Key Insights

The global Online Gambling Market is experiencing robust expansion, projected to reach a substantial USD 93.26 billion by 2025. This growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 10.44% between 2019 and 2033, indicating sustained momentum. The market's trajectory is primarily fueled by several significant drivers. The increasing accessibility of high-speed internet and the proliferation of mobile devices have democratized access to online betting platforms, making them available to a wider audience than ever before. Furthermore, the integration of innovative technologies like AI and blockchain is enhancing user experience through personalized offerings, secure transactions, and more engaging gameplay, thereby attracting new users and retaining existing ones. The legalization and regulation of online gambling in various jurisdictions also contribute significantly, legitimizing the industry and fostering a more trustworthy environment for consumers.

Online Gambling Market Market Size (In Million)

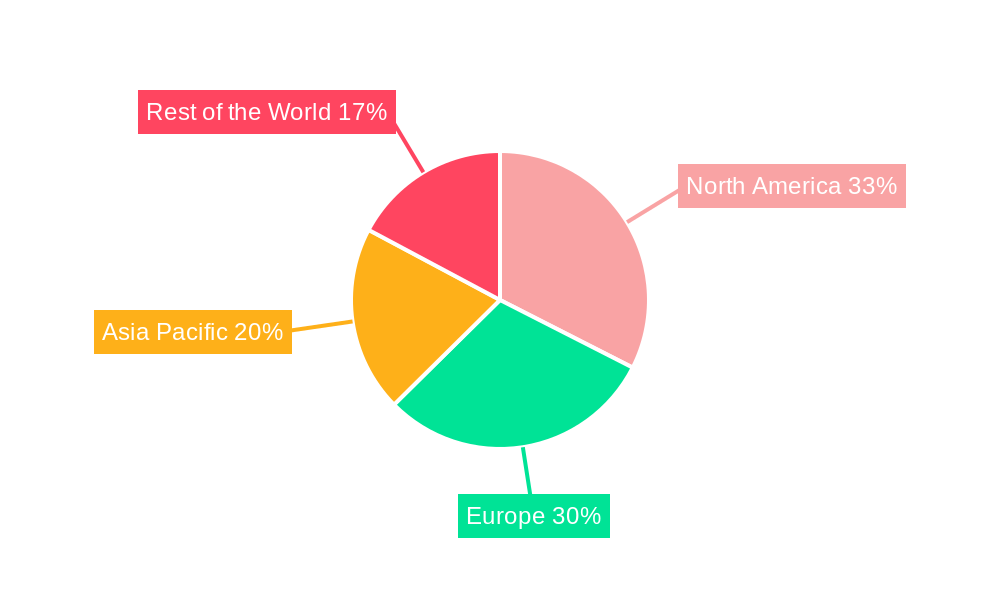

The market's diverse segmentation reflects its broad appeal. Sports betting, encompassing popular verticals like football, horse racing, and tennis, continues to dominate, driven by the passion and engagement of sports enthusiasts worldwide. Simultaneously, the casino segment, particularly live casino offerings, baccarat, blackjack, poker, and slots, is witnessing remarkable growth, benefiting from realistic gaming experiences that mimic land-based casinos. Lotteries and bingo also maintain a steady presence, catering to a different demographic seeking casual entertainment. The shift towards mobile gaming is undeniable, with mobile platforms increasingly becoming the preferred channel for online gambling due to their convenience and flexibility. Geographically, North America and Europe are leading the market, supported by established regulatory frameworks and a high disposable income among consumers. However, the Asia Pacific region presents significant untapped potential for future growth, driven by a rapidly expanding internet user base and increasing urbanization.

Online Gambling Market Company Market Share

Unlocking the Future of Online Gambling: A Comprehensive Market Analysis (2019-2033)

This in-depth report offers an unparalleled view into the dynamic global online gambling market, a sector projected to reach hundreds of billions of dollars in value. Spanning the historical period of 2019–2024, a base year of 2025, and a comprehensive forecast period extending to 2033, this analysis provides stakeholders with actionable insights into market dynamics, industry trends, leading segments, and strategic growth opportunities. Leverage high-traffic keywords such as sports betting, online casino, mobile gambling, iGaming, and gambling market growth to navigate this rapidly evolving landscape.

Online Gambling Market Market Dynamics & Concentration

The online gambling market exhibits a mixed concentration, with a few dominant players like DraftKings Inc., Flutter Entertainment PLC, and Entain PLC holding significant market share, alongside a long tail of smaller operators. Innovation drivers are paramount, fueled by the continuous development of mobile gambling platforms, live dealer online casino experiences, and sophisticated CRM systems. Regulatory frameworks remain a critical factor, with evolving legal landscapes in key regions like North America and Europe shaping market access and operational strategies. Product substitutes, while present in traditional entertainment, are increasingly being edged out by the convenience and accessibility of online gambling. End-user trends show a clear preference for mobile-first experiences, demanding intuitive interfaces and seamless gameplay. Mergers and acquisitions (M&A) activity has been robust, with an estimated over 150 M&A deals recorded in the past five years, consolidating market power and expanding geographic reach.

- Market Concentration: Fragmented yet consolidating, with key players commanding substantial market share.

- Innovation Drivers: Mobile technology, AI for personalization, live dealer advancements, and responsible gambling tools.

- Regulatory Landscape: Divergent regulations across jurisdictions, with a trend towards legalization and stricter oversight.

- Product Substitutes: Limited direct substitutes for the engagement and entertainment offered by online gambling.

- End-User Preferences: Dominance of mobile devices, demand for diverse game portfolios, and a focus on user experience.

- M&A Activities: Strategic acquisitions to gain market entry, acquire technology, and expand customer bases.

Online Gambling Market Industry Trends & Analysis

The online gambling market is poised for exponential growth, driven by increasing internet penetration, smartphone adoption, and a growing acceptance of iGaming as a legitimate form of entertainment. Technological disruptions, including the integration of Artificial Intelligence (AI) for personalized user experiences, the rise of cryptocurrencies for faster transactions, and the potential of Virtual Reality (VR) for immersive online casino environments, are reshaping the industry. Consumer preferences are increasingly shifting towards convenience, a wider variety of games, and socially responsible gaming options. Competitive dynamics are intense, with operators constantly innovating to attract and retain users through attractive bonuses, loyalty programs, and unique sports betting markets. The market penetration of online gambling is steadily increasing globally, projected to reach over 40% by 2033. The Compound Annual Growth Rate (CAGR) for the forecast period is estimated at a robust 12.5%, translating to a projected market value of over $250 Billion by 2033.

- Market Growth Drivers: Favorable demographics, technological advancements, increasing disposable income, and evolving consumer attitudes.

- Technological Disruptions: AI-powered personalization, blockchain for transparency, VR/AR for immersive experiences, and advanced data analytics.

- Consumer Preferences: Demand for mobile accessibility, diverse game offerings (including live casino and slots), responsible gambling features, and secure payment options.

- Competitive Dynamics: Intense competition leading to innovative marketing strategies, product diversification, and strategic partnerships.

- Market Penetration: Steady increase driven by legalization efforts and growing digital literacy across emerging markets.

Leading Markets & Segments in Online Gambling Market

The online gambling market is led by North America and Europe, with the United States emerging as a particularly high-growth region due to the ongoing legalization of sports betting and online casino games. Within game types, Sports Betting remains a dominant segment, driven by the global passion for football, horse racing, and tennis, along with the burgeoning popularity of esports. The Casino segment, particularly Live Casino, is experiencing significant traction, offering an authentic and engaging experience. Slots continue to be a consistent revenue generator, appealing to a broad player base. The Mobile end-user segment is unequivocally leading the market, with the vast majority of wagers placed via smartphones and tablets, underscoring the need for mobile-optimized platforms and applications.

- Dominant Regions: North America (especially the US), Europe (UK, Germany, Spain), and Asia-Pacific.

- Key Country Drivers: Favorable regulatory environments, strong digital infrastructure, and high disposable incomes.

- Leading Game Type: Sports Betting:

- Football: Global popularity drives massive betting volumes.

- Horse Racing: Long-standing tradition and widespread appeal.

- Tennis: High frequency of events and accessible data for betting.

- Other Sports: Growing interest in niche sports and emerging markets.

- Dominant Game Type: Casino:

- Live Casino: Increasing demand for interactive and real-time gaming experiences.

- Slots: High revenue generation and broad player appeal due to simplicity and variety.

- Table Games (Baccarat, Blackjack, Poker): Consistent popularity among experienced players.

- Dominant End User: Mobile:

- Infrastructure: Widespread smartphone penetration and high-speed mobile internet.

- User Behavior: Demand for convenience, accessibility, and on-the-go entertainment.

- Platform Development: Focus on responsive design, intuitive apps, and seamless user journeys.

Online Gambling Market Product Developments

Product developments in the online gambling market are increasingly focused on enhancing user engagement and providing innovative gaming experiences. The integration of AI for personalized recommendations, the expansion of live casino offerings with more interactive dealers and game variations, and the development of mobile-first slots and bingo games are key trends. Competitive advantages are being built through unique game mechanics, attractive bonus structures, and seamless cross-platform integration. The growing demand for responsible gambling tools and features is also driving product innovation, ensuring a safer and more sustainable iGaming ecosystem.

Key Drivers of Online Gambling Market Growth

The online gambling market is experiencing robust growth fueled by several interconnected factors. Technological advancements, particularly in mobile internet speed and device capabilities, have made online gambling more accessible than ever. The increasing legalization and regulation of iGaming in various jurisdictions worldwide have opened up new markets and provided legitimacy. Furthermore, a growing global population with increasing disposable income and a greater acceptance of online entertainment contribute significantly to market expansion. Strategic marketing campaigns and attractive bonus offers by operators also play a crucial role in customer acquisition and retention, further accelerating growth.

Challenges in the Online Gambling Market Market

Despite its impressive growth trajectory, the online gambling market faces significant challenges. Stringent and evolving regulatory landscapes across different countries can create barriers to entry and compliance complexities. Intense competition among operators leads to pressure on profit margins and necessitates continuous investment in marketing and product development. Concerns regarding problem gambling and the need for robust responsible gaming measures are paramount, requiring operators to implement effective tools and protocols. Furthermore, potential supply chain issues related to payment processing and technological infrastructure can impact operational efficiency.

Emerging Opportunities in Online Gambling Market

The online gambling market is ripe with emerging opportunities. The expansion of iGaming into new regulated territories presents significant untapped potential. Technological breakthroughs such as the wider adoption of cryptocurrencies for faster and more secure transactions, the development of more immersive VR/AR online casino experiences, and the use of AI for hyper-personalized player engagement will be key growth catalysts. Strategic partnerships between online gambling operators and traditional land-based casinos, as well as with content providers and technology developers, will unlock new avenues for innovation and market penetration. The increasing popularity of mobile gaming further amplifies opportunities for innovative app development and mobile-specific promotions.

Leading Players in the Online Gambling Market Sector

- Mgm Resorts International

- Draftkings Inc.

- Flutter Entertainment PLC

- Betsson AB

- Super Group (sghc Limited)

- 888 Holdings PLC

- Entain PLC

- Bet

- Kindred Group PLC

- 22bet

Key Milestones in Online Gambling Market Industry

- September 2023: Bet365 partnered with mobile-focused gaming content provider Gaming Realms, integrating their online gaming content selection, including Slingo Rainbow Riches and Slingo Lobstermania.

- June 2023: Groupe Partouche and Betsson AB partnered to launch online casino services in Belgium, combining Groupe Partouche's land-based casino expertise with Betsson's online gaming capabilities for the Belgian market.

- June 2023: Bet365 officially launched in Iowa, USA, through a collaboration with Casino Queen Marquette, marking a significant expansion into the midwestern US market.

Strategic Outlook for Online Gambling Market Market

The strategic outlook for the online gambling market is overwhelmingly positive, driven by continued technological innovation and expanding regulatory frameworks. Future growth will be accelerated by the seamless integration of AI for enhanced user experience, the exploration of emerging technologies like blockchain for greater transparency, and the development of more sophisticated responsible gambling tools. Strategic partnerships and mergers will continue to consolidate the market and foster innovation, while a focus on mobile-first strategies and localized content will be crucial for capturing new user bases across diverse geographical regions. The market's ability to adapt to evolving consumer preferences and regulatory demands will be key to sustained success.

Online Gambling Market Segmentation

-

1. Game Type

-

1.1. Sports Betting

- 1.1.1. Football

- 1.1.2. Horse Racing

- 1.1.3. Tennis

- 1.1.4. Other Sports

-

1.2. Casino

- 1.2.1. Live Casino

- 1.2.2. Baccarat

- 1.2.3. Blackjack

- 1.2.4. Poker

- 1.2.5. Slots

- 1.2.6. Others Casino Games

- 1.3. Lottery

- 1.4. Bingo

-

1.1. Sports Betting

-

2. End User

- 2.1. Desktop

- 2.2. Mobile

Online Gambling Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Sweden

- 2.5. Spain

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. Oceanic Countries

- 3.2. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Online Gambling Market Regional Market Share

Geographic Coverage of Online Gambling Market

Online Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Aggressive Advertisement And Promotional Activities; Advancement In Security

- 3.2.2 Encryption

- 3.2.3 And Streaming Technology

- 3.3. Market Restrains

- 3.3.1. Regulatory and Legal Challenges

- 3.4. Market Trends

- 3.4.1. Various Sponsorships and Convenient Payment Options are Driving the Online Gambling Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 5.1.1. Sports Betting

- 5.1.1.1. Football

- 5.1.1.2. Horse Racing

- 5.1.1.3. Tennis

- 5.1.1.4. Other Sports

- 5.1.2. Casino

- 5.1.2.1. Live Casino

- 5.1.2.2. Baccarat

- 5.1.2.3. Blackjack

- 5.1.2.4. Poker

- 5.1.2.5. Slots

- 5.1.2.6. Others Casino Games

- 5.1.3. Lottery

- 5.1.4. Bingo

- 5.1.1. Sports Betting

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Desktop

- 5.2.2. Mobile

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 6. North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Game Type

- 6.1.1. Sports Betting

- 6.1.1.1. Football

- 6.1.1.2. Horse Racing

- 6.1.1.3. Tennis

- 6.1.1.4. Other Sports

- 6.1.2. Casino

- 6.1.2.1. Live Casino

- 6.1.2.2. Baccarat

- 6.1.2.3. Blackjack

- 6.1.2.4. Poker

- 6.1.2.5. Slots

- 6.1.2.6. Others Casino Games

- 6.1.3. Lottery

- 6.1.4. Bingo

- 6.1.1. Sports Betting

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Desktop

- 6.2.2. Mobile

- 6.1. Market Analysis, Insights and Forecast - by Game Type

- 7. Europe Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Game Type

- 7.1.1. Sports Betting

- 7.1.1.1. Football

- 7.1.1.2. Horse Racing

- 7.1.1.3. Tennis

- 7.1.1.4. Other Sports

- 7.1.2. Casino

- 7.1.2.1. Live Casino

- 7.1.2.2. Baccarat

- 7.1.2.3. Blackjack

- 7.1.2.4. Poker

- 7.1.2.5. Slots

- 7.1.2.6. Others Casino Games

- 7.1.3. Lottery

- 7.1.4. Bingo

- 7.1.1. Sports Betting

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Desktop

- 7.2.2. Mobile

- 7.1. Market Analysis, Insights and Forecast - by Game Type

- 8. Asia Pacific Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Game Type

- 8.1.1. Sports Betting

- 8.1.1.1. Football

- 8.1.1.2. Horse Racing

- 8.1.1.3. Tennis

- 8.1.1.4. Other Sports

- 8.1.2. Casino

- 8.1.2.1. Live Casino

- 8.1.2.2. Baccarat

- 8.1.2.3. Blackjack

- 8.1.2.4. Poker

- 8.1.2.5. Slots

- 8.1.2.6. Others Casino Games

- 8.1.3. Lottery

- 8.1.4. Bingo

- 8.1.1. Sports Betting

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Desktop

- 8.2.2. Mobile

- 8.1. Market Analysis, Insights and Forecast - by Game Type

- 9. Rest of the World Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Game Type

- 9.1.1. Sports Betting

- 9.1.1.1. Football

- 9.1.1.2. Horse Racing

- 9.1.1.3. Tennis

- 9.1.1.4. Other Sports

- 9.1.2. Casino

- 9.1.2.1. Live Casino

- 9.1.2.2. Baccarat

- 9.1.2.3. Blackjack

- 9.1.2.4. Poker

- 9.1.2.5. Slots

- 9.1.2.6. Others Casino Games

- 9.1.3. Lottery

- 9.1.4. Bingo

- 9.1.1. Sports Betting

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Desktop

- 9.2.2. Mobile

- 9.1. Market Analysis, Insights and Forecast - by Game Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Mgm Resorts International

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Draftkings Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Flutter Entertainment PLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Betsson AB

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Super Group (sghc Limited) *List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 888 Holdings PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Entain PLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Bet

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Kindred Group PLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 22bet

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Mgm Resorts International

List of Figures

- Figure 1: Global Online Gambling Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Online Gambling Market Revenue (Million), by Game Type 2025 & 2033

- Figure 3: North America Online Gambling Market Revenue Share (%), by Game Type 2025 & 2033

- Figure 4: North America Online Gambling Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Online Gambling Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Online Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Online Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Online Gambling Market Revenue (Million), by Game Type 2025 & 2033

- Figure 9: Europe Online Gambling Market Revenue Share (%), by Game Type 2025 & 2033

- Figure 10: Europe Online Gambling Market Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Online Gambling Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Online Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Online Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Online Gambling Market Revenue (Million), by Game Type 2025 & 2033

- Figure 15: Asia Pacific Online Gambling Market Revenue Share (%), by Game Type 2025 & 2033

- Figure 16: Asia Pacific Online Gambling Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pacific Online Gambling Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Online Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Online Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Online Gambling Market Revenue (Million), by Game Type 2025 & 2033

- Figure 21: Rest of the World Online Gambling Market Revenue Share (%), by Game Type 2025 & 2033

- Figure 22: Rest of the World Online Gambling Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Rest of the World Online Gambling Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Rest of the World Online Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Online Gambling Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 2: Global Online Gambling Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Online Gambling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 5: Global Online Gambling Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 12: Global Online Gambling Market Revenue Million Forecast, by End User 2020 & 2033

- Table 13: Global Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Sweden Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 22: Global Online Gambling Market Revenue Million Forecast, by End User 2020 & 2033

- Table 23: Global Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Oceanic Countries Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 27: Global Online Gambling Market Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: South America Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Middle East and Africa Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Gambling Market?

The projected CAGR is approximately 10.44%.

2. Which companies are prominent players in the Online Gambling Market?

Key companies in the market include Mgm Resorts International, Draftkings Inc, Flutter Entertainment PLC, Betsson AB, Super Group (sghc Limited) *List Not Exhaustive, 888 Holdings PLC, Entain PLC, Bet, Kindred Group PLC, 22bet.

3. What are the main segments of the Online Gambling Market?

The market segments include Game Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 93.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Advertisement And Promotional Activities; Advancement In Security. Encryption. And Streaming Technology.

6. What are the notable trends driving market growth?

Various Sponsorships and Convenient Payment Options are Driving the Online Gambling Industry.

7. Are there any restraints impacting market growth?

Regulatory and Legal Challenges.

8. Can you provide examples of recent developments in the market?

In September 2023, Bet365 partnered with mobile-focused gaming content provider Gaming Realms. Following the agreement, Gaming Realms provides Bet365 with its online gaming content selection. Slingo Rainbow Riches and Slingo Lobstermania are included in the provider's collection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Gambling Market?

To stay informed about further developments, trends, and reports in the Online Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence