Key Insights

Thailand's luxury goods market, encompassing apparel, footwear, accessories, jewelry, and timepieces, presents a significant investment opportunity. Driven by a growing affluent consumer base, rising disposable incomes, and an increasing demand for premium brands, the market is projected for sustained expansion. Key growth drivers include the robust CAGR of 9.8%, with the market size projected to reach 3.2 billion in 2024, and an anticipated continued growth through 2033. The market is segmented by distribution channels, with single-branded stores offering exclusive experiences and online retail catering to digitally adept consumers. Leading global luxury brands like LVMH, Hermes, and Estee Lauder are strategically positioned to leverage this market expansion. Potential challenges include economic volatility and shifts in consumer spending due to global uncertainties. Successful market penetration will require a deep understanding of Thai luxury consumer preferences, a blend of heritage brand appeal and emerging designer trends, and strategic adaptation across diverse product categories and distribution channels.

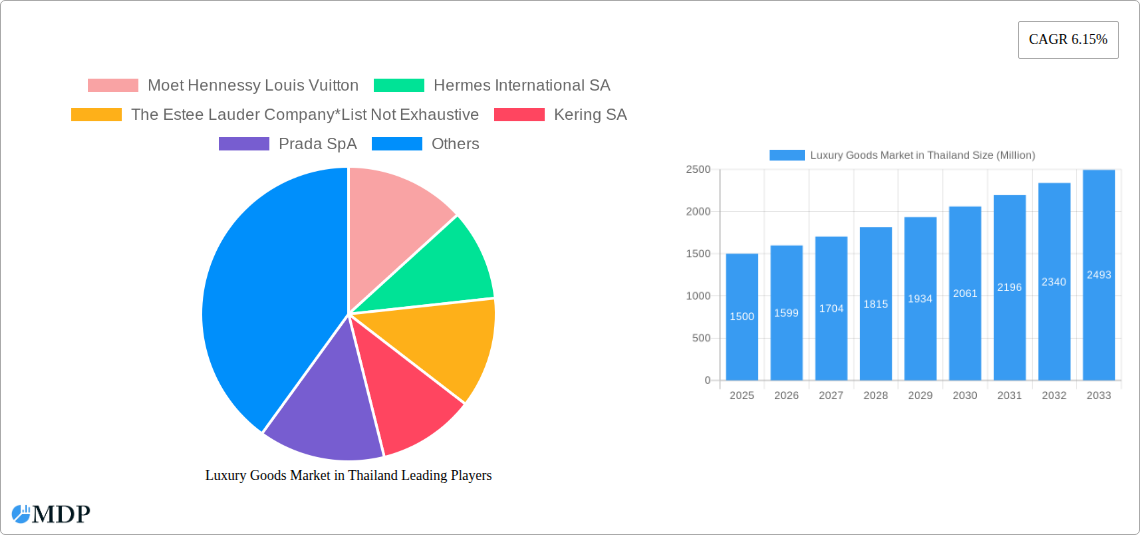

Luxury Goods Market in Thailand Market Size (In Billion)

Continued market growth is expected, fueled by the burgeoning tourism sector and a strengthening domestic luxury consumer demographic. Despite potential headwinds from economic fluctuations and global supply chain issues, Thailand's economic stability and expanding middle class underpin a positive market outlook. Strategic collaborations between international luxury houses and local entities can further enhance market penetration by leveraging local insights and adapting to cultural nuances. This strategic approach, combined with prudent investment, positions the Thai luxury goods market for enduring long-term success.

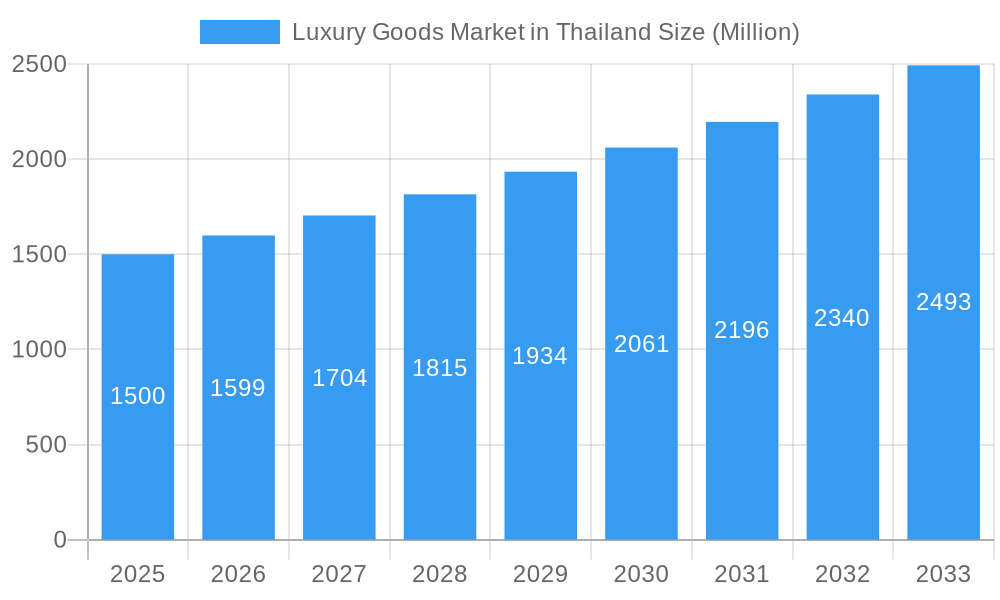

Luxury Goods Market in Thailand Company Market Share

Thailand Luxury Goods Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the thriving luxury goods market in Thailand, covering the period from 2019 to 2033. We delve into market dynamics, industry trends, leading segments, and key players, offering actionable insights for stakeholders across the value chain. The report utilizes data from the base year 2025 and presents a detailed forecast until 2033, providing a clear roadmap for strategic decision-making. Discover the potential of this lucrative market and gain a competitive edge with our data-driven analysis. The total market size in 2025 is estimated at xx Million and is expected to reach xx Million by 2033.

Luxury Goods Market in Thailand Market Dynamics & Concentration

The Thai luxury goods market is characterized by a high degree of concentration, with a handful of global players holding significant market share. Market leaders such as LVMH (Moët Hennessy Louis Vuitton), Kering SA, and Richemont (Cartier) compete intensely, driving innovation and influencing consumer preferences. The market is also subject to a dynamic regulatory framework, including import duties and tax policies, impacting pricing strategies and market access. Luxury goods in Thailand are increasingly subject to the impact of product substitutes, with consumers seeking out more ethical or sustainable alternatives.

Market Concentration:

- Top 5 players account for approximately xx% of market share in 2025.

- LVMH maintains a leading position with an estimated xx% market share.

- Intense competition drives innovation in product design, marketing, and distribution.

Innovation Drivers:

- Increasing demand for personalized experiences and bespoke products.

- Technological advancements in product design and manufacturing.

- The growing influence of social media and digital marketing.

Regulatory Framework:

- Import duties and taxes influence pricing strategies.

- Regulations concerning product labeling and sustainability are evolving.

- Government initiatives focused on promoting tourism influence market growth.

Product Substitutes:

- Increasing consumer interest in sustainable and ethically sourced products poses a challenge to traditional luxury brands.

- The rise of affordable luxury brands offers competitive alternatives.

M&A Activities:

- The number of M&A deals in the Thai luxury goods market has averaged xx per year between 2019 and 2024.

- Strategic acquisitions have been driven by expansion into new segments and geographic markets.

Luxury Goods Market in Thailand Industry Trends & Analysis

The Thai luxury goods market exhibits robust growth, driven primarily by increasing disposable incomes, a burgeoning middle class, and a growing preference for high-quality goods among affluent consumers. The market's Compound Annual Growth Rate (CAGR) is estimated at xx% during the forecast period (2025-2033), with market penetration projected to reach xx% by 2033. Technological disruptions, particularly in e-commerce and digital marketing, are transforming the way luxury goods are sold and consumed. Consumer preferences are shifting towards personalization, exclusivity, and sustainable practices. Competitive dynamics remain intense, with established luxury brands facing challenges from both local and international competitors.

Leading Markets & Segments in Luxury Goods Market in Thailand

The Bangkok Metropolitan Region dominates the Thai luxury goods market, accounting for approximately xx% of total sales in 2025. This is driven by high concentrations of affluent consumers and a strong tourism sector. Within product segments, watches and jewellery exhibit the highest growth rates, fueled by demand from both domestic and international buyers. Single-branded stores remain the primary distribution channel, though online retail is steadily gaining traction.

Dominant Segments:

- Watches: High demand for luxury timepieces from international brands.

- Jewellery: Strong preference for precious metals and gemstones.

- Bags: Significant growth potential driven by rising consumer demand for high quality and unique designer bags.

Dominant Distribution Channel:

- Single-branded Stores: Maintain a dominant position due to brand image and personalized service.

- Online Retail Stores: Experiencing rapid growth, driven by convenience and wider product access.

Key Drivers:

- Economic growth: Rising disposable incomes and a growing middle class.

- Tourism: Significant spending by international tourists.

- Strong brand recognition: Many global luxury brands hold strong brand equity in Thailand.

Luxury Goods Market in Thailand Product Developments

Recent years have witnessed significant product innovation within the Thai luxury goods sector. Brands are increasingly focused on incorporating technological advancements, such as smartwatches and augmented reality experiences, to enhance product functionality and appeal to tech-savvy consumers. Sustainable and ethical production practices are also gaining prominence, aligning with evolving consumer preferences. This has led to the creation of luxury goods that appeal to a wide range of consumer preferences, further enhancing the competitiveness of the market.

Key Drivers of Luxury Goods Market in Thailand Growth

The growth of the Thai luxury goods market is fueled by a confluence of factors. Firstly, rapid economic growth and a rising middle class increase disposable incomes. Secondly, Thailand's vibrant tourism industry brings significant spending by international luxury consumers. Thirdly, the growing influence of social media and celebrity endorsements drives demand, while government initiatives promoting tourism further contribute to the market's expansion.

Challenges in the Luxury Goods Market in Thailand Market

The Thai luxury goods market faces several challenges. Firstly, fluctuations in the Thai baht impact import costs and pricing strategies. Secondly, counterfeit goods pose a significant threat to established brands. Thirdly, increasing competition from both established and emerging brands creates competitive pressure. Finally, supply chain disruptions and sustainability issues add to the complexity of operations.

Emerging Opportunities in Luxury Goods Market in Thailand

The Thai luxury goods market presents several long-term growth opportunities. The increasing adoption of e-commerce and digital marketing technologies provide access to wider consumer segments. Strategic partnerships with local retailers and tourism operators can expand market reach. Investing in sustainable and ethical production practices can attract environmentally conscious consumers and strengthen brand image. The rising demand for personalised luxury goods and experiences will also open up new markets.

Leading Players in the Luxury Goods Market in Thailand Sector

Key Milestones in Luxury Goods Market in Thailand Industry

- June 2022: Estée Lauder Travel Retail launched its luxury fragrance collection in Thailand in partnership with King Power Duty-Free.

- July 2022: Cortina Watch Thailand launched a new luxury watch boutique at The Mandarin Oriental Hotel, featuring Patek Philippe, Franck Muller, and Breguet.

- July 2022: Ulysse Nardin unveiled its new Diver Chrono Great White limited-edition watch.

Strategic Outlook for Luxury Goods Market in Thailand Market

The Thai luxury goods market is poised for continued growth, driven by strong economic fundamentals, increasing consumer affluence, and the ongoing appeal of luxury brands. Strategic investments in digital marketing, personalized experiences, and sustainable practices will be crucial for maintaining competitiveness. Exploring collaborations with local artisans and designers can enhance brand uniqueness and appeal to a wider consumer base, providing significant opportunities for long-term growth and market leadership.

Luxury Goods Market in Thailand Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewellery

- 1.5. Watches

- 1.6. Other Types

-

2. Distibution Channel

- 2.1. Single-branded Stores

- 2.2. Multi-brand Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Luxury Goods Market in Thailand Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Luxury Goods Market in Thailand Regional Market Share

Geographic Coverage of Luxury Goods Market in Thailand

Luxury Goods Market in Thailand REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Appeal for Multi-functional and Damage Control Hair Care Products; Prevalence of Different Hair Concerns Remains the Major Driving Force

- 3.3. Market Restrains

- 3.3.1. Growing Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Growing Influence of Social Media on Buying Decisions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Goods Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewellery

- 5.1.5. Watches

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single-branded Stores

- 5.2.2. Multi-brand Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Luxury Goods Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Clothing and Apparel

- 6.1.2. Footwear

- 6.1.3. Bags

- 6.1.4. Jewellery

- 6.1.5. Watches

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.2.1. Single-branded Stores

- 6.2.2. Multi-brand Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Luxury Goods Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Clothing and Apparel

- 7.1.2. Footwear

- 7.1.3. Bags

- 7.1.4. Jewellery

- 7.1.5. Watches

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.2.1. Single-branded Stores

- 7.2.2. Multi-brand Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Luxury Goods Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Clothing and Apparel

- 8.1.2. Footwear

- 8.1.3. Bags

- 8.1.4. Jewellery

- 8.1.5. Watches

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.2.1. Single-branded Stores

- 8.2.2. Multi-brand Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Luxury Goods Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Clothing and Apparel

- 9.1.2. Footwear

- 9.1.3. Bags

- 9.1.4. Jewellery

- 9.1.5. Watches

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.2.1. Single-branded Stores

- 9.2.2. Multi-brand Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Luxury Goods Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Clothing and Apparel

- 10.1.2. Footwear

- 10.1.3. Bags

- 10.1.4. Jewellery

- 10.1.5. Watches

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 10.2.1. Single-branded Stores

- 10.2.2. Multi-brand Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Moet Hennessy Louis Vuitton

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hermes International SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Estee Lauder Company*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kering SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Prada SpA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Swatch Group Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Chanel SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rolex SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PVH Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ralph Lauren Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Moet Hennessy Louis Vuitton

List of Figures

- Figure 1: Global Luxury Goods Market in Thailand Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Luxury Goods Market in Thailand Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Luxury Goods Market in Thailand Revenue (billion), by Type 2025 & 2033

- Figure 4: North America Luxury Goods Market in Thailand Volume (K Units), by Type 2025 & 2033

- Figure 5: North America Luxury Goods Market in Thailand Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Luxury Goods Market in Thailand Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Luxury Goods Market in Thailand Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 8: North America Luxury Goods Market in Thailand Volume (K Units), by Distibution Channel 2025 & 2033

- Figure 9: North America Luxury Goods Market in Thailand Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 10: North America Luxury Goods Market in Thailand Volume Share (%), by Distibution Channel 2025 & 2033

- Figure 11: North America Luxury Goods Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Luxury Goods Market in Thailand Volume (K Units), by Country 2025 & 2033

- Figure 13: North America Luxury Goods Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Luxury Goods Market in Thailand Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Luxury Goods Market in Thailand Revenue (billion), by Type 2025 & 2033

- Figure 16: South America Luxury Goods Market in Thailand Volume (K Units), by Type 2025 & 2033

- Figure 17: South America Luxury Goods Market in Thailand Revenue Share (%), by Type 2025 & 2033

- Figure 18: South America Luxury Goods Market in Thailand Volume Share (%), by Type 2025 & 2033

- Figure 19: South America Luxury Goods Market in Thailand Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 20: South America Luxury Goods Market in Thailand Volume (K Units), by Distibution Channel 2025 & 2033

- Figure 21: South America Luxury Goods Market in Thailand Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 22: South America Luxury Goods Market in Thailand Volume Share (%), by Distibution Channel 2025 & 2033

- Figure 23: South America Luxury Goods Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 24: South America Luxury Goods Market in Thailand Volume (K Units), by Country 2025 & 2033

- Figure 25: South America Luxury Goods Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Luxury Goods Market in Thailand Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Luxury Goods Market in Thailand Revenue (billion), by Type 2025 & 2033

- Figure 28: Europe Luxury Goods Market in Thailand Volume (K Units), by Type 2025 & 2033

- Figure 29: Europe Luxury Goods Market in Thailand Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Luxury Goods Market in Thailand Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Luxury Goods Market in Thailand Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 32: Europe Luxury Goods Market in Thailand Volume (K Units), by Distibution Channel 2025 & 2033

- Figure 33: Europe Luxury Goods Market in Thailand Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 34: Europe Luxury Goods Market in Thailand Volume Share (%), by Distibution Channel 2025 & 2033

- Figure 35: Europe Luxury Goods Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 36: Europe Luxury Goods Market in Thailand Volume (K Units), by Country 2025 & 2033

- Figure 37: Europe Luxury Goods Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Luxury Goods Market in Thailand Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Luxury Goods Market in Thailand Revenue (billion), by Type 2025 & 2033

- Figure 40: Middle East & Africa Luxury Goods Market in Thailand Volume (K Units), by Type 2025 & 2033

- Figure 41: Middle East & Africa Luxury Goods Market in Thailand Revenue Share (%), by Type 2025 & 2033

- Figure 42: Middle East & Africa Luxury Goods Market in Thailand Volume Share (%), by Type 2025 & 2033

- Figure 43: Middle East & Africa Luxury Goods Market in Thailand Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 44: Middle East & Africa Luxury Goods Market in Thailand Volume (K Units), by Distibution Channel 2025 & 2033

- Figure 45: Middle East & Africa Luxury Goods Market in Thailand Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 46: Middle East & Africa Luxury Goods Market in Thailand Volume Share (%), by Distibution Channel 2025 & 2033

- Figure 47: Middle East & Africa Luxury Goods Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 48: Middle East & Africa Luxury Goods Market in Thailand Volume (K Units), by Country 2025 & 2033

- Figure 49: Middle East & Africa Luxury Goods Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Luxury Goods Market in Thailand Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Luxury Goods Market in Thailand Revenue (billion), by Type 2025 & 2033

- Figure 52: Asia Pacific Luxury Goods Market in Thailand Volume (K Units), by Type 2025 & 2033

- Figure 53: Asia Pacific Luxury Goods Market in Thailand Revenue Share (%), by Type 2025 & 2033

- Figure 54: Asia Pacific Luxury Goods Market in Thailand Volume Share (%), by Type 2025 & 2033

- Figure 55: Asia Pacific Luxury Goods Market in Thailand Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 56: Asia Pacific Luxury Goods Market in Thailand Volume (K Units), by Distibution Channel 2025 & 2033

- Figure 57: Asia Pacific Luxury Goods Market in Thailand Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 58: Asia Pacific Luxury Goods Market in Thailand Volume Share (%), by Distibution Channel 2025 & 2033

- Figure 59: Asia Pacific Luxury Goods Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 60: Asia Pacific Luxury Goods Market in Thailand Volume (K Units), by Country 2025 & 2033

- Figure 61: Asia Pacific Luxury Goods Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Luxury Goods Market in Thailand Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 5: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Type 2020 & 2033

- Table 9: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 10: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 11: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Type 2020 & 2033

- Table 21: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 22: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 23: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Brazil Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Brazil Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 27: Argentina Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Argentina Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Type 2020 & 2033

- Table 32: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Type 2020 & 2033

- Table 33: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 34: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 35: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Germany Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Germany Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: France Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: France Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 43: Italy Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Italy Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 45: Spain Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Spain Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 47: Russia Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Russia Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 49: Benelux Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Benelux Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: Nordics Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Nordics Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Type 2020 & 2033

- Table 56: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Type 2020 & 2033

- Table 57: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 58: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 59: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Country 2020 & 2033

- Table 61: Turkey Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Turkey Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Israel Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Israel Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: GCC Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: GCC Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 67: North Africa Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: North Africa Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 69: South Africa Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: South Africa Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 73: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Type 2020 & 2033

- Table 74: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Type 2020 & 2033

- Table 75: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 76: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 77: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 78: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Country 2020 & 2033

- Table 79: China Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: China Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 81: India Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: India Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 83: Japan Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 84: Japan Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 85: South Korea Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: South Korea Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 89: Oceania Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 90: Oceania Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Goods Market in Thailand?

The projected CAGR is approximately 9.8%.

2. Which companies are prominent players in the Luxury Goods Market in Thailand?

Key companies in the market include Moet Hennessy Louis Vuitton, Hermes International SA, The Estee Lauder Company*List Not Exhaustive, Kering SA, Prada SpA, The Swatch Group Ltd, Chanel SA, Rolex SA, PVH Corp, Ralph Lauren Corporation.

3. What are the main segments of the Luxury Goods Market in Thailand?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Appeal for Multi-functional and Damage Control Hair Care Products; Prevalence of Different Hair Concerns Remains the Major Driving Force.

6. What are the notable trends driving market growth?

Growing Influence of Social Media on Buying Decisions.

7. Are there any restraints impacting market growth?

Growing Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In July 2022, Cortina Watch Thailand launched the new luxury watch boutique at The Mandarin Oriental Hotel. Providing customers the unique shopping experience. The new boutique combined 3 watches brand within area of 156 sqm., including Patek Philippe, Franck Muller, and Breguet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Goods Market in Thailand," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Goods Market in Thailand report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Goods Market in Thailand?

To stay informed about further developments, trends, and reports in the Luxury Goods Market in Thailand, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence