Key Insights

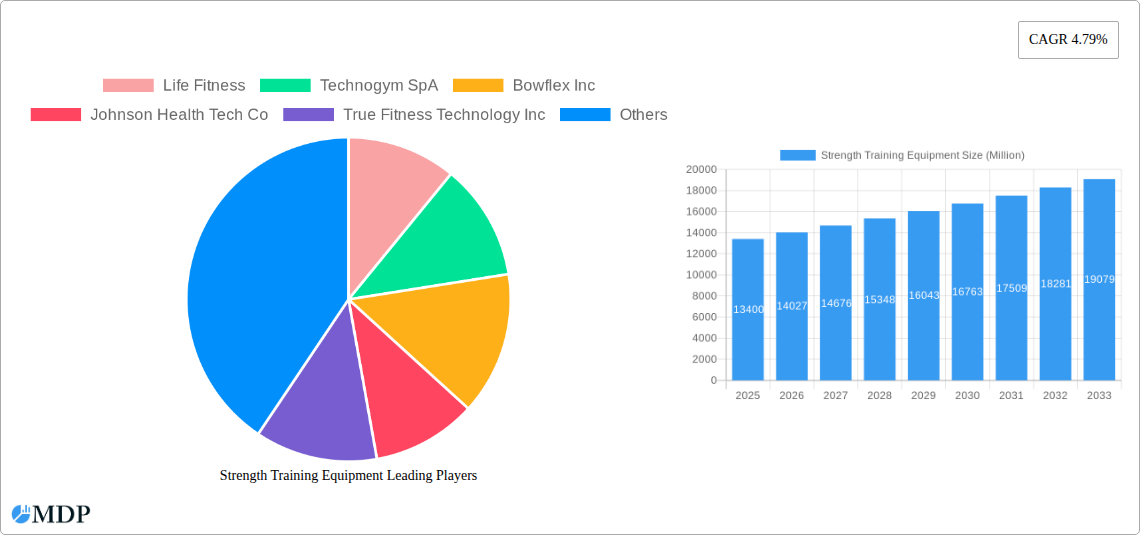

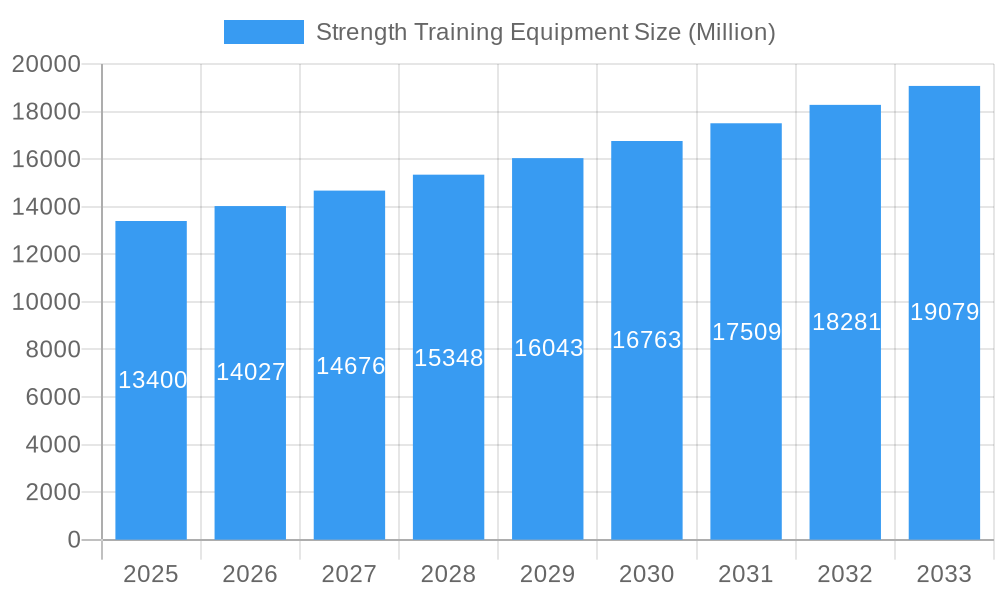

The global strength training equipment market, projected to reach $12.88 billion by 2025, is set for significant expansion. This growth is fueled by a growing health-conscious demographic, heightened awareness of physical fitness benefits, and the increasing adoption of home fitness solutions. The market has demonstrated a Compound Annual Growth Rate (CAGR) of 6.32% from 2019 to 2024, a trend expected to persist through 2033. Key growth catalysts include the expanding fitness industry, innovative equipment design with smart and connected features, and improved accessibility to training resources through online platforms and fitness influencers. Segmentation encompasses diverse equipment types, price points, and distribution channels. Potential restraints may involve fluctuating raw material costs, competitive pressures, and the imperative for continuous product innovation. Leading players are expected to maintain market presence through established brands, while smaller entities may target niche segments or novel offerings. Sustained demand from commercial fitness facilities and the home fitness sector will be pivotal.

Strength Training Equipment Market Size (In Billion)

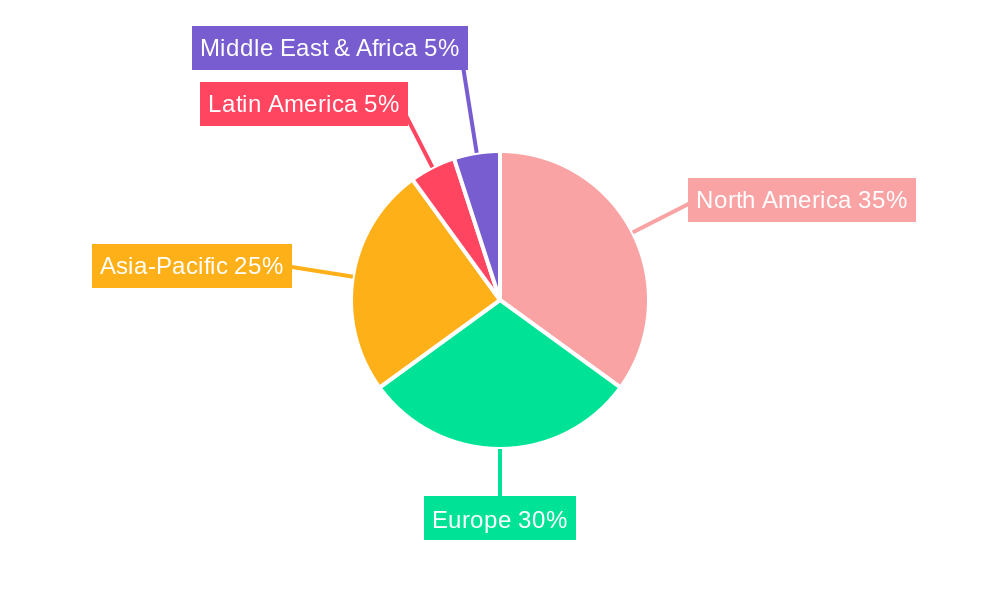

Geographically, North America and Europe currently dominate the market. However, emerging economies in Asia-Pacific and Latin America are anticipated to experience accelerated growth driven by rising disposable incomes and increasing health consciousness. The forecast period (2025-2033) presents substantial opportunities for market development through sustained investment in technological innovation, product diversification, and tailored marketing strategies that address specific consumer needs. The market landscape is favorable for adaptable companies embracing technological advancements and effectively navigating competitive dynamics.

Strength Training Equipment Company Market Share

Strength Training Equipment Market Report: 2019-2033

A comprehensive analysis of the \$XX Million strength training equipment market, projecting a \$XX Million valuation by 2033. This in-depth report provides actionable insights for industry stakeholders, covering market dynamics, leading players, technological advancements, and future growth opportunities. The study period spans 2019-2033, with 2025 as the base and estimated year.

Strength Training Equipment Market Dynamics & Concentration

The global strength training equipment market, valued at \$XX Million in 2024, is experiencing significant growth driven by increasing health consciousness, rising disposable incomes, and the proliferation of home fitness solutions. Market concentration is moderate, with several key players holding substantial market share, but a fragmented landscape exists amongst smaller niche players.

Market Concentration:

- The top 5 players (Life Fitness, Technogym SpA, Bowflex Inc, Johnson Health Tech Co, True Fitness Technology Inc) account for an estimated XX% of the market share.

- The remaining share is distributed amongst numerous smaller companies and regional players.

Innovation Drivers:

- Technological advancements like AI-powered training programs and connected fitness equipment are transforming the industry.

- The trend towards personalized fitness experiences is fueling demand for sophisticated and adaptable equipment.

Regulatory Frameworks:

- Safety and quality standards vary across regions, impacting manufacturing and distribution processes.

- Regulations concerning product labeling and advertising influence market competition and consumer trust.

Product Substitutes:

- Bodyweight exercises and outdoor activities pose competition to dedicated strength training equipment.

- The increasing popularity of online fitness programs and apps offers alternative training solutions.

End-User Trends:

- A growing preference for home fitness is driving demand for compact and versatile strength training equipment.

- The rise of boutique fitness studios and gyms contributes to the professional sector's demand for higher-end equipment.

M&A Activities:

- The number of mergers and acquisitions in the sector has been steadily increasing over the past five years, with an estimated XX deals recorded in the historical period (2019-2024). These are largely driven by companies seeking to expand their market reach and product portfolios.

Strength Training Equipment Industry Trends & Analysis

The strength training equipment market exhibits a robust growth trajectory, projected to achieve a CAGR of XX% during the forecast period (2025-2033). This growth is fueled by several key factors:

- The rising prevalence of chronic diseases like obesity and cardiovascular conditions is driving demand for preventative healthcare measures, including strength training.

- Technological advancements in equipment design and functionality are enhancing user experience and expanding market reach.

- Changing consumer preferences toward personalized fitness solutions and home-based workouts are impacting market segmentation and product development.

- Intense competition amongst leading players is promoting innovation and price optimization, making strength training equipment more accessible.

Market penetration of strength training equipment in households varies significantly across regions, with developed economies exhibiting higher rates than developing ones. The adoption of smart fitness technology is accelerating, with XX% of new equipment sales expected to incorporate connected features by 2033.

Leading Markets & Segments in Strength Training Equipment

North America currently dominates the global strength training equipment market, accounting for an estimated XX% of global revenue in 2024. This dominance is attributable to high consumer spending on fitness products, a well-established fitness culture, and a robust distribution network. Europe holds the second largest market share, driven by similar factors, although at a slightly lower rate. The Asia-Pacific region is witnessing the fastest growth rate, reflecting increasing health awareness and rising disposable incomes.

Key Drivers of Market Dominance:

- North America: High disposable incomes, advanced fitness infrastructure, and established distribution channels.

- Europe: Growing health consciousness, a focus on preventative healthcare, and a sizeable fitness industry.

- Asia-Pacific: Rapid economic development, increasing health awareness, and a growing middle class with higher disposable incomes.

Other regions show promising growth potentials, with considerable untapped market share.

Strength Training Equipment Product Developments

Recent innovations focus on enhancing user experience through digital integration, personalized training programs, and ergonomic design. Examples include AI-powered coaching systems, connected fitness apps that track workout progress, and equipment designed to minimize injury risk. These innovations cater to the growing demand for personalized and effective strength training solutions, boosting market competitiveness.

Key Drivers of Strength Training Equipment Growth

The market's growth is propelled by several key factors: Rising health awareness amongst consumers, the increasing prevalence of sedentary lifestyles and associated health problems, and the growing popularity of home fitness solutions. Technological advancements, particularly the integration of smart technology, further fuel this growth. Government initiatives supporting public health and wellness also positively impact market expansion. Furthermore, the increasing availability of financing options for fitness equipment purchase contributes to increased market accessibility.

Challenges in the Strength Training Equipment Market

The industry faces significant challenges including supply chain disruptions, particularly those felt during the pandemic. Increasing raw material costs impact production costs and profitability. Intense competition amongst numerous players requires companies to differentiate their products effectively. Furthermore, stringent regulatory compliance requirements and safety standards impose additional compliance burdens on manufacturers.

Emerging Opportunities in Strength Training Equipment

The market presents several compelling opportunities. The integration of virtual reality and augmented reality into training programs offers immersive and engaging fitness experiences. Strategic partnerships between equipment manufacturers and fitness apps/platforms could expand market reach and create personalized fitness solutions. Finally, the market expansion into underserved regions shows strong potential, with significant untapped demand, particularly in developing economies.

Leading Players in the Strength Training Equipment Sector

- Life Fitness

- Technogym SpA

- Bowflex Inc

- Johnson Health Tech Co

- True Fitness Technology Inc

- Origin Fitness Limited

- Dyaco International Inc

- Decathlon

- IFIT Health And Fitness Inc

- Body Solid Inc

Key Milestones in Strength Training Equipment Industry

- January 2022: Technogym launched a strength training line incorporating AI and scientific research, aiming to increase market share.

- March 2023: Life Fitness introduced its latest generation of cardio, strength, and digital products, including the Life Fitness Insignia lines and Hammer Strength HD Plate and Plate Loaded machines.

- August 2023: Bowflex Inc. relaunched its iconic BowFlex brand with a new identity and design, expanding its market presence.

Strategic Outlook for Strength Training Equipment Market

The strength training equipment market is poised for sustained growth, driven by technological innovation, expanding health consciousness, and the increasing prevalence of home fitness. Strategic opportunities exist in developing personalized fitness solutions, integrating smart technology, and expanding market penetration in underserved regions. Companies that can effectively address consumer preferences and adapt to the evolving technological landscape are best positioned to thrive in this dynamic market.

Strength Training Equipment Segmentation

-

1. Product Type

- 1.1. Weights

- 1.2. Racks and Benches

- 1.3. Exercise and Medicine Balls

- 1.4. Other Product Types

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Online Retail Stores

- 3.2. Offline retail Stores

Strength Training Equipment Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Austria

- 2.7. Switzerland

- 2.8. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East

Strength Training Equipment Regional Market Share

Geographic Coverage of Strength Training Equipment

Strength Training Equipment REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Influence of Healthy Lifestyles; Social Media Revolutionizing the Fitness Industry

- 3.3. Market Restrains

- 3.3.1. Growing Influence of Healthy Lifestyles; Social Media Revolutionizing the Fitness Industry

- 3.4. Market Trends

- 3.4.1. Strong demand for different types of weights from fitness-conscious consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Strength Training Equipment Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Weights

- 5.1.2. Racks and Benches

- 5.1.3. Exercise and Medicine Balls

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online Retail Stores

- 5.3.2. Offline retail Stores

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Strength Training Equipment Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Weights

- 6.1.2. Racks and Benches

- 6.1.3. Exercise and Medicine Balls

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Online Retail Stores

- 6.3.2. Offline retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Strength Training Equipment Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Weights

- 7.1.2. Racks and Benches

- 7.1.3. Exercise and Medicine Balls

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Online Retail Stores

- 7.3.2. Offline retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Strength Training Equipment Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Weights

- 8.1.2. Racks and Benches

- 8.1.3. Exercise and Medicine Balls

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Online Retail Stores

- 8.3.2. Offline retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Strength Training Equipment Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Weights

- 9.1.2. Racks and Benches

- 9.1.3. Exercise and Medicine Balls

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Online Retail Stores

- 9.3.2. Offline retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Life Fitness

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Technogym SpA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Bowflex Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Johnson Health Tech Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 True Fitness Technology Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Origin Fitness Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Dyaco International Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Decathlon

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 IFIT Health And Fitness Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Body Solid Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Life Fitness

List of Figures

- Figure 1: Global Strength Training Equipment Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Strength Training Equipment Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Strength Training Equipment Revenue (billion), by Product Type 2025 & 2033

- Figure 4: North America Strength Training Equipment Volume (Billion), by Product Type 2025 & 2033

- Figure 5: North America Strength Training Equipment Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Strength Training Equipment Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Strength Training Equipment Revenue (billion), by End User 2025 & 2033

- Figure 8: North America Strength Training Equipment Volume (Billion), by End User 2025 & 2033

- Figure 9: North America Strength Training Equipment Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Strength Training Equipment Volume Share (%), by End User 2025 & 2033

- Figure 11: North America Strength Training Equipment Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 12: North America Strength Training Equipment Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 13: North America Strength Training Equipment Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: North America Strength Training Equipment Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 15: North America Strength Training Equipment Revenue (billion), by Country 2025 & 2033

- Figure 16: North America Strength Training Equipment Volume (Billion), by Country 2025 & 2033

- Figure 17: North America Strength Training Equipment Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Strength Training Equipment Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Strength Training Equipment Revenue (billion), by Product Type 2025 & 2033

- Figure 20: Europe Strength Training Equipment Volume (Billion), by Product Type 2025 & 2033

- Figure 21: Europe Strength Training Equipment Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe Strength Training Equipment Volume Share (%), by Product Type 2025 & 2033

- Figure 23: Europe Strength Training Equipment Revenue (billion), by End User 2025 & 2033

- Figure 24: Europe Strength Training Equipment Volume (Billion), by End User 2025 & 2033

- Figure 25: Europe Strength Training Equipment Revenue Share (%), by End User 2025 & 2033

- Figure 26: Europe Strength Training Equipment Volume Share (%), by End User 2025 & 2033

- Figure 27: Europe Strength Training Equipment Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 28: Europe Strength Training Equipment Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 29: Europe Strength Training Equipment Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Europe Strength Training Equipment Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 31: Europe Strength Training Equipment Revenue (billion), by Country 2025 & 2033

- Figure 32: Europe Strength Training Equipment Volume (Billion), by Country 2025 & 2033

- Figure 33: Europe Strength Training Equipment Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Strength Training Equipment Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Strength Training Equipment Revenue (billion), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Strength Training Equipment Volume (Billion), by Product Type 2025 & 2033

- Figure 37: Asia Pacific Strength Training Equipment Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific Strength Training Equipment Volume Share (%), by Product Type 2025 & 2033

- Figure 39: Asia Pacific Strength Training Equipment Revenue (billion), by End User 2025 & 2033

- Figure 40: Asia Pacific Strength Training Equipment Volume (Billion), by End User 2025 & 2033

- Figure 41: Asia Pacific Strength Training Equipment Revenue Share (%), by End User 2025 & 2033

- Figure 42: Asia Pacific Strength Training Equipment Volume Share (%), by End User 2025 & 2033

- Figure 43: Asia Pacific Strength Training Equipment Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 44: Asia Pacific Strength Training Equipment Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 45: Asia Pacific Strength Training Equipment Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Asia Pacific Strength Training Equipment Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Asia Pacific Strength Training Equipment Revenue (billion), by Country 2025 & 2033

- Figure 48: Asia Pacific Strength Training Equipment Volume (Billion), by Country 2025 & 2033

- Figure 49: Asia Pacific Strength Training Equipment Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Strength Training Equipment Volume Share (%), by Country 2025 & 2033

- Figure 51: Rest of the World Strength Training Equipment Revenue (billion), by Product Type 2025 & 2033

- Figure 52: Rest of the World Strength Training Equipment Volume (Billion), by Product Type 2025 & 2033

- Figure 53: Rest of the World Strength Training Equipment Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Rest of the World Strength Training Equipment Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Rest of the World Strength Training Equipment Revenue (billion), by End User 2025 & 2033

- Figure 56: Rest of the World Strength Training Equipment Volume (Billion), by End User 2025 & 2033

- Figure 57: Rest of the World Strength Training Equipment Revenue Share (%), by End User 2025 & 2033

- Figure 58: Rest of the World Strength Training Equipment Volume Share (%), by End User 2025 & 2033

- Figure 59: Rest of the World Strength Training Equipment Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 60: Rest of the World Strength Training Equipment Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 61: Rest of the World Strength Training Equipment Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 62: Rest of the World Strength Training Equipment Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 63: Rest of the World Strength Training Equipment Revenue (billion), by Country 2025 & 2033

- Figure 64: Rest of the World Strength Training Equipment Volume (Billion), by Country 2025 & 2033

- Figure 65: Rest of the World Strength Training Equipment Revenue Share (%), by Country 2025 & 2033

- Figure 66: Rest of the World Strength Training Equipment Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Strength Training Equipment Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Strength Training Equipment Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Strength Training Equipment Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global Strength Training Equipment Volume Billion Forecast, by End User 2020 & 2033

- Table 5: Global Strength Training Equipment Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Strength Training Equipment Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Strength Training Equipment Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Strength Training Equipment Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Strength Training Equipment Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global Strength Training Equipment Volume Billion Forecast, by Product Type 2020 & 2033

- Table 11: Global Strength Training Equipment Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global Strength Training Equipment Volume Billion Forecast, by End User 2020 & 2033

- Table 13: Global Strength Training Equipment Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Strength Training Equipment Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Strength Training Equipment Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Strength Training Equipment Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United States Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of North America Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of North America Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Global Strength Training Equipment Revenue billion Forecast, by Product Type 2020 & 2033

- Table 24: Global Strength Training Equipment Volume Billion Forecast, by Product Type 2020 & 2033

- Table 25: Global Strength Training Equipment Revenue billion Forecast, by End User 2020 & 2033

- Table 26: Global Strength Training Equipment Volume Billion Forecast, by End User 2020 & 2033

- Table 27: Global Strength Training Equipment Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global Strength Training Equipment Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global Strength Training Equipment Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Strength Training Equipment Volume Billion Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: United Kingdom Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Germany Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Germany Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Spain Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Spain Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: France Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: France Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Italy Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Italy Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Austria Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Austria Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Switzerland Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Switzerland Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of Europe Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Europe Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Global Strength Training Equipment Revenue billion Forecast, by Product Type 2020 & 2033

- Table 48: Global Strength Training Equipment Volume Billion Forecast, by Product Type 2020 & 2033

- Table 49: Global Strength Training Equipment Revenue billion Forecast, by End User 2020 & 2033

- Table 50: Global Strength Training Equipment Volume Billion Forecast, by End User 2020 & 2033

- Table 51: Global Strength Training Equipment Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 52: Global Strength Training Equipment Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 53: Global Strength Training Equipment Revenue billion Forecast, by Country 2020 & 2033

- Table 54: Global Strength Training Equipment Volume Billion Forecast, by Country 2020 & 2033

- Table 55: China Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: China Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Japan Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Japan Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: South Korea Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: South Korea Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Australia Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Australia Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Rest of Asia Pacific Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: Global Strength Training Equipment Revenue billion Forecast, by Product Type 2020 & 2033

- Table 66: Global Strength Training Equipment Volume Billion Forecast, by Product Type 2020 & 2033

- Table 67: Global Strength Training Equipment Revenue billion Forecast, by End User 2020 & 2033

- Table 68: Global Strength Training Equipment Volume Billion Forecast, by End User 2020 & 2033

- Table 69: Global Strength Training Equipment Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 70: Global Strength Training Equipment Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 71: Global Strength Training Equipment Revenue billion Forecast, by Country 2020 & 2033

- Table 72: Global Strength Training Equipment Volume Billion Forecast, by Country 2020 & 2033

- Table 73: South America Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: South America Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: Middle East Strength Training Equipment Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Middle East Strength Training Equipment Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Strength Training Equipment?

The projected CAGR is approximately 6.32%.

2. Which companies are prominent players in the Strength Training Equipment?

Key companies in the market include Life Fitness, Technogym SpA, Bowflex Inc, Johnson Health Tech Co, True Fitness Technology Inc, Origin Fitness Limited, Dyaco International Inc, Decathlon, IFIT Health And Fitness Inc, Body Solid Inc.

3. What are the main segments of the Strength Training Equipment?

The market segments include Product Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.88 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Influence of Healthy Lifestyles; Social Media Revolutionizing the Fitness Industry.

6. What are the notable trends driving market growth?

Strong demand for different types of weights from fitness-conscious consumers.

7. Are there any restraints impacting market growth?

Growing Influence of Healthy Lifestyles; Social Media Revolutionizing the Fitness Industry.

8. Can you provide examples of recent developments in the market?

In March 2023, Life Fitness introduced the latest generation cardio, strength, and digital product innovations, The company’s product innovations include the Life Fitness Insignia lines and the Hammer Strength HD Plate and Plate Loaded machines.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Strength Training Equipment," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Strength Training Equipment report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Strength Training Equipment?

To stay informed about further developments, trends, and reports in the Strength Training Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence