Key Insights

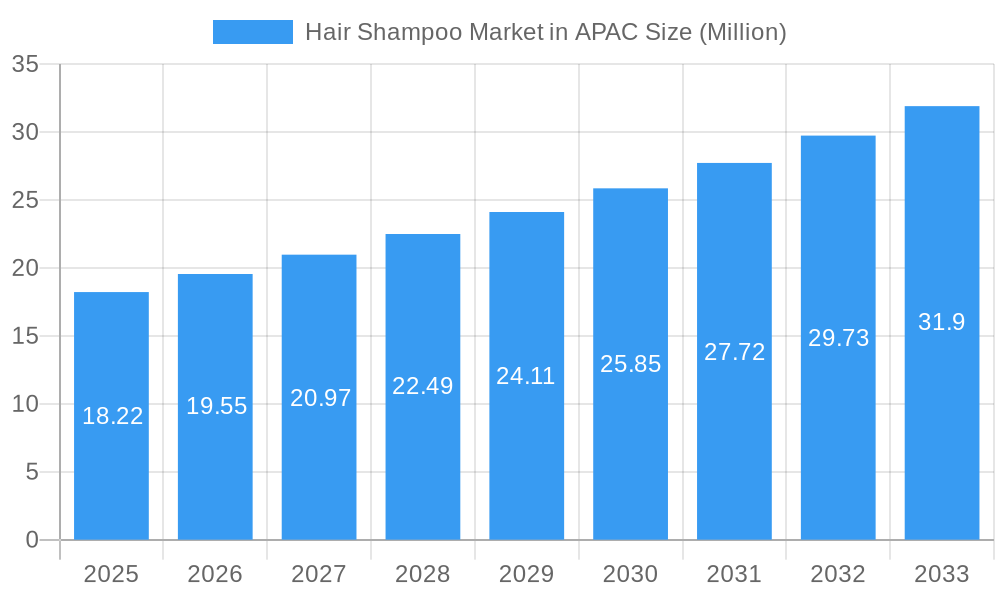

The Asia-Pacific (APAC) Hair Shampoo Market is poised for robust growth, projected to reach an estimated market size of USD 18.22 billion by 2025. This expansion is fueled by a healthy Compound Annual Growth Rate (CAGR) of 7.47% throughout the forecast period of 2025-2033. A significant driver for this growth is the increasing consumer awareness and demand for specialized hair care solutions, including medicated and anti-dandruff shampoos, catering to a wide range of scalp and hair concerns prevalent in the region. Furthermore, the rising disposable incomes across key APAC economies, particularly in China, India, and Southeast Asian nations, are enabling consumers to invest more in premium and branded hair care products. The burgeoning e-commerce landscape is also playing a pivotal role, with online retail channels witnessing exponential growth in accessibility and consumer adoption, offering a wider selection of products and convenient purchasing options.

Hair Shampoo Market in APAC Market Size (In Million)

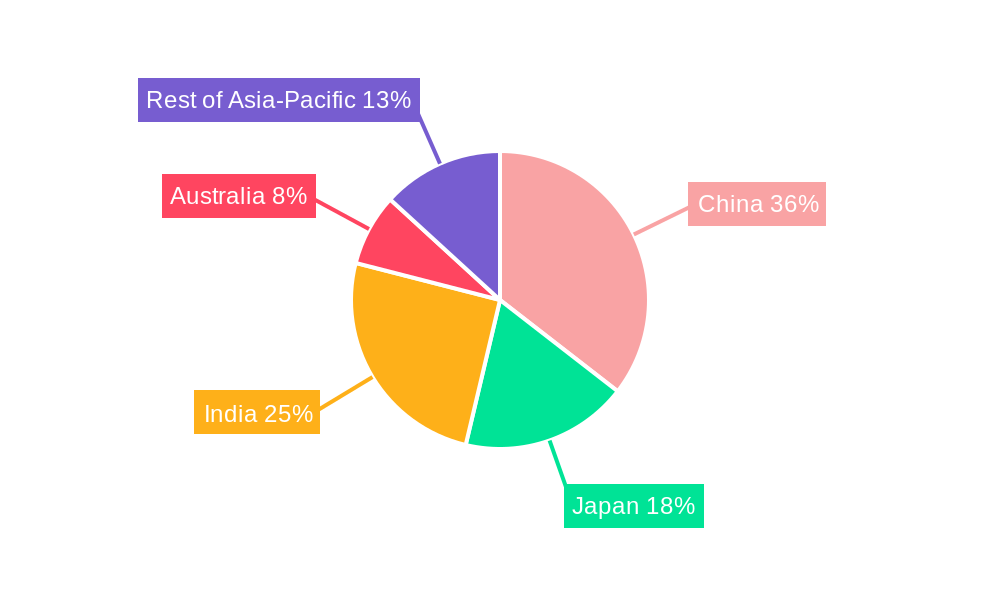

The market segmentation highlights diverse consumer preferences, with "Standard Shampoos" forming the largest segment, reflecting everyday usage. However, segments like "Anti-Dandruff Shampoos" and "Medicated Shampoos" are experiencing accelerated growth due to heightened health consciousness and the desire for targeted treatments. Distribution channels are also evolving, with a notable shift towards online retail stores, complementing traditional avenues like supermarkets/hypermarkets and pharmacies. Geographically, China and India are expected to be the dominant markets, driven by their large populations and rapidly urbanizing consumer bases. Emerging trends include a growing preference for natural and organic ingredients, sustainable packaging, and personalized hair care solutions, all contributing to the dynamic evolution of the APAC hair shampoo landscape.

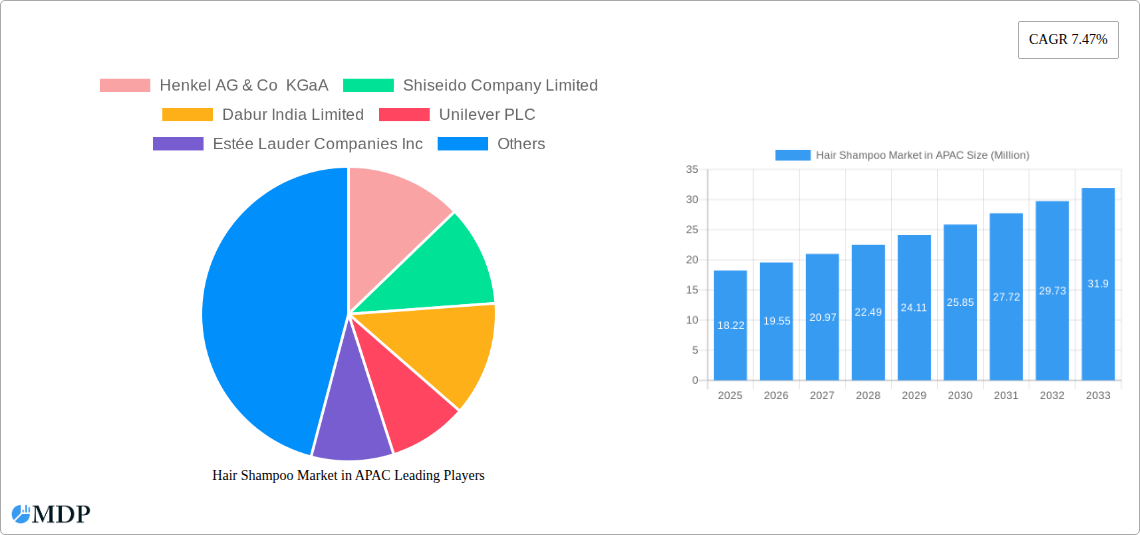

Hair Shampoo Market in APAC Company Market Share

Here is an SEO-optimized and engaging report description for the Hair Shampoo Market in APAC, designed for maximum visibility and actionable insights:

Unlocking Growth: The APAC Hair Shampoo Market Report 2024-2033

Dive deep into the dynamic APAC hair shampoo market with our comprehensive report, analyzing trends, opportunities, and challenges shaping the Asia Pacific hair care industry. This in-depth market intelligence report provides critical insights for shampoo manufacturers, cosmetic brands, retailers, and investors seeking to capitalize on the burgeoning demand for hair care solutions across China, Japan, India, Australia, and the wider Rest of Asia-Pacific.

Our analysis covers the study period of 2019–2033, with a focus on the base year 2025 and an extended forecast period of 2025–2033, building upon the historical period of 2019–2024. Discover key market drivers, segment-specific growth trajectories, and strategic outlooks, all presented with actionable data and clear, concise analysis.

This report explores the hair shampoo market size in APAC, detailing the CAGR of xx% for the forecast period. Understand the competitive landscape featuring major players like Unilever PLC, Procter & Gamble Company, L'Oréal S A, Henkel AG & Co KGaA, Kao Corporation, and Shiseido Company Limited.

Key Report Features:

Whether you're looking to understand the impact of natural ingredients in shampoos, the rise of online beauty sales in Asia, or the influence of anti-dandruff shampoo market growth, this report delivers the intelligence you need to succeed.

- Market Segmentation: In-depth analysis of product types (2-in-1 Shampoos, Anti-Dandruff Shampoos, Kids Shampoos, Medicated Shampoos, Standard Shampoos, Other Shampoos) and distribution channels (Supermarkets/Hypermarkets, Speciality Stores, Online Retail Stores, Pharmacies/Drugstore, Other Distribution Channels).

- Geographical Focus: Detailed breakdown of the China hair shampoo market, Japan hair care market, India beauty market, Australia personal care trends, and the Rest of Asia-Pacific.

- Strategic Insights: Actionable recommendations on market entry strategies, product innovation, and competitive positioning.

- Data-Driven Analysis: Extensive use of market share, CAGR, and other quantifiable metrics to support findings.

Hair Shampoo Market in APAC Market Dynamics & Concentration

The APAC hair shampoo market is characterized by a moderate to high level of concentration, with a few dominant global players holding significant market share, particularly in the standard shampoos and anti-dandruff shampoos segments. However, the landscape is increasingly dynamic due to growing consumer awareness and the rise of local and regional brands. Innovation drivers are primarily focused on addressing specific consumer needs such as hair repair, scalp health, and natural/organic formulations. Regulatory frameworks vary across countries, impacting product formulations and marketing claims, especially for medicated shampoos. Product substitutes include hair conditioners, hair masks, and dry shampoos, which offer alternative hair care solutions and exert competitive pressure. End-user trends indicate a growing demand for premium and specialized shampoos, driven by increasing disposable incomes and a rising awareness of hair health and styling trends. Merger and acquisition (M&A) activities are notable as larger companies seek to expand their product portfolios and geographical reach within the diverse APAC region. For instance, key companies are actively pursuing partnerships and acquisitions to integrate innovative brands and technologies. The market's M&A deal count has seen a steady increase over the historical period, reflecting a strategic consolidation trend among established players and emerging brands looking for scale and market access.

Hair Shampoo Market in APAC Industry Trends & Analysis

The Asia Pacific hair shampoo market is experiencing robust growth, propelled by a confluence of factors that are reshaping consumer preferences and industry dynamics. The increasing disposable incomes across major economies like China, India, and Southeast Asian nations have led to a significant rise in consumer spending on personal care products, with shampoos being a staple. This economic uplift directly translates into higher demand for both mass-market and premium hair care solutions. Technological disruptions are playing a pivotal role, with advancements in product formulations leading to the development of specialized shampoos addressing a wide array of concerns, from hair loss and damage to scalp sensitivity and environmental protection. The widespread adoption of e-commerce platforms has revolutionized distribution, making a vast array of brands and products accessible to consumers in both urban and rural areas, thereby boosting online retail store sales for shampoos. Consumer preferences are evolving rapidly; there's a pronounced shift towards natural, organic, and sulphate-free shampoos, driven by growing health consciousness and environmental concerns. Consumers are increasingly seeking transparency in ingredients and sustainability in packaging. This trend is particularly evident in markets like Japan and Australia, with significant spillover into other APAC nations. Competitive dynamics are intensifying, with both global giants and agile local players vying for market share. The latter are often adept at understanding and catering to specific cultural preferences and local hair concerns, giving them a competitive edge in their home markets. For example, the India hair care market sees strong performance from brands that offer solutions tailored to specific Indian hair types and environmental conditions. The overall market penetration of specialized shampoos is on an upward trajectory, indicating a move beyond basic cleansing to targeted hair treatment. The CAGR of the APAC hair shampoo market is estimated to be xx% during the forecast period, driven by these multifaceted trends and the continuous innovation by leading companies.

Leading Markets & Segments in Hair Shampoo Market in APAC

The APAC hair shampoo market is dominated by a few key geographical regions and product segments, which are crucial for understanding overall market dynamics. China stands as the largest market, driven by its massive population, rising middle class, and a strong inclination towards premium and technologically advanced beauty products. The increasing adoption of Western beauty trends, coupled with a growing emphasis on hair health and styling, fuels the demand for a wide variety of shampoos. India represents another highly significant and rapidly growing market. Its sheer population size, coupled with increasing urbanization and disposable incomes, creates a vast consumer base. The demand for affordable yet effective shampoos, particularly anti-dandruff shampoos and 2-in-1 shampoos, is substantial.

Within product types, Standard Shampoos continue to hold a dominant share due to their widespread availability and affordability. However, the fastest growth is observed in specialized categories. Anti-Dandruff Shampoos are experiencing significant traction across the region, as consumers become more aware of scalp health and seek targeted solutions. Medicated Shampoos, while a smaller segment, are also poised for growth, driven by increasing incidences of scalp issues and greater access to pharmacies and drugstores.

The Distribution Channel landscape is undergoing a transformation. While Supermarkets/Hypermarkets remain a strong pillar for mass-market penetration, Online Retail Stores are rapidly gaining prominence. This shift is particularly pronounced in markets like China and India, where e-commerce penetration is high, offering convenience and a wider selection to consumers. This channel is crucial for reaching a younger demographic and facilitating the growth of niche and premium brands. Pharmacies/Drugstores are gaining importance for medicated shampoos and specialized scalp care products.

Key drivers for dominance in these markets and segments include:

- Economic Policies: Favorable trade agreements and government initiatives supporting the beauty and personal care industry boost market access and growth.

- Infrastructure: Robust logistics and supply chain networks, particularly in e-commerce, enable wider product availability and faster delivery.

- Consumer Demographics: A large, young, and increasingly affluent population in countries like China and India represents a significant consumer base.

- Urbanization: The movement of populations to urban centers leads to greater exposure to global trends and increased purchasing power for premium products.

- Digital Penetration: High internet and smartphone penetration facilitate online shopping and direct-to-consumer sales for shampoo brands.

The dominance of China and India, coupled with the rapid growth of online retail and specialized shampoo segments, underscores the evolving nature of the APAC hair shampoo market.

Hair Shampoo Market in APAC Product Developments

The APAC hair shampoo market is witnessing a surge in product innovation driven by consumer demand for efficacy and natural ingredients. Companies are focusing on developing formulations that offer enhanced benefits beyond basic cleansing, such as deep hydration, damage repair, and scalp soothing. The integration of natural extracts, plant-based ingredients, and scientifically proven actives like hyaluronic acid is a prominent trend. For example, L'Oréal Paris's Hyaluron Moisture range in India targets dehydrated hair with a 72-hour hydration promise, showcasing a focus on advanced scientific claims. Similarly, Kao Corporation's introduction of the Oribe brand in Japan signifies a move towards luxury and premiumization in the hair care segment, offering high-performance styling and treatment products. These developments highlight a market that is increasingly sophisticated, where technological advancements are leveraged to create competitive advantages and meet the diverse and evolving needs of APAC consumers.

Key Drivers of Hair Shampoo Market in APAC Growth

The growth of the APAC hair shampoo market is propelled by several interconnected drivers. Economically, rising disposable incomes across emerging economies like India and China are enabling consumers to spend more on personal care, including premium shampoos. Technologically, advancements in formulation science are leading to specialized products that address specific hair concerns, such as anti-hair fall, anti-pollution, and scalp health solutions, driving the demand for medicated shampoos and anti-dandruff shampoos. Regulatory frameworks, while varying, are generally supportive of product safety and innovation, allowing for the introduction of novel ingredients and claims. Furthermore, the increasing consumer awareness regarding hair health and the influence of digital media and social influencers are significant motivators for product adoption and brand loyalty. The convenience offered by online retail stores also plays a crucial role in expanding market reach.

Challenges in the Hair Shampoo Market in APAC Market

Despite the robust growth, the APAC hair shampoo market faces several challenges. Intense competition from both global giants and agile local players can lead to price wars and pressure on profit margins, particularly in the standard shampoos segment. Varying regulatory landscapes across different countries can create complexities for product approvals and marketing claims, especially for medicated shampoos. Supply chain disruptions, exacerbated by geopolitical factors and logistics challenges in some regions, can impact product availability and increase operational costs. Furthermore, the growing consumer preference for natural and organic products necessitates significant investment in research and development for sustainable sourcing and formulations, which can be a costly endeavor. The penetration of substitutes like hair conditioners and styling products also poses a continuous challenge to market share.

Emerging Opportunities in Hair Shampoo Market in APAC

Emerging opportunities in the APAC hair shampoo market are abundant, driven by evolving consumer trends and technological advancements. The increasing demand for natural and organic hair care presents a significant opportunity for brands that can offer sustainable and ethically sourced products. The burgeoning middle class in Southeast Asian countries and the continued economic development in India and China offer vast untapped potential for market expansion. Strategic partnerships, such as the one between Myntra and L'Oréal Professional Products Division in India, exemplify how collaborations can enhance distribution networks and consumer reach, particularly for specialized product lines. The rise of personalized beauty solutions, driven by AI and data analytics, opens avenues for customized shampoo formulations catering to individual hair needs. Moreover, the growing awareness about scalp health is creating a niche for scalp care shampoos and treatments, representing a lucrative segment for innovation.

Leading Players in the Hair Shampoo Market in APAC Sector

- Henkel AG & Co KGaA

- Shiseido Company Limited

- Dabur India Limited

- Unilever PLC

- Estée Lauder Companies Inc

- Himalaya Global Holdings Ltd

- L'Oréal S A

- Natura & Co

- Johnson & Johnson Services Inc

- Procter & Gamble Company

- Kao Corporation

- Honasa Consumer Pvt Ltd

Key Milestones in Hair Shampoo Market in APAC Industry

- September 2022: L'Oréal Paris Launched the Hyaluron Moisture range of haircare products in India. The products include shampoo, conditioner, and leave-in. The shampoo is targeted at dehydrated hair. It repairs the damage and keeps hair hydrated for 72 hours.

- April 2022: Myntra, an online shopping platform in India, formed a partnership with L'Oréal Professional Products Division. The partnership will offer beauty and personal care products from L'Oréal on Myntra's shopping platform for consumers. The product range includes shampoos, conditioners, hair oils, hair masks, serums, and many more.

- April 2021: Kao Corporation launched a prestige hair salon brand Oribe in Japan. The brand was launched in Japan as a luxury lifestyle brand that includes hair care and styling products like hair sprays, hair colors, and shampoos.

Strategic Outlook for Hair Shampoo Market in APAC Market

The strategic outlook for the APAC hair shampoo market is exceptionally positive, driven by ongoing economic growth, evolving consumer preferences towards specialized and natural products, and the increasing penetration of online retail channels. Key growth accelerators include further investment in sustainable and clean beauty formulations, catering to the growing eco-conscious consumer base. Expanding into underserved rural markets through cost-effective product offerings and robust distribution networks will be crucial for capturing market share. Strategic collaborations between global brands and local players can unlock deeper market understanding and consumer connection. Furthermore, leveraging digital platforms for personalized marketing and e-commerce will remain a pivotal strategy for sustained growth and competitive advantage in this dynamic region. The market is ripe for innovation in scalp care and advanced treatment shampoos.

Hair Shampoo Market in APAC Segmentation

-

1. Product Type

- 1.1. 2-in-1 Shampoos

- 1.2. Anti-Dandruff Sampoos

- 1.3. Kids Shampoos

- 1.4. Medicated Shampoos

- 1.5. Standard Shampoos

- 1.6. Other Shampoos

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Speciality Stores

- 2.3. Online Retail Stores

- 2.4. Pharmacies/Drugstore

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

Hair Shampoo Market in APAC Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

Hair Shampoo Market in APAC Regional Market Share

Geographic Coverage of Hair Shampoo Market in APAC

Hair Shampoo Market in APAC REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives Promoting Menstrual Hygiene; Advertisement and Promotional Campaigns Raising Awareness

- 3.3. Market Restrains

- 3.3.1. Orthodox and Conventional Approach Towards Menstruation

- 3.4. Market Trends

- 3.4.1. Growing Demand for Organic and Natural Hair Care Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hair Shampoo Market in APAC Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. 2-in-1 Shampoos

- 5.1.2. Anti-Dandruff Sampoos

- 5.1.3. Kids Shampoos

- 5.1.4. Medicated Shampoos

- 5.1.5. Standard Shampoos

- 5.1.6. Other Shampoos

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Speciality Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Pharmacies/Drugstore

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Hair Shampoo Market in APAC Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. 2-in-1 Shampoos

- 6.1.2. Anti-Dandruff Sampoos

- 6.1.3. Kids Shampoos

- 6.1.4. Medicated Shampoos

- 6.1.5. Standard Shampoos

- 6.1.6. Other Shampoos

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Speciality Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Pharmacies/Drugstore

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Japan Hair Shampoo Market in APAC Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. 2-in-1 Shampoos

- 7.1.2. Anti-Dandruff Sampoos

- 7.1.3. Kids Shampoos

- 7.1.4. Medicated Shampoos

- 7.1.5. Standard Shampoos

- 7.1.6. Other Shampoos

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Speciality Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Pharmacies/Drugstore

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. India Hair Shampoo Market in APAC Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. 2-in-1 Shampoos

- 8.1.2. Anti-Dandruff Sampoos

- 8.1.3. Kids Shampoos

- 8.1.4. Medicated Shampoos

- 8.1.5. Standard Shampoos

- 8.1.6. Other Shampoos

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Speciality Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Pharmacies/Drugstore

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia Hair Shampoo Market in APAC Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. 2-in-1 Shampoos

- 9.1.2. Anti-Dandruff Sampoos

- 9.1.3. Kids Shampoos

- 9.1.4. Medicated Shampoos

- 9.1.5. Standard Shampoos

- 9.1.6. Other Shampoos

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Speciality Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Pharmacies/Drugstore

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific Hair Shampoo Market in APAC Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. 2-in-1 Shampoos

- 10.1.2. Anti-Dandruff Sampoos

- 10.1.3. Kids Shampoos

- 10.1.4. Medicated Shampoos

- 10.1.5. Standard Shampoos

- 10.1.6. Other Shampoos

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Speciality Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Pharmacies/Drugstore

- 10.2.5. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Henkel AG & Co KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shiseido Company Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dabur India Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Unilever PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Estée Lauder Companies Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Himalaya Global Holdings Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 L'Oréal S A

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Natura & Co

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Johnson & Johnson Services Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Procter & Gamble Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Kao Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Honasa Consumer Pvt Ltd*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Global Hair Shampoo Market in APAC Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Hair Shampoo Market in APAC Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: China Hair Shampoo Market in APAC Revenue (Million), by Product Type 2025 & 2033

- Figure 4: China Hair Shampoo Market in APAC Volume (K Tons), by Product Type 2025 & 2033

- Figure 5: China Hair Shampoo Market in APAC Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: China Hair Shampoo Market in APAC Volume Share (%), by Product Type 2025 & 2033

- Figure 7: China Hair Shampoo Market in APAC Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 8: China Hair Shampoo Market in APAC Volume (K Tons), by Distribution Channel 2025 & 2033

- Figure 9: China Hair Shampoo Market in APAC Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: China Hair Shampoo Market in APAC Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: China Hair Shampoo Market in APAC Revenue (Million), by Geography 2025 & 2033

- Figure 12: China Hair Shampoo Market in APAC Volume (K Tons), by Geography 2025 & 2033

- Figure 13: China Hair Shampoo Market in APAC Revenue Share (%), by Geography 2025 & 2033

- Figure 14: China Hair Shampoo Market in APAC Volume Share (%), by Geography 2025 & 2033

- Figure 15: China Hair Shampoo Market in APAC Revenue (Million), by Country 2025 & 2033

- Figure 16: China Hair Shampoo Market in APAC Volume (K Tons), by Country 2025 & 2033

- Figure 17: China Hair Shampoo Market in APAC Revenue Share (%), by Country 2025 & 2033

- Figure 18: China Hair Shampoo Market in APAC Volume Share (%), by Country 2025 & 2033

- Figure 19: Japan Hair Shampoo Market in APAC Revenue (Million), by Product Type 2025 & 2033

- Figure 20: Japan Hair Shampoo Market in APAC Volume (K Tons), by Product Type 2025 & 2033

- Figure 21: Japan Hair Shampoo Market in APAC Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Japan Hair Shampoo Market in APAC Volume Share (%), by Product Type 2025 & 2033

- Figure 23: Japan Hair Shampoo Market in APAC Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 24: Japan Hair Shampoo Market in APAC Volume (K Tons), by Distribution Channel 2025 & 2033

- Figure 25: Japan Hair Shampoo Market in APAC Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 26: Japan Hair Shampoo Market in APAC Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 27: Japan Hair Shampoo Market in APAC Revenue (Million), by Geography 2025 & 2033

- Figure 28: Japan Hair Shampoo Market in APAC Volume (K Tons), by Geography 2025 & 2033

- Figure 29: Japan Hair Shampoo Market in APAC Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Japan Hair Shampoo Market in APAC Volume Share (%), by Geography 2025 & 2033

- Figure 31: Japan Hair Shampoo Market in APAC Revenue (Million), by Country 2025 & 2033

- Figure 32: Japan Hair Shampoo Market in APAC Volume (K Tons), by Country 2025 & 2033

- Figure 33: Japan Hair Shampoo Market in APAC Revenue Share (%), by Country 2025 & 2033

- Figure 34: Japan Hair Shampoo Market in APAC Volume Share (%), by Country 2025 & 2033

- Figure 35: India Hair Shampoo Market in APAC Revenue (Million), by Product Type 2025 & 2033

- Figure 36: India Hair Shampoo Market in APAC Volume (K Tons), by Product Type 2025 & 2033

- Figure 37: India Hair Shampoo Market in APAC Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: India Hair Shampoo Market in APAC Volume Share (%), by Product Type 2025 & 2033

- Figure 39: India Hair Shampoo Market in APAC Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 40: India Hair Shampoo Market in APAC Volume (K Tons), by Distribution Channel 2025 & 2033

- Figure 41: India Hair Shampoo Market in APAC Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 42: India Hair Shampoo Market in APAC Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 43: India Hair Shampoo Market in APAC Revenue (Million), by Geography 2025 & 2033

- Figure 44: India Hair Shampoo Market in APAC Volume (K Tons), by Geography 2025 & 2033

- Figure 45: India Hair Shampoo Market in APAC Revenue Share (%), by Geography 2025 & 2033

- Figure 46: India Hair Shampoo Market in APAC Volume Share (%), by Geography 2025 & 2033

- Figure 47: India Hair Shampoo Market in APAC Revenue (Million), by Country 2025 & 2033

- Figure 48: India Hair Shampoo Market in APAC Volume (K Tons), by Country 2025 & 2033

- Figure 49: India Hair Shampoo Market in APAC Revenue Share (%), by Country 2025 & 2033

- Figure 50: India Hair Shampoo Market in APAC Volume Share (%), by Country 2025 & 2033

- Figure 51: Australia Hair Shampoo Market in APAC Revenue (Million), by Product Type 2025 & 2033

- Figure 52: Australia Hair Shampoo Market in APAC Volume (K Tons), by Product Type 2025 & 2033

- Figure 53: Australia Hair Shampoo Market in APAC Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Australia Hair Shampoo Market in APAC Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Australia Hair Shampoo Market in APAC Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 56: Australia Hair Shampoo Market in APAC Volume (K Tons), by Distribution Channel 2025 & 2033

- Figure 57: Australia Hair Shampoo Market in APAC Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Australia Hair Shampoo Market in APAC Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Australia Hair Shampoo Market in APAC Revenue (Million), by Geography 2025 & 2033

- Figure 60: Australia Hair Shampoo Market in APAC Volume (K Tons), by Geography 2025 & 2033

- Figure 61: Australia Hair Shampoo Market in APAC Revenue Share (%), by Geography 2025 & 2033

- Figure 62: Australia Hair Shampoo Market in APAC Volume Share (%), by Geography 2025 & 2033

- Figure 63: Australia Hair Shampoo Market in APAC Revenue (Million), by Country 2025 & 2033

- Figure 64: Australia Hair Shampoo Market in APAC Volume (K Tons), by Country 2025 & 2033

- Figure 65: Australia Hair Shampoo Market in APAC Revenue Share (%), by Country 2025 & 2033

- Figure 66: Australia Hair Shampoo Market in APAC Volume Share (%), by Country 2025 & 2033

- Figure 67: Rest of Asia Pacific Hair Shampoo Market in APAC Revenue (Million), by Product Type 2025 & 2033

- Figure 68: Rest of Asia Pacific Hair Shampoo Market in APAC Volume (K Tons), by Product Type 2025 & 2033

- Figure 69: Rest of Asia Pacific Hair Shampoo Market in APAC Revenue Share (%), by Product Type 2025 & 2033

- Figure 70: Rest of Asia Pacific Hair Shampoo Market in APAC Volume Share (%), by Product Type 2025 & 2033

- Figure 71: Rest of Asia Pacific Hair Shampoo Market in APAC Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 72: Rest of Asia Pacific Hair Shampoo Market in APAC Volume (K Tons), by Distribution Channel 2025 & 2033

- Figure 73: Rest of Asia Pacific Hair Shampoo Market in APAC Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 74: Rest of Asia Pacific Hair Shampoo Market in APAC Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 75: Rest of Asia Pacific Hair Shampoo Market in APAC Revenue (Million), by Geography 2025 & 2033

- Figure 76: Rest of Asia Pacific Hair Shampoo Market in APAC Volume (K Tons), by Geography 2025 & 2033

- Figure 77: Rest of Asia Pacific Hair Shampoo Market in APAC Revenue Share (%), by Geography 2025 & 2033

- Figure 78: Rest of Asia Pacific Hair Shampoo Market in APAC Volume Share (%), by Geography 2025 & 2033

- Figure 79: Rest of Asia Pacific Hair Shampoo Market in APAC Revenue (Million), by Country 2025 & 2033

- Figure 80: Rest of Asia Pacific Hair Shampoo Market in APAC Volume (K Tons), by Country 2025 & 2033

- Figure 81: Rest of Asia Pacific Hair Shampoo Market in APAC Revenue Share (%), by Country 2025 & 2033

- Figure 82: Rest of Asia Pacific Hair Shampoo Market in APAC Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 11: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 19: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 21: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 27: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 35: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 36: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Geography 2020 & 2033

- Table 39: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Product Type 2020 & 2033

- Table 42: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 43: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Geography 2020 & 2033

- Table 47: Global Hair Shampoo Market in APAC Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Hair Shampoo Market in APAC Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hair Shampoo Market in APAC?

The projected CAGR is approximately 7.47%.

2. Which companies are prominent players in the Hair Shampoo Market in APAC?

Key companies in the market include Henkel AG & Co KGaA, Shiseido Company Limited, Dabur India Limited, Unilever PLC, Estée Lauder Companies Inc, Himalaya Global Holdings Ltd, L'Oréal S A, Natura & Co, Johnson & Johnson Services Inc, Procter & Gamble Company, Kao Corporation, Honasa Consumer Pvt Ltd*List Not Exhaustive.

3. What are the main segments of the Hair Shampoo Market in APAC?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives Promoting Menstrual Hygiene; Advertisement and Promotional Campaigns Raising Awareness.

6. What are the notable trends driving market growth?

Growing Demand for Organic and Natural Hair Care Products.

7. Are there any restraints impacting market growth?

Orthodox and Conventional Approach Towards Menstruation.

8. Can you provide examples of recent developments in the market?

September 2022: L'Oreal Paris Launched the Hyaluron Moisture range of haircare products in India. The products include shampoo, conditioner, and leave-in. The shampoo is targeted at dehydrated hair. It repairs the damage and keeps hair hydrated for 72 hours.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hair Shampoo Market in APAC," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hair Shampoo Market in APAC report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hair Shampoo Market in APAC?

To stay informed about further developments, trends, and reports in the Hair Shampoo Market in APAC, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence