Key Insights

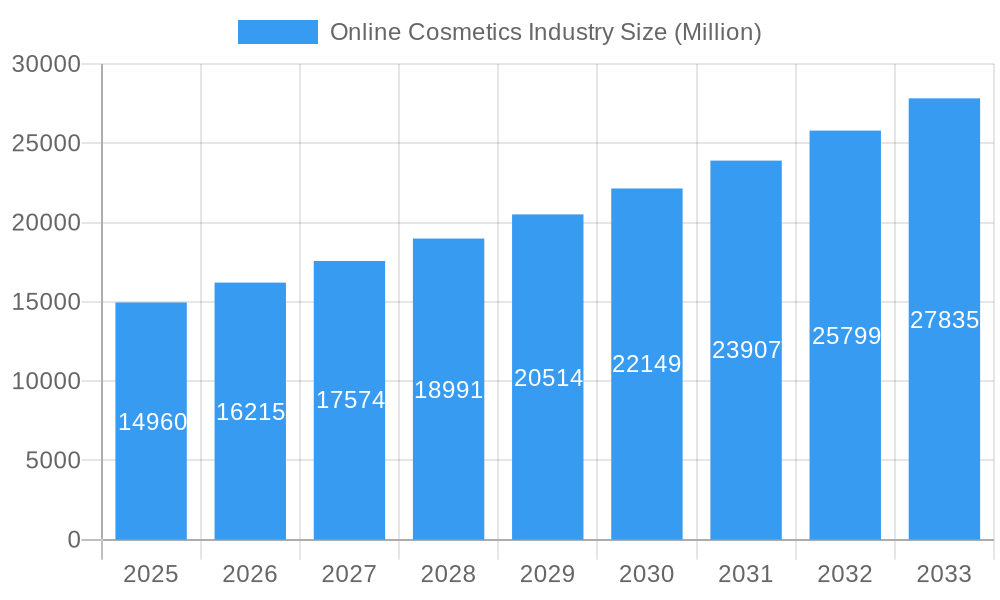

The global Online Cosmetics Industry is poised for substantial growth, projected to reach $14.96 Billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.47% expected between 2025 and 2033. This upward trajectory is fueled by a confluence of factors, including the increasing digital penetration, the convenience and accessibility offered by e-commerce platforms, and a growing consumer preference for personalized beauty experiences. The shift towards online purchasing is particularly pronounced among younger demographics, who are more digitally native and actively engage with social media for beauty inspiration and product discovery. Key drivers for this expansion include the burgeoning influencer marketing landscape, the widespread adoption of mobile commerce, and the continuous innovation in product offerings across various categories. The market is segmented into facial cosmetics, eye cosmetics, lip cosmetics, and nail cosmetics, with both mass and premium segments experiencing significant traction. Distribution channels are increasingly dominated by company websites and retail e-commerce platforms, reflecting the digital-first approach of consumers.

Online Cosmetics Industry Market Size (In Billion)

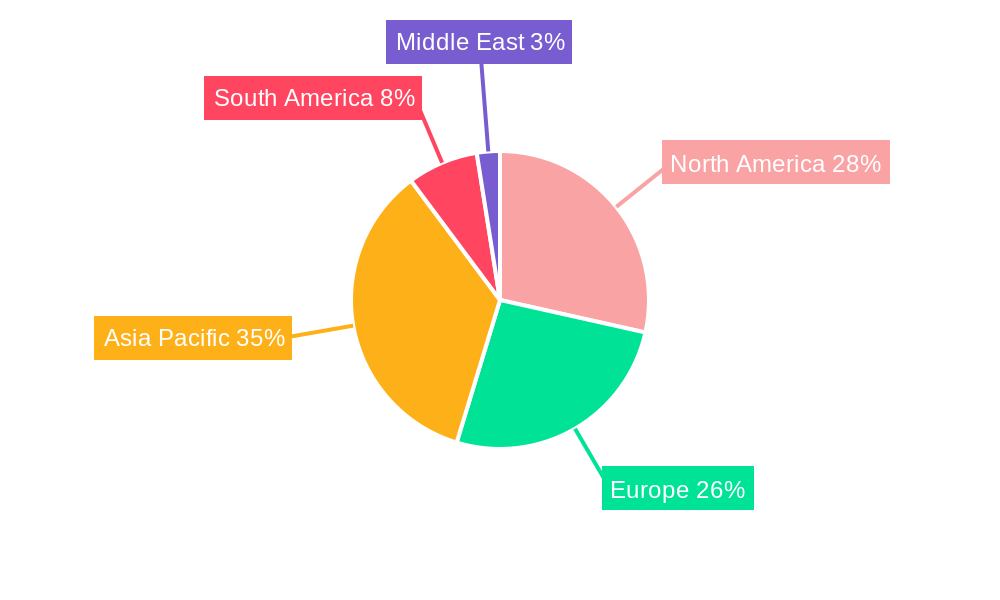

The competitive landscape is dynamic, featuring established global players like L'Oréal SA, Shiseido Co., Ltd., and The Estée Lauder Companies, alongside agile digital-native brands. These companies are actively investing in enhancing their online customer experience through features like virtual try-ons, personalized recommendations, and seamless checkout processes. Emerging trends such as the rise of clean beauty, sustainable packaging, and the integration of AI for tailored beauty advice are further shaping the market. However, challenges such as intense competition, the need for robust cybersecurity measures to protect consumer data, and the logistical complexities of online fulfillment and returns need to be navigated. Regions like Asia Pacific, driven by the massive online consumer base in countries like China and India, are expected to be significant growth engines, alongside established markets in North America and Europe. The industry's ability to adapt to evolving consumer preferences and technological advancements will be critical for sustained success.

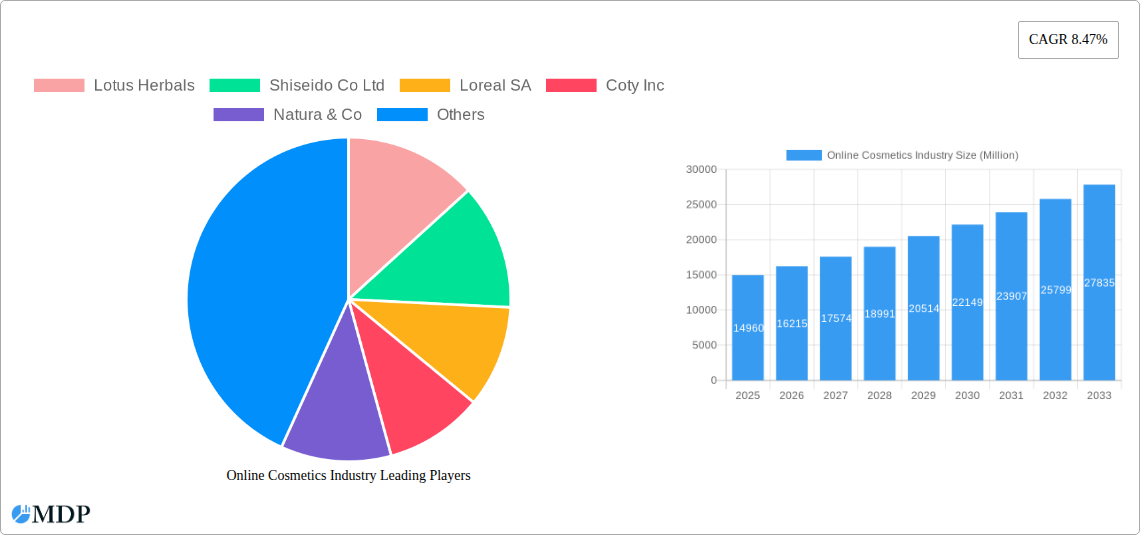

Online Cosmetics Industry Company Market Share

This comprehensive report offers unparalleled insights into the dynamic online cosmetics industry. Delve into market trends, growth drivers, competitive landscapes, and future projections for this rapidly evolving sector. With a study period of 2019–2033, base year of 2025, and forecast period of 2025–2033, this analysis provides a robust understanding of the market's trajectory. We cover key segments including Facial Cosmetics, Eye Cosmetics, Lip Cosmetics, and Nail Cosmetics, across Mass and Premium categories, and analyze distribution channels such as Company Websites and Retail Websites.

Online Cosmetics Industry Market Dynamics & Concentration

The online cosmetics industry is characterized by a dynamic market concentration, driven by continuous innovation and evolving consumer preferences. Major players like L'Oréal SA, Estée Lauder Companies, and Shiseido Co Ltd command significant market share, estimated to be over 60% collectively. Innovation in product formulations, sustainable sourcing, and personalized beauty experiences are key drivers fueling market growth. Regulatory frameworks, while varying by region, are increasingly focused on ingredient transparency and product safety, influencing brand strategies. The threat of product substitutes, primarily from emerging DIY beauty trends and traditional retail channels, remains a consideration, but the convenience and accessibility of online platforms continue to drive end-user engagement. Mergers and acquisitions (M&A) activity is a significant indicator of market consolidation, with an estimated 15-20 major M&A deals in the last five years, primarily involving acquisitions of smaller, digitally native beauty brands by larger corporations to enhance their online presence and product portfolios. The market's concentration is expected to shift as niche brands gain traction online.

Online Cosmetics Industry Industry Trends & Analysis

The online cosmetics industry is experiencing robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of 12.5% from 2025 to 2033. This expansion is primarily fueled by increasing internet penetration globally, a growing digitally-savvy consumer base, and the unparalleled convenience offered by e-commerce platforms. Consumers are increasingly seeking personalized beauty solutions, leading to a surge in demand for customized product recommendations, virtual try-on technologies, and subscription box services. Technologically, Artificial Intelligence (AI) and Augmented Reality (AR) are revolutionizing the online beauty shopping experience. AR-powered virtual try-on tools allow consumers to experiment with different makeup looks from the comfort of their homes, significantly reducing purchase hesitancy and return rates. AI algorithms are being employed to analyze consumer data and provide tailored product suggestions, enhancing customer engagement and loyalty.

Consumer preferences are heavily leaning towards brands that champion inclusivity, sustainability, and ethical sourcing. Clean beauty, cruelty-free products, and eco-friendly packaging are no longer niche demands but mainstream expectations, driving brands to reformulate and re-evaluate their supply chains. The competitive landscape is intense, with both established beauty giants and agile direct-to-consumer (DTC) brands vying for market share. DTC brands, in particular, are leveraging social media marketing, influencer collaborations, and community building to establish strong brand identities and foster direct relationships with their customers. Market penetration for online cosmetics is estimated to reach 55% globally by 2025, with significant variations across developed and emerging economies. The accessibility and affordability of online channels, coupled with targeted digital marketing efforts, are key to driving further market penetration. The rise of live shopping events and shoppable video content is also creating new avenues for product discovery and purchase, further solidifying the online channel's dominance in the beauty sector.

Leading Markets & Segments in Online Cosmetics Industry

The North America region currently dominates the online cosmetics industry, driven by a highly developed digital infrastructure, a large and affluent consumer base, and a strong culture of online shopping. Within North America, the United States holds the largest market share. The Facial Cosmetics segment is the leading product category, accounting for approximately 40% of the total online cosmetics market. This dominance is attributed to the widespread adoption of skincare routines and the continuous innovation in facial care products, including anti-aging serums, sunscreens, and targeted treatments.

- Facial Cosmetics: Key drivers include the growing awareness of skincare benefits, the demand for anti-aging and preventive solutions, and the influence of social media trends promoting healthy skin.

- Eye Cosmetics: This segment follows closely, driven by the popularity of eye makeup tutorials, the demand for innovative and long-lasting formulations, and the growing influence of celebrity endorsements.

- Lip Cosmetics: While a significant segment, it experiences more trend-driven fluctuations compared to facial cosmetics. The rise of bold lip colors and innovative finishes keeps this segment dynamic.

- Nail Cosmetics: This segment, while smaller, shows consistent growth, fueled by at-home manicure trends and the availability of diverse colors and finishes online.

In terms of Category, the Premium segment is experiencing faster growth within the online space. While Mass market products still hold a larger volume, premium brands are effectively leveraging online channels to reach discerning consumers who seek quality, efficacy, and brand prestige. This is supported by luxury e-commerce platforms and direct-to-consumer offerings from high-end brands.

The Distribution Channel analysis reveals a significant shift towards Company Websites and Retail Websites. Company-owned e-commerce platforms provide brands with direct control over their brand messaging, customer data, and pricing strategies, fostering stronger customer loyalty. However, third-party Retail Websites like Sephora, Ulta, and Amazon continue to be crucial for broad market reach and attracting new customers who prefer the convenience of one-stop shopping. The synergy between these channels is vital for comprehensive market coverage. Economic policies encouraging e-commerce growth and robust digital infrastructure are significant enablers for these dominant markets and segments.

Online Cosmetics Industry Product Developments

The online cosmetics industry is a hotbed of innovation, with companies consistently launching new products designed to meet evolving consumer demands. Key trends include the development of multi-functional products, such as primers with SPF and lipsticks that double as cheek tints, catering to the consumer desire for convenience and value. There's a strong emphasis on clean beauty formulations, with brands actively developing products free from parabens, sulfates, and synthetic fragrances, appealing to health-conscious consumers. Technological advancements are driving the creation of high-performance products, including long-wear foundations, smudge-proof eyeliners, and hydrating lipsticks with advanced skincare benefits. Competitive advantages are being carved out through unique ingredient sourcing, sustainable packaging initiatives, and the integration of personalization technologies. For example, the launch of UNLICS by Kao Corporation demonstrates a strategic move to target niche demographics with specialized products.

Key Drivers of Online Cosmetics Industry Growth

The online cosmetics industry's growth is propelled by several converging factors. Technological advancements, particularly in AI and AR, enhance the online shopping experience through virtual try-ons and personalized recommendations, boosting conversion rates. The growing digital penetration globally, especially in emerging markets, opens up vast new consumer bases. Evolving consumer preferences for convenience, accessibility, and personalized beauty solutions directly translate into increased online purchasing. Furthermore, innovative marketing strategies by brands, including influencer collaborations and targeted social media campaigns, effectively reach and engage a wider audience. The shift towards clean and sustainable beauty also drives demand for online brands that prioritize ethical sourcing and eco-friendly practices, aligning with consumer values and fostering brand loyalty.

Challenges in the Online Cosmetics Industry Market

Despite its robust growth, the online cosmetics industry faces several significant challenges. Intense competition from both established brands and new entrants leads to price wars and requires continuous innovation to stand out. Logistical complexities, including shipping costs, delivery times, and managing returns, can impact profitability and customer satisfaction. The inability to physically test products online creates a barrier to trial, potentially leading to higher return rates and customer dissatisfaction, particularly for color cosmetics. Regulatory hurdles related to ingredient disclosure, product claims, and data privacy can vary across different regions, creating compliance challenges for global e-commerce operations. Furthermore, supply chain disruptions, as witnessed in recent global events, can impact product availability and lead times, affecting the consistent delivery of goods to consumers.

Emerging Opportunities in Online Cosmetics Industry

The online cosmetics industry is ripe with emerging opportunities for sustained long-term growth. Personalization through AI and data analytics presents a significant avenue for enhancing customer experience and driving repeat purchases by offering tailored product recommendations and customized beauty routines. The growing demand for sustainable and ethical beauty products creates opportunities for brands that prioritize eco-friendly packaging, cruelty-free formulations, and transparent sourcing. The expansion into emerging markets with increasing internet access and disposable incomes offers substantial growth potential. Strategic partnerships with influencers, beauty tech companies, and complementary lifestyle brands can further expand market reach and consumer engagement. The integration of immersive technologies like AR/VR for virtual try-ons and personalized consultations will continue to bridge the gap between online and offline shopping experiences, driving higher conversion rates and customer satisfaction.

Leading Players in the Online Cosmetics Industry Sector

- L'Oréal SA

- Shiseido Co Ltd

- Coty Inc

- Natura & Co

- NARS Cosmetics

- Revlon

- Oriflame Cosmetics AG

- Kao Corporation

- The Estee Lauder Companies

- Lotus Herbals

Key Milestones in Online Cosmetics Industry Industry

- December 2022: Kao Corporation launched a cosmetic brand named UNLICS for Gen-Z men. The brand offers its products on the official UNLICS online retail site.

- October 2022: Estée Lauder launched its new lipstick collection named Bloom Pure Color Envy Lipstick. The company claims that these products are limited editions and available in three different sizes.

- May 2022: L'Oréal Paris launched the Air Volume Mega Mascara. The brand claims it is a light, waterproof product with a cushiony brush that helps collect and coat each lash.

Strategic Outlook for Online Cosmetics Industry Market

The strategic outlook for the online cosmetics industry is highly optimistic, driven by ongoing digital transformation and shifting consumer behavior. Growth accelerators include the continued adoption of AI and AR technologies to create hyper-personalized shopping experiences and virtual try-on solutions, thereby increasing conversion rates and reducing returns. The increasing consumer demand for clean, sustainable, and ethically sourced beauty products presents a significant opportunity for brands that can authentically integrate these values into their product development and marketing strategies. Expansion into untapped emerging markets, supported by the growth of mobile internet usage, will unlock new customer bases. Strategic partnerships with influencers and the development of engaging content, including live shopping and shoppable videos, will remain crucial for brand visibility and customer acquisition. The focus on building strong online communities and direct-to-consumer relationships will foster brand loyalty and drive long-term market penetration.

Online Cosmetics Industry Segmentation

-

1. Product Type

- 1.1. Facial Cosmetics

- 1.2. Eye Cosmetics

- 1.3. Lip Cosmetics

- 1.4. Nail Cosmetics

-

2. Category

- 2.1. Mass

- 2.2. Premium

-

3. Distribution Channel

- 3.1. Company Website

- 3.2. Retail Website

Online Cosmetics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Online Cosmetics Industry Regional Market Share

Geographic Coverage of Online Cosmetics Industry

Online Cosmetics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Aging Population drives the Market Growth; Technological Advancement and Product Innovation

- 3.3. Market Restrains

- 3.3.1. Product Misrepresentation and Counterfeit Concerns

- 3.4. Market Trends

- 3.4.1. Growing Inclination Towards Natural/Organic Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Cosmetics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Facial Cosmetics

- 5.1.2. Eye Cosmetics

- 5.1.3. Lip Cosmetics

- 5.1.4. Nail Cosmetics

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass

- 5.2.2. Premium

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Company Website

- 5.3.2. Retail Website

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East

- 5.4.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Online Cosmetics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Facial Cosmetics

- 6.1.2. Eye Cosmetics

- 6.1.3. Lip Cosmetics

- 6.1.4. Nail Cosmetics

- 6.2. Market Analysis, Insights and Forecast - by Category

- 6.2.1. Mass

- 6.2.2. Premium

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Company Website

- 6.3.2. Retail Website

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Online Cosmetics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Facial Cosmetics

- 7.1.2. Eye Cosmetics

- 7.1.3. Lip Cosmetics

- 7.1.4. Nail Cosmetics

- 7.2. Market Analysis, Insights and Forecast - by Category

- 7.2.1. Mass

- 7.2.2. Premium

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Company Website

- 7.3.2. Retail Website

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Online Cosmetics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Facial Cosmetics

- 8.1.2. Eye Cosmetics

- 8.1.3. Lip Cosmetics

- 8.1.4. Nail Cosmetics

- 8.2. Market Analysis, Insights and Forecast - by Category

- 8.2.1. Mass

- 8.2.2. Premium

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Company Website

- 8.3.2. Retail Website

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Online Cosmetics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Facial Cosmetics

- 9.1.2. Eye Cosmetics

- 9.1.3. Lip Cosmetics

- 9.1.4. Nail Cosmetics

- 9.2. Market Analysis, Insights and Forecast - by Category

- 9.2.1. Mass

- 9.2.2. Premium

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Company Website

- 9.3.2. Retail Website

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East Online Cosmetics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Facial Cosmetics

- 10.1.2. Eye Cosmetics

- 10.1.3. Lip Cosmetics

- 10.1.4. Nail Cosmetics

- 10.2. Market Analysis, Insights and Forecast - by Category

- 10.2.1. Mass

- 10.2.2. Premium

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Company Website

- 10.3.2. Retail Website

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Saudi Arabia Online Cosmetics Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Facial Cosmetics

- 11.1.2. Eye Cosmetics

- 11.1.3. Lip Cosmetics

- 11.1.4. Nail Cosmetics

- 11.2. Market Analysis, Insights and Forecast - by Category

- 11.2.1. Mass

- 11.2.2. Premium

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Company Website

- 11.3.2. Retail Website

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Lotus Herbals

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Shiseido Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Loreal SA

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Coty Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Natura & Co

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 NARS Cosmetics*List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Revlon

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Oriflame Cosmetics AG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Kao Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 The Estee Lauder Companies

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Lotus Herbals

List of Figures

- Figure 1: Global Online Cosmetics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Online Cosmetics Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Online Cosmetics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Online Cosmetics Industry Revenue (Million), by Category 2025 & 2033

- Figure 5: North America Online Cosmetics Industry Revenue Share (%), by Category 2025 & 2033

- Figure 6: North America Online Cosmetics Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Online Cosmetics Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Online Cosmetics Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Online Cosmetics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Online Cosmetics Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Online Cosmetics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Online Cosmetics Industry Revenue (Million), by Category 2025 & 2033

- Figure 13: Europe Online Cosmetics Industry Revenue Share (%), by Category 2025 & 2033

- Figure 14: Europe Online Cosmetics Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: Europe Online Cosmetics Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Online Cosmetics Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Online Cosmetics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Online Cosmetics Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Online Cosmetics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Online Cosmetics Industry Revenue (Million), by Category 2025 & 2033

- Figure 21: Asia Pacific Online Cosmetics Industry Revenue Share (%), by Category 2025 & 2033

- Figure 22: Asia Pacific Online Cosmetics Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Online Cosmetics Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Online Cosmetics Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Online Cosmetics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Online Cosmetics Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: South America Online Cosmetics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Online Cosmetics Industry Revenue (Million), by Category 2025 & 2033

- Figure 29: South America Online Cosmetics Industry Revenue Share (%), by Category 2025 & 2033

- Figure 30: South America Online Cosmetics Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: South America Online Cosmetics Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: South America Online Cosmetics Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Online Cosmetics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Online Cosmetics Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Middle East Online Cosmetics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Middle East Online Cosmetics Industry Revenue (Million), by Category 2025 & 2033

- Figure 37: Middle East Online Cosmetics Industry Revenue Share (%), by Category 2025 & 2033

- Figure 38: Middle East Online Cosmetics Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Middle East Online Cosmetics Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East Online Cosmetics Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East Online Cosmetics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Saudi Arabia Online Cosmetics Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 43: Saudi Arabia Online Cosmetics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Saudi Arabia Online Cosmetics Industry Revenue (Million), by Category 2025 & 2033

- Figure 45: Saudi Arabia Online Cosmetics Industry Revenue Share (%), by Category 2025 & 2033

- Figure 46: Saudi Arabia Online Cosmetics Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 47: Saudi Arabia Online Cosmetics Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: Saudi Arabia Online Cosmetics Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Saudi Arabia Online Cosmetics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Online Cosmetics Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Online Cosmetics Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 3: Global Online Cosmetics Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Online Cosmetics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Online Cosmetics Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Online Cosmetics Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 7: Global Online Cosmetics Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Online Cosmetics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Online Cosmetics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Online Cosmetics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Online Cosmetics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Online Cosmetics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Online Cosmetics Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Online Cosmetics Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 15: Global Online Cosmetics Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Online Cosmetics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Online Cosmetics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Germany Online Cosmetics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Online Cosmetics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: France Online Cosmetics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Italy Online Cosmetics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Online Cosmetics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Online Cosmetics Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 24: Global Online Cosmetics Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 25: Global Online Cosmetics Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global Online Cosmetics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: China Online Cosmetics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Japan Online Cosmetics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: India Online Cosmetics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Australia Online Cosmetics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Online Cosmetics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Online Cosmetics Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global Online Cosmetics Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 34: Global Online Cosmetics Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Online Cosmetics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Brazil Online Cosmetics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Argentina Online Cosmetics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of South America Online Cosmetics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Online Cosmetics Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 40: Global Online Cosmetics Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 41: Global Online Cosmetics Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global Online Cosmetics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Global Online Cosmetics Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 44: Global Online Cosmetics Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 45: Global Online Cosmetics Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 46: Global Online Cosmetics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 47: South Africa Online Cosmetics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Middle East Online Cosmetics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Cosmetics Industry?

The projected CAGR is approximately 8.47%.

2. Which companies are prominent players in the Online Cosmetics Industry?

Key companies in the market include Lotus Herbals, Shiseido Co Ltd, Loreal SA, Coty Inc, Natura & Co, NARS Cosmetics*List Not Exhaustive, Revlon, Oriflame Cosmetics AG, Kao Corporation, The Estee Lauder Companies.

3. What are the main segments of the Online Cosmetics Industry?

The market segments include Product Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Aging Population drives the Market Growth; Technological Advancement and Product Innovation.

6. What are the notable trends driving market growth?

Growing Inclination Towards Natural/Organic Products.

7. Are there any restraints impacting market growth?

Product Misrepresentation and Counterfeit Concerns.

8. Can you provide examples of recent developments in the market?

December 2022: Kao Corporation launched a cosmetic brand named UNLICS for Gen-Z men. The brand offers its products on the official UNLICS online retail site.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Cosmetics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Cosmetics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Cosmetics Industry?

To stay informed about further developments, trends, and reports in the Online Cosmetics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence