Key Insights

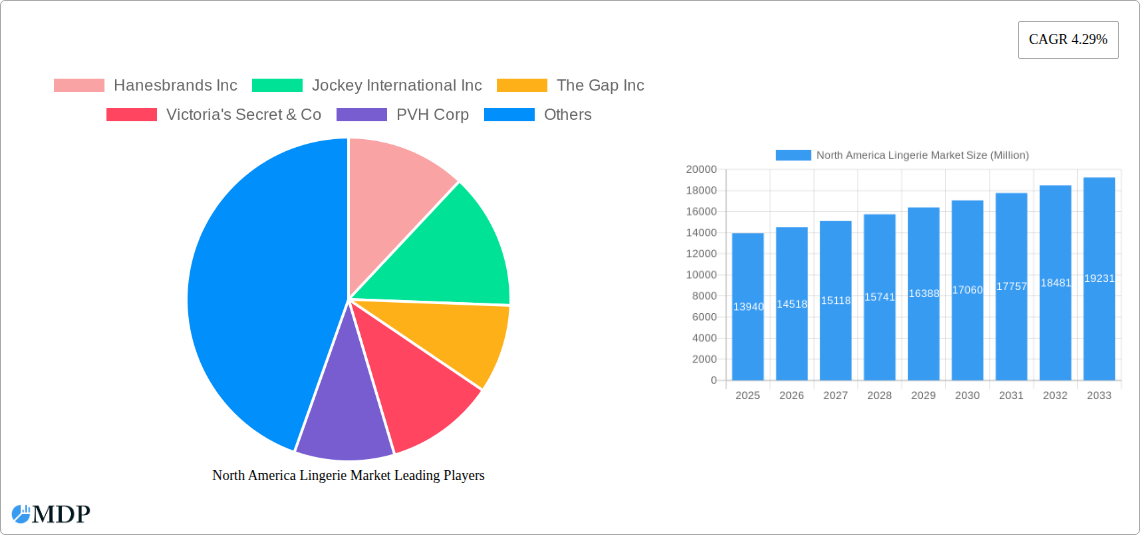

The North American lingerie market, valued at $13.94 billion in 2025, is projected to experience steady growth, driven by several key factors. The increasing awareness of body positivity and inclusivity is fueling demand for diverse styles and sizes, catering to a broader customer base. E-commerce expansion continues to be a significant driver, offering convenience and wider selection to consumers. Furthermore, the growing disposable incomes, particularly amongst millennial and Gen Z consumers, are boosting spending on premium and luxury lingerie brands. The market segmentation reveals a strong preference for brassieres and briefs, with online retail stores experiencing significant growth compared to traditional channels like supermarkets and specialty stores. This shift reflects the growing adoption of online shopping and the ease of accessing a wider variety of products through digital platforms.

North America Lingerie Market Market Size (In Billion)

However, certain challenges exist. The market faces restraints from economic fluctuations that may impact consumer spending on discretionary items like lingerie. Furthermore, intense competition from both established and emerging brands necessitates continuous innovation in product design, marketing, and distribution strategies to maintain market share. Despite these challenges, the long-term forecast suggests sustained growth, with projections extending to 2033. This positive outlook is reinforced by the continued expansion of online channels and the evolving preferences of consumers who are increasingly prioritizing comfort, quality, and sustainable practices in their lingerie choices. Brands focusing on these aspects are expected to experience stronger market penetration and overall growth.

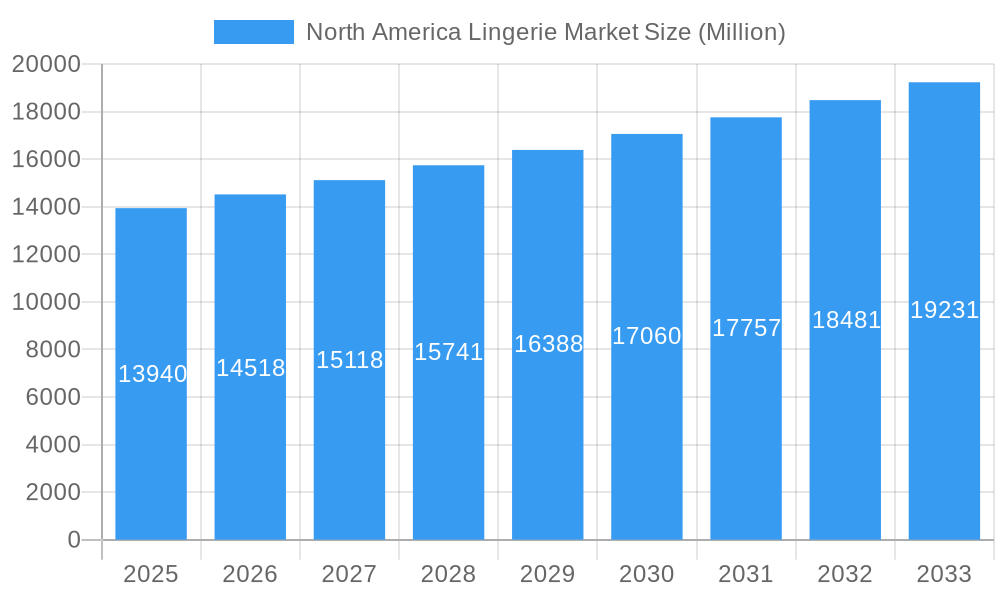

North America Lingerie Market Company Market Share

North America Lingerie Market Report: 2019-2033

Uncover lucrative opportunities and navigate the evolving landscape of the North American lingerie market with this comprehensive report. This in-depth analysis provides a detailed overview of market dynamics, key players, emerging trends, and future projections (2019-2033), empowering stakeholders to make informed strategic decisions. The report covers a market valued at xx Million in 2025, projected to reach xx Million by 2033.

North America Lingerie Market Market Dynamics & Concentration

The North America lingerie market exhibits a moderately consolidated structure with several major players commanding significant market share. Hanesbrands Inc, Jockey International Inc, The Gap Inc, Victoria's Secret & Co, PVH Corp, and others hold prominent positions, though the exact market share for each varies and requires further detailed analysis. Innovation is a key driver, fueled by advancements in materials, design, and manufacturing technologies, particularly in areas like AI-powered personalized fitting and sustainable materials. Regulatory frameworks, including labeling requirements and safety standards, influence market practices. Product substitutes, such as comfortable athleisure wear, exert competitive pressure. Evolving consumer preferences toward inclusivity, sustainability, and body positivity are reshaping the market. M&A activity has been relatively moderate in recent years, with xx major deals recorded between 2019 and 2024. The increasing focus on direct-to-consumer channels is also impacting the market.

- Market Concentration: Moderately Consolidated

- Innovation Drivers: AI-powered fitting, sustainable materials, design innovation.

- Regulatory Framework: Labeling, safety standards

- Product Substitutes: Athleisure wear

- End-User Trends: Inclusivity, sustainability, body positivity

- M&A Activity: xx major deals (2019-2024)

North America Lingerie Market Industry Trends & Analysis

The North America lingerie market is experiencing a period of dynamic transformation. The market is witnessing a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by factors such as increasing disposable incomes, changing fashion trends, and the growing popularity of online retail. Technological disruptions, such as AI-powered personalized fitting and the integration of e-commerce platforms, are enhancing the customer experience and driving market growth. Consumer preferences are shifting towards comfortable, sustainable, and inclusive products, prompting brands to adapt their offerings. The competitive landscape is characterized by intense rivalry among established players and emerging brands, leading to innovative product launches and strategic partnerships. Market penetration of online retail channels is steadily increasing, challenging the dominance of traditional brick-and-mortar stores. The growing adoption of sustainable and ethically sourced materials is also contributing to market evolution.

Leading Markets & Segments in North America Lingerie Market

By Product Type:

- Brassiere: Remains the dominant segment, driven by ongoing innovation in fit, comfort, and support technologies.

- Briefs: A significant segment with consistent demand, influenced by fashion trends and material advancements.

- Other Product Types: Includes shapewear, sleepwear, and other lingerie items, showing growth potential due to diversification in consumer preferences.

By Distribution Channel:

- Online Retail Stores: Experiencing rapid growth due to convenience, accessibility, and targeted marketing capabilities.

- Specialty Stores: Maintain a significant market share catering to specific customer needs and providing personalized service.

- Supermarkets/Hypermarkets: Offer convenience but have a smaller market share compared to specialty stores and online retailers.

- Other Distribution Channels: Includes department stores and boutiques with varying levels of market penetration based on geographic location and consumer preferences.

The United States represents the largest market within North America, driven by strong consumer spending, a developed retail infrastructure, and diverse consumer preferences. Canada shows consistent growth potential, reflecting changing fashion trends and increasing disposable incomes.

- Key Drivers (US): Strong consumer spending, diverse retail infrastructure, established brand presence.

- Key Drivers (Canada): Increasing disposable incomes, evolving fashion preferences, growing online retail penetration.

North America Lingerie Market Product Developments

Recent product innovations highlight the integration of advanced technologies. AI-powered bra fitting, as demonstrated by DOUBL, addresses the challenges of finding the perfect fit, enhancing customer satisfaction. The use of sustainable and eco-friendly materials is gaining traction, reflecting growing consumer awareness and demand for ethically produced products. Improved comfort, design diversification, and inclusive sizing are also key aspects of the ongoing product development efforts, enhancing the overall market appeal.

Key Drivers of North America Lingerie Market Growth

Several factors contribute to the market's growth trajectory:

- Technological Advancements: AI-powered personalization, sustainable materials, improved manufacturing processes.

- Economic Growth: Rising disposable incomes fuel consumer spending on apparel and personal care products.

- Changing Consumer Preferences: Increased demand for comfort, inclusivity, and sustainability.

- E-commerce Expansion: Online retail channels enhance accessibility and personalized shopping experiences.

Challenges in the North America Lingerie Market Market

The market faces challenges:

- Intense Competition: Established players and emerging brands compete for market share.

- Supply Chain Disruptions: Global events can impact the availability of raw materials and manufacturing capacity.

- Economic Fluctuations: Recessions or economic downturns can reduce consumer spending on non-essential items.

- Maintaining Brand Loyalty: The need to constantly innovate and maintain a strong brand identity in a competitive marketplace.

Emerging Opportunities in North America Lingerie Market

Significant opportunities exist for market expansion and growth:

- Technological Innovation: Continued development of AI-powered personalization and sustainable materials will improve market offerings.

- Strategic Partnerships: Collaborations between brands and retailers can broaden reach and enhance brand awareness.

- Market Expansion: Targeting underserved demographics and exploring new geographic markets provides growth avenues.

- Sustainability Initiatives: Prioritizing ethical and sustainable practices strengthens brand image and appeals to environmentally conscious consumers.

Leading Players in the North America Lingerie Market Sector

- Hanesbrands Inc

- Jockey International Inc

- The Gap Inc

- Victoria's Secret & Co

- PVH Corp

- The Natori Company Incorporated

- Fullbeauty Brands

- AEO Inc

- Nike Inc

- La Perla

Key Milestones in North America Lingerie Market Industry

- January 2024: Victoria's Secret & Co. partners with Google Cloud to leverage AI for personalized shopping experiences. This significantly enhances the brand's ability to cater to individual customer preferences and improves operational efficiency.

- March 2024: ThirdLove expands its reach through a partnership with Neiman Marcus, targeting a luxury customer segment. This strategic move increases brand visibility among high-spending consumers.

- March 2024: DOUBL launches an AI-fitted bra, revolutionizing the bra-fitting process and improving customer convenience and satisfaction. This innovative technology disrupts the traditional bra fitting model.

Strategic Outlook for North America Lingerie Market Market

The North America lingerie market holds significant future potential. Continued technological innovation, particularly in AI-powered personalization and sustainable materials, will drive growth. Strategic partnerships and market expansion into underserved segments will be key success factors. Brands that prioritize ethical sourcing, inclusivity, and body positivity will resonate with consumers and secure a stronger market position. The focus on providing a seamless and personalized omnichannel experience, blending online and offline retail touchpoints, will be crucial for future success.

North America Lingerie Market Segmentation

-

1. Product Type

- 1.1. Brassiere

- 1.2. Briefs

- 1.3. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

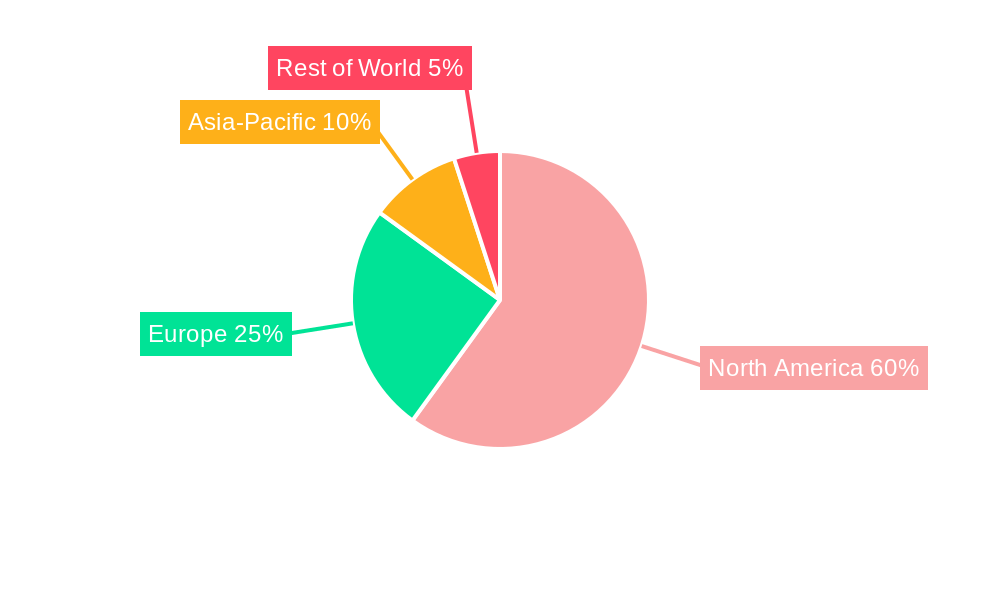

North America Lingerie Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Lingerie Market Regional Market Share

Geographic Coverage of North America Lingerie Market

North America Lingerie Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle and Athleisure

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Influence of Endorsements and Aggressive Marketing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Brassiere

- 5.1.2. Briefs

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Brassiere

- 6.1.2. Briefs

- 6.1.3. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Specialty Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Brassiere

- 7.1.2. Briefs

- 7.1.3. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Specialty Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Brassiere

- 8.1.2. Briefs

- 8.1.3. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Specialty Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Brassiere

- 9.1.2. Briefs

- 9.1.3. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Specialty Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Hanesbrands Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Jockey International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 The Gap Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Victoria's Secret & Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 PVH Corp

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 The Natori Company Incorporated

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Fullbeauty Brands *List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 AEO Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nike Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 La Perla

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Hanesbrands Inc

List of Figures

- Figure 1: North America Lingerie Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Lingerie Market Share (%) by Company 2025

List of Tables

- Table 1: North America Lingerie Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Lingerie Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Lingerie Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Lingerie Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Lingerie Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: North America Lingerie Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: North America Lingerie Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Lingerie Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Lingerie Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: North America Lingerie Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 11: North America Lingerie Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Lingerie Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Lingerie Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: North America Lingerie Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: North America Lingerie Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Lingerie Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: North America Lingerie Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: North America Lingerie Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 19: North America Lingerie Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: North America Lingerie Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Lingerie Market?

The projected CAGR is approximately 4.29%.

2. Which companies are prominent players in the North America Lingerie Market?

Key companies in the market include Hanesbrands Inc, Jockey International Inc, The Gap Inc, Victoria's Secret & Co, PVH Corp, The Natori Company Incorporated, Fullbeauty Brands *List Not Exhaustive, AEO Inc, Nike Inc, La Perla.

3. What are the main segments of the North America Lingerie Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle and Athleisure.

6. What are the notable trends driving market growth?

Influence of Endorsements and Aggressive Marketing.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

March 2024: ThirdLove partnered with Neiman Marcus to expand its reach and gain access to luxury shoppers through the department store across America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Lingerie Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Lingerie Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Lingerie Market?

To stay informed about further developments, trends, and reports in the North America Lingerie Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence