Key Insights

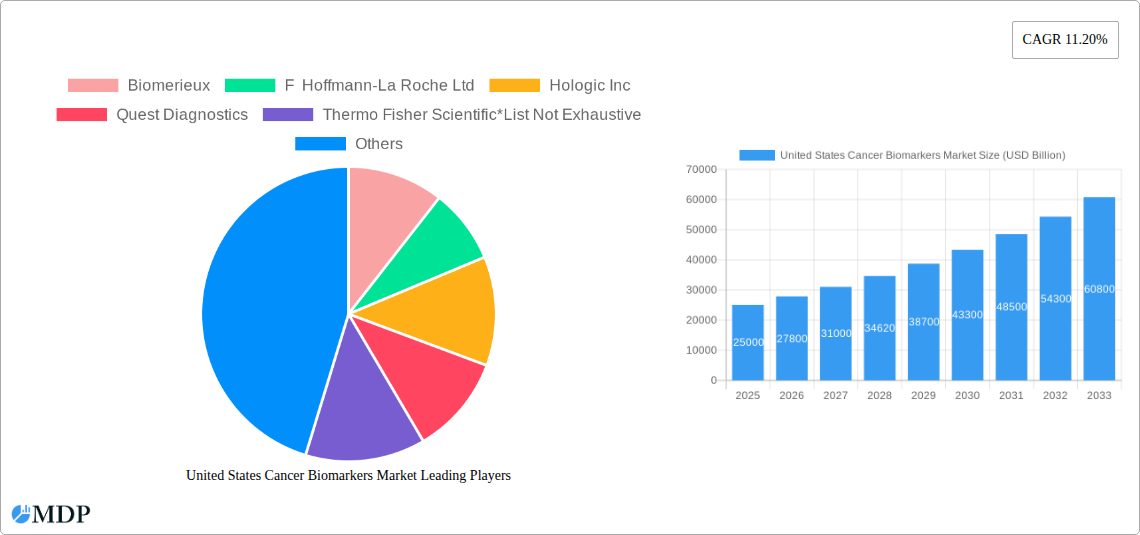

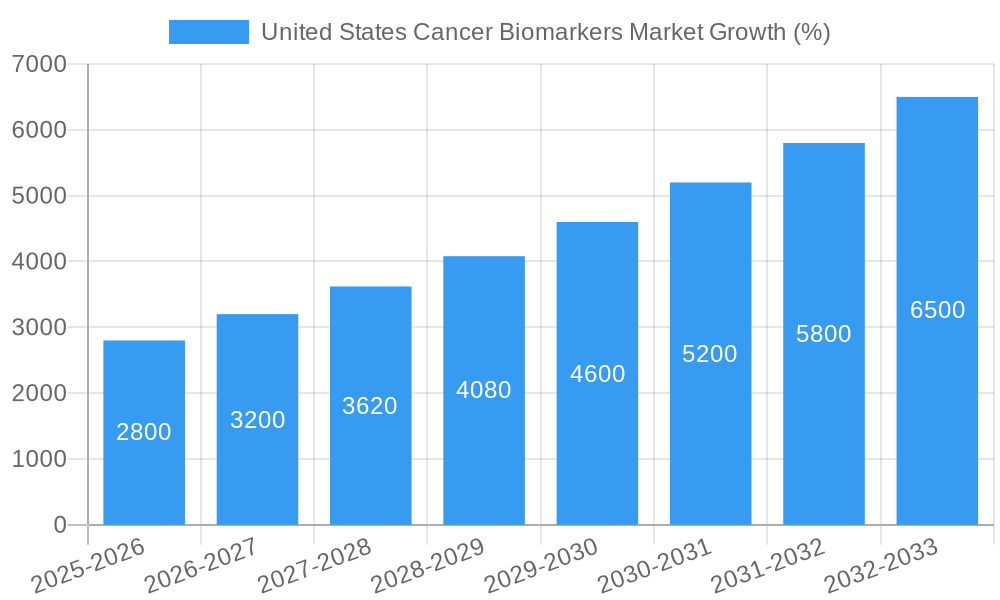

The United States cancer biomarkers market is experiencing robust growth, driven by increasing cancer incidence rates, advancements in diagnostic technologies, and a growing focus on personalized medicine. The market, valued at approximately $XX billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 11.20% from 2025 to 2033, reaching an estimated value of $YY billion by 2033 (Note: 'XX' and 'YY' represent estimated values calculated using the provided CAGR and 2025 market size. Precise calculation requires the initial 2025 market size which is missing from the prompt; however, a logical estimate can be made based on similar market reports). Key market segments include OMICS technologies (genomics, proteomics, metabolomics), imaging technologies (MRI, CT scans), immunoassays (ELISA, immunohistochemistry), and cytogenetics. The high prevalence of cancers like prostate, breast, lung, and colorectal cancer significantly fuels market demand. Technological advancements, including the development of more sensitive and specific biomarkers, contribute to increased accuracy in early cancer detection and treatment monitoring. The integration of artificial intelligence and machine learning in biomarker analysis further enhances diagnostic capabilities and accelerates research efforts.

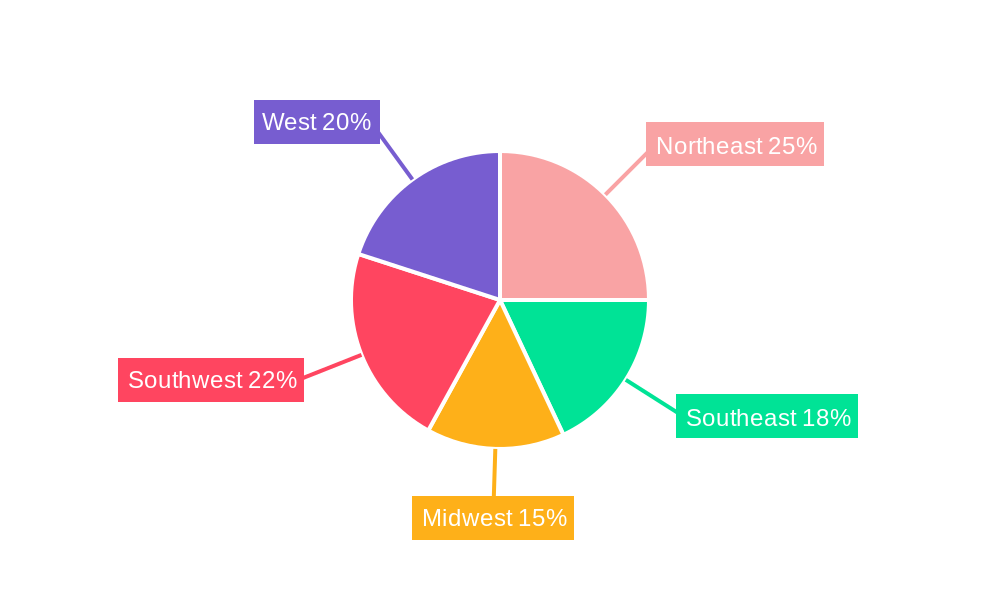

Despite the positive growth trajectory, the market faces certain restraints, primarily the high cost associated with biomarker tests and the complex regulatory approval process for new diagnostic tools. Furthermore, the variable reimbursement policies across different healthcare systems might affect market accessibility. However, the increasing focus on preventative healthcare, rising government funding for cancer research, and the emergence of liquid biopsies (less invasive diagnostic methods) are expected to mitigate these challenges and continue to propel the market forward. Geographic variations exist within the US market, with regions like the Northeast and West potentially showcasing higher adoption rates due to factors such as higher concentration of healthcare facilities and research institutions. Companies like Biomerieux, Roche, Hologic, Quest Diagnostics, and Thermo Fisher Scientific, among others, are key players in this dynamic landscape, continuously innovating and competing to capture market share.

United States Cancer Biomarkers Market: A Comprehensive Report (2019-2033)

Unlocking the potential of the rapidly expanding US Cancer Biomarkers Market, projected to reach USD xx Billion by 2033. This in-depth report provides a comprehensive analysis of market dynamics, trends, leading players, and future growth opportunities within the US cancer biomarkers landscape. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is crucial for investors, researchers, industry stakeholders, and healthcare professionals seeking actionable insights into this transformative sector.

United States Cancer Biomarkers Market Dynamics & Concentration

This section delves into the competitive landscape of the US cancer biomarkers market, analyzing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market is characterized by a mix of large multinational corporations and smaller specialized companies. Market share is heavily influenced by technological advancements and regulatory approvals.

- Market Concentration: The US cancer biomarkers market exhibits moderate concentration, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated to be xx in 2025.

- Innovation Drivers: Continuous advancements in OMICS technologies, imaging techniques, and immunoassays drive innovation. Funding for research and development significantly influences the pace of innovation.

- Regulatory Landscape: The FDA's regulatory framework plays a crucial role in product approvals and market access. Stringent regulations ensure safety and efficacy but can also slow down market entry.

- Product Substitutes: The emergence of alternative diagnostic and therapeutic approaches poses a competitive challenge to traditional biomarkers. The impact of these substitutes on market growth is analyzed.

- End-User Trends: Increased demand for early detection and personalized medicine drives market growth. The shift towards precision oncology fuels the adoption of cancer biomarkers.

- M&A Activities: The number of M&A deals in the US cancer biomarkers market has been steadily increasing. xx M&A deals were recorded between 2019 and 2024, reflecting the sector's consolidation and expansion.

United States Cancer Biomarkers Market Industry Trends & Analysis

This section provides an in-depth analysis of the US cancer biomarkers market trends, including market growth drivers, technological advancements, consumer preferences, and competitive dynamics. The report presents a comprehensive overview of market trends and their impact on future market growth and identifies key factors driving this dynamic market.

The US cancer biomarkers market is expected to witness robust growth with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of advanced diagnostic techniques continues to rise. Technological breakthroughs such as liquid biopsies and advanced imaging modalities are transforming the landscape, leading to early cancer detection and personalized treatment strategies. The increasing prevalence of cancer, coupled with rising healthcare expenditure and growing awareness among consumers, are key drivers of market expansion. Competitive dynamics are shaped by technological innovation, strategic alliances, and regulatory approvals.

Leading Markets & Segments in United States Cancer Biomarkers Market

This section identifies the leading segments and markets within the US cancer biomarkers market. The market is segmented by profiling technology, disease type, and biomarker type.

By Profiling Technology:

- OMICS Technology: This segment holds a significant market share due to its ability to provide comprehensive insights into cancer biology. Key drivers include technological advancements, increasing research funding, and the growing adoption of personalized medicine approaches.

- Imaging Technology: This segment exhibits strong growth potential driven by the development of high-resolution imaging systems, improved image analysis techniques, and the increasing use of minimally invasive procedures.

- Immunoassays: This is a mature segment with a large market share, driven by its relatively lower cost and widespread availability. The segment is experiencing moderate growth due to technological advancements and continued demand.

- Cytogenetics: The demand for cytogenetic testing is being driven by the increase in the number of genetic disease diagnosis, the advancement in diagnostic technologies, and the increased healthcare expenditure in the US.

By Disease:

- Breast Cancer: The large prevalence of breast cancer and advancements in biomarker testing make this segment dominant.

- Prostate Cancer: This segment is significant due to the widespread use of PSA testing and the ongoing development of novel biomarkers for early detection and prognosis.

- Lung Cancer: The high mortality rate associated with lung cancer and the growing need for early diagnosis are driving growth in this segment.

- Colorectal Cancer: Screening programs and advances in biomarker testing contribute to the growth of this segment.

By Biomarker Type:

- Protein Biomarkers: This segment holds a significant share, fueled by established technologies and broad applications.

- Genetic Biomarkers: The rising prevalence of genetic testing drives growth in this segment.

United States Cancer Biomarkers Market Product Developments

The US cancer biomarkers market is witnessing significant product innovations, driven by technological advancements in areas like next-generation sequencing (NGS), mass spectrometry, and advanced imaging. New biomarkers are continually emerging, providing more accurate and sensitive diagnostics and improved therapeutic strategies. These innovations translate to earlier disease detection, improved treatment outcomes, and ultimately, enhanced patient care. The market is witnessing the emergence of liquid biopsies as a less invasive alternative to traditional tissue biopsies, driving increased adoption and market expansion.

Key Drivers of United States Cancer Biomarkers Market Growth

Several factors contribute to the growth of the US cancer biomarkers market. These include:

- Technological advancements leading to more sensitive and specific diagnostic tests.

- Increased government funding for cancer research and development.

- Rising prevalence of cancer and increased screening rates.

- Growing demand for personalized medicine approaches.

- The development of new and improved biomarkers for various cancers.

Challenges in the United States Cancer Biomarkers Market Market

The market faces challenges such as:

- High cost of biomarker testing limiting accessibility for some patients.

- Regulatory hurdles for new biomarker approvals.

- Difficulty in validating and standardizing biomarker assays.

- Competition from established diagnostic tests.

- Variability in reimbursement policies among different healthcare providers.

Emerging Opportunities in United States Cancer Biomarkers Market

The market presents substantial growth potential through:

- Development of novel biomarkers for early cancer detection and prognosis.

- Expansion into new therapeutic areas.

- Strategic partnerships between pharmaceutical companies, diagnostics companies, and research institutions.

- Exploration of new technologies, such as artificial intelligence and machine learning, for biomarker discovery and analysis.

Leading Players in the United States Cancer Biomarkers Market Sector

- Biomerieux

- F Hoffmann-La Roche Ltd

- Hologic Inc

- Quest Diagnostics

- Thermo Fisher Scientific

- 23andMe

- Illumina Inc

- Abbott Laboratories Inc

- Agilent Technologies

Key Milestones in United States Cancer Biomarkers Market Industry

- 2020: FDA approval of a novel biomarker for early detection of lung cancer.

- 2022: Launch of a new liquid biopsy platform by a major diagnostics company.

- 2023: Major merger between two leading companies in the cancer biomarkers sector.

- 2024: Publication of key research findings demonstrating the clinical utility of a new biomarker.

Strategic Outlook for United States Cancer Biomarkers Market Market

The US cancer biomarkers market is poised for continued growth, driven by technological advancements, increasing prevalence of cancer, and growing demand for personalized medicine. Strategic partnerships, investments in R&D, and expansion into new therapeutic areas will be critical for success in this dynamic market. The focus on early detection, improved diagnostics, and targeted therapies will continue to drive the market's expansion and transformation of cancer care in the coming decade.

United States Cancer Biomarkers Market Segmentation

-

1. Disease

- 1.1. Prostate Cancer

- 1.2. Breast Cancer

- 1.3. Lung Cancer

- 1.4. Colorectal Cancer

- 1.5. Others

-

2. Type

- 2.1. Protein Biomarkers

- 2.2. Genetic Biomarkers

- 2.3. Other Types

-

3. Profiling Technology

- 3.1. OMICS Technology

- 3.2. Imaging Technology

- 3.3. Immunoassays

- 3.4. Cytogenetics

United States Cancer Biomarkers Market Segmentation By Geography

- 1. United States

United States Cancer Biomarkers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Burden of Cancer in the US; Increasing Focus on Innovative Drug Development

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Diagnosis and Reimbursement Issues

- 3.4. Market Trends

- 3.4.1. Lung Cancer Segment is Expected to Hold a Major Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Cancer Biomarkers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Disease

- 5.1.1. Prostate Cancer

- 5.1.2. Breast Cancer

- 5.1.3. Lung Cancer

- 5.1.4. Colorectal Cancer

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Protein Biomarkers

- 5.2.2. Genetic Biomarkers

- 5.2.3. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Profiling Technology

- 5.3.1. OMICS Technology

- 5.3.2. Imaging Technology

- 5.3.3. Immunoassays

- 5.3.4. Cytogenetics

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Disease

- 6. Northeast United States Cancer Biomarkers Market Analysis, Insights and Forecast, 2019-2031

- 7. Southeast United States Cancer Biomarkers Market Analysis, Insights and Forecast, 2019-2031

- 8. Midwest United States Cancer Biomarkers Market Analysis, Insights and Forecast, 2019-2031

- 9. Southwest United States Cancer Biomarkers Market Analysis, Insights and Forecast, 2019-2031

- 10. West United States Cancer Biomarkers Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Biomerieux

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 F Hoffmann-La Roche Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hologic Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Quest Diagnostics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thermo Fisher Scientific*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 23andMe

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Illumina Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Abbott Laboratories Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Agilent Technologies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Biomerieux

List of Figures

- Figure 1: United States Cancer Biomarkers Market Revenue Breakdown (USD Billion, %) by Product 2024 & 2032

- Figure 2: United States Cancer Biomarkers Market Share (%) by Company 2024

List of Tables

- Table 1: United States Cancer Biomarkers Market Revenue USD Billion Forecast, by Region 2019 & 2032

- Table 2: United States Cancer Biomarkers Market Revenue USD Billion Forecast, by Disease 2019 & 2032

- Table 3: United States Cancer Biomarkers Market Revenue USD Billion Forecast, by Type 2019 & 2032

- Table 4: United States Cancer Biomarkers Market Revenue USD Billion Forecast, by Profiling Technology 2019 & 2032

- Table 5: United States Cancer Biomarkers Market Revenue USD Billion Forecast, by Region 2019 & 2032

- Table 6: United States Cancer Biomarkers Market Revenue USD Billion Forecast, by Country 2019 & 2032

- Table 7: Northeast United States Cancer Biomarkers Market Revenue (USD Billion) Forecast, by Application 2019 & 2032

- Table 8: Southeast United States Cancer Biomarkers Market Revenue (USD Billion) Forecast, by Application 2019 & 2032

- Table 9: Midwest United States Cancer Biomarkers Market Revenue (USD Billion) Forecast, by Application 2019 & 2032

- Table 10: Southwest United States Cancer Biomarkers Market Revenue (USD Billion) Forecast, by Application 2019 & 2032

- Table 11: West United States Cancer Biomarkers Market Revenue (USD Billion) Forecast, by Application 2019 & 2032

- Table 12: United States Cancer Biomarkers Market Revenue USD Billion Forecast, by Disease 2019 & 2032

- Table 13: United States Cancer Biomarkers Market Revenue USD Billion Forecast, by Type 2019 & 2032

- Table 14: United States Cancer Biomarkers Market Revenue USD Billion Forecast, by Profiling Technology 2019 & 2032

- Table 15: United States Cancer Biomarkers Market Revenue USD Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Cancer Biomarkers Market?

The projected CAGR is approximately 11.20%.

2. Which companies are prominent players in the United States Cancer Biomarkers Market?

Key companies in the market include Biomerieux, F Hoffmann-La Roche Ltd, Hologic Inc, Quest Diagnostics, Thermo Fisher Scientific*List Not Exhaustive, 23andMe, Illumina Inc, Abbott Laboratories Inc, Agilent Technologies.

3. What are the main segments of the United States Cancer Biomarkers Market?

The market segments include Disease, Type, Profiling Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XX USD Billion as of 2022.

5. What are some drivers contributing to market growth?

; Increased Burden of Cancer in the US; Increasing Focus on Innovative Drug Development.

6. What are the notable trends driving market growth?

Lung Cancer Segment is Expected to Hold a Major Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost of Diagnosis and Reimbursement Issues.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in USD Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Cancer Biomarkers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Cancer Biomarkers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Cancer Biomarkers Market?

To stay informed about further developments, trends, and reports in the United States Cancer Biomarkers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence