Key Insights

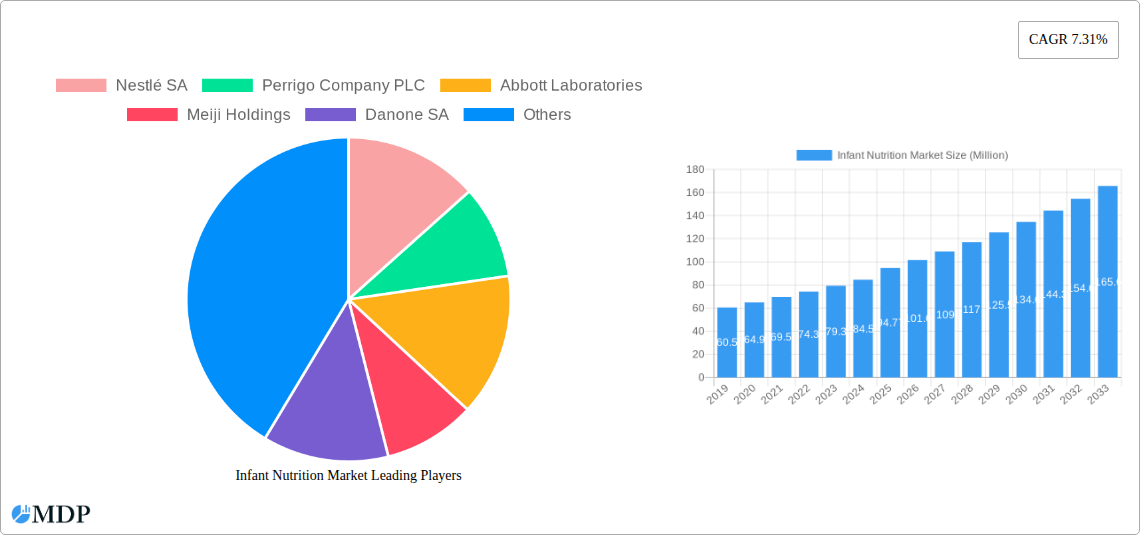

The global Infant Nutrition Market is poised for significant expansion, projected to reach approximately $94.77 million by 2025 and exhibit a robust Compound Annual Growth Rate (CAGR) of 7.31% during the forecast period of 2025-2033. This growth trajectory is underpinned by a confluence of escalating global birth rates, increasing parental awareness regarding the critical role of early nutrition in child development, and a rising disposable income in emerging economies, enabling greater access to premium infant nutrition products. The market is segmented into Infant Formula and Baby Food. Within Infant Formula, First Infant Formula and Follow-on Formula are expected to dominate due to their foundational importance in early childhood. The Specialty Baby Formula segment, catering to specific dietary needs and allergies, is also anticipated to witness substantial growth, driven by advancements in product innovation and a demand for tailored nutritional solutions. The Baby Food segment, encompassing Prepared Food, Dried Food, and Other Baby Foods, will also see steady progress as busy parents seek convenient and nutritious options. Key market drivers include a growing preference for organic and natural ingredients, advancements in product formulations mimicking breast milk, and a burgeoning e-commerce channel facilitating wider product availability.

Infant Nutrition Market Market Size (In Million)

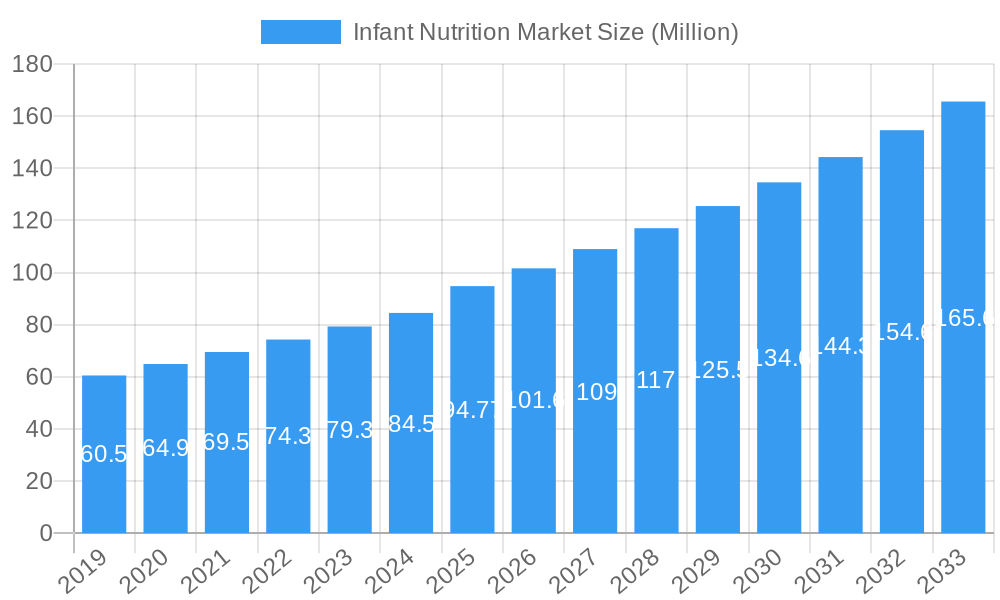

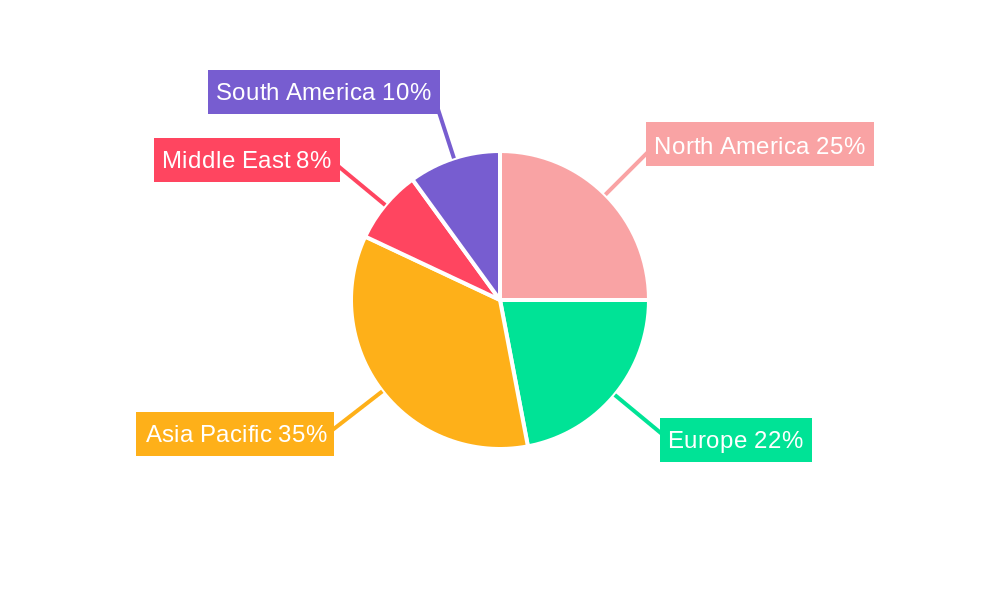

Geographically, the Asia Pacific region is emerging as a powerhouse, driven by the sheer volume of births in countries like China and India, coupled with a rapidly expanding middle class that can afford higher-quality infant nutrition. North America and Europe, while mature markets, continue to be significant contributors, characterized by a strong demand for premium and specialized products. The Middle East and South America present substantial growth opportunities, fueled by improving healthcare infrastructure and increasing parental spending on infant well-being. Major players such as Nestlé SA, Danone SA, and Abbott Laboratories are at the forefront of this market, actively investing in research and development, strategic partnerships, and market expansion to capture a larger share. While the market benefits from strong demand and innovation, potential restraints include stringent regulatory frameworks governing infant food products and fluctuating raw material prices, which could impact manufacturing costs and product pricing. The continued focus on health and safety standards will remain paramount for all stakeholders.

Infant Nutrition Market Company Market Share

This comprehensive Infant Nutrition Market report offers an in-depth analysis of the global market, spanning from 2019 to 2033. With 2025 as the base and estimated year, and a robust forecast period from 2025 to 2033, this study provides critical insights into the dynamics, trends, and future trajectory of this vital industry. Leveraging high-traffic keywords such as "infant formula market," "baby food market," "nutritional products for babies," and "pediatric nutrition," this report is meticulously crafted to maximize search visibility and attract key industry stakeholders. We explore market concentration, innovation drivers, evolving consumer preferences, and the strategic landscape shaped by leading players like Nestlé SA, Abbott Laboratories, and Danone SA. Discover actionable strategies and capitalize on emerging opportunities in the rapidly expanding global infant nutrition market.

Infant Nutrition Market Market Dynamics & Concentration

The global Infant Nutrition Market is characterized by a moderate to high concentration, with a few major players holding significant market share, estimated to be around 60% for the top 5 companies. Nestlé SA, Abbott Laboratories, and Danone SA collectively dominate a substantial portion of the infant formula market. Innovation remains a primary driver, with continuous research and development focused on mimicking breast milk composition and developing specialized formulas for allergies and specific dietary needs. Regulatory frameworks, such as those established by the FDA and EFSA, play a crucial role in ensuring product safety and quality, influencing market entry and product development strategies. Product substitutes, primarily homemade baby food, present a competitive challenge, though convenience and perceived nutritional completeness often favor commercially produced options. End-user trends reveal a growing demand for organic, non-GMO, and plant-based infant nutrition products, driven by increasingly health-conscious parents. Mergers and acquisitions (M&A) activities are a key aspect of market dynamics, with an estimated 8-12 significant M&A deals annually over the historical period, aimed at expanding product portfolios and geographical reach. Key M&A transactions have included acquisitions of smaller specialized brands to gain access to niche markets and innovative technologies. The competitive landscape is dynamic, with ongoing efforts by established players and emerging companies to capture market share through product differentiation and strategic partnerships.

Infant Nutrition Market Industry Trends & Analysis

The infant nutrition market is projected to witness substantial growth, driven by a confluence of factors including increasing global birth rates, a rising disposable income, and a growing awareness among parents regarding the crucial role of early nutrition in a child's development. The Compound Annual Growth Rate (CAGR) for the overall market is estimated at a healthy XX%, with specific segments experiencing even higher growth. Technological disruptions are significantly shaping the industry. Advancements in food processing, fortification technologies, and the development of novel ingredients inspired by breast milk are leading to the creation of more sophisticated and beneficial infant nutrition products. For instance, the inclusion of prebiotics, probiotics, and specific fatty acids like DHA and ARA is becoming standard practice, enhancing cognitive and immune development. Consumer preferences are evolving at a rapid pace. Parents are increasingly seeking out "clean label" products, with a preference for organic, natural, and allergen-free options. This has spurred the growth of specialty baby foods and formulas catering to specific dietary requirements. The competitive dynamics within the baby food market are intense, with both multinational corporations and smaller, niche brands vying for consumer attention. Market penetration for premium and specialized infant nutrition products is on the rise, particularly in developed economies, reflecting a willingness among consumers to invest in what they perceive as the best for their babies. The market penetration for specialized baby formula, for example, is estimated to be around XX% globally, with higher figures in regions like North America and Europe. The shift towards e-commerce platforms has also transformed distribution channels, offering greater accessibility and convenience for consumers to purchase infant nutrition products online. This digital transformation is a significant trend impacting sales volumes and market reach across the baby nutrition sector.

Leading Markets & Segments in Infant Nutrition Market

The infant nutrition market is experiencing significant dominance from the Infant Formula segment, which is projected to hold a substantial market share of approximately XX% of the total market value by 2025. Within the Infant Formula segment, First Infant Formula accounts for the largest share, driven by the fundamental need for complete nutrition from birth. Following-on Formula and Growing-up Formula are also experiencing robust growth as parents continue nutritional support beyond the initial months. The Specialty Baby Formula sub-segment, though smaller, is demonstrating the fastest growth rate, fueled by an increasing incidence of infant allergies and digestive issues. The Baby Food segment, encompassing Prepared Food, Dried Food, and Other Baby Foods, also represents a significant portion of the market, catering to the diverse weaning needs of infants.

- Dominant Region: Asia Pacific is the leading regional market for infant nutrition, driven by a large and growing infant population, increasing urbanization, and a rising middle class with greater purchasing power. Countries like China and India are key contributors to this dominance.

- Key Drivers of Dominance in Asia Pacific:

- High Birth Rates: Sustained high birth rates in many Asian countries provide a consistent consumer base for infant nutrition products.

- Economic Growth and Rising Disposable Income: Economic development has led to increased affordability and a greater willingness among parents to invest in branded infant nutrition.

- Government Initiatives and Awareness Campaigns: Growing awareness about infant health and the importance of proper nutrition, often supported by government programs.

- Rapid Urbanization: Urban populations tend to have higher adoption rates for commercially produced infant nutrition due to convenience and perceived nutritional superiority.

- Expanding Retail Infrastructure: The growth of modern retail channels, including supermarkets and hypermarkets, enhances product accessibility.

- Dominant Country: China stands out as the largest single market within the infant nutrition sector globally, attributed to its massive population and strong consumer demand for high-quality infant products.

- Segmental Dominance Analysis:

- Infant Formula Dominance: The inherent biological need for complete nutrition in the first year of life makes infant formula a foundational product. The increasing sophistication of formula, including the incorporation of advanced ingredients, further bolsters its market position.

- Growth of Specialty Formulas: The rising diagnosis of food allergies and intolerances in infants is a significant catalyst for the growth of specialty baby formulas, offering tailored solutions for specific health concerns.

- Prepared Baby Foods: The convenience of ready-to-eat prepared baby foods is a major factor driving their market share, especially among working parents seeking time-saving solutions.

Infant Nutrition Market Product Developments

Product development in the infant nutrition market is characterized by a relentless pursuit of innovation to closely mimic breast milk and address specific infant needs. Key advancements include the incorporation of novel ingredients such as human milk oligosaccharides (HMOs) to support gut health and immunity, and the refinement of lipid profiles to enhance cognitive development. Companies are also focusing on creating "clean label" products, free from artificial additives and preservatives, and offering organic and plant-based alternatives. These innovations aim to provide competitive advantages by catering to evolving consumer preferences for natural and health-promoting products, thereby solidifying market fit and consumer trust in the baby food and formula sector.

Key Drivers of Infant Nutrition Market Growth

Several key factors are propelling the growth of the infant nutrition market. The increasing global birth rate, particularly in emerging economies, provides a consistently large consumer base. A significant driver is the rising disposable income and the growing awareness among parents regarding the critical importance of optimal early nutrition for a child's long-term health and development. Technological advancements in research and development, allowing for the creation of formulas that more closely replicate the complex composition of breast milk, are also crucial. Furthermore, the expanding retail infrastructure, including the proliferation of e-commerce platforms, enhances product accessibility for consumers worldwide, driving market penetration for infant nutrition products. The increasing demand for organic and natural infant food options is also a significant growth catalyst.

Challenges in the Infant Nutrition Market Market

Despite its robust growth, the infant nutrition market faces several challenges. Stringent regulatory frameworks surrounding product safety, labeling, and marketing can create significant hurdles for new entrants and necessitate substantial investment in compliance. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of raw materials. Intense competition from established global brands and a growing number of niche players puts pressure on pricing and market share. Furthermore, the persistent debate and societal pressure surrounding breastfeeding versus formula feeding can influence consumer choices and brand perception, requiring companies to navigate sensitive marketing landscapes. The cost of premium and specialized infant nutrition products can also be a barrier for some consumers in price-sensitive markets.

Emerging Opportunities in Infant Nutrition Market

Emerging opportunities in the infant nutrition market are primarily driven by ongoing scientific research and evolving consumer demands. The development of personalized infant nutrition solutions, tailored to individual genetic predispositions or specific health needs, presents a significant long-term growth avenue. Strategic partnerships between infant nutrition companies and healthcare providers or research institutions can accelerate innovation and build trust. Market expansion into underserved regions, coupled with localized product offerings that cater to specific cultural preferences and dietary habits, offers substantial untapped potential. Furthermore, the growing interest in plant-based and sustainable infant nutrition products opens new avenues for product diversification and market differentiation. The digitalization of sales and marketing channels provides opportunities for direct consumer engagement and personalized product offerings.

Leading Players in the Infant Nutrition Market Sector

- Nestlé SA

- Perrigo Company PLC

- Abbott Laboratories

- Meiji Holdings

- Danone SA

- Baby Gourmet Foods Inc

- The Kraft Heinz Company

- Parent's Choice Infant Formula

- Royal FrieslandCampina NV

- Reckitt Benckiser (Mead Johnson)

- Dana Dairy Group Ltd

- Bellamy's Australia Limited

- Synutra International Inc

Key Milestones in Infant Nutrition Market Industry

- September 2022: Else Nutrition Holdings Inc. launched its flagship Chinese store on Tmall Global, initiating direct sales of Else Nutrition Toddler Formula and Baby Cereal products to Chinese consumers, marking its third international market entry.

- September 2022: Nestlé identified a novel nutrient blend of components found in breast milk, myelin, and subsequently launched Nutrilearn Connect, an infant formula containing this ingredient, first in Hong Kong before planning wider market expansion.

Strategic Outlook for Infant Nutrition Market Market

The strategic outlook for the infant nutrition market is highly promising, fueled by a combination of demographic trends and continuous innovation. The increasing focus on premiumization, offering specialized and organic options, will continue to drive revenue growth. Companies that invest in robust R&D to develop next-generation formulas, mimicking breast milk even more closely and addressing specific health concerns, will gain a significant competitive edge. Strategic expansion into emerging markets, coupled with localized product development and effective digital marketing strategies, will be crucial for capturing new consumer bases. Building strong brand loyalty through transparency, product efficacy, and engagement with parents will be key to long-term success in this dynamic and vital sector.

Infant Nutrition Market Segmentation

-

1. Product

-

1.1. Infant Formula

- 1.1.1. First Infant Formula

- 1.1.2. Follow-on Formula

- 1.1.3. Growing-up Formula

- 1.1.4. Specialty Baby Formula

-

1.2. Baby Food

- 1.2.1. Prepared Food

- 1.2.2. Dried Food

- 1.2.3. Other Baby Foods

-

1.1. Infant Formula

Infant Nutrition Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Middle East

-

5. GCC

- 5.1. South Africa

- 5.2. Rest of Middle East

-

6. South America

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Rest of South America

Infant Nutrition Market Regional Market Share

Geographic Coverage of Infant Nutrition Market

Infant Nutrition Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Working Mother Population; Higher Spending on Infant Health; Rising Demand for Organic Baby Food

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding Food Safety; Stringent Regulations for Infant Food

- 3.4. Market Trends

- 3.4.1. This section covers the major market trends shaping the Baby Nutrition Market according to our research experts

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Infant Nutrition Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Infant Formula

- 5.1.1.1. First Infant Formula

- 5.1.1.2. Follow-on Formula

- 5.1.1.3. Growing-up Formula

- 5.1.1.4. Specialty Baby Formula

- 5.1.2. Baby Food

- 5.1.2.1. Prepared Food

- 5.1.2.2. Dried Food

- 5.1.2.3. Other Baby Foods

- 5.1.1. Infant Formula

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East

- 5.2.5. GCC

- 5.2.6. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Infant Nutrition Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Infant Formula

- 6.1.1.1. First Infant Formula

- 6.1.1.2. Follow-on Formula

- 6.1.1.3. Growing-up Formula

- 6.1.1.4. Specialty Baby Formula

- 6.1.2. Baby Food

- 6.1.2.1. Prepared Food

- 6.1.2.2. Dried Food

- 6.1.2.3. Other Baby Foods

- 6.1.1. Infant Formula

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Infant Nutrition Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Infant Formula

- 7.1.1.1. First Infant Formula

- 7.1.1.2. Follow-on Formula

- 7.1.1.3. Growing-up Formula

- 7.1.1.4. Specialty Baby Formula

- 7.1.2. Baby Food

- 7.1.2.1. Prepared Food

- 7.1.2.2. Dried Food

- 7.1.2.3. Other Baby Foods

- 7.1.1. Infant Formula

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Infant Nutrition Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Infant Formula

- 8.1.1.1. First Infant Formula

- 8.1.1.2. Follow-on Formula

- 8.1.1.3. Growing-up Formula

- 8.1.1.4. Specialty Baby Formula

- 8.1.2. Baby Food

- 8.1.2.1. Prepared Food

- 8.1.2.2. Dried Food

- 8.1.2.3. Other Baby Foods

- 8.1.1. Infant Formula

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East Infant Nutrition Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Infant Formula

- 9.1.1.1. First Infant Formula

- 9.1.1.2. Follow-on Formula

- 9.1.1.3. Growing-up Formula

- 9.1.1.4. Specialty Baby Formula

- 9.1.2. Baby Food

- 9.1.2.1. Prepared Food

- 9.1.2.2. Dried Food

- 9.1.2.3. Other Baby Foods

- 9.1.1. Infant Formula

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. GCC Infant Nutrition Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Infant Formula

- 10.1.1.1. First Infant Formula

- 10.1.1.2. Follow-on Formula

- 10.1.1.3. Growing-up Formula

- 10.1.1.4. Specialty Baby Formula

- 10.1.2. Baby Food

- 10.1.2.1. Prepared Food

- 10.1.2.2. Dried Food

- 10.1.2.3. Other Baby Foods

- 10.1.1. Infant Formula

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. South America Infant Nutrition Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Infant Formula

- 11.1.1.1. First Infant Formula

- 11.1.1.2. Follow-on Formula

- 11.1.1.3. Growing-up Formula

- 11.1.1.4. Specialty Baby Formula

- 11.1.2. Baby Food

- 11.1.2.1. Prepared Food

- 11.1.2.2. Dried Food

- 11.1.2.3. Other Baby Foods

- 11.1.1. Infant Formula

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Nestlé SA

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Perrigo Company PLC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Abbott Laboratories

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Meiji Holdings

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Danone SA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Baby Gourmet Foods Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 The Kraft Heinz Company

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Parent's Choice Infant Formula

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Royal FrieslandCampina NV

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Reckitt Benckiser (Mead Johnson)

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Dana Dairy Group Ltd*List Not Exhaustive

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Bellamy's Australia Limited

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Synutra International Inc

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Nestlé SA

List of Figures

- Figure 1: Global Infant Nutrition Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Infant Nutrition Market Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Infant Nutrition Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Infant Nutrition Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Infant Nutrition Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Infant Nutrition Market Revenue (Million), by Product 2025 & 2033

- Figure 7: Europe Infant Nutrition Market Revenue Share (%), by Product 2025 & 2033

- Figure 8: Europe Infant Nutrition Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Infant Nutrition Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Infant Nutrition Market Revenue (Million), by Product 2025 & 2033

- Figure 11: Asia Pacific Infant Nutrition Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: Asia Pacific Infant Nutrition Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Infant Nutrition Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East Infant Nutrition Market Revenue (Million), by Product 2025 & 2033

- Figure 15: Middle East Infant Nutrition Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Middle East Infant Nutrition Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East Infant Nutrition Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: GCC Infant Nutrition Market Revenue (Million), by Product 2025 & 2033

- Figure 19: GCC Infant Nutrition Market Revenue Share (%), by Product 2025 & 2033

- Figure 20: GCC Infant Nutrition Market Revenue (Million), by Country 2025 & 2033

- Figure 21: GCC Infant Nutrition Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: South America Infant Nutrition Market Revenue (Million), by Product 2025 & 2033

- Figure 23: South America Infant Nutrition Market Revenue Share (%), by Product 2025 & 2033

- Figure 24: South America Infant Nutrition Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Infant Nutrition Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Infant Nutrition Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Infant Nutrition Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Infant Nutrition Market Revenue Million Forecast, by Product 2020 & 2033

- Table 4: Global Infant Nutrition Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Infant Nutrition Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Infant Nutrition Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Infant Nutrition Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Infant Nutrition Market Revenue Million Forecast, by Product 2020 & 2033

- Table 9: Global Infant Nutrition Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Infant Nutrition Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Infant Nutrition Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: France Infant Nutrition Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Italy Infant Nutrition Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Spain Infant Nutrition Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Infant Nutrition Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Infant Nutrition Market Revenue Million Forecast, by Product 2020 & 2033

- Table 17: Global Infant Nutrition Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Infant Nutrition Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Japan Infant Nutrition Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Infant Nutrition Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Australia Infant Nutrition Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Infant Nutrition Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Infant Nutrition Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Infant Nutrition Market Revenue Million Forecast, by Product 2020 & 2033

- Table 25: Global Infant Nutrition Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Infant Nutrition Market Revenue Million Forecast, by Product 2020 & 2033

- Table 27: Global Infant Nutrition Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: South Africa Infant Nutrition Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Middle East Infant Nutrition Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Infant Nutrition Market Revenue Million Forecast, by Product 2020 & 2033

- Table 31: Global Infant Nutrition Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Infant Nutrition Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Infant Nutrition Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Infant Nutrition Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Infant Nutrition Market?

The projected CAGR is approximately 7.31%.

2. Which companies are prominent players in the Infant Nutrition Market?

Key companies in the market include Nestlé SA, Perrigo Company PLC, Abbott Laboratories, Meiji Holdings, Danone SA, Baby Gourmet Foods Inc, The Kraft Heinz Company, Parent's Choice Infant Formula, Royal FrieslandCampina NV, Reckitt Benckiser (Mead Johnson), Dana Dairy Group Ltd*List Not Exhaustive, Bellamy's Australia Limited, Synutra International Inc.

3. What are the main segments of the Infant Nutrition Market?

The market segments include Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 94.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Working Mother Population; Higher Spending on Infant Health; Rising Demand for Organic Baby Food.

6. What are the notable trends driving market growth?

This section covers the major market trends shaping the Baby Nutrition Market according to our research experts:.

7. Are there any restraints impacting market growth?

Concerns Regarding Food Safety; Stringent Regulations for Infant Food.

8. Can you provide examples of recent developments in the market?

In October 2022, Else Nutrition Holdings Inc. launched its flagship Chinese store on Tmall Global in September and is now selling Else Nutrition Toddler Formula and Baby Cereal products directly to Chinese consumers through the store. The opening of the Chinese market is the third market for Else in its international expansion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Infant Nutrition Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Infant Nutrition Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Infant Nutrition Market?

To stay informed about further developments, trends, and reports in the Infant Nutrition Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence