Key Insights

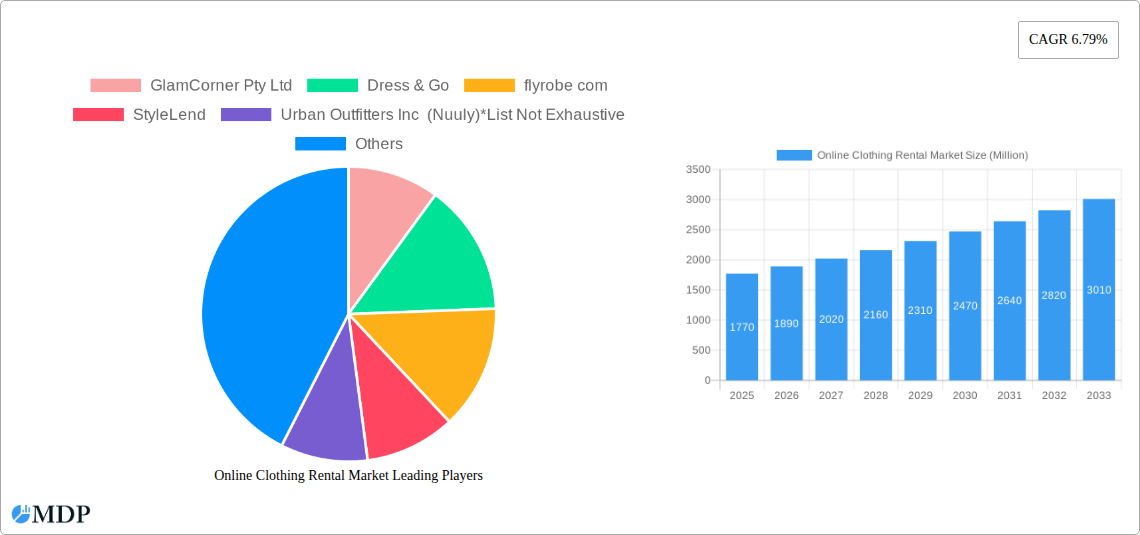

The online clothing rental market is experiencing robust growth, projected to reach a market size of $1.77 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 6.79% from 2019 to 2033. This expansion is driven by several key factors. Firstly, increasing consumer awareness of sustainability and the desire for a more circular economy are fueling demand for rental services as a more environmentally conscious alternative to traditional clothing purchases. Secondly, the convenience and affordability offered by online platforms, allowing access to a wide variety of styles without the commitment of ownership, are attracting a broader customer base. The segment breakdown reveals a diverse market, with significant participation from men, women, and children across various dress codes including formal, casual, partywear, and traditional attire. This diversity demonstrates the versatility and broad appeal of the online clothing rental model. Major players like Rent the Runway, Gwynnie Bee, and GlamCorner are leveraging technology and innovative business models to capture market share and enhance the customer experience. Geographic expansion, particularly within North America and Europe, is also a significant contributor to market growth. However, challenges remain, including managing logistics and inventory effectively to ensure timely delivery and returns, and addressing concerns around clothing hygiene and condition.

Online Clothing Rental Market Market Size (In Billion)

Looking ahead, the online clothing rental market's future growth hinges on continued innovation in technology, such as improved online platforms and personalized styling recommendations. The market will likely see increasing competition among established players and new entrants, leading to potentially more competitive pricing and a wider range of offerings. Successfully navigating the complexities of inventory management, ensuring a seamless customer experience, and maintaining a strong brand reputation will be crucial for sustained success. Furthermore, addressing any potential regulatory hurdles regarding hygiene standards and consumer protection will be paramount to market expansion. Expansion into emerging markets with growing disposable incomes and tech-savvy populations is also expected to drive growth in the coming years.

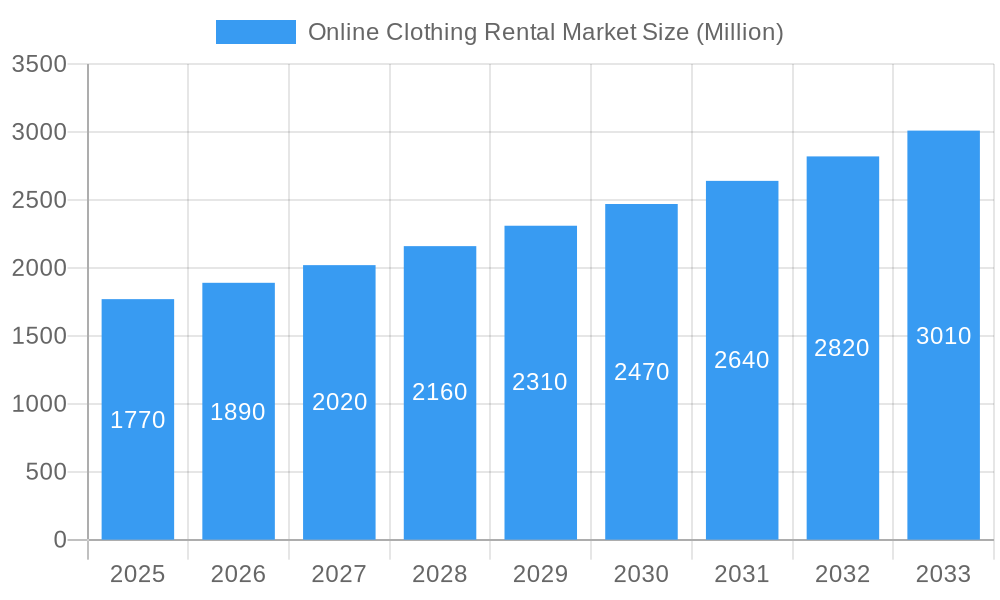

Online Clothing Rental Market Company Market Share

Online Clothing Rental Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the Online Clothing Rental Market, projecting a market value of $XX Million by 2033. The study covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering invaluable insights for industry stakeholders, investors, and entrepreneurs. Discover key trends, competitive landscapes, and growth opportunities within this dynamic market.

Online Clothing Rental Market Market Dynamics & Concentration

The online clothing rental market is characterized by moderate concentration, with several key players vying for market share. While exact figures for market share remain proprietary, Rent the Runway, GlamCorner Pty Ltd, and Nuuly (Urban Outfitters Inc.) are considered major players, each commanding a significant portion of the market. The market exhibits strong innovation, driven by technological advancements in logistics, inventory management, and customer experience. Regulatory frameworks, while evolving, generally favor the growth of the sector, particularly those promoting sustainability and circular economy initiatives. The rise of fast fashion and the increasing awareness of environmental concerns are key drivers behind the market's expansion. Substitutes include traditional clothing retail and secondhand marketplaces, although the convenience and variety offered by rental platforms provide a competitive advantage. Mergers and acquisitions (M&A) activity has been moderate, with notable collaborations and expansions as illustrated below:

- Market Concentration: Moderately concentrated, with several key players dominating.

- Innovation Drivers: Technological advancements in logistics, AI-powered recommendations, and sustainable practices.

- Regulatory Framework: Evolving, generally supportive of sustainable business models.

- Product Substitutes: Traditional retail, secondhand markets; however, rental offers unique value propositions.

- End-User Trends: Shifting towards conscious consumption and experiences over ownership.

- M&A Activities: A moderate number of collaborations and strategic partnerships, driving market consolidation. For example, the number of M&A deals between 2019 and 2024 was approximately xx.

Online Clothing Rental Market Industry Trends & Analysis

The online clothing rental market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of xx% projected between 2025 and 2033. This growth is fueled by several factors. Increased consumer awareness of sustainability and the desire for a more conscious lifestyle are key drivers. The convenience and affordability of renting, coupled with access to a wide variety of styles and brands, are significant attractions. Technological advancements in e-commerce and logistics are streamlining operations and enhancing the customer experience. However, challenges exist, including the management of garment maintenance and the potential for damage or loss. Market penetration is increasing steadily, especially among younger demographics and fashion-conscious consumers. Competitive dynamics are characterized by a blend of competition and collaboration, with companies strategically partnering to expand their reach and offerings. Specific examples include collaborations between rental platforms and established retailers to enhance brand visibility and market access.

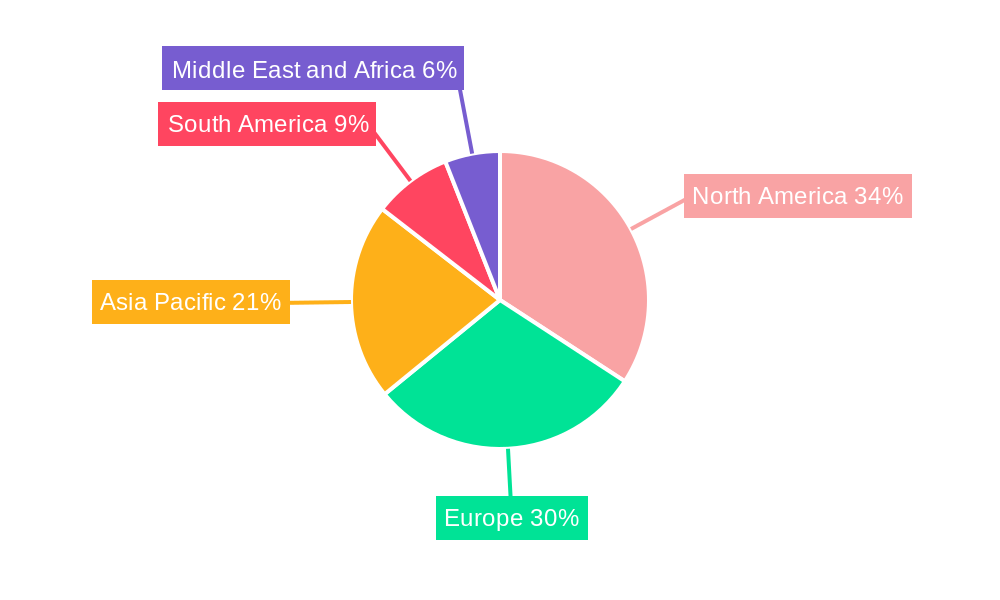

Leading Markets & Segments in Online Clothing Rental Market

The women's segment dominates the online clothing rental market, driven by high demand for versatile and stylish apparel. Within this, the partywear and casual segments are particularly strong, reflecting consumers' need for attire for diverse social occasions. Geographically, North America and Europe currently hold the largest market shares, although growth is anticipated in Asia-Pacific regions.

Key Drivers:

- Women's Segment: High demand for fashion variety and affordability.

- Partywear & Casual: Significant demand for attire suitable for diverse social events.

- North America & Europe: Established e-commerce infrastructure and high disposable incomes.

- Asia-Pacific: Emerging markets with significant growth potential.

Online Clothing Rental Market Product Developments

The online clothing rental market is witnessing continuous product innovation, incorporating features such as AI-powered styling recommendations, improved search functionalities, and more streamlined returns processes. The integration of virtual try-on tools and augmented reality (AR) technologies enhances the customer experience and minimizes uncertainties regarding fit and style. These developments address consumer demands for convenience, personalization, and a seamless online experience. The market is also witnessing the introduction of subscription models, offering flexibility and cost-effectiveness.

Key Drivers of Online Clothing Rental Market Growth

Several key factors propel the growth of the online clothing rental market. Technological advancements are continuously improving the customer experience, simplifying operations and boosting efficiency. Economic factors such as increased disposable incomes in key markets and evolving consumer preferences towards experiences over ownership contribute significantly. Finally, supportive regulatory frameworks and initiatives promoting sustainability are paving the way for market expansion. For example, government incentives promoting circular economy practices are boosting the market.

Challenges in the Online Clothing Rental Market Market

The online clothing rental market faces challenges, including the high cost of maintaining and cleaning garments, the potential for damage or loss, and the management of inventory and logistics. Competitive pressures from established retailers and the rise of other sustainable fashion options pose additional challenges. The impact of these challenges on market growth can be estimated to be around xx%.

Emerging Opportunities in Online Clothing Rental Market

Significant long-term growth opportunities are emerging. Technological advancements, particularly in AI-powered personalization and virtual try-on technology, promise to further enhance the customer experience and expand market reach. Strategic partnerships between rental platforms and established retailers or designers will likely become increasingly important. Expansion into new geographic markets, particularly in developing economies with growing middle classes, presents considerable potential.

Leading Players in the Online Clothing Rental Market Sector

- GlamCorner Pty Ltd

- Dress & Go

- flyrobe com

- StyleLend

- Urban Outfitters Inc (Nuuly)

- The Clothing Rental

- Gwynnie Bee

- Rent the Runway

- Powerlook

- Rent It Bae

Key Milestones in Online Clothing Rental Market Industry

- May 2022: Nuuly launched a new ready-to-rent collection and expanded its resale platform, signifying the increasing integration of rental and resale models within the market.

- April 2022: David Jones partnered with GlamCorner through Reloop, demonstrating a move toward collaborative models promoting the circular economy and conscious consumerism.

- July 2022: Rent the Runway partnered with Saks Off 5th, integrating pre-owned designer items into its platform, showcasing the growing importance of the secondhand market within the rental sector.

Strategic Outlook for Online Clothing Rental Market Market

The online clothing rental market presents significant growth opportunities. Strategic partnerships, technological innovations, and expansion into new markets will drive continued growth. The focus on sustainability and conscious consumption aligns with broader societal trends, ensuring long-term market viability. The market's potential to disrupt traditional fashion retail is substantial, presenting lucrative prospects for both established players and new entrants.

Online Clothing Rental Market Segmentation

-

1. End -User

- 1.1. Men

- 1.2. Women

- 1.3. Children

-

2. Dress Code

- 2.1. Formal

- 2.2. Casual

- 2.3. Partywear

- 2.4. Traditional

Online Clothing Rental Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Online Clothing Rental Market Regional Market Share

Geographic Coverage of Online Clothing Rental Market

Online Clothing Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sustainable Fashion Trend; Strategic Expansion With Respect To E-commerce Subscription

- 3.3. Market Restrains

- 3.3.1. High Cost of Rented Apparel Maintenance

- 3.4. Market Trends

- 3.4.1. Adoption of Subscription-based Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Clothing Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End -User

- 5.1.1. Men

- 5.1.2. Women

- 5.1.3. Children

- 5.2. Market Analysis, Insights and Forecast - by Dress Code

- 5.2.1. Formal

- 5.2.2. Casual

- 5.2.3. Partywear

- 5.2.4. Traditional

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End -User

- 6. North America Online Clothing Rental Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End -User

- 6.1.1. Men

- 6.1.2. Women

- 6.1.3. Children

- 6.2. Market Analysis, Insights and Forecast - by Dress Code

- 6.2.1. Formal

- 6.2.2. Casual

- 6.2.3. Partywear

- 6.2.4. Traditional

- 6.1. Market Analysis, Insights and Forecast - by End -User

- 7. Europe Online Clothing Rental Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End -User

- 7.1.1. Men

- 7.1.2. Women

- 7.1.3. Children

- 7.2. Market Analysis, Insights and Forecast - by Dress Code

- 7.2.1. Formal

- 7.2.2. Casual

- 7.2.3. Partywear

- 7.2.4. Traditional

- 7.1. Market Analysis, Insights and Forecast - by End -User

- 8. Asia Pacific Online Clothing Rental Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End -User

- 8.1.1. Men

- 8.1.2. Women

- 8.1.3. Children

- 8.2. Market Analysis, Insights and Forecast - by Dress Code

- 8.2.1. Formal

- 8.2.2. Casual

- 8.2.3. Partywear

- 8.2.4. Traditional

- 8.1. Market Analysis, Insights and Forecast - by End -User

- 9. South America Online Clothing Rental Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End -User

- 9.1.1. Men

- 9.1.2. Women

- 9.1.3. Children

- 9.2. Market Analysis, Insights and Forecast - by Dress Code

- 9.2.1. Formal

- 9.2.2. Casual

- 9.2.3. Partywear

- 9.2.4. Traditional

- 9.1. Market Analysis, Insights and Forecast - by End -User

- 10. Middle East and Africa Online Clothing Rental Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End -User

- 10.1.1. Men

- 10.1.2. Women

- 10.1.3. Children

- 10.2. Market Analysis, Insights and Forecast - by Dress Code

- 10.2.1. Formal

- 10.2.2. Casual

- 10.2.3. Partywear

- 10.2.4. Traditional

- 10.1. Market Analysis, Insights and Forecast - by End -User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GlamCorner Pty Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dress & Go

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 flyrobe com

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 StyleLend

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Urban Outfitters Inc (Nuuly)*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Clothing Rental

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gwynnie Bee

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rent the Runway

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Powerlook

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rent It Bae

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 GlamCorner Pty Ltd

List of Figures

- Figure 1: Global Online Clothing Rental Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Online Clothing Rental Market Revenue (Million), by End -User 2025 & 2033

- Figure 3: North America Online Clothing Rental Market Revenue Share (%), by End -User 2025 & 2033

- Figure 4: North America Online Clothing Rental Market Revenue (Million), by Dress Code 2025 & 2033

- Figure 5: North America Online Clothing Rental Market Revenue Share (%), by Dress Code 2025 & 2033

- Figure 6: North America Online Clothing Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Online Clothing Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Online Clothing Rental Market Revenue (Million), by End -User 2025 & 2033

- Figure 9: Europe Online Clothing Rental Market Revenue Share (%), by End -User 2025 & 2033

- Figure 10: Europe Online Clothing Rental Market Revenue (Million), by Dress Code 2025 & 2033

- Figure 11: Europe Online Clothing Rental Market Revenue Share (%), by Dress Code 2025 & 2033

- Figure 12: Europe Online Clothing Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Online Clothing Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Online Clothing Rental Market Revenue (Million), by End -User 2025 & 2033

- Figure 15: Asia Pacific Online Clothing Rental Market Revenue Share (%), by End -User 2025 & 2033

- Figure 16: Asia Pacific Online Clothing Rental Market Revenue (Million), by Dress Code 2025 & 2033

- Figure 17: Asia Pacific Online Clothing Rental Market Revenue Share (%), by Dress Code 2025 & 2033

- Figure 18: Asia Pacific Online Clothing Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Online Clothing Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Online Clothing Rental Market Revenue (Million), by End -User 2025 & 2033

- Figure 21: South America Online Clothing Rental Market Revenue Share (%), by End -User 2025 & 2033

- Figure 22: South America Online Clothing Rental Market Revenue (Million), by Dress Code 2025 & 2033

- Figure 23: South America Online Clothing Rental Market Revenue Share (%), by Dress Code 2025 & 2033

- Figure 24: South America Online Clothing Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Online Clothing Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Online Clothing Rental Market Revenue (Million), by End -User 2025 & 2033

- Figure 27: Middle East and Africa Online Clothing Rental Market Revenue Share (%), by End -User 2025 & 2033

- Figure 28: Middle East and Africa Online Clothing Rental Market Revenue (Million), by Dress Code 2025 & 2033

- Figure 29: Middle East and Africa Online Clothing Rental Market Revenue Share (%), by Dress Code 2025 & 2033

- Figure 30: Middle East and Africa Online Clothing Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Online Clothing Rental Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Online Clothing Rental Market Revenue Million Forecast, by End -User 2020 & 2033

- Table 2: Global Online Clothing Rental Market Revenue Million Forecast, by Dress Code 2020 & 2033

- Table 3: Global Online Clothing Rental Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Online Clothing Rental Market Revenue Million Forecast, by End -User 2020 & 2033

- Table 5: Global Online Clothing Rental Market Revenue Million Forecast, by Dress Code 2020 & 2033

- Table 6: Global Online Clothing Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Online Clothing Rental Market Revenue Million Forecast, by End -User 2020 & 2033

- Table 12: Global Online Clothing Rental Market Revenue Million Forecast, by Dress Code 2020 & 2033

- Table 13: Global Online Clothing Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Online Clothing Rental Market Revenue Million Forecast, by End -User 2020 & 2033

- Table 22: Global Online Clothing Rental Market Revenue Million Forecast, by Dress Code 2020 & 2033

- Table 23: Global Online Clothing Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Online Clothing Rental Market Revenue Million Forecast, by End -User 2020 & 2033

- Table 30: Global Online Clothing Rental Market Revenue Million Forecast, by Dress Code 2020 & 2033

- Table 31: Global Online Clothing Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Online Clothing Rental Market Revenue Million Forecast, by End -User 2020 & 2033

- Table 36: Global Online Clothing Rental Market Revenue Million Forecast, by Dress Code 2020 & 2033

- Table 37: Global Online Clothing Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Saudi Arabia Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: South Africa Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Clothing Rental Market?

The projected CAGR is approximately 6.79%.

2. Which companies are prominent players in the Online Clothing Rental Market?

Key companies in the market include GlamCorner Pty Ltd, Dress & Go, flyrobe com, StyleLend, Urban Outfitters Inc (Nuuly)*List Not Exhaustive, The Clothing Rental, Gwynnie Bee, Rent the Runway, Powerlook, Rent It Bae.

3. What are the main segments of the Online Clothing Rental Market?

The market segments include End -User, Dress Code.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Sustainable Fashion Trend; Strategic Expansion With Respect To E-commerce Subscription.

6. What are the notable trends driving market growth?

Adoption of Subscription-based Services.

7. Are there any restraints impacting market growth?

High Cost of Rented Apparel Maintenance.

8. Can you provide examples of recent developments in the market?

July 2022: Rent the Runway joined forces with Saks Off 5th, integrating a dedicated "pre-owned" section on its website, enabling customers to access pre-owned designer items.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Clothing Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Clothing Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Clothing Rental Market?

To stay informed about further developments, trends, and reports in the Online Clothing Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence