Key Insights

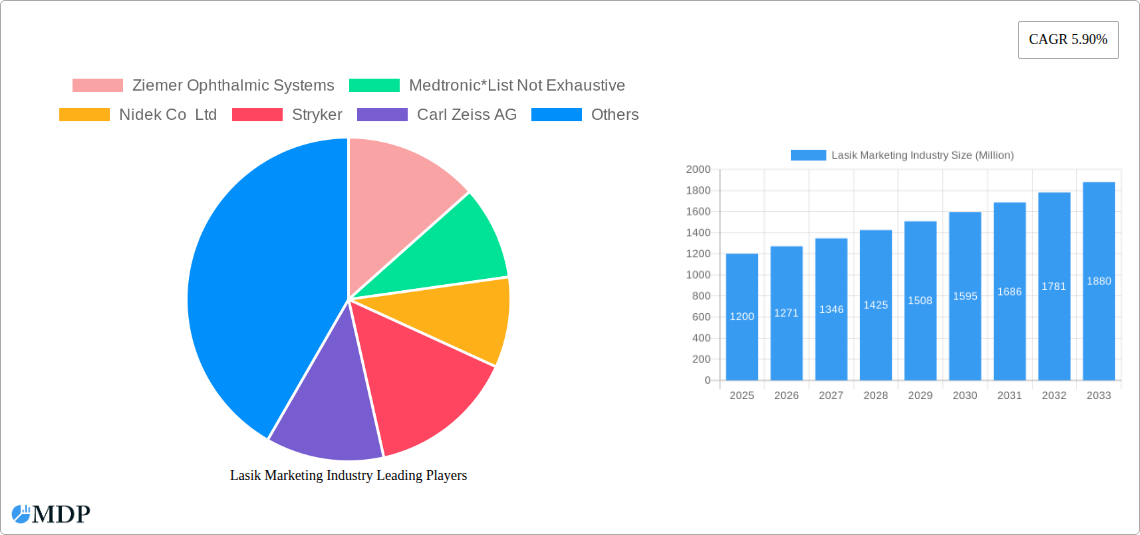

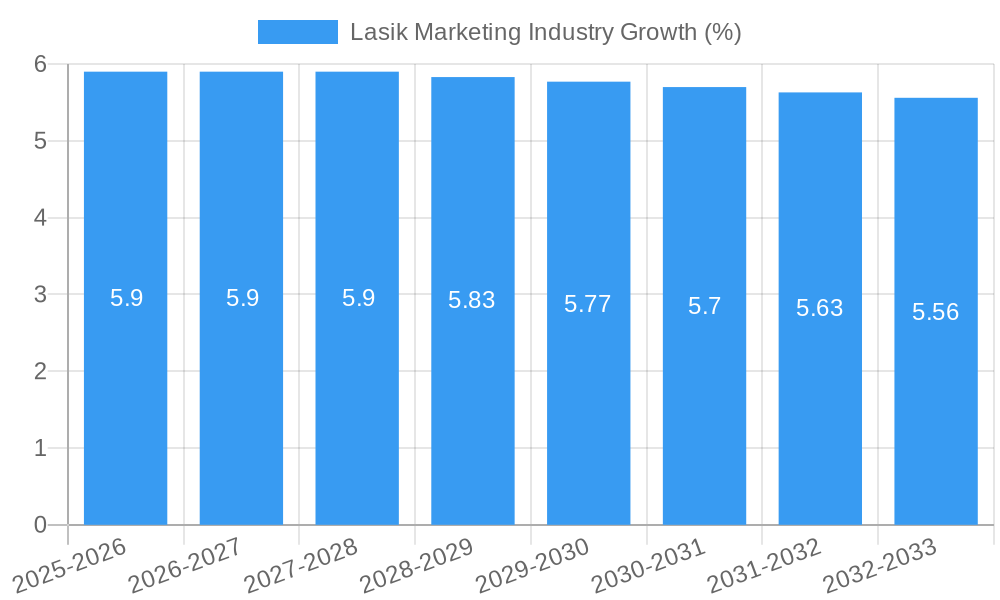

The global LASIK market is poised for significant expansion, projected to reach an estimated market size of approximately $1,200 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.90% through 2033. This sustained growth is primarily fueled by an increasing prevalence of vision impairments such as myopia and hypermetropia, coupled with a growing awareness and acceptance of refractive surgery as a viable alternative to traditional corrective lenses. Advances in LASIK technology, including wavefront-guided and topography-guided procedures, are enhancing surgical precision and patient outcomes, thereby driving demand. Furthermore, the burgeoning healthcare infrastructure and rising disposable incomes in emerging economies, particularly in the Asia Pacific region, are contributing to market expansion. The shift towards outpatient surgical centers (ASCs) for LASIK procedures, driven by cost-effectiveness and convenience, is also a key trend shaping the market landscape.

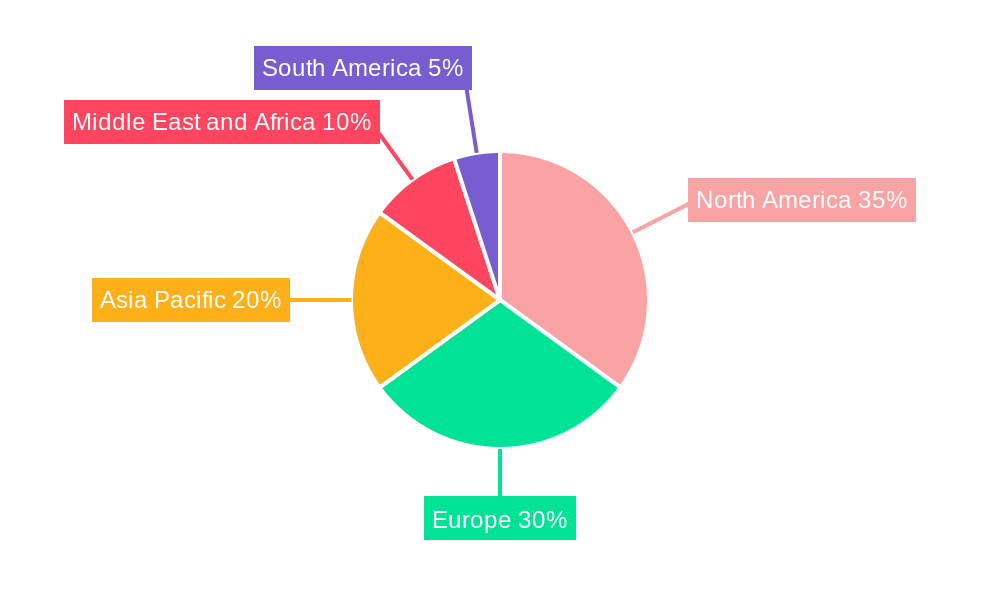

The competitive environment is characterized by the presence of major global players like Alcon Inc., Johnson & Johnson, and Carl Zeiss AG, who are continuously investing in research and development to introduce innovative technologies and expand their product portfolios. Market restraints, however, include the high cost of advanced LASIK procedures and potential patient apprehension regarding surgical risks, although these are being mitigated by improved safety profiles and successful patient testimonials. The market is segmented across various LASIK types, indications, and end-users, with Myopia and Wavefront LASIK representing significant segments. Geographically, North America and Europe currently dominate the market, but the Asia Pacific region is expected to witness the fastest growth due to increasing healthcare expenditure and a large patient pool seeking vision correction solutions.

This comprehensive report provides an in-depth analysis of the global LASIK marketing industry, encompassing market size, growth drivers, technological advancements, and key competitive strategies. With a study period from 2019 to 2033, including a base year of 2025 and a forecast period of 2025–2033, this report offers unparalleled insights for stakeholders seeking to capitalize on the evolving vision correction market. The report delves into market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, key players, and strategic outlook, offering a holistic view of the LASIK landscape.

The LASIK market is segmented by Type (Wavefront LASIK, Topography Guided LASIK, Other Types), Indication (Myopia, Hypermetropia, Presbyopia, Other Indications), and End User (Hospitals, ASC, Others). The historical period covers 2019–2024, providing crucial context for the future projections.

Lasik Marketing Industry Market Dynamics & Concentration

The LASIK marketing industry is characterized by a moderately concentrated market, with a few dominant players holding significant market share, estimated to be around 65% by major companies. Innovation drivers are paramount, fueled by continuous research and development in laser technology, diagnostic tools, and patient outcomes. Regulatory frameworks, such as FDA approvals and country-specific medical device regulations, play a crucial role in market entry and product adoption. Product substitutes, including advanced contact lenses and refractive lens exchange, present ongoing competitive pressures. End-user trends reveal a growing demand for minimally invasive procedures with faster recovery times, driving adoption in Ambulatory Surgery Centers (ASCs). Merger and acquisition (M&A) activities are strategic maneuvers for market consolidation and expansion, with an estimated 15-20 M&A deals occurring annually over the historical period. The market's growth is intrinsically linked to advancements in ophthalmic surgery, increasing awareness of vision correction benefits, and an aging global population seeking to reduce dependence on corrective eyewear. The competitive landscape is shaped by the interplay of technological superiority, brand reputation, and effective marketing strategies targeting both ophthalmologists and potential patients.

Lasik Marketing Industry Industry Trends & Analysis

The LASIK marketing industry is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period (2025–2033). This expansion is significantly driven by technological disruptions, particularly the refinement of excimer and femtosecond laser technologies, leading to enhanced precision and improved patient outcomes. The increasing adoption of topography-guided LASIK and wavefront-guided LASIK procedures is a testament to this trend, offering more personalized vision correction solutions. Consumer preferences are shifting towards permanent vision correction options, fueled by greater awareness of LASIK benefits, including convenience, improved quality of life, and long-term cost savings compared to ongoing spectacle and contact lens expenses. Market penetration is steadily increasing, especially in developed economies, as disposable incomes rise and a larger demographic becomes eligible and interested in refractive surgery. Competitive dynamics are intense, with established players investing heavily in marketing and R&D to maintain market leadership. Newer entrants are focusing on niche segments or innovative technologies to carve out their market share. The global market size for LASIK procedures is estimated to reach over $8 Billion by 2025, further underscoring the industry's upward trajectory. The increasing prevalence of myopia and hypermetropia worldwide also contributes significantly to the sustained demand for LASIK procedures.

Leading Markets & Segments in Lasik Marketing Industry

North America currently dominates the LASIK marketing industry, with the United States leading due to high disposable incomes, advanced healthcare infrastructure, and early adoption of innovative ophthalmic technologies. The Wavefront LASIK segment is a significant revenue generator, driven by its personalized approach to correcting visual aberrations, contributing an estimated 40% to the overall market. Within indications, Myopia remains the most prevalent condition addressed by LASIK, accounting for over 60% of all procedures. This dominance is attributed to the high global prevalence of myopia, particularly among younger demographics and individuals spending prolonged hours on digital devices. The ASC (Ambulatory Surgery Center) end-user segment is experiencing rapid growth, estimated to capture over 50% of the market share by 2025. This surge is due to the cost-effectiveness, convenience, and specialized focus of ASCs for outpatient surgical procedures like LASIK. Economic policies favoring healthcare spending and favorable reimbursement rates for LASIK procedures in certain regions further bolster market growth. Infrastructure development in emerging economies, coupled with increasing healthcare awareness, is also contributing to market expansion. For instance, increased access to advanced laser technology in Asian countries is driving growth in the Topography Guided LASIK segment. The "Other Types" of LASIK, including PRK and SMILE, are also gaining traction due to their specific advantages for certain patient profiles.

Lasik Marketing Industry Product Developments

Product developments in the LASIK marketing industry are characterized by a relentless pursuit of enhanced precision, safety, and patient comfort. Innovations in excimer and femtosecond laser platforms are leading to faster treatment times, reduced thermal effects on corneal tissue, and improved refractive accuracy. The integration of advanced diagnostic imaging techniques, such as high-resolution corneal tomography, enables more personalized treatment plans tailored to individual corneal topography. Competitive advantages are being gained through software algorithms that optimize ablation profiles, minimize aberrations, and predict visual outcomes with greater certainty. This focus on technological advancement and personalized patient care is a key differentiator in the market.

Key Drivers of Lasik Marketing Industry Growth

The LASIK marketing industry's growth is propelled by several key drivers. Technological advancements in laser systems, offering greater precision and safety, are paramount. The increasing prevalence of refractive errors like myopia and hypermetropia globally fuels demand. Rising disposable incomes and greater access to healthcare further enhance market penetration. Moreover, the growing consumer awareness of LASIK as a viable and effective alternative to corrective eyewear, coupled with a desire for improved quality of life and convenience, significantly contributes to market expansion. Regulatory approvals for new technologies and procedures also act as accelerators.

Challenges in the Lasik Marketing Industry Market

Despite its growth, the LASIK marketing industry faces several challenges. High initial costs of laser equipment and the procedure itself can be a barrier to entry for some patients. Stringent regulatory approval processes for new technologies and devices can slow down innovation adoption. Intense competition among established players and the emergence of alternative vision correction methods, like advanced contact lenses and refractive lens exchange, exert pressure on pricing and market share. Supply chain disruptions for essential consumables and the need for highly skilled ophthalmic surgeons also present ongoing operational challenges that can impact market dynamics.

Emerging Opportunities in Lasik Marketing Industry

Emerging opportunities in the LASIK marketing industry are ripe for exploitation. The development and widespread adoption of next-generation laser technologies, offering even faster recovery and reduced side effects, represent a significant growth catalyst. Strategic partnerships between laser manufacturers, ophthalmic clinics, and insurance providers can broaden access and affordability. Market expansion into underserved regions and emerging economies, where the prevalence of refractive errors is high but access to advanced procedures is limited, presents substantial untapped potential. Furthermore, continued research into presbyopia correction using LASIK techniques could unlock a vast new patient demographic.

Leading Players in the Lasik Marketing Industry Sector

- Ziemer Ophthalmic Systems

- Medtronic

- Nidek Co Ltd

- Stryker

- Carl Zeiss AG

- Johnson & Johnson

- Lasersight Technologies Inc

- Alcon Inc

- Bausch Health Companies Inc

Key Milestones in Lasik Marketing Industry Industry

- October 2022: A clinical trial was initiated at the Stanford University School of Medicine, United States, to assess the comparative efficacy of wavefront-guided LASIK versus topography-guided LASIK in myopic individuals via randomized contralateral fellow eye studies.

- May 2022: Sohana Hospital, Mohali, India, launched advanced LASIK treatment, including Contoura Vision LASIK surgery, capable of being performed in under 10 minutes, aiming to reduce dependence on spectacles.

Strategic Outlook for Lasik Marketing Industry Market

- October 2022: A clinical trial was initiated at the Stanford University School of Medicine, United States, to assess the comparative efficacy of wavefront-guided LASIK versus topography-guided LASIK in myopic individuals via randomized contralateral fellow eye studies.

- May 2022: Sohana Hospital, Mohali, India, launched advanced LASIK treatment, including Contoura Vision LASIK surgery, capable of being performed in under 10 minutes, aiming to reduce dependence on spectacles.

Strategic Outlook for Lasik Marketing Industry Market

The strategic outlook for the LASIK marketing industry is exceptionally promising, driven by continuous technological innovation and a growing global demand for vision correction. Key growth accelerators include the development of AI-powered treatment planning, enhancing personalization and predictive outcomes. Expansion into emerging markets with increasing healthcare expenditure and a rising middle class will be crucial. Strategic collaborations with healthcare providers and educational institutions to train more surgeons and increase patient awareness will further fuel adoption. The industry's focus on delivering superior patient experiences, faster recovery times, and long-term visual independence will solidify its position as a leading refractive surgery solution.

Lasik Marketing Industry Segmentation

-

1. Type

- 1.1. Wavefront LASIK

- 1.2. Topography guided LASIK

- 1.3. Other Types

-

2. Indication

- 2.1. Myopia

- 2.2. Hypermetropia

- 2.3. Presbyopia

- 2.4. Other Indications

-

3. End User

- 3.1. Hospitals

- 3.2. ASC

- 3.3. Others

Lasik Marketing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Lasik Marketing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Ophthalmic Diseases; Technological Advancement in LASIK Procedure

- 3.3. Market Restrains

- 3.3.1. Ambiguous Regulatory Framework and Insufficient Reimbursement Policies

- 3.4. Market Trends

- 3.4.1. Myopia Segment is Expected to Witness High Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lasik Marketing Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wavefront LASIK

- 5.1.2. Topography guided LASIK

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Indication

- 5.2.1. Myopia

- 5.2.2. Hypermetropia

- 5.2.3. Presbyopia

- 5.2.4. Other Indications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. ASC

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Lasik Marketing Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wavefront LASIK

- 6.1.2. Topography guided LASIK

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Indication

- 6.2.1. Myopia

- 6.2.2. Hypermetropia

- 6.2.3. Presbyopia

- 6.2.4. Other Indications

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals

- 6.3.2. ASC

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Lasik Marketing Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wavefront LASIK

- 7.1.2. Topography guided LASIK

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Indication

- 7.2.1. Myopia

- 7.2.2. Hypermetropia

- 7.2.3. Presbyopia

- 7.2.4. Other Indications

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals

- 7.3.2. ASC

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Lasik Marketing Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wavefront LASIK

- 8.1.2. Topography guided LASIK

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Indication

- 8.2.1. Myopia

- 8.2.2. Hypermetropia

- 8.2.3. Presbyopia

- 8.2.4. Other Indications

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals

- 8.3.2. ASC

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Lasik Marketing Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wavefront LASIK

- 9.1.2. Topography guided LASIK

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Indication

- 9.2.1. Myopia

- 9.2.2. Hypermetropia

- 9.2.3. Presbyopia

- 9.2.4. Other Indications

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals

- 9.3.2. ASC

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Lasik Marketing Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Wavefront LASIK

- 10.1.2. Topography guided LASIK

- 10.1.3. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Indication

- 10.2.1. Myopia

- 10.2.2. Hypermetropia

- 10.2.3. Presbyopia

- 10.2.4. Other Indications

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals

- 10.3.2. ASC

- 10.3.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Lasik Marketing Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Lasik Marketing Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Lasik Marketing Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Lasik Marketing Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Lasik Marketing Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Ziemer Ophthalmic Systems

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Medtronic*List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Nidek Co Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Stryker

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Carl Zeiss AG

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Johnson & Johnson

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Lasersight Technologies Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Alcon Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Bausch Health Companies Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.1 Ziemer Ophthalmic Systems

List of Figures

- Figure 1: Global Lasik Marketing Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Lasik Marketing Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Lasik Marketing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Lasik Marketing Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Lasik Marketing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Lasik Marketing Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Lasik Marketing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Lasik Marketing Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Lasik Marketing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Lasik Marketing Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Lasik Marketing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Lasik Marketing Industry Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Lasik Marketing Industry Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Lasik Marketing Industry Revenue (Million), by Indication 2024 & 2032

- Figure 15: North America Lasik Marketing Industry Revenue Share (%), by Indication 2024 & 2032

- Figure 16: North America Lasik Marketing Industry Revenue (Million), by End User 2024 & 2032

- Figure 17: North America Lasik Marketing Industry Revenue Share (%), by End User 2024 & 2032

- Figure 18: North America Lasik Marketing Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Lasik Marketing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Lasik Marketing Industry Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Lasik Marketing Industry Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Lasik Marketing Industry Revenue (Million), by Indication 2024 & 2032

- Figure 23: Europe Lasik Marketing Industry Revenue Share (%), by Indication 2024 & 2032

- Figure 24: Europe Lasik Marketing Industry Revenue (Million), by End User 2024 & 2032

- Figure 25: Europe Lasik Marketing Industry Revenue Share (%), by End User 2024 & 2032

- Figure 26: Europe Lasik Marketing Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Lasik Marketing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Lasik Marketing Industry Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific Lasik Marketing Industry Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Lasik Marketing Industry Revenue (Million), by Indication 2024 & 2032

- Figure 31: Asia Pacific Lasik Marketing Industry Revenue Share (%), by Indication 2024 & 2032

- Figure 32: Asia Pacific Lasik Marketing Industry Revenue (Million), by End User 2024 & 2032

- Figure 33: Asia Pacific Lasik Marketing Industry Revenue Share (%), by End User 2024 & 2032

- Figure 34: Asia Pacific Lasik Marketing Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Lasik Marketing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Lasik Marketing Industry Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa Lasik Marketing Industry Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa Lasik Marketing Industry Revenue (Million), by Indication 2024 & 2032

- Figure 39: Middle East and Africa Lasik Marketing Industry Revenue Share (%), by Indication 2024 & 2032

- Figure 40: Middle East and Africa Lasik Marketing Industry Revenue (Million), by End User 2024 & 2032

- Figure 41: Middle East and Africa Lasik Marketing Industry Revenue Share (%), by End User 2024 & 2032

- Figure 42: Middle East and Africa Lasik Marketing Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Lasik Marketing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: South America Lasik Marketing Industry Revenue (Million), by Type 2024 & 2032

- Figure 45: South America Lasik Marketing Industry Revenue Share (%), by Type 2024 & 2032

- Figure 46: South America Lasik Marketing Industry Revenue (Million), by Indication 2024 & 2032

- Figure 47: South America Lasik Marketing Industry Revenue Share (%), by Indication 2024 & 2032

- Figure 48: South America Lasik Marketing Industry Revenue (Million), by End User 2024 & 2032

- Figure 49: South America Lasik Marketing Industry Revenue Share (%), by End User 2024 & 2032

- Figure 50: South America Lasik Marketing Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: South America Lasik Marketing Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Lasik Marketing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Lasik Marketing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Lasik Marketing Industry Revenue Million Forecast, by Indication 2019 & 2032

- Table 4: Global Lasik Marketing Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Global Lasik Marketing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Lasik Marketing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Lasik Marketing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Lasik Marketing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Lasik Marketing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: GCC Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Africa Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Lasik Marketing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Lasik Marketing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Global Lasik Marketing Industry Revenue Million Forecast, by Indication 2019 & 2032

- Table 34: Global Lasik Marketing Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 35: Global Lasik Marketing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Canada Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mexico Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Lasik Marketing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global Lasik Marketing Industry Revenue Million Forecast, by Indication 2019 & 2032

- Table 41: Global Lasik Marketing Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 42: Global Lasik Marketing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Germany Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: United Kingdom Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: France Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Lasik Marketing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Global Lasik Marketing Industry Revenue Million Forecast, by Indication 2019 & 2032

- Table 51: Global Lasik Marketing Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 52: Global Lasik Marketing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Australia Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Lasik Marketing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 60: Global Lasik Marketing Industry Revenue Million Forecast, by Indication 2019 & 2032

- Table 61: Global Lasik Marketing Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 62: Global Lasik Marketing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 63: GCC Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: South Africa Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Middle East and Africa Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Global Lasik Marketing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 67: Global Lasik Marketing Industry Revenue Million Forecast, by Indication 2019 & 2032

- Table 68: Global Lasik Marketing Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 69: Global Lasik Marketing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Brazil Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Argentina Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of South America Lasik Marketing Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lasik Marketing Industry?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the Lasik Marketing Industry?

Key companies in the market include Ziemer Ophthalmic Systems, Medtronic*List Not Exhaustive, Nidek Co Ltd, Stryker, Carl Zeiss AG, Johnson & Johnson, Lasersight Technologies Inc, Alcon Inc, Bausch Health Companies Inc.

3. What are the main segments of the Lasik Marketing Industry?

The market segments include Type, Indication, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Ophthalmic Diseases; Technological Advancement in LASIK Procedure.

6. What are the notable trends driving market growth?

Myopia Segment is Expected to Witness High Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Ambiguous Regulatory Framework and Insufficient Reimbursement Policies.

8. Can you provide examples of recent developments in the market?

In October 2022, a clinical trial was started at the Stanford University School of Medicine, United States, to assess the results of wavefront-guided LASIK versus topography-guided LASIK in myopic individuals' randomized contralateral fellow eye studies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lasik Marketing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lasik Marketing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lasik Marketing Industry?

To stay informed about further developments, trends, and reports in the Lasik Marketing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence