Key Insights

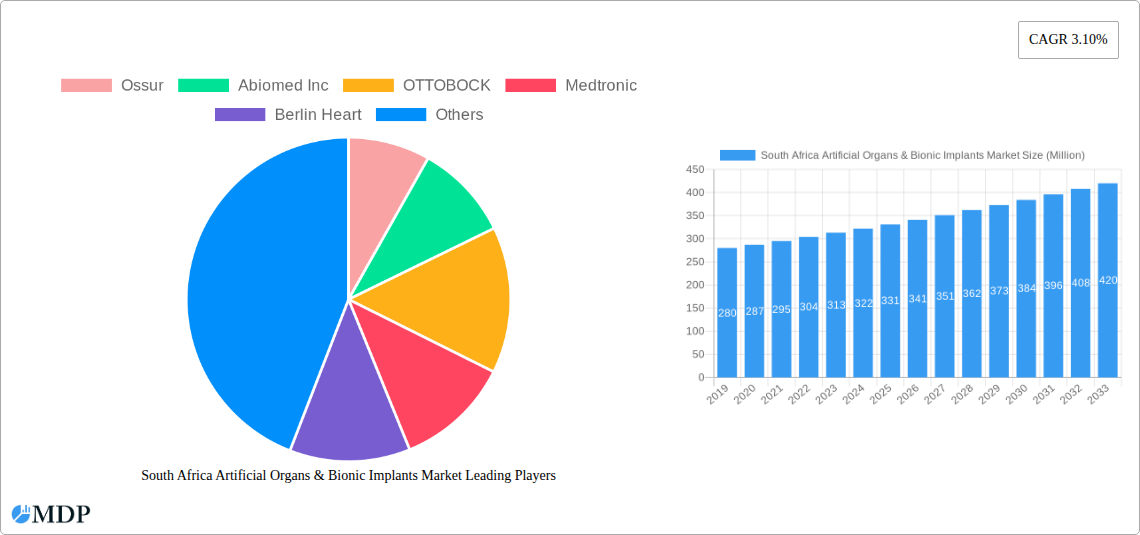

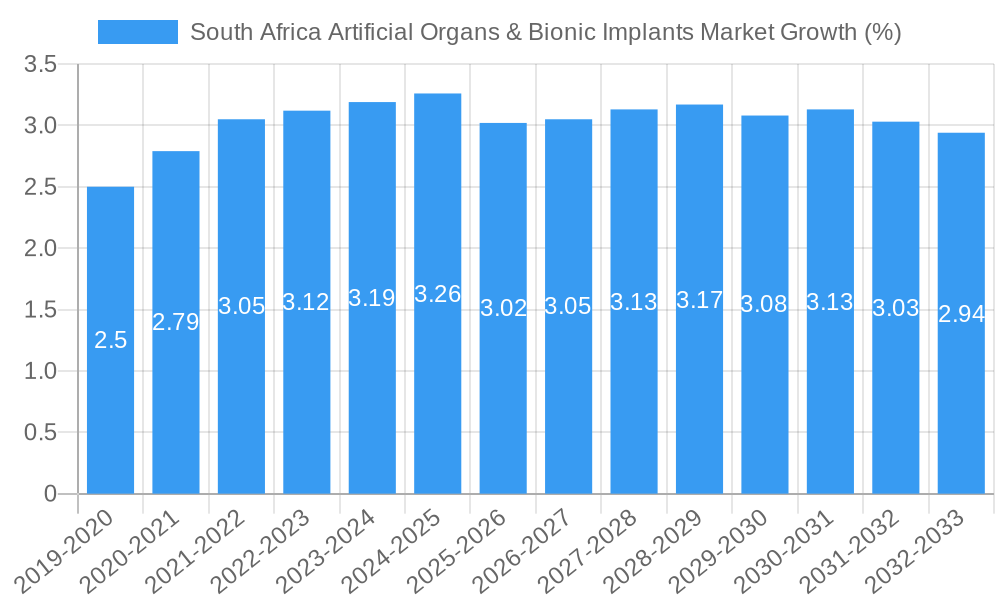

The South African Artificial Organs & Bionic Implants Market is poised for significant expansion, projected to reach a substantial market size of approximately $350 million by 2025. This growth is driven by a confluence of factors, including an aging population, a rising incidence of chronic diseases, and increasing patient awareness and adoption of advanced medical technologies. The market's Compound Annual Growth Rate (CAGR) of 3.10% underscores its steady upward trajectory, indicating a robust demand for solutions that restore or enhance bodily functions. Key market drivers include advancements in biocompatible materials and sophisticated engineering, leading to more effective and durable artificial organs and bionic prosthetics. Furthermore, increased healthcare expenditure, both by government initiatives and private insurance, coupled with a growing emphasis on improving the quality of life for individuals with disabilities or organ failure, are fueling market penetration. The competitive landscape is characterized by a mix of established global players and emerging local innovators, all vying to capture market share through product innovation and strategic partnerships.

The market is segmented into Artificial Organs, encompassing artificial hearts, kidneys, cochlear implants, and other organ types, and Bionics, which includes ear bionics, orthopedic bionics, cardiac bionics, and other bionic categories. Within Artificial Organs, cochlear implants are likely experiencing strong demand due to rising cases of hearing loss, while advancements in artificial kidneys will address the growing burden of renal failure. In the Bionics segment, orthopedic bionics are expected to see significant adoption driven by an increase in sports-related injuries and age-related mobility issues. Restraints such as the high cost of these advanced medical devices and limited accessibility in certain regions within South Africa may temper the growth rate. However, ongoing research and development aimed at cost reduction and improved manufacturing processes, alongside government efforts to expand healthcare access, are expected to mitigate these challenges. The forecast period from 2025 to 2033 anticipates continued innovation and market expansion, solidifying South Africa's position as an important market for artificial organs and bionic implants.

This comprehensive report delves into the dynamic South Africa Artificial Organs & Bionic Implants Market, offering in-depth analysis and actionable insights from 2019 to 2033. Leveraging extensive primary and secondary research, the study provides critical data on market size, segmentation, competitive landscape, and future trends, positioning stakeholders for success in this rapidly evolving sector. With a base year of 2025 and a forecast period extending to 2033, the report highlights key growth drivers, emerging opportunities, and potential challenges within the South African context.

South Africa Artificial Organs & Bionic Implants Market Market Dynamics & Concentration

The South Africa artificial organs and bionic implants market is characterized by a moderate to high concentration, driven by a few dominant global players and a growing number of specialized local and international innovators. The market's trajectory is significantly influenced by advancements in medical technology, a rising prevalence of chronic diseases necessitating organ replacement and functional restoration, and increasing healthcare expenditure. Regulatory frameworks, while evolving to accommodate novel medical devices, play a crucial role in market access and product approval processes, impacting the pace of innovation and adoption. Product substitutes, though limited for complex organ replacements, exist in the form of traditional therapies and less invasive treatments. End-user trends are increasingly focused on minimally invasive procedures, enhanced biocompatibility, and improved long-term patient outcomes. Mergers & Acquisitions (M&A) activities are a significant indicator of market consolidation and strategic expansion, with key players actively seeking to bolster their portfolios and market reach. For instance, in the historical period, there were an estimated 3 major M&A deals, significantly reshaping competitive dynamics and technological integration.

- Market Concentration: Dominated by a few key global players, with growing participation from innovative smaller firms.

- Innovation Drivers: Breakthroughs in biomaterials, robotics, AI, and miniaturization of devices.

- Regulatory Frameworks: National regulatory bodies (e.g., SAHPRA) overseeing device approval, safety, and efficacy.

- Product Substitutes: Traditional medical treatments, rehabilitation therapies, and lifestyle modifications.

- End-User Trends: Demand for personalized solutions, remote monitoring capabilities, and improved quality of life.

- M&A Activities: Strategic acquisitions to expand product portfolios and geographic presence.

South Africa Artificial Organs & Bionic Implants Market Industry Trends & Analysis

The South Africa artificial organs and bionic implants market is poised for substantial growth, driven by an aging population, a higher incidence of lifestyle-related diseases such as diabetes and cardiovascular conditions, and a growing awareness of advanced medical treatment options. Technological advancements are at the forefront, with ongoing research and development in areas like regenerative medicine, 3D printing of organ tissues, and sophisticated bionic limb technology offering enhanced functionality and patient comfort. The market penetration of advanced bionic implants, particularly in orthopedics and audiology, is steadily increasing due to improved affordability and greater accessibility through healthcare financing initiatives. Consumer preferences are shifting towards solutions that offer greater autonomy and a better quality of life, spurring innovation in user-friendly interfaces and long-term device reliability. Competitive dynamics are intensifying, with both established multinational corporations and emerging local companies vying for market share through product differentiation, strategic partnerships, and aggressive marketing strategies. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated to be around 8.5%, reflecting robust market expansion. The increasing adoption of cochlear implants and orthopedic bionic devices is a significant trend, supported by government health programs and private sector investments aimed at improving audiological and mobility outcomes for a larger segment of the population. Furthermore, the development of artificial kidneys and artificial hearts, while still nascent in widespread application, represents a significant future growth avenue as technological maturity and cost-effectiveness improve. The market's expansion is also fueled by a growing number of skilled medical professionals capable of implanting and managing these advanced devices.

Leading Markets & Segments in South Africa Artificial Organs & Bionic Implants Market

The South Africa Artificial Organs & Bionic Implants Market is segmented into two primary categories: Artificial Organs and Bionics, each with distinct sub-segments exhibiting varying growth trajectories and market penetration. Within the Artificial Organs segment, Cochlear Implants currently represent a leading market, driven by the high prevalence of hearing loss, coupled with effective awareness campaigns and supportive reimbursement policies for children and adults. The market for Artificial Kidneys is also experiencing a steady rise, fueled by the increasing incidence of end-stage renal disease and the ongoing quest for more efficient and less burdensome dialysis alternatives. While Artificial Hearts and Other Organ Types are still in developmental stages or catering to niche patient populations, they hold significant future potential as technological advancements mature.

In the Bionics segment, Orthopedic Bionic devices, including advanced prosthetic limbs and exoskeletons, are experiencing substantial growth. This is attributed to a greater demand from amputees, individuals with mobility impairments due to neurological conditions, and a rising interest in wearable robotic assistance for rehabilitation and daily living. Ear Bionics, closely linked to cochlear implants, are integral to addressing hearing restoration needs. Cardiac Bionics, encompassing advanced pacemakers and ventricular assist devices, also form a crucial part of the market, supporting patients with severe heart conditions. The demand for these advanced medical solutions is influenced by several key drivers:

- Economic Policies: Government initiatives promoting healthcare access and medical device adoption.

- Infrastructure: Development of specialized medical centers and rehabilitation facilities equipped for advanced implants.

- Technological Advancements: Continuous innovation in device functionality, biocompatibility, and power management.

- Healthcare Expenditure: Increasing allocation of public and private funds towards advanced medical treatments.

- Demographic Trends: A growing elderly population with age-related health issues, and a young population benefiting from early intervention for congenital conditions.

The dominance of specific segments is also shaped by the availability of specialized surgical expertise and post-operative care infrastructure within South Africa, further solidifying the market position of established bionic and artificial organ types.

South Africa Artificial Organs & Bionic Implants Market Product Developments

The South Africa artificial organs and bionic implants market is witnessing a surge in product innovations aimed at enhancing patient outcomes and expanding therapeutic applications. Key developments include the miniaturization of devices for less invasive implantation, the integration of AI and machine learning for personalized device functionality and improved control in bionic limbs, and advancements in biocompatible materials to reduce rejection rates and increase longevity. Companies are focusing on developing smart implants with remote monitoring capabilities, allowing healthcare providers to track patient progress and device performance in real-time. The development of next-generation cochlear implants with superior sound processing and directional microphones, alongside advanced prosthetic limbs offering greater dexterity and sensory feedback, are key areas of focus. These product advancements are driven by the pursuit of greater patient autonomy, improved quality of life, and reduced long-term healthcare burdens.

Key Drivers of South Africa Artificial Organs & Bionic Implants Market Growth

The South Africa artificial organs and bionic implants market is propelled by a confluence of significant drivers. Increasing healthcare expenditure and government initiatives aimed at improving access to advanced medical treatments for a wider population are crucial. The rising prevalence of chronic diseases, such as cardiovascular conditions and diabetes, directly fuels the demand for artificial organs and bionic solutions. Technological advancements in biomaterials, robotics, and artificial intelligence are continuously enabling the development of more sophisticated, functional, and biocompatible devices. Furthermore, a growing awareness among the populace regarding the benefits of these life-changing technologies, coupled with an increasing pool of skilled medical professionals trained in implantology and advanced prosthetics, are vital contributors to market expansion.

Challenges in the South Africa Artificial Organs & Bionic Implants Market Market

Despite its growth potential, the South Africa artificial organs and bionic implants market faces several significant challenges. The high cost of these advanced medical devices remains a primary barrier, limiting accessibility for a substantial portion of the population, particularly in lower-income segments. Stringent regulatory approval processes, while essential for patient safety, can also lead to delays in market entry for new technologies. Limited availability of specialized medical professionals trained in the implantation and management of complex devices in certain regions of the country poses another hurdle. Furthermore, inadequate healthcare infrastructure in remote areas and challenges in establishing robust post-operative care and rehabilitation services can impede wider adoption and successful patient outcomes. Supply chain disruptions and logistical complexities in sourcing specialized components can also impact market growth.

Emerging Opportunities in South Africa Artificial Organs & Bionic Implants Market

The South Africa artificial organs and bionic implants market presents compelling emerging opportunities for growth and innovation. The increasing focus on preventive healthcare and early diagnosis creates a fertile ground for proactive intervention with bionic solutions, particularly in audiology and mobility. Strategic partnerships between technology providers, healthcare institutions, and government bodies can accelerate the adoption of these technologies by addressing affordability and accessibility concerns. Furthermore, the development of more affordable and user-friendly bionic devices tailored to the specific needs and economic realities of the South African market holds immense potential. Investment in localized manufacturing and research & development for artificial organs and bionic implants can foster innovation and create a more sustainable ecosystem. The expanding market for rehabilitation and assistive technologies, driven by an aging population and the ongoing need for functional restoration post-injury or illness, represents a significant long-term growth avenue.

Leading Players in the South Africa Artificial Organs & Bionic Implants Market Sector

- Ossur

- Abiomed Inc

- OTTOBOCK

- Medtronic

- Berlin Heart

- Ekso Bionics

- Abbott

- Sonova (Advanced Bionics AG)

- Cochlear Ltd

- Zimmer Biomet

Key Milestones in South Africa Artificial Organs & Bionic Implants Market Industry

- May 2022: Medtronic PLC acquired Intersect ENT, increasing the company's comprehensive ENT portfolio with cutting-edge technologies used in sinus surgeries to enhance post-operative results and cure nasal polyps.

- April 2022: Cochlear Limited agreed to acquire Oticon Medical following Demant's decision to exit its hearing implant business activities. As part of the transaction, Cochlear committed to providing ongoing support for Oticon Medical's base of more than 75,000 hearing implant recipients, which includes cochlear and acoustic implants.

Strategic Outlook for South Africa Artificial Organs & Bionic Implants Market Market

- May 2022: Medtronic PLC acquired Intersect ENT, increasing the company's comprehensive ENT portfolio with cutting-edge technologies used in sinus surgeries to enhance post-operative results and cure nasal polyps.

- April 2022: Cochlear Limited agreed to acquire Oticon Medical following Demant's decision to exit its hearing implant business activities. As part of the transaction, Cochlear committed to providing ongoing support for Oticon Medical's base of more than 75,000 hearing implant recipients, which includes cochlear and acoustic implants.

Strategic Outlook for South Africa Artificial Organs & Bionic Implants Market Market

The strategic outlook for the South Africa artificial organs and bionic implants market is highly positive, driven by sustained technological advancements and increasing healthcare investments. Key growth accelerators will include the expansion of public-private partnerships to enhance affordability and accessibility of advanced medical devices, coupled with a focus on localized manufacturing to reduce import costs and improve supply chain resilience. Continued investment in research and development for next-generation artificial organs and bionic implants, with an emphasis on AI integration and improved patient-centric design, will be critical. Furthermore, the development of comprehensive training programs for healthcare professionals will ensure the efficient and effective deployment of these sophisticated technologies. Strategic market penetration into underserved regions and the introduction of tiered pricing models will also be crucial for unlocking the full market potential.

South Africa Artificial Organs & Bionic Implants Market Segmentation

-

1. Type

-

1.1. Artificial Organ

- 1.1.1. Artificial Heart

- 1.1.2. Artificial Kidney

- 1.1.3. Cochlear Implants

- 1.1.4. Other Organ Types

-

1.2. Bionics

- 1.2.1. Ear Bionics

- 1.2.2. Orthopedic Bionic

- 1.2.3. Cardiac Bionics

- 1.2.4. Other Bionics

-

1.1. Artificial Organ

South Africa Artificial Organs & Bionic Implants Market Segmentation By Geography

- 1. South Africa

South Africa Artificial Organs & Bionic Implants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased Incidence of Disabilities

- 3.2.2 Organ Failures

- 3.2.3 and Scarcity of Donor Organs; Technological Advancements in Artificial Organs and Bionics

- 3.3. Market Restrains

- 3.3.1. Expensive Procedures; Risk of Compatibility Issues and Malfunctions

- 3.4. Market Trends

- 3.4.1. Artificial Kidney Segment Expected to Garner a Large Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Artificial Organ

- 5.1.1.1. Artificial Heart

- 5.1.1.2. Artificial Kidney

- 5.1.1.3. Cochlear Implants

- 5.1.1.4. Other Organ Types

- 5.1.2. Bionics

- 5.1.2.1. Ear Bionics

- 5.1.2.2. Orthopedic Bionic

- 5.1.2.3. Cardiac Bionics

- 5.1.2.4. Other Bionics

- 5.1.1. Artificial Organ

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ossur

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Abiomed Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 OTTOBOCK

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Medtronic

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Berlin Heart

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ekso Bionics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Abbott

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sonova (Advanced Bionics AG)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cochlear Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zimmer Biomet

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ossur

List of Figures

- Figure 1: South Africa Artificial Organs & Bionic Implants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Artificial Organs & Bionic Implants Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Artificial Organs & Bionic Implants Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: South Africa Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: South Africa Artificial Organs & Bionic Implants Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: South Africa Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South Africa Artificial Organs & Bionic Implants Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: South Africa Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: South Africa Artificial Organs & Bionic Implants Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: South Africa Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: South Africa Artificial Organs & Bionic Implants Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 11: South Africa Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: South Africa Artificial Organs & Bionic Implants Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Artificial Organs & Bionic Implants Market?

The projected CAGR is approximately 3.10%.

2. Which companies are prominent players in the South Africa Artificial Organs & Bionic Implants Market?

Key companies in the market include Ossur, Abiomed Inc, OTTOBOCK, Medtronic, Berlin Heart, Ekso Bionics, Abbott, Sonova (Advanced Bionics AG), Cochlear Ltd, Zimmer Biomet.

3. What are the main segments of the South Africa Artificial Organs & Bionic Implants Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Incidence of Disabilities. Organ Failures. and Scarcity of Donor Organs; Technological Advancements in Artificial Organs and Bionics.

6. What are the notable trends driving market growth?

Artificial Kidney Segment Expected to Garner a Large Share of the Market.

7. Are there any restraints impacting market growth?

Expensive Procedures; Risk of Compatibility Issues and Malfunctions.

8. Can you provide examples of recent developments in the market?

May 2022: Medtronic PLC acquired Intersect ENT, increasing the company's comprehensive ENT portfolio with cutting-edge technologies used in sinus surgeries to enhance post-operative results and cure nasal polyps.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Artificial Organs & Bionic Implants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Artificial Organs & Bionic Implants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Artificial Organs & Bionic Implants Market?

To stay informed about further developments, trends, and reports in the South Africa Artificial Organs & Bionic Implants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence