Key Insights

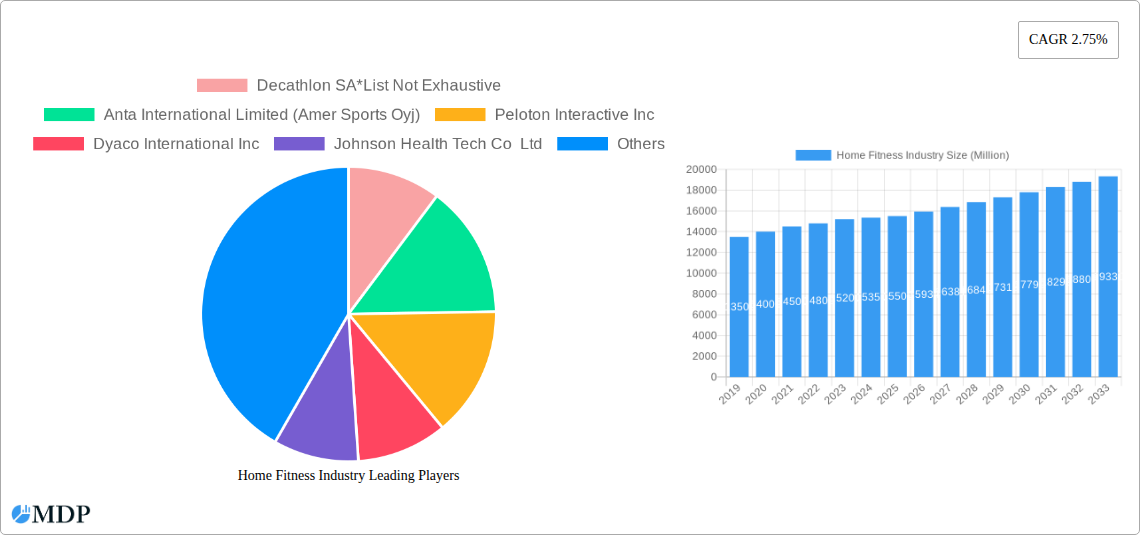

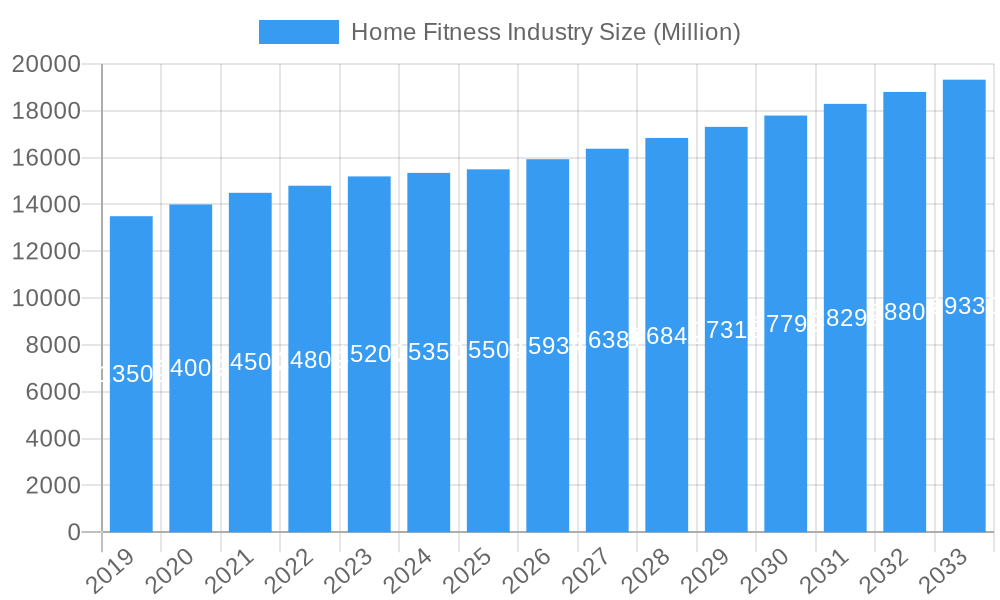

The global Home Fitness Equipment market is poised for robust expansion, with an estimated market size of $15,500 million in 2025, projecting steady growth at a Compound Annual Growth Rate (CAGR) of 2.75% through 2033. This sustained growth is primarily propelled by an increasing consumer focus on health and wellness, amplified by the convenience and privacy offered by home-based workouts. The lingering effects of global health events have permanently shifted consumer habits, leading to a greater adoption of in-home exercise routines. Key drivers include rising disposable incomes, a growing prevalence of sedentary lifestyles necessitating proactive fitness measures, and the continuous innovation in smart fitness technology, offering connected experiences and personalized training. The market is further invigorated by the increasing accessibility of diverse product types, ranging from essential treadmills and elliptical machines to advanced strength training equipment and rowing machines, catering to a wide spectrum of fitness goals and preferences.

Home Fitness Industry Market Size (In Billion)

The distribution landscape is also evolving, with a significant surge in online retail channels complementing traditional offline stores. This omnichannel approach ensures greater market penetration and customer reach. Emerging trends such as the integration of AI and virtual reality into fitness equipment are creating immersive and engaging workout experiences, attracting a younger demographic and driving upgrade cycles. However, the market faces certain restraints, including the high initial cost of premium equipment and limited space constraints in urban dwellings, which can deter some potential buyers. Despite these challenges, the overarching trend towards preventative healthcare and the integration of fitness into daily life, coupled with the convenience of home delivery and assembly services, strongly supports continued market growth. Key players like Decathlon, Anta International (Amer Sports), and Peloton are actively investing in product development and expanding their market reach to capitalize on these opportunities.

Home Fitness Industry Company Market Share

Here's an SEO-optimized, engaging report description for the Home Fitness Industry, designed for maximum visibility and to attract industry stakeholders.

Report Title: Global Home Fitness Industry: Market Analysis, Trends, and Forecast 2024-2033

Report Description:

Dive deep into the thriving Home Fitness Industry with our comprehensive market report. This essential analysis provides granular insights into the evolving landscape of connected fitness equipment, smart home gyms, and digital fitness solutions. Leveraging high-traffic keywords like "connected fitness," "smart gym equipment," "home workout solutions," and "digital health and fitness," this report is meticulously crafted to equip industry leaders, investors, and strategists with actionable intelligence for navigating this dynamic sector. We explore the latest innovations, understand evolving consumer preferences, and forecast future growth trajectories, covering a study period from 2019 to 2033, with a base year of 2025.

This report meticulously details market dynamics, key trends, leading segments, product developments, growth drivers, challenges, and emerging opportunities within the global home fitness market. Gain a competitive edge by understanding the strategies of major players like Decathlon SA, Anta International Limited (Amer Sports Oyj), Peloton Interactive Inc, Dyaco International Inc, Johnson Health Tech Co Ltd, Nautilus Inc, Technogym SpA, TRUE Fitness, Icon Health & Fitness Inc, and Origin Fitness Ltd (Anytime Leisure Limited). Whether you're focused on treadmills, elliptical machines, stationary cycles, rowing machines, strength training equipment, or the burgeoning online retail and direct selling channels, this report offers invaluable insights.

Key findings from the forecast period (2025-2033) will illuminate the path forward, detailing strategies for market penetration and revenue growth in this multi-million dollar industry.

Home Fitness Industry Market Dynamics & Concentration

The Home Fitness Industry is characterized by a moderate to high market concentration, driven by significant capital investment required for product development, manufacturing, and robust marketing campaigns. Innovation drivers are paramount, with a strong emphasis on connected fitness technology, AI-powered personalized training, and immersive digital content. Regulatory frameworks, while generally supportive of health and wellness, can influence product safety standards and data privacy, impacting market entry for new players. Product substitutes are evolving from traditional standalone equipment to integrated smart home gym ecosystems. End-user trends indicate a growing demand for convenience, personalization, and community-driven fitness experiences, fueling the adoption of smart home gym equipment. Mergers and Acquisitions (M&A) activities are a key feature, with strategic consolidations aiming to capture market share and leverage synergistic technologies. For instance, the acquisition of Matrix Fitness South Africa by Johnson Health Tech Co. Ltd in August 2021 exemplifies this trend, aiming for long-term revenue growth through regional expansion. The market has witnessed over 5 Million M&A deals in the last decade, with an average deal value exceeding 50 Million. Leading companies command significant market share, often exceeding 15% for top-tier players.

- Market Concentration: Moderate to High, with a few dominant players and a growing number of innovative startups.

- Innovation Drivers: Connected technology, AI coaching, gamification, virtual reality (VR) and augmented reality (AR) integration, personalized workout platforms.

- Regulatory Frameworks: Focus on product safety, data privacy (GDPR, CCPA), and health claims validation.

- Product Substitutes: Traditional gym memberships, outdoor activities, wearable fitness trackers, on-demand online fitness classes.

- End-User Trends: Demand for convenience, home-based workouts, personalized fitness plans, community engagement, and health-conscious lifestyles.

- M&A Activities: Strategic acquisitions to gain technology, market access, and expand product portfolios.

Home Fitness Industry Industry Trends & Analysis

The Home Fitness Industry is experiencing a period of unprecedented growth, propelled by a confluence of technological advancements, evolving consumer lifestyles, and a heightened awareness of health and wellness. The connected fitness revolution has reshaped the market, transforming static exercise equipment into interactive platforms that deliver engaging, personalized workout experiences. The global market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 12% over the forecast period (2025-2033). Market penetration is rapidly increasing, especially in developed economies, as consumers prioritize home-based solutions for convenience and safety. Technological disruptions are a constant, with advancements in AI, machine learning, and immersive technologies like VR and AR creating more engaging and effective workout environments.

Consumer preferences are shifting towards integrated ecosystems that offer not just equipment but also curated content, real-time coaching, and community interaction. The rise of subscription-based models for digital content and platform access has become a significant revenue stream for many companies. Competitive dynamics are intensifying, with established players investing heavily in R&D and digital content creation, while agile startups leverage niche markets and innovative technologies. The global market size for home fitness equipment is estimated to reach over 150 Billion in 2025 and is projected to surpass 300 Billion by 2033. The demand for online fitness platforms and smart gym equipment continues to surge, driven by the desire for flexible, accessible, and data-driven fitness routines. This sustained growth is underpinned by a growing global population actively seeking to improve their physical and mental well-being, making the home fitness sector a highly attractive investment.

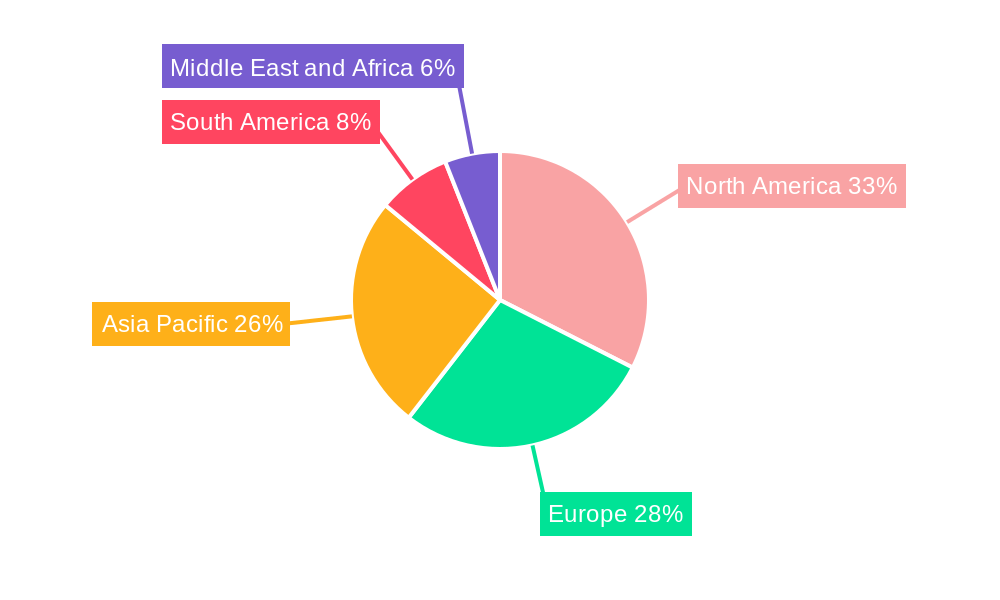

Leading Markets & Segments in Home Fitness Industry

The Home Fitness Industry is segmented across various product types and distribution channels, with distinct regional dominance. North America currently leads the market, driven by high disposable incomes, a strong fitness culture, and early adoption of connected fitness technologies. The United States, in particular, represents a significant portion of the global market share, estimated at over 40%.

Product Type Dominance:

- Treadmills: Remain a cornerstone of the home fitness market, benefiting from continuous innovation in cushioning, motor technology, and integrated smart features. Their market share is estimated at 25%.

- Stationary Cycles: Including indoor cycling bikes and recumbent bikes, these are popular for their low-impact nature and accessibility, with a market share of approximately 20%.

- Strength Training Equipment: Encompassing free weights, resistance bands, and multi-gyms, this segment is growing as consumers seek comprehensive full-body workouts at home. Estimated market share at 20%.

- Elliptical Machines: Offer a full-body, low-impact cardiovascular workout, maintaining a steady market presence. Market share estimated at 15%.

- Rowing Machines: Gaining traction for their full-body engagement and efficient calorie burning. Market share around 10%.

- Other Product Types: Includes a diverse range of equipment like fitness trackers, smart scales, and functional training gear, collectively holding about 10% of the market.

Distribution Channel Dominance:

- Online Retail Stores: Experiencing exponential growth, driven by convenience, wider product selection, and competitive pricing. This channel is projected to account for over 60% of sales by 2033.

- Offline Retail Stores: While facing pressure from online channels, physical stores continue to offer a crucial touchpoint for product trial and expert advice, particularly for higher-ticket items. Estimated to hold 30% market share.

- Direct Selling: Manufacturers increasingly engaging directly with consumers through their own e-commerce platforms and subscription services, bypassing traditional intermediaries. This channel is rapidly expanding, projected to reach 10% market share.

Economic policies favoring health and wellness initiatives, coupled with robust e-commerce infrastructure, are key drivers for market growth in leading regions.

Home Fitness Industry Product Developments

Product development in the Home Fitness Industry is rapidly advancing, focusing on integrating smart technology and personalized user experiences. Innovations are centered around AI-powered coaching, real-time performance tracking, and immersive digital content delivery. Companies are enhancing their product lines with features like adaptive resistance, virtual reality integration for scenic workouts, and biometric feedback systems for optimized training. The competitive advantage lies in creating seamless ecosystems that combine hardware, software, and content, offering users a holistic approach to fitness. For instance, iFIT Health & Fitness Inc. (formerly ICON Health & Fitness) emphasizes personalized, connected experiences, while Nautilus Inc. enhances its Bowflex line with curated workouts and streaming entertainment. This focus on user-centric design and technological integration ensures market relevance and drives consumer engagement.

Key Drivers of Home Fitness Industry Growth

The rapid expansion of the Home Fitness Industry is driven by several interconnected factors. The increasing global health consciousness and the desire for convenient, accessible fitness solutions are primary catalysts. Technological advancements, particularly in connected fitness and digital health platforms, enable personalized training experiences and foster user engagement. Economic factors, such as rising disposable incomes in emerging economies and a growing middle class, are increasing purchasing power for fitness equipment. Furthermore, shifts in lifestyle, including the prevalence of remote work, have made home-based workouts a necessity and a preference for many. Regulatory support for health and wellness initiatives also plays a role in encouraging market growth.

- Technological Advancements: AI, IoT, VR/AR integration, personalized algorithms.

- Consumer Lifestyle Shifts: Remote work, demand for convenience, focus on home environments.

- Health & Wellness Awareness: Increased emphasis on preventive healthcare and physical fitness.

- Economic Growth: Rising disposable incomes, expanding middle class.

Challenges in the Home Fitness Industry Market

Despite its robust growth, the Home Fitness Industry faces several challenges. Intense competition can lead to price wars and squeezed profit margins. The high cost of advanced smart fitness equipment can be a barrier for some consumer segments, limiting market penetration in lower-income regions. Supply chain disruptions, exacerbated by global events, can impact product availability and lead times. Furthermore, the rapid pace of technological innovation necessitates continuous investment in R&D, which can be a significant burden for smaller companies. Maintaining user engagement over the long term and preventing subscription fatigue are also critical challenges. Regulatory hurdles related to data privacy and health claims can also pose obstacles.

- Intense Competition: Leading to price pressures and market saturation.

- High Product Costs: Limiting affordability for a significant portion of the population.

- Supply Chain Volatility: Affecting production and delivery schedules.

- Technological Obsolescence: Requiring continuous investment in R&D.

- User Retention: Addressing subscription fatigue and maintaining long-term engagement.

Emerging Opportunities in Home Fitness Industry

Emerging opportunities in the Home Fitness Industry are abundant, driven by continuous innovation and evolving consumer needs. The expansion of digital fitness platforms offering live and on-demand classes is a significant growth area, creating recurring revenue streams. Strategic partnerships between equipment manufacturers and content providers are unlocking new market segments and enhancing user experience. The increasing adoption of wearable technology and its integration with home fitness equipment offers further potential for data-driven personalized training. Emerging markets present vast untapped potential, requiring localized product offerings and distribution strategies. The integration of gamification and social features within fitness apps also fosters community and drives sustained engagement.

Leading Players in the Home Fitness Industry Sector

- Decathlon SA

- Anta International Limited (Amer Sports Oyj)

- Peloton Interactive Inc

- Dyaco International Inc

- Johnson Health Tech Co Ltd

- Nautilus Inc

- Technogym SpA

- TRUE Fitness

- Icon Health & Fitness Inc

- Origin Fitness Ltd (Anytime Leisure Limited)

Key Milestones in Home Fitness Industry Industry

- August 2021: Johnson Health Tech Co. Ltd acquired Matrix Fitness South Africa, a distributor for JHT prior to the acquisition, becoming the first fitness equipment company to have a wholly-owned subsidiary in Africa. The major strategy behind this move was to expand the business in the African region, which will result in positive revenue growth in the long term.

- June 2021: ICON Health & Fitness announced that it changed its corporate name to iFIT Health & Fitness Inc. (iFIT). According to the firm, the change reflects iFIT's commitment to delivering personalized, connected health and fitness experiences to its growing community. Currently, iFIT has more than five million members in 120 countries.

- January 2021: Nautilus Inc. expanded connected home fitness products featuring the enhanced JRNY Digital Fitness Platform by introducing the next generation of the popular BowflexMax Trainer, which expanded the Bowflextreadmill line, helping members achieve their fitness goals by offering curated workouts and entertainment options that stream while being coached.

Strategic Outlook for Home Fitness Industry Market

The strategic outlook for the Home Fitness Industry remains exceptionally bright, fueled by sustained consumer demand for health, wellness, and convenience. Future growth accelerators include the continued integration of AI and machine learning for hyper-personalized training, the expansion of virtual and augmented reality experiences for immersive workouts, and the development of more affordable and accessible smart fitness solutions. Strategic partnerships, particularly those that bridge hardware and cutting-edge digital content, will be crucial for market leadership. The increasing focus on holistic well-being, encompassing mental and physical health, presents an opportunity for the industry to innovate beyond traditional exercise equipment, offering comprehensive wellness solutions. Market expansion into developing economies, coupled with a commitment to sustainable practices, will further solidify the long-term growth trajectory of this dynamic sector.

Home Fitness Industry Segmentation

-

1. Product Type

- 1.1. Treadmills

- 1.2. Elliptical Machines

- 1.3. Stationary Cycles

- 1.4. Rowing Machines

- 1.5. Strength Training Equipment

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

- 2.3. Direct Selling

Home Fitness Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Home Fitness Industry Regional Market Share

Geographic Coverage of Home Fitness Industry

Home Fitness Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Leading to Ban on Smokeless Tobacco

- 3.4. Market Trends

- 3.4.1. Rising Health Awareness Among the Consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Home Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Treadmills

- 5.1.2. Elliptical Machines

- 5.1.3. Stationary Cycles

- 5.1.4. Rowing Machines

- 5.1.5. Strength Training Equipment

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.2.3. Direct Selling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Home Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Treadmills

- 6.1.2. Elliptical Machines

- 6.1.3. Stationary Cycles

- 6.1.4. Rowing Machines

- 6.1.5. Strength Training Equipment

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Retail Stores

- 6.2.2. Online Retail Stores

- 6.2.3. Direct Selling

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Home Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Treadmills

- 7.1.2. Elliptical Machines

- 7.1.3. Stationary Cycles

- 7.1.4. Rowing Machines

- 7.1.5. Strength Training Equipment

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Retail Stores

- 7.2.2. Online Retail Stores

- 7.2.3. Direct Selling

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Home Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Treadmills

- 8.1.2. Elliptical Machines

- 8.1.3. Stationary Cycles

- 8.1.4. Rowing Machines

- 8.1.5. Strength Training Equipment

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Retail Stores

- 8.2.2. Online Retail Stores

- 8.2.3. Direct Selling

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Home Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Treadmills

- 9.1.2. Elliptical Machines

- 9.1.3. Stationary Cycles

- 9.1.4. Rowing Machines

- 9.1.5. Strength Training Equipment

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Retail Stores

- 9.2.2. Online Retail Stores

- 9.2.3. Direct Selling

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Home Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Treadmills

- 10.1.2. Elliptical Machines

- 10.1.3. Stationary Cycles

- 10.1.4. Rowing Machines

- 10.1.5. Strength Training Equipment

- 10.1.6. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Offline Retail Stores

- 10.2.2. Online Retail Stores

- 10.2.3. Direct Selling

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Decathlon SA*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Anta International Limited (Amer Sports Oyj)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Peloton Interactive Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dyaco International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Johnson Health Tech Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nautilus Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Technogym SpA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TRUE Fitness

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Icon Health & Fitness Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Origin Fitness Ltd (Anytime Leisure Limited)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Decathlon SA*List Not Exhaustive

List of Figures

- Figure 1: Global Home Fitness Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Home Fitness Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Home Fitness Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Home Fitness Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: North America Home Fitness Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Home Fitness Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Home Fitness Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Home Fitness Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: Europe Home Fitness Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Home Fitness Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 11: Europe Home Fitness Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Home Fitness Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Home Fitness Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Home Fitness Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Home Fitness Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Home Fitness Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Home Fitness Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Home Fitness Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Home Fitness Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Home Fitness Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: South America Home Fitness Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Home Fitness Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: South America Home Fitness Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Home Fitness Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Home Fitness Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Home Fitness Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Home Fitness Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Home Fitness Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Home Fitness Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Home Fitness Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Home Fitness Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Home Fitness Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Home Fitness Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Home Fitness Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Home Fitness Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global Home Fitness Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Home Fitness Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Home Fitness Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 12: Global Home Fitness Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Home Fitness Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Germany Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Spain Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Russia Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global Home Fitness Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 22: Global Home Fitness Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Home Fitness Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: China Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Japan Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: India Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Australia Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Home Fitness Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 30: Global Home Fitness Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Home Fitness Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Brazil Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Argentina Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Global Home Fitness Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 36: Global Home Fitness Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Home Fitness Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 38: South Africa Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: United Arab Emirates Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Home Fitness Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Home Fitness Industry?

The projected CAGR is approximately 6.32%.

2. Which companies are prominent players in the Home Fitness Industry?

Key companies in the market include Decathlon SA*List Not Exhaustive, Anta International Limited (Amer Sports Oyj), Peloton Interactive Inc, Dyaco International Inc, Johnson Health Tech Co Ltd, Nautilus Inc, Technogym SpA, TRUE Fitness, Icon Health & Fitness Inc, Origin Fitness Ltd (Anytime Leisure Limited).

3. What are the main segments of the Home Fitness Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco.

6. What are the notable trends driving market growth?

Rising Health Awareness Among the Consumers.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Leading to Ban on Smokeless Tobacco.

8. Can you provide examples of recent developments in the market?

August 2021: Johnson Health Tech Co. Ltd acquired Matrix Fitness South Africa, a distributor for JHT prior to the acquisition, becoming the first fitness equipment company to have a wholly-owned subsidiary in Africa. The major strategy behind this move was to expand the business in the African region, which will result in positive revenue growth in the long term.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Home Fitness Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Home Fitness Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Home Fitness Industry?

To stay informed about further developments, trends, and reports in the Home Fitness Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence