Key Insights

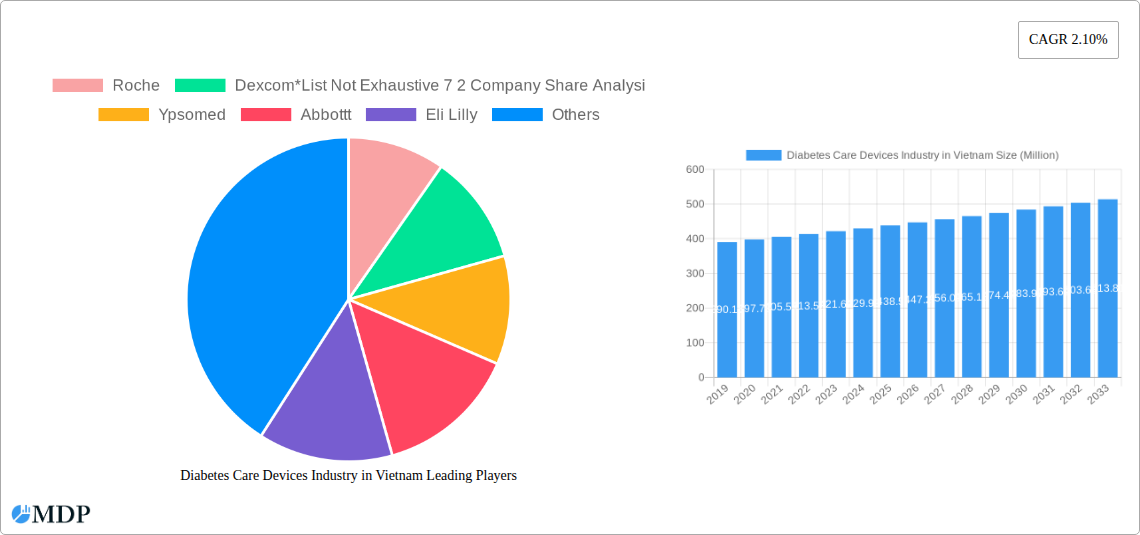

The global Diabetes Care Devices market is projected to reach a substantial USD 424.10 million by 2025, exhibiting a steady Compound Annual Growth Rate (CAGR) of 2.10% from 2019 to 2033. This sustained growth is primarily fueled by the escalating global prevalence of diabetes, driven by factors such as changing lifestyles, increasing obesity rates, and an aging population. The market is segmented into Monitoring Devices, which include self-monitoring blood glucose devices (glucometers, test strips, lancets) and continuous blood glucose monitoring (CGM) systems (sensors, durables), and Management Devices, encompassing insulin pumps (devices, reservoirs, infusion sets), insulin syringes, cartridges, and disposable pens. Key industry players like Roche, Dexcom, Abbott, and Medtronic are actively investing in research and development to introduce innovative and user-friendly diabetes management solutions, further stimulating market expansion.

Diabetes Care Devices Industry in Vietnam Market Size (In Million)

Emerging trends such as the increasing adoption of connected devices and digital health platforms are transforming diabetes care. These technologies facilitate real-time data tracking, remote patient monitoring, and personalized treatment plans, thereby enhancing patient outcomes and reducing healthcare burdens. The shift towards minimally invasive and more comfortable monitoring solutions, like CGM, is also a significant growth driver. However, the market faces restraints such as the high cost of advanced diabetes care devices, limited reimbursement policies in certain regions, and a lack of awareness among specific patient populations. Despite these challenges, the growing demand for advanced diabetes management tools, coupled with increasing healthcare expenditure and government initiatives to combat diabetes, positions the market for continued robust growth throughout the forecast period.

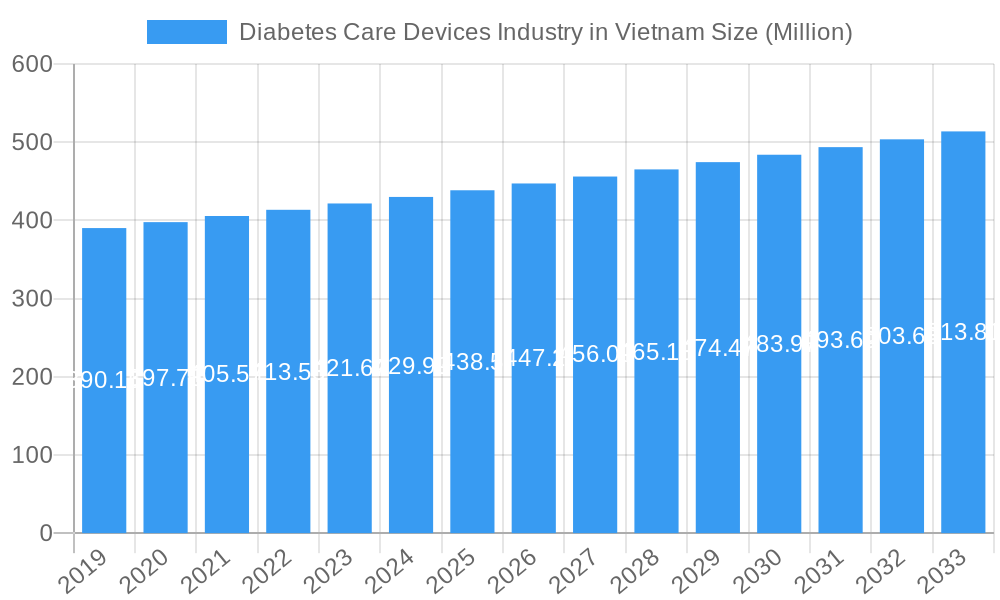

Diabetes Care Devices Industry in Vietnam Company Market Share

This comprehensive report offers an in-depth analysis of the burgeoning Diabetes Care Devices Market in Vietnam, providing critical insights for stakeholders from 2019 to 2033, with a focused base year of 2025. Delve into the dynamics shaping the Vietnamese diabetes technology landscape, driven by increasing diabetes prevalence and a growing demand for advanced glucose monitoring devices and diabetes management solutions. Our analysis covers key segments including Self-monitoring Blood Glucose Devices (Glucometer Devices, Test Strips, Lancets) and Continuous Blood Glucose Monitoring (Sensors, Durables), alongside essential Management Devices like Insulin Pumps (Insulin Pump Device, Insulin Pump Reservoir, Infusion Set), Insulin Syringes, Insulin Cartridges, and Disposable Pens.

This report leverages high-traffic keywords such as Vietnam Diabetes Market, Diabetes Devices Vietnam, Glucose Monitoring Vietnam, Insulin Pumps Vietnam, and Type 1 Diabetes Vietnam to ensure maximum search visibility and attract key industry players. Discover actionable strategies and anticipate future trends in one of Southeast Asia's fastest-growing healthcare markets.

Diabetes Care Devices Industry in Vietnam Market Dynamics & Concentration

The Diabetes Care Devices Industry in Vietnam is characterized by a moderate to high market concentration, with major global players like Roche, Dexcom, Abbott, and Novo Nordisk holding significant market share. The company share analysis reveals a competitive landscape where innovation and strategic partnerships are key differentiators. The market's growth is propelled by increasing diabetes prevalence, a rising middle class with greater healthcare spending power, and a growing awareness of the benefits of proactive diabetes management. Regulatory frameworks are evolving to align with international standards, facilitating the adoption of advanced technologies. However, the availability of lower-cost product substitutes, particularly in the glucometer devices and insulin syringes segments, presents a challenge to market penetration for premium devices. End-user trends are shifting towards less invasive monitoring solutions and automated insulin delivery systems, driving demand for continuous blood glucose monitoring and insulin pump technologies. Merger and acquisition (M&A) activities, though nascent, are expected to increase as larger companies seek to consolidate their market position and acquire innovative technologies. While specific M&A deal counts are not publicly available, the strategic importance of the Vietnamese market suggests potential for future consolidation. The overall market concentration is influenced by the strong presence of multinational corporations alongside a growing number of local distributors and manufacturers.

Diabetes Care Devices Industry in Vietnam Industry Trends & Analysis

The Diabetes Care Devices Industry in Vietnam is experiencing robust growth, driven by a confluence of factors including increasing diabetes prevalence, a growing focus on preventative healthcare, and advancements in medical technology. The market penetration of diabetes care devices, particularly self-monitoring blood glucose devices, has steadily increased over the historical period (2019-2024). The Compound Annual Growth Rate (CAGR) for the overall market is projected to be robust during the forecast period (2025-2033), fueled by rising disposable incomes and a heightened awareness of diabetes complications. Technological disruptions are playing a pivotal role, with the introduction of continuous blood glucose monitoring (CGM) systems and sophisticated insulin pump therapy transforming patient care. Consumer preferences are evolving towards user-friendly, connected devices that offer real-time data and seamless integration with digital health platforms. This shift is putting pressure on traditional glucometer devices and test strips markets, although they remain significant due to affordability and accessibility. The competitive dynamics are intense, with global giants like Abbott, Roche, and Dexcom vying for market dominance against established players in insulin delivery such as Novo Nordisk, Sanofi, and Eli Lilly. The market's expansion is also influenced by government initiatives aimed at improving chronic disease management and increasing access to affordable healthcare solutions. The trend towards personalized medicine and the integration of artificial intelligence in diabetes management platforms are emerging as key growth drivers, promising to enhance treatment efficacy and patient outcomes.

Leading Markets & Segments in Diabetes Care Devices Industry in Vietnam

The Monitoring Devices segment, specifically Self-monitoring Blood Glucose Devices, currently dominates the Diabetes Care Devices Industry in Vietnam. This dominance is attributed to their affordability, widespread availability, and established user base across various socioeconomic strata. Within this segment, Glucometer Devices and Test Strips are the most significant contributors, driven by the high prevalence of both Type 1 and Type 2 diabetes in Vietnam. The increasing awareness among individuals regarding the importance of regular blood glucose checks to manage their condition is a primary driver.

- Key Drivers for Self-monitoring Blood Glucose Devices Dominance:

- Economic Policies: Government initiatives promoting primary healthcare and chronic disease management contribute to the accessibility of these devices.

- Infrastructure: A well-established distribution network across urban and rural areas ensures widespread availability.

- Affordability: Compared to advanced technologies, glucometers and test strips are more budget-friendly for a larger segment of the population.

- Incidence of Diabetes: The high and rising incidence of diabetes necessitates frequent monitoring.

The Continuous Blood Glucose Monitoring (CGM) segment, including Sensors and Durables, is experiencing rapid growth, albeit from a smaller base. This surge is fueled by technological advancements offering greater convenience, real-time data insights, and improved glycemic control. As the technology becomes more accessible and reimbursement policies evolve, CGM is poised to capture a larger market share.

In the Management Devices segment, Insulin Pump Therapy represents a significant and growing area. The adoption of Insulin Pump Devices, along with associated Insulin Pump Reservoirs and Infusion Sets, is gaining traction among patients requiring intensive insulin management, particularly those with Type 1 diabetes. This trend is supported by increasing physician recommendations and patient demand for more flexible and precise insulin delivery solutions compared to traditional methods like Insulin Syringes, Insulin Cartridges, and Disposable Pens. However, the latter still retain a substantial market share due to their established use and lower cost. The overall market growth is being significantly shaped by the evolving patient needs and the increasing integration of digital health technologies into diabetes management.

Diabetes Care Devices Industry in Vietnam Product Developments

Product development in the Diabetes Care Devices Industry in Vietnam is characterized by a strong emphasis on innovation and user-centric design. Key trends include the miniaturization and enhanced accuracy of glucose monitoring devices, with continuous glucose monitoring (CGM) systems becoming more sophisticated and less invasive. The integration of artificial intelligence and connectivity features in insulin pumps and smart pens is revolutionizing diabetes management, offering personalized therapy and seamless data sharing with healthcare providers. Companies are focusing on developing closed-loop systems that automate insulin delivery based on real-time glucose readings, improving glycemic control and reducing the burden of manual adjustments. The competitive advantage lies in offering devices that are not only technologically advanced but also affordable, easy to use, and integrated into a holistic diabetes care ecosystem.

Key Drivers of Diabetes Care Devices Industry in Vietnam Growth

The Diabetes Care Devices Industry in Vietnam is being propelled by several critical growth drivers. Firstly, the rising prevalence of diabetes, both Type 1 and Type 2, is creating a sustained demand for monitoring and management solutions. Secondly, increasing healthcare expenditure and a growing middle class with greater disposable income are enabling more individuals to access advanced diabetes care technologies. Thirdly, significant technological advancements, particularly in continuous glucose monitoring and insulin delivery systems, are enhancing treatment efficacy and patient quality of life. Government initiatives focused on improving chronic disease management and increasing healthcare access further bolster market growth. Finally, the growing awareness among patients and healthcare professionals about the long-term benefits of proactive diabetes management, including the prevention of costly complications, is a key accelerator.

Challenges in the Diabetes Care Devices Industry in Vietnam Market

Despite the promising growth, the Diabetes Care Devices Industry in Vietnam faces several challenges. Regulatory hurdles and varying approval timelines for new medical devices can slow down market entry for innovative products. Supply chain disruptions, particularly in the context of global logistics, can impact product availability and pricing. High upfront costs associated with advanced devices like insulin pumps and continuous glucose monitors remain a significant barrier for a substantial portion of the population, limiting market penetration in lower-income segments. Limited reimbursement coverage for newer technologies further exacerbates affordability issues. Furthermore, fierce competition from established players and the availability of lower-cost alternatives create price pressures. Lack of widespread awareness and understanding of advanced diabetes management technologies among some patient groups and healthcare providers can also hinder adoption.

Emerging Opportunities in Diabetes Care Devices Industry in Vietnam

The Diabetes Care Devices Industry in Vietnam presents significant emerging opportunities. The rapid adoption of digital health and telemedicine platforms creates a fertile ground for connected diabetes devices, enabling remote patient monitoring and personalized interventions. Strategic partnerships between device manufacturers, local healthcare providers, and technology companies can foster innovation and improve market access. The increasing focus on Gestational Diabetes Mellitus (GDM) management, as highlighted by the 'Gestational Diabetes in Vietnam' project, opens up new avenues for targeted screening and management solutions. Furthermore, as the market matures, there will be an increasing demand for integrated diabetes care solutions that combine monitoring, management, and data analytics, offering a holistic approach to patient care. Expansion into underserved rural areas with tailored product offerings and distribution strategies also presents substantial growth potential.

Leading Players in the Diabetes Care Devices Industry in Vietnam Sector

- Roche

- Dexcom

- Ypsomed

- Abbott

- Eli Lilly

- Sanofi

- Medtronic

- Tandem

- Insulet

- Lifescan (Johnson & Johnson)

- Becton and Dickenson

- Novo Nordisk

Key Milestones in Diabetes Care Devices Industry in Vietnam Industry

- May 2023: The VPA and Roche Diabetes Care Vietnam, represented by Roche Vietnam Company Limited, partnered to improve healthcare access for disadvantaged children with Type 1 diabetes in Vietnam as part of the global initiative CDiC. Led by Novo Nordisk and Roche Diabetes Care, this program aims to expand healthcare access and provide insulin and supplies to children and young individuals with Type 1 diabetes up to age 25 in countries with limited resources.

- January 2022: With a grant of DKK 5 million from the Danish Ministry of Foreign Affairs, the project 'Gestational Diabetes in Vietnam' will, in close collaboration with local researchers and health care workers, investigate GDM in Vietnam's northern Thai Binh province. GDM is estimated to affect about one in five pregnant women in Vietnam, but little is known about how it is handled by pregnant women, families, and healthcare providers.

- March 2021: Abbott Vietnam introduced the FreeStyle Libre system, the world's leading glucose monitoring technology, for people with diabetes in Việt Nam.

Strategic Outlook for Diabetes Care Devices Industry in Vietnam Market

The strategic outlook for the Diabetes Care Devices Industry in Vietnam is highly optimistic, driven by a strong upward trajectory in market growth. Future success will hinge on embracing technological advancements, particularly in the realm of connected devices, artificial intelligence, and personalized medicine. Companies that can offer innovative yet affordable solutions, coupled with robust patient support and education programs, will likely gain a competitive edge. Strategic partnerships with local healthcare providers and government entities will be crucial for navigating regulatory landscapes and enhancing market penetration, especially in underserved regions. Focusing on the expanding continuous glucose monitoring and insulin pump segments, while maintaining a strong presence in the established self-monitoring blood glucose devices market, will define the winning strategies for stakeholders aiming to capitalize on the significant opportunities in Vietnam's evolving healthcare sector.

Diabetes Care Devices Industry in Vietnam Segmentation

-

1. Monitoring Devices

-

1.1. Self-monitoring Blood Glucose Devices

- 1.1.1. Glucometer Devices

- 1.1.2. Test Strips

- 1.1.3. Lancets

-

1.2. Continuous Blood Glucose Monitoring

- 1.2.1. Sensors

- 1.2.2. Durables

-

1.1. Self-monitoring Blood Glucose Devices

-

2. Management Devices

-

2.1. Insulin Pump

- 2.1.1. Insulin Pump Device

- 2.1.2. Insulin Pump Reservoir

- 2.1.3. Infusion Set

- 2.2. Insulin Syringes

- 2.3. Insulin Cartridges

- 2.4. Disposable Pens

-

2.1. Insulin Pump

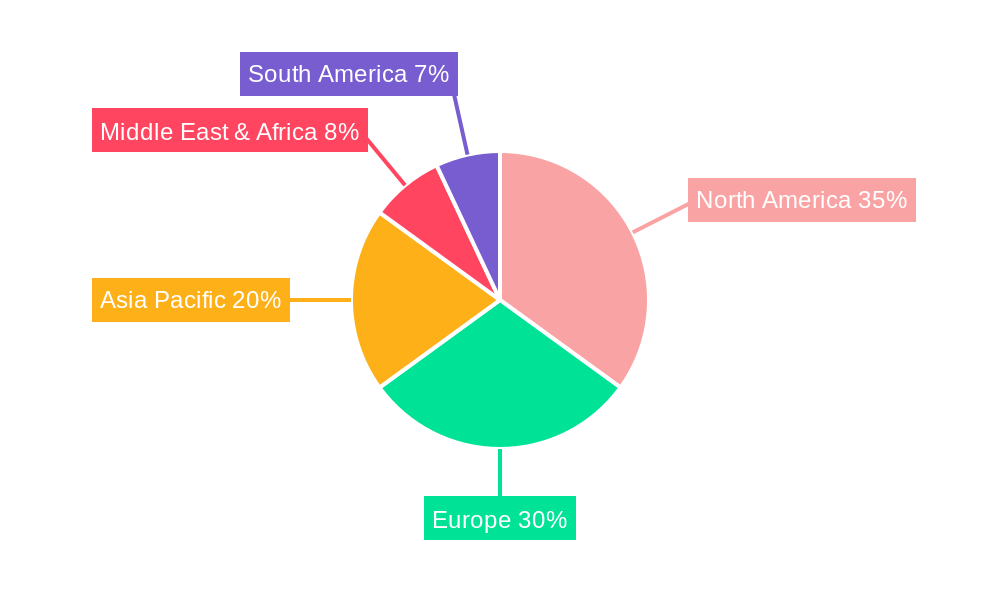

Diabetes Care Devices Industry in Vietnam Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Diabetes Care Devices Industry in Vietnam Regional Market Share

Geographic Coverage of Diabetes Care Devices Industry in Vietnam

Diabetes Care Devices Industry in Vietnam REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Preterm and Low-weight Births; Advanced Technology in Fetal and Prenatal Monitoring

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Procedures

- 3.4. Market Trends

- 3.4.1. Management Devices Hold Highest Market Share in Vietnam Diabetes Care Devices Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Diabetes Care Devices Industry in Vietnam Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 5.1.1. Self-monitoring Blood Glucose Devices

- 5.1.1.1. Glucometer Devices

- 5.1.1.2. Test Strips

- 5.1.1.3. Lancets

- 5.1.2. Continuous Blood Glucose Monitoring

- 5.1.2.1. Sensors

- 5.1.2.2. Durables

- 5.1.1. Self-monitoring Blood Glucose Devices

- 5.2. Market Analysis, Insights and Forecast - by Management Devices

- 5.2.1. Insulin Pump

- 5.2.1.1. Insulin Pump Device

- 5.2.1.2. Insulin Pump Reservoir

- 5.2.1.3. Infusion Set

- 5.2.2. Insulin Syringes

- 5.2.3. Insulin Cartridges

- 5.2.4. Disposable Pens

- 5.2.1. Insulin Pump

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 6. North America Diabetes Care Devices Industry in Vietnam Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 6.1.1. Self-monitoring Blood Glucose Devices

- 6.1.1.1. Glucometer Devices

- 6.1.1.2. Test Strips

- 6.1.1.3. Lancets

- 6.1.2. Continuous Blood Glucose Monitoring

- 6.1.2.1. Sensors

- 6.1.2.2. Durables

- 6.1.1. Self-monitoring Blood Glucose Devices

- 6.2. Market Analysis, Insights and Forecast - by Management Devices

- 6.2.1. Insulin Pump

- 6.2.1.1. Insulin Pump Device

- 6.2.1.2. Insulin Pump Reservoir

- 6.2.1.3. Infusion Set

- 6.2.2. Insulin Syringes

- 6.2.3. Insulin Cartridges

- 6.2.4. Disposable Pens

- 6.2.1. Insulin Pump

- 6.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 7. South America Diabetes Care Devices Industry in Vietnam Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 7.1.1. Self-monitoring Blood Glucose Devices

- 7.1.1.1. Glucometer Devices

- 7.1.1.2. Test Strips

- 7.1.1.3. Lancets

- 7.1.2. Continuous Blood Glucose Monitoring

- 7.1.2.1. Sensors

- 7.1.2.2. Durables

- 7.1.1. Self-monitoring Blood Glucose Devices

- 7.2. Market Analysis, Insights and Forecast - by Management Devices

- 7.2.1. Insulin Pump

- 7.2.1.1. Insulin Pump Device

- 7.2.1.2. Insulin Pump Reservoir

- 7.2.1.3. Infusion Set

- 7.2.2. Insulin Syringes

- 7.2.3. Insulin Cartridges

- 7.2.4. Disposable Pens

- 7.2.1. Insulin Pump

- 7.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 8. Europe Diabetes Care Devices Industry in Vietnam Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 8.1.1. Self-monitoring Blood Glucose Devices

- 8.1.1.1. Glucometer Devices

- 8.1.1.2. Test Strips

- 8.1.1.3. Lancets

- 8.1.2. Continuous Blood Glucose Monitoring

- 8.1.2.1. Sensors

- 8.1.2.2. Durables

- 8.1.1. Self-monitoring Blood Glucose Devices

- 8.2. Market Analysis, Insights and Forecast - by Management Devices

- 8.2.1. Insulin Pump

- 8.2.1.1. Insulin Pump Device

- 8.2.1.2. Insulin Pump Reservoir

- 8.2.1.3. Infusion Set

- 8.2.2. Insulin Syringes

- 8.2.3. Insulin Cartridges

- 8.2.4. Disposable Pens

- 8.2.1. Insulin Pump

- 8.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 9. Middle East & Africa Diabetes Care Devices Industry in Vietnam Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 9.1.1. Self-monitoring Blood Glucose Devices

- 9.1.1.1. Glucometer Devices

- 9.1.1.2. Test Strips

- 9.1.1.3. Lancets

- 9.1.2. Continuous Blood Glucose Monitoring

- 9.1.2.1. Sensors

- 9.1.2.2. Durables

- 9.1.1. Self-monitoring Blood Glucose Devices

- 9.2. Market Analysis, Insights and Forecast - by Management Devices

- 9.2.1. Insulin Pump

- 9.2.1.1. Insulin Pump Device

- 9.2.1.2. Insulin Pump Reservoir

- 9.2.1.3. Infusion Set

- 9.2.2. Insulin Syringes

- 9.2.3. Insulin Cartridges

- 9.2.4. Disposable Pens

- 9.2.1. Insulin Pump

- 9.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 10. Asia Pacific Diabetes Care Devices Industry in Vietnam Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 10.1.1. Self-monitoring Blood Glucose Devices

- 10.1.1.1. Glucometer Devices

- 10.1.1.2. Test Strips

- 10.1.1.3. Lancets

- 10.1.2. Continuous Blood Glucose Monitoring

- 10.1.2.1. Sensors

- 10.1.2.2. Durables

- 10.1.1. Self-monitoring Blood Glucose Devices

- 10.2. Market Analysis, Insights and Forecast - by Management Devices

- 10.2.1. Insulin Pump

- 10.2.1.1. Insulin Pump Device

- 10.2.1.2. Insulin Pump Reservoir

- 10.2.1.3. Infusion Set

- 10.2.2. Insulin Syringes

- 10.2.3. Insulin Cartridges

- 10.2.4. Disposable Pens

- 10.2.1. Insulin Pump

- 10.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Roche

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dexcom*List Not Exhaustive 7 2 Company Share Analysi

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ypsomed

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Abbottt

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eli Lilly

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sanofi

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Medtronic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tandem

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Insulet

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lifescan (Johnson &Johnson)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Becton and Dickenson

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Novo Nordisk

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Roche

List of Figures

- Figure 1: Global Diabetes Care Devices Industry in Vietnam Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Diabetes Care Devices Industry in Vietnam Revenue (Million), by Monitoring Devices 2025 & 2033

- Figure 3: North America Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Monitoring Devices 2025 & 2033

- Figure 4: North America Diabetes Care Devices Industry in Vietnam Revenue (Million), by Management Devices 2025 & 2033

- Figure 5: North America Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Management Devices 2025 & 2033

- Figure 6: North America Diabetes Care Devices Industry in Vietnam Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Diabetes Care Devices Industry in Vietnam Revenue (Million), by Monitoring Devices 2025 & 2033

- Figure 9: South America Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Monitoring Devices 2025 & 2033

- Figure 10: South America Diabetes Care Devices Industry in Vietnam Revenue (Million), by Management Devices 2025 & 2033

- Figure 11: South America Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Management Devices 2025 & 2033

- Figure 12: South America Diabetes Care Devices Industry in Vietnam Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Diabetes Care Devices Industry in Vietnam Revenue (Million), by Monitoring Devices 2025 & 2033

- Figure 15: Europe Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Monitoring Devices 2025 & 2033

- Figure 16: Europe Diabetes Care Devices Industry in Vietnam Revenue (Million), by Management Devices 2025 & 2033

- Figure 17: Europe Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Management Devices 2025 & 2033

- Figure 18: Europe Diabetes Care Devices Industry in Vietnam Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Diabetes Care Devices Industry in Vietnam Revenue (Million), by Monitoring Devices 2025 & 2033

- Figure 21: Middle East & Africa Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Monitoring Devices 2025 & 2033

- Figure 22: Middle East & Africa Diabetes Care Devices Industry in Vietnam Revenue (Million), by Management Devices 2025 & 2033

- Figure 23: Middle East & Africa Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Management Devices 2025 & 2033

- Figure 24: Middle East & Africa Diabetes Care Devices Industry in Vietnam Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Diabetes Care Devices Industry in Vietnam Revenue (Million), by Monitoring Devices 2025 & 2033

- Figure 27: Asia Pacific Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Monitoring Devices 2025 & 2033

- Figure 28: Asia Pacific Diabetes Care Devices Industry in Vietnam Revenue (Million), by Management Devices 2025 & 2033

- Figure 29: Asia Pacific Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Management Devices 2025 & 2033

- Figure 30: Asia Pacific Diabetes Care Devices Industry in Vietnam Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Monitoring Devices 2020 & 2033

- Table 2: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Management Devices 2020 & 2033

- Table 3: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Monitoring Devices 2020 & 2033

- Table 5: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Management Devices 2020 & 2033

- Table 6: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Monitoring Devices 2020 & 2033

- Table 11: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Management Devices 2020 & 2033

- Table 12: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Monitoring Devices 2020 & 2033

- Table 17: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Management Devices 2020 & 2033

- Table 18: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Monitoring Devices 2020 & 2033

- Table 29: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Management Devices 2020 & 2033

- Table 30: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Monitoring Devices 2020 & 2033

- Table 38: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Management Devices 2020 & 2033

- Table 39: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Diabetes Care Devices Industry in Vietnam?

The projected CAGR is approximately 2.10%.

2. Which companies are prominent players in the Diabetes Care Devices Industry in Vietnam?

Key companies in the market include Roche, Dexcom*List Not Exhaustive 7 2 Company Share Analysi, Ypsomed, Abbottt, Eli Lilly, Sanofi, Medtronic, Tandem, Insulet, Lifescan (Johnson &Johnson), Becton and Dickenson, Novo Nordisk.

3. What are the main segments of the Diabetes Care Devices Industry in Vietnam?

The market segments include Monitoring Devices, Management Devices.

4. Can you provide details about the market size?

The market size is estimated to be USD 424.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Preterm and Low-weight Births; Advanced Technology in Fetal and Prenatal Monitoring.

6. What are the notable trends driving market growth?

Management Devices Hold Highest Market Share in Vietnam Diabetes Care Devices Market.

7. Are there any restraints impacting market growth?

Stringent Regulatory Procedures.

8. Can you provide examples of recent developments in the market?

May 2023: The VPA and Roche Diabetes Care Vietnam, represented by Roche Vietnam Company Limited, have partnered to improve healthcare access for disadvantaged children with Type 1 diabetes in Vietnam as part of the global initiative CDiC. Led by Novo Nordisk and Roche Diabetes Care, this program aims to expand healthcare access and provide insulin and supplies to children and young individuals with Type 1 diabetes up to age 25 in countries with limited resources.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Diabetes Care Devices Industry in Vietnam," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Diabetes Care Devices Industry in Vietnam report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Diabetes Care Devices Industry in Vietnam?

To stay informed about further developments, trends, and reports in the Diabetes Care Devices Industry in Vietnam, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence