Key Insights

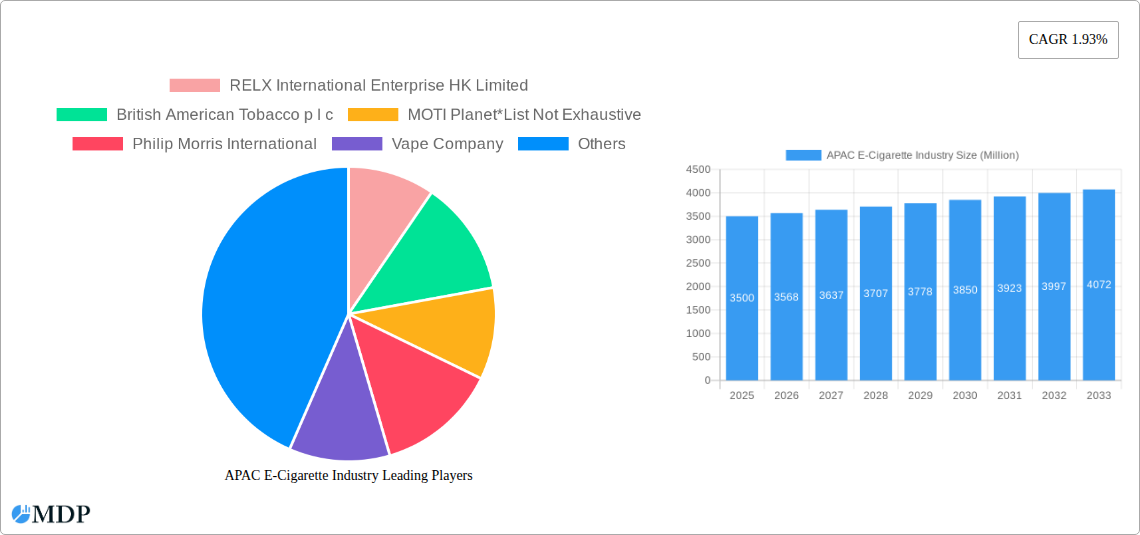

The Asia-Pacific (APAC) e-cigarette market is forecast to reach $423.7 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 1.8% from 2025 to 2033. This expansion is driven by shifting consumer preferences towards less harmful tobacco alternatives and increased awareness of vaping's potential health advantages over traditional smoking. Aggressive marketing by manufacturers and strong demand for both devices and e-liquids, supported by both retail and online channels, will fuel growth. Emerging economies like Indonesia and Bangladesh, with young populations and rising incomes, are key growth markets. However, regulatory challenges and public health concerns may temper the market's trajectory.

APAC E-Cigarette Industry Market Size (In Billion)

The APAC e-cigarette market features diverse product segments, including advanced devices and a wide range of e-liquids, served by both offline retail and burgeoning online channels. While New Zealand represents a mature market, Bangladesh, Indonesia, and the broader Rest of APAC offer significant growth opportunities. Leading players such as RELX International, Philip Morris International, and JUUL Labs compete through innovation and strategic alliances. Success hinges on navigating complex regional regulations and shaping public perception.

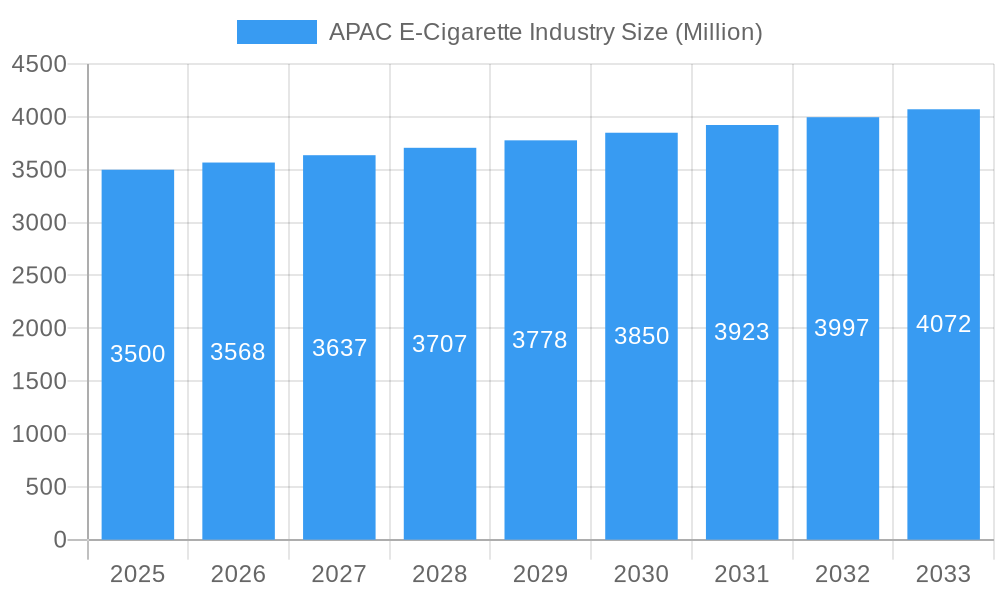

APAC E-Cigarette Industry Company Market Share

APAC E-Cigarette Industry Report: Market Insights, Trends, and Forecasts (2019-2033)

This comprehensive report offers an in-depth analysis of the Asia-Pacific (APAC) E-Cigarette Industry, providing critical insights into market dynamics, prevailing trends, product developments, growth drivers, challenges, and future opportunities. Covering the historical period from 2019 to 2024 and a forecast period extending to 2033, with a base year of 2025, this report is an indispensable resource for industry stakeholders, investors, and policymakers seeking to navigate this rapidly evolving market. Our analysis delves into key segments including E-cigarette Devices and E-liquid, distribution channels such as Offline Retail Stores and Online Retail Stores, and crucial geographies like New Zealand, Bangladesh, Indonesia, and the Rest of Asia-Pacific.

APAC E-Cigarette Industry Market Dynamics & Concentration

The APAC E-Cigarette Industry exhibits a dynamic market concentration characterized by a blend of established global players and emerging regional contenders. Innovation drivers are primarily fueled by advancements in battery technology, flavor profiles, and device portability, leading to increased consumer adoption. The regulatory landscape across APAC is diverse, with some nations implementing stringent controls while others adopt a more permissive approach, significantly influencing market penetration and company strategies. Product substitutes, including traditional tobacco products and nicotine replacement therapies, continue to pose a competitive challenge, although the perceived harm reduction benefits of e-cigarettes are gradually shifting consumer preferences. End-user trends indicate a growing demand for sophisticated, user-friendly devices, alongside a keen interest in diverse e-liquid flavors. Mergers and acquisitions (M&A) activities, though not extensively documented in public records for every player, represent a key strategy for consolidation and market expansion. For instance, several smaller vape companies have been acquired by larger entities seeking to broaden their product portfolios and distribution networks, indicating a trend towards industry consolidation. Market share is fragmented, with key players holding varying percentages across different sub-regions.

APAC E-Cigarette Industry Industry Trends & Analysis

The APAC E-Cigarette Industry is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 15% during the forecast period (2025-2033). This surge is propelled by an increasing awareness among adult smokers about the potential harm reduction benefits of vaping compared to combustible cigarettes. Technological disruptions are a significant trend, with manufacturers continuously innovating to develop sleeker, more powerful, and safer e-cigarette devices. Innovations in pod systems and disposable vapes are particularly popular, offering convenience and ease of use that appeals to a broad consumer base. Consumer preferences are evolving, with a growing demand for premium e-liquids featuring diverse flavor options, from classic tobacco to exotic fruit and dessert profiles. The younger demographic, though subject to varying regulations, also represents a growing segment of the market, attracted by the modern appeal and perceived social acceptance of vaping. Competitive dynamics are intensifying, marked by aggressive marketing campaigns, strategic product launches, and a focus on building strong brand loyalty. Companies are investing heavily in research and development to stay ahead of the curve and capture market share in this highly competitive environment. Market penetration is steadily increasing across various APAC nations, although significant variations exist due to differing regulatory frameworks and consumer adoption rates.

Leading Markets & Segments in APAC E-Cigarette Industry

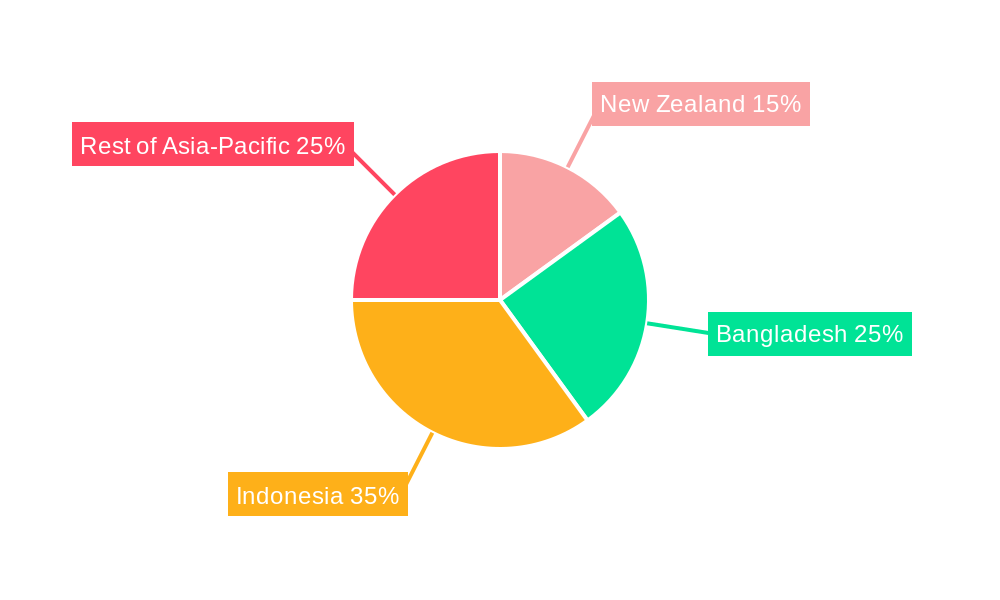

The "Rest of Asia-Pacific" segment is currently the dominant geographic market within the APAC E-Cigarette Industry, driven by a combination of large populations, growing disposable incomes, and an increasing awareness of vaping as an alternative to traditional smoking. Within this vast region, countries like Indonesia and Vietnam show particularly strong growth potential, fueled by their large smoking populations and a nascent but expanding vaping culture.

Product Type Dominance:

- E-cigarette Devices: Devices, particularly pod-based systems and disposables, hold the largest market share. Their user-friendliness, portability, and discreet design cater to a wide range of consumers. Innovations in battery life and heating technology are key drivers in this segment.

- E-liquid: The e-liquid segment is experiencing significant expansion due to the increasing demand for diverse flavor profiles. Manufacturers are investing in R&D to offer a wide array of options, from tobacco and menthol to exotic fruits and desserts, catering to evolving consumer preferences.

Distribution Channel Insights:

- Offline Retail Stores: Traditional brick-and-mortar stores, including convenience stores and specialized vape shops, continue to be a primary distribution channel. Their accessibility and the ability for consumers to physically inspect products before purchase contribute to their sustained importance.

- Online Retail Stores: The e-commerce segment is rapidly growing, driven by the convenience of home delivery, wider product selection, and competitive pricing. Online platforms are crucial for reaching younger demographics and consumers in less accessible urban areas.

Geographic Performance:

- Indonesia: With its massive population and high smoking rates, Indonesia represents a significant growth opportunity. The increasing disposable income and a growing acceptance of harm reduction products are key factors.

- New Zealand: While a smaller market in terms of population, New Zealand demonstrates a mature vaping market with a strong emphasis on product quality and regulatory compliance. The demand for high-nicotine e-liquids and advanced devices is notable.

- Bangladesh: Emerging as a key market, Bangladesh's large population and a significant base of traditional smokers present substantial potential for e-cigarette adoption as awareness and accessibility increase.

- Rest of Asia-Pacific: This broad category encompasses rapidly developing economies and urban centers where the adoption of vaping technology is accelerating. Economic policies supportive of new consumer product categories and developing retail infrastructure play a crucial role in market expansion within these areas.

APAC E-Cigarette Industry Product Developments

Product innovation in the APAC E-Cigarette Industry is a critical differentiator, focusing on enhanced user experience and safety. Manufacturers are concentrating on developing devices with longer battery life, faster charging capabilities, and improved pod systems for easier refills and better flavor delivery. The rise of sophisticated temperature control technologies and leak-resistant designs are also prominent trends, addressing key consumer pain points. Furthermore, there is a growing emphasis on premium e-liquid formulations with more natural flavorings and reduced artificial ingredients, appealing to health-conscious consumers. The competitive advantage is being built on technological sophistication, aesthetic appeal, and the ability to offer a diverse range of customizable options for both devices and e-liquids, effectively meeting the varied demands of the market.

Key Drivers of APAC E-Cigarette Industry Growth

The APAC E-Cigarette Industry's growth is propelled by a confluence of factors. Primarily, the increasing global awareness of e-cigarettes as a potential harm reduction tool compared to traditional tobacco smoking is a significant driver. Technological advancements in device manufacturing, leading to more user-friendly, portable, and aesthetically appealing products, are attracting a wider consumer base. Economic growth in many APAC nations is increasing disposable incomes, allowing consumers to explore premium vaping products. Furthermore, a shifting consumer preference towards modern lifestyle products, coupled with a desire for a less harmful nicotine alternative, contributes significantly to market expansion. Regulatory shifts in certain regions, moving towards a more nuanced approach to vaping, are also creating a more favorable environment for industry growth.

Challenges in the APAC E-Cigarette Industry Market

Despite its growth, the APAC E-Cigarette Industry faces substantial challenges. Foremost among these are evolving and often stringent regulatory frameworks across different countries, creating market access barriers and compliance complexities. Concerns regarding youth access and potential health risks associated with vaping products continue to fuel public and governmental scrutiny. Supply chain disruptions, exacerbated by global economic conditions and geopolitical events, can impact product availability and manufacturing costs. Intense competition from established tobacco companies and a plethora of new entrants leads to price pressures and necessitates continuous innovation to maintain market share. Moreover, negative public perception and ongoing debates about the long-term health effects of vaping can deter potential consumers and influence regulatory decisions.

Emerging Opportunities in APAC E-Cigarette Industry

The APAC E-Cigarette Industry presents significant emerging opportunities for growth and expansion. Technological breakthroughs in battery efficiency, flavor encapsulation, and device miniaturization are poised to create next-generation vaping products that offer superior performance and appeal. Strategic partnerships between e-cigarette manufacturers and e-liquid flavor houses are enabling the development of unique and highly sought-after product offerings. Market expansion into untapped or emerging economies within APAC, where smoking rates are high and awareness of vaping is growing, offers substantial potential. Furthermore, the development of specialized e-liquids catering to specific demographic preferences or designed for therapeutic purposes (e.g., nicotine cessation aids) could unlock new market niches. The increasing focus on sustainability in product design and packaging also represents a growing opportunity to appeal to environmentally conscious consumers.

Leading Players in the APAC E-Cigarette Industry Sector

- RELX International Enterprise HK Limited

- British American Tobacco p l c

- MOTI Planet

- Philip Morris International

- Vape Company

- Smoore International Holdings Ltd

- JUUL Labs Inc

- Imperial Brands

- Japan Tobacco International

- Vaping Gadget Limited

Key Milestones in APAC E-Cigarette Industry Industry

- November 2022: Moti Planet expanded its business operation in the Malaysian market by launching its flagship product MOTI K Pro. At International Electronic Cigarettes Exhibitions in Malaysia, the company also presented other products such as MIOTI X Mini, and MOTI X Play, as well as disposable new products MOTI BOTO 6000, MOTI Box R7000, and the industry's first replaceable disposable electronic cigarettes i.e., MOTI One 4000.

- August 2021: Philip Morris International Inc. launched IQOS ILUMA. According to the company, the product is one of the most innovative additions to its growing portfolio of smoke-free products for adults who would otherwise smoke or use nicotine products.

- August 2021: Japan Tobacco Inc. launched Ploom X, a next-generation heated tobacco device. Ploom X plans to sell across Japan through convenience stores and selected tobacco retail stores.

Strategic Outlook for APAC E-Cigarette Industry Market

The strategic outlook for the APAC E-Cigarette Industry remains strongly positive, driven by continued innovation and evolving consumer preferences. Companies are expected to focus on developing advanced devices with enhanced safety features and longer-lasting performance. The diversification of e-liquid flavors and formulations will be crucial for capturing and retaining market share, especially among younger adult demographics. Strategic emphasis will be placed on expanding distribution networks, both online and offline, to reach a broader consumer base across diverse geographic regions within APAC. Furthermore, proactive engagement with regulatory bodies to advocate for evidence-based policies that balance public health concerns with harm reduction goals will be a key strategic imperative. Identifying and capitalizing on emerging market trends, such as the demand for premium and customized vaping experiences, will accelerate future growth and solidify market leadership positions.

APAC E-Cigarette Industry Segmentation

-

1. Product Type

- 1.1. E-cigarette Devices

- 1.2. E-liquid

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

-

3. Geography

- 3.1. New Zealand

- 3.2. Bangladesh

- 3.3. Indonesia

- 3.4. Rest of Asia-Pacific

APAC E-Cigarette Industry Segmentation By Geography

- 1. New Zealand

- 2. Bangladesh

- 3. Indonesia

- 4. Rest of Asia Pacific

APAC E-Cigarette Industry Regional Market Share

Geographic Coverage of APAC E-Cigarette Industry

APAC E-Cigarette Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enhanced Participation In Water Sports; Popularity Of Beach Culture And Adventure Tourism

- 3.3. Market Restrains

- 3.3.1. Presence of counterfeit products

- 3.4. Market Trends

- 3.4.1. Demand for Nicotine-free Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC E-Cigarette Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. E-cigarette Devices

- 5.1.2. E-liquid

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. New Zealand

- 5.3.2. Bangladesh

- 5.3.3. Indonesia

- 5.3.4. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. New Zealand

- 5.4.2. Bangladesh

- 5.4.3. Indonesia

- 5.4.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. New Zealand APAC E-Cigarette Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. E-cigarette Devices

- 6.1.2. E-liquid

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Retail Stores

- 6.2.2. Online Retail Stores

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. New Zealand

- 6.3.2. Bangladesh

- 6.3.3. Indonesia

- 6.3.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Bangladesh APAC E-Cigarette Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. E-cigarette Devices

- 7.1.2. E-liquid

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Retail Stores

- 7.2.2. Online Retail Stores

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. New Zealand

- 7.3.2. Bangladesh

- 7.3.3. Indonesia

- 7.3.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Indonesia APAC E-Cigarette Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. E-cigarette Devices

- 8.1.2. E-liquid

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Retail Stores

- 8.2.2. Online Retail Stores

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. New Zealand

- 8.3.2. Bangladesh

- 8.3.3. Indonesia

- 8.3.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Asia Pacific APAC E-Cigarette Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. E-cigarette Devices

- 9.1.2. E-liquid

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Retail Stores

- 9.2.2. Online Retail Stores

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. New Zealand

- 9.3.2. Bangladesh

- 9.3.3. Indonesia

- 9.3.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 RELX International Enterprise HK Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 British American Tobacco p l c

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 MOTI Planet*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Philip Morris International

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Vape Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Smoore International Holdings Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 JUUL Labs Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Imperial Brands

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Japan Tobacco International

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Vaping Gadget Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 RELX International Enterprise HK Limited

List of Figures

- Figure 1: Global APAC E-Cigarette Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: New Zealand APAC E-Cigarette Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: New Zealand APAC E-Cigarette Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: New Zealand APAC E-Cigarette Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: New Zealand APAC E-Cigarette Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: New Zealand APAC E-Cigarette Industry Revenue (billion), by Geography 2025 & 2033

- Figure 7: New Zealand APAC E-Cigarette Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: New Zealand APAC E-Cigarette Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: New Zealand APAC E-Cigarette Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Bangladesh APAC E-Cigarette Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Bangladesh APAC E-Cigarette Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Bangladesh APAC E-Cigarette Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 13: Bangladesh APAC E-Cigarette Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: Bangladesh APAC E-Cigarette Industry Revenue (billion), by Geography 2025 & 2033

- Figure 15: Bangladesh APAC E-Cigarette Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Bangladesh APAC E-Cigarette Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Bangladesh APAC E-Cigarette Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Indonesia APAC E-Cigarette Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Indonesia APAC E-Cigarette Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Indonesia APAC E-Cigarette Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 21: Indonesia APAC E-Cigarette Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Indonesia APAC E-Cigarette Industry Revenue (billion), by Geography 2025 & 2033

- Figure 23: Indonesia APAC E-Cigarette Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Indonesia APAC E-Cigarette Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Indonesia APAC E-Cigarette Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of Asia Pacific APAC E-Cigarette Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Rest of Asia Pacific APAC E-Cigarette Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Rest of Asia Pacific APAC E-Cigarette Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Rest of Asia Pacific APAC E-Cigarette Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Rest of Asia Pacific APAC E-Cigarette Industry Revenue (billion), by Geography 2025 & 2033

- Figure 31: Rest of Asia Pacific APAC E-Cigarette Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Rest of Asia Pacific APAC E-Cigarette Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of Asia Pacific APAC E-Cigarette Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC E-Cigarette Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global APAC E-Cigarette Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global APAC E-Cigarette Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global APAC E-Cigarette Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global APAC E-Cigarette Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global APAC E-Cigarette Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global APAC E-Cigarette Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global APAC E-Cigarette Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global APAC E-Cigarette Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global APAC E-Cigarette Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global APAC E-Cigarette Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global APAC E-Cigarette Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global APAC E-Cigarette Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global APAC E-Cigarette Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global APAC E-Cigarette Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global APAC E-Cigarette Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global APAC E-Cigarette Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global APAC E-Cigarette Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global APAC E-Cigarette Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global APAC E-Cigarette Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC E-Cigarette Industry?

The projected CAGR is approximately 1.8%.

2. Which companies are prominent players in the APAC E-Cigarette Industry?

Key companies in the market include RELX International Enterprise HK Limited, British American Tobacco p l c, MOTI Planet*List Not Exhaustive, Philip Morris International, Vape Company, Smoore International Holdings Ltd, JUUL Labs Inc, Imperial Brands, Japan Tobacco International, Vaping Gadget Limited.

3. What are the main segments of the APAC E-Cigarette Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 423.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Enhanced Participation In Water Sports; Popularity Of Beach Culture And Adventure Tourism.

6. What are the notable trends driving market growth?

Demand for Nicotine-free Products.

7. Are there any restraints impacting market growth?

Presence of counterfeit products.

8. Can you provide examples of recent developments in the market?

November 2022: Moti Planet expanded its business operation in the Malaysian market by launching its flagship product MOTI K Pro. At International Electronic Cigarettes Exhibitions in Malaysia, the company has also presented other products such as MIOTI X Mini, and MOTI X Play, as well as disposable new products MOTI BOTO 6000, MOTI Box R7000, and the industry's first replaceable disposable electronic cigarettes were also presented in exhibitions i.e., MOTI One 4000.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC E-Cigarette Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC E-Cigarette Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC E-Cigarette Industry?

To stay informed about further developments, trends, and reports in the APAC E-Cigarette Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence