Key Insights

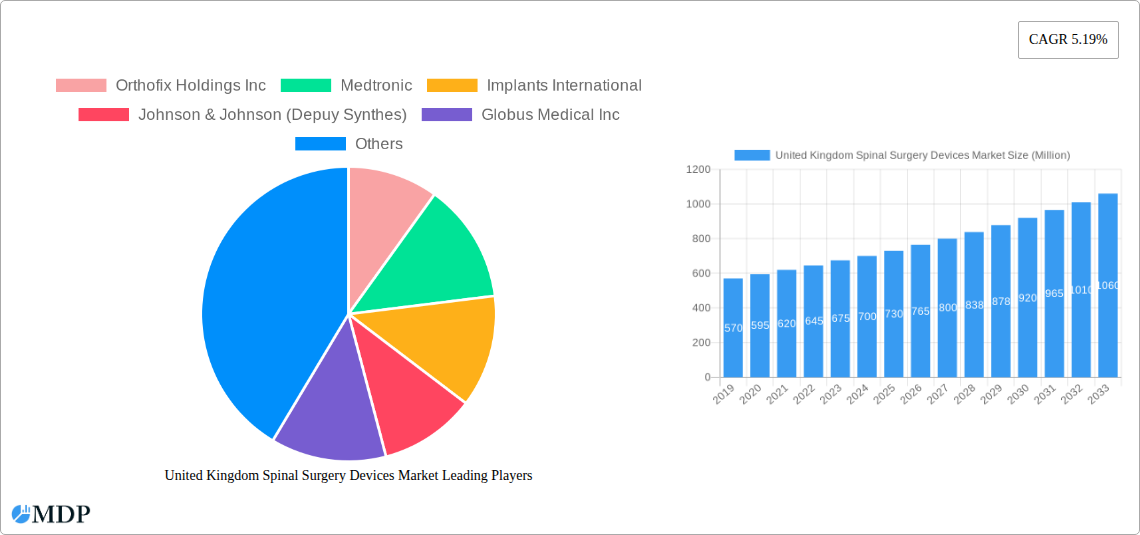

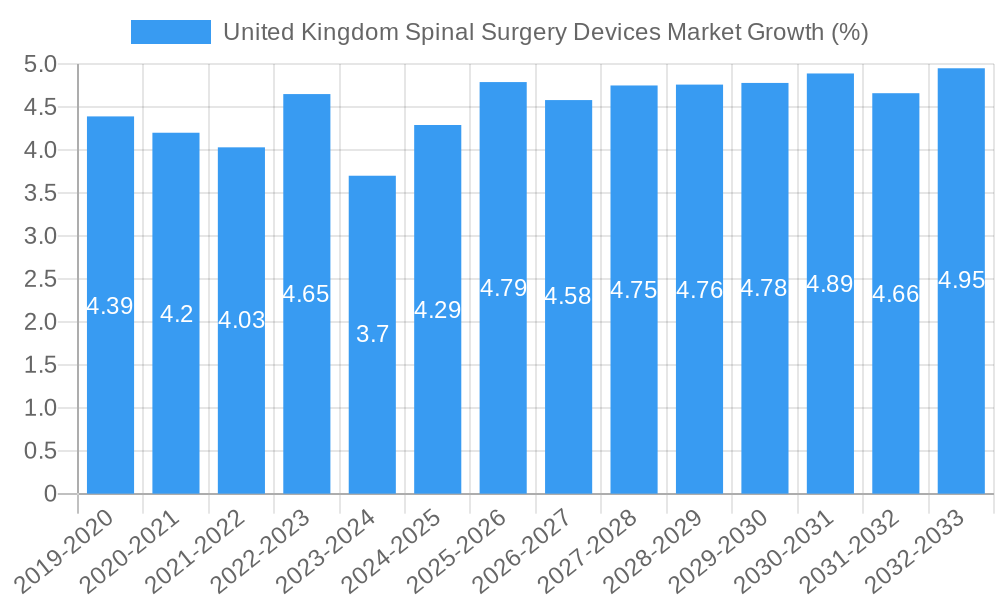

The United Kingdom spinal surgery devices market is poised for robust growth, projected to reach approximately £750 million by the end of 2025. This expansion is driven by an increasing prevalence of spinal disorders, an aging population, and advancements in surgical techniques and implantable technologies. The market is expected to witness a Compound Annual Growth Rate (CAGR) of 5.19% during the forecast period of 2025-2033, indicating sustained and healthy expansion. Key segments contributing to this growth include spinal decompression devices, vital for alleviating nerve compression, and spinal fusion devices, essential for stabilizing the spine. Fracture repair devices also play a significant role, particularly in addressing traumatic spinal injuries. The demand for these sophisticated medical instruments is largely fueled by hospitals and ambulatory surgery centers, which are equipped to handle complex spinal procedures and are increasingly adopting minimally invasive surgical approaches that often necessitate advanced device utilization.

Further analysis reveals that the United Kingdom's investment in healthcare infrastructure and the growing demand for specialized spinal care are significant accelerators. The rising incidence of degenerative spinal conditions, coupled with a greater awareness and accessibility to advanced surgical solutions, underpins the positive market trajectory. Trends such as the increasing adoption of robotic-assisted surgery and the development of biologics for spinal fusion are expected to further enhance the market. While the market demonstrates strong upward momentum, potential restraints might include stringent regulatory approvals for new devices and the considerable cost associated with advanced spinal surgery equipment, which could influence adoption rates in certain healthcare settings. However, the overarching demand for improved patient outcomes and the continuous innovation within the sector are expected to overcome these challenges, solidifying the UK's position as a significant market for spinal surgery devices.

United Kingdom Spinal Surgery Devices Market Report Description: Unlocking Growth in a Dynamic Landscape

This comprehensive report offers an in-depth analysis of the United Kingdom spinal surgery devices market, providing crucial insights for stakeholders navigating this complex and rapidly evolving sector. Examine the market from 2019 to 2033, with a detailed focus on the base year of 2025 and an extensive forecast period from 2025 to 2033. This research delves into the core dynamics, trends, and future trajectory of spinal fusion devices, spinal decompression devices, and fracture repair devices, catering to end-users such as hospitals, clinics, and ambulatory surgery centers. With an estimated market size reaching $XXX Million in 2025, this report is an indispensable tool for understanding market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and strategic M&A activities. Discover key industry trends, including market growth drivers, technological disruptions, evolving consumer preferences, and intense competitive dynamics, projected with a Compound Annual Growth Rate (CAGR) of XX.X%.

This report highlights leading segments, analyzes product developments, pinpoints growth drivers, identifies market challenges, and uncovers emerging opportunities. Gain an advantage by understanding the strategies of key players such as Orthofix Holdings Inc, Medtronic, Implants International, Johnson & Johnson (Depuy Synthes), Globus Medical Inc, Axis Spine Technologies, Stryker, Vadin Implants, and NuVasive Inc. Analyze critical industry milestones that have shaped the UK spinal surgery devices market, including significant mergers, product launches, and technological advancements. The United Kingdom spinal surgery devices market is poised for significant expansion, driven by an aging population, increasing incidence of spinal disorders, and advancements in minimally invasive surgical techniques. Strategic partnerships, technological innovation, and a focus on patient outcomes are key to unlocking future market potential. This report provides actionable intelligence for manufacturers, suppliers, distributors, investors, and healthcare providers seeking to capitalize on the burgeoning United Kingdom spinal implants market and UK spine surgery technology.

United Kingdom Spinal Surgery Devices Market Market Dynamics & Concentration

The United Kingdom spinal surgery devices market exhibits a moderate to high level of concentration, with a few dominant players like Medtronic, Stryker, and Johnson & Johnson holding significant market share. This concentration is driven by substantial R&D investments required for innovation and the stringent regulatory approval processes. Innovation drivers are primarily focused on developing less invasive surgical techniques, enhancing implant biomaterials for better fusion rates and patient recovery, and integrating digital technologies like robotics and AI for improved surgical precision and patient monitoring. Regulatory frameworks, overseen by bodies like the MHRA, are robust, ensuring patient safety and product efficacy, which can act as a barrier to entry for new players but also instills confidence in established products. Product substitutes, such as conservative treatments like physical therapy and pain management, exist but are increasingly becoming complementary rather than direct replacements for surgical interventions, especially for severe conditions. End-user trends show a growing preference for outpatient procedures in ambulatory surgery centers due to cost-effectiveness and faster recovery times, alongside continued demand from hospitals for complex spinal reconstructions. Mergers and acquisitions (M&A) are a notable trend, aimed at consolidating portfolios and expanding market reach. For instance, the planned merger of Orthofix and SeaSpine underscores the industry's drive towards creating comprehensive offerings. The market has witnessed approximately XX M&A deals in the historical period, indicating a strategic consolidation phase.

United Kingdom Spinal Surgery Devices Market Industry Trends & Analysis

The United Kingdom spinal surgery devices market is experiencing robust growth, propelled by a confluence of demographic shifts, technological advancements, and evolving healthcare practices. An aging population is a primary growth driver, leading to an increased incidence of degenerative spinal conditions such as osteoarthritis, herniated discs, and spinal stenosis. This demographic trend is further amplified by the rising prevalence of sedentary lifestyles and obesity, contributing to a higher burden of spinal ailments across all age groups. Technological disruptions are at the forefront of market expansion. The development and adoption of minimally invasive surgical (MIS) techniques have revolutionized spinal surgery, leading to reduced patient trauma, shorter hospital stays, and quicker recovery times. This shift is directly fueling the demand for specialized MIS instruments and implants. Furthermore, the integration of navigation systems, robotics, and artificial intelligence (AI) in spinal surgeries is enhancing surgical precision, predictability, and ultimately, patient outcomes. Medtronic's expansion of its UK spinal surgery ecosystem, integrating implants, biologics, navigation, robotics, and AI, exemplifies this trend towards a holistic technological approach.

Consumer preferences are increasingly aligned with patient-centric care, emphasizing less invasive procedures, faster recovery, and improved long-term functional outcomes. Patients are also becoming more informed about treatment options, actively seeking less invasive alternatives when appropriate. This evolving demand is pushing manufacturers to innovate and offer solutions that minimize patient morbidity. Competitive dynamics within the UK spine surgery market are characterized by intense innovation and strategic partnerships. Companies are investing heavily in R&D to develop novel biomaterials, advanced implant designs, and integrated digital solutions. The market penetration of advanced spinal technologies is steadily increasing, driven by their proven efficacy and the growing willingness of healthcare providers and insurers to cover these innovative solutions. The overall market penetration for advanced spinal surgery devices is estimated at XX% in 2025, with significant room for further growth as awareness and accessibility increase. The projected CAGR of XX.X% for the forecast period signifies a strong and sustained expansion trajectory for the United Kingdom spinal surgery devices market.

Leading Markets & Segments in United Kingdom Spinal Surgery Devices Market

The United Kingdom spinal surgery devices market is segmented by Device Type and End-User, each presenting distinct growth dynamics and opportunities.

Device Type Dominance:

Spinal Fusion Devices: This segment is anticipated to dominate the UK spinal surgery devices market. The increasing prevalence of degenerative disc disease, spondylolisthesis, and spinal deformities, particularly among the aging demographic, is the primary driver. Advances in fusion technologies, including innovative interbody cages, bone graft substitutes, and spinal instrumentation, are enabling higher fusion rates and improved patient outcomes. The development of advanced materials and techniques for spinal fusion surgery ensures sustained demand. For example, the Axis-ALIF modular cage's introduction aims to reduce complications like cage subsidence, directly addressing a key concern in spinal fusion.

- Key Drivers:

- Growing incidence of degenerative spinal conditions.

- Advancements in biomaterials and implant designs for enhanced fusion.

- Increasing adoption of minimally invasive spinal fusion techniques.

- Higher success rates and improved patient satisfaction.

Spinal Decompression Devices: This segment also holds a significant share, driven by conditions like spinal stenosis and herniated discs. Devices designed for laminectomy, discectomy, and foraminotomy are crucial for alleviating nerve compression. The demand is fueled by the need to restore mobility and reduce chronic pain.

- Key Drivers:

- High prevalence of spinal stenosis and disc herniation.

- Development of more precise and less invasive decompression tools.

- Growing awareness of pain management and functional restoration.

Fracture Repair Devices: While a smaller segment compared to fusion and decompression, fracture repair devices play a critical role in treating traumatic spinal injuries and pathological fractures. These often involve specialized screws, rods, and plates to stabilize the spine post-injury or tumor removal.

- Key Drivers:

- Management of spinal trauma and vertebral compression fractures.

- Technological improvements in stabilization and fixation devices.

- Increasing number of road traffic accidents and sports-related injuries.

End-User Dominance:

Hospitals: Hospitals remain the largest end-user segment in the United Kingdom spinal surgery devices market. They cater to the majority of complex spinal surgeries, including fusion, deformity correction, and trauma cases, requiring comprehensive surgical infrastructure and specialized medical teams.

- Key Drivers:

- Capability to handle complex and high-risk spinal procedures.

- Presence of specialized spine units and experienced surgical teams.

- Integration of advanced diagnostic and surgical technologies.

- Government healthcare initiatives and funding allocation.

Ambulatory Surgery Centers (ASCs): ASCs are experiencing rapid growth in this market. Their ability to perform less complex spinal procedures, such as some decompression surgeries and minor fusion procedures, in an outpatient setting offers significant cost savings and convenience for patients.

- Key Drivers:

- Cost-effectiveness compared to hospital stays.

- Shorter recovery times and increased patient convenience.

- Streamlined operational efficiency for routine procedures.

- Growing preference for outpatient care.

Clinics: While smaller in comparison, specialized clinics focusing on pain management and specific spinal interventions contribute to the market, often acting as referral points for ASCs and hospitals.

Spinal Fusion Devices: This segment is anticipated to dominate the UK spinal surgery devices market. The increasing prevalence of degenerative disc disease, spondylolisthesis, and spinal deformities, particularly among the aging demographic, is the primary driver. Advances in fusion technologies, including innovative interbody cages, bone graft substitutes, and spinal instrumentation, are enabling higher fusion rates and improved patient outcomes. The development of advanced materials and techniques for spinal fusion surgery ensures sustained demand. For example, the Axis-ALIF modular cage's introduction aims to reduce complications like cage subsidence, directly addressing a key concern in spinal fusion.

- Key Drivers:

- Growing incidence of degenerative spinal conditions.

- Advancements in biomaterials and implant designs for enhanced fusion.

- Increasing adoption of minimally invasive spinal fusion techniques.

- Higher success rates and improved patient satisfaction.

Spinal Decompression Devices: This segment also holds a significant share, driven by conditions like spinal stenosis and herniated discs. Devices designed for laminectomy, discectomy, and foraminotomy are crucial for alleviating nerve compression. The demand is fueled by the need to restore mobility and reduce chronic pain.

- Key Drivers:

- High prevalence of spinal stenosis and disc herniation.

- Development of more precise and less invasive decompression tools.

- Growing awareness of pain management and functional restoration.

Fracture Repair Devices: While a smaller segment compared to fusion and decompression, fracture repair devices play a critical role in treating traumatic spinal injuries and pathological fractures. These often involve specialized screws, rods, and plates to stabilize the spine post-injury or tumor removal.

- Key Drivers:

- Management of spinal trauma and vertebral compression fractures.

- Technological improvements in stabilization and fixation devices.

- Increasing number of road traffic accidents and sports-related injuries.

Hospitals: Hospitals remain the largest end-user segment in the United Kingdom spinal surgery devices market. They cater to the majority of complex spinal surgeries, including fusion, deformity correction, and trauma cases, requiring comprehensive surgical infrastructure and specialized medical teams.

- Key Drivers:

- Capability to handle complex and high-risk spinal procedures.

- Presence of specialized spine units and experienced surgical teams.

- Integration of advanced diagnostic and surgical technologies.

- Government healthcare initiatives and funding allocation.

- Key Drivers:

Ambulatory Surgery Centers (ASCs): ASCs are experiencing rapid growth in this market. Their ability to perform less complex spinal procedures, such as some decompression surgeries and minor fusion procedures, in an outpatient setting offers significant cost savings and convenience for patients.

- Key Drivers:

- Cost-effectiveness compared to hospital stays.

- Shorter recovery times and increased patient convenience.

- Streamlined operational efficiency for routine procedures.

- Growing preference for outpatient care.

- Key Drivers:

Clinics: While smaller in comparison, specialized clinics focusing on pain management and specific spinal interventions contribute to the market, often acting as referral points for ASCs and hospitals.

The dominance of Spinal Fusion Devices within the Device Type segment and Hospitals within the End-User segment are key indicators of the current market landscape, with Ambulatory Surgery Centers showing the most significant growth potential.

United Kingdom Spinal Surgery Devices Market Product Developments

Product development in the United Kingdom spinal surgery devices market is characterized by a strong emphasis on innovation that enhances surgical efficacy, patient safety, and recovery. Companies are investing in advanced biomaterials, such as porous titanium and PEEK composites, to improve implant integration and reduce the risk of non-union. The development of modular cage systems, like Axis Spine Technologies' Alpha release of the Axis-ALIF modular cage, aims to minimize damage to vertebral endplates during insertion, thereby reducing complications such as cage subsidence and improving fusion rates. Furthermore, the integration of navigation, robotics, and AI-powered data analytics by companies like Medtronic signifies a paradigm shift towards more intelligent and precise surgical interventions. These technologies not only enhance surgical accuracy but also offer surgeons real-time feedback and data-driven insights, leading to optimized surgical plans and personalized patient care. Competitive advantages are being carved out through the development of specialized instruments for minimally invasive approaches and implant designs that promote biological fusion.

Key Drivers of United Kingdom Spinal Surgery Devices Market Growth

Several key factors are propelling the United Kingdom spinal surgery devices market forward. The aging population in the UK is a primary driver, as older individuals are more susceptible to degenerative spinal conditions. Technological advancements, particularly in minimally invasive surgery (MIS), are making procedures safer, less painful, and resulting in faster recovery, thus increasing patient and surgeon adoption. The integration of robotics and AI in spinal surgery is enhancing precision and predictability, further boosting the appeal of surgical interventions. Furthermore, increasing healthcare expenditure and government initiatives aimed at improving spinal care access contribute to market expansion. The development of novel biomaterials and implant designs that promote better fusion rates and reduce complications is also a significant growth accelerator.

Challenges in the United Kingdom Spinal Surgery Devices Market Market

Despite the promising growth, the United Kingdom spinal surgery devices market faces several challenges. Stringent regulatory approvals from bodies like the MHRA can prolong time-to-market for new innovations and increase development costs. Reimbursement policies can sometimes lag behind technological advancements, creating pricing pressures and limiting access to the latest devices. The high cost of advanced technologies, such as robotic systems, can be a barrier to adoption, particularly for smaller healthcare facilities. Furthermore, competition from conservative treatment options and the increasing demand for evidence of long-term efficacy and cost-effectiveness of surgical interventions pose ongoing challenges. Supply chain disruptions and the need for specialized surgeon training also present hurdles to market expansion.

Emerging Opportunities in United Kingdom Spinal Surgery Devices Market

The United Kingdom spinal surgery devices market is ripe with emerging opportunities. The growing focus on personalized medicine is driving demand for custom-made implants and patient-specific surgical planning solutions. The increasing adoption of value-based healthcare models presents an opportunity for manufacturers to demonstrate the cost-effectiveness and long-term outcomes of their devices. Expansion into ambulatory surgery centers (ASCs) for less complex procedures offers a significant growth avenue due to their cost efficiencies. Furthermore, the development of biologics and regenerative medicine in conjunction with surgical implants holds immense potential for improving fusion rates and reducing revision surgeries. Strategic partnerships between device manufacturers, healthcare providers, and academic institutions can accelerate innovation and clinical validation, creating new market frontiers.

Leading Players in the United Kingdom Spinal Surgery Devices Market Sector

- Orthofix Holdings Inc

- Medtronic

- Implants International

- Johnson & Johnson (Depuy Synthes)

- Globus Medical Inc

- Axis Spine Technologies

- Stryker

- Vadin Implants

- NuVasive Inc

Key Milestones in United Kingdom Spinal Surgery Devices Market Industry

- October 2022: Orthofix and SeaSpine entered into a definitive agreement to combine in an all-stock merger of equals, aiming to create a company with complementary spine and orthopedics portfolios.

- February 2022: Axis Spine Technologies Ltd. completed the Alpha release of its Axis-ALIF modular cage, leveraging modular technology to reduce damage to vertebral endplates during insertion and mitigate cage subsidence.

- October 2021: Medtronic expanded its United Kingdom spinal surgery devices ecosystem with next-generation spinal technologies, offering a comprehensive suite of implants, biologics, navigation, robotics, and AI-powered data.

Strategic Outlook for United Kingdom Spinal Surgery Devices Market Market

The strategic outlook for the United Kingdom spinal surgery devices market is one of sustained growth and innovation. The market is poised to benefit from increasing investments in healthcare infrastructure and a growing demand for advanced surgical solutions. Key growth accelerators include the continued development and adoption of minimally invasive surgical techniques, further integration of robotics and AI for enhanced surgical precision, and the exploration of novel biomaterials for improved patient outcomes. Manufacturers are likely to focus on developing integrated solutions that encompass implants, biologics, and digital technologies to provide comprehensive care pathways. Strategic partnerships and collaborations will be crucial for market players to expand their product portfolios, enhance market reach, and address the evolving needs of healthcare providers and patients. The increasing preference for outpatient procedures in ambulatory surgery centers also presents a significant opportunity for market expansion.

United Kingdom Spinal Surgery Devices Market Segmentation

-

1. Device Type

- 1.1. Spinal Decompression

- 1.2. Spinal Fusion

- 1.3. Fracture Repair Devices

-

2. End-User

- 2.1. Hospitals

- 2.2. Clinics

- 2.3. Ambulatory Surgery Centers

United Kingdom Spinal Surgery Devices Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Spinal Surgery Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.19% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Minimally Invasive Surgical Procedures; Technological Advances in Spinal Surgery

- 3.3. Market Restrains

- 3.3.1. Complications Associated with the Spine Surgery

- 3.4. Market Trends

- 3.4.1. Discectomy by Spinal Decompression Segment is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Spinal Surgery Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Spinal Decompression

- 5.1.2. Spinal Fusion

- 5.1.3. Fracture Repair Devices

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Hospitals

- 5.2.2. Clinics

- 5.2.3. Ambulatory Surgery Centers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. North America United Kingdom Spinal Surgery Devices Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 7. Europe United Kingdom Spinal Surgery Devices Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Germany

- 7.1.2 United Kingdom

- 7.1.3 France

- 7.1.4 Italy

- 7.1.5 Spain

- 7.1.6 Rest of Europe

- 8. Asia Pacific United Kingdom Spinal Surgery Devices Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 Japan

- 8.1.3 India

- 8.1.4 Australia

- 8.1.5 South Korea

- 8.1.6 Rest of Asia Pacific

- 9. Middle East and Africa United Kingdom Spinal Surgery Devices Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 GCC

- 9.1.2 South Africa

- 9.1.3 Rest of Middle East and Africa

- 10. South America United Kingdom Spinal Surgery Devices Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 Brazil

- 10.1.2 Argentina

- 10.1.3 Rest of South America

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Orthofix Holdings Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Medtronic

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Implants International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Johnson & Johnson (Depuy Synthes)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Globus Medical Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Axis Spine Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Stryker

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Vadin Implants

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NuVasive Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Orthofix Holdings Inc

List of Figures

- Figure 1: United Kingdom Spinal Surgery Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Spinal Surgery Devices Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Spinal Surgery Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Spinal Surgery Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: United Kingdom Spinal Surgery Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 4: United Kingdom Spinal Surgery Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 5: United Kingdom Spinal Surgery Devices Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: United Kingdom Spinal Surgery Devices Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 7: United Kingdom Spinal Surgery Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United Kingdom Spinal Surgery Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: United Kingdom Spinal Surgery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom Spinal Surgery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Spinal Surgery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Spinal Surgery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Germany United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Germany United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: United Kingdom United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United Kingdom United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: France United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Italy United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Italy United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Spain United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: United Kingdom Spinal Surgery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United Kingdom Spinal Surgery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: China United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: China United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Japan United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Japan United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: India United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Australia United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Australia United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: South Korea United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Korea United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Rest of Asia Pacific United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Asia Pacific United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: United Kingdom Spinal Surgery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United Kingdom Spinal Surgery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 47: GCC United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: GCC United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: South Africa United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Africa United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Rest of Middle East and Africa United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Middle East and Africa United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: United Kingdom Spinal Surgery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: United Kingdom Spinal Surgery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 55: Brazil United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Brazil United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Argentina United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Argentina United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Rest of South America United Kingdom Spinal Surgery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of South America United Kingdom Spinal Surgery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 61: United Kingdom Spinal Surgery Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 62: United Kingdom Spinal Surgery Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 63: United Kingdom Spinal Surgery Devices Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 64: United Kingdom Spinal Surgery Devices Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 65: United Kingdom Spinal Surgery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: United Kingdom Spinal Surgery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Spinal Surgery Devices Market?

The projected CAGR is approximately 5.19%.

2. Which companies are prominent players in the United Kingdom Spinal Surgery Devices Market?

Key companies in the market include Orthofix Holdings Inc, Medtronic, Implants International, Johnson & Johnson (Depuy Synthes), Globus Medical Inc, Axis Spine Technologies, Stryker, Vadin Implants, NuVasive Inc.

3. What are the main segments of the United Kingdom Spinal Surgery Devices Market?

The market segments include Device Type, End-User .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Minimally Invasive Surgical Procedures; Technological Advances in Spinal Surgery.

6. What are the notable trends driving market growth?

Discectomy by Spinal Decompression Segment is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Complications Associated with the Spine Surgery.

8. Can you provide examples of recent developments in the market?

In October 2022, Orthofix, accompanied by a spine and orthopedics focus, and SeaSpine, a medical technology company focused on surgical solutions for the treatment of spinal disorders, entered into a definitive agreement to combine in an all-stock merger of equals. The new company aims to provide complementary spine and orthopedics portfolios.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Spinal Surgery Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Spinal Surgery Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Spinal Surgery Devices Market?

To stay informed about further developments, trends, and reports in the United Kingdom Spinal Surgery Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence