Key Insights

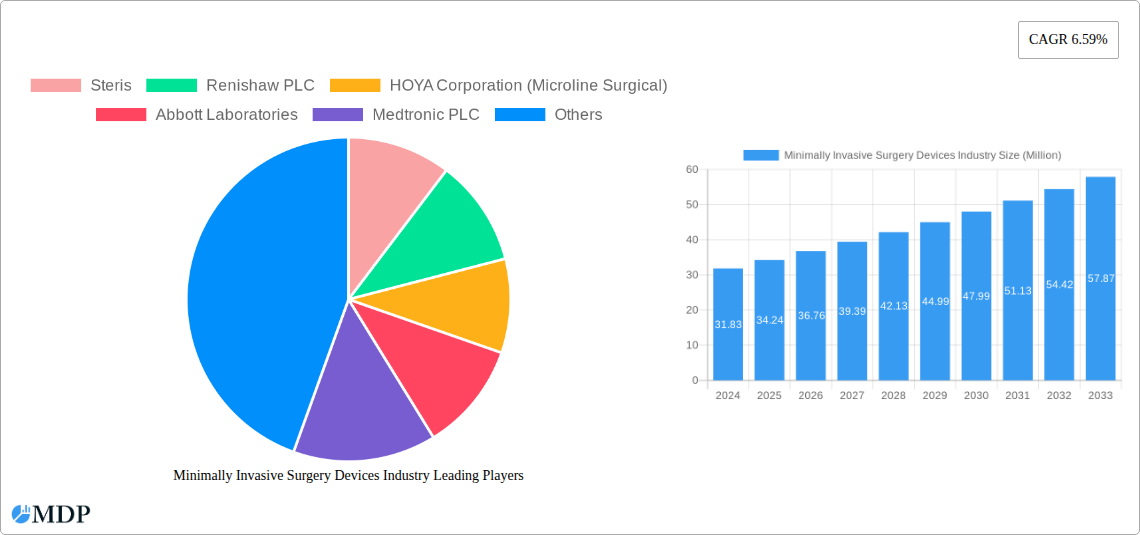

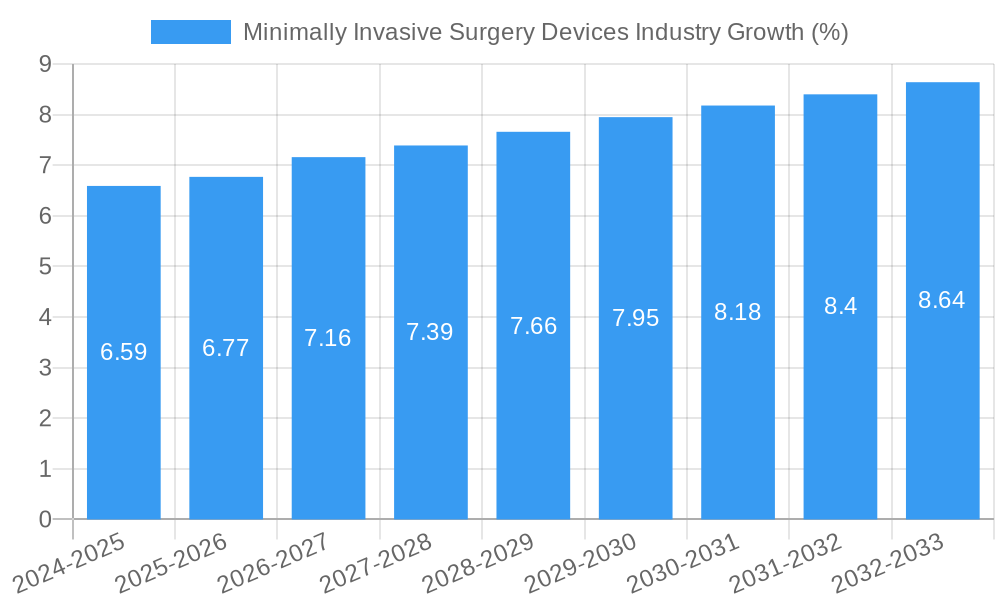

The global Minimally Invasive Surgery (MIS) Devices market is projected to experience substantial growth, reaching an estimated market size of USD 34.24 million by 2025. This expansion is fueled by a Compound Annual Growth Rate (CAGR) of 6.59% from 2025 to 2033, indicating a robust upward trajectory driven by advancements in surgical techniques and patient demand for less invasive procedures. Key market drivers include the increasing prevalence of chronic diseases requiring surgical intervention, a growing elderly population that benefits from reduced recovery times, and significant technological innovations in areas like robotic-assisted surgery, advanced imaging, and intelligent instrumentation. The shift towards outpatient procedures and a greater emphasis on cost-effectiveness in healthcare further bolster the adoption of MIS devices.

The market landscape is characterized by a diverse range of segments, with Handheld Instruments, Guiding Devices (Guiding Catheters, Guidewires), and Electrosurgical Devices holding significant market share due to their foundational role in numerous MIS procedures. Applications span across critical specialties such as Cardiovascular, Gastrointestinal, Urological, and Gynecological procedures, reflecting the broad applicability of MIS. However, the market faces restraints including the high initial cost of some advanced MIS systems, the need for specialized training for surgeons, and regulatory hurdles in certain regions. Despite these challenges, the continuous influx of new products, strategic collaborations between leading players like Medtronic, Boston Scientific, and Intuitive Surgical Inc., and expansion into emerging economies are expected to propel sustained market growth throughout the forecast period.

Minimally Invasive Surgery Devices Industry: Market Analysis, Trends, and Forecast (2019–2033)

Unlock deep insights into the rapidly evolving Minimally Invasive Surgery Devices market with this comprehensive report. Explore key trends, market dynamics, leading players, and future opportunities shaping the surgical landscape from 2019 to 2033, with a detailed focus on the 2025-2033 forecast period.

Minimally Invasive Surgery Devices Industry Market Dynamics & Concentration

The Minimally Invasive Surgery (MIS) Devices market is characterized by moderate to high concentration, driven by a few dominant players and a steady stream of technological advancements. Innovation is a primary driver, with continuous development in robotics, imaging, and advanced instrumentation. Regulatory frameworks, such as FDA approvals and CE marking, are crucial for market entry and product lifecycle management, impacting market accessibility and the pace of innovation. Product substitutes exist, particularly in traditional open surgery methods, but the benefits of MIS—reduced recovery times, smaller incisions, and lower complication rates—consistently favor minimally invasive approaches. End-user trends are shifting towards outpatient procedures and increased adoption in emerging economies. Merger and acquisition (M&A) activities are significant, with approximately 15-20 major deals annually, reflecting strategic consolidation and expansion. Key M&A transactions in the historical period (2019-2024) include Abbott Laboratories' acquisition of Alere for approximately $5.3 Billion in 2017, and Stryker Corporation's acquisition of K2M Group Holdings for $1.4 Billion in 2018, showcasing the intense competition and strategic moves to enhance product portfolios and market reach. Market share for leading companies like Medtronic PLC and Intuitive Surgical Inc. ranges from 15% to 25% each, underscoring the competitive landscape.

Minimally Invasive Surgery Devices Industry Industry Trends & Analysis

The Minimally Invasive Surgery Devices industry is poised for robust growth, projected to experience a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period of 2025–2033. This expansion is fueled by an increasing global prevalence of chronic diseases requiring surgical intervention, such as cardiovascular conditions, gastrointestinal disorders, and orthopedic ailments. Technological advancements are at the forefront of market evolution, with a significant push towards robotic-assisted surgical systems offering enhanced precision, dexterity, and patient outcomes. The development of high-definition visualization devices, advanced imaging technologies like 4K and 3D endoscopy, and intelligent surgical instruments further drives adoption. Consumer preferences are increasingly leaning towards less invasive procedures due to shorter hospital stays, reduced pain, and faster recovery times, which translates to lower healthcare costs. This demand is pushing manufacturers to innovate and expand their product offerings in areas like flexible endoscopy and advanced laparoscopic tools. Competitive dynamics are intensifying, with both established giants and agile startups vying for market share. Key players are investing heavily in research and development to introduce next-generation devices and secure intellectual property. Market penetration of robotic surgery, for instance, has surged, with an estimated 10% market penetration in developed economies and significant potential for growth in developing regions. The integration of artificial intelligence (AI) and machine learning (ML) in surgical planning and execution is another significant trend, promising to revolutionize surgical accuracy and efficiency.

Leading Markets & Segments in Minimally Invasive Surgery Devices Industry

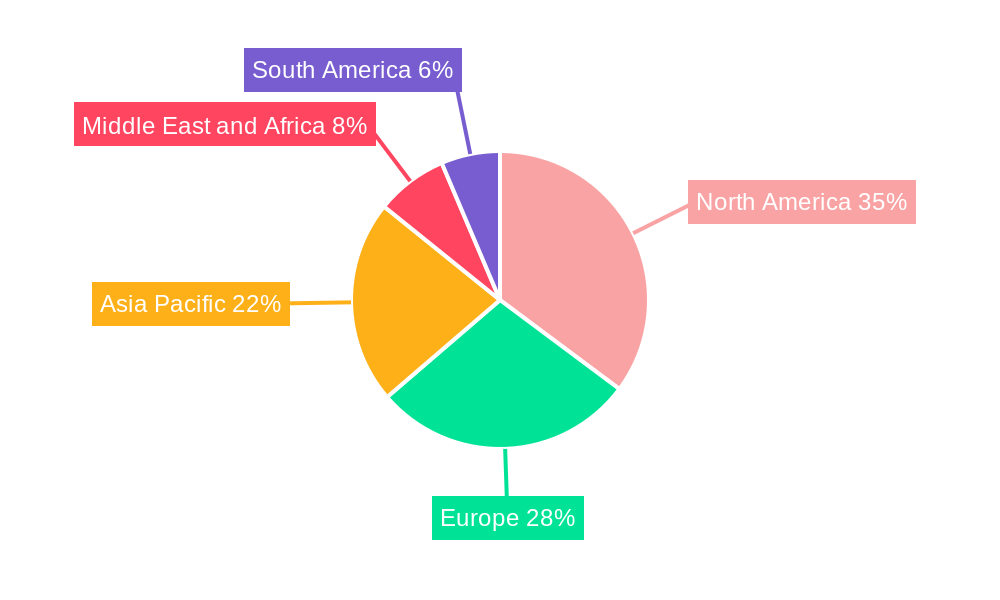

The North America region currently dominates the Minimally Invasive Surgery Devices market, driven by high healthcare spending, advanced technological infrastructure, and a well-established reimbursement system. Within North America, the United States leads with a significant market share, owing to the early adoption of sophisticated surgical technologies and a high volume of complex surgical procedures.

Product Segment Dominance:

- Robotic-assisted Surgical Systems: This segment is witnessing the fastest growth and commands a substantial market share due to its ability to perform complex procedures with enhanced precision and minimal invasiveness. The increasing demand for robotic-assisted procedures in specialties like urology, gynecology, and general surgery is a key driver.

- Endoscopic Devices: Endoscopes, including video endoscopes and flexible endoscopes, are crucial for diagnostic and therapeutic procedures across various applications, particularly in gastroenterology and pulmonology. Their widespread use in routine screenings and treatments contributes to their significant market presence.

- Laparoscopic Devices: These devices remain a cornerstone of MIS, offering versatile solutions for abdominal surgeries. Continuous innovation in laparoscopic instruments, such as advanced graspers and energy devices, ensures their continued relevance and market dominance.

Application Segment Dominance:

- Cardiovascular: The high burden of cardiovascular diseases globally fuels the demand for minimally invasive cardiac procedures, such as angioplasty, stenting, and TAVI (Transcatheter Aortic Valve Implantation), making this a leading application segment for MIS devices.

- Orthopedic: The increasing incidence of orthopedic conditions, coupled with an aging population and a growing preference for less invasive joint replacement and spinal surgeries, positions the orthopedic segment as a significant growth area.

- Gastrointestinal: Routine diagnostic and therapeutic procedures for conditions like colorectal cancer, inflammatory bowel disease, and gastroesophageal reflux disease ensure a consistent and substantial demand for gastrointestinal MIS devices.

Key drivers for dominance in these segments include economic policies that favor healthcare investment, robust healthcare infrastructure, significant R&D expenditure by leading companies, and a strong regulatory environment that encourages innovation.

Minimally Invasive Surgery Devices Industry Product Developments

Product development in the Minimally Invasive Surgery Devices industry is focused on enhancing precision, miniaturization, and integration of advanced technologies. Key innovations include the development of next-generation robotic surgical platforms with improved haptic feedback and smaller instrument footprints, alongside smarter endoscopic devices featuring enhanced imaging capabilities and AI-driven analytics for real-time decision support. New generations of electrosurgical devices are being designed for more precise tissue cutting and coagulation, minimizing collateral damage. The integration of laser-based devices for targeted ablation and advanced guiding catheters and guidewires for complex interventional procedures are also notable. These developments aim to expand the scope of MIS procedures, improve patient outcomes, and reduce recovery times, thereby strengthening the competitive advantage of companies investing in these cutting-edge solutions.

Key Drivers of Minimally Invasive Surgery Devices Industry Growth

The growth of the Minimally Invasive Surgery Devices industry is primarily driven by several interconnected factors. Technological advancements are paramount, with ongoing innovation in robotics, imaging, and instrumentation enabling more complex procedures to be performed minimally invasively. The increasing prevalence of chronic diseases such as cardiovascular conditions, cancer, and orthopedic disorders necessitates surgical interventions, with MIS offering superior patient benefits. Favorable reimbursement policies in developed countries and a growing focus on cost-effectiveness in healthcare by reducing hospital stays and complications also accelerate adoption. Furthermore, the aging global population contributes to a higher demand for surgical solutions, particularly in orthopedics and cardiology. Finally, growing patient awareness and preference for less invasive procedures due to reduced pain, faster recovery, and smaller scars are significant market stimulants.

Challenges in the Minimally Invasive Surgery Devices Industry Market

Despite its robust growth, the Minimally Invasive Surgery Devices industry faces several challenges. High initial investment costs for advanced systems, particularly robotic platforms, can be a significant barrier to adoption for smaller hospitals and in developing economies. Stringent regulatory approval processes by bodies like the FDA and EMA, while ensuring safety, can lead to lengthy development timelines and increased costs. The need for specialized training for surgeons and surgical teams to effectively operate these advanced devices also presents a hurdle, requiring substantial investment in education and skill development. Furthermore, reimbursement complexities and variations across different regions and insurance providers can impact the affordability and accessibility of MIS procedures. Lastly, supply chain disruptions and the increasing threat of cybersecurity for connected surgical devices pose ongoing risks to market stability.

Emerging Opportunities in Minimally Invasive Surgery Devices Industry

Emerging opportunities in the Minimally Invasive Surgery Devices industry are ripe for exploration. The expansion of robotic surgery into new specialties beyond traditional urology and gynecology, such as general surgery, neurosurgery, and even ophthalmology, presents a vast untapped market. The increasing demand for single-use and disposable MIS devices offers opportunities for manufacturers focused on cost-effective, sterile solutions. The integration of Artificial Intelligence (AI) and machine learning (ML) into surgical planning, intraoperative guidance, and post-operative analysis holds immense potential for improving surgical outcomes and driving efficiency. Market expansion into emerging economies in Asia-Pacific and Latin America, where healthcare infrastructure is developing and the demand for advanced medical treatments is growing, represents a significant long-term growth catalyst. Strategic partnerships and collaborations between technology companies and healthcare providers are also crucial for co-developing innovative solutions and accelerating market penetration.

Leading Players in the Minimally Invasive Surgery Devices Industry Sector

- Steris

- Renishaw PLC

- HOYA Corporation (Microline Surgical)

- Abbott Laboratories

- Medtronic PLC

- Boston Scientific

- CONMED Corporation

- Koninklijke Philips NV

- Intuitive Surgical Inc

- Johnson & Johnson Inc

- Stryker Corporation

- Olympus Corporation

- Zimmer Biomet Holdings Inc

Key Milestones in Minimally Invasive Surgery Devices Industry Industry

- January 2023: PENTAX Medical obtained CE marks for its PENTAX Medical INSPIRA, a premium video processor, and the i20c video endoscope series, enhancing compatibility and setting new standards in endoscopic imaging.

- June 2022: Boston Scientific signed a deal to acquire a majority stake in M.I.Tech, a maker and distributor of non-vascular metal stents, for approximately USD 230 Million, strengthening its urology and endoscopic device portfolio.

Strategic Outlook for Minimally Invasive Surgery Devices Industry Market

The strategic outlook for the Minimally Invasive Surgery Devices market is exceptionally positive, driven by sustained innovation and expanding clinical applications. Companies are expected to focus on developing more intelligent, smaller, and cost-effective MIS devices. Increased investment in research and development for AI-powered surgical systems and advanced visualization technologies will be a key differentiator. Strategic partnerships and acquisitions will continue to shape the competitive landscape, allowing companies to broaden their product portfolios and geographical reach. The growing emphasis on value-based healthcare will further accelerate the adoption of MIS technologies that demonstrate superior patient outcomes and cost efficiencies. Expansion into emerging markets, coupled with a focus on user-friendly interfaces and comprehensive training programs, will be crucial for capturing future growth opportunities and solidifying market leadership.

Minimally Invasive Surgery Devices Industry Segmentation

-

1. Product

- 1.1. Handheld Instruments

-

1.2. Guiding Devices

- 1.2.1. Guiding Catheters

- 1.2.2. Guidewires

- 1.3. Electrosurgical Devices

- 1.4. Endoscopic Devices

- 1.5. Laproscopic Devices

- 1.6. Monitoring and Visualization Devices

- 1.7. Ablation Devices

- 1.8. Laser-based Devices

- 1.9. Robotic-assisted Surgical Systems

- 1.10. Other MIS Devices

-

2. Application

- 2.1. Aesthetic

- 2.2. Cardiovascular

- 2.3. Gastrointestinal

- 2.4. Gynecological

- 2.5. Orthopedic

- 2.6. Urological

- 2.7. Other Applications

Minimally Invasive Surgery Devices Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Minimally Invasive Surgery Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Acceptance Rate of Minimally Invasive Surgeries Over Traditional Surgeries; Increasing Prevalence of Lifestyle-related and Chronic Disorders; Growing Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Shortage of Experienced Professionals; Uncertain Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Endoscopic Devices is Expected to be the Fastest-growing Segment During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Minimally Invasive Surgery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Handheld Instruments

- 5.1.2. Guiding Devices

- 5.1.2.1. Guiding Catheters

- 5.1.2.2. Guidewires

- 5.1.3. Electrosurgical Devices

- 5.1.4. Endoscopic Devices

- 5.1.5. Laproscopic Devices

- 5.1.6. Monitoring and Visualization Devices

- 5.1.7. Ablation Devices

- 5.1.8. Laser-based Devices

- 5.1.9. Robotic-assisted Surgical Systems

- 5.1.10. Other MIS Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Aesthetic

- 5.2.2. Cardiovascular

- 5.2.3. Gastrointestinal

- 5.2.4. Gynecological

- 5.2.5. Orthopedic

- 5.2.6. Urological

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Minimally Invasive Surgery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Handheld Instruments

- 6.1.2. Guiding Devices

- 6.1.2.1. Guiding Catheters

- 6.1.2.2. Guidewires

- 6.1.3. Electrosurgical Devices

- 6.1.4. Endoscopic Devices

- 6.1.5. Laproscopic Devices

- 6.1.6. Monitoring and Visualization Devices

- 6.1.7. Ablation Devices

- 6.1.8. Laser-based Devices

- 6.1.9. Robotic-assisted Surgical Systems

- 6.1.10. Other MIS Devices

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Aesthetic

- 6.2.2. Cardiovascular

- 6.2.3. Gastrointestinal

- 6.2.4. Gynecological

- 6.2.5. Orthopedic

- 6.2.6. Urological

- 6.2.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Minimally Invasive Surgery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Handheld Instruments

- 7.1.2. Guiding Devices

- 7.1.2.1. Guiding Catheters

- 7.1.2.2. Guidewires

- 7.1.3. Electrosurgical Devices

- 7.1.4. Endoscopic Devices

- 7.1.5. Laproscopic Devices

- 7.1.6. Monitoring and Visualization Devices

- 7.1.7. Ablation Devices

- 7.1.8. Laser-based Devices

- 7.1.9. Robotic-assisted Surgical Systems

- 7.1.10. Other MIS Devices

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Aesthetic

- 7.2.2. Cardiovascular

- 7.2.3. Gastrointestinal

- 7.2.4. Gynecological

- 7.2.5. Orthopedic

- 7.2.6. Urological

- 7.2.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Minimally Invasive Surgery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Handheld Instruments

- 8.1.2. Guiding Devices

- 8.1.2.1. Guiding Catheters

- 8.1.2.2. Guidewires

- 8.1.3. Electrosurgical Devices

- 8.1.4. Endoscopic Devices

- 8.1.5. Laproscopic Devices

- 8.1.6. Monitoring and Visualization Devices

- 8.1.7. Ablation Devices

- 8.1.8. Laser-based Devices

- 8.1.9. Robotic-assisted Surgical Systems

- 8.1.10. Other MIS Devices

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Aesthetic

- 8.2.2. Cardiovascular

- 8.2.3. Gastrointestinal

- 8.2.4. Gynecological

- 8.2.5. Orthopedic

- 8.2.6. Urological

- 8.2.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Minimally Invasive Surgery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Handheld Instruments

- 9.1.2. Guiding Devices

- 9.1.2.1. Guiding Catheters

- 9.1.2.2. Guidewires

- 9.1.3. Electrosurgical Devices

- 9.1.4. Endoscopic Devices

- 9.1.5. Laproscopic Devices

- 9.1.6. Monitoring and Visualization Devices

- 9.1.7. Ablation Devices

- 9.1.8. Laser-based Devices

- 9.1.9. Robotic-assisted Surgical Systems

- 9.1.10. Other MIS Devices

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Aesthetic

- 9.2.2. Cardiovascular

- 9.2.3. Gastrointestinal

- 9.2.4. Gynecological

- 9.2.5. Orthopedic

- 9.2.6. Urological

- 9.2.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Minimally Invasive Surgery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Handheld Instruments

- 10.1.2. Guiding Devices

- 10.1.2.1. Guiding Catheters

- 10.1.2.2. Guidewires

- 10.1.3. Electrosurgical Devices

- 10.1.4. Endoscopic Devices

- 10.1.5. Laproscopic Devices

- 10.1.6. Monitoring and Visualization Devices

- 10.1.7. Ablation Devices

- 10.1.8. Laser-based Devices

- 10.1.9. Robotic-assisted Surgical Systems

- 10.1.10. Other MIS Devices

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Aesthetic

- 10.2.2. Cardiovascular

- 10.2.3. Gastrointestinal

- 10.2.4. Gynecological

- 10.2.5. Orthopedic

- 10.2.6. Urological

- 10.2.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America Minimally Invasive Surgery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Minimally Invasive Surgery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Minimally Invasive Surgery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Minimally Invasive Surgery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Minimally Invasive Surgery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Steris

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Renishaw PLC

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 HOYA Corporation (Microline Surgical)

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Abbott Laboratories

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Medtronic PLC

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Boston Scientific

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 CONMED Corporation*List Not Exhaustive

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Koninklijke Philips NV

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Intuitive Surgical Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Johnson & Johnson Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Stryker Corporation

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Olympus Corporation

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Zimmer Biomet Holdings Inc

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 Steris

List of Figures

- Figure 1: Global Minimally Invasive Surgery Devices Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Minimally Invasive Surgery Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Minimally Invasive Surgery Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Minimally Invasive Surgery Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Minimally Invasive Surgery Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Minimally Invasive Surgery Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Minimally Invasive Surgery Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Minimally Invasive Surgery Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Minimally Invasive Surgery Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Minimally Invasive Surgery Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Minimally Invasive Surgery Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Minimally Invasive Surgery Devices Industry Revenue (Million), by Product 2024 & 2032

- Figure 13: North America Minimally Invasive Surgery Devices Industry Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America Minimally Invasive Surgery Devices Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Minimally Invasive Surgery Devices Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Minimally Invasive Surgery Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Minimally Invasive Surgery Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Minimally Invasive Surgery Devices Industry Revenue (Million), by Product 2024 & 2032

- Figure 19: Europe Minimally Invasive Surgery Devices Industry Revenue Share (%), by Product 2024 & 2032

- Figure 20: Europe Minimally Invasive Surgery Devices Industry Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Minimally Invasive Surgery Devices Industry Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Minimally Invasive Surgery Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Minimally Invasive Surgery Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Minimally Invasive Surgery Devices Industry Revenue (Million), by Product 2024 & 2032

- Figure 25: Asia Pacific Minimally Invasive Surgery Devices Industry Revenue Share (%), by Product 2024 & 2032

- Figure 26: Asia Pacific Minimally Invasive Surgery Devices Industry Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Pacific Minimally Invasive Surgery Devices Industry Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Minimally Invasive Surgery Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Minimally Invasive Surgery Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Minimally Invasive Surgery Devices Industry Revenue (Million), by Product 2024 & 2032

- Figure 31: Middle East and Africa Minimally Invasive Surgery Devices Industry Revenue Share (%), by Product 2024 & 2032

- Figure 32: Middle East and Africa Minimally Invasive Surgery Devices Industry Revenue (Million), by Application 2024 & 2032

- Figure 33: Middle East and Africa Minimally Invasive Surgery Devices Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: Middle East and Africa Minimally Invasive Surgery Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Minimally Invasive Surgery Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Minimally Invasive Surgery Devices Industry Revenue (Million), by Product 2024 & 2032

- Figure 37: South America Minimally Invasive Surgery Devices Industry Revenue Share (%), by Product 2024 & 2032

- Figure 38: South America Minimally Invasive Surgery Devices Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: South America Minimally Invasive Surgery Devices Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: South America Minimally Invasive Surgery Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: South America Minimally Invasive Surgery Devices Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: GCC Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of South America Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 32: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 33: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 38: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 39: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Germany Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United Kingdom Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 47: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 48: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: India Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Korea Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 56: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 57: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: GCC Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: South Africa Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East and Africa Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 62: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 63: Global Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Brazil Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Argentina Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of South America Minimally Invasive Surgery Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Minimally Invasive Surgery Devices Industry?

The projected CAGR is approximately 6.59%.

2. Which companies are prominent players in the Minimally Invasive Surgery Devices Industry?

Key companies in the market include Steris, Renishaw PLC, HOYA Corporation (Microline Surgical), Abbott Laboratories, Medtronic PLC, Boston Scientific, CONMED Corporation*List Not Exhaustive, Koninklijke Philips NV, Intuitive Surgical Inc, Johnson & Johnson Inc, Stryker Corporation, Olympus Corporation, Zimmer Biomet Holdings Inc.

3. What are the main segments of the Minimally Invasive Surgery Devices Industry?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Higher Acceptance Rate of Minimally Invasive Surgeries Over Traditional Surgeries; Increasing Prevalence of Lifestyle-related and Chronic Disorders; Growing Technological Advancements.

6. What are the notable trends driving market growth?

Endoscopic Devices is Expected to be the Fastest-growing Segment During the Forecast Period.

7. Are there any restraints impacting market growth?

Shortage of Experienced Professionals; Uncertain Regulatory Framework.

8. Can you provide examples of recent developments in the market?

In January 2023, PENTAX Medical obtained CE marks for its PENTAX Medical INSPIRA, the new premium video processor, and the i20c video endoscope series. The new video processor maintains compatibility with PENTAX Medical's recent endoscope models and sets new standards with the new i20c video endoscope generation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Minimally Invasive Surgery Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Minimally Invasive Surgery Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Minimally Invasive Surgery Devices Industry?

To stay informed about further developments, trends, and reports in the Minimally Invasive Surgery Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence