Key Insights

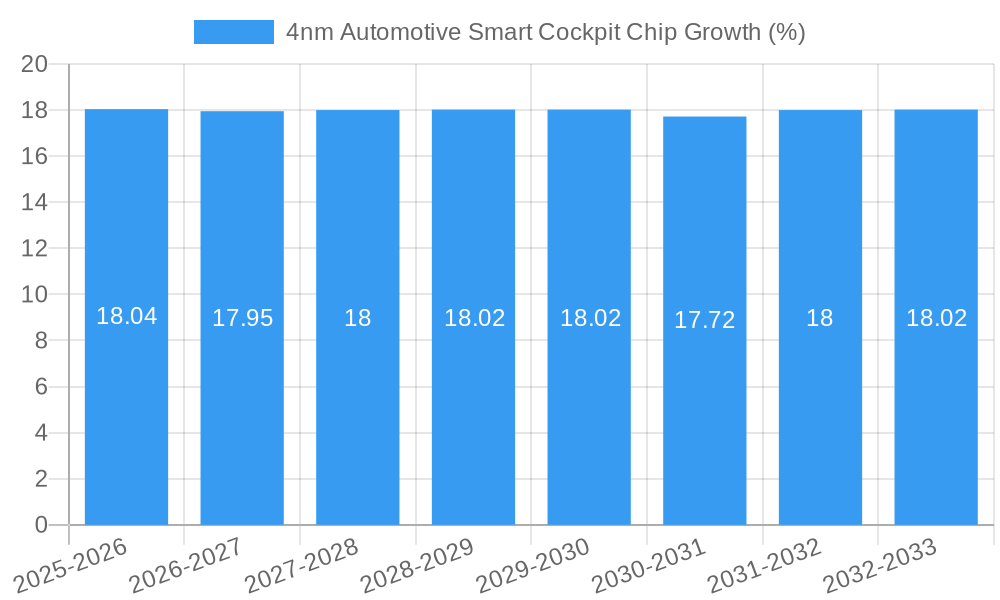

The global 4nm automotive smart cockpit chip market is poised for explosive growth, projected to reach an estimated $1652 million by 2025, driven by an impressive 18% CAGR. This significant expansion is fueled by the escalating demand for advanced in-car digital experiences, encompassing sophisticated infotainment systems, sophisticated driver assistance features, and seamless connectivity. The increasing integration of AI and machine learning capabilities within vehicle cockpits, enabling personalized user interfaces and predictive functionalities, is a paramount driver. Furthermore, the relentless pursuit of enhanced safety features, including advanced sensor fusion and real-time data processing for autonomous driving functionalities, is a critical catalyst. The shift towards electric vehicles (EVs), which often feature more integrated and technologically advanced cockpits to appeal to a tech-savvy demographic, also plays a substantial role in market acceleration. As consumers increasingly expect their vehicles to offer a seamless extension of their digital lives, the demand for powerful and efficient 4nm automotive smart cockpit chips will continue to surge, pushing the market into new frontiers of innovation and adoption.

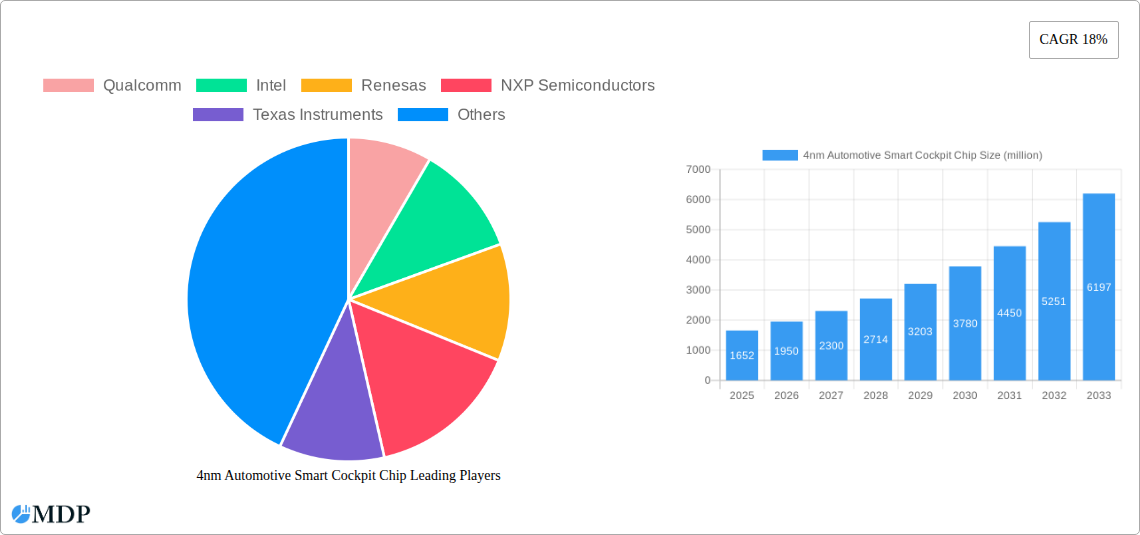

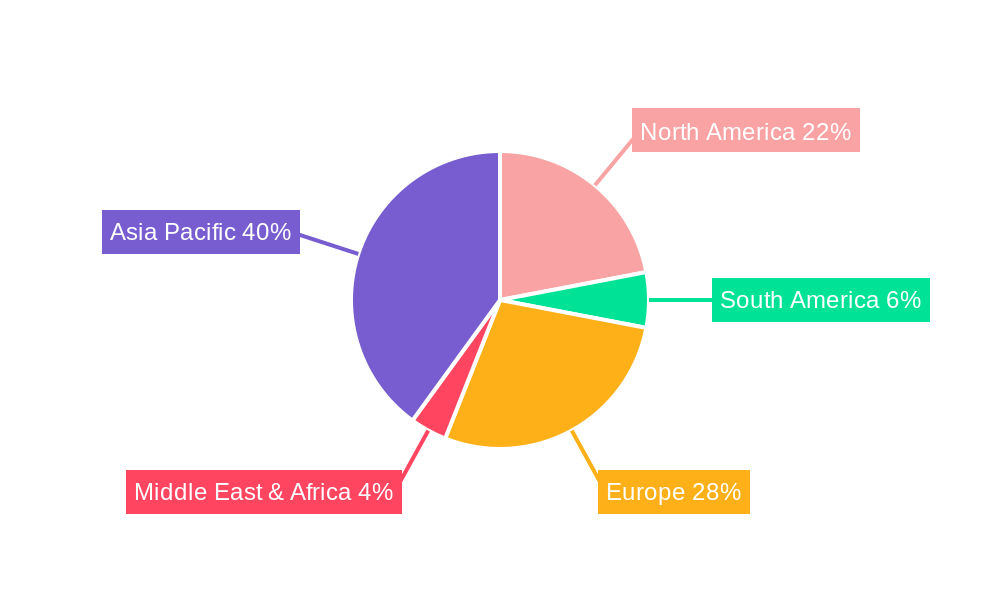

The market is segmented by application into Commercial Vehicles and Passenger Vehicles, with Passenger Vehicles likely dominating due to higher production volumes and consumer demand for premium features. By type, the market encompasses 8-core, 16-core, and other configurations, with 16-core and higher-performance variants expected to see the most substantial growth as complexity and processing demands increase. Key players such as Qualcomm, Intel, Renesas, NXP Semiconductors, and NVIDIA are at the forefront, investing heavily in research and development to deliver next-generation solutions. Emerging players like Horizon Robotics Technology R&D and BYD Semiconductor are also making significant inroads, particularly in the burgeoning Asia Pacific region. Geographically, Asia Pacific, led by China, is expected to be the largest and fastest-growing market due to its massive automotive production and increasing adoption of smart technologies. North America and Europe will also remain significant markets, driven by stringent safety regulations and a strong consumer appetite for advanced automotive features. Challenges such as the high cost of advanced node manufacturing and supply chain complexities could pose minor restraints, but the overarching trend of technological advancement in automotive cockpits will likely outweigh these hurdles, ensuring a robust growth trajectory.

Gain unparalleled insights into the rapidly evolving 4nm Automotive Smart Cockpit Chip Market. This comprehensive report, spanning 2019-2033 with a base and estimated year of 2025, delves deep into the technological advancements, market dynamics, and strategic imperatives shaping the next generation of in-car experiences. Discover how cutting-edge automotive processors, powered by advanced semiconductor technology, are redefining connectivity, infotainment, and autonomous driving capabilities for both commercial vehicles and passenger vehicles.

This report offers actionable intelligence for automotive OEMs, Tier-1 suppliers, semiconductor manufacturers, and investors seeking to capitalize on the burgeoning demand for sophisticated smart cockpit solutions. Explore key trends, competitive landscapes, and future projections with data-driven analysis.

4nm Automotive Smart Cockpit Chip Market Dynamics & Concentration

The 4nm Automotive Smart Cockpit Chip Market is characterized by dynamic growth driven by escalating consumer demand for immersive and intelligent in-car experiences. Market concentration is moderately high, with a few dominant players vying for market share. Innovation is primarily fueled by advancements in AI processing, graphics rendering, and power efficiency within the semiconductor industry. Regulatory frameworks, particularly concerning vehicle safety and data privacy, are increasingly influencing chip design and deployment. Product substitutes, such as less advanced SoC solutions and integrated infotainment systems, exist but are rapidly being outpaced by the capabilities offered by 4nm automotive chips. End-user trends favor personalized digital experiences, advanced driver-assistance systems (ADAS), and seamless connectivity. Merger and acquisition (M&A) activities are expected to increase as companies seek to consolidate expertise and expand their portfolios. Projections indicate approximately 500 million units in M&A deal counts within the forecast period, underscoring a trend towards consolidation and strategic partnerships.

- Innovation Drivers: Enhanced AI and ML capabilities, powerful graphics processing units (GPUs), increased power efficiency, dedicated automotive safety features.

- Regulatory Frameworks: Stringent automotive safety standards (e.g., ISO 26262), data privacy regulations (e.g., GDPR), emissions standards influencing power consumption.

- End-User Trends: Demand for seamless connectivity (5G, Wi-Fi 6E), advanced infotainment systems, personalized user interfaces, integrated ADAS features, over-the-air (OTA) updates.

- Market Share: Leading players are projected to hold significant market share, with Qualcomm and NVIDIA anticipated to be major contributors.

- M&A Activities: Strategic acquisitions and partnerships are expected to be prevalent as companies aim to bolster their R&D capabilities and market reach.

4nm Automotive Smart Cockpit Chip Industry Trends & Analysis

The 4nm Automotive Smart Cockpit Chip Industry is experiencing robust growth, propelled by a confluence of technological advancements and evolving consumer expectations. The increasing integration of sophisticated features within vehicle cockpits, ranging from advanced infotainment systems and digital instrument clusters to head-up displays (HUDs) and driver monitoring systems, is a primary growth driver. Furthermore, the ongoing shift towards electric vehicles (EVs) and autonomous driving technologies necessitates more powerful and efficient processing capabilities, a role expertly filled by 4nm automotive chips. The Compound Annual Growth Rate (CAGR) for this market is projected to be approximately 25% over the forecast period. Market penetration is rapidly increasing, with an estimated 40% of new vehicles expected to feature advanced smart cockpit solutions by 2028.

Technological disruptions are at the forefront, with the continuous miniaturization of semiconductor nodes to 4nm enabling higher performance, reduced power consumption, and a smaller form factor – crucial for space-constrained automotive interiors. The adoption of heterogeneous computing architectures, combining powerful CPUs, dedicated GPUs, AI accelerators, and safety-certified microcontrollers on a single System-on-Chip (SoC), is transforming the capabilities of smart cockpits. Consumer preferences are increasingly leaning towards a connected, personalized, and intuitive in-car digital environment, mirroring their smartphone experiences. This includes demand for high-resolution displays, immersive audio, advanced voice control, and seamless integration with personal devices and cloud services.

The competitive dynamics are intense, with established semiconductor giants and emerging players alike investing heavily in R&D to capture market share. Key players are focusing on developing integrated solutions that offer a comprehensive suite of functionalities, including advanced cybersecurity features, real-time data processing for ADAS, and support for the latest connectivity standards like 5G. The report anticipates significant growth in the adoption of 8-core and 16-core configurations to handle the increasing computational demands of next-generation smart cockpits. This sustained innovation, coupled with strong market demand, positions the 4nm Automotive Smart Cockpit Chip Market for substantial expansion.

Leading Markets & Segments in 4nm Automotive Smart Cockpit Chip

The 4nm Automotive Smart Cockpit Chip Market is dominated by the Passenger Vehicles segment, which accounts for an estimated 75% of the market share. This dominance is driven by several factors, including higher production volumes, a strong consumer appetite for advanced in-car technology, and the increasing trend of premium features becoming standard even in mid-range vehicles. The economic policies in developed and developing nations, which often incentivize the adoption of advanced automotive technologies and support R&D in the automotive sector, further bolster this segment's growth.

Within the Passenger Vehicles segment, the demand for 16-core processors is rapidly increasing. These high-performance chips are essential for powering complex infotainment systems, multi-display setups, sophisticated ADAS functionalities, and advanced digital cockpits that offer immersive user experiences. The market penetration of 16-core solutions is expected to reach approximately 60% of new passenger vehicles by 2030.

Geographically, North America and Europe currently lead the market, driven by their established automotive industries, high disposable incomes, and early adoption of advanced automotive technologies. However, the Asia-Pacific region, particularly China, is emerging as a significant growth engine. This surge is attributed to the rapid expansion of the automotive market, government initiatives promoting technological innovation, and the presence of major automotive manufacturers and semiconductor suppliers. The economic policies in these regions, including substantial investments in EV infrastructure and smart city development, are creating a fertile ground for the widespread adoption of 4nm automotive chips.

- Dominant Application: Passenger Vehicles (Estimated 75% Market Share).

- Key Drivers: High consumer demand for advanced features, premiumization of in-car technology, increasing adoption in mid-range vehicles, strong aftermarket demand for upgrades.

- Economic Policies: Government incentives for vehicle electrification and advanced technology integration, favorable trade agreements boosting automotive exports.

- Infrastructure: Robust charging infrastructure for EVs, growing development of smart city initiatives integrating vehicles with urban ecosystems.

- Dominant Type: 16 Cores (Rapidly increasing demand within Passenger Vehicles).

- Key Drivers: Need for powerful processing for AI, complex graphics, multiple displays, and integrated ADAS.

- Consumer Preferences: Desire for seamless multitasking, high-fidelity infotainment, and advanced digital cockpit functionalities.

- Leading Regions: North America, Europe, and the rapidly growing Asia-Pacific region (especially China).

- Key Drivers: Mature automotive markets, strong R&D capabilities, government support for innovation, large consumer base.

4nm Automotive Smart Cockpit Chip Product Developments

Product developments in the 4nm Automotive Smart Cockpit Chip Market are focused on enhanced processing power, AI acceleration, and improved power efficiency. Leading companies are introducing SoCs that integrate advanced GPUs for stunning visuals, dedicated AI engines for on-device machine learning tasks like voice recognition and predictive diagnostics, and robust cybersecurity features to protect sensitive data. These innovations enable richer user interfaces, real-time processing for ADAS, and seamless integration with cloud services. Competitive advantages lie in offering integrated solutions that reduce Bill of Materials (BOM) costs for automakers and provide a superior, personalized driving experience.

Key Drivers of 4nm Automotive Smart Cockpit Chip Growth

The growth of the 4nm Automotive Smart Cockpit Chip Market is primarily propelled by several key factors. Firstly, the escalating consumer demand for highly integrated and personalized in-car digital experiences, akin to their smartphone interactions, is a major catalyst. Secondly, the rapid advancement and widespread adoption of Advanced Driver-Assistance Systems (ADAS) and the ongoing development towards higher levels of vehicle autonomy necessitate the processing power and efficiency offered by 4nm chips. Thirdly, the increasing electrification of vehicles often leads to redesigned interiors and a greater emphasis on sophisticated electronic systems, including advanced cockpits. Lastly, government regulations and incentives promoting technological innovation and vehicle safety standards are indirectly driving the adoption of these advanced semiconductor solutions.

Challenges in the 4nm Automotive Smart Cockpit Chip Market

Despite its promising growth, the 4nm Automotive Smart Cockpit Chip Market faces several significant challenges. Regulatory hurdles, particularly the rigorous automotive qualification processes and stringent safety certifications (e.g., ISO 26262), can prolong development cycles and increase costs for chip manufacturers. Supply chain complexities, exacerbated by the global semiconductor shortage and geopolitical tensions, pose a continuous risk of production delays and price volatility, impacting an estimated 30% of projected production capacity. Furthermore, intense competitive pressures from established players and new entrants can lead to price erosion and require substantial ongoing investment in R&D to maintain a competitive edge.

Emerging Opportunities in 4nm Automotive Smart Cockpit Chip

Emerging opportunities in the 4nm Automotive Smart Cockpit Chip Market are abundant, driven by technological breakthroughs and evolving market demands. The burgeoning field of in-cabin sensing and monitoring, utilizing AI for driver fatigue detection, passenger identification, and personalized climate control, presents a significant growth avenue. Strategic partnerships between semiconductor manufacturers and automotive OEMs are crucial for co-developing next-generation cockpit architectures tailored to specific vehicle platforms. Furthermore, the expansion of the smart cockpit concept into commercial vehicles and the increasing demand for sophisticated infotainment systems in developing markets offer substantial untapped potential for market expansion.

Leading Players in the 4nm Automotive Smart Cockpit Chip Sector

- Qualcomm

- Intel

- Renesas Electronics Corporation

- NXP Semiconductors

- Texas Instruments

- NVIDIA

- Samsung Electronics

- Telechips

- MediaTek

- Horizon Robotics Technology R&D

- Rockchip Electronics

- Allwinner Technology

- UNISOC

- Siengine

- Nio

- Hisilicon

- BYD Semiconductor

Key Milestones in 4nm Automotive Smart Cockpit Chip Industry

- 2019: Increased investment in R&D for next-generation automotive processors by leading semiconductor companies.

- 2020: Launch of initial automotive-grade SoCs with advanced AI capabilities by key players, paving the way for 4nm integration.

- 2021: Growing demand for integrated infotainment and ADAS solutions, signaling the need for more powerful chips.

- 2022: Significant advancements in semiconductor manufacturing technology reaching the 4nm node, making it viable for automotive applications.

- 2023: First automotive-specific 4nm chips announced by major manufacturers, promising enhanced performance and efficiency.

- 2024: Pilot programs and early adoption of 4nm automotive smart cockpit chips in high-end vehicle models.

Strategic Outlook for 4nm Automotive Smart Cockpit Chip Market

- 2019: Increased investment in R&D for next-generation automotive processors by leading semiconductor companies.

- 2020: Launch of initial automotive-grade SoCs with advanced AI capabilities by key players, paving the way for 4nm integration.

- 2021: Growing demand for integrated infotainment and ADAS solutions, signaling the need for more powerful chips.

- 2022: Significant advancements in semiconductor manufacturing technology reaching the 4nm node, making it viable for automotive applications.

- 2023: First automotive-specific 4nm chips announced by major manufacturers, promising enhanced performance and efficiency.

- 2024: Pilot programs and early adoption of 4nm automotive smart cockpit chips in high-end vehicle models.

Strategic Outlook for 4nm Automotive Smart Cockpit Chip Market

The strategic outlook for the 4nm Automotive Smart Cockpit Chip Market is exceptionally positive, driven by a robust combination of technological innovation and escalating consumer demand. Future growth will be significantly accelerated by the increasing integration of AI and machine learning capabilities, enabling more personalized and predictive in-car experiences. The continuous evolution of ADAS and the pursuit of higher levels of autonomous driving will further necessitate the adoption of these high-performance automotive semiconductor solutions. Strategic opportunities lie in developing highly integrated platforms that offer cost efficiencies for OEMs, enhancing cybersecurity measures to address growing data protection concerns, and expanding into emerging markets with tailored product offerings. The market is poised for sustained expansion as automakers prioritize creating compelling digital cockpits that redefine the driving experience.

4nm Automotive Smart Cockpit Chip Segmentation

-

1. Application

- 1.1. Commercial Vehicles

- 1.2. Passenger Vehicles

-

2. Type

- 2.1. 8 Cores

- 2.2. 16 Cores

- 2.3. Others

4nm Automotive Smart Cockpit Chip Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

4nm Automotive Smart Cockpit Chip REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 4nm Automotive Smart Cockpit Chip Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Vehicles

- 5.1.2. Passenger Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. 8 Cores

- 5.2.2. 16 Cores

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America 4nm Automotive Smart Cockpit Chip Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Vehicles

- 6.1.2. Passenger Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. 8 Cores

- 6.2.2. 16 Cores

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America 4nm Automotive Smart Cockpit Chip Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Vehicles

- 7.1.2. Passenger Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. 8 Cores

- 7.2.2. 16 Cores

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe 4nm Automotive Smart Cockpit Chip Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Vehicles

- 8.1.2. Passenger Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. 8 Cores

- 8.2.2. 16 Cores

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa 4nm Automotive Smart Cockpit Chip Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Vehicles

- 9.1.2. Passenger Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. 8 Cores

- 9.2.2. 16 Cores

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific 4nm Automotive Smart Cockpit Chip Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Vehicles

- 10.1.2. Passenger Vehicles

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. 8 Cores

- 10.2.2. 16 Cores

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Qualcomm

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Intel

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Renesas

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 NXP Semiconductors

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Texas Instruments

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NVIDIA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Samsung

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Telechips

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MediaTek

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Horizon Robotics Technology R&D

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rockchip Electronics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Allwinner Technology

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 UNISOC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Siengine

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Nio

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Hisilicon

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 BYD Semiconductor

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Qualcomm

List of Figures

- Figure 1: Global 4nm Automotive Smart Cockpit Chip Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America 4nm Automotive Smart Cockpit Chip Revenue (million), by Application 2024 & 2032

- Figure 3: North America 4nm Automotive Smart Cockpit Chip Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America 4nm Automotive Smart Cockpit Chip Revenue (million), by Type 2024 & 2032

- Figure 5: North America 4nm Automotive Smart Cockpit Chip Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America 4nm Automotive Smart Cockpit Chip Revenue (million), by Country 2024 & 2032

- Figure 7: North America 4nm Automotive Smart Cockpit Chip Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America 4nm Automotive Smart Cockpit Chip Revenue (million), by Application 2024 & 2032

- Figure 9: South America 4nm Automotive Smart Cockpit Chip Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America 4nm Automotive Smart Cockpit Chip Revenue (million), by Type 2024 & 2032

- Figure 11: South America 4nm Automotive Smart Cockpit Chip Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America 4nm Automotive Smart Cockpit Chip Revenue (million), by Country 2024 & 2032

- Figure 13: South America 4nm Automotive Smart Cockpit Chip Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe 4nm Automotive Smart Cockpit Chip Revenue (million), by Application 2024 & 2032

- Figure 15: Europe 4nm Automotive Smart Cockpit Chip Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe 4nm Automotive Smart Cockpit Chip Revenue (million), by Type 2024 & 2032

- Figure 17: Europe 4nm Automotive Smart Cockpit Chip Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe 4nm Automotive Smart Cockpit Chip Revenue (million), by Country 2024 & 2032

- Figure 19: Europe 4nm Automotive Smart Cockpit Chip Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa 4nm Automotive Smart Cockpit Chip Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa 4nm Automotive Smart Cockpit Chip Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa 4nm Automotive Smart Cockpit Chip Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa 4nm Automotive Smart Cockpit Chip Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa 4nm Automotive Smart Cockpit Chip Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa 4nm Automotive Smart Cockpit Chip Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific 4nm Automotive Smart Cockpit Chip Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific 4nm Automotive Smart Cockpit Chip Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific 4nm Automotive Smart Cockpit Chip Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific 4nm Automotive Smart Cockpit Chip Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific 4nm Automotive Smart Cockpit Chip Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific 4nm Automotive Smart Cockpit Chip Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global 4nm Automotive Smart Cockpit Chip Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global 4nm Automotive Smart Cockpit Chip Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global 4nm Automotive Smart Cockpit Chip Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global 4nm Automotive Smart Cockpit Chip Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global 4nm Automotive Smart Cockpit Chip Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global 4nm Automotive Smart Cockpit Chip Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global 4nm Automotive Smart Cockpit Chip Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global 4nm Automotive Smart Cockpit Chip Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global 4nm Automotive Smart Cockpit Chip Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global 4nm Automotive Smart Cockpit Chip Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global 4nm Automotive Smart Cockpit Chip Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global 4nm Automotive Smart Cockpit Chip Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global 4nm Automotive Smart Cockpit Chip Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global 4nm Automotive Smart Cockpit Chip Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global 4nm Automotive Smart Cockpit Chip Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global 4nm Automotive Smart Cockpit Chip Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global 4nm Automotive Smart Cockpit Chip Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global 4nm Automotive Smart Cockpit Chip Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global 4nm Automotive Smart Cockpit Chip Revenue million Forecast, by Country 2019 & 2032

- Table 41: China 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific 4nm Automotive Smart Cockpit Chip Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 4nm Automotive Smart Cockpit Chip?

The projected CAGR is approximately 18%.

2. Which companies are prominent players in the 4nm Automotive Smart Cockpit Chip?

Key companies in the market include Qualcomm, Intel, Renesas, NXP Semiconductors, Texas Instruments, NVIDIA, Samsung, Telechips, MediaTek, Horizon Robotics Technology R&D, Rockchip Electronics, Allwinner Technology, UNISOC, Siengine, Nio, Hisilicon, BYD Semiconductor.

3. What are the main segments of the 4nm Automotive Smart Cockpit Chip?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1652 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "4nm Automotive Smart Cockpit Chip," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 4nm Automotive Smart Cockpit Chip report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 4nm Automotive Smart Cockpit Chip?

To stay informed about further developments, trends, and reports in the 4nm Automotive Smart Cockpit Chip, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence