Key Insights

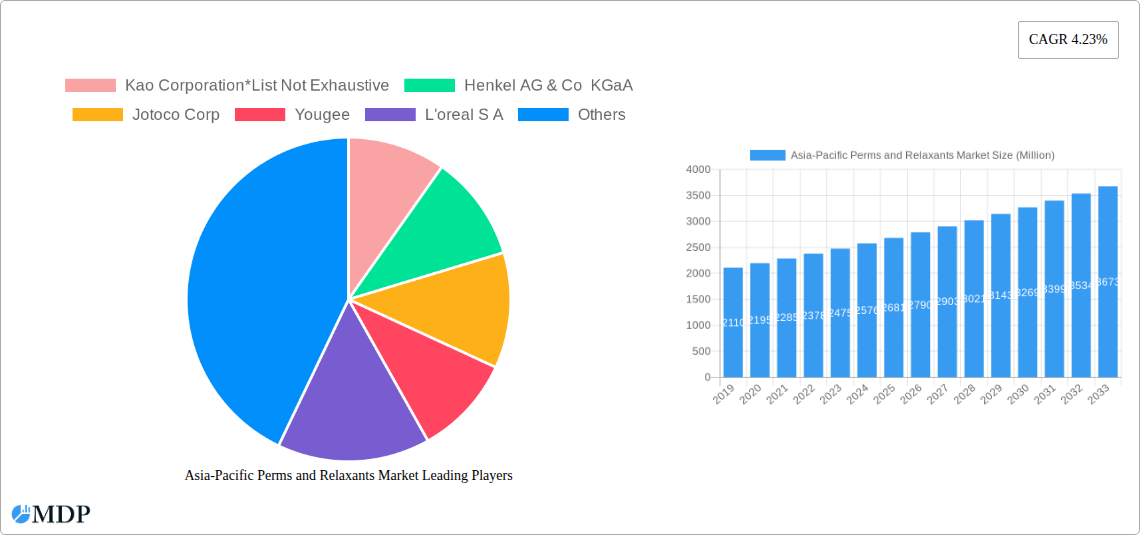

The Asia-Pacific Perms and Relaxants Market is projected to achieve a valuation of $1.04 billion by 2023, exhibiting a Compound Annual Growth Rate (CAGR) of 4.27% through 2033. This growth is propelled by rising disposable incomes in key economies, escalating consumer interest in advanced hair treatments, and the enduring appeal of voluminous hairstyles. The "Perms" segment is anticipated to lead, driven by demand for long-lasting styles, while "Relaxants" cater to the widespread preference for managing textured hair.

Asia-Pacific Perms and Relaxants Market Market Size (In Billion)

Evolving distribution channels, including the rapid expansion of e-commerce alongside traditional retail, are enhancing market accessibility. China, India, and Southeast Asia are central to this market's expansion. Key challenges include consumer concerns regarding chemical treatments and a growing preference for natural alternatives. However, ongoing innovation in formulation efficacy and sustainability is expected to ensure continued market growth.

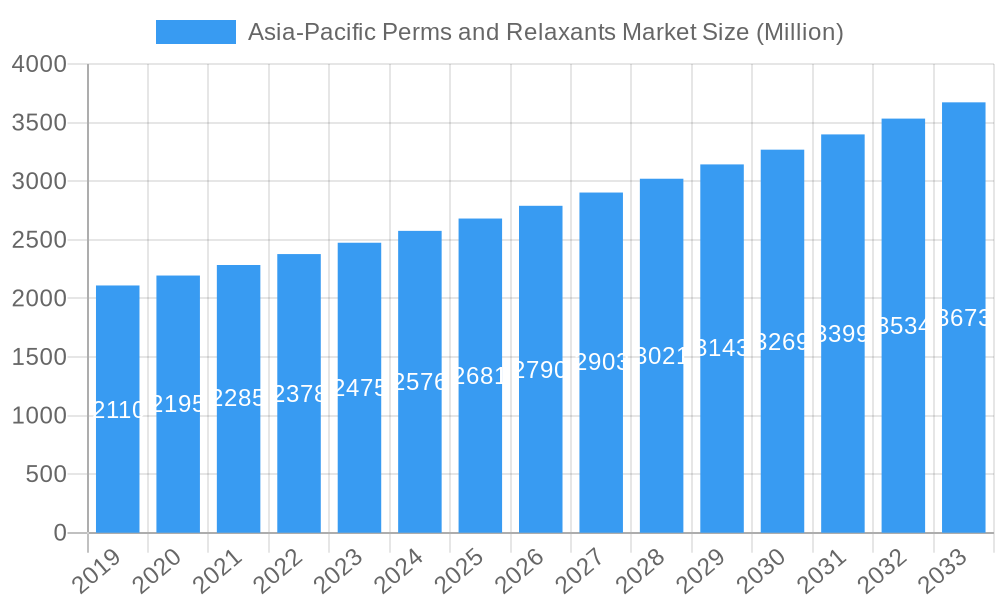

Asia-Pacific Perms and Relaxants Market Company Market Share

Asia-Pacific Perms and Relaxants Market: Strategic Analysis and Forecast (2023-2033)

Gain a competitive edge with comprehensive market intelligence on the Asia-Pacific Perms and Relaxants Market. This report details market dynamics, key trends, segment performance, and product innovations within the beauty and personal care industry. With a base year of 2023 and a forecast extending to 2033, this analysis offers strategic insights for industry stakeholders. Identify growth opportunities, understand market drivers, and navigate challenges to capitalize on this evolving market.

Asia-Pacific Perms and Relaxants Market Market Dynamics & Concentration

The Asia-Pacific Perms and Relaxants Market exhibits a XX% market concentration, driven by a blend of established global players and increasingly influential local brands. Innovation is a key differentiator, with manufacturers investing heavily in developing gentler formulations, long-lasting results, and hair health-focused solutions, contributing to approximately 40% of new product development. Regulatory frameworks are evolving, with some countries implementing stricter guidelines on chemical ingredients, potentially impacting product formulations and market access. Product substitutes, such as heat styling tools and professional salon treatments, offer alternative styling options but lack the permanence of perms and relaxants, representing a XX% competitive threat. End-user trends highlight a growing demand for personalized hair solutions, diverse styling options, and products catering to various hair types, especially within the booming ethnic hair care segment, which accounts for an estimated 35% of market demand. Mergers and acquisitions (M&A) activities are moderate, with around 5 major deals recorded between 2021 and 2024, primarily focused on expanding regional presence and acquiring innovative technologies, totaling an estimated USD 500 Million in deal value.

Asia-Pacific Perms and Relaxants Market Industry Trends & Analysis

The Asia-Pacific Perms and Relaxants Market is experiencing robust growth, driven by a confluence of socioeconomic factors and evolving consumer preferences. A projected Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033 underscores the sector's significant expansion. This growth is fueled by rising disposable incomes across the region, particularly in emerging economies like India and Southeast Asian nations, leading to increased discretionary spending on personal care products. Technological disruptions are playing a pivotal role, with advancements in chemical formulations leading to safer, more effective, and less damaging perming and relaxing treatments. Innovations such as keratin-infused relaxants and ammonia-free perms are gaining traction, addressing consumer concerns about hair damage. Consumer preferences are shifting towards styles that offer convenience and manageability, with a growing interest in texture enhancement and long-term styling solutions. The influence of social media and beauty influencers is also substantial, creating demand for trending hairstyles achievable through perming and relaxing services. Competitive dynamics are characterized by intense rivalry between multinational corporations and local brands, each vying for market share through product innovation, aggressive marketing campaigns, and strategic distribution network expansion. The market penetration of perms and relaxants is estimated to reach 55% by 2028, indicating significant untapped potential. Furthermore, the increasing adoption of e-commerce platforms has democratized access to these products, expanding reach to urban and semi-urban populations alike. The demand for salon-quality results at home is also a significant trend, driving the sales of at-home perming and relaxing kits. The influence of K-beauty and J-beauty trends, emphasizing healthy hair and specific styling aesthetics, continues to shape product development and consumer demand within the region.

Leading Markets & Segments in Asia-Pacific Perms and Relaxants Market

China currently stands as the dominant market within the Asia-Pacific Perms and Relaxants sector, driven by its massive consumer base, rapid urbanization, and a strong inclination towards adopting global beauty trends. The perms segment, in particular, holds a significant market share estimated at 60% of the total market value, reflecting a strong consumer desire for versatile and lasting hairstyles. Economic policies in China have supported the growth of the beauty and personal care industry, with increasing disposable incomes and a burgeoning middle class contributing to higher spending on cosmetic treatments. The distribution channel of Specialist Retailers and Online Stores are key drivers for this segment's dominance, accounting for over 70% of sales, as consumers seek expert advice and a wide product selection.

- Dominant Country: China's market leadership is underpinned by a robust beauty retail infrastructure and a highly engaged consumer base. Economic growth and rising disposable incomes have made premium hair care products more accessible.

- Dominant Product Type: Perms represent the largest segment, fueled by a persistent demand for textured and styled hair. Innovations in perming technology, focusing on hair health and reduced damage, are further bolstering this segment's appeal.

- Dominant Distribution Channel: Specialist Retailers, including beauty salons and dedicated hair care stores, along with Online Stores, are crucial for reaching consumers seeking both professional advice and convenient purchasing options. Their combined market share is estimated at approximately 70%.

- Key Drivers for Dominance:

- Economic Policies: Favorable trade policies and government support for the consumer goods sector in China.

- Infrastructure: Well-developed retail and e-commerce networks facilitating widespread product availability.

- Consumer Behavior: A strong cultural emphasis on appearance and a high adoption rate of new beauty trends.

- Technological Adoption: Early and widespread adoption of advanced hair care technologies and product formulations.

India and Japan also represent substantial markets, with unique consumer preferences and growth drivers. India's market is rapidly expanding due to its young demographic and increasing awareness of styling products, while Japan's market is characterized by a demand for high-quality, sophisticated hair care solutions. Australia, though smaller in population, exhibits a high per capita consumption driven by a strong beauty consciousness. The Rest of Asia-Pacific, encompassing countries like South Korea, Indonesia, and Thailand, presents diverse growth opportunities influenced by local trends and increasing disposable incomes.

Asia-Pacific Perms and Relaxants Market Product Developments

Product development in the Asia-Pacific Perms and Relaxants Market is highly focused on innovation for healthier hair and enhanced performance. Key trends include the introduction of ammonia-free and low-odor formulations, catering to growing consumer concerns about chemical exposure and harsh fumes. Advanced ingredients such as keratin, collagen, and natural extracts are being integrated to provide conditioning benefits and minimize hair damage during chemical processing. The development of pH-balanced formulas and advanced neutralization agents is also a priority, ensuring optimal hair health post-treatment. Furthermore, brands are innovating in application ease, with many products now offering simplified at-home kits designed for greater convenience.

Key Drivers of Asia-Pacific Perms and Relaxants Market Growth

The Asia-Pacific Perms and Relaxants Market growth is propelled by several key factors. Rising disposable incomes across the region are enabling consumers to spend more on personal grooming and beauty treatments, making perms and relaxants a more accessible luxury. The increasing influence of social media and celebrity endorsements has significantly boosted awareness and demand for diverse hairstyles achievable through these treatments. Technological advancements in product formulations, leading to gentler, more effective, and hair-health-conscious options, are overcoming past concerns about hair damage. Finally, a growing preference for long-lasting hairstyles that reduce daily styling time, particularly among busy urban populations, is a major driver.

Challenges in the Asia-Pacific Perms and Relaxants Market Market

Despite strong growth, the Asia-Pacific Perms and Relaxants Market faces several challenges. Regulatory hurdles regarding the import and use of certain chemical ingredients can impact product availability and formulation flexibility in specific countries. Intense competition from both global and local players leads to price pressures and necessitates continuous innovation to maintain market share, with an estimated XX% of companies engaging in aggressive pricing strategies. Consumer perception of hair damage associated with older perming and relaxing technologies still lingers, requiring ongoing education and promotion of advanced, hair-friendly products. Supply chain disruptions, as observed in recent global events, can also affect raw material sourcing and product distribution.

Emerging Opportunities in Asia-Pacific Perms and Relaxants Market

Emerging opportunities in the Asia-Pacific Perms and Relaxants Market lie in capitalizing on the growing demand for personalized hair solutions. The expansion of e-commerce and direct-to-consumer (DTC) channels presents a significant opportunity for brands to reach a wider audience and build direct customer relationships. Strategic partnerships with online influencers and beauty bloggers can amplify marketing reach and consumer engagement. Furthermore, the increasing focus on sustainable and ethically sourced ingredients offers a niche for brands to differentiate themselves and appeal to environmentally conscious consumers. The development of specialized product lines catering to specific hair types and concerns (e.g., color-treated hair, sensitive scalps) also presents a lucrative avenue for growth.

Leading Players in the Asia-Pacific Perms and Relaxants Market Sector

- Kao Corporation

- Henkel AG & Co KGaA

- Jotoco Corp

- Yougee

- L'oreal S A

- Coty Inc

- Makarizo International

- Shiseido Co Ltd

Key Milestones in Asia-Pacific Perms and Relaxants Market Industry

- 2020: Launch of ammonia-free perming solutions by several major brands, addressing consumer health concerns.

- 2021: Increased investment in research and development for plant-based and natural relaxant formulations.

- 2022: Significant growth in online sales channels for perms and relaxants, driven by e-commerce expansion.

- 2023: Introduction of advanced keratin-infused relaxant treatments promising reduced hair damage.

- Early 2024: Growing consumer interest in DIY hair treatments, leading to the launch of user-friendly at-home kits.

- Mid-2024: Expansion of product offerings catering to diverse hair textures and types across the Asia-Pacific region.

Strategic Outlook for Asia-Pacific Perms and Relaxants Market Market

The strategic outlook for the Asia-Pacific Perms and Relaxants Market is exceptionally promising, fueled by a continuous upward trajectory in consumer demand for enhanced hair styling and management solutions. Growth accelerators include the relentless pursuit of product innovation focused on hair health and sustainability, strategic expansion into untapped emerging markets within the region, and the leveraging of digital platforms for direct consumer engagement and sales. Brands that can effectively tailor their offerings to diverse cultural preferences and hair types, while emphasizing safety and efficacy, will be well-positioned for sustained success. The market's future will likely be shaped by a blend of technological advancements and a keen understanding of evolving consumer desires.

Asia-Pacific Perms and Relaxants Market Segmentation

-

1. Product Type

- 1.1. Perms

- 1.2. Relaxants

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Retailers

- 2.4. Online Stores

- 2.5. Others

-

3. Geography

-

3.1. Asia Pacific

- 3.1.1. China

- 3.1.2. Japan

- 3.1.3. India

- 3.1.4. Australia

- 3.1.5. Rest of Asia-Pacific

-

3.1. Asia Pacific

Asia-Pacific Perms and Relaxants Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. Australia

- 1.5. Rest of Asia Pacific

Asia-Pacific Perms and Relaxants Market Regional Market Share

Geographic Coverage of Asia-Pacific Perms and Relaxants Market

Asia-Pacific Perms and Relaxants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Appeal for Multi-functional and Damage Control Hair Care Products; Prevalence of Different Hair Concerns Remains the Major Driving Force

- 3.3. Market Restrains

- 3.3.1. Growing Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Demand for Organic/Natural Products is Rising Rapidly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Perms and Relaxants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Perms

- 5.1.2. Relaxants

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Retailers

- 5.2.4. Online Stores

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia Pacific

- 5.3.1.1. China

- 5.3.1.2. Japan

- 5.3.1.3. India

- 5.3.1.4. Australia

- 5.3.1.5. Rest of Asia-Pacific

- 5.3.1. Asia Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kao Corporation*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Henkel AG & Co KGaA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jotoco Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Yougee

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 L'oreal S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Coty Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Makarizo International

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shiseido Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Kao Corporation*List Not Exhaustive

List of Figures

- Figure 1: Asia-Pacific Perms and Relaxants Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Perms and Relaxants Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Perms and Relaxants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Asia-Pacific Perms and Relaxants Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asia-Pacific Perms and Relaxants Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Perms and Relaxants Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Perms and Relaxants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Asia-Pacific Perms and Relaxants Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Asia-Pacific Perms and Relaxants Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Perms and Relaxants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Perms and Relaxants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Perms and Relaxants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: India Asia-Pacific Perms and Relaxants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Australia Asia-Pacific Perms and Relaxants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Asia-Pacific Perms and Relaxants Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Perms and Relaxants Market?

The projected CAGR is approximately 4.27%.

2. Which companies are prominent players in the Asia-Pacific Perms and Relaxants Market?

Key companies in the market include Kao Corporation*List Not Exhaustive, Henkel AG & Co KGaA, Jotoco Corp, Yougee, L'oreal S A, Coty Inc, Makarizo International, Shiseido Co Ltd.

3. What are the main segments of the Asia-Pacific Perms and Relaxants Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.04 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Appeal for Multi-functional and Damage Control Hair Care Products; Prevalence of Different Hair Concerns Remains the Major Driving Force.

6. What are the notable trends driving market growth?

Demand for Organic/Natural Products is Rising Rapidly.

7. Are there any restraints impacting market growth?

Growing Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Perms and Relaxants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Perms and Relaxants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Perms and Relaxants Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Perms and Relaxants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence