Key Insights

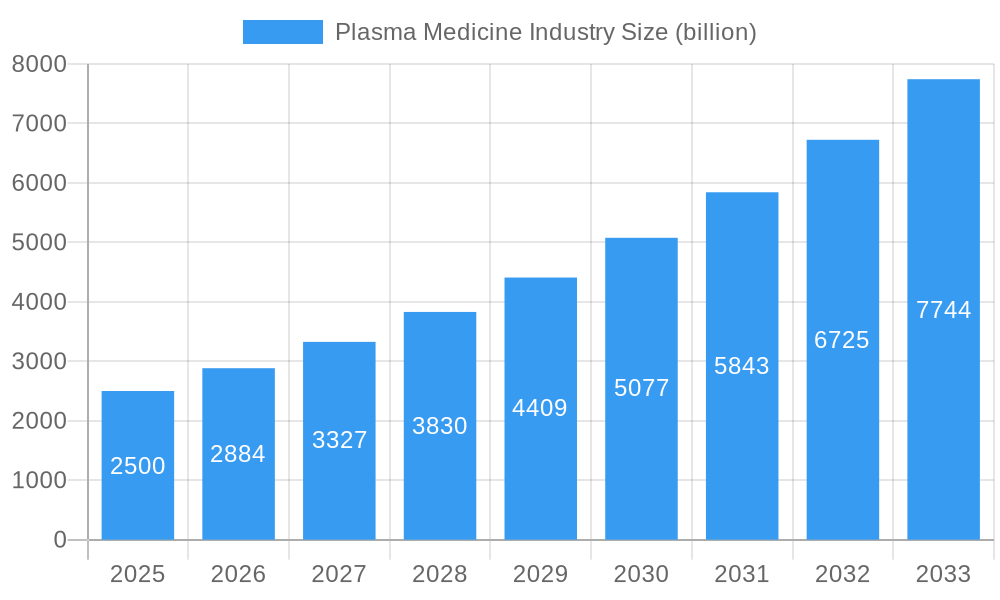

The global Plasma Medicine Industry is experiencing robust expansion, projected to reach a substantial market size by the end of the study period. Driven by its innovative applications in healthcare, particularly in wound healing and surgical procedures, the industry is set to witness a significant Compound Annual Growth Rate (CAGR) of 15.30%. This impressive growth trajectory is fueled by increasing demand for minimally invasive treatments, enhanced sterilization techniques, and advanced therapeutic solutions for chronic conditions. The unique properties of cold atmospheric plasma, including its antimicrobial efficacy and ability to promote tissue regeneration without damaging surrounding healthy cells, are making it a preferred choice in modern medical practices. Emerging applications in dermatology, oncology, and dentistry further broaden the market's scope, attracting significant investment and research efforts.

Plasma Medicine Industry Market Size (In Billion)

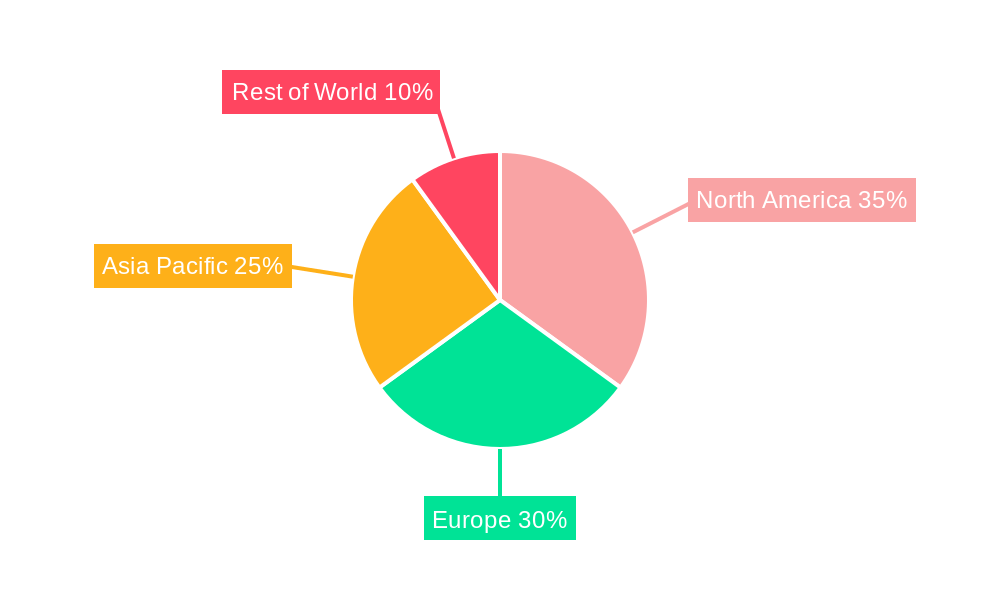

Key market restraints include the high initial cost of advanced plasma equipment and the need for specialized training among medical professionals. However, ongoing technological advancements and increasing awareness about the benefits of plasma-based treatments are gradually mitigating these challenges. Geographically, North America and Europe currently lead the market, owing to well-established healthcare infrastructures and a strong focus on R&D. The Asia Pacific region is anticipated to emerge as a rapidly growing market, propelled by expanding healthcare expenditure, increasing adoption of advanced medical technologies, and a growing prevalence of target diseases. Companies are actively investing in research and development to introduce novel plasma devices and expand their product portfolios, aiming to capture a significant share of this dynamic and evolving market.

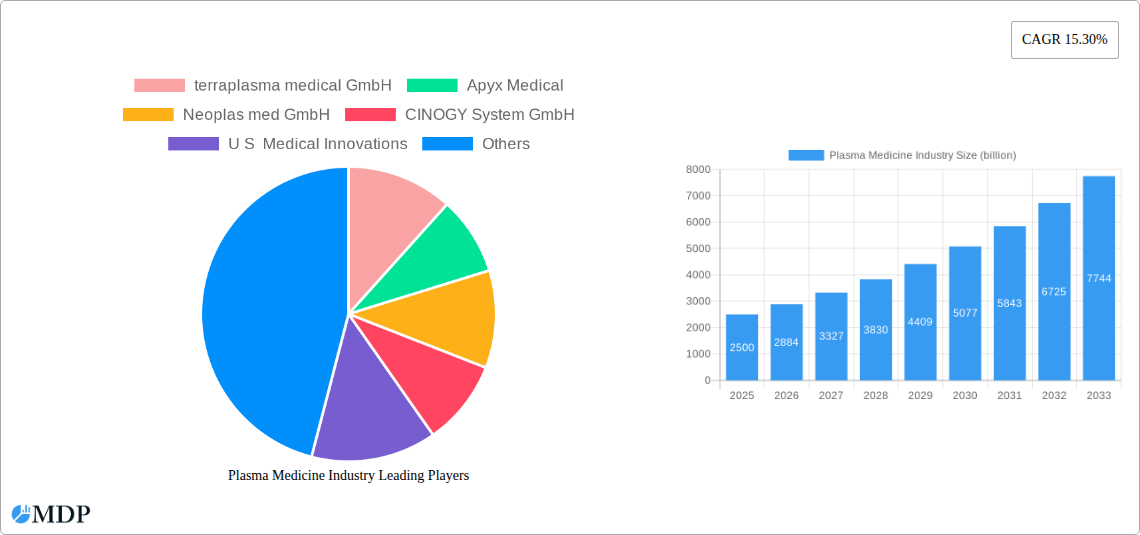

Plasma Medicine Industry Company Market Share

This comprehensive report offers an in-depth analysis of the plasma medicine industry, a rapidly evolving sector poised to transform therapeutic interventions. Spanning the study period of 2019–2033, with a base year of 2025, this report meticulously examines market dynamics, industry trends, leading segments, and key players, providing invaluable insights for stakeholders, investors, and industry professionals. With an estimated market size projected to reach hundreds of billions, this report deciphers the growth trajectory and competitive landscape of this groundbreaking field. The forecast period of 2025–2033 and the historical period of 2019–2024 are thoroughly investigated to understand past performance and future potential, focusing on cold atmospheric plasma (CAP) technologies for medical applications.

Plasma Medicine Industry Market Dynamics & Concentration

The plasma medicine industry, while still nascent, exhibits a dynamic market concentration driven by innovation and increasing regulatory acceptance. The market is characterized by a blend of established medical device manufacturers venturing into this space and specialized cold atmospheric plasma (CAP) startups. Innovation drivers are primarily focused on enhancing therapeutic efficacy, safety, and portability of plasma devices. Regulatory frameworks, though evolving, are a crucial aspect influencing market entry and product development. The absence of direct, highly effective product substitutes for all plasma medicine applications creates a unique market position. End-user trends indicate a growing demand for minimally invasive and non-pharmacological treatment options, particularly in wound care and oncology. Mergers and acquisitions (M&A) activities are expected to increase as larger players seek to acquire specialized CAP technologies and expertise. The M&A deal counts are projected to rise significantly in the coming years. While precise market share data is emerging, early indications suggest a highly competitive environment with key players vying for dominance in specific application segments.

Plasma Medicine Industry Industry Trends & Analysis

The plasma medicine industry is experiencing robust growth, propelled by its unique therapeutic capabilities in areas such as wound healing, surgical applications, and other medical applications. The global market is projected to witness a significant Compound Annual Growth Rate (CAGR) of XX% over the forecast period, driven by increasing awareness of CAP's benefits and its ability to address unmet medical needs. Technological advancements in plasma jet generators, plasma torches, and plasma-activated solutions are expanding the scope of applications. The convergence of plasma physics, biology, and medicine is fostering novel treatment modalities. Consumer preferences are shifting towards less invasive and drug-free therapies, making plasma medicine an attractive alternative. The competitive landscape is intensifying with continuous product innovation and the emergence of new startups. Market penetration is gradually increasing, especially in developed regions with advanced healthcare infrastructure and higher R&D spending. The development of advanced plasma delivery systems and targeted plasma therapies are key trends influencing market expansion. The exploration of plasma's potential in areas like dermatology, dentistry, and infectious disease control further fuels this growth trajectory. The estimated market size is expected to reach hundreds of billions by 2025, underscoring the substantial investment and innovation within this sector.

Leading Markets & Segments in Plasma Medicine Industry

The Wound Healing segment is currently the dominant force within the plasma medicine industry, driven by the critical need for effective treatments for chronic, non-healing wounds, such as diabetic ulcers and pressure sores. This segment's dominance is further bolstered by the direct impact of cold atmospheric plasma (CAP) on promoting cell proliferation, reducing bacterial load, and accelerating tissue regeneration. Economic policies supporting advancements in chronic disease management and robust healthcare infrastructure in developed nations further fuel the growth of this segment.

- Key Drivers for Wound Healing Dominance:

- High prevalence of chronic wounds globally.

- CAP's proven efficacy in disinfection and accelerated healing.

- Increasing adoption of minimally invasive therapies.

- Supportive reimbursement policies for advanced wound care.

- Dominance Analysis: The Wound Healing segment benefits from extensive clinical trials and a growing body of evidence showcasing CAP's superiority over traditional treatments. The market penetration of CAP devices for wound care is significantly higher compared to other medical applications, reflecting its established position.

The Surgical Application segment is emerging as a significant growth area, driven by CAP's potential for enhanced hemostasis, precise tissue ablation, and sterilization during surgical procedures. Technological advancements in surgical plasma devices are enabling surgeons to perform complex procedures with greater precision and reduced complications. The growing number of surgical interventions globally, coupled with the pursuit of improved patient outcomes, are key factors contributing to the expansion of this segment.

- Key Drivers for Surgical Application Growth:

- Demand for sterile surgical environments.

- Advancements in plasma-based electrosurgery and coagulation.

- Minimally invasive surgical techniques.

- Potential for reduced post-operative infections.

- Dominance Analysis: While currently smaller than wound healing, the Surgical Application segment is poised for substantial growth as more CAP devices gain regulatory approval and are integrated into surgical workflows. The ability of CAP to offer a multi-faceted benefit in surgery, including disinfection and tissue interaction, positions it for significant market adoption.

The Other Medical Applications segment, encompassing areas such as dermatology, dentistry, oncology, and sterile device manufacturing, represents a vast and largely untapped market. As research into CAP's broader biological effects continues, new applications are constantly being discovered. This segment is driven by the inherent versatility of CAP and its potential to address a wide array of unmet medical needs.

- Key Drivers for Other Medical Applications:

- Continuous scientific research uncovering new therapeutic benefits.

- Growing interest in plasma for cosmetic and aesthetic treatments.

- Exploration of CAP for cancer therapy and drug delivery.

- Applications in sterilization and biosafety.

- Dominance Analysis: The Other Medical Applications segment is characterized by its high potential for disruptive innovation. Its dominance will be determined by the speed of research breakthroughs, clinical validation, and market acceptance of novel CAP-based treatments across diverse medical fields.

Geographically, North America and Europe currently lead the plasma medicine market due to their strong research ecosystems, advanced healthcare infrastructure, and significant investments in medical technology. However, the Asia-Pacific region is anticipated to witness the fastest growth due to increasing healthcare expenditure, a large patient population, and rising adoption of innovative medical technologies.

Plasma Medicine Industry Product Developments

Product developments in the plasma medicine industry are characterized by a focus on enhanced portability, improved plasma uniformity, and increased therapeutic efficacy. Companies are developing advanced cold atmospheric plasma (CAP) devices that are user-friendly, cost-effective, and suitable for a wider range of clinical settings, from hospitals to homecare. Innovations include sophisticated plasma jet systems for targeted treatments, plasma-activated solutions for topical applications, and integrated devices for wound healing and surgical procedures. The competitive advantage lies in the ability to demonstrate superior clinical outcomes, offer non-invasive alternatives to traditional therapies, and secure regulatory approvals for novel applications. Technological trends are leaning towards miniaturization and the integration of artificial intelligence for personalized treatment delivery.

Key Drivers of Plasma Medicine Industry Growth

The plasma medicine industry is experiencing significant growth driven by several key factors. Technologically, the continuous advancement in cold atmospheric plasma (CAP) generation and control systems allows for more precise and effective therapeutic interventions. Economically, the increasing healthcare expenditure globally, coupled with the demand for cost-effective and minimally invasive treatments, favors plasma-based solutions. Regulatory bodies are becoming more amenable to approving novel CAP devices as clinical evidence mounts, creating a more favorable environment for market penetration. For instance, the growing acceptance of CAP for chronic wound healing applications is a testament to this trend. The inherent advantages of CAP, such as its ability to sterilize and promote tissue regeneration without significant heat damage, are driving its adoption across various medical specialties, from surgery to dermatology.

Challenges in the Plasma Medicine Industry Market

Despite its promising trajectory, the plasma medicine industry faces several challenges. Regulatory hurdles remain a significant barrier, with the complex and lengthy approval processes for novel medical devices potentially slowing down market entry. The high initial cost of some advanced cold atmospheric plasma (CAP) devices can be a restraint, particularly in resource-limited settings. Furthermore, a lack of widespread clinician awareness and understanding of CAP's mechanisms and applications can hinder adoption. Supply chain issues related to specialized components and the need for skilled personnel to operate and maintain these sophisticated systems also present challenges. Competitive pressures from established treatment modalities and the ongoing need for extensive clinical validation to build stronger evidence bases are critical factors that the industry must address to achieve its full potential.

Emerging Opportunities in Plasma Medicine Industry

Emerging opportunities in the plasma medicine industry are vast and varied, fueled by ongoing scientific research and technological innovation. The development of new therapeutic modalities for challenging conditions like cancer and neurodegenerative diseases represents a significant long-term growth catalyst. Strategic partnerships between academic institutions and industry players are accelerating the translation of laboratory discoveries into clinical applications. Market expansion into underserved geographical regions and the exploration of novel applications in areas like anti-microbial resistance and tissue engineering offer substantial growth potential. The increasing demand for personalized medicine also opens avenues for cold atmospheric plasma (CAP) devices that can be tailored to individual patient needs, further solidifying the industry's future growth trajectory.

Leading Players in the Plasma Medicine Industry Sector

- terraplasma medical GmbH

- Apyx Medical

- Neoplas med GmbH

- CINOGY System GmbH

- U S Medical Innovations

- ADTEC Plasma Technology Co Ltd

Key Milestones in Plasma Medicine Industry Industry

- March 2022: Neoplas Med GmbH announced the superiority of cold atmospheric plasma beam therapy in the treatment of chronic wounds with a gold standard trial. A comparative clinical study demonstrated significant improvement in wound closure and infection control following treatment with plasmajet kINPen MED from Neoplas Med compared to other wound care procedures.

- September 2021: US Medical Innovations, LLC (USMI), an FDA-registered United States life sciences and biomedical device company, and the Jerome Canady Research Institute for Advanced and Biological Technological Sciences (JCRI-ABTS), announced the successful results of Phase I clinical trial using cold atmospheric plasma for the treatment of solid tumors at the Baird 2021 Global Healthcare Conference.

Strategic Outlook for Plasma Medicine Industry Market

The strategic outlook for the plasma medicine industry market is exceptionally positive, driven by its potential to revolutionize healthcare. Growth accelerators include the increasing focus on non-invasive and regenerative therapies, further research into the diverse biological effects of cold atmospheric plasma (CAP), and the expansion of CAP applications into new medical fields. Strategic opportunities lie in fostering collaborations for clinical validation, developing more accessible and affordable CAP devices, and penetrating emerging markets with high unmet medical needs. The integration of advanced materials and AI-driven treatment protocols will further enhance the efficacy and personalization of plasma-based treatments, positioning the industry for sustained, significant growth in the coming decade. The estimated market size is projected to reach hundreds of billions by 2025, indicating a robust and expanding market.

Plasma Medicine Industry Segmentation

-

1. Application

- 1.1. Wound Healing

- 1.2. Surgical Application

- 1.3. Other Medical Applications

Plasma Medicine Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of World

Plasma Medicine Industry Regional Market Share

Geographic Coverage of Plasma Medicine Industry

Plasma Medicine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Environment Friendliness and Other Benefits of Cold Plasma Techniques; Increasing Use of Cold Plasma in Wound Healing

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness about Cold Plasma Technology in the Healthcare Industry and Stringent regulatory Policies

- 3.4. Market Trends

- 3.4.1. Wound Healing Segment is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plasma Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Wound Healing

- 5.1.2. Surgical Application

- 5.1.3. Other Medical Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Plasma Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Wound Healing

- 6.1.2. Surgical Application

- 6.1.3. Other Medical Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Plasma Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Wound Healing

- 7.1.2. Surgical Application

- 7.1.3. Other Medical Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Plasma Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Wound Healing

- 8.1.2. Surgical Application

- 8.1.3. Other Medical Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of World Plasma Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Wound Healing

- 9.1.2. Surgical Application

- 9.1.3. Other Medical Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 terraplasma medical GmbH

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Apyx Medical

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Neoplas med GmbH

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 CINOGY System GmbH

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 U S Medical Innovations

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ADTEC Plasma Technology Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 terraplasma medical GmbH

List of Figures

- Figure 1: Global Plasma Medicine Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Plasma Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Plasma Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Plasma Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Plasma Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Plasma Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 7: Europe Plasma Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Plasma Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Plasma Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Plasma Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Asia Pacific Plasma Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Plasma Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Plasma Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of World Plasma Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: Rest of World Plasma Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Rest of World Plasma Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Rest of World Plasma Medicine Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Plasma Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Plasma Medicine Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Plasma Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Plasma Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Plasma Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Plasma Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Plasma Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Plasma Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Plasma Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Germany Plasma Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Plasma Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: France Plasma Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Italy Plasma Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Spain Plasma Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Plasma Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Plasma Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Plasma Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: China Plasma Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Japan Plasma Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Plasma Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Australia Plasma Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: South Korea Plasma Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Plasma Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Plasma Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 25: Global Plasma Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plasma Medicine Industry?

The projected CAGR is approximately 15.30%.

2. Which companies are prominent players in the Plasma Medicine Industry?

Key companies in the market include terraplasma medical GmbH, Apyx Medical, Neoplas med GmbH, CINOGY System GmbH, U S Medical Innovations, ADTEC Plasma Technology Co Ltd.

3. What are the main segments of the Plasma Medicine Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX billion as of 2022.

5. What are some drivers contributing to market growth?

Environment Friendliness and Other Benefits of Cold Plasma Techniques; Increasing Use of Cold Plasma in Wound Healing.

6. What are the notable trends driving market growth?

Wound Healing Segment is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Awareness about Cold Plasma Technology in the Healthcare Industry and Stringent regulatory Policies.

8. Can you provide examples of recent developments in the market?

In March 2022, Neoplas Med GmbH announced the superiority of cold atmospheric plasma beam therapy in the treatment of chronic wounds with a gold standard trial. A comparative clinical study demonstrated significant improvement in wound closure and infection control following treatment with plasmajet kINPen MED from Neoplas Med compared to other wound care procedures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plasma Medicine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plasma Medicine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plasma Medicine Industry?

To stay informed about further developments, trends, and reports in the Plasma Medicine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence