Key Insights

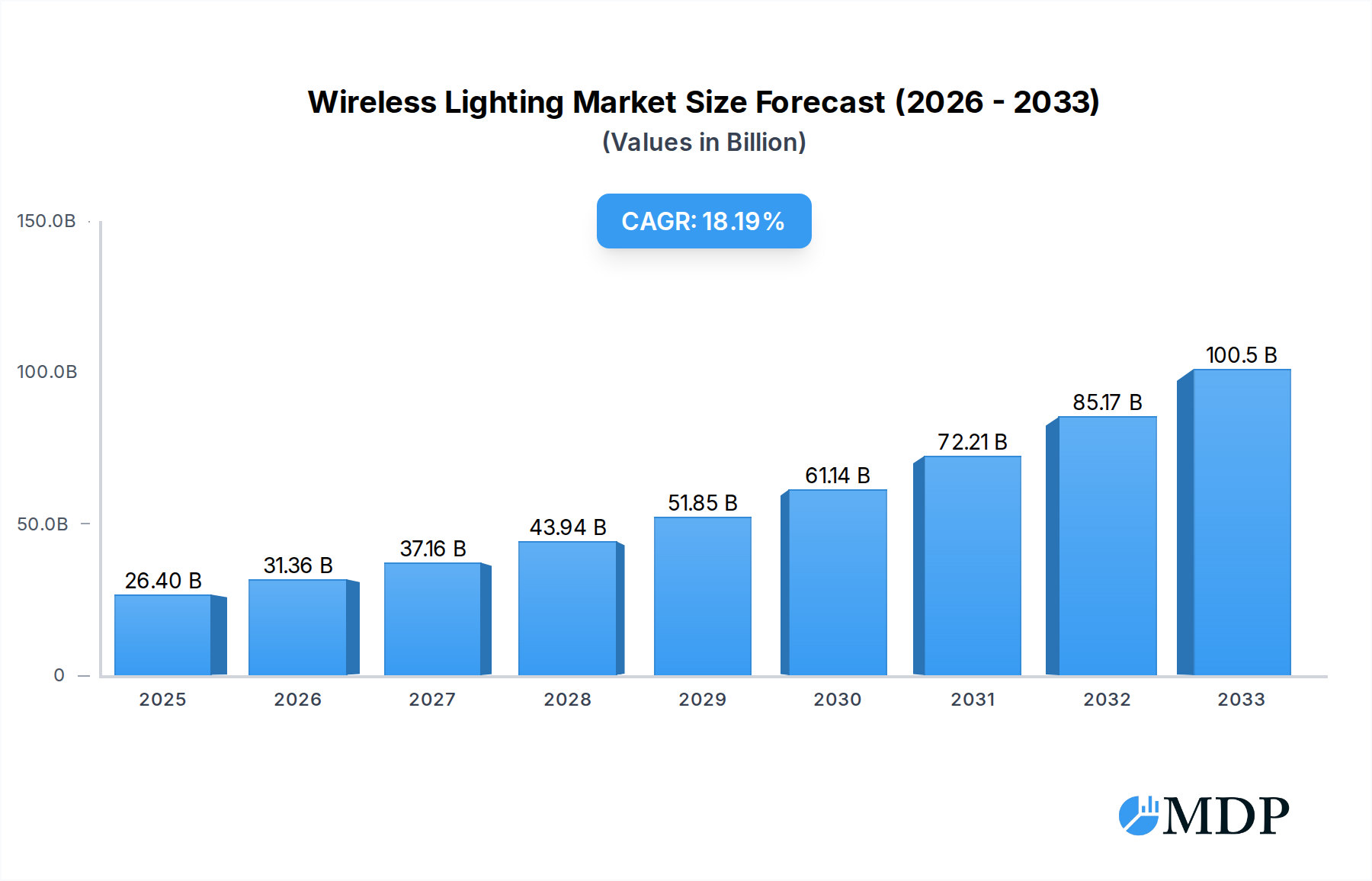

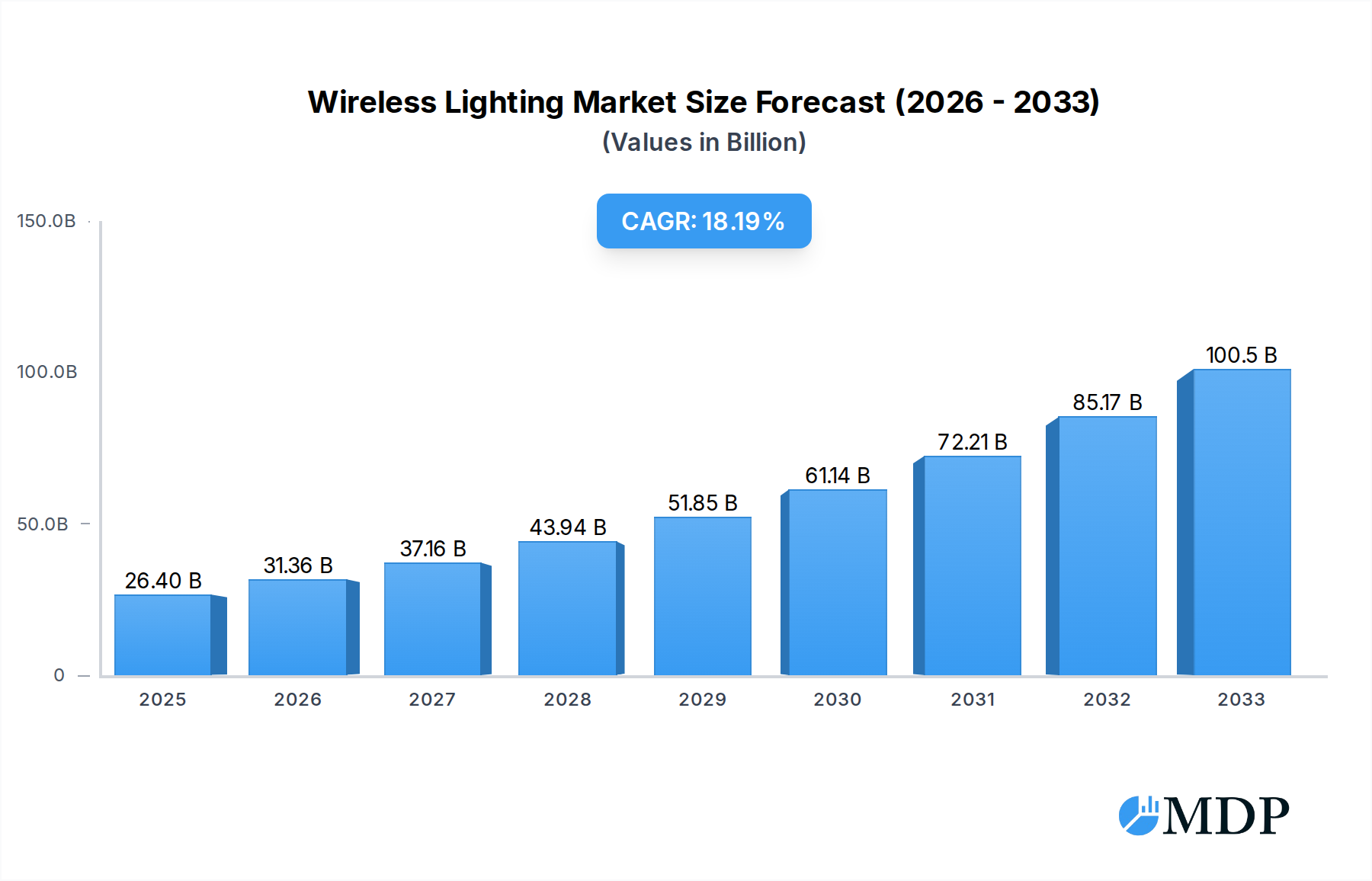

The global Wireless Lighting market is poised for substantial growth, projected to reach $26.4 billion by 2025. This rapid expansion is fueled by an impressive Compound Annual Growth Rate (CAGR) of 18.5%, indicating a dynamic and highly promising sector. The market's growth is primarily driven by the increasing demand for energy-efficient lighting solutions, coupled with the burgeoning adoption of smart home and building technologies. The convenience, flexibility, and advanced control offered by wireless lighting systems are making them increasingly attractive across various applications, including residential buildings, commercial spaces, government offices, and public infrastructure like streetlights. The ongoing digital transformation and the integration of Internet of Things (IoT) devices are further accelerating the adoption of these sophisticated lighting systems, promising a future where lighting is not just functional but also intelligent and adaptive.

Wireless Lighting Market Size (In Billion)

The market's robust CAGR is supported by several key trends, including the continuous innovation in wireless communication protocols like Wi-Fi, Z-Wave, ZigBee, and Bluetooth, leading to enhanced interoperability and performance. The growing awareness of sustainability and the need to reduce carbon footprints are also significant catalysts, as wireless lighting systems enable precise control and dimming capabilities, thus optimizing energy consumption. While the market benefits from strong growth drivers and favorable trends, certain restraints, such as the initial cost of implementation and concerns regarding cybersecurity in networked systems, need to be addressed by industry players. However, the long-term benefits in terms of operational efficiency, cost savings, and enhanced user experience are expected to outweigh these challenges, ensuring sustained market expansion. Key players like Panasonic Corporation, GE Lighting, and Schneider Electric are actively investing in research and development to offer cutting-edge wireless lighting solutions, further shaping the market landscape.

Wireless Lighting Company Market Share

This comprehensive report delves into the burgeoning global Wireless Lighting market, offering an in-depth analysis of its dynamics, trends, and future trajectory. Covering the study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report provides actionable insights for industry stakeholders. We examine the market's intricate segmentation across applications like Residential Buildings, Commercial Buildings, Government Offices and Buildings, and Street Lighting, alongside various wireless technologies including Wi-Fi, Z-Wave, ZigBee, Bluetooth, and EnOcean. With a projected market size expected to reach billions in the coming years, this report is an essential guide for manufacturers, investors, and policymakers navigating this rapidly evolving sector.

Wireless Lighting Market Dynamics & Concentration

The global Wireless Lighting market is characterized by a dynamic interplay of technological innovation, evolving consumer preferences, and strategic corporate maneuvering. Market concentration is moderately high, with key players like Panasonic Corporation, GE Lighting, Schneider Electric, Acuity Brands Lighting, Inc., Hubbell Lighting, Inc., Honeywell International, OSRAM, Eaton Corporation, Cree Inc., and Philips Lighting (Signify) holding significant market shares. These companies are actively investing in research and development to enhance product features, energy efficiency, and user experience. Innovation drivers include the increasing demand for smart homes and buildings, the imperative for energy conservation, and advancements in IoT connectivity. Regulatory frameworks are largely supportive, with government initiatives promoting energy-efficient lighting solutions and smart city development. However, the presence of product substitutes, such as traditional wired lighting systems and emerging alternative illumination technologies, presents a constant competitive pressure. End-user trends are heavily influenced by the desire for convenience, customization, and cost savings through reduced energy consumption. Mergers and acquisition (M&A) activities are on the rise, with an estimated XX billion in M&A deal counts historically, as companies seek to expand their product portfolios, gain market access, and consolidate their positions. This ongoing consolidation is reshaping the competitive landscape, leading to a more integrated and sophisticated market.

Wireless Lighting Industry Trends & Analysis

The Wireless Lighting industry is poised for significant expansion, driven by a confluence of technological advancements and growing market demand. The market growth drivers are multifaceted, encompassing the escalating adoption of smart home ecosystems and the increasing awareness of energy efficiency benefits. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into lighting systems is enabling personalized lighting experiences, predictive maintenance, and optimized energy consumption, further fueling market penetration. Technological disruptions are occurring at an unprecedented pace, with the development of more robust and secure wireless protocols, enhanced LED efficiency, and the integration of sensors for advanced functionality. Consumer preferences are shifting towards user-friendly interfaces, voice control compatibility, and seamless integration with other smart devices. The competitive dynamics are intensifying, with both established players and new entrants vying for market dominance. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% over the forecast period. Market penetration is currently estimated at XX%, with substantial room for growth across all application segments. The increasing affordability of wireless lighting solutions, coupled with government incentives for energy-efficient technologies, is accelerating adoption rates. The proliferation of smart city initiatives globally, with a strong emphasis on intelligent infrastructure, is a significant catalyst for street lighting and public space illumination solutions. The evolution of wireless communication standards is also playing a crucial role, ensuring interoperability and enabling a more connected lighting environment.

Leading Markets & Segments in Wireless Lighting

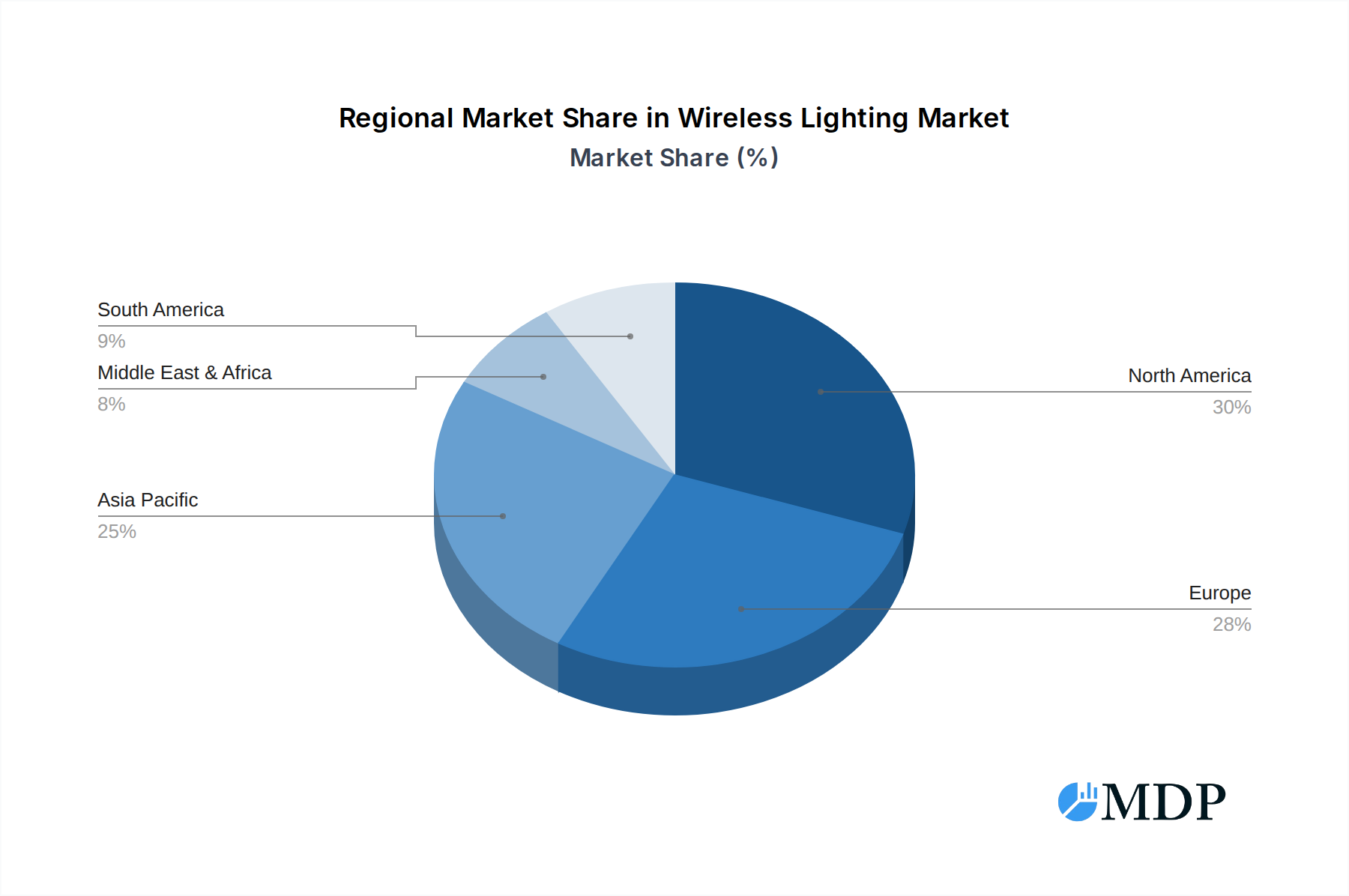

The global Wireless Lighting market exhibits distinct regional dominance and segment penetration. North America currently leads in market share, driven by its strong adoption of smart home technologies and substantial investments in smart city infrastructure. Within North America, the United States stands out as a key market, propelled by robust economic policies supporting energy efficiency and innovation. The Commercial Buildings segment is a major revenue generator, owing to the increasing demand for intelligent lighting solutions that enhance productivity, occupant comfort, and operational cost savings. Furthermore, government offices and buildings are increasingly adopting wireless lighting for security, energy management, and advanced control capabilities.

Application Dominance:

- Commercial Buildings: This segment is projected to maintain its leadership due to the high return on investment offered by energy-efficient and adaptable lighting systems in office spaces, retail environments, and industrial facilities.

- Residential Buildings: The growing popularity of smart homes and the desire for convenience and ambiance are driving significant growth in this segment.

- Street Lighting: Smart city initiatives worldwide are boosting the adoption of connected streetlights for improved safety, energy savings, and data collection.

- Government Offices and Buildings: Driven by mandates for energy efficiency and smart building standards.

- Others: This segment includes applications in hospitality, healthcare, and educational institutions, all of which are increasingly integrating wireless lighting.

Technology Dominance:

- Wi-Fi: Dominates due to its widespread availability and ease of integration with existing home and office networks.

- ZigBee: Holds a strong position in smart home applications, offering low power consumption and mesh networking capabilities.

- Bluetooth: Gaining traction in localized control and personal device integration.

- Z-Wave: Known for its reliability and suitability for dedicated smart home networks.

- EnOcean: Prominent in energy harvesting applications and building automation.

The economic policies promoting energy-efficient retrofits and new constructions, coupled with substantial infrastructure development in emerging economies, are crucial factors influencing the market's growth across these segments.

Wireless Lighting Product Developments

Recent product developments in the wireless lighting sector are focused on enhanced connectivity, intelligent control, and energy efficiency. Innovations include luminaire designs that seamlessly integrate Wi-Fi, ZigBee, and Bluetooth modules, enabling robust mesh networking and remote access. The incorporation of advanced sensors for occupancy detection, daylight harvesting, and color temperature adjustment is becoming standard, allowing for dynamic and personalized lighting experiences. Furthermore, the development of energy-harvesting technologies for wireless switches and sensors, such as those utilizing EnOcean protocols, is reducing reliance on batteries and further contributing to sustainability. Competitive advantages are being gained through intuitive mobile applications for control, voice assistant integration, and the ability to integrate with broader smart home and building management systems, offering a holistic and user-centric approach to illumination.

Key Drivers of Wireless Lighting Growth

The growth of the wireless lighting market is propelled by several key factors. Technological advancements in LED efficiency and wireless communication protocols are making solutions more affordable and accessible. The increasing global emphasis on energy conservation and sustainability is a significant driver, with governments and corporations actively seeking to reduce their carbon footprint. The burgeoning smart home and smart city movements are creating substantial demand for connected lighting systems that offer convenience, security, and enhanced functionality. Furthermore, the declining cost of smart devices and the growing consumer awareness of the benefits of intelligent lighting are accelerating adoption rates across residential and commercial sectors.

Challenges in the Wireless Lighting Market

Despite its promising growth, the wireless lighting market faces several challenges. Regulatory hurdles and the lack of universal interoperability standards across different wireless protocols can impede seamless integration and user adoption. Supply chain issues, including the availability of key components and manufacturing capacity, can impact production and pricing. Intense competitive pressures from both established players and emerging startups can lead to price wars and reduced profit margins. Furthermore, cybersecurity concerns related to connected devices require robust security measures to build consumer trust and ensure the integrity of these systems.

Emerging Opportunities in Wireless Lighting

The future of wireless lighting is brimming with emerging opportunities. Technological breakthroughs in areas like Li-Fi (Light Fidelity) and advanced sensor integration are opening new avenues for data transmission and enhanced functionality. Strategic partnerships between lighting manufacturers, technology providers, and smart home ecosystem developers are crucial for creating integrated and compelling user experiences. Market expansion into emerging economies, where the demand for energy-efficient and modern lighting solutions is rapidly growing, presents significant untapped potential. The development of specialized wireless lighting solutions for niche applications, such as agriculture and healthcare, is also a promising area for growth and innovation.

Leading Players in the Wireless Lighting Sector

- Panasonic Corporation

- GE Lighting

- Schneider Electric

- Acuity Brands Lighting, Inc.

- Hubbell Lighting, Inc.

- Honeywell International

- OSRAM

- Eaton Corporation

- Cree Inc.

- Philips Lighting (Signify)

- IKEA

Key Milestones in Wireless Lighting Industry

- 2019: Increased adoption of ZigBee 3.0 for enhanced interoperability in smart home devices.

- 2020: Growth in Wi-Fi enabled smart bulbs and lighting systems for easy integration into existing home networks.

- 2021: Focus on energy-efficient LED advancements and increased demand for smart street lighting solutions.

- 2022: Expansion of Bluetooth mesh networking capabilities for more robust lighting control.

- 2023: Rise in AI-powered lighting systems offering predictive maintenance and personalized experiences.

- 2024: Increased M&A activity as companies seek to consolidate market positions and expand technological portfolios.

Strategic Outlook for Wireless Lighting Market

The strategic outlook for the wireless lighting market is exceptionally bright, fueled by continuous innovation and increasing global demand for smart, energy-efficient solutions. Growth accelerators include the further integration of AI and machine learning for intelligent automation, the development of more sustainable and energy-harvesting technologies, and the expansion of wireless lighting into new application areas. Strategic opportunities lie in forging cross-industry collaborations, focusing on user-centric design and enhanced cybersecurity, and capitalizing on the global push towards smart cities and sustainable infrastructure development. The market is poised for sustained expansion as wireless lighting becomes an indispensable component of modern living and working environments.

Wireless Lighting Segmentation

-

1. Application

- 1.1. Residential Buildings

- 1.2. Commercial Buildings

- 1.3. Government Offices and Buildings

- 1.4. Street Lighting

- 1.5. Others

-

2. Types

- 2.1. Wi-Fi

- 2.2. Z-Wave

- 2.3. ZigBee

- 2.4. Bluetooth

- 2.5. EnOcean

Wireless Lighting Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Wireless Lighting Regional Market Share

Geographic Coverage of Wireless Lighting

Wireless Lighting REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wireless Lighting Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential Buildings

- 5.1.2. Commercial Buildings

- 5.1.3. Government Offices and Buildings

- 5.1.4. Street Lighting

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Wi-Fi

- 5.2.2. Z-Wave

- 5.2.3. ZigBee

- 5.2.4. Bluetooth

- 5.2.5. EnOcean

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Wireless Lighting Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential Buildings

- 6.1.2. Commercial Buildings

- 6.1.3. Government Offices and Buildings

- 6.1.4. Street Lighting

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Wi-Fi

- 6.2.2. Z-Wave

- 6.2.3. ZigBee

- 6.2.4. Bluetooth

- 6.2.5. EnOcean

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Wireless Lighting Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential Buildings

- 7.1.2. Commercial Buildings

- 7.1.3. Government Offices and Buildings

- 7.1.4. Street Lighting

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Wi-Fi

- 7.2.2. Z-Wave

- 7.2.3. ZigBee

- 7.2.4. Bluetooth

- 7.2.5. EnOcean

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Wireless Lighting Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential Buildings

- 8.1.2. Commercial Buildings

- 8.1.3. Government Offices and Buildings

- 8.1.4. Street Lighting

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Wi-Fi

- 8.2.2. Z-Wave

- 8.2.3. ZigBee

- 8.2.4. Bluetooth

- 8.2.5. EnOcean

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Wireless Lighting Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential Buildings

- 9.1.2. Commercial Buildings

- 9.1.3. Government Offices and Buildings

- 9.1.4. Street Lighting

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Wi-Fi

- 9.2.2. Z-Wave

- 9.2.3. ZigBee

- 9.2.4. Bluetooth

- 9.2.5. EnOcean

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Wireless Lighting Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential Buildings

- 10.1.2. Commercial Buildings

- 10.1.3. Government Offices and Buildings

- 10.1.4. Street Lighting

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Wi-Fi

- 10.2.2. Z-Wave

- 10.2.3. ZigBee

- 10.2.4. Bluetooth

- 10.2.5. EnOcean

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Panasonic Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GE Lighting

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Schneider Electric

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Acuity Brands Lighting

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Inc.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hubbell Lighting

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Inc.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Honeywell International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 OSRAM

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eaton Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Cree Inc.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Philips Lighting (Signify)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 IKEA

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Panasonic Corporation

List of Figures

- Figure 1: Global Wireless Lighting Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Wireless Lighting Volume Breakdown (K, %) by Region 2025 & 2033

- Figure 3: North America Wireless Lighting Revenue (undefined), by Application 2025 & 2033

- Figure 4: North America Wireless Lighting Volume (K), by Application 2025 & 2033

- Figure 5: North America Wireless Lighting Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Wireless Lighting Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Wireless Lighting Revenue (undefined), by Types 2025 & 2033

- Figure 8: North America Wireless Lighting Volume (K), by Types 2025 & 2033

- Figure 9: North America Wireless Lighting Revenue Share (%), by Types 2025 & 2033

- Figure 10: North America Wireless Lighting Volume Share (%), by Types 2025 & 2033

- Figure 11: North America Wireless Lighting Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Wireless Lighting Volume (K), by Country 2025 & 2033

- Figure 13: North America Wireless Lighting Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Wireless Lighting Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Wireless Lighting Revenue (undefined), by Application 2025 & 2033

- Figure 16: South America Wireless Lighting Volume (K), by Application 2025 & 2033

- Figure 17: South America Wireless Lighting Revenue Share (%), by Application 2025 & 2033

- Figure 18: South America Wireless Lighting Volume Share (%), by Application 2025 & 2033

- Figure 19: South America Wireless Lighting Revenue (undefined), by Types 2025 & 2033

- Figure 20: South America Wireless Lighting Volume (K), by Types 2025 & 2033

- Figure 21: South America Wireless Lighting Revenue Share (%), by Types 2025 & 2033

- Figure 22: South America Wireless Lighting Volume Share (%), by Types 2025 & 2033

- Figure 23: South America Wireless Lighting Revenue (undefined), by Country 2025 & 2033

- Figure 24: South America Wireless Lighting Volume (K), by Country 2025 & 2033

- Figure 25: South America Wireless Lighting Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Wireless Lighting Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Wireless Lighting Revenue (undefined), by Application 2025 & 2033

- Figure 28: Europe Wireless Lighting Volume (K), by Application 2025 & 2033

- Figure 29: Europe Wireless Lighting Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Wireless Lighting Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Wireless Lighting Revenue (undefined), by Types 2025 & 2033

- Figure 32: Europe Wireless Lighting Volume (K), by Types 2025 & 2033

- Figure 33: Europe Wireless Lighting Revenue Share (%), by Types 2025 & 2033

- Figure 34: Europe Wireless Lighting Volume Share (%), by Types 2025 & 2033

- Figure 35: Europe Wireless Lighting Revenue (undefined), by Country 2025 & 2033

- Figure 36: Europe Wireless Lighting Volume (K), by Country 2025 & 2033

- Figure 37: Europe Wireless Lighting Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Wireless Lighting Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Wireless Lighting Revenue (undefined), by Application 2025 & 2033

- Figure 40: Middle East & Africa Wireless Lighting Volume (K), by Application 2025 & 2033

- Figure 41: Middle East & Africa Wireless Lighting Revenue Share (%), by Application 2025 & 2033

- Figure 42: Middle East & Africa Wireless Lighting Volume Share (%), by Application 2025 & 2033

- Figure 43: Middle East & Africa Wireless Lighting Revenue (undefined), by Types 2025 & 2033

- Figure 44: Middle East & Africa Wireless Lighting Volume (K), by Types 2025 & 2033

- Figure 45: Middle East & Africa Wireless Lighting Revenue Share (%), by Types 2025 & 2033

- Figure 46: Middle East & Africa Wireless Lighting Volume Share (%), by Types 2025 & 2033

- Figure 47: Middle East & Africa Wireless Lighting Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East & Africa Wireless Lighting Volume (K), by Country 2025 & 2033

- Figure 49: Middle East & Africa Wireless Lighting Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Wireless Lighting Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Wireless Lighting Revenue (undefined), by Application 2025 & 2033

- Figure 52: Asia Pacific Wireless Lighting Volume (K), by Application 2025 & 2033

- Figure 53: Asia Pacific Wireless Lighting Revenue Share (%), by Application 2025 & 2033

- Figure 54: Asia Pacific Wireless Lighting Volume Share (%), by Application 2025 & 2033

- Figure 55: Asia Pacific Wireless Lighting Revenue (undefined), by Types 2025 & 2033

- Figure 56: Asia Pacific Wireless Lighting Volume (K), by Types 2025 & 2033

- Figure 57: Asia Pacific Wireless Lighting Revenue Share (%), by Types 2025 & 2033

- Figure 58: Asia Pacific Wireless Lighting Volume Share (%), by Types 2025 & 2033

- Figure 59: Asia Pacific Wireless Lighting Revenue (undefined), by Country 2025 & 2033

- Figure 60: Asia Pacific Wireless Lighting Volume (K), by Country 2025 & 2033

- Figure 61: Asia Pacific Wireless Lighting Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Wireless Lighting Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wireless Lighting Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Wireless Lighting Volume K Forecast, by Application 2020 & 2033

- Table 3: Global Wireless Lighting Revenue undefined Forecast, by Types 2020 & 2033

- Table 4: Global Wireless Lighting Volume K Forecast, by Types 2020 & 2033

- Table 5: Global Wireless Lighting Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Wireless Lighting Volume K Forecast, by Region 2020 & 2033

- Table 7: Global Wireless Lighting Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Wireless Lighting Volume K Forecast, by Application 2020 & 2033

- Table 9: Global Wireless Lighting Revenue undefined Forecast, by Types 2020 & 2033

- Table 10: Global Wireless Lighting Volume K Forecast, by Types 2020 & 2033

- Table 11: Global Wireless Lighting Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Wireless Lighting Volume K Forecast, by Country 2020 & 2033

- Table 13: United States Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 15: Canada Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 17: Mexico Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 19: Global Wireless Lighting Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Global Wireless Lighting Volume K Forecast, by Application 2020 & 2033

- Table 21: Global Wireless Lighting Revenue undefined Forecast, by Types 2020 & 2033

- Table 22: Global Wireless Lighting Volume K Forecast, by Types 2020 & 2033

- Table 23: Global Wireless Lighting Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Wireless Lighting Volume K Forecast, by Country 2020 & 2033

- Table 25: Brazil Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Brazil Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 27: Argentina Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Argentina Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 31: Global Wireless Lighting Revenue undefined Forecast, by Application 2020 & 2033

- Table 32: Global Wireless Lighting Volume K Forecast, by Application 2020 & 2033

- Table 33: Global Wireless Lighting Revenue undefined Forecast, by Types 2020 & 2033

- Table 34: Global Wireless Lighting Volume K Forecast, by Types 2020 & 2033

- Table 35: Global Wireless Lighting Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global Wireless Lighting Volume K Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 39: Germany Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Germany Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 41: France Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: France Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 43: Italy Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Italy Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 45: Spain Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Spain Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 47: Russia Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Russia Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 49: Benelux Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Benelux Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 51: Nordics Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Nordics Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 55: Global Wireless Lighting Revenue undefined Forecast, by Application 2020 & 2033

- Table 56: Global Wireless Lighting Volume K Forecast, by Application 2020 & 2033

- Table 57: Global Wireless Lighting Revenue undefined Forecast, by Types 2020 & 2033

- Table 58: Global Wireless Lighting Volume K Forecast, by Types 2020 & 2033

- Table 59: Global Wireless Lighting Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Wireless Lighting Volume K Forecast, by Country 2020 & 2033

- Table 61: Turkey Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Turkey Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 63: Israel Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Israel Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 65: GCC Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: GCC Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 67: North Africa Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 68: North Africa Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 69: South Africa Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 70: South Africa Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 73: Global Wireless Lighting Revenue undefined Forecast, by Application 2020 & 2033

- Table 74: Global Wireless Lighting Volume K Forecast, by Application 2020 & 2033

- Table 75: Global Wireless Lighting Revenue undefined Forecast, by Types 2020 & 2033

- Table 76: Global Wireless Lighting Volume K Forecast, by Types 2020 & 2033

- Table 77: Global Wireless Lighting Revenue undefined Forecast, by Country 2020 & 2033

- Table 78: Global Wireless Lighting Volume K Forecast, by Country 2020 & 2033

- Table 79: China Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 80: China Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 81: India Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 82: India Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 83: Japan Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 84: Japan Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 85: South Korea Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 86: South Korea Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 89: Oceania Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 90: Oceania Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Wireless Lighting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Wireless Lighting Volume (K) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wireless Lighting?

The projected CAGR is approximately 18.5%.

2. Which companies are prominent players in the Wireless Lighting?

Key companies in the market include Panasonic Corporation, GE Lighting, Schneider Electric, Acuity Brands Lighting, Inc., Hubbell Lighting, Inc., Honeywell International, OSRAM, Eaton Corporation, Cree Inc., Philips Lighting (Signify), IKEA.

3. What are the main segments of the Wireless Lighting?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wireless Lighting," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wireless Lighting report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wireless Lighting?

To stay informed about further developments, trends, and reports in the Wireless Lighting, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence