Key Insights

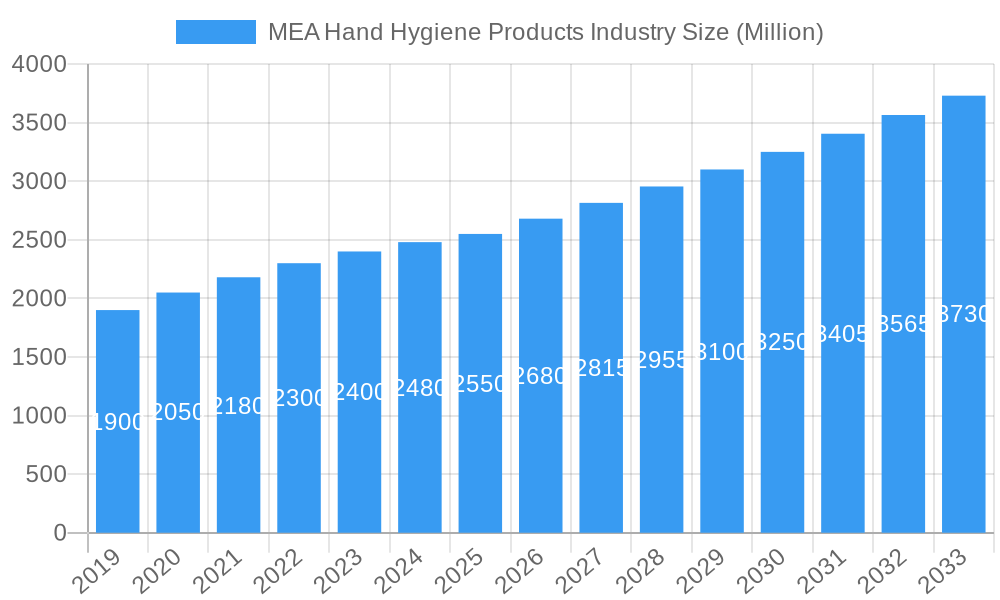

The Middle East and Africa (MEA) Hand Hygiene Products market is projected for significant expansion, anticipated to reach 6405.6 million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.5% between 2025 and 2033. Growth drivers include rising consumer health consciousness, increased awareness of infectious disease prevention, and growing demand for convenient sanitization. Regional population growth, improving healthcare infrastructure, and increasing disposable income in key economies like South Africa and Saudi Arabia further support this growth. Government initiatives promoting public health and hygiene, alongside the expansion of online retail and distribution networks, are also key contributors to market penetration.

MEA Hand Hygiene Products Industry Market Size (In Billion)

The MEA Hand Hygiene Products market is segmented by product type, distribution channel, and geography. Liquid sanitizers and sanitizing wipes are expected to lead product segments, while Supermarkets & Hypermarkets and Pharmaceutical Stores will remain dominant distribution channels. Online channels present substantial growth opportunities. South Africa and Saudi Arabia are identified as primary growth regions. Key industry players are investing in innovation and market strategies to capitalize on these expanding opportunities within a competitive landscape.

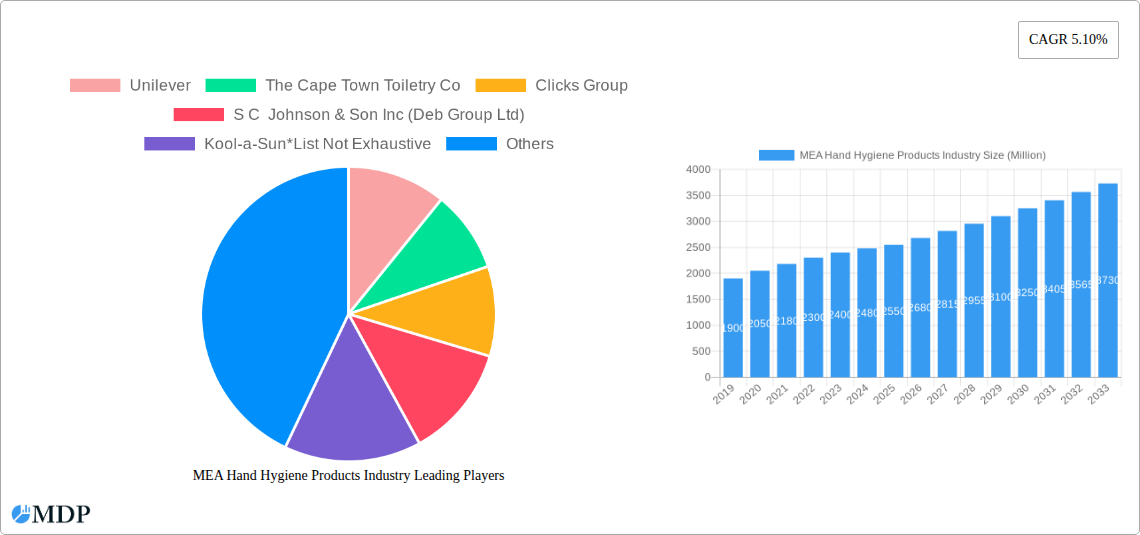

MEA Hand Hygiene Products Industry Company Market Share

This report offers a comprehensive analysis of the MEA Hand Hygiene Products market, detailing dynamics, key trends, leading players, and future opportunities. It serves as an essential guide for navigating the evolving hand hygiene solutions market across South Africa, Saudi Arabia, and the broader Rest of Middle East & Africa. The report includes high-traffic keywords such as hand sanitizer market share, hand wash market growth, disinfectant wipes demand, and alcohol-based sanitizers, providing actionable insights for industry stakeholders.

MEA Hand Hygiene Products Industry Market Dynamics & Concentration

The MEA Hand Hygiene Products Industry is characterized by moderate to high market concentration, with a few dominant players influencing market trends. Key innovation drivers include the increasing demand for effective and convenient hygiene solutions, spurred by heightened health consciousness post-pandemic. Regulatory frameworks, while evolving, generally support the market's growth by setting standards for product efficacy and safety. Product substitutes, such as traditional soap and water, remain prevalent but are increasingly supplemented by specialized hand hygiene products. End-user trends reveal a growing preference for portable and eco-friendly options, alongside a demand for specialized formulations addressing specific needs like sensitive skin. Mergers and acquisitions (M&A) activity, though not at its peak, indicates a strategic consolidation aimed at expanding market reach and product portfolios. For instance, M&A deal counts have seen a steady rise in recent years, indicating consolidation among key players. Estimated market share for leading companies like Unilever and Reckitt Benckiser collectively exceeds 50% in several key markets.

MEA Hand Hygiene Products Industry Industry Trends & Analysis

The MEA Hand Hygiene Products Industry is poised for robust growth, driven by a confluence of factors including escalating public health awareness, stringent hygiene protocols in public and private sectors, and rising disposable incomes across the region. The historical period (2019-2024) witnessed a surge in demand for hand sanitizers and disinfectant wipes, directly linked to the global pandemic. Looking ahead, the forecast period (2025-2033) is expected to maintain a strong Compound Annual Growth Rate (CAGR) of approximately 8-10%, with the base year (2025) setting a significant benchmark for future expansion. Market penetration for various hand hygiene products continues to deepen, particularly in urban centers and emerging economies within the MEA region. Technological disruptions are playing a pivotal role, with innovations in formulation, packaging, and delivery systems enhancing user experience and product efficacy. Consumer preferences are increasingly leaning towards natural and organic ingredients, alcohol-free formulations, and convenient, travel-sized products. The competitive landscape is dynamic, with both global giants and emerging local players vying for market dominance through product differentiation and strategic marketing campaigns. The sustained emphasis on preventative healthcare measures is a fundamental market growth driver, ensuring a consistent demand for hand hygiene solutions. The increasing availability and adoption of hand sanitizer dispensers in public spaces further bolster market growth.

Leading Markets & Segments in MEA Hand Hygiene Products Industry

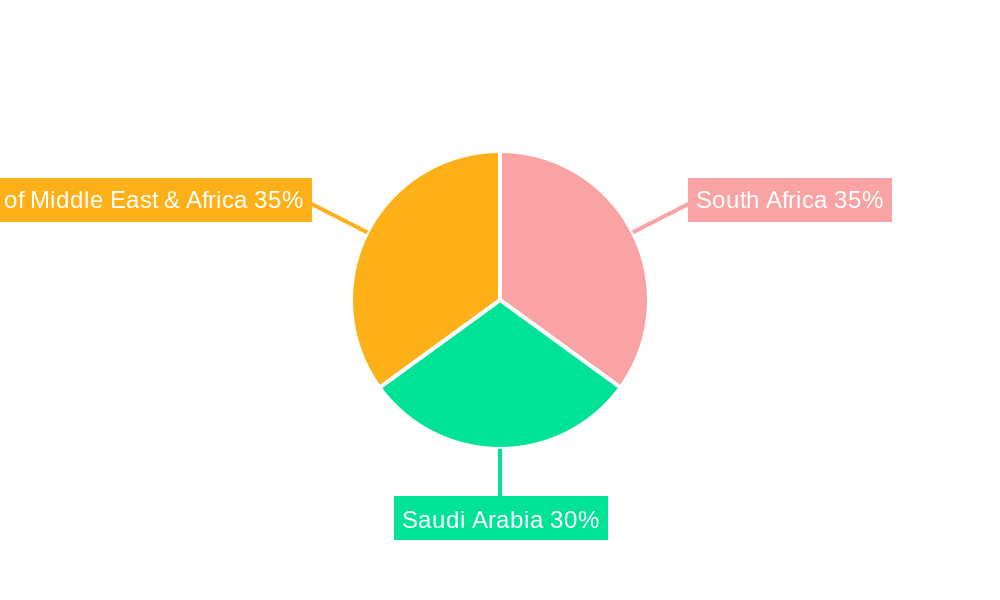

Within the MEA Hand Hygiene Products Industry, South Africa consistently emerges as a leading market, driven by established healthcare infrastructure, higher consumer spending power, and proactive public health initiatives. Saudi Arabia follows closely, fueled by significant investments in healthcare and a large population with a growing awareness of hygiene practices, particularly within its burgeoning tourism and religious pilgrimage sectors. The "Rest of Middle East & Africa" presents a diverse yet rapidly expanding landscape, with countries like the UAE and Egypt showing substantial growth potential.

In terms of product types:

- Gel formulations dominate the market due to their efficacy, ease of use, and portability, accounting for an estimated 40% of the market share.

- Liquid hand sanitizers and soaps remain popular, especially in household and institutional settings, holding approximately 30% market share.

- Sanitizing Wipes are gaining traction for their convenience and targeted application, particularly in travel and public spaces, with a projected market share of 15%.

- Spray and Foam formulations, while smaller segments, are growing due to their innovative delivery mechanisms and consumer appeal, with an estimated combined share of 15%.

Distribution channels are equally vital to market reach:

- Supermarkets & Hypermarkets are key channels, benefiting from high foot traffic and a wide consumer base, contributing significantly to overall sales.

- Pharmaceutical Stores cater to a health-conscious demographic, offering specialized and medically endorsed products.

- Online Channels are experiencing exponential growth, providing convenience, wider product selection, and competitive pricing, becoming a dominant force in the market.

- Convenience Stores and Others (including direct sales to institutions) also play a crucial role in ensuring widespread accessibility.

MEA Hand Hygiene Products Industry Product Developments

Product innovation in the MEA Hand Hygiene Products Industry is primarily focused on enhanced efficacy, improved user experience, and sustainability. Companies are developing advanced alcohol-based sanitizers with moisturizing agents to combat dryness and irritation. The emergence of alcohol-free sanitizers with natural disinfectants is catering to sensitive skin and niche markets. Innovations in packaging, such as smart dispenser technologies and eco-friendly refillable options, are gaining traction. Furthermore, product developments are extending to specialized formulations for specific environments like healthcare settings and educational institutions, aiming to provide superior antimicrobial protection and a competitive advantage.

Key Drivers of MEA Hand Hygiene Products Industry Growth

Several key drivers are propelling the MEA Hand Hygiene Products Industry forward. Increased health and hygiene awareness post-pandemic remains a primary catalyst. Government initiatives and public health campaigns promoting hand hygiene practices are significantly boosting demand. Technological advancements in product formulation and delivery systems are creating more effective and appealing products. Economic growth and rising disposable incomes in many MEA countries are enabling greater consumer spending on personal care and health products. The growing prevalence of infectious diseases and the need for preventative measures further solidify the market's importance.

Challenges in the MEA Hand Hygiene Products Industry Market

Despite strong growth, the MEA Hand Hygiene Products Industry faces several challenges. Fluctuating raw material prices, particularly for alcohol and other key ingredients, can impact production costs and profit margins. Intense price competition among numerous players, both global and local, puts pressure on profitability. Stringent and evolving regulatory requirements across different MEA countries can create compliance hurdles and add to operational complexities. Counterfeit products and concerns about product efficacy in some segments also pose significant challenges to market integrity and consumer trust. Supply chain disruptions can further impact the availability of essential raw materials and finished goods.

Emerging Opportunities in MEA Hand Hygiene Products Industry

Emerging opportunities within the MEA Hand Hygiene Products Industry are abundant. The expansion of online retail channels offers unprecedented reach to a wider consumer base across geographically diverse regions. Growing demand for eco-friendly and sustainable hand hygiene solutions, including biodegradable packaging and natural ingredients, presents a significant niche. The development of smart hygiene technologies, such as automated dispensers and app-integrated monitoring systems, offers a futuristic growth avenue. Strategic partnerships with healthcare providers and institutions can unlock substantial B2B market potential. Furthermore, increasing health tourism and large-scale events in the region create sustained demand for portable and effective hygiene products.

Leading Players in the MEA Hand Hygiene Products Industry Sector

- Unilever

- The Cape Town Toiletry Co

- Clicks Group

- S C Johnson & Son Inc (Deb Group Ltd)

- Kool-a-Sun*List Not Exhaustive

- Reckitt Benckiser

Key Milestones in MEA Hand Hygiene Products Industry Industry

- 2019-2020: Significant surge in demand for hand sanitizers and disinfectant wipes due to rising global health concerns.

- 2021: Increased investment in production capacity by key players to meet sustained demand for hand hygiene products.

- 2022: Emergence of new formulations and alcohol-free hand sanitizers catering to specific consumer needs.

- 2023: Growing adoption of online channels for the distribution and sale of hand hygiene solutions.

- 2024: Focus on sustainable packaging and eco-friendly product offerings gaining momentum.

- 2025 (Base Year): Market stabilization and continued strong demand anticipated for hand hygiene products across MEA.

- 2026-2033 (Forecast Period): Continued innovation in product types and distribution strategies expected to drive sustained market growth.

Strategic Outlook for MEA Hand Hygiene Products Industry Market

The strategic outlook for the MEA Hand Hygiene Products Industry remains exceptionally positive. Growth accelerators include the ongoing prioritization of public health, continuous product innovation, and the expanding reach of e-commerce platforms. Companies should focus on developing a diversified product portfolio, catering to both mass-market and niche segments, while emphasizing sustainability and advanced formulations. Strategic partnerships with local distributors and healthcare providers will be crucial for market penetration and expansion. Investing in digital marketing and e-commerce capabilities will be paramount to capturing the growing online consumer base and solidifying market presence in this dynamic sector.

MEA Hand Hygiene Products Industry Segmentation

-

1. Type

- 1.1. Gel

- 1.2. Liquid

- 1.3. Spray

- 1.4. Foam

- 1.5. Sanitizing Wipes

-

2. Distribution Channel

- 2.1. Supermarkets & Hypermarkets

- 2.2. Convenience Stores

- 2.3. Pharmaceutical Stores

- 2.4. Online Channels

- 2.5. Others

-

3. Geography

-

3.1. Middle East and Africa

- 3.1.1. South Africa

- 3.1.2. Saudi Arabia

- 3.1.3. Rest of Middle East & Africa

-

3.1. Middle East and Africa

MEA Hand Hygiene Products Industry Segmentation By Geography

-

1. Middle East and Africa

- 1.1. South Africa

- 1.2. Saudi Arabia

- 1.3. Rest of Middle East

MEA Hand Hygiene Products Industry Regional Market Share

Geographic Coverage of MEA Hand Hygiene Products Industry

MEA Hand Hygiene Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Skin Concerns Among Men Leading to Purchase of Skincare Products; The Taming and Beard Maintenance Market Dominates the Men's Grooming Products Market

- 3.3. Market Restrains

- 3.3.1. Increasing Awareness Regarding the Side Effects Associated with Chemical Cosmetic/Skincare Products

- 3.4. Market Trends

- 3.4.1. Rising Awareness towards Hand Hygiene owing to Rising Coronavirus Disease Cases in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Hand Hygiene Products Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Gel

- 5.1.2. Liquid

- 5.1.3. Spray

- 5.1.4. Foam

- 5.1.5. Sanitizing Wipes

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets & Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Pharmaceutical Stores

- 5.2.4. Online Channels

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Middle East and Africa

- 5.3.1.1. South Africa

- 5.3.1.2. Saudi Arabia

- 5.3.1.3. Rest of Middle East & Africa

- 5.3.1. Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Unilever

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Cape Town Toiletry Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Clicks Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 S C Johnson & Son Inc (Deb Group Ltd)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kool-a-Sun*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Reckitt Benckiser

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Unilever

List of Figures

- Figure 1: Global MEA Hand Hygiene Products Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Middle East and Africa MEA Hand Hygiene Products Industry Revenue (million), by Type 2025 & 2033

- Figure 3: Middle East and Africa MEA Hand Hygiene Products Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: Middle East and Africa MEA Hand Hygiene Products Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 5: Middle East and Africa MEA Hand Hygiene Products Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: Middle East and Africa MEA Hand Hygiene Products Industry Revenue (million), by Geography 2025 & 2033

- Figure 7: Middle East and Africa MEA Hand Hygiene Products Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Middle East and Africa MEA Hand Hygiene Products Industry Revenue (million), by Country 2025 & 2033

- Figure 9: Middle East and Africa MEA Hand Hygiene Products Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Hand Hygiene Products Industry Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global MEA Hand Hygiene Products Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global MEA Hand Hygiene Products Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 4: Global MEA Hand Hygiene Products Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global MEA Hand Hygiene Products Industry Revenue million Forecast, by Type 2020 & 2033

- Table 6: Global MEA Hand Hygiene Products Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global MEA Hand Hygiene Products Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 8: Global MEA Hand Hygiene Products Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: South Africa MEA Hand Hygiene Products Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Saudi Arabia MEA Hand Hygiene Products Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Middle East MEA Hand Hygiene Products Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Hand Hygiene Products Industry?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the MEA Hand Hygiene Products Industry?

Key companies in the market include Unilever, The Cape Town Toiletry Co, Clicks Group, S C Johnson & Son Inc (Deb Group Ltd), Kool-a-Sun*List Not Exhaustive, Reckitt Benckiser.

3. What are the main segments of the MEA Hand Hygiene Products Industry?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 6405.6 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Skin Concerns Among Men Leading to Purchase of Skincare Products; The Taming and Beard Maintenance Market Dominates the Men's Grooming Products Market.

6. What are the notable trends driving market growth?

Rising Awareness towards Hand Hygiene owing to Rising Coronavirus Disease Cases in the Region.

7. Are there any restraints impacting market growth?

Increasing Awareness Regarding the Side Effects Associated with Chemical Cosmetic/Skincare Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Hand Hygiene Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Hand Hygiene Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Hand Hygiene Products Industry?

To stay informed about further developments, trends, and reports in the MEA Hand Hygiene Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence