Key Insights

The Italian drug delivery devices market is set for significant expansion, driven by a robust Compound Annual Growth Rate (CAGR) of 6.6%. This growth is primarily fueled by the increasing prevalence of chronic diseases such as cancer, cardiovascular conditions, and diabetes, which necessitate advanced and efficient drug delivery mechanisms for improved patient outcomes. An aging Italian population also contributes to this demand, requiring long-term medication management. Technological advancements, including smart devices, implantable pumps, and needle-free technologies, are enhancing treatment precision and patient compliance, further propelling market growth. A focus on minimally invasive procedures and personalized medicine also stimulates the adoption of sophisticated drug delivery solutions.

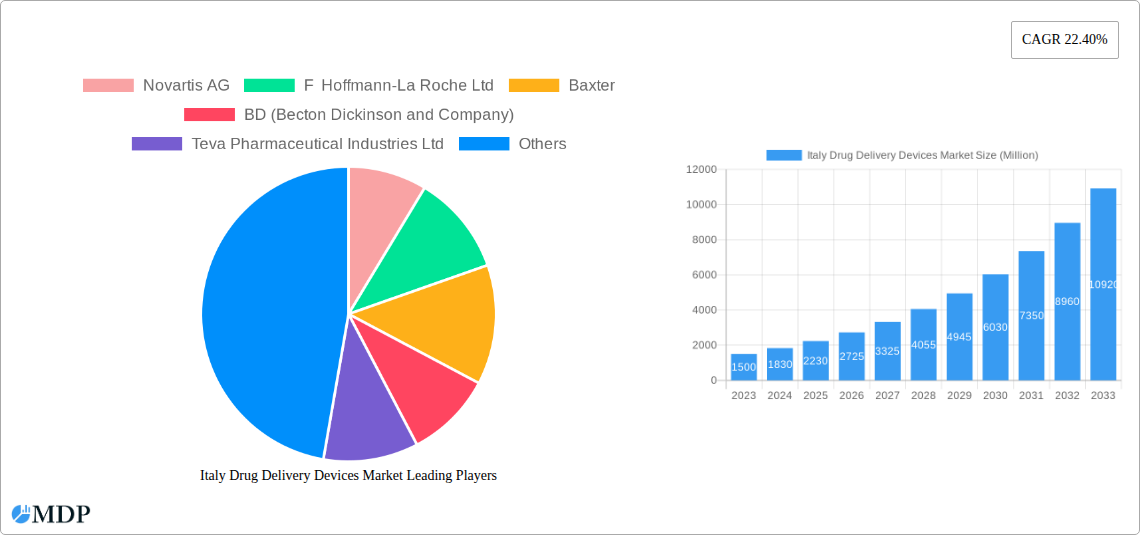

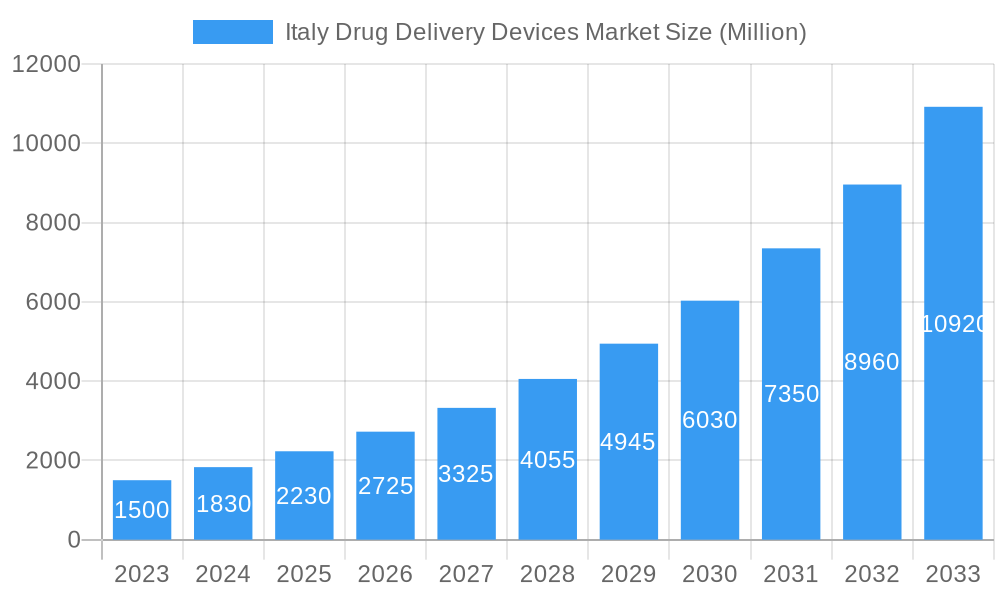

Italy Drug Delivery Devices Market Market Size (In Billion)

The market is segmented by route of administration, application, and end-user. Injectable and topical drug delivery devices are anticipated to dominate due to their widespread use in treating prevalent conditions. The oncology segment is a major contributor, driven by continuous development of novel targeted therapies and immunotherapies requiring precise drug delivery. Hospitals and ambulatory surgical centers are the primary end-users, due to established infrastructure and specialized medical professionals. Key players are investing in research and development to innovate and expand product portfolios, intensifying competition and innovation. The forecast period anticipates sustained momentum, supported by government initiatives promoting advanced healthcare solutions and increasing patient awareness of advanced drug delivery technologies.

Italy Drug Delivery Devices Market Company Market Share

This report provides comprehensive insights into the Italian drug delivery devices market, analyzing its current landscape and future trajectory. The study, with a base year of 2025, offers a detailed analysis of market dynamics, industry trends, leading segments, product developments, key growth drivers, challenges, emerging opportunities, and the strategic outlook for this vital healthcare sector. Leveraging high-traffic keywords such as "drug delivery devices Italy," "pharmaceutical packaging Italy," "medical devices Italy," "injectable drug delivery," and "oncology drug delivery," this report is designed for maximum search visibility and engagement with industry stakeholders including pharmaceutical manufacturers, device developers, investors, and healthcare providers. With an estimated market size of 96.73 billion in 2025, explore the competitive strategies and innovation catalysts shaping the Italian market.

Italy Drug Delivery Devices Market Market Dynamics & Concentration

The Italy drug delivery devices market is characterized by a moderate to high concentration, with a few dominant players holding significant market share. Innovation is a key driver, fueled by increasing demand for advanced drug delivery solutions that offer improved patient compliance, efficacy, and safety. The regulatory framework in Italy, aligned with European Union directives, plays a crucial role in shaping market access and product development. Strict adherence to quality standards and approval processes influences the speed of market entry for new devices. Product substitutes, such as oral formulations for certain drugs previously requiring injection, pose a competitive challenge, but advancements in novel drug delivery systems are continually creating new niches. End-user trends are shifting towards home-based and self-administration devices, driven by an aging population and the increasing prevalence of chronic diseases. Mergers and acquisitions (M&A) activities, while not exceptionally high, are strategic in nature, aimed at consolidating portfolios, acquiring novel technologies, and expanding market reach. For instance, recent collaborations like the one between Stevanato Group SpA and Gerresheimer AG underscore the trend towards strategic partnerships to enhance RTU solution offerings. The M&A deal count in the Italian market is estimated to be in the low single digits annually, reflecting a focus on organic growth and targeted acquisitions rather than broad consolidation. Market share distribution sees companies like Novartis AG, F Hoffmann-La Roche Ltd, and Baxter holding substantial portions, especially in segments like injectables for chronic disease management.

Italy Drug Delivery Devices Market Industry Trends & Analysis

The Italian drug delivery devices market is poised for significant growth, driven by a confluence of technological advancements, evolving patient needs, and a robust healthcare infrastructure. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% between 2025 and 2033. A primary growth driver is the increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular conditions, which necessitate continuous and effective drug administration. This escalating disease burden directly translates into a higher demand for sophisticated drug delivery systems that can enhance therapeutic outcomes and patient quality of life.

Technological disruptions are at the forefront of market evolution. Innovations in areas such as microfluidics, nanotechnology, and smart drug delivery systems are enabling more targeted and controlled release of medications, minimizing side effects and maximizing drug efficacy. The development of patient-centric devices, including auto-injectors and pre-filled syringes, is transforming the landscape of self-administration, empowering patients to manage their conditions more effectively at home. This trend is particularly pronounced in the diabetes and autoimmune disease segments, where home monitoring and regular injections are commonplace.

Consumer preferences are increasingly aligning with convenience, safety, and improved therapeutic experience. Patients are actively seeking drug delivery solutions that reduce pain, minimize the frequency of administration, and are easy to use. This demand is pushing manufacturers to invest in ergonomic designs and user-friendly interfaces. Furthermore, the growing emphasis on personalized medicine is creating opportunities for customized drug delivery devices tailored to individual patient needs and treatment regimens.

The competitive dynamics within the Italian market are characterized by strategic partnerships, product differentiation, and a strong focus on R&D. Companies are actively collaborating to leverage each other's expertise and technologies. For example, the joint development of Ready-To-Use (RTU) solution platforms by Stevanato Group SpA and Gerresheimer AG exemplifies this trend, aiming to streamline the pharmaceutical supply chain and enhance product offerings. Market penetration for advanced drug delivery devices is steadily increasing, particularly in urban centers and regions with advanced healthcare facilities. The push towards digitalization and connectivity in healthcare also presents opportunities for smart drug delivery devices that can track adherence and transmit data to healthcare providers, thereby improving treatment adherence and outcomes. The overall market penetration is estimated to be around XX% in 2025, with significant potential for expansion.

Leading Markets & Segments in Italy Drug Delivery Devices Market

The Italian drug delivery devices market exhibits a clear dominance in specific segments, driven by prevailing healthcare needs and technological advancements.

Route of Administration: The Injectable route of administration is the most dominant segment within the Italian drug delivery devices market. This supremacy is primarily attributed to:

- High Efficacy for Chronic Diseases: Many critical medications for conditions like cancer, diabetes, and autoimmune diseases are most effectively delivered via injection due to poor oral bioavailability or the need for rapid therapeutic onset.

- Advancements in Injectable Technology: The continuous development of innovative injectable devices such as pre-filled syringes, auto-injectors, and pen injectors has made self-administration more convenient and less intimidating for patients.

- Growing Pharmaceutical Pipeline: A substantial portion of new drug development, particularly biologics and biosimilars, are designed for injectable administration. The Topical segment holds a significant share due to the widespread use of creams, gels, and patches for dermatological conditions and localized pain management. Ocular drug delivery devices, while a niche, are experiencing steady growth driven by the increasing prevalence of eye conditions and advancements in targeted ocular therapies. Other Routes of Administration, including inhalation and transdermal patches for systemic delivery, are also gaining traction as therapeutic options expand.

Application: The Cancer application segment is a major revenue generator and growth engine for the Italian drug delivery devices market. This is propelled by:

- Rising Cancer Incidence: Italy, like many developed nations, faces a significant and growing burden of cancer diagnoses.

- Sophistication of Oncology Treatments: Modern cancer therapies, including chemotherapy, immunotherapy, and targeted therapies, often require precise and controlled drug delivery, frequently via injectables.

- Development of Biologics: A significant number of new oncology drugs are biologics, which are primarily administered through injectable routes. The Cardiovascular and Diabetes segments are also substantial, driven by the high prevalence of these chronic conditions and the necessity for ongoing medication. The continuous management of blood glucose levels in diabetes and the long-term treatment of heart conditions rely heavily on effective drug delivery systems. Infectious Diseases application is witnessing growth with the development of novel treatments and vaccines requiring specific delivery mechanisms.

End User: Hospitals represent the largest end-user segment in the Italian drug delivery devices market. This dominance stems from:

- Inpatient and Outpatient Treatments: A vast majority of complex medical procedures, critical care, and initial treatment phases for many diseases occur within hospital settings.

- High Volume of Procedures: Hospitals administer a wide array of injectable drugs for various therapeutic areas, including surgery, critical care, and chronic disease management.

- Procurement Power: Hospitals often have larger procurement budgets and established supply chains for medical devices. Ambulatory Surgical Centers are a growing segment, especially for outpatient procedures requiring drug administration. The focus on same-day surgeries and efficient patient throughput favors easy-to-use and pre-packaged drug delivery devices. Other End Users, including clinics, long-term care facilities, and home healthcare settings, are also expanding, reflecting the trend towards decentralized healthcare and home-based treatment.

Italy Drug Delivery Devices Market Product Developments

The Italian drug delivery devices market is characterized by continuous product innovation focused on enhancing patient compliance, therapeutic efficacy, and safety. Key trends include the development of advanced auto-injector designs offering improved ergonomics and reduced injection force, alongside the proliferation of pre-filled syringes and vials with integrated safety features to prevent needlestick injuries. Smart drug delivery systems are emerging, incorporating electronic components for dose tracking, adherence monitoring, and data transmission to healthcare providers, especially crucial for chronic disease management. The focus is on miniaturization, disposability, and user-friendly interfaces, catering to a growing demand for home-use devices and self-administration. This innovation pipeline is crucial for maintaining competitive advantage and addressing evolving patient and healthcare provider needs.

Key Drivers of Italy Drug Delivery Devices Market Growth

The growth of the Italy drug delivery devices market is propelled by several interconnected factors. The rising incidence of chronic diseases, including cancer, diabetes, and cardiovascular ailments, necessitates continuous and effective drug administration, driving demand for advanced delivery systems. Technological advancements in areas like biologics, nanotechnology, and smart devices are enabling more targeted, efficient, and patient-friendly drug delivery solutions. An aging population further contributes to this demand, as older individuals often require more frequent and specialized medication. Government initiatives and healthcare reforms aimed at improving patient outcomes and reducing healthcare costs also play a significant role, encouraging the adoption of innovative and cost-effective drug delivery technologies.

Challenges in the Italy Drug Delivery Devices Market Market

Despite its robust growth potential, the Italy drug delivery devices market faces several challenges. Stringent regulatory approvals and the lengthy validation process for new devices can hinder rapid market entry and increase development costs. The high cost associated with advanced drug delivery technologies can be a barrier to widespread adoption, particularly in budget-constrained healthcare systems or for certain patient populations. Intense competition from both established players and emerging manufacturers, coupled with the threat of product obsolescence due to rapid technological advancements, requires continuous innovation and cost optimization. Furthermore, supply chain disruptions, geopolitical uncertainties, and the potential for patent expirations of key drugs can impact the market's stability.

Emerging Opportunities in Italy Drug Delivery Devices Market

Emerging opportunities within the Italian drug delivery devices market are largely driven by unmet medical needs and technological breakthroughs. The growing field of personalized medicine presents significant potential for the development of customized drug delivery devices tailored to individual patient profiles and genetic predispositions. Advancements in biologics and biosimilars are creating a continuous demand for sophisticated delivery systems capable of handling complex molecular structures. The increasing adoption of digital health technologies offers a fertile ground for smart drug delivery devices that can enhance patient adherence, enable remote monitoring, and integrate with electronic health records. Furthermore, strategic partnerships and collaborations between device manufacturers and pharmaceutical companies are crucial for co-developing integrated solutions and accelerating market penetration. The expanding market for rare disease treatments also presents a niche opportunity for specialized drug delivery solutions.

Leading Players in the Italy Drug Delivery Devices Market Sector

- Novartis AG

- F Hoffmann-La Roche Ltd

- Baxter

- BD (Becton Dickinson and Company)

- Teva Pharmaceutical Industries Ltd

- Johnson & Johnson Services Inc

- Viatris Inc

- Gerresheimer AG

- Pfizer Inc

Key Milestones in Italy Drug Delivery Devices Market Industry

- September 2022: Stevanato Group SpA and Gerresheimer AG jointly developed a high-end Ready-To-Use (RTU) solution platform with an initial focus on vials based on Stevanato Group's market-leading EZ-fill technology. This collaboration aims to enhance the pharmaceutical supply chain's efficiency and product quality.

- May 2022: Stevanato Group SpA, an Italian multinational company, signed an exclusive agreement with leading medical device developer and manufacturer Owen Mumford Ltd for its Aidaptus auto-injector. This agreement positions Stevanato Group as an exclusive manufacturing partner, offering comprehensive capabilities to its pharmaceutical clientele and reinforcing its presence in the auto-injector market.

Strategic Outlook for Italy Drug Delivery Devices Market Market

The strategic outlook for the Italy drug delivery devices market is highly promising, fueled by ongoing innovation and a robust demand for advanced healthcare solutions. Key growth accelerators include the continued development of user-friendly and patient-centric devices that promote self-administration and improve treatment adherence, particularly for chronic conditions. The integration of digital technologies, leading to the emergence of connected and smart drug delivery systems, will be critical for enhancing therapeutic outcomes and providing valuable data insights for healthcare providers. Strategic partnerships between pharmaceutical companies, device manufacturers, and technology providers will continue to be instrumental in accelerating product development and market penetration. Furthermore, a sustained focus on expanding into niche therapeutic areas and addressing the needs of an aging population will solidify the market's long-term growth trajectory.

Italy Drug Delivery Devices Market Segmentation

-

1. Route of Administration

- 1.1. Injectable

- 1.2. Topical

- 1.3. Ocular

- 1.4. Other Routes of Administration

-

2. Application

- 2.1. Cancer

- 2.2. Cardiovascular

- 2.3. Diabetes

- 2.4. Infectious Diseases

- 2.5. Other Applications

-

3. End User

- 3.1. Hospitals

- 3.2. Ambulatory Surgical Centers

- 3.3. Other End Users

Italy Drug Delivery Devices Market Segmentation By Geography

- 1. Italy

Italy Drug Delivery Devices Market Regional Market Share

Geographic Coverage of Italy Drug Delivery Devices Market

Italy Drug Delivery Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Chronic Diseases; Technological Advancements Coupled with Rapidly Growing Biologics Market

- 3.3. Market Restrains

- 3.3.1. Risk of Needlestick Injuries

- 3.4. Market Trends

- 3.4.1. Injectable Under Route of Administration is Estimated to Witness Healthy Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Drug Delivery Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 5.1.1. Injectable

- 5.1.2. Topical

- 5.1.3. Ocular

- 5.1.4. Other Routes of Administration

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cancer

- 5.2.2. Cardiovascular

- 5.2.3. Diabetes

- 5.2.4. Infectious Diseases

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Ambulatory Surgical Centers

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Novartis AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 F Hoffmann-La Roche Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Baxter

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BD (Becton Dickinson and Company)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Teva Pharmaceutical Industries Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Johnson & Johnson Services Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Viatris Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gerresheimer AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pfizer Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Novartis AG

List of Figures

- Figure 1: Italy Drug Delivery Devices Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Drug Delivery Devices Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Drug Delivery Devices Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 2: Italy Drug Delivery Devices Market Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 3: Italy Drug Delivery Devices Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Italy Drug Delivery Devices Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Italy Drug Delivery Devices Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Italy Drug Delivery Devices Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Italy Drug Delivery Devices Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Italy Drug Delivery Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Italy Drug Delivery Devices Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 10: Italy Drug Delivery Devices Market Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 11: Italy Drug Delivery Devices Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Italy Drug Delivery Devices Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Italy Drug Delivery Devices Market Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Italy Drug Delivery Devices Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Italy Drug Delivery Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Italy Drug Delivery Devices Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Drug Delivery Devices Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the Italy Drug Delivery Devices Market?

Key companies in the market include Novartis AG, F Hoffmann-La Roche Ltd, Baxter, BD (Becton Dickinson and Company), Teva Pharmaceutical Industries Ltd, Johnson & Johnson Services Inc, Viatris Inc , Gerresheimer AG, Pfizer Inc.

3. What are the main segments of the Italy Drug Delivery Devices Market?

The market segments include Route of Administration, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 96.73 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Chronic Diseases; Technological Advancements Coupled with Rapidly Growing Biologics Market.

6. What are the notable trends driving market growth?

Injectable Under Route of Administration is Estimated to Witness Healthy Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Risk of Needlestick Injuries.

8. Can you provide examples of recent developments in the market?

In September 2022, Stevanato Group SpA and Gerresheimer AG jointly developed a high-end Ready-To-Use (RTU) solution platform with an initial focus on vials based on Stevanato Group's market-leading EZ-fill technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Drug Delivery Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Drug Delivery Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Drug Delivery Devices Market?

To stay informed about further developments, trends, and reports in the Italy Drug Delivery Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence