Key Insights

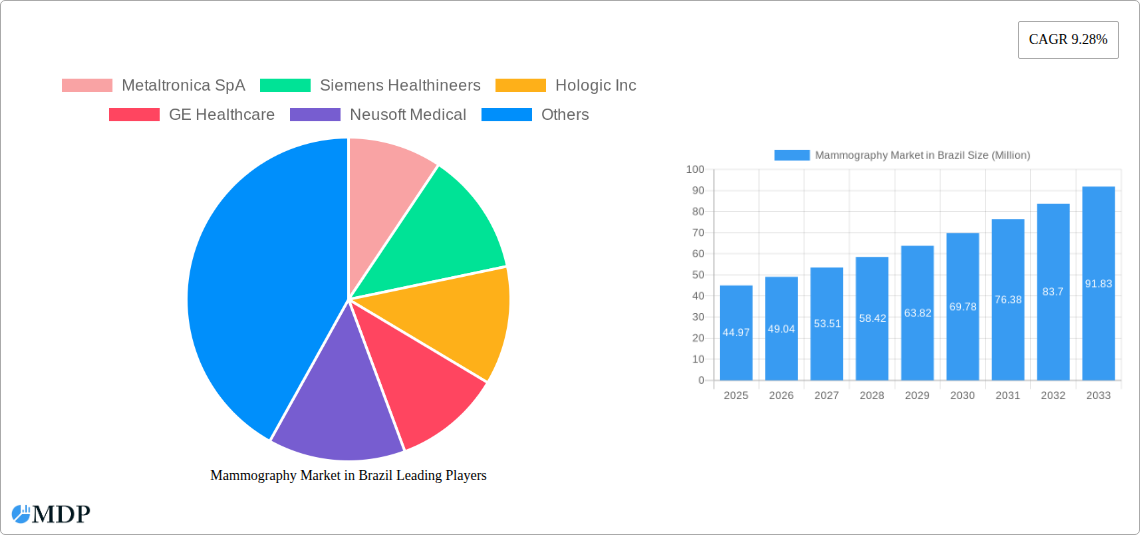

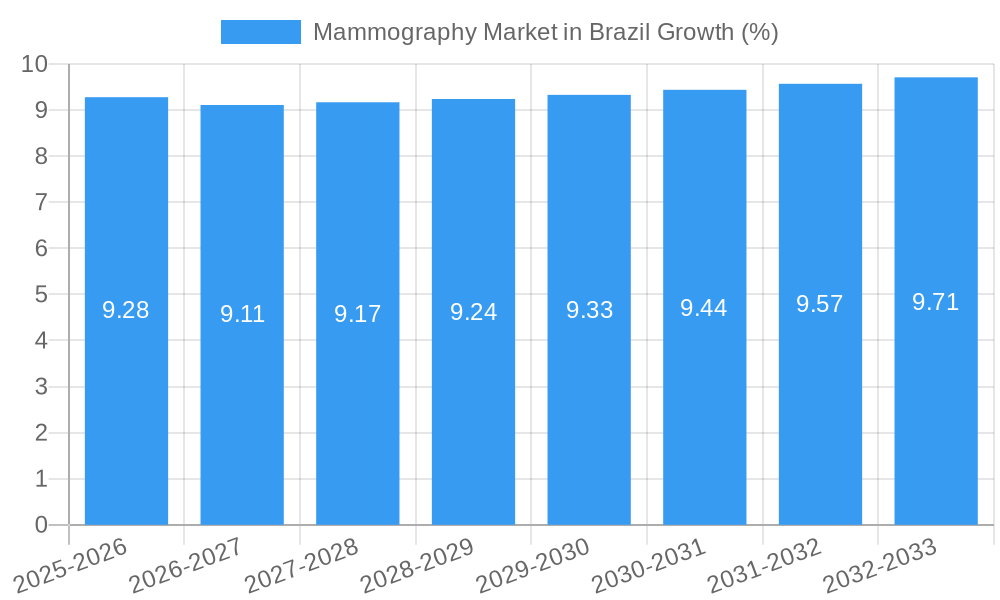

The Brazilian mammography market is poised for significant growth, driven by an increasing focus on early breast cancer detection and the rising prevalence of the disease within the country. With a projected market size of approximately USD 44.97 million, the market is expected to expand at a robust Compound Annual Growth Rate (CAGR) of 9.28% through 2033. This upward trajectory is fueled by factors such as growing government initiatives promoting women's health, increasing healthcare expenditure, and a rising awareness among the population regarding the importance of regular mammographic screenings. Furthermore, technological advancements in mammography systems, including the adoption of digital mammography and the increasing integration of AI-powered diagnostic tools, are enhancing diagnostic accuracy and patient outcomes, thereby stimulating market demand. The demand for advanced digital systems, including those with tomosynthesis capabilities, is anticipated to outpace that of analog systems as healthcare providers increasingly invest in state-of-the-art equipment to improve diagnostic efficiency and patient care.

The market's expansion in Brazil is also influenced by strategic investments in healthcare infrastructure and the growing presence of both domestic and international players. Hospitals and diagnostic centers are at the forefront of adopting these advanced mammography solutions to meet the escalating demand for diagnostic services. While the market benefits from strong growth drivers, it also faces certain restraints, such as the high initial cost of advanced mammography equipment and the need for skilled personnel to operate and interpret the results effectively. However, ongoing efforts to improve healthcare accessibility and affordability, coupled with evolving reimbursement policies, are expected to mitigate these challenges. The strategic focus on preventive healthcare and the increasing emphasis on women's well-being are likely to ensure sustained growth and a positive outlook for the Brazilian mammography market in the coming years.

Unlock the Future of Women's Health: Brazil's Mammography Market Report (2019-2033)

Gain unparalleled insights into the dynamic Brazilian mammography market with this comprehensive, SEO-optimized report. Spanning from 2019 to 2033, with a deep dive into the base year of 2025 and a robust forecast period (2025-2033), this analysis is your definitive guide to understanding market dynamics, industry trends, leading players, and pivotal developments. Strategically crafted with high-traffic keywords like "mammography market Brazil," "digital mammography Brazil," "breast tomosynthesis Brazil," and "medical imaging Brazil," this report is designed to maximize search visibility and attract key industry stakeholders, including manufacturers, healthcare providers, investors, and policymakers.

Explore actionable insights on:

- Market Size & Growth: Understand current market valuations and future growth trajectories.

- Segmentation: Deep dive into product types (Digital Systems, Analog Systems, Breast Tomosynthesis, Other Product Types) and end-users (Hospitals, Specialty Clinics, Diagnostic Centers).

- Competitive Landscape: Identify leading companies and their strategies.

- Technological Advancements: Stay ahead of innovations in AI, digital imaging, and more.

- Regulatory Environment: Navigate ANVISA approvals and other critical policies.

- Future Outlook: Strategize for emerging opportunities and growth acceleration.

Whether you're looking to invest, expand, or innovate, this report provides the data-driven intelligence necessary to make informed decisions and capitalize on the burgeoning Brazilian mammography sector.

Mammography Market in Brazil Market Dynamics & Concentration

The mammography market in Brazil is characterized by a moderate to high level of concentration, with a few dominant players holding significant market share. Innovation drivers are primarily fueled by the increasing adoption of digital mammography technologies, including breast tomosynthesis, and the growing integration of Artificial Intelligence (AI) for enhanced diagnostic accuracy. The regulatory framework, overseen by Brazil's Agência Nacional de Vigilância Sanitária (ANVISA), plays a crucial role in product approvals and market entry, influencing the pace of technological diffusion. While analog systems still hold a presence, the shift towards digital is irreversible, driven by superior imaging capabilities and workflow efficiencies. Product substitutes are limited in the core mammography function, but advancements in other imaging modalities like MRI and ultrasound for breast diagnostics present indirect competition. End-user trends indicate a strong preference for integrated diagnostic centers and hospitals equipped with advanced mammography units, driven by a growing awareness of early breast cancer detection and the rising incidence of breast cancer in the country. Merger and acquisition (M&A) activities have been observed, albeit at a moderate pace, as larger companies seek to consolidate their market position, expand their product portfolios, and gain access to new technologies and customer bases. The market share of leading companies is estimated to be around 70% held by the top five players. M&A deal counts have averaged 2-3 significant transactions annually over the historical period.

Mammography Market in Brazil Industry Trends & Analysis

The mammography market in Brazil is experiencing robust growth, propelled by a confluence of factors that are reshaping the landscape of women's healthcare. The Compound Annual Growth Rate (CAGR) for the Brazilian mammography market is projected to be approximately 7.5% during the forecast period of 2025-2033, indicating a healthy expansion trajectory. This growth is significantly influenced by the increasing adoption of advanced digital mammography systems, including digital breast tomosynthesis (DBT), which offers superior detection rates for challenging breast tissue and reduces recall rates. The rising incidence of breast cancer in Brazil, coupled with heightened public awareness campaigns promoting early screening, is a primary market driver. Government initiatives aimed at improving healthcare infrastructure and expanding access to diagnostic services, particularly in underserved regions, are also contributing to market penetration. Technological disruptions are at the forefront, with the integration of AI in mammography interpretation showing immense promise. AI-powered software can assist radiologists in identifying subtle abnormalities, improving diagnostic speed and accuracy, and ultimately enhancing patient outcomes. Consumer preferences are shifting towards facilities that offer state-of-the-art imaging technology and a comfortable patient experience, driving demand for advanced mammography solutions. Competitive dynamics are intensifying, with global manufacturers vying for market share through product innovation, strategic partnerships, and aggressive marketing strategies. Companies are investing heavily in research and development to introduce next-generation mammography equipment that offers enhanced image quality, reduced radiation exposure, and improved workflow integration. The increasing demand for minimally invasive screening and diagnostic procedures further fuels the adoption of advanced mammography technologies. The market penetration of digital mammography systems has surpassed 85% in major urban centers, with a growing demand from rural and semi-urban areas.

Leading Markets & Segments in Mammography Market in Brazil

Within the Brazilian mammography market, Digital Systems represent the dominant product type segment. This dominance is fueled by a clear technological imperative and the inherent advantages of digital imaging over its analog counterpart. The superior image quality, digital storage and retrieval capabilities, and the ease of image manipulation offered by digital systems make them the preferred choice for modern diagnostic centers and hospitals. Furthermore, the increasing integration of advanced features such as tomosynthesis and AI-powered analysis further solidifies the supremacy of digital solutions.

Breast Tomosynthesis, a subset of digital mammography, is rapidly emerging as a critical growth driver. Its ability to provide three-dimensional images of the breast significantly improves the detection of abnormalities, especially in dense breast tissue, leading to higher cancer detection rates and a reduction in false positives. The growing awareness of tomosynthesis's diagnostic prowess is translating into increased adoption across healthcare facilities in Brazil.

Hospitals emerge as the leading end-user segment in the Brazilian mammography market. This is attributable to their comprehensive healthcare offerings, higher patient volumes, and greater capacity to invest in advanced medical equipment. Hospitals are often equipped with a wider range of diagnostic services, making them central hubs for mammography screenings and follow-up procedures. The increasing focus on women's health within hospital settings further amplifies their demand for sophisticated mammography technologies.

The economic policies in Brazil, such as government subsidies for healthcare infrastructure development and tax incentives for medical equipment imports, play a crucial role in driving the adoption of advanced mammography systems across all segments. Infrastructure development, particularly in expanding access to healthcare facilities in remote and underserved areas, directly influences the market penetration of mammography services. The increasing demand for comprehensive cancer screening programs within specialized women's health clinics also contributes significantly to the market share of segments catering to these specific end-users.

Mammography Market in Brazil Product Developments

Product development in the Brazilian mammography market is heavily focused on enhancing diagnostic accuracy and patient comfort. The integration of Artificial Intelligence (AI) into mammography software is a major trend, exemplified by solutions like CureMetrix Inc.'s cmAssist, which received ANVISA approval in May 2021. AI algorithms aid in detecting subtle abnormalities, reducing interpretation time, and improving overall diagnostic confidence. Furthermore, advancements in detector technology are leading to higher resolution images with reduced radiation doses, making mammography safer and more effective. Companies are also developing more ergonomic and user-friendly mammography machines to improve the patient experience and streamline radiologist workflows. These innovations aim to provide competitive advantages by offering superior clinical outcomes and operational efficiencies, thereby meeting the evolving demands of the Brazilian healthcare sector.

Key Drivers of Mammography Market in Brazil Growth

Several key drivers are propelling the growth of the mammography market in Brazil. Firstly, the rising incidence of breast cancer, coupled with increasing awareness campaigns promoting early detection, is a primary catalyst. Secondly, technological advancements, particularly the widespread adoption of digital mammography and the increasing integration of AI for enhanced diagnostic accuracy, are transforming the market. Thirdly, favorable government initiatives aimed at improving women's healthcare access and infrastructure, including subsidies and programs for diagnostic services, are significantly boosting demand. Finally, the growing preference among healthcare providers and patients for advanced imaging solutions that offer higher diagnostic precision and improved patient comfort is a continuous growth accelerator.

Challenges in the Mammography Market in Brazil Market

Despite the promising growth, the mammography market in Brazil faces several challenges. High upfront costs associated with advanced digital mammography systems and tomosynthesis equipment can be a significant barrier, particularly for smaller clinics and those in less developed regions. Regulatory hurdles and the lengthy approval processes for new medical devices can also slow down market entry and innovation diffusion. Furthermore, ensuring a consistent and accessible supply chain for spare parts and maintenance services across Brazil's vast geography can be complex. Competitive pressures from established global players and the need for continuous investment in training and education for healthcare professionals to effectively utilize new technologies also present ongoing challenges.

Emerging Opportunities in Mammography Market in Brazil

Emerging opportunities in the Brazilian mammography market are primarily driven by technological breakthroughs and strategic market expansion. The continued integration of AI in mammography promises to revolutionize early detection and personalized treatment pathways. Government focus on expanding healthcare access to remote and underserved communities presents a significant opportunity for the deployment of mobile mammography units and digital imaging solutions. Strategic partnerships between technology providers and healthcare institutions can foster greater adoption of advanced technologies and improve screening rates. The growing demand for integrated women's health services also creates opportunities for comprehensive diagnostic solutions that include advanced mammography capabilities.

Leading Players in the Mammography Market in Brazil Sector

- Metaltronica SpA

- Siemens Healthineers

- Hologic Inc

- GE Healthcare

- Neusoft Medical

- Lunit Inc

- Koninklijke Philips NV

- Canon Medical Systems Corporation

- Planmed Oy

- Carestream Health Inc

- Fujifilm Holdings Corporation

Key Milestones in Mammography Market in Brazil Industry

- May 2021: CureMetrix Inc. received approval from Brazil's Agência Nacional de Vigilância Sanitária (ANVISA) for its cmAssist, an artificial intelligence-based software for mammography, enhancing diagnostic capabilities.

- July 2022: The International Atomic Energy Agency installed a mammography machine for women living in Amazon River communities, improving access to essential screening services in remote areas.

Strategic Outlook for Mammography Market in Brazil Market

The strategic outlook for the Brazilian mammography market is highly positive, driven by a sustained demand for advanced diagnostic tools and a growing emphasis on women's health. Key growth accelerators include the continued expansion of digital mammography and tomosynthesis adoption, further penetration of AI-powered diagnostic solutions, and government-led initiatives to enhance healthcare infrastructure, particularly in underserved regions. Strategic partnerships between technology providers, diagnostic centers, and government health agencies will be crucial in overcoming existing barriers and capitalizing on emerging opportunities. The market is poised for significant growth as Brazil continues to prioritize early breast cancer detection and women's well-being.

Mammography Market in Brazil Segmentation

-

1. Product Type

- 1.1. Digital Systems

- 1.2. Analog Systems

- 1.3. Breast Tomosynthesis

- 1.4. Other Product Types

-

2. End User

- 2.1. Hospitals

- 2.2. Specialty Clinics

- 2.3. Diagnostic Centers

Mammography Market in Brazil Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mammography Market in Brazil REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Breast Cancer; Technological Advancements in the Field of Breast Imaging

- 3.3. Market Restrains

- 3.3.1. Risk of Adverse Effects from Radiation Exposure

- 3.4. Market Trends

- 3.4.1. Breast Tomosynthesis is Expected to Witness Healthy Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mammography Market in Brazil Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Digital Systems

- 5.1.2. Analog Systems

- 5.1.3. Breast Tomosynthesis

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals

- 5.2.2. Specialty Clinics

- 5.2.3. Diagnostic Centers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Mammography Market in Brazil Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Digital Systems

- 6.1.2. Analog Systems

- 6.1.3. Breast Tomosynthesis

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals

- 6.2.2. Specialty Clinics

- 6.2.3. Diagnostic Centers

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Mammography Market in Brazil Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Digital Systems

- 7.1.2. Analog Systems

- 7.1.3. Breast Tomosynthesis

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals

- 7.2.2. Specialty Clinics

- 7.2.3. Diagnostic Centers

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Mammography Market in Brazil Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Digital Systems

- 8.1.2. Analog Systems

- 8.1.3. Breast Tomosynthesis

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals

- 8.2.2. Specialty Clinics

- 8.2.3. Diagnostic Centers

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Mammography Market in Brazil Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Digital Systems

- 9.1.2. Analog Systems

- 9.1.3. Breast Tomosynthesis

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals

- 9.2.2. Specialty Clinics

- 9.2.3. Diagnostic Centers

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Mammography Market in Brazil Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Digital Systems

- 10.1.2. Analog Systems

- 10.1.3. Breast Tomosynthesis

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals

- 10.2.2. Specialty Clinics

- 10.2.3. Diagnostic Centers

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Metaltronica SpA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Siemens Healthineers

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hologic Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GE Healthcare

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Neusoft Medical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lunit Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Koninklijke Philips NV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Canon Medical Systems Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Planmed Oy

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Carestream Health Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Fujifilm Holdings Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Metaltronica SpA

List of Figures

- Figure 1: Global Mammography Market in Brazil Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Brazil Mammography Market in Brazil Revenue (Million), by Country 2024 & 2032

- Figure 3: Brazil Mammography Market in Brazil Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Mammography Market in Brazil Revenue (Million), by Product Type 2024 & 2032

- Figure 5: North America Mammography Market in Brazil Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America Mammography Market in Brazil Revenue (Million), by End User 2024 & 2032

- Figure 7: North America Mammography Market in Brazil Revenue Share (%), by End User 2024 & 2032

- Figure 8: North America Mammography Market in Brazil Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Mammography Market in Brazil Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Mammography Market in Brazil Revenue (Million), by Product Type 2024 & 2032

- Figure 11: South America Mammography Market in Brazil Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: South America Mammography Market in Brazil Revenue (Million), by End User 2024 & 2032

- Figure 13: South America Mammography Market in Brazil Revenue Share (%), by End User 2024 & 2032

- Figure 14: South America Mammography Market in Brazil Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Mammography Market in Brazil Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Mammography Market in Brazil Revenue (Million), by Product Type 2024 & 2032

- Figure 17: Europe Mammography Market in Brazil Revenue Share (%), by Product Type 2024 & 2032

- Figure 18: Europe Mammography Market in Brazil Revenue (Million), by End User 2024 & 2032

- Figure 19: Europe Mammography Market in Brazil Revenue Share (%), by End User 2024 & 2032

- Figure 20: Europe Mammography Market in Brazil Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Mammography Market in Brazil Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Mammography Market in Brazil Revenue (Million), by Product Type 2024 & 2032

- Figure 23: Middle East & Africa Mammography Market in Brazil Revenue Share (%), by Product Type 2024 & 2032

- Figure 24: Middle East & Africa Mammography Market in Brazil Revenue (Million), by End User 2024 & 2032

- Figure 25: Middle East & Africa Mammography Market in Brazil Revenue Share (%), by End User 2024 & 2032

- Figure 26: Middle East & Africa Mammography Market in Brazil Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Mammography Market in Brazil Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Mammography Market in Brazil Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Asia Pacific Mammography Market in Brazil Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Asia Pacific Mammography Market in Brazil Revenue (Million), by End User 2024 & 2032

- Figure 31: Asia Pacific Mammography Market in Brazil Revenue Share (%), by End User 2024 & 2032

- Figure 32: Asia Pacific Mammography Market in Brazil Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Mammography Market in Brazil Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mammography Market in Brazil Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Mammography Market in Brazil Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Mammography Market in Brazil Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global Mammography Market in Brazil Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Mammography Market in Brazil Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Mammography Market in Brazil Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Global Mammography Market in Brazil Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Global Mammography Market in Brazil Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Mammography Market in Brazil Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: Global Mammography Market in Brazil Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Global Mammography Market in Brazil Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Mammography Market in Brazil Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Global Mammography Market in Brazil Revenue Million Forecast, by End User 2019 & 2032

- Table 20: Global Mammography Market in Brazil Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Mammography Market in Brazil Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Global Mammography Market in Brazil Revenue Million Forecast, by End User 2019 & 2032

- Table 32: Global Mammography Market in Brazil Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Mammography Market in Brazil Revenue Million Forecast, by Product Type 2019 & 2032

- Table 40: Global Mammography Market in Brazil Revenue Million Forecast, by End User 2019 & 2032

- Table 41: Global Mammography Market in Brazil Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Mammography Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mammography Market in Brazil?

The projected CAGR is approximately 9.28%.

2. Which companies are prominent players in the Mammography Market in Brazil?

Key companies in the market include Metaltronica SpA, Siemens Healthineers, Hologic Inc, GE Healthcare, Neusoft Medical, Lunit Inc, Koninklijke Philips NV, Canon Medical Systems Corporation, Planmed Oy, Carestream Health Inc, Fujifilm Holdings Corporation.

3. What are the main segments of the Mammography Market in Brazil?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 44.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Breast Cancer; Technological Advancements in the Field of Breast Imaging.

6. What are the notable trends driving market growth?

Breast Tomosynthesis is Expected to Witness Healthy Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Risk of Adverse Effects from Radiation Exposure.

8. Can you provide examples of recent developments in the market?

In July 2022, the International Atomic Energy Agency installed a mammography machine for women living in Amazon River communities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mammography Market in Brazil," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mammography Market in Brazil report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mammography Market in Brazil?

To stay informed about further developments, trends, and reports in the Mammography Market in Brazil, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence