Key Insights

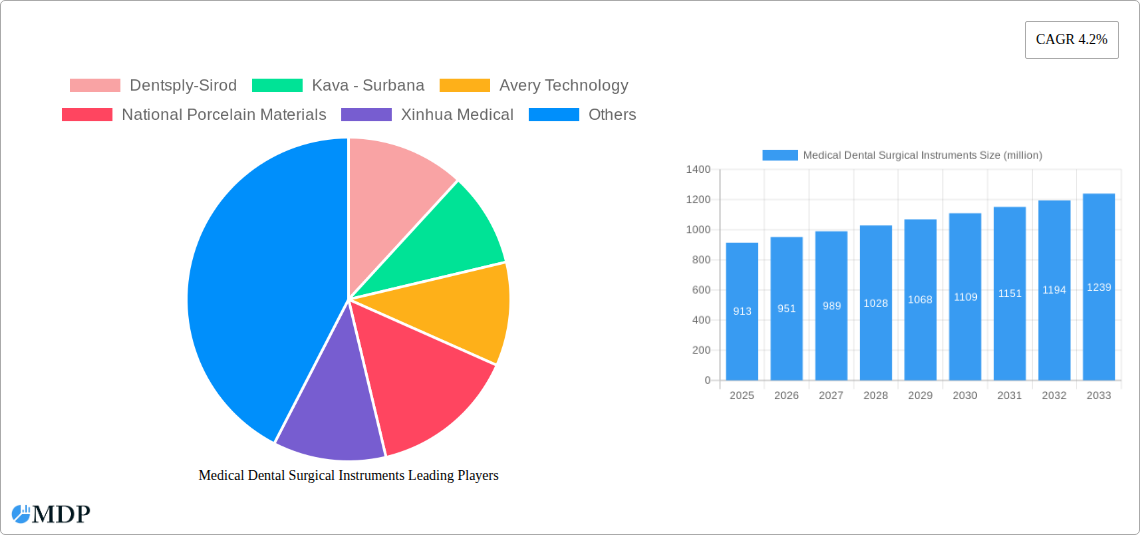

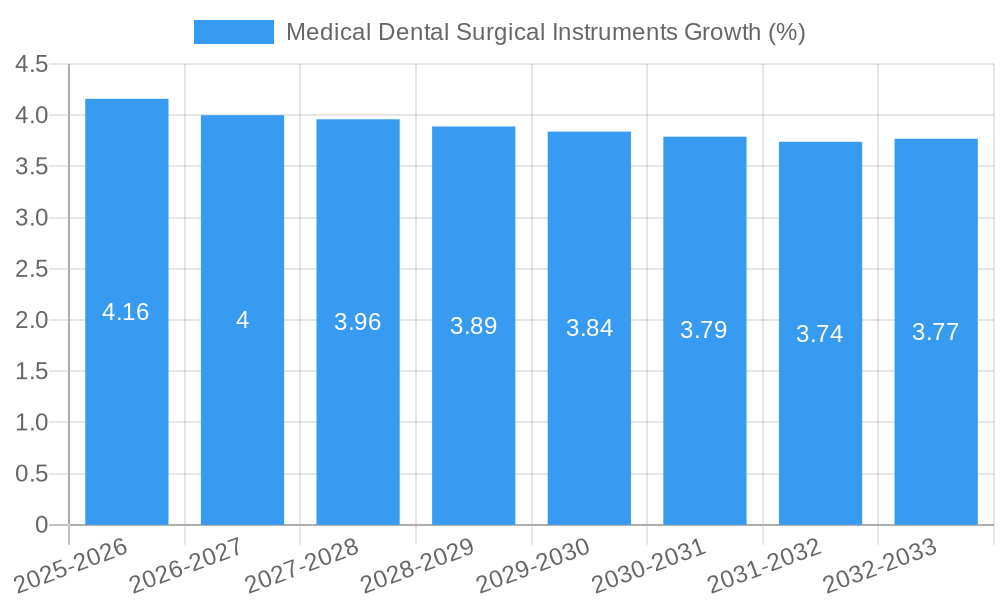

The global Medical Dental Surgical Instruments market is projected to reach \$913 million in 2025, exhibiting a steady Compound Annual Growth Rate (CAGR) of 4.2% throughout the forecast period of 2025-2033. This growth is primarily fueled by the increasing prevalence of dental conditions, a rising global demand for cosmetic dentistry, and advancements in dental technology. As oral health awareness continues to rise, so does the adoption of sophisticated surgical instruments, driving market expansion. The aging global population also contributes significantly, as older demographics tend to require more extensive dental treatments and surgical interventions. Furthermore, the growing emphasis on preventive dental care and regular check-ups further necessitates the use of high-quality surgical instruments in dental practices worldwide. Emerging economies are witnessing substantial growth due to increased disposable income and the development of healthcare infrastructure, making advanced dental treatments more accessible.

The market is segmented by application into dental hospitals and dental clinics, with both segments demonstrating robust growth. Dental clinics, in particular, are expanding their service offerings to include more complex surgical procedures, leading to increased demand for specialized instruments. By type, the market encompasses a wide range of products including dental knives, oral scissors, oral forceps, and oral needles. Innovations in material science and ergonomic design are leading to the development of more precise, durable, and user-friendly instruments, further stimulating market demand. Key players like Dentsply-Sirod and Kava-Surbana are at the forefront of these innovations, investing heavily in research and development. Restraints such as the high cost of advanced equipment and the stringent regulatory landscape for medical devices are being mitigated by technological advancements and strategic collaborations within the industry. The market is poised for sustained expansion, driven by evolving patient needs and technological progress in dental surgery.

Medical Dental Surgical Instruments Market: Comprehensive Analysis & Future Outlook (2019-2033)

Report Description:

This in-depth report offers a definitive analysis of the global Medical Dental Surgical Instruments market, providing a comprehensive roadmap for industry stakeholders. Covering the study period of 2019–2033, with a base year of 2025 and an estimated year also of 2025, this research delves into the intricate dynamics, trends, and future trajectory of this vital sector. We meticulously examine key segments such as Dental Hospitals and Dental Clinics, along with product types including Dental Knives, Oral Scissors, Oral Forceps, Oral Needles, and Others. Our analysis forecasts significant growth, with the market projected to reach an estimated value of over xx million by 2033. This report is an indispensable resource for manufacturers, suppliers, investors, and policymakers seeking to capitalize on emerging opportunities and navigate the evolving landscape of medical and dental surgical instrumentation.

Medical Dental Surgical Instruments Market Dynamics & Concentration

The Medical Dental Surgical Instruments market exhibits a moderate to high level of concentration, with a few key players holding substantial market share. The presence of established giants like Dentsply Sirona, Kava - Surbana, and Xinhua Medical indicates a competitive landscape driven by innovation and product quality. Market concentration is further influenced by the ongoing trend of mergers and acquisitions, with an estimated xx M&A deals anticipated within the forecast period. Innovation drivers are primarily fueled by advancements in material science, miniaturization technologies, and the demand for minimally invasive surgical tools. Regulatory frameworks, particularly those enforced by bodies like the FDA and EMA, play a crucial role in shaping product development and market access, demanding stringent quality control and safety standards. Product substitutes, while present in the form of less specialized tools, are generally unable to match the precision and efficacy of dedicated medical and dental surgical instruments. End-user trends are shifting towards greater demand for ergonomic designs, enhanced sterilization capabilities, and disposable or single-use instruments to mitigate infection risks. The projected market size for the Medical Dental Surgical Instruments sector is estimated to be over xx million by 2033, indicating robust growth potential.

Medical Dental Surgical Instruments Industry Trends & Analysis

The Medical Dental Surgical Instruments industry is poised for substantial expansion, driven by a confluence of factors. The increasing global prevalence of oral health issues, coupled with a growing awareness of the importance of dental hygiene, directly fuels the demand for a wide array of surgical instruments. Technological advancements are at the forefront of this growth, with innovations in material science leading to the development of lighter, stronger, and more biocompatible instruments. Furthermore, the advent of digital dentistry, including CAD/CAM technologies and 3D printing, is revolutionizing instrument design and manufacturing, enabling greater customization and precision. The compound annual growth rate (CAGR) for this market is estimated to be in the healthy range of xx% during the forecast period. Market penetration is steadily increasing as dental healthcare accessibility expands globally, particularly in emerging economies. Consumer preferences are increasingly leaning towards minimally invasive procedures, which necessitates the use of specialized, high-precision surgical instruments. Competitive dynamics are characterized by intense R&D efforts, strategic partnerships, and a focus on product differentiation. Companies are investing heavily in the development of advanced surgical kits and robotic-assisted instrumentation to cater to evolving procedural demands. The estimated market value is projected to exceed xx million by 2033, underscoring the sector's upward trajectory.

Leading Markets & Segments in Medical Dental Surgical Instruments

The Dental Hospital application segment is projected to dominate the Medical Dental Surgical Instruments market, driven by the increasing complexity of procedures performed in hospital settings and a higher patient volume requiring specialized surgical interventions. This dominance is further bolstered by factors such as enhanced healthcare infrastructure, greater accessibility to advanced medical technologies, and the presence of highly trained dental surgeons within hospital environments. Economically, countries with developed healthcare systems and higher disposable incomes are likely to exhibit stronger demand within this segment.

Within the Dental Clinic application, sustained growth is expected due to the rising number of outpatient dental procedures and the expanding network of private dental practices globally. Factors contributing to this growth include government initiatives promoting oral health, increasing affordability of routine dental care, and the growing preference of patients for less invasive and more convenient treatment options available in clinics. Economic policies that support small and medium-sized enterprises within the healthcare sector also play a role in the proliferation of dental clinics.

Analyzing the product types, Oral Forceps are anticipated to hold a significant market share. This is attributed to their ubiquitous use in a wide range of dental procedures, from extractions to implant placements. Their versatility and essential nature in everyday dental practice ensure consistent demand.

Oral Scissors are also expected to witness robust growth. Advancements in microsurgical techniques within dentistry have increased the need for precise and sharp oral scissors for delicate tissue manipulation and suturing.

The Dental Knife segment, while perhaps not as voluminous as forceps, is critical for specialized procedures requiring precise incisions. Innovation in blade materials and ergonomic handle designs will continue to drive demand in this niche.

The Oral Needle segment is characterized by consistent demand, driven by procedures like local anesthesia administration and suturing. The development of finer gauge needles and specialized needle designs for different therapeutic applications will influence this segment's trajectory.

The "Others" category, encompassing specialized instruments like elevators, probes, and bone chisels, is expected to grow in parallel with advancements in surgical techniques and the introduction of new dental procedures.

Medical Dental Surgical Instruments Product Developments

Recent product developments in the Medical Dental Surgical Instruments market are characterized by a strong emphasis on enhanced precision, improved ergonomics, and advanced material science. Manufacturers are focusing on creating instruments with superior sharpness, durability, and biocompatibility, often utilizing high-grade stainless steel alloys and titanium. Innovations in coatings are also gaining traction, offering antimicrobial properties and reduced friction for smoother procedures. The integration of minimally invasive surgical techniques has spurred the development of finer, more specialized instruments for complex procedures like endodontics and periodontics. Competitive advantages are being carved out through the introduction of modular instrument designs, sterilizable components, and the incorporation of smart technologies for better instrument tracking and sterilization verification.

Key Drivers of Medical Dental Surgical Instruments Growth

The Medical Dental Surgical Instruments market is propelled by several key drivers. Technologically, the continuous innovation in materials and manufacturing processes, leading to sharper, more durable, and ergonomic instruments, is paramount. The increasing global prevalence of dental diseases and disorders, such as cavities, periodontal disease, and oral cancer, directly elevates the need for surgical interventions. Furthermore, a growing emphasis on aesthetics and cosmetic dentistry fuels demand for specialized instruments used in procedures like veneers and smile makeovers. Economically, rising disposable incomes in emerging markets are making advanced dental care more accessible. Regulatory frameworks, while stringent, also drive innovation by setting higher quality and safety standards, pushing manufacturers to develop superior products.

Challenges in the Medical Dental Surgical Instruments Market

Despite the strong growth potential, the Medical Dental Surgical Instruments market faces several challenges. Stringent regulatory approvals and compliance requirements can increase development costs and time-to-market for new products. Fluctuations in raw material prices, particularly for specialized alloys, can impact manufacturing costs and profit margins. The presence of counterfeit products and intense price competition from lower-cost manufacturers in certain regions also pose a significant threat. Moreover, the need for continuous investment in research and development to keep pace with technological advancements presents a financial burden for smaller players. Supply chain disruptions, as evidenced by recent global events, can also impact the availability of critical components and finished goods.

Emerging Opportunities in Medical Dental Surgical Instruments

Emerging opportunities in the Medical Dental Surgical Instruments market are primarily driven by technological breakthroughs and expanding market reach. The integration of artificial intelligence (AI) and robotics in dental surgery presents a significant avenue for growth, leading to the development of AI-assisted surgical planning tools and robotic surgical arms. The increasing demand for minimally invasive dentistry continues to fuel the need for advanced micro-instruments. Furthermore, the growing geriatric population, often experiencing a higher incidence of dental complications, represents a substantial and expanding patient base. Strategic partnerships between instrument manufacturers and dental education institutions can foster the development of next-generation instruments tailored to evolving clinical needs. Expansion into untapped emerging markets with improving healthcare infrastructure also offers substantial growth prospects.

Leading Players in the Medical Dental Surgical Instruments Sector

- Dentsply Sirona

- Kava - Surbana

- Avery Technology

- National Porcelain Materials

- Xinhua Medical

- Modern Dentistry

- Kaisa Health

- Meiya Optoelectronics

- Kang Tuo Medical

- Maipu Medicine

- Emondi

Key Milestones in Medical Dental Surgical Instruments Industry

- 2019: Introduction of advanced antimicrobial coatings on surgical instrument surfaces, reducing the risk of hospital-acquired infections.

- 2020: Increased adoption of single-use and disposable surgical instruments to enhance patient safety and streamline sterilization processes.

- 2021: Significant advancements in 3D printing technologies enabling the rapid prototyping and production of customized dental surgical instruments.

- 2022: Emergence of AI-powered diagnostic and surgical planning tools, influencing the design of instruments for precision procedures.

- 2023: Growing focus on ergonomic design principles to reduce surgeon fatigue and improve dexterity during complex operations.

- 2024: Strategic partnerships between major manufacturers and technology firms to integrate digital solutions into surgical workflows.

Strategic Outlook for Medical Dental Surgical Instruments Market

The strategic outlook for the Medical Dental Surgical Instruments market is highly positive, characterized by sustained growth driven by innovation and increasing global healthcare expenditure. Key growth accelerators include the continuous evolution of dental procedures towards less invasive techniques, the integration of digital technologies like AI and robotics, and the expanding market penetration in developing economies. Manufacturers are advised to focus on developing high-precision, user-friendly instruments that meet stringent international quality standards. Strategic opportunities lie in expanding product portfolios to cater to the growing demand for specialized instruments in areas like implantology and orthodontics, and in forging collaborations to accelerate the adoption of novel technologies. The market is expected to witness further consolidation and innovation as companies strive to capture a larger share of this dynamic and essential sector.

Medical Dental Surgical Instruments Segmentation

-

1. Application

- 1.1. Dental Hospital

- 1.2. Dental Clinic

-

2. Type

- 2.1. Dental Knife

- 2.2. Oral Scissors

- 2.3. Oral Forceps

- 2.4. Oral Needle

- 2.5. Others

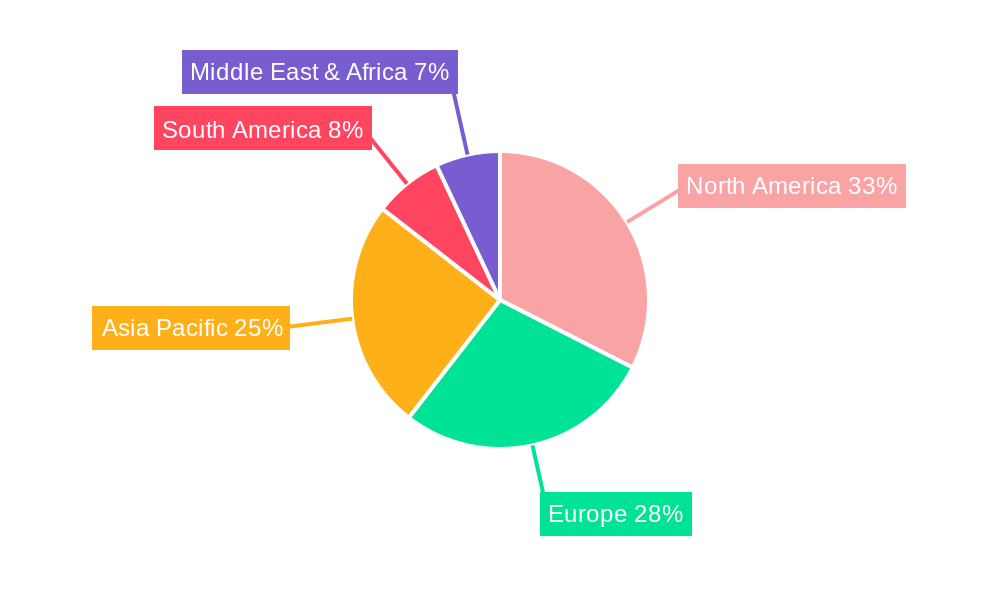

Medical Dental Surgical Instruments Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Medical Dental Surgical Instruments REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.2% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Dental Surgical Instruments Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Dental Hospital

- 5.1.2. Dental Clinic

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Dental Knife

- 5.2.2. Oral Scissors

- 5.2.3. Oral Forceps

- 5.2.4. Oral Needle

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Medical Dental Surgical Instruments Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Dental Hospital

- 6.1.2. Dental Clinic

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Dental Knife

- 6.2.2. Oral Scissors

- 6.2.3. Oral Forceps

- 6.2.4. Oral Needle

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Medical Dental Surgical Instruments Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Dental Hospital

- 7.1.2. Dental Clinic

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Dental Knife

- 7.2.2. Oral Scissors

- 7.2.3. Oral Forceps

- 7.2.4. Oral Needle

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Medical Dental Surgical Instruments Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Dental Hospital

- 8.1.2. Dental Clinic

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Dental Knife

- 8.2.2. Oral Scissors

- 8.2.3. Oral Forceps

- 8.2.4. Oral Needle

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Medical Dental Surgical Instruments Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Dental Hospital

- 9.1.2. Dental Clinic

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Dental Knife

- 9.2.2. Oral Scissors

- 9.2.3. Oral Forceps

- 9.2.4. Oral Needle

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Medical Dental Surgical Instruments Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Dental Hospital

- 10.1.2. Dental Clinic

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Dental Knife

- 10.2.2. Oral Scissors

- 10.2.3. Oral Forceps

- 10.2.4. Oral Needle

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Dentsply-Sirod

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kava - Surbana

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Avery Technology

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 National Porcelain Materials

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Xinhua Medical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Modern Dentistry

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kaisa Health

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Meiya Optoelectronics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kang Tuo Medical

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Maipu Medicine

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Emondi

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Dentsply-Sirod

List of Figures

- Figure 1: Global Medical Dental Surgical Instruments Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Medical Dental Surgical Instruments Revenue (million), by Application 2024 & 2032

- Figure 3: North America Medical Dental Surgical Instruments Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Medical Dental Surgical Instruments Revenue (million), by Type 2024 & 2032

- Figure 5: North America Medical Dental Surgical Instruments Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Medical Dental Surgical Instruments Revenue (million), by Country 2024 & 2032

- Figure 7: North America Medical Dental Surgical Instruments Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Medical Dental Surgical Instruments Revenue (million), by Application 2024 & 2032

- Figure 9: South America Medical Dental Surgical Instruments Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Medical Dental Surgical Instruments Revenue (million), by Type 2024 & 2032

- Figure 11: South America Medical Dental Surgical Instruments Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Medical Dental Surgical Instruments Revenue (million), by Country 2024 & 2032

- Figure 13: South America Medical Dental Surgical Instruments Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Medical Dental Surgical Instruments Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Medical Dental Surgical Instruments Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Medical Dental Surgical Instruments Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Medical Dental Surgical Instruments Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Medical Dental Surgical Instruments Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Medical Dental Surgical Instruments Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Medical Dental Surgical Instruments Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Medical Dental Surgical Instruments Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Medical Dental Surgical Instruments Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Medical Dental Surgical Instruments Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Medical Dental Surgical Instruments Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Medical Dental Surgical Instruments Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Medical Dental Surgical Instruments Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Medical Dental Surgical Instruments Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Medical Dental Surgical Instruments Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Medical Dental Surgical Instruments Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Medical Dental Surgical Instruments Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Medical Dental Surgical Instruments Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medical Dental Surgical Instruments Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Medical Dental Surgical Instruments Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Medical Dental Surgical Instruments Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Medical Dental Surgical Instruments Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Medical Dental Surgical Instruments Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Medical Dental Surgical Instruments Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Medical Dental Surgical Instruments Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Medical Dental Surgical Instruments Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Medical Dental Surgical Instruments Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Medical Dental Surgical Instruments Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Medical Dental Surgical Instruments Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Medical Dental Surgical Instruments Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Medical Dental Surgical Instruments Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Medical Dental Surgical Instruments Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Medical Dental Surgical Instruments Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Medical Dental Surgical Instruments Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Medical Dental Surgical Instruments Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Medical Dental Surgical Instruments Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Medical Dental Surgical Instruments Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Medical Dental Surgical Instruments Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Dental Surgical Instruments?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Medical Dental Surgical Instruments?

Key companies in the market include Dentsply-Sirod, Kava - Surbana, Avery Technology, National Porcelain Materials, Xinhua Medical, Modern Dentistry, Kaisa Health, Meiya Optoelectronics, Kang Tuo Medical, Maipu Medicine, Emondi.

3. What are the main segments of the Medical Dental Surgical Instruments?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 913 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Dental Surgical Instruments," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Dental Surgical Instruments report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Dental Surgical Instruments?

To stay informed about further developments, trends, and reports in the Medical Dental Surgical Instruments, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence