Key Insights

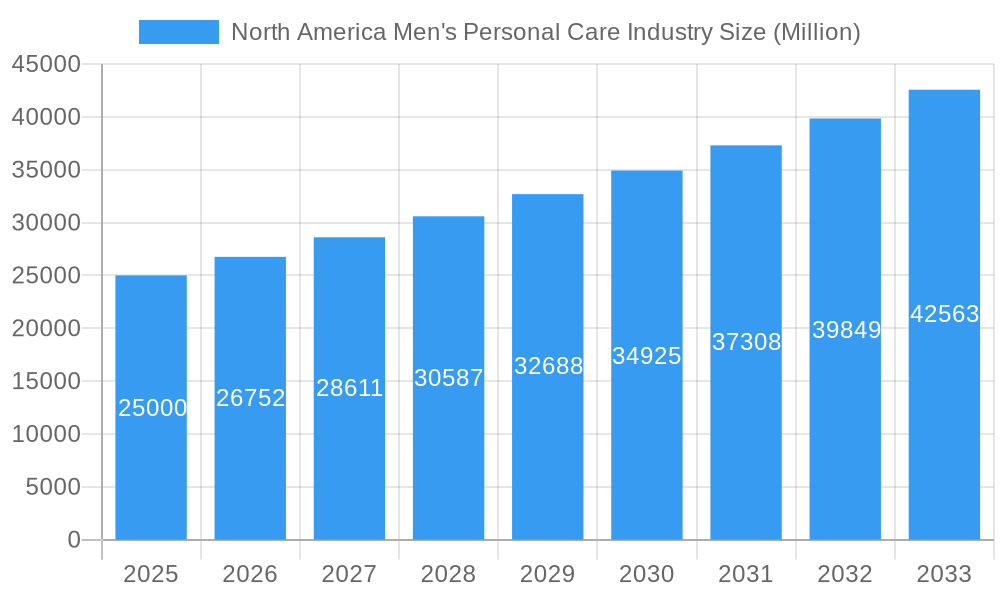

The North American Men's Personal Care Market is projected for substantial growth, estimated to reach 47.06 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.39% anticipated through 2033. This expansion is fueled by increasing male engagement in grooming and self-care, mirroring broader beauty market trends. Key drivers include the rising popularity of premium and specialized products, heightened awareness of skincare benefits, and the influence of social media and celebrity endorsements on male beauty standards. The "men-in-science" movement, promoting scientifically validated formulations and ingredient transparency, also encourages investment in effective personal care solutions. Evolving perceptions of masculinity, embracing grooming as integral to professional and personal presentation, further propel demand.

North America Men's Personal Care Industry Market Size (In Billion)

Market segmentation reveals a dynamic landscape. Shaving products, including pre-shave and post-shave items, exhibit consistent demand, with specialized offerings catering to diverse skin needs. The razors and blades segment continues to evolve with advanced multi-blade systems and electric shavers enhancing convenience and precision. Distribution channels are diversifying, with e-commerce emerging as a dominant force due to accessibility, extensive product selection, and competitive pricing. While supermarkets and hypermarkets remain vital for essential purchases, specialty stores serve consumers seeking premium and niche brands. Geographically, North America, led by the United States, represents a leading market, supported by high disposable incomes and a strong consumer grooming culture.

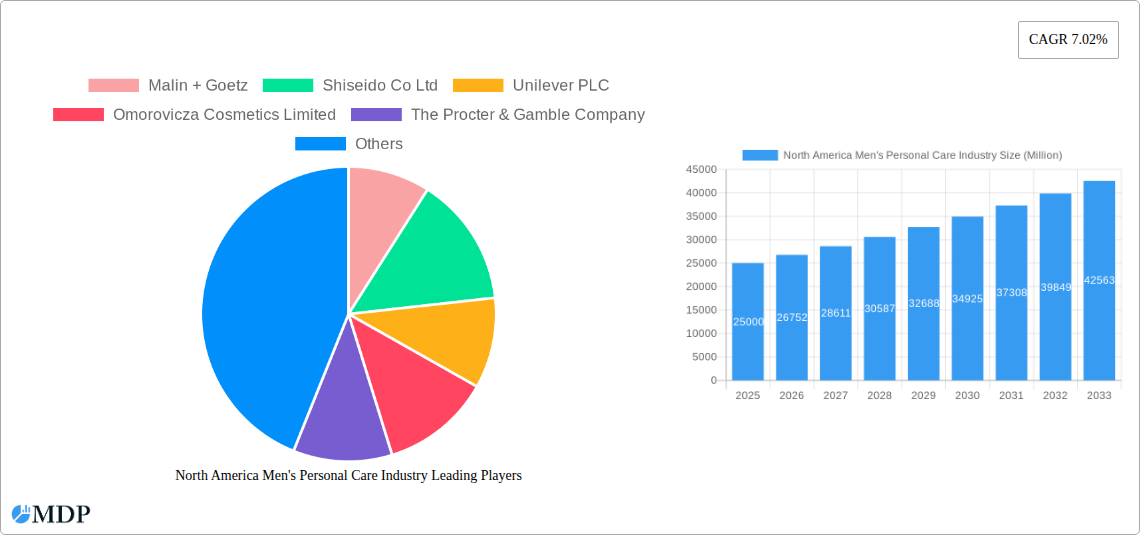

North America Men's Personal Care Industry Company Market Share

This comprehensive report provides an in-depth analysis of the North America Men's Personal Care Industry, a rapidly evolving sector. Covering the period from 2019 to 2033, with 2025 as the base year and an estimated market size of 47.06 billion, this resource details market dynamics, key trends, leading segments, product innovations, growth drivers, challenges, opportunities, and the competitive landscape. Our analysis incorporates high-traffic keywords such as "men's grooming market," "male skincare trends," "shaving products market share," and "e-commerce men's care" to optimize search visibility for stakeholders. This report delivers actionable insights and precise data to inform strategic decision-making within the multi-billion dollar North America Men's Personal Care Industry.

North America Men's Personal Care Industry Market Dynamics & Concentration

The North America Men's Personal Care Industry exhibits a moderately concentrated market, with several large multinational corporations holding significant market share. Innovation drivers are primarily fueled by increasing consumer demand for natural and sustainable ingredients, personalized grooming routines, and advanced formulations addressing specific skin concerns. Regulatory frameworks, particularly concerning ingredient safety and product claims, play a crucial role in shaping product development and market entry strategies. Product substitutes, such as DIY grooming solutions or traditional barbershop services, pose a minor challenge but are largely outweighed by the convenience and efficacy of branded personal care products. End-user trends reveal a growing emphasis on holistic well-being, self-care, and a desire for premium, results-driven products. Merger and acquisition (M&A) activities are ongoing, driven by the pursuit of market expansion, technological integration, and diversification of product portfolios. For instance, recent M&A deal counts have reached xx transactions, with an estimated market share for the top 5 players hovering around xx%. Key players are actively acquiring smaller, innovative brands to tap into niche markets and leverage emerging consumer preferences.

North America Men's Personal Care Industry Industry Trends & Analysis

The North America Men's Personal Care Industry is experiencing robust growth, propelled by evolving societal norms around masculinity and increased male engagement with grooming and skincare. This trend is reflected in a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Market penetration continues to rise as more men adopt multi-step grooming routines beyond basic hygiene. Technological disruptions are transforming the industry, with the advent of AI-powered personalized product recommendations, smart grooming devices, and innovative delivery systems like microencapsulation for enhanced active ingredient efficacy. Online retail stores have emerged as a dominant force, accounting for an estimated xx% of market sales, driven by convenience, wider product selection, and direct-to-consumer (DTC) brand engagement. Consumer preferences are shifting towards clean beauty, ethically sourced ingredients, and products with transparent labeling. The rise of subscription boxes for grooming essentials further underscores this trend. Competitive dynamics are intensifying, with both established players and agile startups vying for market share. The industry is witnessing a surge in demand for specialized products targeting issues such as acne, anti-aging, and beard care, indicating a move towards more sophisticated and results-oriented personal care.

Leading Markets & Segments in North America Men's Personal Care Industry

The United States remains the dominant market within North America for men's personal care products, driven by its large consumer base, high disposable income, and strong adoption of grooming trends. Within product types, Shaving Products continue to hold a significant share, with Post-shave products, particularly after-shaves and balms, experiencing robust growth due to increased consumer awareness of skin health and irritation reduction. The Razors and blades segment also remains a core component, with advancements in blade technology and ergonomic handle designs catering to consumer demands for comfort and efficiency.

In terms of distribution channels, Online Retail Stores are projected to witness the highest growth, capturing an increasing market share. This dominance is attributed to the unparalleled convenience, extensive product variety, competitive pricing, and the rise of direct-to-consumer (DTC) brands catering specifically to the male demographic. Specialty Stores also maintain a strong presence, offering curated selections and expert advice, particularly for premium and niche brands. Supermarkets/Hypermarkets continue to be important for accessibility, offering a broad range of everyday grooming essentials.

Key drivers for the dominance of the US market include:

- High disposable income: Enabling consumers to spend more on premium and specialized personal care items.

- Cultural acceptance of grooming: A societal shift towards men embracing comprehensive skincare and grooming routines.

- Proactive marketing campaigns: Extensive advertising and influencer marketing targeting male consumers.

- Robust e-commerce infrastructure: Facilitating seamless online purchasing experiences.

The United States is expected to represent xx% of the total North America Men's Personal Care Industry revenue in 2025, followed by Canada (xx%) and Mexico (xx%). The "Rest of North America" segment, while smaller, is also showing promising growth.

North America Men's Personal Care Industry Product Developments

Product innovation in the North America Men's Personal Care Industry is characterized by a strong emphasis on natural and organic ingredients, advanced formulations for specific skin concerns (e.g., anti-aging, sensitive skin), and the integration of cutting-edge technologies. Brands are increasingly developing multi-functional products that simplify grooming routines while delivering superior results. The demand for sustainable packaging and ethically sourced components is also a significant trend, driving the development of eco-friendly product lines. Competitive advantages are being built through unique ingredient combinations, proprietary formulations, and personalized product offerings.

Key Drivers of North America Men's Personal Care Industry Growth

Several factors are propelling the growth of the North America Men's Personal Care Industry. Technologically, advancements in ingredient science and product delivery systems are enabling more effective and targeted solutions. Economically, rising disposable incomes and a growing middle class in North America are translating into increased consumer spending on personal care. Regulatory frameworks, while sometimes challenging, also create opportunities for brands that prioritize safety and transparency. Furthermore, the increasing social acceptance of male grooming and self-care routines is a significant cultural driver, encouraging wider adoption of diverse personal care products.

Challenges in the North America Men's Personal Care Industry Market

Despite its growth trajectory, the North America Men's Personal Care Industry faces several challenges. Stringent regulatory hurdles and evolving compliance requirements for cosmetic ingredients can increase development costs and time-to-market. Supply chain disruptions, as witnessed in recent global events, can impact product availability and pricing. Intense competitive pressures from both established brands and emerging DTC players necessitate continuous innovation and effective marketing strategies. Additionally, the need to educate a segment of the male population about the benefits of advanced personal care products remains a persistent challenge.

Emerging Opportunities in North America Men's Personal Care Industry

Emerging opportunities within the North America Men's Personal Care Industry are vast and evolving. Technological breakthroughs in biotechnology and sustainable ingredient sourcing are paving the way for next-generation products. Strategic partnerships between established brands and niche, digitally native companies offer avenues for market expansion and innovation. The growing demand in underserved segments, such as older demographics or specific ethnic groups, presents significant untapped potential. Furthermore, the increasing interest in holistic wellness and men's mental health is creating opportunities for brands to position their products as integral to self-care rituals.

Leading Players in the North America Men's Personal Care Industry Sector

- Malin + Goetz

- Shiseido Co Ltd

- Unilever PLC

- Omorovicza Cosmetics Limited

- The Procter & Gamble Company

- Beiersdorf AG

- Anthony Brands

- Baxter of California

Key Milestones in North America Men's Personal Care Industry Industry

- 2019: Increased consumer demand for "clean beauty" products in men's skincare.

- 2020: Rise in e-commerce sales driven by pandemic-induced lockdowns.

- 2021: Growing popularity of subscription box services for men's grooming essentials.

- 2022: Major brands launch targeted anti-aging and specialized skincare lines for men.

- 2023: Increased focus on sustainable sourcing and eco-friendly packaging by leading manufacturers.

- 2024: Emergence of AI-driven personalized grooming recommendations and product customization.

Strategic Outlook for North America Men's Personal Care Industry Market

The strategic outlook for the North America Men's Personal Care Industry is highly positive, fueled by continuous product innovation and evolving consumer behavior. Growth accelerators will include the expansion of online retail channels, the development of highly specialized and customized product offerings, and a persistent focus on natural and sustainable ingredients. Brands that can effectively leverage digital marketing, influencer collaborations, and DTC strategies will be best positioned for success. The industry is poised for sustained growth, driven by an increasing male willingness to invest in their personal care and well-being.

North America Men's Personal Care Industry Segmentation

-

1. Product Type

-

1.1. Shaving Products

-

1.1.1. Pre-shave

- 1.1.1.1. Shaving Cream

- 1.1.1.2. Pre-shave Oil

- 1.1.1.3. Shaving Soap

- 1.1.1.4. Others

-

1.1.2. Post-shave

- 1.1.2.1. After-shave

- 1.1.2.2. Balms

-

1.1.1. Pre-shave

- 1.2. Razors and blades

-

1.1. Shaving Products

-

2. Distribution Channel

- 2.1. Specialty Stores

- 2.2. Supermarkets/Hypermarkets

- 2.3. Convenience Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

- 3.1.3. Mexico

- 3.1.4. Rest of North America

-

3.1. North America

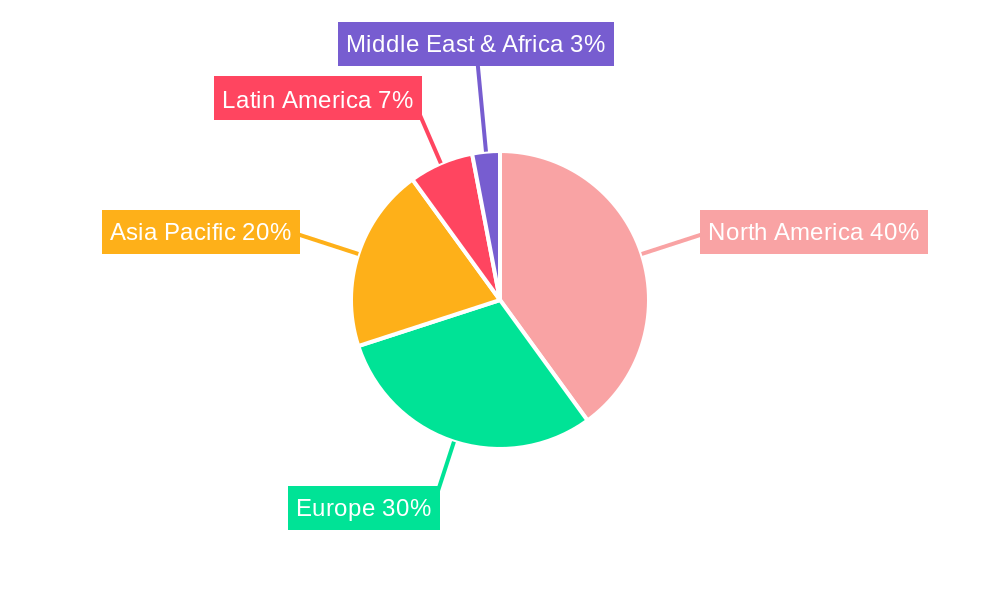

North America Men's Personal Care Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

North America Men's Personal Care Industry Regional Market Share

Geographic Coverage of North America Men's Personal Care Industry

North America Men's Personal Care Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovative Launches; Hair Concerns Among Consumers

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Razors and Blades Hold the Major Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Men's Personal Care Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Shaving Products

- 5.1.1.1. Pre-shave

- 5.1.1.1.1. Shaving Cream

- 5.1.1.1.2. Pre-shave Oil

- 5.1.1.1.3. Shaving Soap

- 5.1.1.1.4. Others

- 5.1.1.2. Post-shave

- 5.1.1.2.1. After-shave

- 5.1.1.2.2. Balms

- 5.1.1.1. Pre-shave

- 5.1.2. Razors and blades

- 5.1.1. Shaving Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Specialty Stores

- 5.2.2. Supermarkets/Hypermarkets

- 5.2.3. Convenience Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1.3. Mexico

- 5.3.1.4. Rest of North America

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Malin + Goetz

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shiseido Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Unilever PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Omorovicza Cosmetics Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Procter & Gamble Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Beiersdorf AG*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Anthony Brands

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Baxter of California

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Malin + Goetz

List of Figures

- Figure 1: North America Men's Personal Care Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Men's Personal Care Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Men's Personal Care Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Men's Personal Care Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Men's Personal Care Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Men's Personal Care Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Men's Personal Care Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: North America Men's Personal Care Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: North America Men's Personal Care Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Men's Personal Care Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Men's Personal Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Men's Personal Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Men's Personal Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America North America Men's Personal Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Men's Personal Care Industry?

The projected CAGR is approximately 6.39%.

2. Which companies are prominent players in the North America Men's Personal Care Industry?

Key companies in the market include Malin + Goetz, Shiseido Co Ltd, Unilever PLC, Omorovicza Cosmetics Limited, The Procter & Gamble Company, Beiersdorf AG*List Not Exhaustive, Anthony Brands, Baxter of California.

3. What are the main segments of the North America Men's Personal Care Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 47.06 billion as of 2022.

5. What are some drivers contributing to market growth?

Innovative Launches; Hair Concerns Among Consumers.

6. What are the notable trends driving market growth?

Razors and Blades Hold the Major Share of the Market.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Men's Personal Care Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Men's Personal Care Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Men's Personal Care Industry?

To stay informed about further developments, trends, and reports in the North America Men's Personal Care Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence