Key Insights

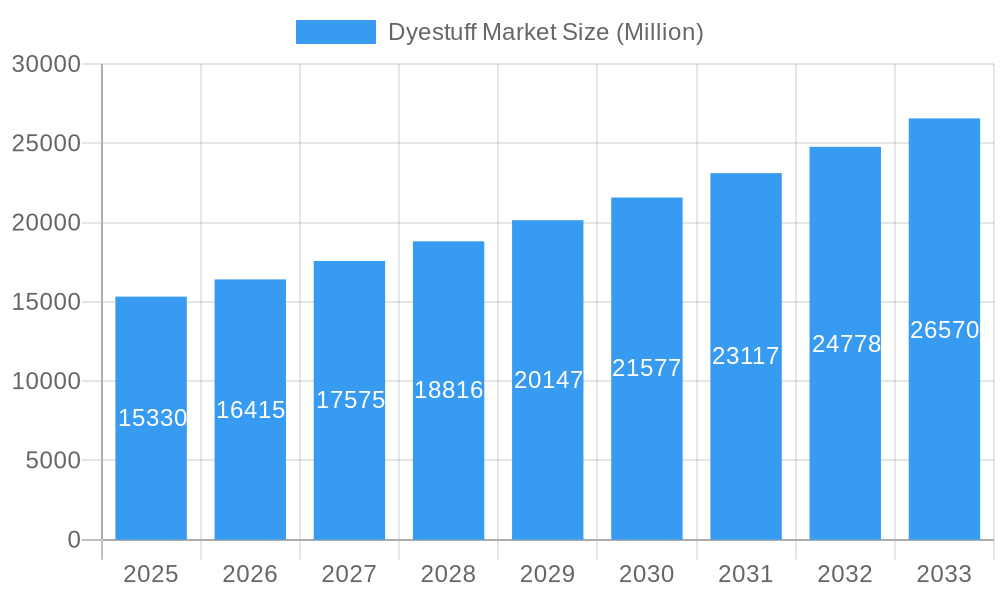

The global dyestuff market is poised for significant expansion, projected to reach an estimated $15.33 billion in 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.28%. This impressive trajectory is driven by escalating demand from key end-user industries, most notably textiles, which continues to be a dominant consumer of dyestuffs and pigments. The paints and coatings sector also represents a substantial growth avenue, fueled by increasing construction activities and the demand for aesthetically pleasing and durable finishes. Furthermore, the printing inks industry's evolution towards more sophisticated and environmentally friendly formulations is creating new opportunities for advanced dyestuffs and pigments. Emerging economies, particularly in Asia Pacific, are anticipated to lead this growth due to rapid industrialization, increasing disposable incomes, and a burgeoning manufacturing base.

Dyestuff Market Market Size (In Billion)

The market's expansion is further propelled by ongoing technological advancements in dye and pigment synthesis, leading to the development of products with enhanced colorfastness, environmental sustainability, and application efficiency. Innovations focusing on eco-friendly and biodegradable dyestuffs are gaining traction, driven by increasing regulatory pressures and consumer preferences for sustainable products. While the market benefits from these drivers, it also faces certain restraints, such as the fluctuating raw material prices, stringent environmental regulations concerning effluent discharge from manufacturing processes, and the inherent complexity in developing novel, high-performance colorants. Despite these challenges, the diverse range of applications across various industries, coupled with strategic investments in research and development by leading players like BASF SE, Clariant, and ALTANA AG, ensures a dynamic and promising future for the global dyestuff market.

Dyestuff Market Company Market Share

Unlock the future of the vibrant dyestuff market with our comprehensive report, offering deep dives into market dynamics, industry trends, leading segments, and strategic opportunities. This essential resource provides actionable insights for stakeholders navigating the evolving landscape of dyes and pigments, projected to reach $XX billion by 2033. Leveraging extensive historical data (2019-2024) and robust forecasts (2025-2033), this report equips you with the knowledge to capitalize on emerging trends and competitive advantages.

Dyestuff Market Market Dynamics & Concentration

The global dyestuff market exhibits moderate concentration, with key players like ALTANA AG, Clariant, BASF SE, and DIC CORPORATION holding significant market share. Innovation remains a primary driver, fueled by advancements in eco-friendly formulations and high-performance pigments. Regulatory frameworks, particularly concerning environmental impact and sustainability, are increasingly shaping market strategies and product development. The threat of product substitutes, while present from alternative coloring technologies, is mitigated by the inherent properties and cost-effectiveness of traditional dyes and pigments across diverse applications. End-user industry trends, such as the growing demand for sustainable textiles and vibrant automotive coatings, directly influence market growth. Mergers and acquisitions (M&A) activities are strategic tools for market expansion and portfolio diversification. For instance, the January 2022 divestment of Clariant's Pigments business and June 2021 acquisition of BASF's pigments business by DIC Corporation highlight significant shifts in market structure and ownership. These M&A events underscore the dynamic nature of industry consolidation and the pursuit of competitive advantage.

Dyestuff Market Industry Trends & Analysis

The dyestuff market is poised for robust growth, driven by a confluence of factors including escalating demand from the textile industry, burgeoning paints and coatings sector, and the expanding applications of pigments in plastics and printing inks. The projected Compound Annual Growth Rate (CAGR) for the forecast period is XX%, reflecting a strong upward trajectory. Technological disruptions are at the forefront, with a significant emphasis on the development and adoption of sustainable dyestuffs and eco-friendly pigment manufacturing processes. Consumer preferences are increasingly shifting towards products with reduced environmental footprints, driving innovation in biodegradable dyes and low-VOC pigments. This paradigm shift is fostering the adoption of novel colorant chemistries and advanced application techniques. The competitive landscape is characterized by intense R&D efforts, strategic partnerships, and a constant pursuit of cost optimization and product differentiation. Market penetration of specialty pigments and high-performance dyes is on the rise, catering to niche applications demanding superior durability, color fastness, and specific functional properties. The integration of digital technologies in color matching and production is also gaining traction, enhancing efficiency and precision within the industry. The growing disposable incomes in emerging economies are further fueling demand across various end-user segments, particularly textiles and consumer goods, thereby reinforcing the market's expansionary trend.

Leading Markets & Segments in Dyestuff Market

The Textile industry stands as a dominant end-user segment within the global dyestuff market, propelled by the ever-present demand for colored apparel and home furnishings. Within the Dye category, Reactive Dyes and Disperse Dyes command significant market share due to their versatility and widespread application in dyeing cotton and polyester fibers, respectively. The Paints and Coatings industry represents another substantial market, driven by construction, automotive, and industrial applications. In the Pigment segment, Organic Pigments are witnessing robust demand owing to their superior color strength and versatility, particularly in printing inks and plastics.

Dominant Segments:

- End-User Industry: Textile (driven by global apparel demand, increasing fashion trends, and home textile production).

- Type (Dye): Reactive Dye (essential for vibrant and wash-fast colors on cotton), Disperse Dye (critical for synthetic fiber coloration).

- Type (Pigment): Organic Pigment (widely used in printing inks, plastics, and automotive coatings due to high tinting strength and color variety).

Key Drivers of Dominance:

- Economic Policies: Favorable trade agreements and industrial policies in key textile-producing nations stimulate demand for dyes.

- Infrastructure Development: Growth in the construction sector directly impacts the demand for paints and coatings, and consequently, pigments.

- Consumer Trends: The persistent demand for colored products across fashion, automotive, and packaging sectors fuels segment growth.

- Technological Advancements: Development of high-performance and eco-friendly dyes and pigments enhances their applicability and market penetration.

- Urbanization: Increasing urbanization in developing regions leads to higher consumption of consumer goods that utilize dyes and pigments.

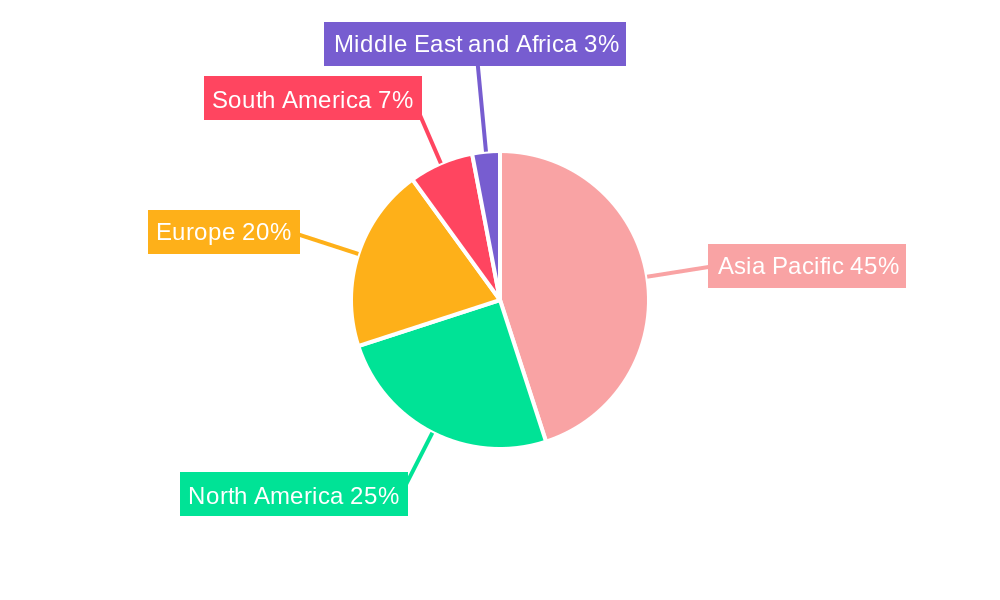

The Asia-Pacific region is the largest and fastest-growing geographical market for dyestuffs, owing to its robust manufacturing base in textiles, plastics, and coatings, coupled with a burgeoning consumer market. Countries like China and India are pivotal to this regional dominance.

Dyestuff Market Product Developments

Product innovation in the dyestuff market centers on enhancing sustainability, performance, and application efficiency. Key developments include the creation of high-fastness dyes with reduced water consumption, bio-based pigments derived from renewable resources, and specialized effect pigments for premium finishes. Advancements in nanotechnology are enabling the development of colorants with improved UV stability and durability. These innovations offer distinct competitive advantages by meeting stringent environmental regulations and catering to the growing demand for visually appealing and long-lasting colored products across various end-user industries.

Key Drivers of Dyestuff Market Growth

The growth of the dyestuff market is primarily propelled by the sustained demand from the textile sector, driven by fast fashion trends and increasing global apparel consumption. The expanding paints and coatings industry, fueled by construction and automotive manufacturing, is a significant contributor. Furthermore, the increasing application of pigments in plastics for consumer goods, packaging, and automotive components adds to market expansion. Technological innovations focusing on eco-friendly and high-performance colorants, coupled with supportive regulatory frameworks promoting sustainable practices, are also key growth catalysts. The rising disposable incomes in emerging economies further boost demand across various consumer-facing industries.

Challenges in the Dyestuff Market Market

Despite strong growth prospects, the dyestuff market faces several challenges. Stringent environmental regulations regarding wastewater discharge and the use of certain chemical compounds pose compliance hurdles for manufacturers, leading to increased operational costs. Fluctuations in raw material prices, particularly petrochemical derivatives, can impact profitability and supply chain stability. Intense competition and price sensitivity in some segments, especially for commodity dyes, can limit profit margins. Moreover, the ongoing shift towards digital printing technologies, while an opportunity, also presents a challenge for traditional dyeing methods, requiring adaptation and innovation.

Emerging Opportunities in Dyestuff Market

Emerging opportunities in the dyestuff market lie in the burgeoning demand for sustainable and bio-based colorants, driven by increasing consumer awareness and regulatory pressure. The development of functional dyes and pigments with properties like UV protection, antimicrobial activity, and thermal regulation presents significant growth avenues. Expansion into emerging economies with rapidly growing manufacturing sectors and consumer bases offers substantial market penetration potential. Strategic partnerships and collaborations for research and development of novel colorant technologies, as well as M&A activities to consolidate market positions and expand product portfolios, are crucial for leveraging these opportunities.

Leading Players in the Dyestuff Market Sector

- ALTANA AG

- Clariant

- Sudarshan Chemical Industries Limited

- Merck KGaA

- Kiri Industries Ltd

- Tronox Holdings PLC

- LANXESS

- BASF SE

- Huntsman International LLC

- CATHAY INDUSTRIES

- DuPont

- Archroma

- Bodal Chemicals Ltd

- Meghmani Group

- DIC CORPORATION

- Carl Schlenk AG

- KRONOS Worldwide Inc

- ISHIHARA SANGYO KAISHA LTD

- Flint Group

Key Milestones in Dyestuff Market Industry

- January 2022: Clariant completed the sale of its Pigments business to a consortium of Heubach Group and SK Capital Partners, retaining a 20% stake in the newly formed Group. This strategic divestment reshaped market dynamics and ownership structures.

- June 2021: DIC Corporation finalized the acquisition of BASF's global pigments business, known as BASF Colors & Effects (BCE), following an announcement in August 2019. This major acquisition significantly consolidated the pigment market landscape.

Strategic Outlook for Dyestuff Market Market

The strategic outlook for the dyestuff market is characterized by a strong emphasis on sustainable innovation, market expansion in high-growth regions, and a focus on value-added specialty products. Companies are investing in R&D to develop environmentally friendly dyes and pigments that meet stringent global regulations and evolving consumer preferences. Exploring new applications for colorants in emerging sectors like smart textiles and advanced materials will be crucial. Strategic acquisitions and partnerships will continue to play a vital role in enhancing market reach, technological capabilities, and product portfolios, ensuring sustained growth and competitive advantage in the dynamic global dyestuff landscape.

Dyestuff Market Segmentation

-

1. Type

-

1.1. Dye

- 1.1.1. Reactive Dye

- 1.1.2. Disperse Dye

- 1.1.3. Sulfur Dye

- 1.1.4. Vat Dye

- 1.1.5. Azo Dye

- 1.1.6. Acid Dye

-

1.2. Pigment

- 1.2.1. Organic Pigment

- 1.2.2. Inorganic Pigment

-

1.1. Dye

-

2. End-user Industry

- 2.1. Paints and Coatings

- 2.2. Textile

- 2.3. Printing Inks

- 2.4. Plastics

- 2.5. Other End-user Industries

Dyestuff Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Dyestuff Market Regional Market Share

Geographic Coverage of Dyestuff Market

Dyestuff Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Paints and Coating Industry in Asia-Pacific; Increasing Demand from the Textile Industry

- 3.3. Market Restrains

- 3.3.1. Environmental Concerns Regarding the Use of Dyes and Pigments; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Paints and Coatings

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dyestuff Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Dye

- 5.1.1.1. Reactive Dye

- 5.1.1.2. Disperse Dye

- 5.1.1.3. Sulfur Dye

- 5.1.1.4. Vat Dye

- 5.1.1.5. Azo Dye

- 5.1.1.6. Acid Dye

- 5.1.2. Pigment

- 5.1.2.1. Organic Pigment

- 5.1.2.2. Inorganic Pigment

- 5.1.1. Dye

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Paints and Coatings

- 5.2.2. Textile

- 5.2.3. Printing Inks

- 5.2.4. Plastics

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Dyestuff Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Dye

- 6.1.1.1. Reactive Dye

- 6.1.1.2. Disperse Dye

- 6.1.1.3. Sulfur Dye

- 6.1.1.4. Vat Dye

- 6.1.1.5. Azo Dye

- 6.1.1.6. Acid Dye

- 6.1.2. Pigment

- 6.1.2.1. Organic Pigment

- 6.1.2.2. Inorganic Pigment

- 6.1.1. Dye

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Paints and Coatings

- 6.2.2. Textile

- 6.2.3. Printing Inks

- 6.2.4. Plastics

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Dyestuff Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Dye

- 7.1.1.1. Reactive Dye

- 7.1.1.2. Disperse Dye

- 7.1.1.3. Sulfur Dye

- 7.1.1.4. Vat Dye

- 7.1.1.5. Azo Dye

- 7.1.1.6. Acid Dye

- 7.1.2. Pigment

- 7.1.2.1. Organic Pigment

- 7.1.2.2. Inorganic Pigment

- 7.1.1. Dye

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Paints and Coatings

- 7.2.2. Textile

- 7.2.3. Printing Inks

- 7.2.4. Plastics

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Dyestuff Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Dye

- 8.1.1.1. Reactive Dye

- 8.1.1.2. Disperse Dye

- 8.1.1.3. Sulfur Dye

- 8.1.1.4. Vat Dye

- 8.1.1.5. Azo Dye

- 8.1.1.6. Acid Dye

- 8.1.2. Pigment

- 8.1.2.1. Organic Pigment

- 8.1.2.2. Inorganic Pigment

- 8.1.1. Dye

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Paints and Coatings

- 8.2.2. Textile

- 8.2.3. Printing Inks

- 8.2.4. Plastics

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Dyestuff Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Dye

- 9.1.1.1. Reactive Dye

- 9.1.1.2. Disperse Dye

- 9.1.1.3. Sulfur Dye

- 9.1.1.4. Vat Dye

- 9.1.1.5. Azo Dye

- 9.1.1.6. Acid Dye

- 9.1.2. Pigment

- 9.1.2.1. Organic Pigment

- 9.1.2.2. Inorganic Pigment

- 9.1.1. Dye

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Paints and Coatings

- 9.2.2. Textile

- 9.2.3. Printing Inks

- 9.2.4. Plastics

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Dyestuff Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Dye

- 10.1.1.1. Reactive Dye

- 10.1.1.2. Disperse Dye

- 10.1.1.3. Sulfur Dye

- 10.1.1.4. Vat Dye

- 10.1.1.5. Azo Dye

- 10.1.1.6. Acid Dye

- 10.1.2. Pigment

- 10.1.2.1. Organic Pigment

- 10.1.2.2. Inorganic Pigment

- 10.1.1. Dye

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Paints and Coatings

- 10.2.2. Textile

- 10.2.3. Printing Inks

- 10.2.4. Plastics

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ALTANA AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clariant

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sudarshan Chemical Industries Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Merck KGaA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kiri Industries Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tronox Holdings PLC*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LANXESS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BASF SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Huntsman International LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CATHAY INDUSTRIES

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 DuPont

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Archroma

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Bodal Chemicals Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Meghmani Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 DIC CORPORATION

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Carl Schlenk AG

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 KRONOS Worldwide Inc

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 ISHIHARA SANGYO KAISHA LTD

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Flint Group

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 ALTANA AG

List of Figures

- Figure 1: Global Dyestuff Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Dyestuff Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: Asia Pacific Dyestuff Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Dyestuff Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Dyestuff Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Dyestuff Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Dyestuff Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Dyestuff Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: North America Dyestuff Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Dyestuff Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: North America Dyestuff Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Dyestuff Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Dyestuff Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Dyestuff Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Europe Dyestuff Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Dyestuff Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Europe Dyestuff Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Dyestuff Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Dyestuff Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Dyestuff Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: South America Dyestuff Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Dyestuff Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: South America Dyestuff Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Dyestuff Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Dyestuff Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Dyestuff Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa Dyestuff Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Dyestuff Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Dyestuff Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Dyestuff Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Dyestuff Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Dyestuff Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Dyestuff Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Dyestuff Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Dyestuff Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Dyestuff Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Dyestuff Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Dyestuff Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Dyestuff Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Dyestuff Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Dyestuff Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Dyestuff Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Dyestuff Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 13: Global Dyestuff Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Dyestuff Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States Dyestuff Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Dyestuff Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico Dyestuff Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Dyestuff Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 19: Global Dyestuff Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Dyestuff Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany Dyestuff Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Dyestuff Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Dyestuff Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: France Dyestuff Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Dyestuff Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Dyestuff Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 27: Global Dyestuff Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Dyestuff Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil Dyestuff Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina Dyestuff Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Dyestuff Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Dyestuff Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global Dyestuff Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Dyestuff Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Dyestuff Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Dyestuff Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Dyestuff Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dyestuff Market?

The projected CAGR is approximately 7.28%.

2. Which companies are prominent players in the Dyestuff Market?

Key companies in the market include ALTANA AG, Clariant, Sudarshan Chemical Industries Limited, Merck KGaA, Kiri Industries Ltd, Tronox Holdings PLC*List Not Exhaustive, LANXESS, BASF SE, Huntsman International LLC, CATHAY INDUSTRIES, DuPont, Archroma, Bodal Chemicals Ltd, Meghmani Group, DIC CORPORATION, Carl Schlenk AG, KRONOS Worldwide Inc, ISHIHARA SANGYO KAISHA LTD, Flint Group.

3. What are the main segments of the Dyestuff Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Paints and Coating Industry in Asia-Pacific; Increasing Demand from the Textile Industry.

6. What are the notable trends driving market growth?

Increasing Demand from the Paints and Coatings.

7. Are there any restraints impacting market growth?

Environmental Concerns Regarding the Use of Dyes and Pigments; Other Restraints.

8. Can you provide examples of recent developments in the market?

January 2022: Clariant completed the sale of its Pigments business to a consortium of Heubach Group ('Heubach') and SK Capital Partners ('SK Capital'). However, the company retains a 20 % stake in the newly formed Group.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dyestuff Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dyestuff Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dyestuff Market?

To stay informed about further developments, trends, and reports in the Dyestuff Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence