Key Insights

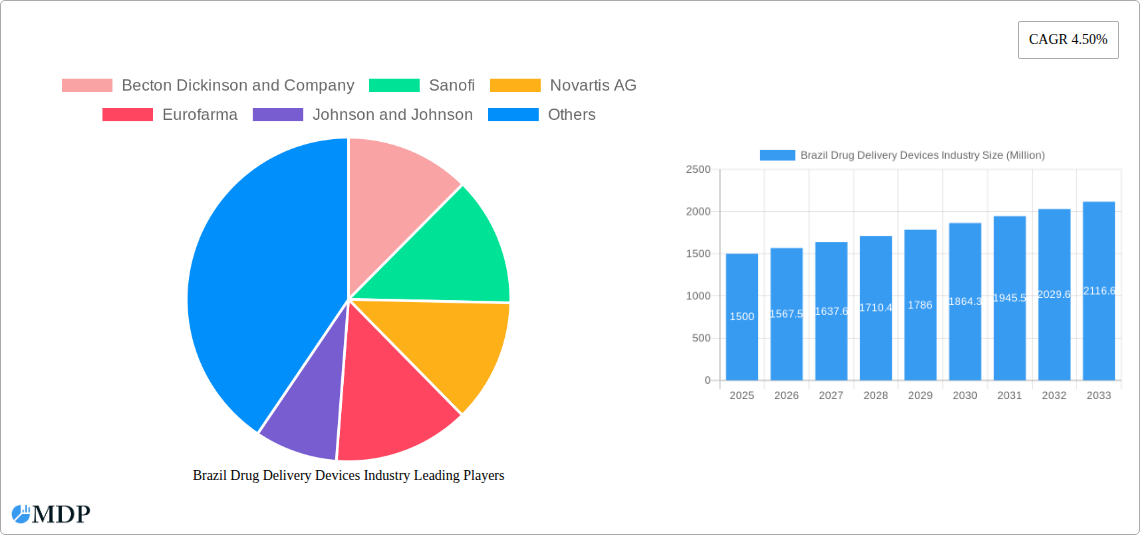

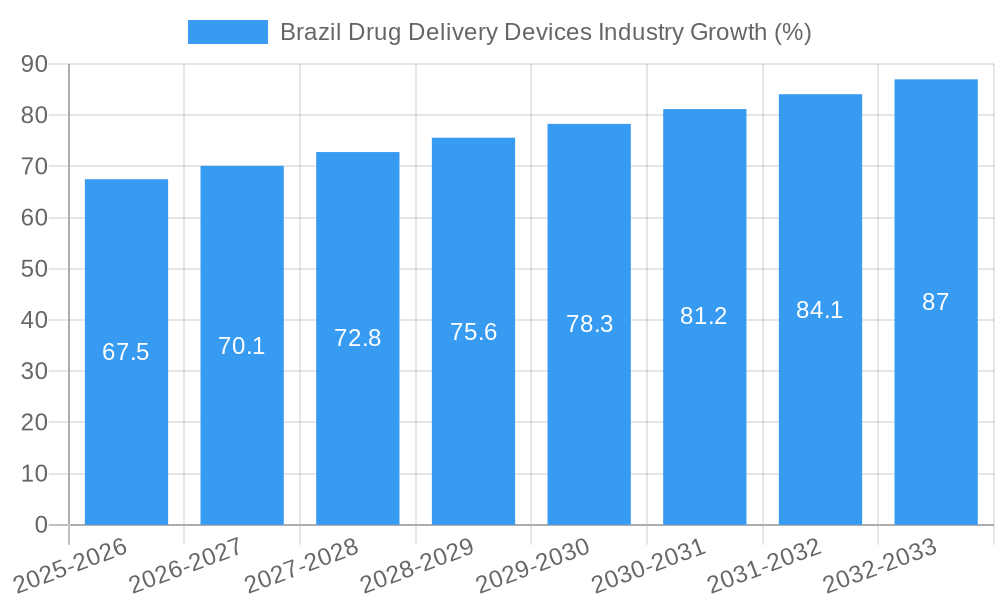

The Brazilian drug delivery devices market presents a compelling investment opportunity, exhibiting a Compound Annual Growth Rate (CAGR) of 4.50% from 2019 to 2033. This growth is driven by several key factors. Firstly, the increasing prevalence of chronic diseases like cancer, cardiovascular conditions, and diabetes fuels demand for efficient drug delivery systems. Advancements in technology are leading to the development of innovative devices such as advanced injectables, targeted drug delivery systems, and minimally invasive technologies, enhancing treatment efficacy and patient compliance. Furthermore, the expanding healthcare infrastructure in Brazil, coupled with rising government initiatives to improve healthcare access, is contributing to market expansion. The market is segmented by route of administration (Injectable, Topical, Ocular, Other), application (Cancer, Cardiovascular, Diabetes, Infectious Diseases, Other), and end-user (Hospitals, Ambulatory Surgical Centers, Other). Injectable devices dominate the market, reflecting the prevalence of injectable medications across various therapeutic areas. Hospitals represent the largest end-user segment due to their advanced infrastructure and specialized medical staff.

However, certain challenges restrain market growth. High costs associated with advanced drug delivery devices and limited healthcare insurance coverage may hinder access for a significant portion of the population. Strict regulatory approvals and stringent quality control measures also pose hurdles for market entrants. Despite these constraints, the long-term outlook remains positive, fueled by a growing geriatric population, increasing awareness of chronic diseases, and ongoing technological advancements. The market is expected to see substantial growth in the forecast period (2025-2033), particularly in segments related to technologically advanced drug delivery systems catering to specific therapeutic needs. Major players like Becton Dickinson, Sanofi, Novartis, and others are actively engaged in expanding their market presence through strategic partnerships, acquisitions, and product innovation within the Brazilian healthcare landscape.

Brazil Drug Delivery Devices Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Brazil drug delivery devices industry, offering invaluable insights for stakeholders across the pharmaceutical and medical device sectors. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report illuminates current market dynamics and future growth trajectories. We leverage historical data (2019-2024) to create a robust and reliable forecast. The report covers key segments, leading players, and emerging opportunities within the Brazilian market, providing actionable intelligence for strategic decision-making. The estimated market size for 2025 is xx Million.

Brazil Drug Delivery Devices Industry Market Dynamics & Concentration

The Brazilian drug delivery devices market is characterized by a dynamic interplay of factors impacting its concentration and growth. While a few multinational corporations hold significant market share, the presence of strong domestic players like Eurofarma fosters competition. The market exhibits a moderately concentrated structure, with the top 5 players holding an estimated xx% market share in 2025. Innovation, driven by the need for improved drug efficacy and patient compliance, is a key driver. The regulatory landscape, while evolving, presents both opportunities and challenges. Stringent regulatory approvals can slow market entry but ensure higher quality standards. Substitutes such as traditional drug formulations exist, but the advantages of advanced drug delivery systems, such as targeted drug release and reduced side effects, are driving market growth. End-user trends, particularly the increasing preference for outpatient care and minimally invasive procedures, are influencing device demand. The M&A landscape is relatively active, with an estimated xx M&A deals in the past five years, reflecting consolidation and expansion strategies among industry players.

- Market Share: Top 5 players hold approximately xx% in 2025.

- M&A Activity: Approximately xx deals in the past 5 years (2020-2024).

- Innovation Drivers: Improved drug efficacy, patient compliance, and minimally invasive procedures.

- Regulatory Landscape: Stringent approvals, promoting quality but potentially slowing market entry.

Brazil Drug Delivery Devices Industry Industry Trends & Analysis

The Brazilian drug delivery devices market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Several factors contribute to this growth. Firstly, increasing prevalence of chronic diseases such as diabetes, cardiovascular diseases, and cancer fuels demand for effective drug delivery solutions. Secondly, advancements in nanotechnology and other technological disruptions are leading to the development of more sophisticated and targeted drug delivery systems. Consumer preferences are shifting towards convenient and user-friendly devices, impacting product design and market penetration. Competitive dynamics are intense, with both multinational and domestic companies vying for market share. This leads to continuous product innovation and pricing pressures. Market penetration of advanced drug delivery systems is gradually increasing, particularly in urban areas with better healthcare infrastructure.

Leading Markets & Segments in Brazil Drug Delivery Devices Industry

The Brazilian drug delivery devices market is geographically diverse, though concentrated in major urban centers. However, regional disparities in healthcare infrastructure and access influence segment dominance.

By Route of Administration:

Injectable: This segment holds the largest market share (xx%), driven by the high prevalence of injectable medications for various therapeutic areas, including infectious diseases and cancer. Key drivers include increasing investment in healthcare infrastructure and the growing demand for biologics.

Topical: This segment shows a steady growth rate (xx%), fueled by the increasing use of topical medications for skin conditions and chronic pain management.

Ocular: This niche segment is exhibiting moderate growth (xx%), propelled by the rising prevalence of age-related eye diseases and advancements in ophthalmic drug delivery technologies.

Other Routes of Administration: This segment encompasses various routes (e.g., oral, inhalation) and experiences a combined growth rate reflective of individual segments’ performance.

By Application:

Cancer: This segment is a major driver of growth due to rising cancer incidence and the demand for targeted therapies.

Cardiovascular: The large prevalence of cardiovascular diseases contributes significantly to the market.

Diabetes: The high prevalence of diabetes fuels the demand for insulin delivery devices.

Infectious Diseases: This segment shows significant growth due to disease prevalence and government initiatives to combat infectious diseases.

Other Applications: This segment includes various applications such as pain management and respiratory diseases.

By End User:

Hospitals: Hospitals account for the largest market share, owing to their significant drug administration volumes.

Ambulatory Surgical Centers: This segment is growing rapidly, driven by an increasing preference for outpatient procedures.

Other End Users: This segment includes home healthcare settings and pharmacies.

Brazil Drug Delivery Devices Industry Product Developments

Recent product developments emphasize miniaturization, improved patient comfort, and enhanced drug delivery precision. Smart inhalers with digital tracking capabilities and implantable pumps with programmable drug release profiles are examples of innovations gaining traction. These advancements offer significant advantages in terms of patient adherence and treatment efficacy, enhancing the competitive landscape by catering to the growing demand for technologically advanced and patient-centric solutions.

Key Drivers of Brazil Drug Delivery Devices Industry Growth

Several factors fuel the growth of the Brazilian drug delivery devices market. These include a rising prevalence of chronic diseases, escalating healthcare expenditure, and increasing government support for healthcare infrastructure development. Technological advancements, particularly in areas like nanotechnology and biomaterials, are continuously improving drug delivery systems' efficacy and safety. Furthermore, favorable regulatory policies are encouraging innovation and market entry.

Challenges in the Brazil Drug Delivery Devices Industry Market

Despite substantial growth potential, several challenges exist. High import duties and reliance on imported components increase manufacturing costs. Furthermore, the fragmented healthcare system and regional disparities in access to healthcare can limit market penetration in certain areas. Lastly, strong competition from both domestic and multinational companies necessitates continuous innovation and cost-effectiveness strategies.

Emerging Opportunities in Brazil Drug Delivery Devices Industry

The market presents considerable long-term growth opportunities. Strategic collaborations between domestic and international companies can leverage local expertise and global technology. Expansion into underserved regions with increasing healthcare investments holds significant market potential. Furthermore, the development of personalized medicine and targeted drug delivery systems creates lucrative opportunities for innovative players.

Leading Players in the Brazil Drug Delivery Devices Industry Sector

- Becton Dickinson and Company

- Sanofi

- Novartis AG

- Eurofarma

- Johnson and Johnson

- Teva Pharmaceutical Industries Ltd

- Merck KGaA

- GSK plc

- Pfizer Inc

Key Milestones in Brazil Drug Delivery Devices Industry Industry

- September 2022: Evandro Chagas National Institute of Infectious Disease sponsors a clinical trial ("ImPrepCab") evaluating injectable Cabotegravir for pre-exposure prophylaxis. This highlights growing interest in advanced injectable drug delivery for infectious disease management.

- June 2021: Instituto Nacional de Cancer sponsors a Phase III clinical trial ("ELSA") assessing intravenous Lidocaine delivery via an infusion pump to accelerate recovery in COVID-19 patients. This exemplifies the role of drug delivery systems in critical care settings.

Strategic Outlook for Brazil Drug Delivery Devices Industry Market

The Brazilian drug delivery devices market presents a promising outlook for long-term growth. Focusing on innovation in areas like personalized medicine and expanding into underserved regions will yield significant returns. Strategic partnerships and investments in local manufacturing capacity will be crucial for navigating challenges and capitalizing on the market's potential. A focus on patient-centric designs and cost-effective solutions will be essential for sustained success in the competitive landscape.

Brazil Drug Delivery Devices Industry Segmentation

-

1. Route of Administration

- 1.1. Injectable

- 1.2. Topical

- 1.3. Ocular

- 1.4. Other Route of Administration

-

2. Application

- 2.1. Cancer

- 2.2. Cardiovascular

- 2.3. Diabetes

- 2.4. Infectious diseases

- 2.5. Other Applications

-

3. End User

- 3.1. Hospitals

- 3.2. Ambulatory Surgical Centers

- 3.3. Other End Users

Brazil Drug Delivery Devices Industry Segmentation By Geography

- 1. Brazil

Brazil Drug Delivery Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Chronic Diseases; Increased Funding and Research Activity in Drug Development

- 3.3. Market Restrains

- 3.3.1. Risk Associated With Needlestick Injuries

- 3.4. Market Trends

- 3.4.1. Ocular Segment is Likely to Witness a Growth in the Brazil Drug Delivery Devices Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Drug Delivery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 5.1.1. Injectable

- 5.1.2. Topical

- 5.1.3. Ocular

- 5.1.4. Other Route of Administration

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cancer

- 5.2.2. Cardiovascular

- 5.2.3. Diabetes

- 5.2.4. Infectious diseases

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Ambulatory Surgical Centers

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Becton Dickinson and Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sanofi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Novartis AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eurofarma

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson and Johnson

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Teva Pharmaceutical Industries Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Merck KGaA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GSK plc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pfizer Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Brazil Drug Delivery Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Drug Delivery Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazil Drug Delivery Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Drug Delivery Devices Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Brazil Drug Delivery Devices Industry Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 4: Brazil Drug Delivery Devices Industry Volume K Unit Forecast, by Route of Administration 2019 & 2032

- Table 5: Brazil Drug Delivery Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Brazil Drug Delivery Devices Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Brazil Drug Delivery Devices Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Brazil Drug Delivery Devices Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 9: Brazil Drug Delivery Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Brazil Drug Delivery Devices Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Brazil Drug Delivery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Drug Delivery Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Brazil Drug Delivery Devices Industry Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 14: Brazil Drug Delivery Devices Industry Volume K Unit Forecast, by Route of Administration 2019 & 2032

- Table 15: Brazil Drug Delivery Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Brazil Drug Delivery Devices Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 17: Brazil Drug Delivery Devices Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 18: Brazil Drug Delivery Devices Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 19: Brazil Drug Delivery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil Drug Delivery Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Drug Delivery Devices Industry?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Brazil Drug Delivery Devices Industry?

Key companies in the market include Becton Dickinson and Company, Sanofi, Novartis AG, Eurofarma, Johnson and Johnson, Teva Pharmaceutical Industries Ltd, Merck KGaA, GSK plc, Pfizer Inc.

3. What are the main segments of the Brazil Drug Delivery Devices Industry?

The market segments include Route of Administration, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Chronic Diseases; Increased Funding and Research Activity in Drug Development.

6. What are the notable trends driving market growth?

Ocular Segment is Likely to Witness a Growth in the Brazil Drug Delivery Devices Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Risk Associated With Needlestick Injuries.

8. Can you provide examples of recent developments in the market?

In September 2022, Evandro Chagas National Institute of Infectious Disease sponsored a clinical trial study under the title "The Implementation of Pre-exposure Prophylaxis of Injectable Cabotegravir (ImPrepCab)" the study is to assess the safety and effectiveness of open-label CAB LA PrEP when offered at public health facilities to cisgender men and transgender or gender non-binary individuals. Cabotegravir (CAB-LA) is given as injectable.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Drug Delivery Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Drug Delivery Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Drug Delivery Devices Industry?

To stay informed about further developments, trends, and reports in the Brazil Drug Delivery Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence