Key Insights

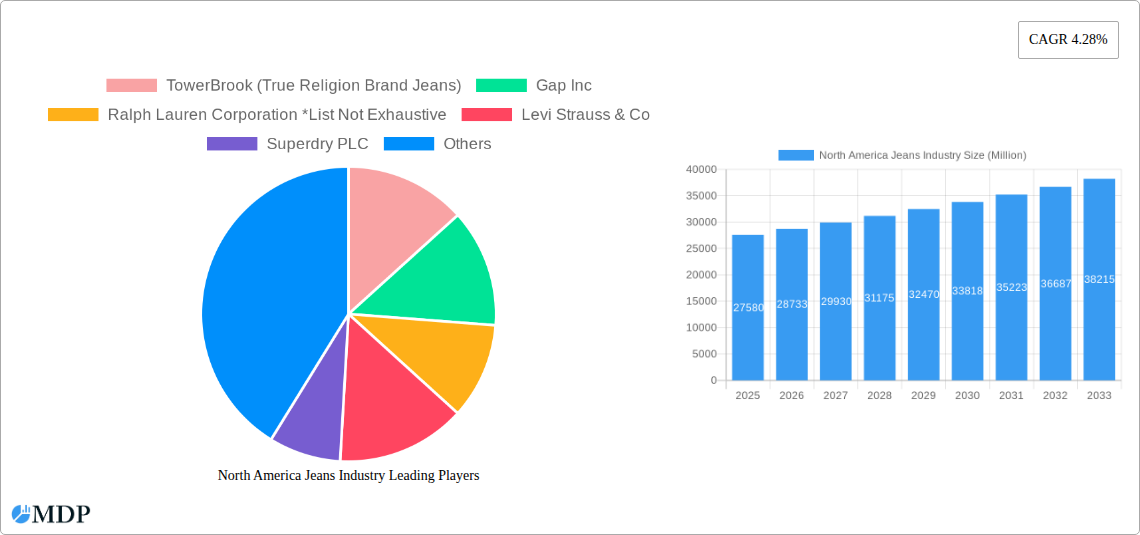

The North American jeans market is poised for steady expansion, projected to reach approximately USD 27.58 billion by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 4.28% through 2033. This growth is fueled by a confluence of factors, including evolving fashion trends, the enduring appeal of denim as a versatile wardrobe staple, and increasing consumer spending power, particularly among younger demographics. The "athleisure" trend has significantly influenced the jeans market, driving demand for more comfortable and stretchable denim options that blend style with functionality. Furthermore, a strong emphasis on brand perception and the influence of social media continue to shape consumer preferences, leading to a dynamic market where both heritage brands and emerging players compete for market share. The increasing adoption of sustainable manufacturing practices and the popularity of vintage or "retro" styles are also contributing to market resilience and growth.

North America Jeans Industry Market Size (In Billion)

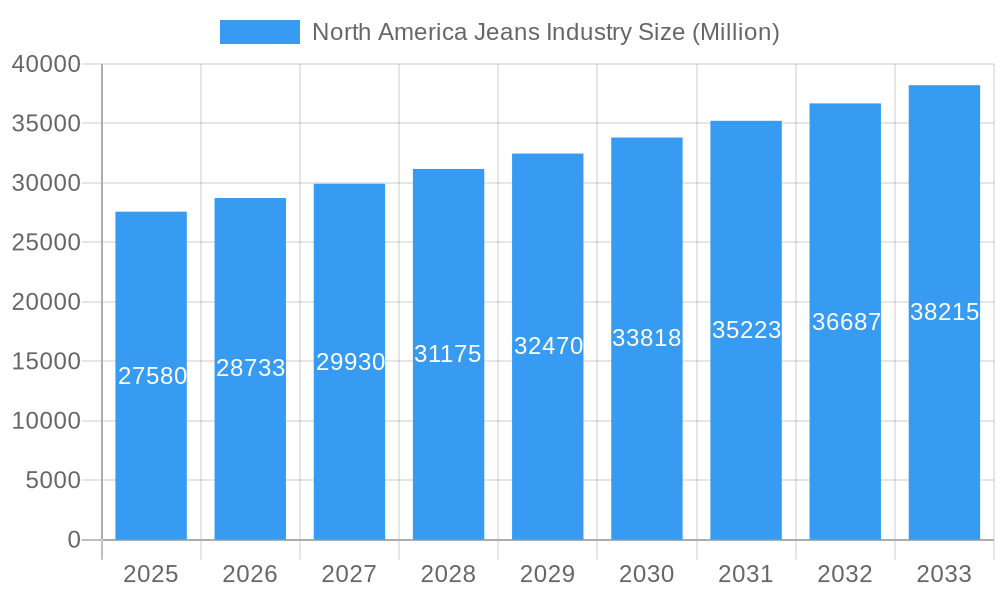

Within North America, the United States, Canada, and Mexico form the core of this lucrative market. The competitive landscape is characterized by a mix of established global players like Levi Strauss & Co., Gap Inc., and Ralph Lauren Corporation, alongside fast-fashion giants such as H&M and Superdry. These companies are strategically leveraging various distribution channels, including specialty stores, supermarkets, and the rapidly expanding online retail segment, to reach a diverse consumer base. The market caters to all end-users – men, women, and children – with product segmentation spanning both mass-market offerings and premium, designer collections. The ongoing innovation in denim fabric technology, wash treatments, and fits ensures continuous product evolution, keeping the North American jeans market vibrant and attractive to consumers seeking both classic and contemporary denim styles.

North America Jeans Industry Company Market Share

North America Jeans Industry Report: Comprehensive Analysis & Forecast (2019-2033)

Dive deep into the dynamic North America Jeans Industry with this in-depth report, covering market dynamics, crucial trends, leading segments, and strategic opportunities. The study spans the historical period of 2019-2024, with a base year of 2025 and a forecast period extending to 2033. This report offers invaluable insights for industry stakeholders, from manufacturers and retailers to investors and analysts, seeking to understand and capitalize on the evolving North American denim market. Expect to discover actionable strategies and critical data points, including an estimated market size of xx Million for 2025 and a projected xx% CAGR during the forecast period.

North America Jeans Industry Market Dynamics & Concentration

The North America Jeans Industry exhibits a moderate to high level of market concentration, driven by a few dominant players alongside a growing number of niche and emerging brands. Innovation remains a key differentiator, with companies continuously investing in sustainable materials, advanced manufacturing techniques, and unique design aesthetics to capture consumer attention. Regulatory frameworks are primarily focused on environmental impact and labor practices, influencing production methods and material sourcing. Product substitutes, such as leggings, athleisure wear, and other casual bottoms, present a constant competitive challenge, forcing jeans manufacturers to emphasize durability, style, and brand value. End-user trends are shifting towards comfort, sustainability, and personalized fits, impacting product development across all segments. Merger and acquisition (M&A) activities, while not at an all-time high, are strategically significant, allowing larger players to expand their market reach and product portfolios. For instance, recent M&A activities have involved consolidation within the premium denim segment and acquisitions aimed at integrating innovative supply chain technologies. The market share of key players is closely watched, with leading companies commanding significant portions of the overall market revenue. M&A deal counts are indicative of strategic moves to gain market share and acquire technological capabilities.

North America Jeans Industry Industry Trends & Analysis

The North America Jeans Industry is experiencing robust growth, fueled by a confluence of evolving consumer preferences, technological advancements, and a renewed focus on sustainability. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, a testament to the enduring appeal of denim and its adaptability to contemporary fashion. A significant trend is the increasing demand for sustainable and ethically produced jeans. Consumers are more aware of the environmental footprint of clothing production, leading to a surge in demand for organic cotton, recycled materials, and water-saving manufacturing processes. This has spurred innovation in denim washes and dyeing techniques that minimize water usage and chemical discharge. Technological disruptions are playing a pivotal role, with advancements in 3D printing, artificial intelligence for personalized fit recommendations, and digital garment creation transforming the production and retail landscape. Online retail stores are experiencing substantial growth, driven by convenience, wider product selection, and targeted marketing. This shift necessitates robust e-commerce strategies and investments in digital infrastructure. The competitive dynamics are intensifying, with established global brands competing fiercely against agile direct-to-consumer (DTC) startups. This competition fosters innovation and drives down prices in certain segments, while premium brands focus on exclusivity and superior craftsmanship. Market penetration is deepening, particularly in emerging demographic groups and regions, as denim continues its evolution from a utilitarian garment to a fashion staple. The industry is also witnessing a trend towards "conscious consumption," where consumers are willing to invest in higher-quality, durable pieces that offer long-term value.

Leading Markets & Segments in North America Jeans Industry

The North America Jeans Industry showcases distinct market leadership across various segments. Women's jeans consistently dominate the market, driven by a broader range of styles, fits, and fashion-forward trends that cater to diverse consumer tastes. The Premium category is a significant growth engine, where consumers are willing to pay a higher price for superior quality, unique designs, and brand heritage. Online retail stores have emerged as the leading distribution channel, overtaking traditional brick-and-mortar formats due to convenience, extensive product availability, and the rise of e-commerce giants and DTC brands.

End User Dominance:

- Women: This segment leads due to extensive product variety, fast-changing fashion trends, and a higher propensity for fashion experimentation. Key drivers include the constant introduction of new silhouettes, washes, and embellishments tailored to female consumers.

- Men: While a substantial market, it often exhibits a more stable demand for classic fits and enduring styles. Growth is driven by comfort innovations and the integration of performance fabrics.

- Children: This segment is characterized by frequent purchases driven by growth and a focus on durability and affordability, with an increasing trend towards character-driven designs.

Category Dominance:

- Premium: This segment commands significant value share through brands emphasizing craftsmanship, sustainable materials, and exclusive designs, appealing to consumers seeking lasting quality and brand prestige.

- Mass: This segment drives volume through accessible pricing, wide availability, and a focus on everyday wear, catering to a broad consumer base.

Distribution Channel Dominance:

- Online Retail Stores: This channel's dominance is fueled by the convenience of at-home shopping, personalized recommendations, vast product assortments, and the rise of social commerce. Key drivers include advanced logistics, seamless user interfaces, and effective digital marketing.

- Specialty Stores: These retain a strong presence for premium and niche brands, offering curated selections and expert customer service, appealing to consumers seeking a personalized shopping experience and expert advice.

- Supermarkets/Hypermarkets: While a smaller channel for dedicated denim, it caters to opportunistic purchases of basic or value-oriented jeans, driven by price sensitivity and impulse buying.

North America Jeans Industry Product Developments

Recent product developments in the North America Jeans Industry highlight a strong emphasis on innovation, sustainability, and catering to evolving consumer needs. Levi's, in July 2023, celebrated the 150th anniversary of its iconic 501 jeans by launching a suite of eco-conscious iterations: the Plant-Based 501, the hemp-cotton blend Selvedge 501, and the Circular 501. These innovations showcase the brand's commitment to sustainable materials and circular economy principles. In September 2023, the Lee brand unveiled its re-imagined women’s Lee Rider Jean, specifically designed to enhance fit and comfort for the female form. This launch included two distinct straight-legged silhouettes: the Rider Classic Jean with a relaxed fit and the Rider Slim Straight Jean with a slimmer leg. Also in September 2023, Lee partnered with Daydreamer, a LA-based t-shirt company, to create a collection that expanded beyond denim, encompassing women's t-shirts, crews, sweatshirts, and denim jackets, demonstrating a collaborative approach to lifestyle branding and market reach. These developments underscore a trend towards responsible manufacturing, improved fit technologies, and cross-category brand collaborations.

Key Drivers of North America Jeans Industry Growth

The North America Jeans Industry's growth is propelled by several interconnected factors. Firstly, evolving consumer preferences for comfort, style, and versatility continue to drive demand for denim as a wardrobe staple. Secondly, technological innovations in manufacturing, such as water-saving techniques and sustainable material development, are appealing to a growing segment of environmentally conscious consumers. The increasing adoption of online retail channels provides greater accessibility and convenience, expanding market reach. Furthermore, strategic marketing campaigns and the influence of social media continue to shape trends and consumer purchasing decisions, making denim a prominent fashion item. The growing disposable income in certain demographic segments also supports increased spending on apparel, including premium denim offerings.

Challenges in the North America Jeans Industry Market

The North America Jeans Industry faces several significant challenges that impact its growth trajectory. Intensifying competition from both established players and new entrants, particularly in the fast-fashion and DTC segments, puts pressure on pricing and margins. Rising raw material costs, especially for cotton, can directly affect production expenses. Supply chain disruptions, as witnessed in recent years, can lead to delays and increased logistical costs. Furthermore, changing consumer trends and the fleeting nature of fashion can lead to overstocking and markdowns if brands fail to accurately predict demand. Regulatory hurdles, particularly concerning environmental sustainability and labor practices, require continuous investment in compliance and ethical sourcing, adding to operational costs.

Emerging Opportunities in North America Jeans Industry

The North America Jeans Industry is ripe with emerging opportunities for growth and innovation. The burgeoning demand for sustainable and eco-friendly denim presents a significant avenue, with consumers actively seeking products made from organic cotton, recycled materials, and through water-efficient processes. The expansion of e-commerce and direct-to-consumer (DTC) models allows brands to bypass traditional retail intermediaries, fostering closer customer relationships and enabling personalized marketing. Technological advancements in areas like AI-powered fit prediction and virtual try-on solutions offer opportunities to enhance the online shopping experience and reduce returns. Furthermore, the increasing interest in gender-neutral and inclusive sizing opens up new market segments and caters to a broader consumer base. Collaborations with influencers and lifestyle brands also provide opportunities to tap into new audiences and reinforce brand relevance.

Leading Players in the North America Jeans Industry Sector

- TowerBrook (True Religion Brand Jeans)

- Gap Inc

- Ralph Lauren Corporation

- Levi Strauss & Co

- Superdry PLC

- American Eagle

- PVH Corp

- OTB Group

- H & M Hennes & Mauritz AB

- Kontoor Brands Inc

Key Milestones in North America Jeans Industry Industry

- September 2023: The Lee brand launched its re-imagined women’s Lee Rider Jean, designed to fit the shape of a woman’s body. This initiative included the Rider Classic Jean (mid-rise, straight leg, relaxed fit) and the Rider Slim Straight Jean (mid-rise, straight leg, slimmer leg fit), directly addressing consumer demand for improved fit.

- September 2023: Lee collaborated with Daydreamer, the LA-based t-shirt company, to launch a collection that broadened its product offering beyond jeans to include women’s t-shirts, crews, sweatshirts, and denim jackets, showcasing a strategic partnership for lifestyle brand expansion.

- July 2023: American clothing company Levi’s launched a suite of products—the Plant-Based 501, the hemp-cotton blend Selvedge 501, and the Circular 501—marking a significant step in sustainable innovation and celebrating the 150th anniversary of the iconic Levi’s 501 jeans by integrating new materials and circular economy principles.

Strategic Outlook for North America Jeans Industry Market

The strategic outlook for the North America Jeans Industry is characterized by a continued drive towards innovation, sustainability, and enhanced customer engagement. Brands will increasingly focus on leveraging advanced technologies for personalized product offerings and a seamless online shopping experience. Investments in sustainable materials and ethical manufacturing processes will be crucial for maintaining brand reputation and appealing to a growing segment of conscious consumers. Strategic partnerships, both within the supply chain and with complementary lifestyle brands, will be vital for expanding market reach and diversifying product portfolios. The ongoing evolution of fashion trends will necessitate agile product development and responsive marketing strategies to capitalize on emerging opportunities and mitigate market challenges, ensuring sustained growth in the coming years.

North America Jeans Industry Segmentation

-

1. End User

- 1.1. Men

- 1.2. Women

- 1.3. Children

-

2. Category

- 2.1. Mass

- 2.2. Premium

-

3. Distribution Channel

- 3.1. Specialty Stores

- 3.2. Supermarkets/Hypermarkets

- 3.3. Online Retail Stores

- 3.4. Other Distribution Channels

North America Jeans Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Jeans Industry Regional Market Share

Geographic Coverage of North America Jeans Industry

North America Jeans Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Inclination of Consumers Toward Fashionable Clothing; Rising Influence of Social Media

- 3.3. Market Restrains

- 3.3.1. Unorganized Apparel Sector and Availability of Counterfeit Goods

- 3.4. Market Trends

- 3.4.1. Women are the Largest Customer Base for Brands

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Jeans Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Men

- 5.1.2. Women

- 5.1.3. Children

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass

- 5.2.2. Premium

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Specialty Stores

- 5.3.2. Supermarkets/Hypermarkets

- 5.3.3. Online Retail Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 TowerBrook (True Religion Brand Jeans)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Gap Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ralph Lauren Corporation *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Levi Strauss & Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Superdry PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 American Eagle

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PVH Corp

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 OTB Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 H & M Hennes & Mauritz AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kontoor Brands Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 TowerBrook (True Religion Brand Jeans)

List of Figures

- Figure 1: North America Jeans Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Jeans Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Jeans Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 2: North America Jeans Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 3: North America Jeans Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Jeans Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Jeans Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: North America Jeans Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 7: North America Jeans Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: North America Jeans Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Jeans Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Jeans Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Jeans Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Jeans Industry?

The projected CAGR is approximately 4.28%.

2. Which companies are prominent players in the North America Jeans Industry?

Key companies in the market include TowerBrook (True Religion Brand Jeans), Gap Inc, Ralph Lauren Corporation *List Not Exhaustive, Levi Strauss & Co, Superdry PLC, American Eagle, PVH Corp, OTB Group, H & M Hennes & Mauritz AB, Kontoor Brands Inc.

3. What are the main segments of the North America Jeans Industry?

The market segments include End User, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Strong Inclination of Consumers Toward Fashionable Clothing; Rising Influence of Social Media.

6. What are the notable trends driving market growth?

Women are the Largest Customer Base for Brands.

7. Are there any restraints impacting market growth?

Unorganized Apparel Sector and Availability of Counterfeit Goods.

8. Can you provide examples of recent developments in the market?

September 2023: The Lee brand launched its re-imagined women’s Lee Rider Jean, designed to fit the shape of a woman’s body. The new launch included two versions of the straight-legged silhouette: the Rider Classic Jean, mid-rise jeans with a straight leg and relaxed fit, and the Rider Slim Straight Jean, mid-rise jeans with a straight leg and slimmer leg fit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Jeans Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Jeans Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Jeans Industry?

To stay informed about further developments, trends, and reports in the North America Jeans Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence