Key Insights

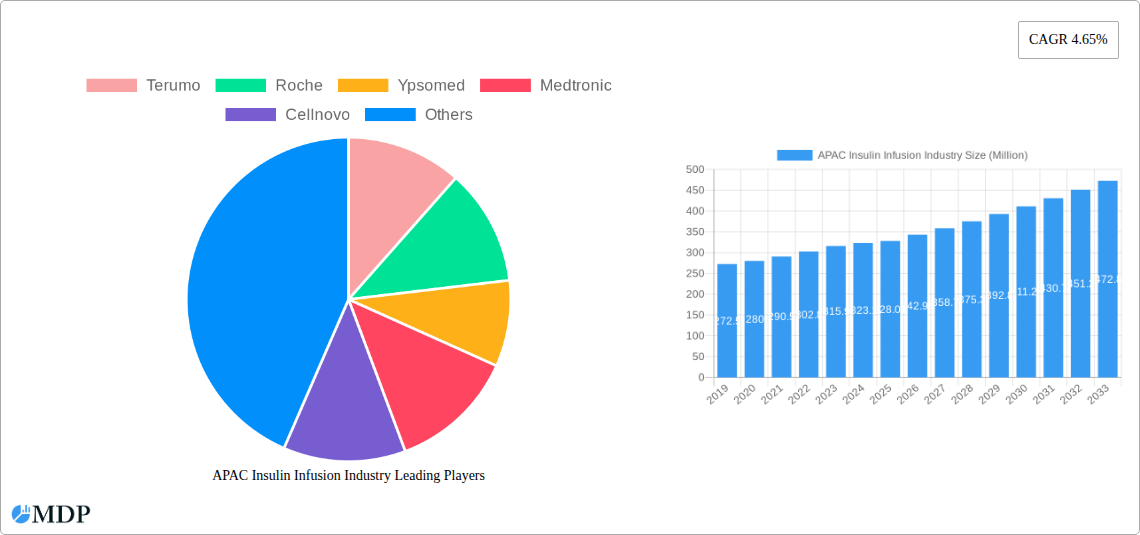

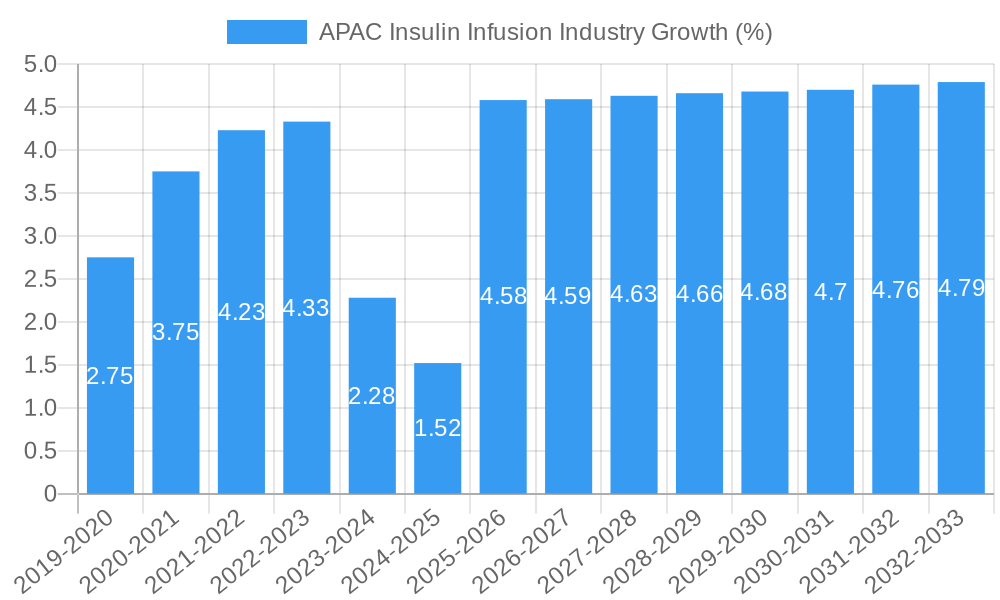

The Asia-Pacific (APAC) Insulin Infusion market is poised for significant expansion, projected to reach approximately USD 328.01 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 4.65%. This growth trajectory is primarily propelled by the escalating prevalence of diabetes across the region, driven by lifestyle changes, an aging population, and increased awareness regarding diabetes management. Technological advancements are further fueling market dynamics, with a discernible shift towards more convenient and user-friendly insulin delivery systems. The increasing adoption of both tethered and tubeless insulin pumps signifies a growing demand for sophisticated solutions that enhance patient compliance and therapeutic outcomes. Furthermore, the rising disposable incomes in key APAC economies are enabling greater access to advanced medical devices, contributing to the overall market surge.

The competitive landscape is characterized by the presence of established global players alongside emerging regional manufacturers, all striving to capture market share. Companies are focusing on research and development to introduce innovative products that cater to diverse patient needs, including miniaturized pumps, smart insulin delivery systems with connectivity features, and cost-effective solutions. The market is segmented by technology (tethered and tubeless insulin pumps) and components (insulin pump devices, reservoirs, and infusion sets), with substantial growth anticipated across all segments. Geographically, countries like China and India are expected to lead the market expansion due to their large populations and the increasing burden of diabetes. While the market presents immense opportunities, factors such as the high cost of advanced insulin pumps and the need for extensive patient training and healthcare infrastructure development present potential restraints that require strategic mitigation.

APAC Insulin Infusion Industry Market Dynamics & Concentration

The APAC Insulin Infusion Industry is characterized by a dynamic market landscape with significant growth potential, driven by increasing diabetes prevalence and advancements in diabetes management technology. Market concentration is moderately consolidated, with key players like Terumo, Roche, Ypsomed, Medtronic, and Insulet holding substantial market shares. Innovation is a primary driver, with continuous development in closed-loop systems and user-friendly devices. Regulatory frameworks across APAC countries are evolving, gradually aligning with global standards to facilitate market access for advanced insulin infusion technologies. Product substitutes, primarily traditional injection methods, still represent a considerable portion of the market but are increasingly being displaced by the convenience and efficacy of insulin pumps. End-user trends indicate a strong preference for home-based care and personalized treatment solutions, fueling the demand for tubeless and wearable insulin pumps. Mergers and acquisitions (M&A) activities, though not as frequent as in more mature markets, are on the rise as companies seek to expand their product portfolios and geographical reach. For instance, a predicted xx M&A deals are expected within the forecast period, indicating a trend towards consolidation and strategic partnerships to leverage synergies and accelerate market penetration. The overall market size for APAC insulin infusion is projected to reach approximately USD 1,200 Million by 2025.

- Market Share Drivers: Increasing prevalence of Type 1 and Type 2 diabetes, growing awareness of diabetes management technologies, rising disposable incomes, and supportive government initiatives.

- Innovation Focus: Development of smart insulin pumps with advanced algorithms, integration with continuous glucose monitoring (CGM) systems, miniaturization of devices, and enhanced connectivity features.

- Regulatory Landscape: Varying degrees of regulatory approval processes across different APAC nations, with a gradual move towards faster adoption of innovative medical devices.

- End-User Preferences: Shift towards a 'diabetes at home' model, demand for discreet and wearable insulin delivery systems, and preference for integrated solutions for better diabetes management.

- M&A Activity: Potential for strategic acquisitions to gain access to innovative technologies, expand market presence, and strengthen competitive positioning.

APAC Insulin Infusion Industry Industry Trends & Analysis

The APAC Insulin Infusion Industry is poised for robust expansion, driven by a confluence of factors that are reshaping the diabetes care landscape. The escalating global burden of diabetes, particularly in densely populated Asian nations, acts as a primary catalyst for market growth. As awareness surrounding advanced diabetes management solutions like insulin pumps increases, consumer preferences are shifting away from conventional methods towards more efficient and convenient technologies. The market penetration of insulin pumps in APAC, though still lower than in Western markets, is steadily climbing, with a projected Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. Technological disruptions are at the forefront of this evolution. The advent of smart insulin pumps, often referred to as automated insulin delivery (AID) systems or closed-loop systems, which integrate with continuous glucose monitors (CGM) to automatically adjust insulin delivery, is revolutionizing diabetes management. These sophisticated systems offer improved glycemic control, reduce the burden of manual insulin calculations, and enhance the quality of life for individuals with diabetes.

The competitive dynamics within the APAC region are intensifying as both established global players and emerging local manufacturers vie for market share. Companies are focusing on developing localized solutions that cater to the specific needs and affordability considerations of different markets. Consumer preferences are increasingly leaning towards user-friendly, discreet, and wearable devices, leading to significant innovation in tubeless insulin pump technology. The integration of mobile health applications and remote monitoring capabilities further enhances patient engagement and facilitates better communication between patients and healthcare providers. The economic development across several APAC nations, leading to increased disposable incomes and greater healthcare expenditure, also plays a crucial role in driving market adoption. Furthermore, government initiatives and health insurance schemes aimed at subsidizing diabetes management devices are becoming more prevalent, making these life-changing technologies accessible to a wider population. The market is projected to reach an estimated USD 2,500 Million by the end of the forecast period, reflecting a strong upward trajectory.

Leading Markets & Segments in APAC Insulin Infusion Industry

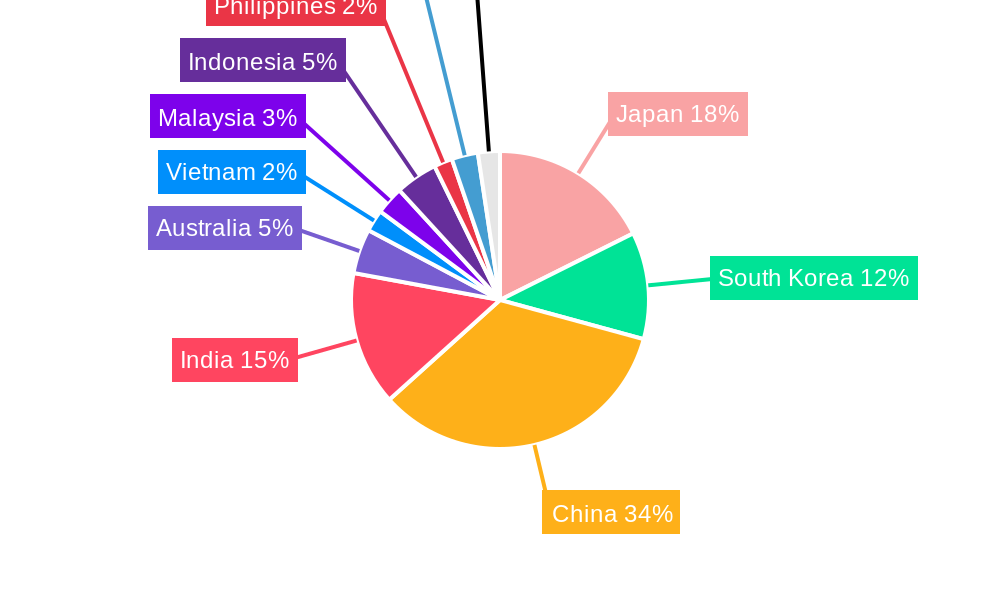

The APAC Insulin Infusion Industry showcases distinct leadership across various segments and geographies, underscoring the diverse adoption patterns and market opportunities. China stands out as a dominant market, fueled by its vast population, increasing disposable incomes, and a growing prevalence of diabetes. The Chinese government's focus on improving healthcare infrastructure and the expanding middle class's demand for advanced medical technologies contribute significantly to its leadership. Japan also holds a prominent position, characterized by its early adoption of sophisticated medical devices and a well-established healthcare system that supports the use of insulin pumps. South Korea, with its advanced technological ecosystem and high healthcare spending, is another key market. India, despite its lower per capita income, represents a rapidly growing market due to the sheer volume of its diabetic population and increasing government support for diabetes management programs.

Geographically, the Rest of Asia-Pacific, encompassing countries like Vietnam, Malaysia, Indonesia, Philippines, and Thailand, collectively forms a significant and rapidly expanding market. While individual market sizes may be smaller, the aggregate growth potential driven by improving healthcare access and rising awareness is substantial.

Within the Technology segment, the Tubeless Insulin Pump technology is gaining significant traction. This innovation offers enhanced user convenience and discretion, appealing to a broad patient demographic seeking to integrate diabetes management seamlessly into their daily lives. While Tethered Insulin Pumps still hold a considerable market share due to their established presence and often lower initial cost, the trend is undeniably shifting towards wireless solutions.

In terms of Components, the Insulin Pump Device itself is the core driver of market value. However, the growth of the Infusion Set segment is directly correlated with pump adoption, and advancements in infusion set comfort and longevity are crucial for user retention. The Insulin Pump Reservoir segment is also vital, with ongoing innovation focused on increasing capacity and ease of refilling.

The End User segment highlights a strong preference for Home/Personal use. As diabetes management becomes increasingly decentralized and patients are empowered to manage their condition at home, the demand for personal insulin infusion devices continues to surge. Hospital/Clinics remain crucial for initial diagnosis, training, and prescription, but the long-term usage predominantly occurs in personal settings. This shift in user behavior underscores the importance of user-friendly, connected, and reliable devices for home-based diabetes care.

- Dominant Geography Drivers:

- China: Large population, rising diabetes prevalence, economic growth, government initiatives for healthcare improvement.

- Japan: High adoption of advanced medical technology, strong regulatory framework, aging population with higher diabetes incidence.

- India: Massive diabetic population, growing middle class, increasing health awareness, government focus on chronic disease management.

- Dominant Technology Drivers:

- Tubeless Insulin Pumps: Superior user convenience, discreet wearability, integration with smart devices.

- Smart Insulin Pumps/AID Systems: Improved glycemic control, reduced patient burden, enhanced safety features.

- Dominant Component Drivers:

- Insulin Pump Device: Core product offering, innovation in miniaturization and functionality.

- Infusion Sets: Comfort, ease of use, and longevity are key for user satisfaction and adherence.

- Dominant End-User Drivers:

- Home/Personal: Shift towards self-management, demand for convenience and integration into daily life.

- Increased patient empowerment and desire for greater autonomy in managing their health.

APAC Insulin Infusion Industry Product Developments

The APAC Insulin Infusion Industry is witnessing a rapid evolution in product development, driven by the pursuit of enhanced patient outcomes and user experience. Innovations are focused on creating smarter, more intuitive, and less intrusive insulin delivery systems. Key trends include the advancement of automated insulin delivery (AID) systems, which integrate continuous glucose monitoring (CGM) with insulin pumps to create a closed-loop or hybrid-closed-loop system. These systems offer personalized insulin dosing based on real-time glucose readings, significantly improving glycemic control and reducing the burden of manual adjustments. The development of tubeless insulin pumps is another significant trend, offering discreet and wearable solutions that enhance user comfort and adherence. Companies are also focusing on miniaturizing devices, improving battery life, and enhancing connectivity features to enable seamless integration with smartphones and other digital health platforms. These developments aim to provide patients with greater autonomy, convenience, and a higher quality of life while managing their diabetes. The market is also seeing the introduction of novel infusion sets designed for improved comfort, reduced pain, and longer wear times.

Key Drivers of APAC Insulin Infusion Industry Growth

Several key factors are propelling the growth of the APAC Insulin Infusion Industry. The escalating prevalence of diabetes across the region, driven by lifestyle changes, aging populations, and genetic predispositions, forms the fundamental market driver. Technological advancements in insulin pump technology, particularly the development of smart insulin pumps with integrated CGM capabilities and automated insulin delivery algorithms, are revolutionizing diabetes management and increasing adoption rates. Growing awareness among patients and healthcare professionals about the benefits of insulin pump therapy over traditional injection methods, such as improved glycemic control, reduced hypoglycemia, and enhanced quality of life, is a significant growth catalyst. Supportive government initiatives and reimbursement policies in several APAC countries, aimed at increasing access to advanced diabetes care technologies, are also playing a crucial role. Furthermore, rising disposable incomes and increased healthcare expenditure across many APAC nations are making these advanced devices more affordable and accessible to a larger segment of the population.

Challenges in the APAC Insulin Infusion Industry Market

Despite its promising growth trajectory, the APAC Insulin Infusion Industry faces several significant challenges. High device costs remain a primary barrier, particularly in emerging economies where affordability is a critical concern for a large segment of the population. Limited reimbursement and insurance coverage in many regions restrict access to these advanced technologies, forcing patients to bear a substantial portion of the cost. Regulatory hurdles and varying approval timelines across different APAC countries can delay market entry for new products and innovations. Lack of awareness and understanding about insulin pump therapy among both patients and healthcare providers in certain areas can hinder adoption. Shortage of skilled healthcare professionals trained in insulin pump management and patient education can also pose a significant challenge. Finally, infrastructure limitations, such as inconsistent access to reliable electricity or internet connectivity in remote areas, can impact the effective use of connected insulin pump systems.

Emerging Opportunities in APAC Insulin Infusion Industry

The APAC Insulin Infusion Industry is brimming with emerging opportunities driven by unmet needs and technological advancements. The burgeoning middle class and increasing health consciousness in emerging economies like India and Southeast Asian nations present a vast untapped market for insulin pump adoption. The rapid advancements in artificial intelligence (AI) and machine learning are paving the way for more sophisticated smart insulin pumps with predictive capabilities, further enhancing glycemic control and reducing the risk of complications. The growing integration of wearable technology and the Internet of Medical Things (IoMT) opens avenues for seamless data sharing between pumps, CGMs, and healthcare providers, enabling more personalized and proactive diabetes management. Strategic partnerships between global insulin pump manufacturers and local distributors or healthcare providers can facilitate market penetration and address regional specificities. The increasing focus on preventive healthcare and early diagnosis of diabetes will also drive demand for advanced management solutions. Furthermore, the development of cost-effective insulin pump solutions tailored to the economic realities of emerging APAC markets presents a significant opportunity for market expansion.

Leading Players in the APAC Insulin Infusion Industry Sector

- Terumo

- Roche

- Ypsomed

- Medtronic

- Cellnovo

- Animas

- Tandem

- Insulet

- Other Company Share Analyse

Key Milestones in APAC Insulin Infusion Industry Industry

- April 2023: Medtronic's MiniMed 780G system, featuring Guardian 4 sensor and SmartGuard technology, received U.S. FDA approval. This system's meal detection technology, offering automatic adjustments to blood sugar levels every 5 minutes for both basal and bolus insulin, marks a significant advancement in automated insulin delivery, compensating for overlooked mealtime insulin doses or underestimated carbohydrate intake.

- July 2022: The Australian Albanese Government invested USD 273.1 million over four years under the National Diabetes Services Scheme (NDSS) to subsidize Continuous Glucose Monitoring (CGM) products for 130,000 Australians with type-1 diabetes. This initiative also included expanded access to the Insulin Pump Program, with a commitment to provide an additional 35 fully subsidized insulin pumps annually for low-income young adults aged 18-21 with type-1 diabetes, broadening eligibility beyond the previous age limit of 18.

Strategic Outlook for APAC Insulin Infusion Industry Market

The strategic outlook for the APAC Insulin Infusion Industry is exceptionally positive, with growth accelerators focused on innovation, accessibility, and patient empowerment. Continued investment in research and development for advanced automated insulin delivery systems and user-friendly tubeless insulin pumps will be crucial for market leadership. Expanding distribution networks and strategic partnerships with local healthcare providers and distributors will be essential for penetrating diverse markets and addressing regional specificities. The increasing focus on digital health integration and mobile connectivity will enable more personalized and remote patient management, enhancing adherence and outcomes. Furthermore, advocating for supportive reimbursement policies and government subsidies will be vital in making these life-saving technologies accessible to a broader population segment, particularly in emerging economies. The industry's future lies in creating a holistic ecosystem of devices, data, and support to empower individuals with diabetes to live fuller, healthier lives.

APAC Insulin Infusion Industry Segmentation

-

1. Technology

- 1.1. Tethered Insulin Pump

- 1.2. Tubeless Insulin Pump

-

2. Component

- 2.1. Insulin Pump Device

- 2.2. Insulin Pump Reservoir

- 2.3. Infusion Set

-

3. End User

- 3.1. Hospital/Clinics

- 3.2. Home/Personal

-

4. Geography

- 4.1. Japan

- 4.2. South Korea

- 4.3. China

- 4.4. India

- 4.5. Australia

- 4.6. Vietnam

- 4.7. Malaysia

- 4.8. Indonesia

- 4.9. Philippines

- 4.10. Thailand

- 4.11. Rest of Asia-Pacific

APAC Insulin Infusion Industry Segmentation By Geography

- 1. Japan

- 2. South Korea

- 3. China

- 4. India

- 5. Australia

- 6. Vietnam

- 7. Malaysia

- 8. Indonesia

- 9. Philippines

- 10. Thailand

- 11. Rest of Asia Pacific

APAC Insulin Infusion Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Applications of Cryosurgery; Technological Advancements in Cryotherapy Equipment; Rising Preference for Minimally Invasive Techniques

- 3.3. Market Restrains

- 3.3.1. Hazardous Effects of Cryogenic Gases; Complexity of the Cryotherapy Mechanisms

- 3.4. Market Trends

- 3.4.1. Insulin Infusion Pump Devices Dominating the Asia-Pacific Insulin Infusion Pump Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Insulin Infusion Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Tethered Insulin Pump

- 5.1.2. Tubeless Insulin Pump

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Insulin Pump Device

- 5.2.2. Insulin Pump Reservoir

- 5.2.3. Infusion Set

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospital/Clinics

- 5.3.2. Home/Personal

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Japan

- 5.4.2. South Korea

- 5.4.3. China

- 5.4.4. India

- 5.4.5. Australia

- 5.4.6. Vietnam

- 5.4.7. Malaysia

- 5.4.8. Indonesia

- 5.4.9. Philippines

- 5.4.10. Thailand

- 5.4.11. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Japan

- 5.5.2. South Korea

- 5.5.3. China

- 5.5.4. India

- 5.5.5. Australia

- 5.5.6. Vietnam

- 5.5.7. Malaysia

- 5.5.8. Indonesia

- 5.5.9. Philippines

- 5.5.10. Thailand

- 5.5.11. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Japan APAC Insulin Infusion Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Tethered Insulin Pump

- 6.1.2. Tubeless Insulin Pump

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Insulin Pump Device

- 6.2.2. Insulin Pump Reservoir

- 6.2.3. Infusion Set

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospital/Clinics

- 6.3.2. Home/Personal

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Japan

- 6.4.2. South Korea

- 6.4.3. China

- 6.4.4. India

- 6.4.5. Australia

- 6.4.6. Vietnam

- 6.4.7. Malaysia

- 6.4.8. Indonesia

- 6.4.9. Philippines

- 6.4.10. Thailand

- 6.4.11. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. South Korea APAC Insulin Infusion Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Tethered Insulin Pump

- 7.1.2. Tubeless Insulin Pump

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Insulin Pump Device

- 7.2.2. Insulin Pump Reservoir

- 7.2.3. Infusion Set

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospital/Clinics

- 7.3.2. Home/Personal

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Japan

- 7.4.2. South Korea

- 7.4.3. China

- 7.4.4. India

- 7.4.5. Australia

- 7.4.6. Vietnam

- 7.4.7. Malaysia

- 7.4.8. Indonesia

- 7.4.9. Philippines

- 7.4.10. Thailand

- 7.4.11. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. China APAC Insulin Infusion Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Tethered Insulin Pump

- 8.1.2. Tubeless Insulin Pump

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Insulin Pump Device

- 8.2.2. Insulin Pump Reservoir

- 8.2.3. Infusion Set

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospital/Clinics

- 8.3.2. Home/Personal

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Japan

- 8.4.2. South Korea

- 8.4.3. China

- 8.4.4. India

- 8.4.5. Australia

- 8.4.6. Vietnam

- 8.4.7. Malaysia

- 8.4.8. Indonesia

- 8.4.9. Philippines

- 8.4.10. Thailand

- 8.4.11. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. India APAC Insulin Infusion Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Tethered Insulin Pump

- 9.1.2. Tubeless Insulin Pump

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Insulin Pump Device

- 9.2.2. Insulin Pump Reservoir

- 9.2.3. Infusion Set

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospital/Clinics

- 9.3.2. Home/Personal

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Japan

- 9.4.2. South Korea

- 9.4.3. China

- 9.4.4. India

- 9.4.5. Australia

- 9.4.6. Vietnam

- 9.4.7. Malaysia

- 9.4.8. Indonesia

- 9.4.9. Philippines

- 9.4.10. Thailand

- 9.4.11. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Australia APAC Insulin Infusion Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Tethered Insulin Pump

- 10.1.2. Tubeless Insulin Pump

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Insulin Pump Device

- 10.2.2. Insulin Pump Reservoir

- 10.2.3. Infusion Set

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospital/Clinics

- 10.3.2. Home/Personal

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Japan

- 10.4.2. South Korea

- 10.4.3. China

- 10.4.4. India

- 10.4.5. Australia

- 10.4.6. Vietnam

- 10.4.7. Malaysia

- 10.4.8. Indonesia

- 10.4.9. Philippines

- 10.4.10. Thailand

- 10.4.11. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Vietnam APAC Insulin Infusion Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. Tethered Insulin Pump

- 11.1.2. Tubeless Insulin Pump

- 11.2. Market Analysis, Insights and Forecast - by Component

- 11.2.1. Insulin Pump Device

- 11.2.2. Insulin Pump Reservoir

- 11.2.3. Infusion Set

- 11.3. Market Analysis, Insights and Forecast - by End User

- 11.3.1. Hospital/Clinics

- 11.3.2. Home/Personal

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. Japan

- 11.4.2. South Korea

- 11.4.3. China

- 11.4.4. India

- 11.4.5. Australia

- 11.4.6. Vietnam

- 11.4.7. Malaysia

- 11.4.8. Indonesia

- 11.4.9. Philippines

- 11.4.10. Thailand

- 11.4.11. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. Malaysia APAC Insulin Infusion Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Technology

- 12.1.1. Tethered Insulin Pump

- 12.1.2. Tubeless Insulin Pump

- 12.2. Market Analysis, Insights and Forecast - by Component

- 12.2.1. Insulin Pump Device

- 12.2.2. Insulin Pump Reservoir

- 12.2.3. Infusion Set

- 12.3. Market Analysis, Insights and Forecast - by End User

- 12.3.1. Hospital/Clinics

- 12.3.2. Home/Personal

- 12.4. Market Analysis, Insights and Forecast - by Geography

- 12.4.1. Japan

- 12.4.2. South Korea

- 12.4.3. China

- 12.4.4. India

- 12.4.5. Australia

- 12.4.6. Vietnam

- 12.4.7. Malaysia

- 12.4.8. Indonesia

- 12.4.9. Philippines

- 12.4.10. Thailand

- 12.4.11. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Technology

- 13. Indonesia APAC Insulin Infusion Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - by Technology

- 13.1.1. Tethered Insulin Pump

- 13.1.2. Tubeless Insulin Pump

- 13.2. Market Analysis, Insights and Forecast - by Component

- 13.2.1. Insulin Pump Device

- 13.2.2. Insulin Pump Reservoir

- 13.2.3. Infusion Set

- 13.3. Market Analysis, Insights and Forecast - by End User

- 13.3.1. Hospital/Clinics

- 13.3.2. Home/Personal

- 13.4. Market Analysis, Insights and Forecast - by Geography

- 13.4.1. Japan

- 13.4.2. South Korea

- 13.4.3. China

- 13.4.4. India

- 13.4.5. Australia

- 13.4.6. Vietnam

- 13.4.7. Malaysia

- 13.4.8. Indonesia

- 13.4.9. Philippines

- 13.4.10. Thailand

- 13.4.11. Rest of Asia-Pacific

- 13.1. Market Analysis, Insights and Forecast - by Technology

- 14. Philippines APAC Insulin Infusion Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - by Technology

- 14.1.1. Tethered Insulin Pump

- 14.1.2. Tubeless Insulin Pump

- 14.2. Market Analysis, Insights and Forecast - by Component

- 14.2.1. Insulin Pump Device

- 14.2.2. Insulin Pump Reservoir

- 14.2.3. Infusion Set

- 14.3. Market Analysis, Insights and Forecast - by End User

- 14.3.1. Hospital/Clinics

- 14.3.2. Home/Personal

- 14.4. Market Analysis, Insights and Forecast - by Geography

- 14.4.1. Japan

- 14.4.2. South Korea

- 14.4.3. China

- 14.4.4. India

- 14.4.5. Australia

- 14.4.6. Vietnam

- 14.4.7. Malaysia

- 14.4.8. Indonesia

- 14.4.9. Philippines

- 14.4.10. Thailand

- 14.4.11. Rest of Asia-Pacific

- 14.1. Market Analysis, Insights and Forecast - by Technology

- 15. Thailand APAC Insulin Infusion Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - by Technology

- 15.1.1. Tethered Insulin Pump

- 15.1.2. Tubeless Insulin Pump

- 15.2. Market Analysis, Insights and Forecast - by Component

- 15.2.1. Insulin Pump Device

- 15.2.2. Insulin Pump Reservoir

- 15.2.3. Infusion Set

- 15.3. Market Analysis, Insights and Forecast - by End User

- 15.3.1. Hospital/Clinics

- 15.3.2. Home/Personal

- 15.4. Market Analysis, Insights and Forecast - by Geography

- 15.4.1. Japan

- 15.4.2. South Korea

- 15.4.3. China

- 15.4.4. India

- 15.4.5. Australia

- 15.4.6. Vietnam

- 15.4.7. Malaysia

- 15.4.8. Indonesia

- 15.4.9. Philippines

- 15.4.10. Thailand

- 15.4.11. Rest of Asia-Pacific

- 15.1. Market Analysis, Insights and Forecast - by Technology

- 16. Rest of Asia Pacific APAC Insulin Infusion Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - by Technology

- 16.1.1. Tethered Insulin Pump

- 16.1.2. Tubeless Insulin Pump

- 16.2. Market Analysis, Insights and Forecast - by Component

- 16.2.1. Insulin Pump Device

- 16.2.2. Insulin Pump Reservoir

- 16.2.3. Infusion Set

- 16.3. Market Analysis, Insights and Forecast - by End User

- 16.3.1. Hospital/Clinics

- 16.3.2. Home/Personal

- 16.4. Market Analysis, Insights and Forecast - by Geography

- 16.4.1. Japan

- 16.4.2. South Korea

- 16.4.3. China

- 16.4.4. India

- 16.4.5. Australia

- 16.4.6. Vietnam

- 16.4.7. Malaysia

- 16.4.8. Indonesia

- 16.4.9. Philippines

- 16.4.10. Thailand

- 16.4.11. Rest of Asia-Pacific

- 16.1. Market Analysis, Insights and Forecast - by Technology

- 17. North America APAC Insulin Infusion Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 United States

- 17.1.2 Canada

- 17.1.3 Mexico

- 18. Europe APAC Insulin Infusion Industry Analysis, Insights and Forecast, 2019-2031

- 18.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 18.1.1 Germany

- 18.1.2 United Kingdom

- 18.1.3 France

- 18.1.4 Spain

- 18.1.5 Italy

- 18.1.6 Spain

- 18.1.7 Belgium

- 18.1.8 Netherland

- 18.1.9 Nordics

- 18.1.10 Rest of Europe

- 19. Asia Pacific APAC Insulin Infusion Industry Analysis, Insights and Forecast, 2019-2031

- 19.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 19.1.1 China

- 19.1.2 Japan

- 19.1.3 India

- 19.1.4 South Korea

- 19.1.5 Southeast Asia

- 19.1.6 Australia

- 19.1.7 Indonesia

- 19.1.8 Phillipes

- 19.1.9 Singapore

- 19.1.10 Thailandc

- 19.1.11 Rest of Asia Pacific

- 20. South America APAC Insulin Infusion Industry Analysis, Insights and Forecast, 2019-2031

- 20.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 20.1.1 Brazil

- 20.1.2 Argentina

- 20.1.3 Peru

- 20.1.4 Chile

- 20.1.5 Colombia

- 20.1.6 Ecuador

- 20.1.7 Venezuela

- 20.1.8 Rest of South America

- 21. North America APAC Insulin Infusion Industry Analysis, Insights and Forecast, 2019-2031

- 21.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 21.1.1 United States

- 21.1.2 Canada

- 21.1.3 Mexico

- 22. MEA APAC Insulin Infusion Industry Analysis, Insights and Forecast, 2019-2031

- 22.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 22.1.1 United Arab Emirates

- 22.1.2 Saudi Arabia

- 22.1.3 South Africa

- 22.1.4 Rest of Middle East and Africa

- 23. Competitive Analysis

- 23.1. Global Market Share Analysis 2024

- 23.2. Company Profiles

- 23.2.1 Terumo

- 23.2.1.1. Overview

- 23.2.1.2. Products

- 23.2.1.3. SWOT Analysis

- 23.2.1.4. Recent Developments

- 23.2.1.5. Financials (Based on Availability)

- 23.2.2 Roche

- 23.2.2.1. Overview

- 23.2.2.2. Products

- 23.2.2.3. SWOT Analysis

- 23.2.2.4. Recent Developments

- 23.2.2.5. Financials (Based on Availability)

- 23.2.3 Ypsomed

- 23.2.3.1. Overview

- 23.2.3.2. Products

- 23.2.3.3. SWOT Analysis

- 23.2.3.4. Recent Developments

- 23.2.3.5. Financials (Based on Availability)

- 23.2.4 Medtronic

- 23.2.4.1. Overview

- 23.2.4.2. Products

- 23.2.4.3. SWOT Analysis

- 23.2.4.4. Recent Developments

- 23.2.4.5. Financials (Based on Availability)

- 23.2.5 Cellnovo

- 23.2.5.1. Overview

- 23.2.5.2. Products

- 23.2.5.3. SWOT Analysis

- 23.2.5.4. Recent Developments

- 23.2.5.5. Financials (Based on Availability)

- 23.2.6 Animas

- 23.2.6.1. Overview

- 23.2.6.2. Products

- 23.2.6.3. SWOT Analysis

- 23.2.6.4. Recent Developments

- 23.2.6.5. Financials (Based on Availability)

- 23.2.7 Tandem

- 23.2.7.1. Overview

- 23.2.7.2. Products

- 23.2.7.3. SWOT Analysis

- 23.2.7.4. Recent Developments

- 23.2.7.5. Financials (Based on Availability)

- 23.2.8 Insulet

- 23.2.8.1. Overview

- 23.2.8.2. Products

- 23.2.8.3. SWOT Analysis

- 23.2.8.4. Recent Developments

- 23.2.8.5. Financials (Based on Availability)

- 23.2.9 Other Company Share Analyse

- 23.2.9.1. Overview

- 23.2.9.2. Products

- 23.2.9.3. SWOT Analysis

- 23.2.9.4. Recent Developments

- 23.2.9.5. Financials (Based on Availability)

- 23.2.1 Terumo

List of Figures

- Figure 1: Global APAC Insulin Infusion Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global APAC Insulin Infusion Industry Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: North America APAC Insulin Infusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: North America APAC Insulin Infusion Industry Volume (K Unit), by Country 2024 & 2032

- Figure 5: North America APAC Insulin Infusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America APAC Insulin Infusion Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe APAC Insulin Infusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe APAC Insulin Infusion Industry Volume (K Unit), by Country 2024 & 2032

- Figure 9: Europe APAC Insulin Infusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe APAC Insulin Infusion Industry Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific APAC Insulin Infusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific APAC Insulin Infusion Industry Volume (K Unit), by Country 2024 & 2032

- Figure 13: Asia Pacific APAC Insulin Infusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific APAC Insulin Infusion Industry Volume Share (%), by Country 2024 & 2032

- Figure 15: South America APAC Insulin Infusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 16: South America APAC Insulin Infusion Industry Volume (K Unit), by Country 2024 & 2032

- Figure 17: South America APAC Insulin Infusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America APAC Insulin Infusion Industry Volume Share (%), by Country 2024 & 2032

- Figure 19: North America APAC Insulin Infusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 20: North America APAC Insulin Infusion Industry Volume (K Unit), by Country 2024 & 2032

- Figure 21: North America APAC Insulin Infusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: North America APAC Insulin Infusion Industry Volume Share (%), by Country 2024 & 2032

- Figure 23: MEA APAC Insulin Infusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 24: MEA APAC Insulin Infusion Industry Volume (K Unit), by Country 2024 & 2032

- Figure 25: MEA APAC Insulin Infusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: MEA APAC Insulin Infusion Industry Volume Share (%), by Country 2024 & 2032

- Figure 27: Japan APAC Insulin Infusion Industry Revenue (Million), by Technology 2024 & 2032

- Figure 28: Japan APAC Insulin Infusion Industry Volume (K Unit), by Technology 2024 & 2032

- Figure 29: Japan APAC Insulin Infusion Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 30: Japan APAC Insulin Infusion Industry Volume Share (%), by Technology 2024 & 2032

- Figure 31: Japan APAC Insulin Infusion Industry Revenue (Million), by Component 2024 & 2032

- Figure 32: Japan APAC Insulin Infusion Industry Volume (K Unit), by Component 2024 & 2032

- Figure 33: Japan APAC Insulin Infusion Industry Revenue Share (%), by Component 2024 & 2032

- Figure 34: Japan APAC Insulin Infusion Industry Volume Share (%), by Component 2024 & 2032

- Figure 35: Japan APAC Insulin Infusion Industry Revenue (Million), by End User 2024 & 2032

- Figure 36: Japan APAC Insulin Infusion Industry Volume (K Unit), by End User 2024 & 2032

- Figure 37: Japan APAC Insulin Infusion Industry Revenue Share (%), by End User 2024 & 2032

- Figure 38: Japan APAC Insulin Infusion Industry Volume Share (%), by End User 2024 & 2032

- Figure 39: Japan APAC Insulin Infusion Industry Revenue (Million), by Geography 2024 & 2032

- Figure 40: Japan APAC Insulin Infusion Industry Volume (K Unit), by Geography 2024 & 2032

- Figure 41: Japan APAC Insulin Infusion Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 42: Japan APAC Insulin Infusion Industry Volume Share (%), by Geography 2024 & 2032

- Figure 43: Japan APAC Insulin Infusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 44: Japan APAC Insulin Infusion Industry Volume (K Unit), by Country 2024 & 2032

- Figure 45: Japan APAC Insulin Infusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 46: Japan APAC Insulin Infusion Industry Volume Share (%), by Country 2024 & 2032

- Figure 47: South Korea APAC Insulin Infusion Industry Revenue (Million), by Technology 2024 & 2032

- Figure 48: South Korea APAC Insulin Infusion Industry Volume (K Unit), by Technology 2024 & 2032

- Figure 49: South Korea APAC Insulin Infusion Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 50: South Korea APAC Insulin Infusion Industry Volume Share (%), by Technology 2024 & 2032

- Figure 51: South Korea APAC Insulin Infusion Industry Revenue (Million), by Component 2024 & 2032

- Figure 52: South Korea APAC Insulin Infusion Industry Volume (K Unit), by Component 2024 & 2032

- Figure 53: South Korea APAC Insulin Infusion Industry Revenue Share (%), by Component 2024 & 2032

- Figure 54: South Korea APAC Insulin Infusion Industry Volume Share (%), by Component 2024 & 2032

- Figure 55: South Korea APAC Insulin Infusion Industry Revenue (Million), by End User 2024 & 2032

- Figure 56: South Korea APAC Insulin Infusion Industry Volume (K Unit), by End User 2024 & 2032

- Figure 57: South Korea APAC Insulin Infusion Industry Revenue Share (%), by End User 2024 & 2032

- Figure 58: South Korea APAC Insulin Infusion Industry Volume Share (%), by End User 2024 & 2032

- Figure 59: South Korea APAC Insulin Infusion Industry Revenue (Million), by Geography 2024 & 2032

- Figure 60: South Korea APAC Insulin Infusion Industry Volume (K Unit), by Geography 2024 & 2032

- Figure 61: South Korea APAC Insulin Infusion Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 62: South Korea APAC Insulin Infusion Industry Volume Share (%), by Geography 2024 & 2032

- Figure 63: South Korea APAC Insulin Infusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 64: South Korea APAC Insulin Infusion Industry Volume (K Unit), by Country 2024 & 2032

- Figure 65: South Korea APAC Insulin Infusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 66: South Korea APAC Insulin Infusion Industry Volume Share (%), by Country 2024 & 2032

- Figure 67: China APAC Insulin Infusion Industry Revenue (Million), by Technology 2024 & 2032

- Figure 68: China APAC Insulin Infusion Industry Volume (K Unit), by Technology 2024 & 2032

- Figure 69: China APAC Insulin Infusion Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 70: China APAC Insulin Infusion Industry Volume Share (%), by Technology 2024 & 2032

- Figure 71: China APAC Insulin Infusion Industry Revenue (Million), by Component 2024 & 2032

- Figure 72: China APAC Insulin Infusion Industry Volume (K Unit), by Component 2024 & 2032

- Figure 73: China APAC Insulin Infusion Industry Revenue Share (%), by Component 2024 & 2032

- Figure 74: China APAC Insulin Infusion Industry Volume Share (%), by Component 2024 & 2032

- Figure 75: China APAC Insulin Infusion Industry Revenue (Million), by End User 2024 & 2032

- Figure 76: China APAC Insulin Infusion Industry Volume (K Unit), by End User 2024 & 2032

- Figure 77: China APAC Insulin Infusion Industry Revenue Share (%), by End User 2024 & 2032

- Figure 78: China APAC Insulin Infusion Industry Volume Share (%), by End User 2024 & 2032

- Figure 79: China APAC Insulin Infusion Industry Revenue (Million), by Geography 2024 & 2032

- Figure 80: China APAC Insulin Infusion Industry Volume (K Unit), by Geography 2024 & 2032

- Figure 81: China APAC Insulin Infusion Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 82: China APAC Insulin Infusion Industry Volume Share (%), by Geography 2024 & 2032

- Figure 83: China APAC Insulin Infusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 84: China APAC Insulin Infusion Industry Volume (K Unit), by Country 2024 & 2032

- Figure 85: China APAC Insulin Infusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 86: China APAC Insulin Infusion Industry Volume Share (%), by Country 2024 & 2032

- Figure 87: India APAC Insulin Infusion Industry Revenue (Million), by Technology 2024 & 2032

- Figure 88: India APAC Insulin Infusion Industry Volume (K Unit), by Technology 2024 & 2032

- Figure 89: India APAC Insulin Infusion Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 90: India APAC Insulin Infusion Industry Volume Share (%), by Technology 2024 & 2032

- Figure 91: India APAC Insulin Infusion Industry Revenue (Million), by Component 2024 & 2032

- Figure 92: India APAC Insulin Infusion Industry Volume (K Unit), by Component 2024 & 2032

- Figure 93: India APAC Insulin Infusion Industry Revenue Share (%), by Component 2024 & 2032

- Figure 94: India APAC Insulin Infusion Industry Volume Share (%), by Component 2024 & 2032

- Figure 95: India APAC Insulin Infusion Industry Revenue (Million), by End User 2024 & 2032

- Figure 96: India APAC Insulin Infusion Industry Volume (K Unit), by End User 2024 & 2032

- Figure 97: India APAC Insulin Infusion Industry Revenue Share (%), by End User 2024 & 2032

- Figure 98: India APAC Insulin Infusion Industry Volume Share (%), by End User 2024 & 2032

- Figure 99: India APAC Insulin Infusion Industry Revenue (Million), by Geography 2024 & 2032

- Figure 100: India APAC Insulin Infusion Industry Volume (K Unit), by Geography 2024 & 2032

- Figure 101: India APAC Insulin Infusion Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 102: India APAC Insulin Infusion Industry Volume Share (%), by Geography 2024 & 2032

- Figure 103: India APAC Insulin Infusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 104: India APAC Insulin Infusion Industry Volume (K Unit), by Country 2024 & 2032

- Figure 105: India APAC Insulin Infusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 106: India APAC Insulin Infusion Industry Volume Share (%), by Country 2024 & 2032

- Figure 107: Australia APAC Insulin Infusion Industry Revenue (Million), by Technology 2024 & 2032

- Figure 108: Australia APAC Insulin Infusion Industry Volume (K Unit), by Technology 2024 & 2032

- Figure 109: Australia APAC Insulin Infusion Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 110: Australia APAC Insulin Infusion Industry Volume Share (%), by Technology 2024 & 2032

- Figure 111: Australia APAC Insulin Infusion Industry Revenue (Million), by Component 2024 & 2032

- Figure 112: Australia APAC Insulin Infusion Industry Volume (K Unit), by Component 2024 & 2032

- Figure 113: Australia APAC Insulin Infusion Industry Revenue Share (%), by Component 2024 & 2032

- Figure 114: Australia APAC Insulin Infusion Industry Volume Share (%), by Component 2024 & 2032

- Figure 115: Australia APAC Insulin Infusion Industry Revenue (Million), by End User 2024 & 2032

- Figure 116: Australia APAC Insulin Infusion Industry Volume (K Unit), by End User 2024 & 2032

- Figure 117: Australia APAC Insulin Infusion Industry Revenue Share (%), by End User 2024 & 2032

- Figure 118: Australia APAC Insulin Infusion Industry Volume Share (%), by End User 2024 & 2032

- Figure 119: Australia APAC Insulin Infusion Industry Revenue (Million), by Geography 2024 & 2032

- Figure 120: Australia APAC Insulin Infusion Industry Volume (K Unit), by Geography 2024 & 2032

- Figure 121: Australia APAC Insulin Infusion Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 122: Australia APAC Insulin Infusion Industry Volume Share (%), by Geography 2024 & 2032

- Figure 123: Australia APAC Insulin Infusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 124: Australia APAC Insulin Infusion Industry Volume (K Unit), by Country 2024 & 2032

- Figure 125: Australia APAC Insulin Infusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 126: Australia APAC Insulin Infusion Industry Volume Share (%), by Country 2024 & 2032

- Figure 127: Vietnam APAC Insulin Infusion Industry Revenue (Million), by Technology 2024 & 2032

- Figure 128: Vietnam APAC Insulin Infusion Industry Volume (K Unit), by Technology 2024 & 2032

- Figure 129: Vietnam APAC Insulin Infusion Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 130: Vietnam APAC Insulin Infusion Industry Volume Share (%), by Technology 2024 & 2032

- Figure 131: Vietnam APAC Insulin Infusion Industry Revenue (Million), by Component 2024 & 2032

- Figure 132: Vietnam APAC Insulin Infusion Industry Volume (K Unit), by Component 2024 & 2032

- Figure 133: Vietnam APAC Insulin Infusion Industry Revenue Share (%), by Component 2024 & 2032

- Figure 134: Vietnam APAC Insulin Infusion Industry Volume Share (%), by Component 2024 & 2032

- Figure 135: Vietnam APAC Insulin Infusion Industry Revenue (Million), by End User 2024 & 2032

- Figure 136: Vietnam APAC Insulin Infusion Industry Volume (K Unit), by End User 2024 & 2032

- Figure 137: Vietnam APAC Insulin Infusion Industry Revenue Share (%), by End User 2024 & 2032

- Figure 138: Vietnam APAC Insulin Infusion Industry Volume Share (%), by End User 2024 & 2032

- Figure 139: Vietnam APAC Insulin Infusion Industry Revenue (Million), by Geography 2024 & 2032

- Figure 140: Vietnam APAC Insulin Infusion Industry Volume (K Unit), by Geography 2024 & 2032

- Figure 141: Vietnam APAC Insulin Infusion Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 142: Vietnam APAC Insulin Infusion Industry Volume Share (%), by Geography 2024 & 2032

- Figure 143: Vietnam APAC Insulin Infusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 144: Vietnam APAC Insulin Infusion Industry Volume (K Unit), by Country 2024 & 2032

- Figure 145: Vietnam APAC Insulin Infusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 146: Vietnam APAC Insulin Infusion Industry Volume Share (%), by Country 2024 & 2032

- Figure 147: Malaysia APAC Insulin Infusion Industry Revenue (Million), by Technology 2024 & 2032

- Figure 148: Malaysia APAC Insulin Infusion Industry Volume (K Unit), by Technology 2024 & 2032

- Figure 149: Malaysia APAC Insulin Infusion Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 150: Malaysia APAC Insulin Infusion Industry Volume Share (%), by Technology 2024 & 2032

- Figure 151: Malaysia APAC Insulin Infusion Industry Revenue (Million), by Component 2024 & 2032

- Figure 152: Malaysia APAC Insulin Infusion Industry Volume (K Unit), by Component 2024 & 2032

- Figure 153: Malaysia APAC Insulin Infusion Industry Revenue Share (%), by Component 2024 & 2032

- Figure 154: Malaysia APAC Insulin Infusion Industry Volume Share (%), by Component 2024 & 2032

- Figure 155: Malaysia APAC Insulin Infusion Industry Revenue (Million), by End User 2024 & 2032

- Figure 156: Malaysia APAC Insulin Infusion Industry Volume (K Unit), by End User 2024 & 2032

- Figure 157: Malaysia APAC Insulin Infusion Industry Revenue Share (%), by End User 2024 & 2032

- Figure 158: Malaysia APAC Insulin Infusion Industry Volume Share (%), by End User 2024 & 2032

- Figure 159: Malaysia APAC Insulin Infusion Industry Revenue (Million), by Geography 2024 & 2032

- Figure 160: Malaysia APAC Insulin Infusion Industry Volume (K Unit), by Geography 2024 & 2032

- Figure 161: Malaysia APAC Insulin Infusion Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 162: Malaysia APAC Insulin Infusion Industry Volume Share (%), by Geography 2024 & 2032

- Figure 163: Malaysia APAC Insulin Infusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 164: Malaysia APAC Insulin Infusion Industry Volume (K Unit), by Country 2024 & 2032

- Figure 165: Malaysia APAC Insulin Infusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 166: Malaysia APAC Insulin Infusion Industry Volume Share (%), by Country 2024 & 2032

- Figure 167: Indonesia APAC Insulin Infusion Industry Revenue (Million), by Technology 2024 & 2032

- Figure 168: Indonesia APAC Insulin Infusion Industry Volume (K Unit), by Technology 2024 & 2032

- Figure 169: Indonesia APAC Insulin Infusion Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 170: Indonesia APAC Insulin Infusion Industry Volume Share (%), by Technology 2024 & 2032

- Figure 171: Indonesia APAC Insulin Infusion Industry Revenue (Million), by Component 2024 & 2032

- Figure 172: Indonesia APAC Insulin Infusion Industry Volume (K Unit), by Component 2024 & 2032

- Figure 173: Indonesia APAC Insulin Infusion Industry Revenue Share (%), by Component 2024 & 2032

- Figure 174: Indonesia APAC Insulin Infusion Industry Volume Share (%), by Component 2024 & 2032

- Figure 175: Indonesia APAC Insulin Infusion Industry Revenue (Million), by End User 2024 & 2032

- Figure 176: Indonesia APAC Insulin Infusion Industry Volume (K Unit), by End User 2024 & 2032

- Figure 177: Indonesia APAC Insulin Infusion Industry Revenue Share (%), by End User 2024 & 2032

- Figure 178: Indonesia APAC Insulin Infusion Industry Volume Share (%), by End User 2024 & 2032

- Figure 179: Indonesia APAC Insulin Infusion Industry Revenue (Million), by Geography 2024 & 2032

- Figure 180: Indonesia APAC Insulin Infusion Industry Volume (K Unit), by Geography 2024 & 2032

- Figure 181: Indonesia APAC Insulin Infusion Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 182: Indonesia APAC Insulin Infusion Industry Volume Share (%), by Geography 2024 & 2032

- Figure 183: Indonesia APAC Insulin Infusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 184: Indonesia APAC Insulin Infusion Industry Volume (K Unit), by Country 2024 & 2032

- Figure 185: Indonesia APAC Insulin Infusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 186: Indonesia APAC Insulin Infusion Industry Volume Share (%), by Country 2024 & 2032

- Figure 187: Philippines APAC Insulin Infusion Industry Revenue (Million), by Technology 2024 & 2032

- Figure 188: Philippines APAC Insulin Infusion Industry Volume (K Unit), by Technology 2024 & 2032

- Figure 189: Philippines APAC Insulin Infusion Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 190: Philippines APAC Insulin Infusion Industry Volume Share (%), by Technology 2024 & 2032

- Figure 191: Philippines APAC Insulin Infusion Industry Revenue (Million), by Component 2024 & 2032

- Figure 192: Philippines APAC Insulin Infusion Industry Volume (K Unit), by Component 2024 & 2032

- Figure 193: Philippines APAC Insulin Infusion Industry Revenue Share (%), by Component 2024 & 2032

- Figure 194: Philippines APAC Insulin Infusion Industry Volume Share (%), by Component 2024 & 2032

- Figure 195: Philippines APAC Insulin Infusion Industry Revenue (Million), by End User 2024 & 2032

- Figure 196: Philippines APAC Insulin Infusion Industry Volume (K Unit), by End User 2024 & 2032

- Figure 197: Philippines APAC Insulin Infusion Industry Revenue Share (%), by End User 2024 & 2032

- Figure 198: Philippines APAC Insulin Infusion Industry Volume Share (%), by End User 2024 & 2032

- Figure 199: Philippines APAC Insulin Infusion Industry Revenue (Million), by Geography 2024 & 2032

- Figure 200: Philippines APAC Insulin Infusion Industry Volume (K Unit), by Geography 2024 & 2032

- Figure 201: Philippines APAC Insulin Infusion Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 202: Philippines APAC Insulin Infusion Industry Volume Share (%), by Geography 2024 & 2032

- Figure 203: Philippines APAC Insulin Infusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 204: Philippines APAC Insulin Infusion Industry Volume (K Unit), by Country 2024 & 2032

- Figure 205: Philippines APAC Insulin Infusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 206: Philippines APAC Insulin Infusion Industry Volume Share (%), by Country 2024 & 2032

- Figure 207: Thailand APAC Insulin Infusion Industry Revenue (Million), by Technology 2024 & 2032

- Figure 208: Thailand APAC Insulin Infusion Industry Volume (K Unit), by Technology 2024 & 2032

- Figure 209: Thailand APAC Insulin Infusion Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 210: Thailand APAC Insulin Infusion Industry Volume Share (%), by Technology 2024 & 2032

- Figure 211: Thailand APAC Insulin Infusion Industry Revenue (Million), by Component 2024 & 2032

- Figure 212: Thailand APAC Insulin Infusion Industry Volume (K Unit), by Component 2024 & 2032

- Figure 213: Thailand APAC Insulin Infusion Industry Revenue Share (%), by Component 2024 & 2032

- Figure 214: Thailand APAC Insulin Infusion Industry Volume Share (%), by Component 2024 & 2032

- Figure 215: Thailand APAC Insulin Infusion Industry Revenue (Million), by End User 2024 & 2032

- Figure 216: Thailand APAC Insulin Infusion Industry Volume (K Unit), by End User 2024 & 2032

- Figure 217: Thailand APAC Insulin Infusion Industry Revenue Share (%), by End User 2024 & 2032

- Figure 218: Thailand APAC Insulin Infusion Industry Volume Share (%), by End User 2024 & 2032

- Figure 219: Thailand APAC Insulin Infusion Industry Revenue (Million), by Geography 2024 & 2032

- Figure 220: Thailand APAC Insulin Infusion Industry Volume (K Unit), by Geography 2024 & 2032

- Figure 221: Thailand APAC Insulin Infusion Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 222: Thailand APAC Insulin Infusion Industry Volume Share (%), by Geography 2024 & 2032

- Figure 223: Thailand APAC Insulin Infusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 224: Thailand APAC Insulin Infusion Industry Volume (K Unit), by Country 2024 & 2032

- Figure 225: Thailand APAC Insulin Infusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 226: Thailand APAC Insulin Infusion Industry Volume Share (%), by Country 2024 & 2032

- Figure 227: Rest of Asia Pacific APAC Insulin Infusion Industry Revenue (Million), by Technology 2024 & 2032

- Figure 228: Rest of Asia Pacific APAC Insulin Infusion Industry Volume (K Unit), by Technology 2024 & 2032

- Figure 229: Rest of Asia Pacific APAC Insulin Infusion Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 230: Rest of Asia Pacific APAC Insulin Infusion Industry Volume Share (%), by Technology 2024 & 2032

- Figure 231: Rest of Asia Pacific APAC Insulin Infusion Industry Revenue (Million), by Component 2024 & 2032

- Figure 232: Rest of Asia Pacific APAC Insulin Infusion Industry Volume (K Unit), by Component 2024 & 2032

- Figure 233: Rest of Asia Pacific APAC Insulin Infusion Industry Revenue Share (%), by Component 2024 & 2032

- Figure 234: Rest of Asia Pacific APAC Insulin Infusion Industry Volume Share (%), by Component 2024 & 2032

- Figure 235: Rest of Asia Pacific APAC Insulin Infusion Industry Revenue (Million), by End User 2024 & 2032

- Figure 236: Rest of Asia Pacific APAC Insulin Infusion Industry Volume (K Unit), by End User 2024 & 2032

- Figure 237: Rest of Asia Pacific APAC Insulin Infusion Industry Revenue Share (%), by End User 2024 & 2032

- Figure 238: Rest of Asia Pacific APAC Insulin Infusion Industry Volume Share (%), by End User 2024 & 2032

- Figure 239: Rest of Asia Pacific APAC Insulin Infusion Industry Revenue (Million), by Geography 2024 & 2032

- Figure 240: Rest of Asia Pacific APAC Insulin Infusion Industry Volume (K Unit), by Geography 2024 & 2032

- Figure 241: Rest of Asia Pacific APAC Insulin Infusion Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 242: Rest of Asia Pacific APAC Insulin Infusion Industry Volume Share (%), by Geography 2024 & 2032

- Figure 243: Rest of Asia Pacific APAC Insulin Infusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 244: Rest of Asia Pacific APAC Insulin Infusion Industry Volume (K Unit), by Country 2024 & 2032

- Figure 245: Rest of Asia Pacific APAC Insulin Infusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 246: Rest of Asia Pacific APAC Insulin Infusion Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Technology 2019 & 2032

- Table 5: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 6: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Component 2019 & 2032

- Table 7: Global APAC Insulin Infusion Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 9: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 10: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 11: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: United States APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Canada APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Mexico APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 23: Germany APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Germany APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: United Kingdom APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United Kingdom APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: France APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Spain APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Italy APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Italy APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Spain APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Spain APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Belgium APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Belgium APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Netherland APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Netherland APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Nordics APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Nordics APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Rest of Europe APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 45: China APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: China APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Japan APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Japan APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: India APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: India APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: South Korea APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: South Korea APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Southeast Asia APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Southeast Asia APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Australia APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Australia APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Indonesia APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Indonesia APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Phillipes APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Phillipes APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 61: Singapore APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Singapore APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 63: Thailandc APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Thailandc APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 65: Rest of Asia Pacific APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of Asia Pacific APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 67: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 68: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 69: Brazil APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Brazil APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 71: Argentina APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Argentina APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 73: Peru APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Peru APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 75: Chile APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Chile APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 77: Colombia APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Colombia APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 79: Ecuador APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: Ecuador APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 81: Venezuela APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: Venezuela APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 83: Rest of South America APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: Rest of South America APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 85: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 86: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 87: United States APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: United States APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 89: Canada APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: Canada APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 91: Mexico APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: Mexico APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 93: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 94: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 95: United Arab Emirates APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: United Arab Emirates APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 97: Saudi Arabia APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: Saudi Arabia APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 99: South Africa APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 100: South Africa APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 101: Rest of Middle East and Africa APAC Insulin Infusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 102: Rest of Middle East and Africa APAC Insulin Infusion Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 103: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 104: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Technology 2019 & 2032

- Table 105: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 106: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Component 2019 & 2032

- Table 107: Global APAC Insulin Infusion Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 108: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 109: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 110: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 111: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 112: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 113: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 114: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Technology 2019 & 2032

- Table 115: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 116: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Component 2019 & 2032

- Table 117: Global APAC Insulin Infusion Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 118: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 119: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 120: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 121: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 122: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 123: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 124: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Technology 2019 & 2032

- Table 125: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 126: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Component 2019 & 2032

- Table 127: Global APAC Insulin Infusion Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 128: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 129: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 130: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 131: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 132: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 133: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 134: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Technology 2019 & 2032

- Table 135: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 136: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Component 2019 & 2032

- Table 137: Global APAC Insulin Infusion Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 138: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 139: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 140: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 141: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 142: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 143: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 144: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Technology 2019 & 2032

- Table 145: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 146: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Component 2019 & 2032

- Table 147: Global APAC Insulin Infusion Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 148: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 149: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 150: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 151: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 152: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 153: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 154: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Technology 2019 & 2032

- Table 155: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 156: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Component 2019 & 2032

- Table 157: Global APAC Insulin Infusion Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 158: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 159: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 160: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 161: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 162: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 163: Global APAC Insulin Infusion Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 164: Global APAC Insulin Infusion Industry Volume K Unit Forecast, by Technology 2019 & 2032