Key Insights

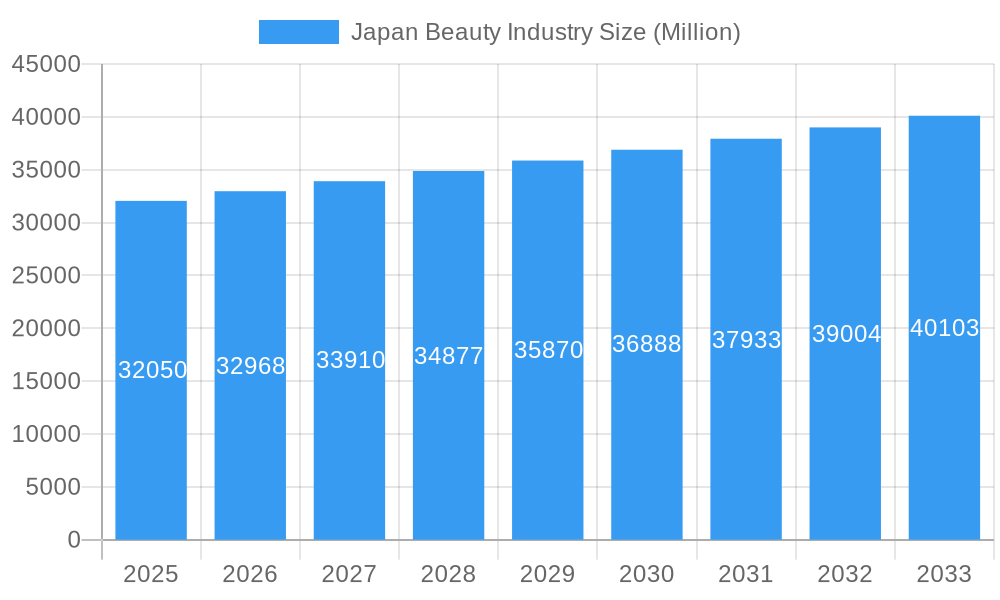

The Japan beauty industry, valued at approximately ¥3.2 trillion (assuming ¥100 to $1 USD conversion for simplicity) in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 2.87% from 2025 to 2033. This growth is fueled by several key drivers. The increasing disposable income of Japanese consumers, particularly among younger demographics, fuels demand for premium and innovative beauty products. Furthermore, the rising popularity of K-beauty and other international trends is influencing consumer preferences and creating opportunities for both domestic and international brands. The strong emphasis on skincare in Japanese culture continues to be a major factor, with consumers prioritizing products addressing specific skin concerns and incorporating advanced technologies. E-commerce channels are witnessing significant expansion, providing convenient access to a wider range of products and contributing to market growth. However, the industry faces certain restraints such as a shrinking population and an increasingly competitive landscape with both established players and emerging niche brands vying for market share. The aging population also presents a challenge, requiring brands to tailor products and marketing strategies to address the unique needs and preferences of older consumers. The market segmentation reveals a diverse landscape with skincare holding a significant share, followed by makeup, hair care, fragrances, and personal care products. Retail stores remain a dominant distribution channel, though online sales are rapidly gaining traction. Key players like Procter & Gamble, Shiseido, L'Oreal, and Kao Corporation, along with strong domestic and regional players, fiercely compete for consumer attention.

Japan Beauty Industry Market Size (In Billion)

The Asia-Pacific region, specifically Japan, is a crucial market within the global beauty industry. The significant market size and steady growth trajectory make it an attractive destination for both established and emerging beauty brands. Strategic partnerships, innovative product development focusing on advanced technologies and natural ingredients, and targeted marketing campaigns to specific demographics are essential for success in this competitive landscape. The focus on sustainability and ethical sourcing is also growing in importance, influencing consumer purchasing decisions and shaping the future of the industry. Understanding the unique cultural nuances and consumer preferences in Japan is crucial for brands to effectively penetrate and thrive in this dynamic and influential market. Future growth will likely be driven by increased demand for personalized beauty products, technologically advanced skincare solutions, and an ever-growing interest in self-care and wellness.

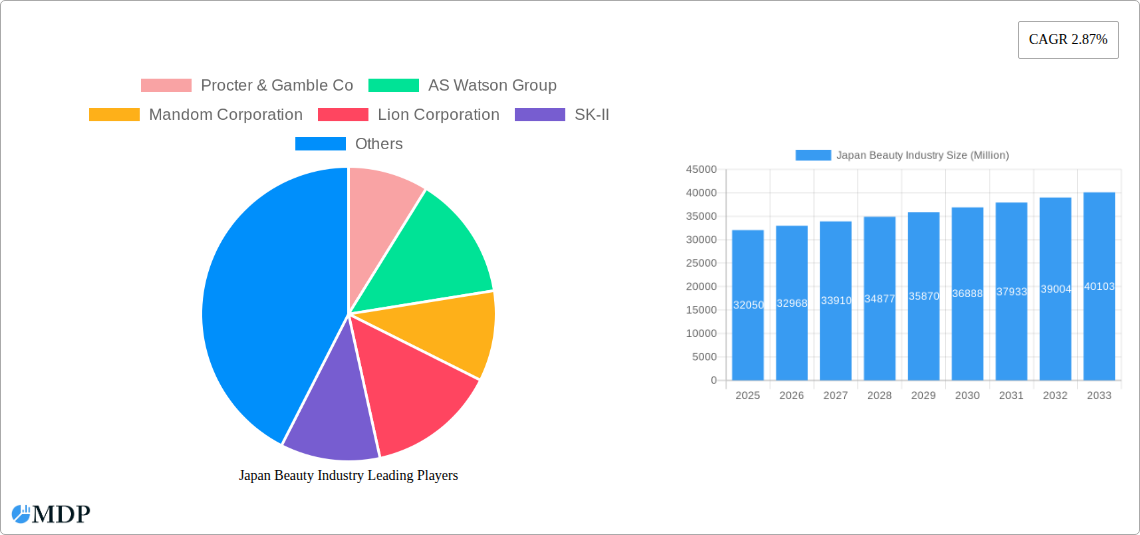

Japan Beauty Industry Company Market Share

This in-depth report provides a comprehensive analysis of the Japan beauty industry, covering market dynamics, leading players, emerging trends, and future growth prospects. Valued at xx Million in 2025, the market is poised for significant expansion, reaching xx Million by 2033. This report is essential reading for industry stakeholders, investors, and anyone seeking to understand this dynamic and lucrative market.

Japan Beauty Industry Market Dynamics & Concentration

The Japan beauty industry, valued at xx Million in 2025, exhibits a moderately concentrated market structure, dominated by global and domestic giants. Market share is primarily divided among key players like Shiseido Company, Kao Corporation, and Procter & Gamble Co, AS Watson Group, Mandom Corporation, Lion Corporation, SK-II, Unilever PLC, Makanai, L'Oreal SA. However, a vibrant ecosystem of smaller, niche brands also contributes to the market's diversity.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Innovation Drivers: Consumer demand for natural, sustainable, and technologically advanced beauty products drives innovation. The rising popularity of personalized skincare and customized beauty solutions also fuels R&D efforts.

- Regulatory Frameworks: Stringent regulations regarding product safety and labeling significantly impact market operations. Compliance costs and the need for rigorous testing influence pricing and product development.

- Product Substitutes: The availability of affordable generic alternatives and the rising interest in natural remedies pose a competitive threat to established brands.

- End-User Trends: A growing emphasis on health and wellness, coupled with increasing disposable incomes, fuels demand for premium and specialized beauty products. The rise of social media influencers further shapes consumer preferences and buying behavior.

- M&A Activities: The industry has witnessed a moderate number of mergers and acquisitions (xx deals in the past 5 years) as larger players seek to expand their market share and product portfolios.

Japan Beauty Industry Industry Trends & Analysis

The Japan beauty industry is experiencing robust growth, driven by several key factors. The market is projected to register a CAGR of xx% from 2025 to 2033. This growth is fueled by increasing disposable incomes, a strong focus on personal care, and the adoption of advanced technologies in beauty product development. Market penetration for premium skincare products is increasing, while the demand for natural and organic cosmetics is also growing rapidly.

The competitive landscape is highly dynamic, with both established players and emerging brands vying for market share. Technological disruptions, such as the rise of e-commerce and personalized beauty solutions, reshape the industry. Consumer preferences are shifting towards efficacy, sustainability, and ethical sourcing.

Leading Markets & Segments in Japan Beauty Industry

The skincare segment dominates the Japan beauty market, accounting for xx% of total revenue in 2025. E-commerce is gaining traction as a distribution channel, with a projected xx% market share by 2033, driven by increased internet penetration and convenience. The key drivers for the dominance of skincare and e-commerce include:

- Skincare: A deep-rooted culture of skincare rituals and a high demand for anti-aging and brightening products.

- E-commerce: Increased internet and smartphone penetration, convenient online shopping, and targeted advertising campaigns.

The urban areas of Japan, particularly Tokyo and Osaka, show higher market penetration for premium beauty products due to higher disposable incomes and greater access to diverse brands.

Japan Beauty Industry Product Developments

Recent product innovations reflect a strong focus on natural ingredients, technological advancements, and personalized solutions. Kao Corporation's launch of the "Smile Performer" sheet mask and "Oribe" hair salon brand exemplifies this trend. Similarly, Shiseido Company’s "Shiseido Men" line demonstrates the market’s responsiveness to emerging consumer needs. These developments showcase the industry's commitment to delivering high-quality, innovative, and tailored beauty experiences.

Key Drivers of Japan Beauty Industry Growth

The Japan beauty industry's growth is propelled by several factors. First, the rising disposable income of the Japanese population fuels demand for premium beauty products. Second, increasing awareness of health and wellness trends encourages the adoption of skincare routines and high-quality cosmetics. Third, technological advancements, such as personalized beauty solutions and AI-powered skin analysis tools, enhance consumer engagement. Finally, supportive government policies and regulatory frameworks further contribute to market expansion.

Challenges in the Japan Beauty Industry Market

The Japan beauty industry faces challenges, including intense competition from both domestic and international brands, increasing raw material costs, and stringent regulatory requirements. Supply chain disruptions and changing consumer preferences also pose significant hurdles. These factors affect profitability and necessitate continuous innovation and adaptation.

Emerging Opportunities in Japan Beauty Industry

The Japan beauty market presents exciting long-term growth opportunities. The rising popularity of personalized beauty solutions, driven by advancements in biotechnology and AI, provides substantial potential. Strategic partnerships between established brands and technology companies could lead to innovative products and services. Moreover, expansion into niche segments, such as men's grooming and sustainable beauty, can unlock further growth opportunities.

Leading Players in the Japan Beauty Industry Sector

- Procter & Gamble Co

- AS Watson Group

- Mandom Corporation

- Lion Corporation

- SK-II

- Shiseido Company

- Unilever PLC

- Makanai

- L'Oreal SA

- Kao Corporation

Key Milestones in Japan Beauty Industry Industry

- February 2021: Shiseido Company launched "Shiseido Men," expanding into the men's skincare and makeup market.

- April 2021: Kao Corporation launched the Oribe hair salon brand in Japan, introducing 23 new product lines.

- September 2021: Kao Corporation introduced the "Smile Performer" sheet mask, highlighting innovative skincare technology.

Strategic Outlook for Japan Beauty Industry Market

The future of the Japan beauty industry appears promising, with considerable growth potential in the coming years. Strategic partnerships, technological innovation, and a focus on sustainability will play crucial roles in driving long-term market expansion. Brands that successfully adapt to evolving consumer preferences and leverage digital channels will be best positioned to capture market share.

Japan Beauty Industry Segmentation

-

1. Product Type

-

1.1. Personal Care

-

1.1.1. Hair Care

- 1.1.1.1. Shampoo

- 1.1.1.2. Conditioners

- 1.1.1.3. Other Products

-

1.1.2. Skin Care

- 1.1.2.1. Facial Care Products

- 1.1.2.2. Body Care Products

- 1.1.2.3. Lip Care Products

-

1.1.3. Bath and Shower

- 1.1.3.1. Shower Gels

- 1.1.3.2. Soaps

-

1.1.4. Oral Care

- 1.1.4.1. Toothbrushes

- 1.1.4.2. Toothpaste

- 1.1.4.3. Mouthwashes and Rinses

- 1.1.5. Men's Grooming Products

- 1.1.6. Deodrants and Antiperspirants

-

1.1.1. Hair Care

-

1.2. Cosmetics/Make-up Products

-

1.2.1. Colour Cosmetics

- 1.2.1.1. Facial Make-up Products

- 1.2.1.2. Eye Make-up Products

- 1.2.1.3. Lip and Nail Make-up Products

- 1.2.1.4. Hair Styling and Coloring Products

-

1.2.1. Colour Cosmetics

-

1.1. Personal Care

-

2. Category

- 2.1. Premium Products

- 2.2. Mass Products

-

3. Distribution Channel

- 3.1. Specialist Retail Stores

- 3.2. Supermarkets/Hypermarkets

- 3.3. Convenience Stores

- 3.4. Pharmacies/Drug Stores

- 3.5. Online Retail Channels

- 3.6. Other Distribution Channels

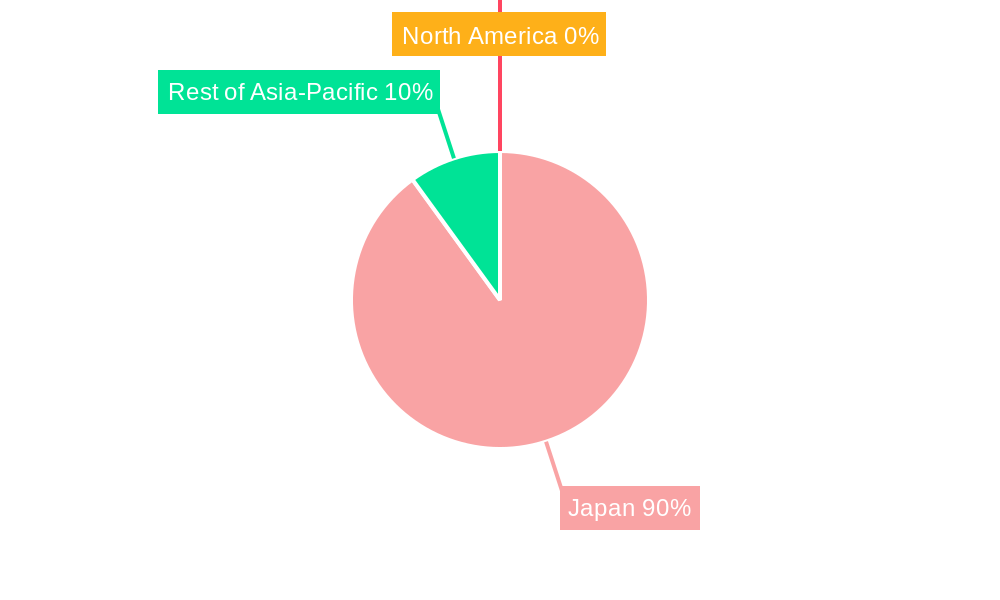

Japan Beauty Industry Segmentation By Geography

- 1. Japan

Japan Beauty Industry Regional Market Share

Geographic Coverage of Japan Beauty Industry

Japan Beauty Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Natural/Organic Beauty and Personal Care Products; Skincare Trends Revolutionizing Beauty Industry

- 3.3. Market Restrains

- 3.3.1. Counterfeiting In the Cosmetics And Personal Care Sector

- 3.4. Market Trends

- 3.4.1. Rising Demand for Natural Cosmetics and Skincare Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Beauty Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Personal Care

- 5.1.1.1. Hair Care

- 5.1.1.1.1. Shampoo

- 5.1.1.1.2. Conditioners

- 5.1.1.1.3. Other Products

- 5.1.1.2. Skin Care

- 5.1.1.2.1. Facial Care Products

- 5.1.1.2.2. Body Care Products

- 5.1.1.2.3. Lip Care Products

- 5.1.1.3. Bath and Shower

- 5.1.1.3.1. Shower Gels

- 5.1.1.3.2. Soaps

- 5.1.1.4. Oral Care

- 5.1.1.4.1. Toothbrushes

- 5.1.1.4.2. Toothpaste

- 5.1.1.4.3. Mouthwashes and Rinses

- 5.1.1.5. Men's Grooming Products

- 5.1.1.6. Deodrants and Antiperspirants

- 5.1.1.1. Hair Care

- 5.1.2. Cosmetics/Make-up Products

- 5.1.2.1. Colour Cosmetics

- 5.1.2.1.1. Facial Make-up Products

- 5.1.2.1.2. Eye Make-up Products

- 5.1.2.1.3. Lip and Nail Make-up Products

- 5.1.2.1.4. Hair Styling and Coloring Products

- 5.1.2.1. Colour Cosmetics

- 5.1.1. Personal Care

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Premium Products

- 5.2.2. Mass Products

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Specialist Retail Stores

- 5.3.2. Supermarkets/Hypermarkets

- 5.3.3. Convenience Stores

- 5.3.4. Pharmacies/Drug Stores

- 5.3.5. Online Retail Channels

- 5.3.6. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Procter & Gamble Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AS Watson Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mandom Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lion Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SK-II

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shiseido Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Unilever PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Makanai*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 L'Oreal SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kao Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Procter & Gamble Co

List of Figures

- Figure 1: Japan Beauty Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Beauty Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Beauty Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Japan Beauty Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 3: Japan Beauty Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Japan Beauty Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Japan Beauty Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Japan Beauty Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 7: Japan Beauty Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Japan Beauty Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Beauty Industry?

The projected CAGR is approximately 2.87%.

2. Which companies are prominent players in the Japan Beauty Industry?

Key companies in the market include Procter & Gamble Co, AS Watson Group, Mandom Corporation, Lion Corporation, SK-II, Shiseido Company, Unilever PLC, Makanai*List Not Exhaustive, L'Oreal SA, Kao Corporation.

3. What are the main segments of the Japan Beauty Industry?

The market segments include Product Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Natural/Organic Beauty and Personal Care Products; Skincare Trends Revolutionizing Beauty Industry.

6. What are the notable trends driving market growth?

Rising Demand for Natural Cosmetics and Skincare Products.

7. Are there any restraints impacting market growth?

Counterfeiting In the Cosmetics And Personal Care Sector.

8. Can you provide examples of recent developments in the market?

September 2021: Kao Corporation launched a new sheet mask called Smile Performer. The sheet mask claims to add radiance and bounce to the skin, which creates a smiling impression.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Beauty Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Beauty Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Beauty Industry?

To stay informed about further developments, trends, and reports in the Japan Beauty Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence