Key Insights

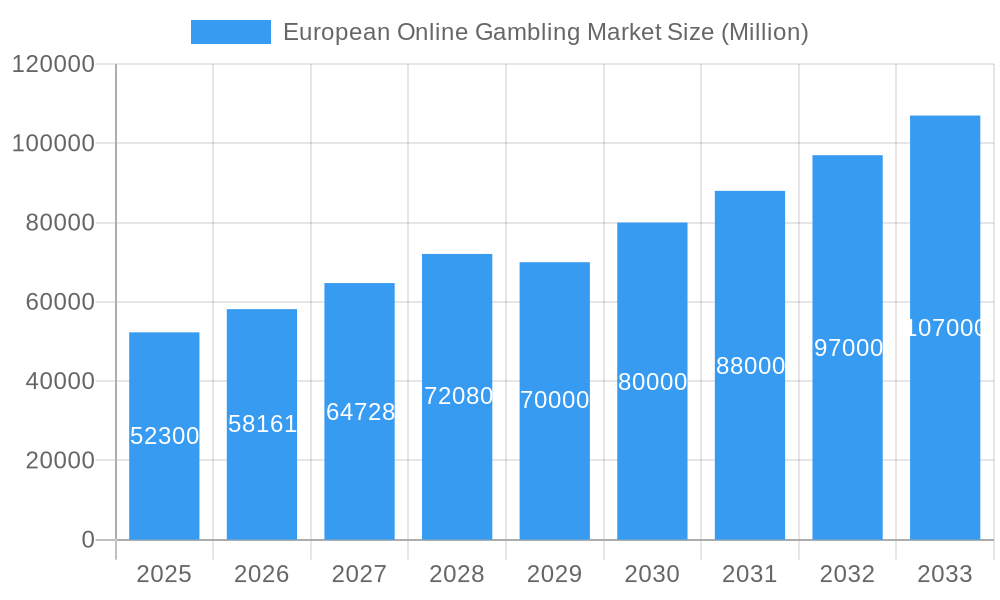

The European online gambling market, valued at €52.30 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 11.01% from 2025 to 2033. This expansion is fueled by several key factors. Increasing smartphone penetration and readily available high-speed internet access across Europe are significantly broadening market reach and accessibility. The rising popularity of mobile betting and the diversification of game offerings beyond traditional sports betting—encompassing casino games, lottery, and bingo—contribute to market expansion. Furthermore, the legalization and regulation efforts in various European countries are creating a more structured and secure environment for online gambling operators, boosting investor confidence and overall market growth. However, stringent regulations aimed at responsible gambling and preventing underage access, coupled with potential economic downturns impacting consumer spending, represent significant restraints. The market is segmented by game type (sports betting, casino games, lottery, bingo) and end-use (desktop, mobile), with mobile gaming experiencing particularly rapid growth. Key players like GVC Holdings, LeoVegas AB, Flutter Entertainment, and Bet365 Group Ltd. are aggressively competing for market share through innovative product offerings, targeted marketing campaigns, and strategic acquisitions. The UK, Germany, France, and Italy represent the largest national markets within Europe, contributing a significant portion of the overall market value.

European Online Gambling Market Market Size (In Billion)

The future growth of the European online gambling market hinges on several factors. Continued technological advancements will play a critical role in enhancing the user experience, while evolving consumer preferences and the introduction of new gaming formats will drive innovation. The ongoing regulatory landscape will significantly influence market dynamics, with the potential for both opportunities and challenges. Market leaders will need to prioritize responsible gambling initiatives and adapt to evolving regulations to maintain sustainability and growth. The expansion into new markets within Europe, coupled with effective marketing strategies that cater to specific regional preferences, will be crucial for companies seeking to gain a competitive edge. The increasing use of data analytics to personalize the gaming experience and to predict user behavior will also play a significant role in driving future growth.

European Online Gambling Market Company Market Share

European Online Gambling Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European online gambling market, offering invaluable insights for industry stakeholders, investors, and strategists. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future opportunities. The market is projected to reach xx Million by 2033.

European Online Gambling Market Market Dynamics & Concentration

The European online gambling market is a dynamic landscape characterized by intense competition, rapid technological advancements, and evolving regulatory frameworks. Market concentration is relatively high, with a few major players controlling a significant share. The market share held by the top 5 players in 2024 is estimated at 60%, indicating a consolidated yet competitive space. Innovation is a key driver, with companies constantly developing new games, platforms, and technologies to attract and retain players. Regulatory environments vary across European countries, creating both opportunities and challenges. The prevalence of alternative entertainment options and the increasing focus on responsible gambling also influence market dynamics. Mergers and acquisitions (M&A) activity has been significant, with numerous deals shaping the competitive landscape. For instance, xx M&A deals were recorded between 2019 and 2024, consolidating market power and driving growth.

- Key Market Dynamics:

- High market concentration

- Continuous technological innovation

- Varying regulatory frameworks across Europe

- Growth of responsible gambling initiatives

- Significant M&A activity

European Online Gambling Market Industry Trends & Analysis

The European online gambling market has experienced robust growth throughout the historical period (2019-2024), driven by increasing internet and smartphone penetration, changing consumer preferences towards digital entertainment, and the legalization and regulation of online gambling in several European countries. The Compound Annual Growth Rate (CAGR) during this period is estimated at xx%. This growth is expected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace, as the market matures. Technological advancements, such as the rise of mobile gaming, virtual reality (VR) and augmented reality (AR) integration, and the adoption of blockchain technology for secure transactions, are further reshaping the industry. Consumer preferences are shifting towards mobile-first experiences, personalized gaming options, and greater emphasis on responsible gaming features. Competitive dynamics are characterized by intense rivalry, strategic partnerships, and a focus on differentiation through innovative products and services. Market penetration is expected to reach xx% by 2033.

Leading Markets & Segments in European Online Gambling Market

The United Kingdom, Germany, and France represent the leading markets within Europe, driven by factors such as high internet penetration, favorable regulatory environments (in certain segments), and a strong gambling culture. Sports betting remains the dominant game type, followed by casino games (including slots, table games, and live dealer games). The mobile segment displays the fastest growth due to the increasing adoption of smartphones and tablets.

- Key Drivers:

- UK: Established gambling market, high internet penetration, favorable regulatory environment (with some restrictions)

- Germany: Growing regulated market, increasing online penetration.

- France: Growing regulated market, high smartphone usage.

- Sports Betting: Popularity of major sporting events, ease of access, diverse betting options.

- Casino Games: Wide variety of games, engaging gameplay, attractive bonuses and promotions.

- Mobile: Convenience, accessibility, portability.

European Online Gambling Market Product Developments

The online gambling market witnesses continuous product innovation, with a focus on enhancing user experience and incorporating cutting-edge technology. Developments include enhanced mobile apps, immersive VR/AR experiences, personalized game recommendations, and the integration of social features. These advancements cater to evolving player preferences and boost engagement, driving market growth. The competitive advantage increasingly lies in delivering seamless, personalized, and secure gambling experiences.

Key Drivers of European Online Gambling Market Growth

Several factors drive the growth of the European online gambling market. Firstly, the increasing penetration of smartphones and internet access across Europe fuels the expansion of the online gambling sector. Secondly, the evolving regulatory landscape, with certain countries adopting more liberal licensing frameworks, opens doors to new operators and encourages market expansion. Finally, continuous technological innovation, including the integration of AI and VR/AR technologies, attracts new players and enhances the overall gambling experience.

Challenges in the European Online Gambling Market Market

The European online gambling market faces several challenges. Stringent regulatory frameworks, varying across countries, impose compliance costs and limit market expansion for some operators. The rise of responsible gambling initiatives and the increasing need for effective player protection measures add operational complexities. Moreover, intense competition, particularly from established players with significant brand recognition, poses a hurdle for newcomers. These challenges negatively impact revenue generation, especially for smaller, less-established companies, preventing market consolidation.

Emerging Opportunities in European Online Gambling Market

The European online gambling market presents several exciting opportunities for growth. The increasing integration of advanced technologies, such as artificial intelligence (AI) and virtual reality (VR), offers enhanced personalization and creates innovative gambling experiences. Strategic partnerships between gambling operators and technology providers can leverage technological advancements to build better gambling products and attract new player segments. Finally, expansion into emerging markets in Europe with relaxed or recently established regulatory frameworks presents promising avenues for market penetration and revenue generation.

Leading Players in the European Online Gambling Market Sector

- GVC Holdings

- LeoVegas AB

- Flutter Entertainment

- 888 Holdings PLC

- Betsson AB

- The Kindered Group

- Bragg Gaming Group

- Entain PLC (William Hill PLC)

- Bet365 Group Ltd

Key Milestones in European Online Gambling Market Industry

- March 2021: Playtech extended its partnership with Flutter Entertainment, enhancing Flutter's technological capabilities. This strengthened Flutter's market position and its product offerings.

- July 2021: Betway launched a France-facing website, expanding its market reach into a new regulated territory. This move signifies increasing interest in the French online gambling market.

- February 2022: GiG extended its partnership with Betsson Group, solidifying its position as a leading platform provider in the European market. This deal reflects the growing importance of technology and platform services for online gambling operators.

Strategic Outlook for European Online Gambling Market Market

The European online gambling market is poised for sustained growth, driven by technological advancements, regulatory changes, and evolving consumer preferences. Strategic opportunities lie in leveraging innovative technologies such as AI and VR/AR, forging strategic partnerships to expand market reach and product offerings, and proactively adapting to evolving regulatory landscapes. Companies that prioritize responsible gambling practices and deliver personalized, secure, and engaging experiences will be well-positioned to capitalize on the market's long-term potential.

European Online Gambling Market Segmentation

-

1. Game Type

-

1.1. Sports Betting

- 1.1.1. Football

- 1.1.2. Horse Racing

- 1.1.3. E-Sports

- 1.1.4. Other Game Types

-

1.2. Casino

- 1.2.1. Live Casino

- 1.2.2. Baccarat

- 1.2.3. Blackjack

- 1.2.4. Poker

- 1.2.5. Slots

- 1.2.6. Other Casino Games

- 1.3. Lottery

- 1.4. Bingo

-

1.1. Sports Betting

-

2. End Use

- 2.1. Desktop

- 2.2. Mobile

European Online Gambling Market Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. Germany

- 4. France

- 5. Italy

- 6. Russia

- 7. Rest of Europe

European Online Gambling Market Regional Market Share

Geographic Coverage of European Online Gambling Market

European Online Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Aggressive Advertisement And Promotional Activities; Advancement In Security

- 3.2.2 Encryption

- 3.2.3 And Streaming Technology

- 3.3. Market Restrains

- 3.3.1. Regulatory and Legal Challenges

- 3.4. Market Trends

- 3.4.1. Improved Internet Connections and Streaming Technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 5.1.1. Sports Betting

- 5.1.1.1. Football

- 5.1.1.2. Horse Racing

- 5.1.1.3. E-Sports

- 5.1.1.4. Other Game Types

- 5.1.2. Casino

- 5.1.2.1. Live Casino

- 5.1.2.2. Baccarat

- 5.1.2.3. Blackjack

- 5.1.2.4. Poker

- 5.1.2.5. Slots

- 5.1.2.6. Other Casino Games

- 5.1.3. Lottery

- 5.1.4. Bingo

- 5.1.1. Sports Betting

- 5.2. Market Analysis, Insights and Forecast - by End Use

- 5.2.1. Desktop

- 5.2.2. Mobile

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.3.2. United Kingdom

- 5.3.3. Germany

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 6. Spain European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Game Type

- 6.1.1. Sports Betting

- 6.1.1.1. Football

- 6.1.1.2. Horse Racing

- 6.1.1.3. E-Sports

- 6.1.1.4. Other Game Types

- 6.1.2. Casino

- 6.1.2.1. Live Casino

- 6.1.2.2. Baccarat

- 6.1.2.3. Blackjack

- 6.1.2.4. Poker

- 6.1.2.5. Slots

- 6.1.2.6. Other Casino Games

- 6.1.3. Lottery

- 6.1.4. Bingo

- 6.1.1. Sports Betting

- 6.2. Market Analysis, Insights and Forecast - by End Use

- 6.2.1. Desktop

- 6.2.2. Mobile

- 6.1. Market Analysis, Insights and Forecast - by Game Type

- 7. United Kingdom European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Game Type

- 7.1.1. Sports Betting

- 7.1.1.1. Football

- 7.1.1.2. Horse Racing

- 7.1.1.3. E-Sports

- 7.1.1.4. Other Game Types

- 7.1.2. Casino

- 7.1.2.1. Live Casino

- 7.1.2.2. Baccarat

- 7.1.2.3. Blackjack

- 7.1.2.4. Poker

- 7.1.2.5. Slots

- 7.1.2.6. Other Casino Games

- 7.1.3. Lottery

- 7.1.4. Bingo

- 7.1.1. Sports Betting

- 7.2. Market Analysis, Insights and Forecast - by End Use

- 7.2.1. Desktop

- 7.2.2. Mobile

- 7.1. Market Analysis, Insights and Forecast - by Game Type

- 8. Germany European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Game Type

- 8.1.1. Sports Betting

- 8.1.1.1. Football

- 8.1.1.2. Horse Racing

- 8.1.1.3. E-Sports

- 8.1.1.4. Other Game Types

- 8.1.2. Casino

- 8.1.2.1. Live Casino

- 8.1.2.2. Baccarat

- 8.1.2.3. Blackjack

- 8.1.2.4. Poker

- 8.1.2.5. Slots

- 8.1.2.6. Other Casino Games

- 8.1.3. Lottery

- 8.1.4. Bingo

- 8.1.1. Sports Betting

- 8.2. Market Analysis, Insights and Forecast - by End Use

- 8.2.1. Desktop

- 8.2.2. Mobile

- 8.1. Market Analysis, Insights and Forecast - by Game Type

- 9. France European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Game Type

- 9.1.1. Sports Betting

- 9.1.1.1. Football

- 9.1.1.2. Horse Racing

- 9.1.1.3. E-Sports

- 9.1.1.4. Other Game Types

- 9.1.2. Casino

- 9.1.2.1. Live Casino

- 9.1.2.2. Baccarat

- 9.1.2.3. Blackjack

- 9.1.2.4. Poker

- 9.1.2.5. Slots

- 9.1.2.6. Other Casino Games

- 9.1.3. Lottery

- 9.1.4. Bingo

- 9.1.1. Sports Betting

- 9.2. Market Analysis, Insights and Forecast - by End Use

- 9.2.1. Desktop

- 9.2.2. Mobile

- 9.1. Market Analysis, Insights and Forecast - by Game Type

- 10. Italy European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Game Type

- 10.1.1. Sports Betting

- 10.1.1.1. Football

- 10.1.1.2. Horse Racing

- 10.1.1.3. E-Sports

- 10.1.1.4. Other Game Types

- 10.1.2. Casino

- 10.1.2.1. Live Casino

- 10.1.2.2. Baccarat

- 10.1.2.3. Blackjack

- 10.1.2.4. Poker

- 10.1.2.5. Slots

- 10.1.2.6. Other Casino Games

- 10.1.3. Lottery

- 10.1.4. Bingo

- 10.1.1. Sports Betting

- 10.2. Market Analysis, Insights and Forecast - by End Use

- 10.2.1. Desktop

- 10.2.2. Mobile

- 10.1. Market Analysis, Insights and Forecast - by Game Type

- 11. Russia European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Game Type

- 11.1.1. Sports Betting

- 11.1.1.1. Football

- 11.1.1.2. Horse Racing

- 11.1.1.3. E-Sports

- 11.1.1.4. Other Game Types

- 11.1.2. Casino

- 11.1.2.1. Live Casino

- 11.1.2.2. Baccarat

- 11.1.2.3. Blackjack

- 11.1.2.4. Poker

- 11.1.2.5. Slots

- 11.1.2.6. Other Casino Games

- 11.1.3. Lottery

- 11.1.4. Bingo

- 11.1.1. Sports Betting

- 11.2. Market Analysis, Insights and Forecast - by End Use

- 11.2.1. Desktop

- 11.2.2. Mobile

- 11.1. Market Analysis, Insights and Forecast - by Game Type

- 12. Rest of Europe European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Game Type

- 12.1.1. Sports Betting

- 12.1.1.1. Football

- 12.1.1.2. Horse Racing

- 12.1.1.3. E-Sports

- 12.1.1.4. Other Game Types

- 12.1.2. Casino

- 12.1.2.1. Live Casino

- 12.1.2.2. Baccarat

- 12.1.2.3. Blackjack

- 12.1.2.4. Poker

- 12.1.2.5. Slots

- 12.1.2.6. Other Casino Games

- 12.1.3. Lottery

- 12.1.4. Bingo

- 12.1.1. Sports Betting

- 12.2. Market Analysis, Insights and Forecast - by End Use

- 12.2.1. Desktop

- 12.2.2. Mobile

- 12.1. Market Analysis, Insights and Forecast - by Game Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 GVC Holdings

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 LeoVegas AB

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 The Stars Group Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Betsson AB

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Flutter Entertainment

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 888 Holdings PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 The Kindered Group

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Bragg Gaming Group*List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Entain PLC (William Hill PLC)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Bet365 Group Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 GVC Holdings

List of Figures

- Figure 1: European Online Gambling Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Online Gambling Market Share (%) by Company 2025

List of Tables

- Table 1: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 2: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 3: European Online Gambling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 5: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 6: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 8: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 9: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 11: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 12: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 14: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 15: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 17: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 18: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 20: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 21: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 23: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 24: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Online Gambling Market?

The projected CAGR is approximately 11.01%.

2. Which companies are prominent players in the European Online Gambling Market?

Key companies in the market include GVC Holdings, LeoVegas AB, The Stars Group Inc, Betsson AB, Flutter Entertainment, 888 Holdings PLC, The Kindered Group, Bragg Gaming Group*List Not Exhaustive, Entain PLC (William Hill PLC), Bet365 Group Ltd.

3. What are the main segments of the European Online Gambling Market?

The market segments include Game Type, End Use.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Advertisement And Promotional Activities; Advancement In Security. Encryption. And Streaming Technology.

6. What are the notable trends driving market growth?

Improved Internet Connections and Streaming Technology.

7. Are there any restraints impacting market growth?

Regulatory and Legal Challenges.

8. Can you provide examples of recent developments in the market?

February 2022: The Gaming Innovation Group Inc. (GiG) announced that it signed an extension of its agreement of partnership with Betsson Group to provide the Platform & Managed Services, which included customer services and full business operations of multiple territories. The contract extension was signed for the extension till 2025. The agreement included the brand's Guts, Thrills, Kaboo, and Rizk.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Online Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Online Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Online Gambling Market?

To stay informed about further developments, trends, and reports in the European Online Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence