contractors Company of Nigeria

- South African Airways Technical (SAAT)

- Rostec

- Airbus SE

- Egyptair Maintenance & Engineering

- Safran SA

- Denel SOC Ltd

- RTX Corporation

- Pilatus Aircraft Ltd

- Lufthansa Technik AG

- Leonardo S p A

- Saab AB

- Sabena technics S A

Key Milestones in Africa Aviation MRO Market Industry

- May 2023: ExecuJet MRO Services appointed as an authorized service center for Embraer business jets, expanding Embraer's service network and strengthening ExecuJet's position.

- January 2023: RwandAir signed a multi-year contract with Iberia Maintenance for engine maintenance, ensuring fleet upkeep and service reliability.

Strategic Outlook for Africa Aviation MRO Market

The African aviation MRO market is poised for continued strong growth, driven by technological advancements, expanding airline fleets, and supportive government policies. Strategic partnerships, investments in advanced technologies, and expansion into underserved markets will be crucial for success. The market's future potential is substantial, presenting lucrative opportunities for both established players and new entrants.

Africa Aviation MRO Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Africa Aviation MRO Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Aviation MRO Market Regional Market Share

Geographic Coverage of Africa Aviation MRO Market

Africa Aviation MRO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries

- 3.3. Market Restrains

- 3.3.1. ; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies

- 3.4. Market Trends

- 3.4.1. Fixed-Wing Aircraft to Witness Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Aviation MRO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ethiopian Airlines

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dassault Aviation SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aero Contractors Company of Nigeria

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 South African Airways Technical (SAAT)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rostec

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Airbus SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Egyptair Maintenance & Engineering

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Safran SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Denel SOC Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 RTX Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Pilatus Aircraft Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Lufthansa Technik AG

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Leonardo S p A

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Saab AB

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Sabena technics S A

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Ethiopian Airlines

List of Figures

- Figure 1: Africa Aviation MRO Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Aviation MRO Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Aviation MRO Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Africa Aviation MRO Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Africa Aviation MRO Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Africa Aviation MRO Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Africa Aviation MRO Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Africa Aviation MRO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Africa Aviation MRO Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Africa Aviation MRO Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Africa Aviation MRO Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Africa Aviation MRO Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Africa Aviation MRO Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Africa Aviation MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Nigeria Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: South Africa Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Egypt Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Kenya Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Ethiopia Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Morocco Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Ghana Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Algeria Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Tanzania Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Ivory Coast Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Aviation MRO Market?

The projected CAGR is approximately 4.79%.

2. Which companies are prominent players in the Africa Aviation MRO Market?

Key companies in the market include Ethiopian Airlines, Dassault Aviation SA, Aero Contractors Company of Nigeria, South African Airways Technical (SAAT), Rostec, Airbus SE, Egyptair Maintenance & Engineering, Safran SA, Denel SOC Ltd, RTX Corporation, Pilatus Aircraft Ltd, Lufthansa Technik AG, Leonardo S p A, Saab AB, Sabena technics S A.

3. What are the main segments of the Africa Aviation MRO Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.54 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries.

6. What are the notable trends driving market growth?

Fixed-Wing Aircraft to Witness Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies.

8. Can you provide examples of recent developments in the market?

May 2023: ExecuJet MRO Services, the business aviation maintenance, repair, and overhaul (MRO) organization in Africa, was appointed as the authorized service center (ASC) for Embraer business jets across the region. The partnership signifies a significant expansion of Embraer’s service network in the region and reinforces ExecuJet’s position as a trusted and reliable MRO provider.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Aviation MRO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Aviation MRO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Aviation MRO Market?

To stay informed about further developments, trends, and reports in the Africa Aviation MRO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence