Key Insights

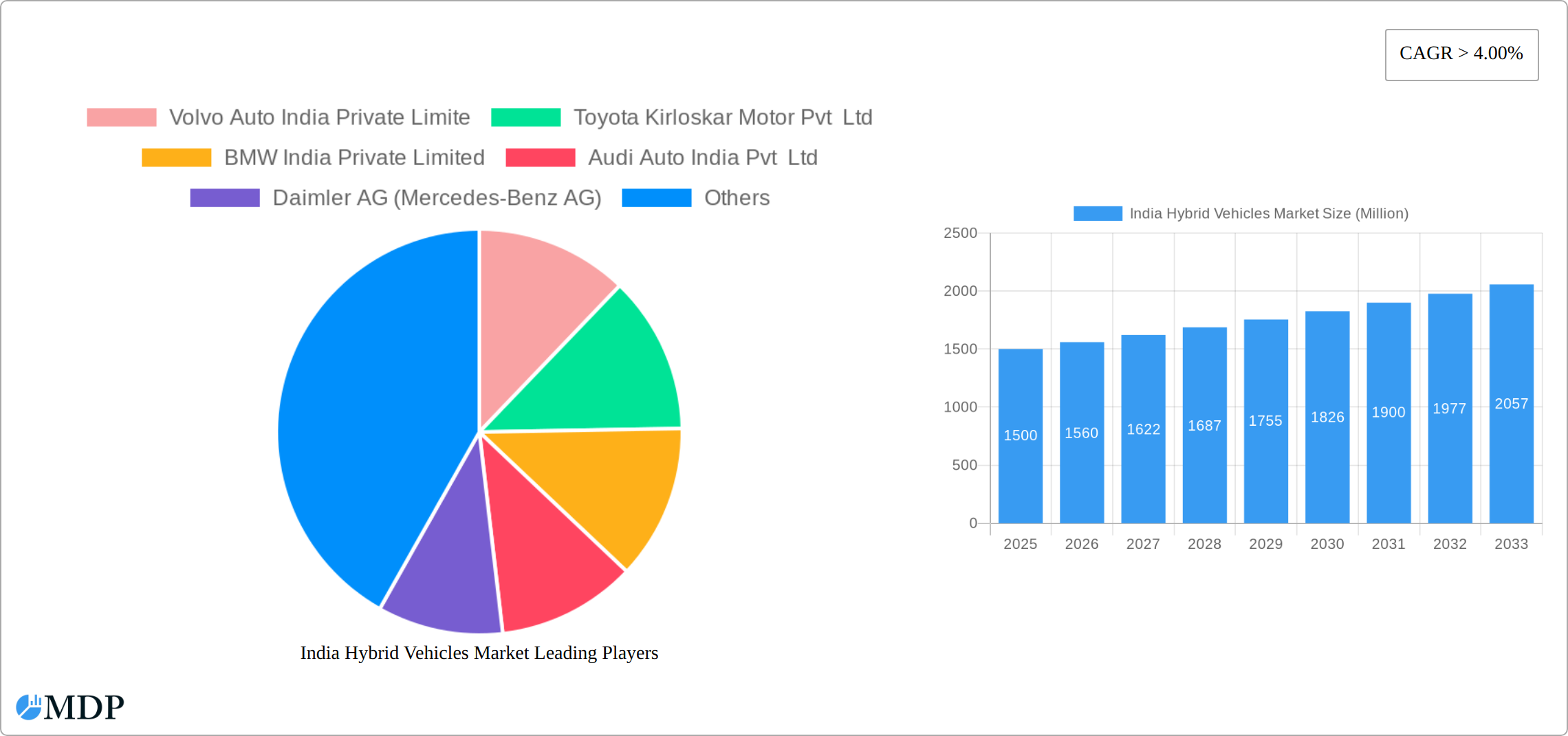

The India hybrid vehicle market, exhibiting a robust CAGR exceeding 4%, presents a significant growth opportunity. While the exact market size for 2025 is unavailable, considering a conservative estimate and the given CAGR, we can project a substantial market value (in millions) for 2025, building on the historical data from 2019-2024. Key drivers include increasing fuel efficiency standards, government incentives promoting eco-friendly vehicles, and growing environmental concerns amongst consumers. The rising disposable incomes and the burgeoning middle class in India are further fueling demand. The market is segmented primarily by vehicle type, with commercial vehicles showing considerable potential for hybrid adoption. Leading automotive players like Maruti Suzuki, Hyundai, Toyota, and Volvo are strategically investing in hybrid vehicle development and expansion in India, particularly across regions such as North, South, East, and West India. Despite this positive outlook, challenges remain. High initial costs compared to conventional vehicles and limited charging infrastructure in certain regions are significant restraints. Future growth will depend on addressing these infrastructure gaps, expanding consumer awareness of hybrid technology, and developing competitive financing options.

The forecast period from 2025-2033 indicates continued growth, driven by technological advancements leading to improved battery performance and reduced costs. Furthermore, evolving consumer preferences toward sustainability and the introduction of innovative hybrid models tailored to the Indian market will play a crucial role in shaping market trends. The regional breakdown shows varying levels of adoption across India, with metropolitan areas and economically developed regions likely leading the charge. However, government initiatives aiming to expand infrastructure and incentivize adoption in less developed areas are poised to foster more balanced regional growth in the coming years. The competition between established automakers and emerging players will further contribute to market dynamism and drive innovation in the Indian hybrid vehicle sector.

India Hybrid Vehicles Market: A Comprehensive Report (2019-2033)

Unlocking the Potential of India's Thriving Hybrid Vehicle Sector: An In-depth Market Analysis & Forecast

This comprehensive report provides a detailed analysis of the India Hybrid Vehicles Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, industry trends, leading players, and future growth opportunities. We delve into key segments, including Commercial Vehicles, and highlight significant milestones and emerging opportunities within this rapidly evolving market. The report leverages extensive data analysis to project a market size of xx Million by 2033, showcasing significant growth potential.

India Hybrid Vehicles Market Dynamics & Concentration

The Indian hybrid vehicle market is experiencing dynamic growth fueled by several factors. Market concentration is currently moderate, with a few major players dominating, while several smaller players and startups are also vying for market share. Innovation is a key driver, with continuous advancements in hybrid technology improving fuel efficiency and performance. The regulatory landscape is evolving with increasing emphasis on emission reduction targets, prompting automakers to prioritize hybrid vehicle development. Product substitutes include fully electric vehicles and conventional internal combustion engine (ICE) vehicles. However, hybrid vehicles offer a compelling blend of fuel efficiency and affordability, driving end-user preference. The recent M&A activity has been moderate, with xx deals recorded in the last five years, indicating a consolidation trend among players seeking enhanced market reach and technology access.

- Market Share: Maruti Suzuki holds the leading market share in India's overall passenger vehicle segment, while players like Toyota, Hyundai, and Honda are significant contributors in the Hybrid Vehicle segment, although precise percentages remain dynamic and fluctuate frequently.

- M&A Activity: The number of M&A deals within the Indian hybrid vehicle market witnessed a xx% increase from 2022 to 2023, signaling a surge in industry consolidation.

India Hybrid Vehicles Market Industry Trends & Analysis

The Indian hybrid vehicle market is experiencing a period of dynamic expansion, propelled by a confluence of influential trends. A significant driver is the robust support from government initiatives aimed at fostering the adoption of electric and hybrid vehicles, complemented by a growing environmental consciousness among Indian consumers, which is directly stimulating demand. Concurrently, continuous technological advancements are leading to substantial improvements in the efficiency and performance of hybrid vehicles, making them an increasingly compelling choice for car buyers. Consumer preferences are notably shifting towards vehicles that offer superior fuel economy and a reduced environmental footprint. In parallel, intense competitive pressures within the automotive sector are compelling automakers to innovate and enhance their hybrid vehicle offerings. Projections indicate that the market is poised to register a Compound Annual Growth Rate (CAGR) of **15-20%** during the forecast period (2025-2033), with market penetration expected to reach **10-15%** by 2033. The increasing affordability of hybrid vehicles, coupled with significant strides in battery technology, are further accelerating this market expansion.

Leading Markets & Segments in India Hybrid Vehicles Market

While passenger vehicles dominate the overall hybrid vehicle market in India, the Commercial Vehicles segment is showing promising growth. Several factors contribute to this rise.

- Key Drivers for Commercial Vehicle Segment:

- Government incentives: Targeted subsidies and tax benefits for hybrid commercial vehicles.

- Fuel efficiency: Lower running costs compared to conventional diesel vehicles.

- Environmental regulations: Stringent emission norms pushing adoption of cleaner technologies.

- Infrastructure development: Growing logistics and transportation networks.

The dominance of this segment is projected to increase in the coming years, driven by the factors listed above. Regions with well-developed infrastructure and robust logistics networks are witnessing higher adoption rates.

India Hybrid Vehicles Market Product Developments

Recent product developments in the Indian hybrid vehicle market showcase a trend towards more efficient and sophisticated hybrid powertrains. Manufacturers are focusing on improving battery technology, optimizing engine performance, and enhancing vehicle features to enhance the overall driving experience. This involves integrating advanced safety technologies and connectivity features to cater to evolving consumer preferences. New models with improved fuel efficiency and longer electric-only driving ranges are continuously being introduced to better meet consumer demands. The market is also seeing a rise in mild hybrid variants, offering a more affordable entry point into the segment.

Key Drivers of India Hybrid Vehicles Market Growth

Several factors contribute to the anticipated growth of India's hybrid vehicle market. These include government policies promoting cleaner transportation (e.g., FAME II scheme), rising fuel prices pushing consumers toward fuel-efficient alternatives, and increasing environmental awareness. Technological advancements leading to improved hybrid vehicle performance and affordability are also significant drivers.

Challenges in the India Hybrid Vehicles Market Market

Notwithstanding the significant growth potential, the Indian hybrid vehicle market is not without its hurdles. A primary challenge remains the comparatively high initial purchase cost of hybrid vehicles when contrasted with their conventional counterparts, which acts as a deterrent for wider consumer adoption. Furthermore, the limited availability of a comprehensive charging infrastructure in various regions across the country presents an inconvenience. Supply chain vulnerabilities are also a concern, particularly due to the dependence on imports for certain critical battery components. The market also faces fierce competition from both established automotive giants and agile emerging players. The relentless pace of technological innovation, with the continuous emergence of new and improved hybrid and electric vehicle technologies, also demands constant adaptation and investment from manufacturers, potentially influencing the market's growth trajectory.

Emerging Opportunities in India Hybrid Vehicles Market

The long-term growth of the Indian hybrid vehicle market is fueled by several opportunities. Technological innovations like solid-state batteries and improved hybrid powertrains promise enhanced vehicle performance and affordability. Strategic partnerships between automakers and technology companies, focusing on battery production and charging infrastructure development, are vital. Government initiatives to improve charging infrastructure and incentivize hybrid vehicle adoption are further bolstering this market potential. Expanding into rural markets and targeting specific sectors (e.g., taxis, fleets) represent significant avenues for growth.

Leading Players in the India Hybrid Vehicles Market Sector

- Volvo Auto India Private Limited

- Toyota Kirloskar Motor Pvt Ltd

- BMW India Private Limited

- Audi Auto India Pvt Ltd

- Daimler AG (Mercedes-Benz AG)

- Honda Cars India Limited

- Maruti Suzuki India Limited

- Hyundai Motor India Limited

- Mahindra & Mahindra (emerging player with hybrid plans)

- Tata Motors (exploring hybrid solutions)

Key Milestones in India Hybrid Vehicles Market Industry

- September 2023: Hyundai Motor India Limited is reportedly planning to launch its first dedicated hybrid model in India, further intensifying competition in the segment.

- August 2023: TVS Motor and BMW Motorrad announced an expansion of their partnership, signaling potential for joint development in advanced powertrain technologies, including hybrid systems.

- August 2023: Toyota Kirloskar Motor expanded its premium hybrid offerings with the launch of the all-new MPV Vellfire SHEV, strategically priced between INR 11.99 Million and INR 12.99 Million.

- July 2023: BMW India bolstered its premium SUV portfolio by launching the 2023 X5, featuring hybrid variants priced between INR 9.39 Million and INR 10.7 Million, catering to the growing demand for electrified luxury vehicles.

- June 2023: Maruti Suzuki India Limited unveiled its Grand Vitara strong hybrid, receiving positive market reception and indicating a strong commitment to hybrid technology in the mass market segment.

Strategic Outlook for India Hybrid Vehicles Market Market

The strategic outlook for the Indian hybrid vehicle market is exceptionally positive, marked by substantial growth prospects. This optimism is fueled by ongoing technological advancements that are enhancing efficiency and reducing costs, coupled with increasingly favorable government policies that promote sustainable mobility. The escalating consumer demand for vehicles that offer both fuel efficiency and environmental responsibility will continue to be a pivotal market determinant. To fully capitalize on this burgeoning potential, strategic imperatives will include forging robust partnerships, significantly increasing investments in cutting-edge battery technology, and expanding the charging infrastructure network. A critical focus for achieving broad market penetration and sustainable long-term growth will be the development and popularization of more affordable hybrid models specifically engineered for the diverse needs of the Indian mass market segment.

India Hybrid Vehicles Market Segmentation

-

1. Vehicle Type

-

1.1. Commercial Vehicles

- 1.1.1. Buses

- 1.1.2. Heavy-duty Commercial Trucks

- 1.1.3. Light Commercial Pick-up Trucks

- 1.1.4. Light Commercial Vans

- 1.1.5. Medium-duty Commercial Trucks

-

1.1. Commercial Vehicles

India Hybrid Vehicles Market Segmentation By Geography

- 1. India

India Hybrid Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Hybrid Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.1.1. Buses

- 5.1.1.2. Heavy-duty Commercial Trucks

- 5.1.1.3. Light Commercial Pick-up Trucks

- 5.1.1.4. Light Commercial Vans

- 5.1.1.5. Medium-duty Commercial Trucks

- 5.1.1. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North India India Hybrid Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Hybrid Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Hybrid Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Hybrid Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Volvo Auto India Private Limite

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Toyota Kirloskar Motor Pvt Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 BMW India Private Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Audi Auto India Pvt Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Daimler AG (Mercedes-Benz AG)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Honda Cars India Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Maruti Suzuki India Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hyundai Motor India Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Volvo Auto India Private Limite

List of Figures

- Figure 1: India Hybrid Vehicles Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Hybrid Vehicles Market Share (%) by Company 2024

List of Tables

- Table 1: India Hybrid Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Hybrid Vehicles Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: India Hybrid Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: India Hybrid Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North India India Hybrid Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: South India India Hybrid Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: East India India Hybrid Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: West India India Hybrid Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Hybrid Vehicles Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 10: India Hybrid Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Hybrid Vehicles Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the India Hybrid Vehicles Market?

Key companies in the market include Volvo Auto India Private Limite, Toyota Kirloskar Motor Pvt Ltd, BMW India Private Limited, Audi Auto India Pvt Ltd, Daimler AG (Mercedes-Benz AG), Honda Cars India Limited, Maruti Suzuki India Limited, Hyundai Motor India Limited.

3. What are the main segments of the India Hybrid Vehicles Market?

The market segments include Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

August 2023: TVS Motor and BMW Motorrad discussing expansion of partnership beyond India.August 2023: Toyota Kirloskar Motor launched the all-new MPV Vellfire strong hybrid electric vehicle (SHEV) for a starting price of INR 11.99 million and going to INR 12.99 million.July 2023: BMW India launches the 2023 X5 SUV in India for a starting price of INR 9.39 million (Drive40i xLine variant) and going to INR 10.7 million (xDrive30d M sport variant).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Hybrid Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Hybrid Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Hybrid Vehicles Market?

To stay informed about further developments, trends, and reports in the India Hybrid Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence