Key Insights

The global online lottery market, projected to reach $19.43 billion by 2025, is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2033. This expansion is fueled by increasing global smartphone penetration and widespread internet access, enhancing convenience and accessibility, particularly in emerging economies. Innovations in mobile-optimized platforms, a diverse range of game offerings including lotto, sports betting, virtual lottery terminals (VLTs), and scratch cards, along with improved user interfaces, are attracting a broader demographic. The establishment of regulated online lottery platforms is also fostering trust and promoting responsible gambling. While regulatory complexities and concerns regarding gambling addiction present potential challenges, the market is poised for sustained, robust growth.

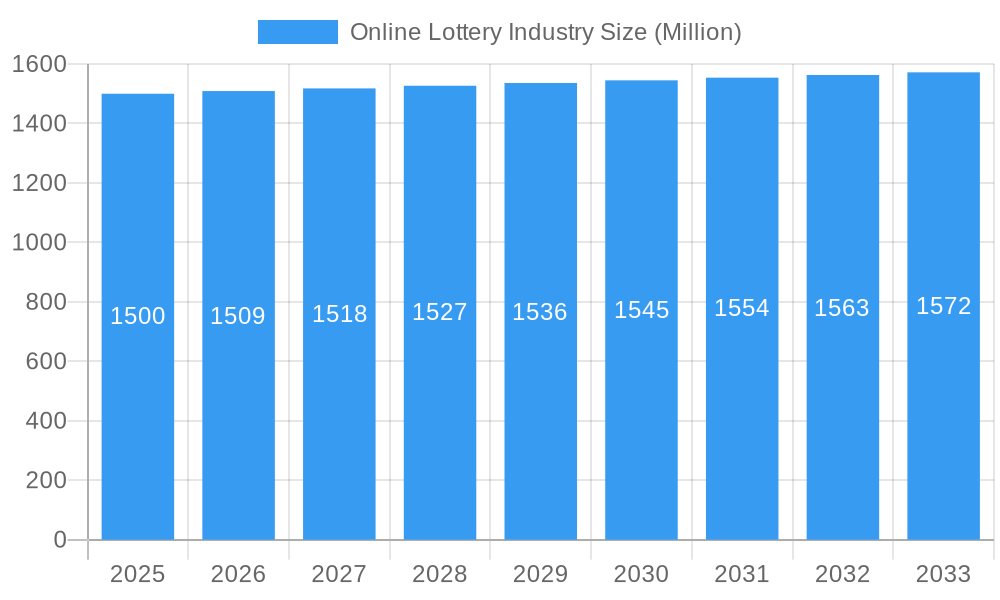

Online Lottery Industry Market Size (In Billion)

The online lottery market is characterized by a fragmented competitive landscape, with prominent players such as Lottoland, Lotto, and WinTrillions actively pursuing market share through strategic alliances, technological innovation, and targeted marketing. North America and Europe currently dominate the market, driven by high internet penetration and established regulatory frameworks. The Asia-Pacific region presents significant growth opportunities, owing to rising internet and mobile adoption, although regulatory hurdles may temper immediate expansion. Market segmentation by product type (lotto, sports betting, VLTs, scratch cards) highlights varied player preferences, with regional adoption influenced by cultural norms and existing gambling behaviors. Future market expansion will be contingent upon effective regulation, responsible gambling initiatives, and continuous technological advancements to elevate the player experience.

Online Lottery Industry Company Market Share

Unlocking the Billion-Dollar Potential: A Comprehensive Report on the Online Lottery Industry (2019-2033)

This in-depth report provides a comprehensive analysis of the global online lottery market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a detailed study period spanning 2019-2033, including a base year of 2025 and a forecast period from 2025-2033, this report unveils the dynamics driving this multi-billion dollar industry. Expect rigorous data analysis, market sizing, and future projections, revealing lucrative opportunities and potential challenges within the online lottery sector.

Online Lottery Industry Market Dynamics & Concentration

The online lottery market, valued at $XX Billion in 2024, is experiencing robust growth driven by technological advancements, increasing internet penetration, and evolving consumer preferences. Market concentration is relatively high, with a few major players commanding significant market share. However, the landscape is dynamic, with ongoing mergers and acquisitions (M&A) reshaping the competitive structure.

- Market Concentration: The top 5 players account for approximately XX% of the global market share in 2024. This number is projected to decrease to XX% by 2033 due to increased competition and market entry.

- Innovation Drivers: The integration of mobile technologies, gamification, and innovative game formats are driving market innovation. The use of blockchain technology and cryptocurrencies is also emerging as a potential disruptor.

- Regulatory Frameworks: Stringent regulations governing online gambling vary significantly across jurisdictions, creating both challenges and opportunities. Regions with clear and supportive regulations experience faster growth.

- Product Substitutes: The online lottery market faces competition from other forms of online gambling, such as sports betting and casino games. However, the unique appeal of lottery games, especially the potential for large jackpots, maintains strong consumer interest.

- End-User Trends: A shift towards mobile platforms is evident, with a growing percentage of users accessing online lotteries through smartphones and tablets. Demographic trends, such as increasing smartphone penetration and internet usage, are major growth drivers.

- M&A Activities: The number of M&A deals in the online lottery industry has increased significantly in recent years, reflecting the consolidation trend and the strategic importance of this market segment. In the historical period (2019-2024) there were XX M&A deals, with an estimated XX deals projected for the forecast period (2025-2033).

Online Lottery Industry Industry Trends & Analysis

The online lottery market is characterized by substantial growth, fueled by several key factors. The Compound Annual Growth Rate (CAGR) is estimated to be XX% from 2025 to 2033, reflecting the increasing popularity of online gaming and the expanding reach of internet access. Market penetration is currently at XX% globally, with significant potential for expansion in untapped markets. Technological disruptions, like the rise of mobile gaming and the potential for blockchain integration, are reshaping the competitive landscape. Consumer preferences are shifting towards convenience, personalized experiences, and the integration of social features within online lottery platforms. This increased convenience has increased market penetration in all segments. Competitive dynamics are marked by intense rivalry among established players and the emergence of new entrants.

Leading Markets & Segments in Online Lottery Industry

The North American and European markets currently dominate the online lottery industry. However, significant growth potential exists in Asia and Latin America.

- Dominant Region: North America holds the largest market share due to high internet penetration and a mature regulatory framework in several regions. Europe follows closely.

- Dominant Segments:

- End User: Mobile is the fastest-growing segment, surpassing desktop usage due to increased smartphone penetration and convenience.

- Product: Lotto remains the most popular product, although scratch cards and other instant-win games are gaining traction. The sports betting segment is growing as it integrates with online lottery platforms. VLT penetration is market specific and varies across regions.

Key Drivers:

- Strong economic growth and disposable income in developed markets.

- Development of robust digital infrastructure.

- Supportive regulatory environments that encourage regulated online lottery participation.

Online Lottery Industry Product Developments

Recent product innovations focus on enhancing user experience, gamification, and integration with mobile platforms. The use of advanced analytics and personalized recommendations is improving user engagement. The development of new instant-win games and the integration of sports betting features are also key trends. These innovative products cater to evolving consumer preferences and create competitive advantages.

Key Drivers of Online Lottery Industry Growth

Several factors are driving the growth of the online lottery industry. Technological advancements, such as mobile optimization and innovative game formats, are enhancing user experience. Economic factors, including rising disposable incomes in emerging markets, are fueling increased participation. Supportive regulatory environments in some regions are fostering growth, while expanding internet and mobile penetration allows for easier access and broad distribution. Examples include the growing popularity of mobile gaming and the introduction of new game formats like virtual lottery terminals.

Challenges in the Online Lottery Industry Market

The online lottery industry faces several challenges, including stringent regulations and licensing requirements, which vary significantly across jurisdictions. This creates barriers to entry and increases operational complexity. Supply chain disruptions in the case of physical prizes can impact profitability. Intense competition among established players and new entrants puts pressure on margins and necessitates innovation to remain competitive. The illegal lottery market also poses a significant threat, impacting overall market revenue.

Emerging Opportunities in Online Lottery Industry

Long-term growth is driven by opportunities in untapped markets, particularly in Asia and Latin America. Technological advancements, such as the use of augmented reality (AR) and virtual reality (VR), are creating new opportunities for immersive gaming experiences. Strategic partnerships between lottery operators and technology providers are further enhancing product offerings and expanding market reach. The increasing acceptance of cryptocurrencies in online gambling is also an area of interest for online lottery platforms.

Leading Players in the Online Lottery Industry Sector

- Lottoland

- Lotto (Note: This link may refer to multiple lottery organizations.)

- WinTrillions

- Lotto Agent

- Francaise des Jeux

- Camelot Group

- LottoKings

- ZEAL Network SE

- Lotto Direct Limited

- Annexio Limited

Key Milestones in Online Lottery Industry Industry

- December 2021: Crypto Millions Lotto launched four new lottery games (India Fantasy 5, India Million Lotto, Powerball+, Mega Millions+). This broadened their product portfolio and targeted new geographical markets.

- February 2022: ZEAL Network SE partnered with Lotto Hessian, expanding its instant win game offerings and solidifying its market position. This highlights strategic partnerships for growth.

- October 2022: ZEAL Network SE expanded internationally through a collaboration with Park Avenue Gaming, showcasing the potential for global expansion and strategic alliances in the online lottery sector.

Strategic Outlook for Online Lottery Industry Market

The online lottery market presents significant growth potential driven by technological innovation, expanding global reach, and strategic partnerships. Focus on enhancing user experience, integrating new technologies, and expanding into under-served markets will be key to success. The future of the online lottery industry lies in adapting to evolving consumer preferences, maintaining regulatory compliance, and harnessing the power of technological advancements to create engaging and profitable gaming experiences.

Online Lottery Industry Segmentation

-

1. End User

- 1.1. Desktop

- 1.2. Mobile

Online Lottery Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Sweden

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Online Lottery Industry Regional Market Share

Geographic Coverage of Online Lottery Industry

Online Lottery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Appeal for Multi-functional and Damage Control Hair Care Products; Prevalence of Different Hair Concerns Remains the Major Driving Force

- 3.3. Market Restrains

- 3.3.1. Growing Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1 Improved Internet Connections

- 3.4.2 Advances in Security

- 3.4.3 and Increased Number of Internet Users

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Lottery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Desktop

- 5.1.2. Mobile

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Online Lottery Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Desktop

- 6.1.2. Mobile

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Online Lottery Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Desktop

- 7.1.2. Mobile

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Online Lottery Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Desktop

- 8.1.2. Mobile

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. South America Online Lottery Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Desktop

- 9.1.2. Mobile

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East and Africa Online Lottery Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Desktop

- 10.1.2. Mobile

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Lottoland

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lotto

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 WinTrillions

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lotto Agent

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Francaise des Jeux

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Camelot Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LottoKings

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ZEAL Network SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Lotto Direct Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Annexio Limited*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Lottoland

List of Figures

- Figure 1: Global Online Lottery Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Online Lottery Industry Revenue (billion), by End User 2025 & 2033

- Figure 3: North America Online Lottery Industry Revenue Share (%), by End User 2025 & 2033

- Figure 4: North America Online Lottery Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Online Lottery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Online Lottery Industry Revenue (billion), by End User 2025 & 2033

- Figure 7: Europe Online Lottery Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: Europe Online Lottery Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Online Lottery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Online Lottery Industry Revenue (billion), by End User 2025 & 2033

- Figure 11: Asia Pacific Online Lottery Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Asia Pacific Online Lottery Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Online Lottery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Online Lottery Industry Revenue (billion), by End User 2025 & 2033

- Figure 15: South America Online Lottery Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: South America Online Lottery Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Online Lottery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Online Lottery Industry Revenue (billion), by End User 2025 & 2033

- Figure 19: Middle East and Africa Online Lottery Industry Revenue Share (%), by End User 2025 & 2033

- Figure 20: Middle East and Africa Online Lottery Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Online Lottery Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Online Lottery Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 2: Global Online Lottery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Online Lottery Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global Online Lottery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Rest of North America Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Online Lottery Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 10: Global Online Lottery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Spain Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Italy Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Online Lottery Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 19: Global Online Lottery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: China Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: India Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Japan Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Australia Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Online Lottery Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 26: Global Online Lottery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 27: Brazil Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Argentina Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Global Online Lottery Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 31: Global Online Lottery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: South Africa Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: United Arab Emirates Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of Middle East and Africa Online Lottery Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Lottery Industry?

The projected CAGR is approximately 9.5%.

2. Which companies are prominent players in the Online Lottery Industry?

Key companies in the market include Lottoland, Lotto, WinTrillions, Lotto Agent, Francaise des Jeux, Camelot Group, LottoKings, ZEAL Network SE, Lotto Direct Limited, Annexio Limited*List Not Exhaustive.

3. What are the main segments of the Online Lottery Industry?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.43 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Appeal for Multi-functional and Damage Control Hair Care Products; Prevalence of Different Hair Concerns Remains the Major Driving Force.

6. What are the notable trends driving market growth?

Improved Internet Connections. Advances in Security. and Increased Number of Internet Users.

7. Are there any restraints impacting market growth?

Growing Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

October 2022: Zeal Network SE expanded its games business internationally. The German market leader for online lotteries collaborated with American online lottery provider Park Avenue Gaming to integrate the online instant games of Zeal into its video lottery terminal business in Argentina and its online platforms in Peru.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Lottery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Lottery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Lottery Industry?

To stay informed about further developments, trends, and reports in the Online Lottery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence