Key Insights

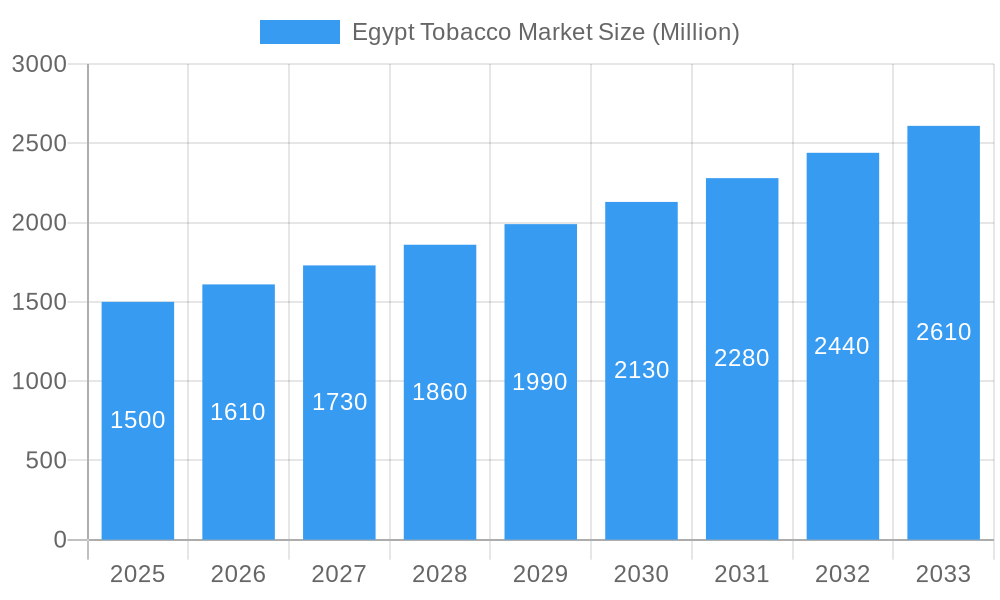

The Egypt tobacco market, exhibiting a Compound Annual Growth Rate (CAGR) of 7.16%, presents a dynamic landscape shaped by several key factors. The market size in 2025 is estimated at $X million (assuming a reasonable market size based on regional comparisons and the provided CAGR – specific value requires further data). Key drivers include a large adult population, established smoking habits, and relatively low tobacco taxation compared to some international markets. However, increasing health awareness campaigns, stringent regulations aimed at curbing smoking prevalence, and the rising popularity of e-cigarettes and Heat-Not-Burn (HNB) products represent significant market restraints. The market is segmented by product type (cigarettes dominating the market share, followed by cigars, cigarillos, and pipes; e-cigarettes/HNBs showing significant growth), end-user demographics (with male smokers historically forming a larger segment but a gradual increase in female smokers), and distribution channels (supermarkets and convenience stores being major players). Leading companies such as Japan Tobacco International, British American Tobacco, Philip Morris International, and several local players are intensely competing, driving innovation and influencing market dynamics.

Egypt Tobacco Market Market Size (In Billion)

The forecast period of 2025-2033 suggests continued growth despite regulatory pressures. The rising popularity of alternative tobacco products like e-cigarettes and HNB devices will likely influence market segmentation and product innovation. The success of these alternatives depends heavily on consumer adoption rates and government regulations regarding their marketing and availability. Further expansion in the market is predicted to rely on successful marketing strategies that balance consumer preferences with changing regulatory landscapes. Geographical focus is likely to remain on major urban centers, with distribution channels adapting to reach diverse consumer segments. Further research into the specific dynamics of the Egyptian market, incorporating data on taxation policies and public health initiatives, would provide a more comprehensive analysis.

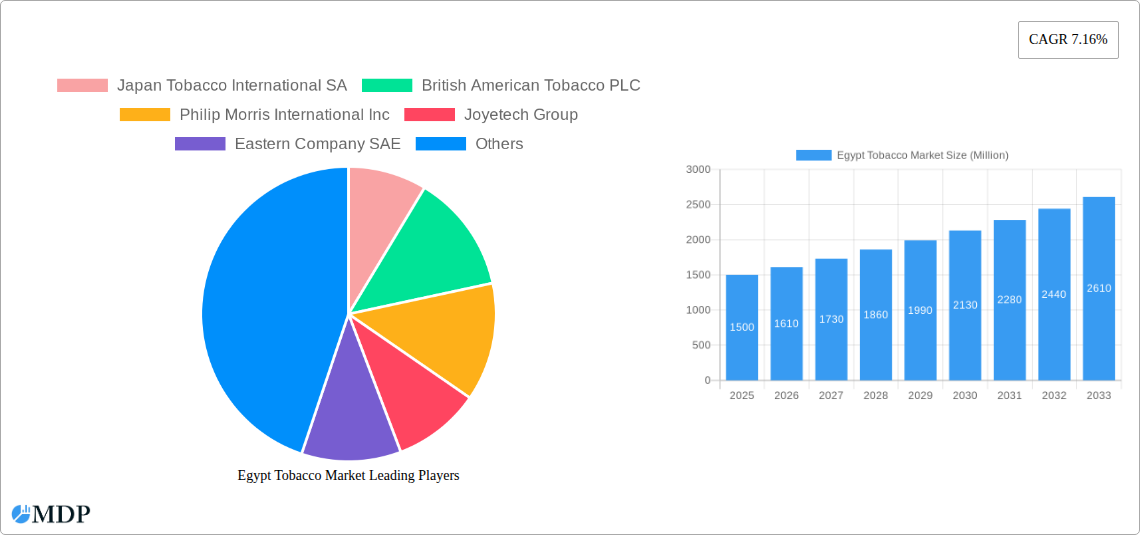

Egypt Tobacco Market Company Market Share

Egypt Tobacco Market: A Comprehensive Report (2019-2033)

Dive deep into the dynamic Egypt tobacco market with this comprehensive report, offering in-depth analysis and forecasting from 2019 to 2033. This essential resource covers market size, segmentation, leading players, and future trends, providing crucial insights for stakeholders in this lucrative yet complex sector. The report leverages extensive data analysis to uncover opportunities and challenges, equipping you to make informed business decisions.

Egypt Tobacco Market Market Dynamics & Concentration

The Egyptian tobacco market, valued at xx Million in 2024, exhibits a moderately concentrated landscape dominated by established international and domestic players. Key dynamics shaping the market include:

Market Concentration: While precise market share data for each player is proprietary, Eastern Company SAE holds a significant domestic market share, alongside substantial contributions from international giants like British American Tobacco PLC, Philip Morris International Inc, and Japan Tobacco International SA. The market concentration ratio (CR4) is estimated to be around xx%.

Innovation Drivers: The emergence of e-cigarettes and heated tobacco products (HTPs) is driving innovation, with companies like Joyetech Group, Innokin Technology Co Ltd, and J Well France SARL actively participating. This is further fueled by consumer demand for diverse product offerings and reduced-risk alternatives.

Regulatory Framework: Stringent government regulations concerning tobacco manufacturing, sales, and advertising significantly impact market dynamics. Tax policies and licensing requirements influence pricing and profitability. The recent USD 450 Million licensing deal by Philip Morris illustrates the importance of navigating the regulatory landscape.

Product Substitutes: The market faces competition from substitutes like nicotine pouches and vaping products, impacting the overall demand for traditional cigarettes.

End-User Trends: The market is primarily driven by male consumers, although female smoking rates are also present, presenting untapped potential for certain product segments. Understanding evolving consumer preferences—regarding product type, flavor profiles, and pricing—is crucial.

M&A Activities: Recent mergers and acquisitions, such as the Eastern Company and Al-Mansour International Distribution Company's agreement, highlight the ongoing consolidation within the industry. The number of M&A deals within the period 2019-2024 is estimated at xx.

Egypt Tobacco Market Industry Trends & Analysis

The Egypt tobacco market is experiencing a period of transformation, driven by several key factors. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 is estimated at xx%, with projections suggesting a xx% CAGR from 2025-2033. Market penetration for e-cigarettes is at xx% in 2024, expected to reach xx% by 2033. This growth is fueled by:

Market Growth Drivers: Factors such as population growth, increasing disposable incomes (particularly among younger demographics), and the changing preferences towards new product formats contribute significantly to market expansion.

Technological Disruptions: The introduction of novel products like e-cigarettes and HTPs is revolutionizing the market, offering consumers alternatives to traditional cigarettes. Technological advancements in these segments are expected to drive further growth.

Consumer Preferences: Shifting consumer preferences toward flavored tobacco products, reduced-risk alternatives, and more diverse product portfolios influence brand strategy and product development.

Competitive Dynamics: Intense competition among domestic and international players drives product innovation, marketing initiatives, and strategic partnerships, leading to pricing pressure and a dynamic market environment. The entrance of Philip Morris with its UTC subsidiary further intensifies competition.

Leading Markets & Segments in Egypt Tobacco Market

The Egyptian tobacco market exhibits regional variations in consumption patterns and preferences, although national-level data is prevalent. The cigarette segment remains dominant across all distribution channels, but the e-cigarette and HTP segments are showing strong growth potential.

Product Type: Cigarettes dominate the market, accounting for xx% of total revenue in 2024. The E-Cigarette/HTP segment is experiencing the fastest growth.

End User: Males constitute the majority of tobacco consumers. However, the market presents opportunities for targeted marketing strategies towards the female segment.

Distribution Channel: Convenience/Small Grocery Stores are the most prominent distribution channels for tobacco products in Egypt, offering broad reach and accessibility. Supermarket/Hypermarkets hold a significant share, followed by Specialty/Tobacco Stores. Other distribution channels (online, etc.) are emerging but still contribute a smaller proportion.

Key Drivers: Economic policies (taxation, licensing), existing infrastructure supporting retail distribution, and cultural acceptance contribute to the dominance of cigarettes and the distribution networks.

Egypt Tobacco Market Product Developments

Product innovation is pivotal in the Egyptian tobacco market. The focus is on developing reduced-risk products (RRPs) like e-cigarettes and HTPs to meet the evolving consumer demands and comply with increasingly stringent regulations. The introduction of novel flavors and formulations enhances the appeal of existing products, creating competitive advantages. Technological trends include improved battery life and heating mechanisms for e-cigarettes, coupled with sophisticated flavor delivery systems and advanced filter technologies in traditional cigarettes. The market fit for RRPs is anticipated to grow substantially in line with consumer demand for perceived less-harmful alternatives.

Key Drivers of Egypt Tobacco Market Growth

The growth of the Egypt tobacco market is driven by several key factors:

Technological Advancements: The development of innovative products, including e-cigarettes and HTPs, expands market options and attracts new consumer segments.

Economic Growth: Increasing disposable incomes among certain demographics boost consumer spending power and fuel demand for tobacco products, although this is countered by economic downturns which affect affordability.

Regulatory Landscape: While restrictive regulations exist, the granting of new licenses and favorable policies can stimulate investment and market expansion. Philip Morris' acquisition of a new license is a prominent example of the effect of favorable regulation.

Challenges in the Egypt Tobacco Market Market

The Egypt tobacco market faces several challenges:

Regulatory Hurdles: Stringent regulations on advertising, pricing, and product formulations create obstacles for companies operating in the market, impacting market size and revenue streams.

Supply Chain Issues: Economic instability and political events can disrupt supply chains and affect product availability and pricing.

Competitive Pressures: Intense competition from both domestic and multinational companies leads to pricing wars and limits profitability. The arrival of new players and a proliferation of product types increases competition.

Emerging Opportunities in Egypt Tobacco Market

Significant long-term growth potential exists in the Egyptian tobacco market:

Expansion of E-cigarette and HTP Segments: Increased adoption of reduced-risk products, driven by consumer preferences and innovation, presents significant opportunities for growth.

Strategic Partnerships: Collaborations between international and domestic companies can leverage resources and expertise to enhance market penetration.

Market Expansion Strategies: Targeting new consumer segments and geographical areas with tailored product offerings can unlock untapped growth potential.

Leading Players in the Egypt Tobacco Market Sector

- Japan Tobacco International SA

- British American Tobacco PLC

- Philip Morris International Inc

- Joyetech Group

- Eastern Company SAE

- Innokin Technology Co Ltd

- J Well France SARL

- Imperial Brands PLC

Key Milestones in Egypt Tobacco Market Industry

December 2021: Eastern Company and Al-Mansour International Distribution Company signed a distribution agreement to manufacture Davidoff Evolve cigarettes, expanding the market offering and increasing competition.

June 2022: Philip Morris secured a new license to manufacture traditional and electronic cigarettes after paying approximately USD 450 million, demonstrating significant investment and commitment to the Egyptian market.

September 2022: Philip Morris announced that its UTC subsidiary would begin manufacturing its products for the Egyptian market, further increasing competition and impacting existing manufacturing partnerships.

Strategic Outlook for Egypt Tobacco Market Market

The future of the Egyptian tobacco market appears promising, particularly with the growth of e-cigarettes and HTPs. Strategic partnerships, innovation in product development, and effective navigation of the regulatory landscape will be essential for success. The market is poised for continued expansion, presenting significant opportunities for companies that can adapt to evolving consumer preferences and technological advancements. Growth will be particularly determined by consumer acceptance of novel products and government policies.

Egypt Tobacco Market Segmentation

-

1. Product Type

- 1.1. Cigarettes

- 1.2. Cigar, Cigarillos, and Cigar Pipes

- 1.3. E-Cigarette/HTP's

-

2. End User

- 2.1. Male

- 2.2. Female

-

3. Distribution Channel

- 3.1. Supermarket/Hypermarket

- 3.2. Convenience/Small Grocery Stores

- 3.3. Specialty/Tobacco Stores

- 3.4. Other Distribution Channels

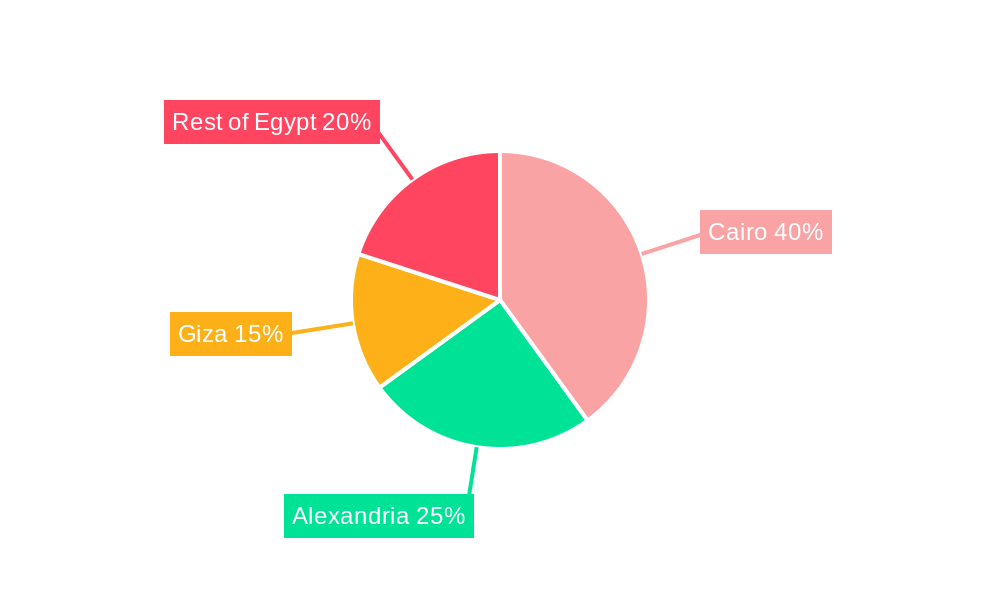

Egypt Tobacco Market Segmentation By Geography

- 1. Egypt

Egypt Tobacco Market Regional Market Share

Geographic Coverage of Egypt Tobacco Market

Egypt Tobacco Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumption of Tobacco is Rising as Cigarette Segment is Growing at a Significant Pace; Strong Penetration of Retail Distribution Network

- 3.3. Market Restrains

- 3.3.1. Growing Awareness about the Harmful effects of Tobacco Products to Hamper Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Consumption of Cigarettes across the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Tobacco Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cigarettes

- 5.1.2. Cigar, Cigarillos, and Cigar Pipes

- 5.1.3. E-Cigarette/HTP's

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Male

- 5.2.2. Female

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarket/Hypermarket

- 5.3.2. Convenience/Small Grocery Stores

- 5.3.3. Specialty/Tobacco Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Japan Tobacco International SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 British American Tobacco PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Philip Morris International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Joyetech Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eastern Company SAE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Innokin Technology Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 J Well France SARL*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Imperial Brands PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Japan Tobacco International SA

List of Figures

- Figure 1: Egypt Tobacco Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Egypt Tobacco Market Share (%) by Company 2025

List of Tables

- Table 1: Egypt Tobacco Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Egypt Tobacco Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Egypt Tobacco Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Egypt Tobacco Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Egypt Tobacco Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: Egypt Tobacco Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 7: Egypt Tobacco Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 8: Egypt Tobacco Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Tobacco Market?

The projected CAGR is approximately 7.16%.

2. Which companies are prominent players in the Egypt Tobacco Market?

Key companies in the market include Japan Tobacco International SA, British American Tobacco PLC, Philip Morris International Inc, Joyetech Group, Eastern Company SAE, Innokin Technology Co Ltd, J Well France SARL*List Not Exhaustive, Imperial Brands PLC.

3. What are the main segments of the Egypt Tobacco Market?

The market segments include Product Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Consumption of Tobacco is Rising as Cigarette Segment is Growing at a Significant Pace; Strong Penetration of Retail Distribution Network.

6. What are the notable trends driving market growth?

Rising Consumption of Cigarettes across the Country.

7. Are there any restraints impacting market growth?

Growing Awareness about the Harmful effects of Tobacco Products to Hamper Market Growth.

8. Can you provide examples of recent developments in the market?

September 2022: Philip Morris announced that its United Tobacco Co. (UTC) subsidiary would begin manufacturing its products for the Egyptian market. Philip Morris' cigarettes will continue to be manufactured by Eastern Co. until its production stock is depleted.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Tobacco Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Tobacco Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Tobacco Market?

To stay informed about further developments, trends, and reports in the Egypt Tobacco Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence