Key Insights

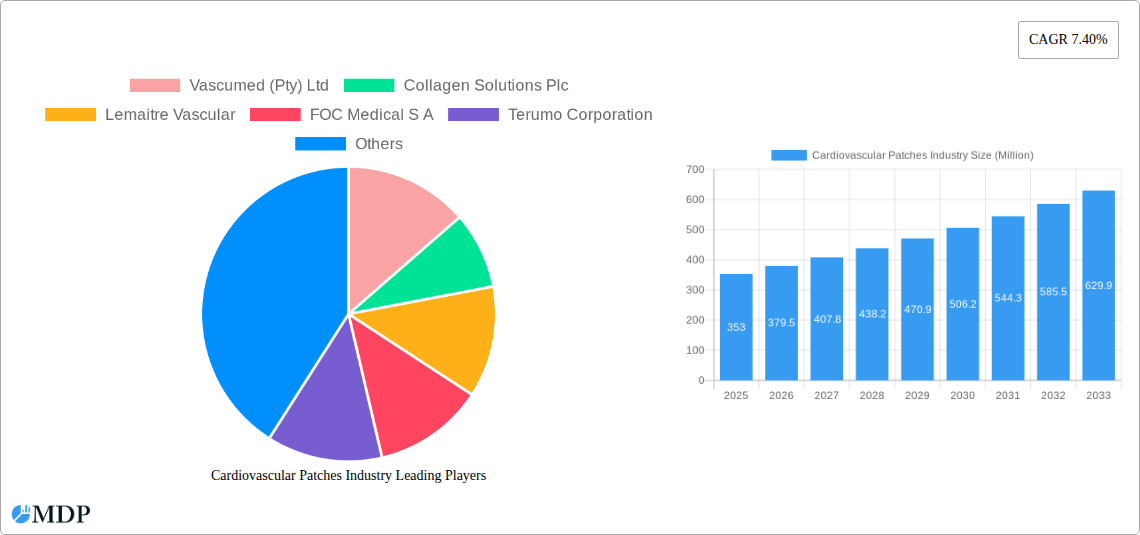

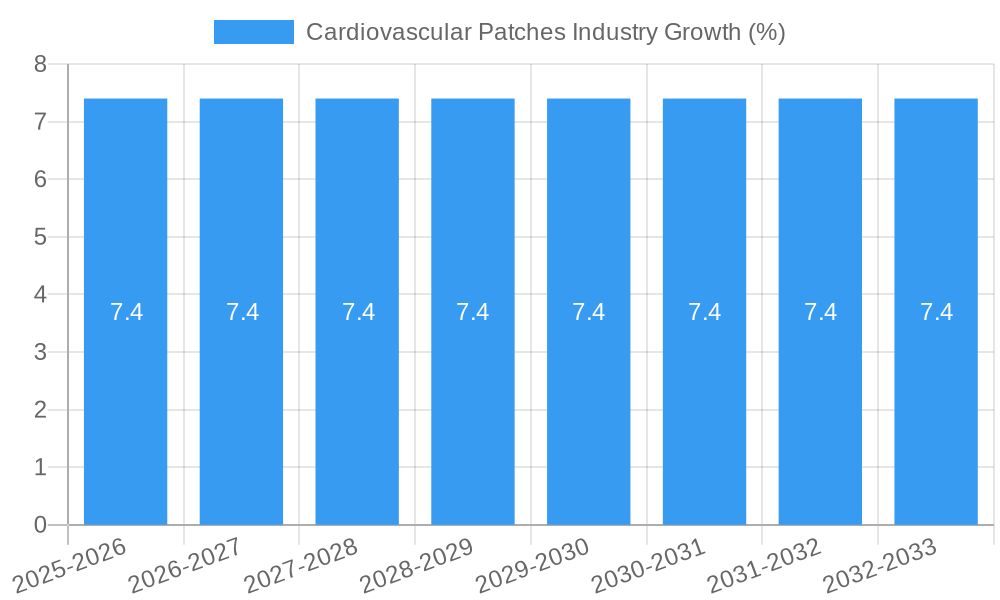

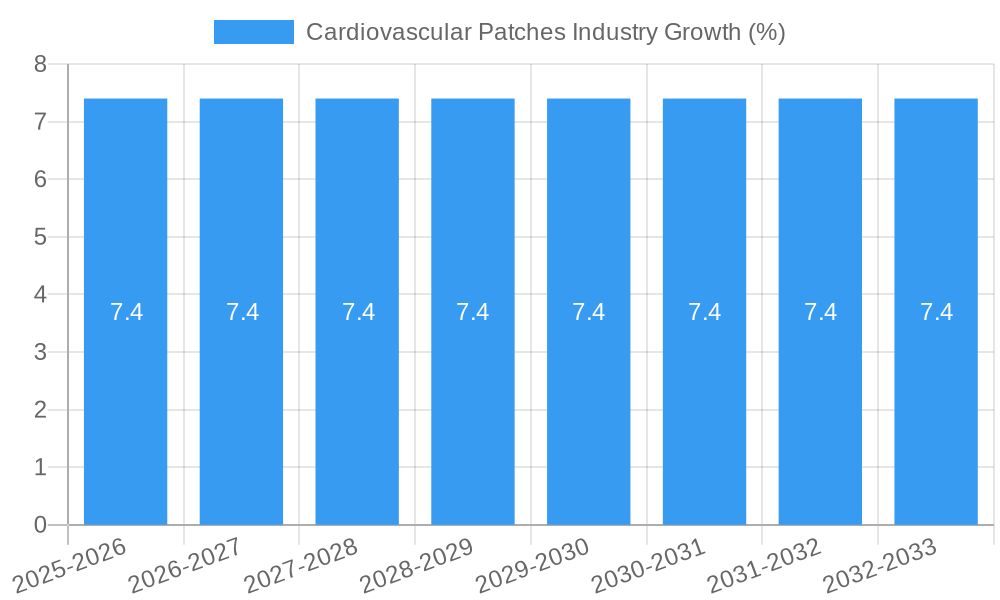

The global Cardiovascular Patches market is poised for robust expansion, projected to reach an estimated \$353 million in 2025 and exhibit a Compound Annual Growth Rate (CAGR) of 7.40% through 2033. This significant growth is underpinned by the increasing prevalence of cardiovascular diseases worldwide, including conditions like aortic aneurysms and carotid artery blockages, which necessitate advanced surgical interventions. The rising demand for minimally invasive procedures and the continuous innovation in patch materials, such as advanced biologic and synthetic options, are further fueling market growth. Biologic vascular patches are gaining traction due to their superior biocompatibility and potential for tissue regeneration, while synthetic patches offer durability and cost-effectiveness, catering to a diverse range of surgical needs. The market's trajectory indicates a growing emphasis on developing safer, more effective, and patient-centric vascular graft solutions.

The market landscape is characterized by a dynamic interplay of drivers and restraints. Key drivers include the aging global population, a significant risk factor for cardiovascular ailments, and advancements in surgical techniques that enhance procedural outcomes. Furthermore, increased healthcare expenditure and greater access to sophisticated medical infrastructure in emerging economies are contributing to market expansion. However, challenges such as stringent regulatory approvals for new medical devices and the high cost associated with advanced patch technologies could pose some limitations. The market is segmented by material (Biologic Vascular Patches, Synthetic Vascular Patches) and application (Carotid Endarterectomy, Aortic Aneurysms, Profundaplasty, Other Applications), with a strong focus on addressing complex vascular reconstructions. Leading players like Terumo Corporation, Edwards Lifesciences, and B Braun SE are actively investing in research and development to introduce next-generation cardiovascular patches.

Cardiovascular Patches Market: Global Industry Analysis, Trends, and Forecast 2025-2033

This comprehensive report provides an in-depth analysis of the global Cardiovascular Patches Market, offering critical insights for industry stakeholders. Explore market dynamics, key trends, leading segments, product developments, growth drivers, challenges, and emerging opportunities, all within the context of a detailed forecast from 2025 to 2033. This report leverages high-traffic keywords such as "cardiovascular patches," "vascular grafts," "cardiac surgery," "endovascular repair," and "medical devices" to maximize search visibility and attract relevant industry professionals.

Cardiovascular Patches Industry Market Dynamics & Concentration

The Cardiovascular Patches Market exhibits moderate to high concentration, driven by the specialized nature of product development and stringent regulatory approvals. Innovation is primarily fueled by advancements in biomaterials and surgical techniques, with a significant focus on enhancing patch biocompatibility, durability, and ease of implantation. Regulatory frameworks, including FDA and EMA approvals, play a crucial role in market entry and product lifecycle management, acting as both a barrier and a quality assurance mechanism. Product substitutes, such as advanced suturing techniques and alternative graft materials, pose a competitive threat, necessitating continuous product innovation. End-user trends indicate a growing preference for minimally invasive procedures, which in turn drives demand for flexible and adaptable vascular patches. Mergers and acquisitions (M&A) activity is present, though less frequent, as larger players strategically acquire innovative technologies or expand their product portfolios. For instance, companies are actively seeking collaborations or acquisitions to integrate novel patch technologies with their existing cardiovascular device offerings, aiming to secure a larger market share. The market share is distributed among several key players, with the top 5 companies holding approximately 60-70% of the market. M&A deal counts are typically around 5-10 significant transactions annually, focused on niche technologies or market expansion.

Cardiovascular Patches Industry Industry Trends & Analysis

The Cardiovascular Patches Market is poised for significant growth, driven by an increasing prevalence of cardiovascular diseases worldwide and the escalating demand for effective surgical treatments. The market is experiencing a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period 2025-2033. This growth is underpinned by several key factors, including the rising aging global population, which is more susceptible to cardiovascular conditions, and the subsequent increase in the number of cardiovascular surgeries performed. Technological disruptions are a major catalyst, with continuous innovation in biomaterial science leading to the development of advanced synthetic and biologic vascular patches offering improved hemocompatibility, reduced thrombogenicity, and enhanced tissue integration. These advancements are critical for improving patient outcomes and minimizing complications post-surgery. Consumer preferences are leaning towards minimally invasive surgical approaches, which often require specialized patches designed for smaller incisions and quicker recovery times. This trend is spurring research and development into more flexible and conformable patch designs. Competitive dynamics are characterized by intense R&D efforts to develop superior products, alongside strategic partnerships and collaborations aimed at expanding market reach and product offerings. Market penetration of advanced cardiovascular patches is steadily increasing, particularly in developed economies with advanced healthcare infrastructure and higher disposable incomes. The continuous development of innovative biomaterials and the growing number of cardiovascular procedures, especially for conditions like aortic aneurysms and coronary artery disease, are significant drivers for market expansion. The increasing focus on personalized medicine and the development of patient-specific grafts further contribute to market dynamism.

Leading Markets & Segments in Cardiovascular Patches Industry

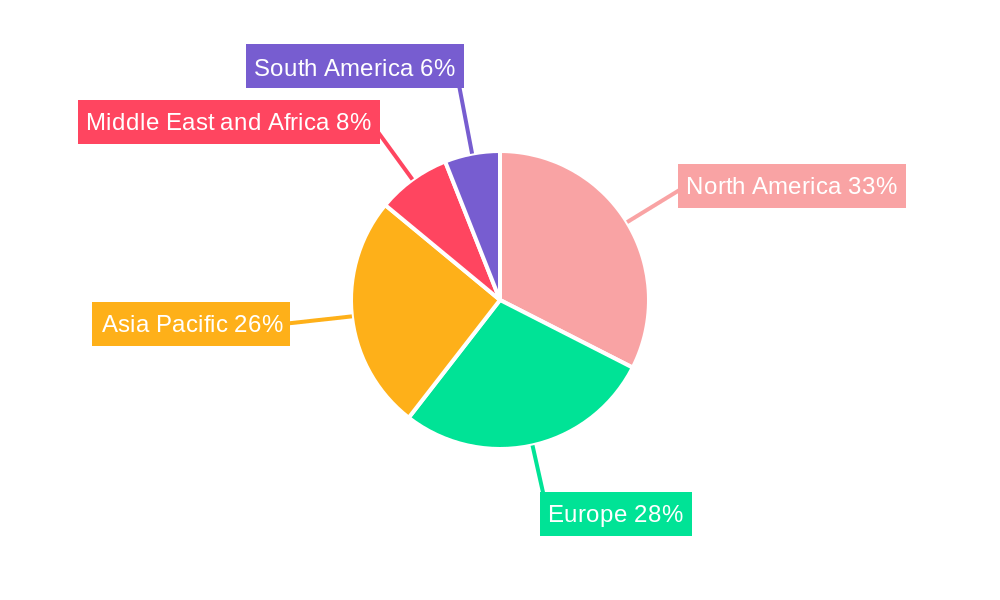

The North America region, particularly the United States, currently dominates the Cardiovascular Patches Market. This leadership is attributed to several key drivers, including advanced healthcare infrastructure, high per capita healthcare spending, and a high prevalence of cardiovascular diseases. The region benefits from robust research and development activities and early adoption of new medical technologies. The presence of major medical device manufacturers and a strong regulatory framework also contributes to its leading position.

Within the Material segment, Synthetic Vascular Patches hold a significant market share. Their dominance is driven by their widespread availability, cost-effectiveness, and consistent performance characteristics. These patches, often made from materials like ePTFE and PET, offer excellent tensile strength and are resistant to infection.

In terms of Application, the Aortic Aneurysms segment represents a substantial portion of the market. The increasing incidence of abdominal and thoracic aortic aneurysms, coupled with the growing preference for endovascular aneurysm repair (EVAR) and open surgical repair, directly fuels demand for vascular patches used in these procedures.

Key drivers for this regional and segmental dominance include:

- Economic Policies: Favorable reimbursement policies and government initiatives supporting cardiovascular health research and treatment in North America.

- Healthcare Infrastructure: Well-established hospitals, advanced surgical centers, and widespread availability of specialized cardiovascular care.

- Technological Advancement: Early adoption and continuous innovation in vascular patch technologies, driven by a competitive landscape and academic research.

- Disease Prevalence: A high incidence of cardiovascular diseases, including coronary artery disease and aortic aneurysms, leading to a consistent demand for surgical interventions.

- Regulatory Environment: A well-defined and supportive regulatory pathway for medical device approvals, fostering innovation and market entry.

Cardiovascular Patches Industry Product Developments

Product developments in the cardiovascular patches market are focused on enhancing hemocompatibility, reducing thrombogenicity, and improving tissue integration. Innovations include the development of bioresorbable synthetic materials that gradually degrade in the body, eliminating the need for permanent implants and minimizing long-term complications. Advancements in biologic patches, derived from natural tissues, offer superior biocompatibility and promote natural tissue healing. Companies are also investing in developing antimicrobial coatings for patches to prevent post-operative infections. These innovations aim to provide surgeons with more versatile and effective solutions for complex cardiovascular reconstructions, ultimately improving patient outcomes and reducing recovery times.

Key Drivers of Cardiovascular Patches Industry Growth

Several factors are propelling the growth of the Cardiovascular Patches Industry. Firstly, the escalating global burden of cardiovascular diseases, including atherosclerosis and aneurysms, necessitates a greater number of surgical interventions. Secondly, technological advancements in biomaterials are leading to the development of more sophisticated, biocompatible, and durable vascular patches, enhancing surgical efficacy. Thirdly, the increasing adoption of minimally invasive surgical techniques, which often require specialized patches, further fuels market expansion. Finally, favorable reimbursement policies and government initiatives supporting cardiovascular healthcare infrastructure in emerging economies are creating new growth avenues.

Challenges in the Cardiovascular Patches Industry Market

Despite its promising growth trajectory, the Cardiovascular Patches Industry faces several challenges. Stringent regulatory approval processes for new medical devices can lead to lengthy development timelines and significant R&D costs. The high cost of advanced vascular patches can also be a barrier to adoption, particularly in resource-limited regions. Furthermore, the potential for post-operative complications, such as infection and thrombosis, necessitates continuous innovation and rigorous clinical validation. Intense competition among established players and emerging companies can also exert downward pressure on pricing and profit margins.

Emerging Opportunities in Cardiovascular Patches Industry

The Cardiovascular Patches Industry is ripe with emerging opportunities. The development of novel bioengineered and regenerative patches that promote endogenous tissue repair presents a significant frontier. Expansion into emerging markets in Asia-Pacific and Latin America, driven by increasing healthcare expenditure and a rising prevalence of cardiovascular diseases, offers substantial growth potential. Strategic partnerships between medical device manufacturers and academic institutions for collaborative research and development of next-generation patch technologies are also key opportunities. Furthermore, the growing demand for patient-specific grafts, tailored to individual anatomical needs, is an evolving area of innovation.

Leading Players in the Cardiovascular Patches Industry Sector

- Vascumed (Pty) Ltd

- Collagen Solutions Plc

- Lemaitre Vascular

- FOC Medical S A

- Terumo Corporation

- Getinge AB

- Edwards Lifesciences

- Baxter International

- B Braun SE

- BD

- Artivion

- W L Gore & Associates

Key Milestones in Cardiovascular Patches Industry Industry

- May 2022: Vivasure Medical closed the first tranche of USD 22 million (USD 23 million) as part of its Series D financing round led by a multi-national strategic corporation. The funding supports the United States and European clinical development and regulatory approval of the company's portfolio of fully absorbable, patch-based, large-bore percutaneous vessel closure devices for transcatheter endovascular and cardiovascular procedures.

- June 2021: Axio Biosolutions received FDA approval for its hemostatic Axiostat patch, which is intended to control moderate-to-severe bleeding in vascular procedures and at the sites of surgical debridement and punctures.

Strategic Outlook for Cardiovascular Patches Industry Market

The strategic outlook for the Cardiovascular Patches Market is positive, driven by ongoing innovation and increasing global demand. Future growth accelerators will include the continued development of advanced biomaterials, such as fully bioresorbable and regenerative patches, which promise improved patient outcomes and reduced long-term complications. Strategic partnerships and collaborations will be crucial for navigating complex regulatory landscapes and expanding market reach, particularly in emerging economies. Furthermore, the increasing integration of digital health technologies with cardiovascular devices, including smart patches that monitor post-operative recovery, presents a significant avenue for market differentiation and value creation.

Cardiovascular Patches Industry Segmentation

-

1. Material

- 1.1. Biologic Vascular Patches

- 1.2. Synthetic Vascular Patches

-

2. Application

- 2.1. Carotid Endarterectomy

- 2.2. Aortic Aneurysms

- 2.3. Profundaplasty

- 2.4. Other Applications

Cardiovascular Patches Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Cardiovascular Patches Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Growing Geriatric Population and Increase in the Prevalence of Vascular Diseases; Increasing Adoption of Biological Patches

- 3.3. Market Restrains

- 3.3.1. Risk of Immune Response and Serious Complications; Product Failures and Recalls

- 3.4. Market Trends

- 3.4.1. Aortic Aneurysms Segment Expects to Register a Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cardiovascular Patches Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Biologic Vascular Patches

- 5.1.2. Synthetic Vascular Patches

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Carotid Endarterectomy

- 5.2.2. Aortic Aneurysms

- 5.2.3. Profundaplasty

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Cardiovascular Patches Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Biologic Vascular Patches

- 6.1.2. Synthetic Vascular Patches

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Carotid Endarterectomy

- 6.2.2. Aortic Aneurysms

- 6.2.3. Profundaplasty

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Cardiovascular Patches Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Biologic Vascular Patches

- 7.1.2. Synthetic Vascular Patches

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Carotid Endarterectomy

- 7.2.2. Aortic Aneurysms

- 7.2.3. Profundaplasty

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Cardiovascular Patches Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Biologic Vascular Patches

- 8.1.2. Synthetic Vascular Patches

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Carotid Endarterectomy

- 8.2.2. Aortic Aneurysms

- 8.2.3. Profundaplasty

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Middle East and Africa Cardiovascular Patches Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Biologic Vascular Patches

- 9.1.2. Synthetic Vascular Patches

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Carotid Endarterectomy

- 9.2.2. Aortic Aneurysms

- 9.2.3. Profundaplasty

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. South America Cardiovascular Patches Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Biologic Vascular Patches

- 10.1.2. Synthetic Vascular Patches

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Carotid Endarterectomy

- 10.2.2. Aortic Aneurysms

- 10.2.3. Profundaplasty

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. North America Cardiovascular Patches Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Cardiovascular Patches Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Cardiovascular Patches Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Cardiovascular Patches Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Cardiovascular Patches Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Vascumed (Pty) Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Collagen Solutions Plc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Lemaitre Vascular

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 FOC Medical S A

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Terumo Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Getinge AB

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Edwards Lifesciences

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Baxter International

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 B Braun SE

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 BD

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Artivion

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 W L Gore & Associates

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Vascumed (Pty) Ltd

List of Figures

- Figure 1: Global Cardiovascular Patches Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Cardiovascular Patches Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Cardiovascular Patches Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Cardiovascular Patches Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Cardiovascular Patches Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Cardiovascular Patches Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Cardiovascular Patches Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Cardiovascular Patches Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Cardiovascular Patches Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Cardiovascular Patches Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Cardiovascular Patches Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Cardiovascular Patches Industry Revenue (Million), by Material 2024 & 2032

- Figure 13: North America Cardiovascular Patches Industry Revenue Share (%), by Material 2024 & 2032

- Figure 14: North America Cardiovascular Patches Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Cardiovascular Patches Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Cardiovascular Patches Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Cardiovascular Patches Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Cardiovascular Patches Industry Revenue (Million), by Material 2024 & 2032

- Figure 19: Europe Cardiovascular Patches Industry Revenue Share (%), by Material 2024 & 2032

- Figure 20: Europe Cardiovascular Patches Industry Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Cardiovascular Patches Industry Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Cardiovascular Patches Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Cardiovascular Patches Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Cardiovascular Patches Industry Revenue (Million), by Material 2024 & 2032

- Figure 25: Asia Pacific Cardiovascular Patches Industry Revenue Share (%), by Material 2024 & 2032

- Figure 26: Asia Pacific Cardiovascular Patches Industry Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Pacific Cardiovascular Patches Industry Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Cardiovascular Patches Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Cardiovascular Patches Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Cardiovascular Patches Industry Revenue (Million), by Material 2024 & 2032

- Figure 31: Middle East and Africa Cardiovascular Patches Industry Revenue Share (%), by Material 2024 & 2032

- Figure 32: Middle East and Africa Cardiovascular Patches Industry Revenue (Million), by Application 2024 & 2032

- Figure 33: Middle East and Africa Cardiovascular Patches Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: Middle East and Africa Cardiovascular Patches Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Cardiovascular Patches Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Cardiovascular Patches Industry Revenue (Million), by Material 2024 & 2032

- Figure 37: South America Cardiovascular Patches Industry Revenue Share (%), by Material 2024 & 2032

- Figure 38: South America Cardiovascular Patches Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: South America Cardiovascular Patches Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: South America Cardiovascular Patches Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: South America Cardiovascular Patches Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cardiovascular Patches Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Cardiovascular Patches Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 3: Global Cardiovascular Patches Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Cardiovascular Patches Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Cardiovascular Patches Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Cardiovascular Patches Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Germany Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Cardiovascular Patches Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Cardiovascular Patches Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: GCC Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Cardiovascular Patches Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of South America Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Cardiovascular Patches Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 32: Global Cardiovascular Patches Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 33: Global Cardiovascular Patches Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Cardiovascular Patches Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 38: Global Cardiovascular Patches Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 39: Global Cardiovascular Patches Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: United Kingdom Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Germany Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Cardiovascular Patches Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 47: Global Cardiovascular Patches Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 48: Global Cardiovascular Patches Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: India Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Korea Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Cardiovascular Patches Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 56: Global Cardiovascular Patches Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 57: Global Cardiovascular Patches Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: GCC Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: South Africa Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East and Africa Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Cardiovascular Patches Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 62: Global Cardiovascular Patches Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 63: Global Cardiovascular Patches Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Brazil Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Argentina Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of South America Cardiovascular Patches Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cardiovascular Patches Industry?

The projected CAGR is approximately 7.40%.

2. Which companies are prominent players in the Cardiovascular Patches Industry?

Key companies in the market include Vascumed (Pty) Ltd, Collagen Solutions Plc, Lemaitre Vascular, FOC Medical S A, Terumo Corporation, Getinge AB, Edwards Lifesciences, Baxter International, B Braun SE, BD , Artivion, W L Gore & Associates.

3. What are the main segments of the Cardiovascular Patches Industry?

The market segments include Material, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 353 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Growing Geriatric Population and Increase in the Prevalence of Vascular Diseases; Increasing Adoption of Biological Patches.

6. What are the notable trends driving market growth?

Aortic Aneurysms Segment Expects to Register a Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Risk of Immune Response and Serious Complications; Product Failures and Recalls.

8. Can you provide examples of recent developments in the market?

May 2022: Vivasure Medical closed the first tranche of USD 22 million (USD 23 million) as part of its Series D financing round led by a multi-national strategic corporation. The funding supports the United States and European clinical development and regulatory approval of the company's portfolio of fully absorbable, patch-based, large-bore percutaneous vessel closure devices for transcatheter endovascular and cardiovascular procedures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cardiovascular Patches Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cardiovascular Patches Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cardiovascular Patches Industry?

To stay informed about further developments, trends, and reports in the Cardiovascular Patches Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence