Key Insights

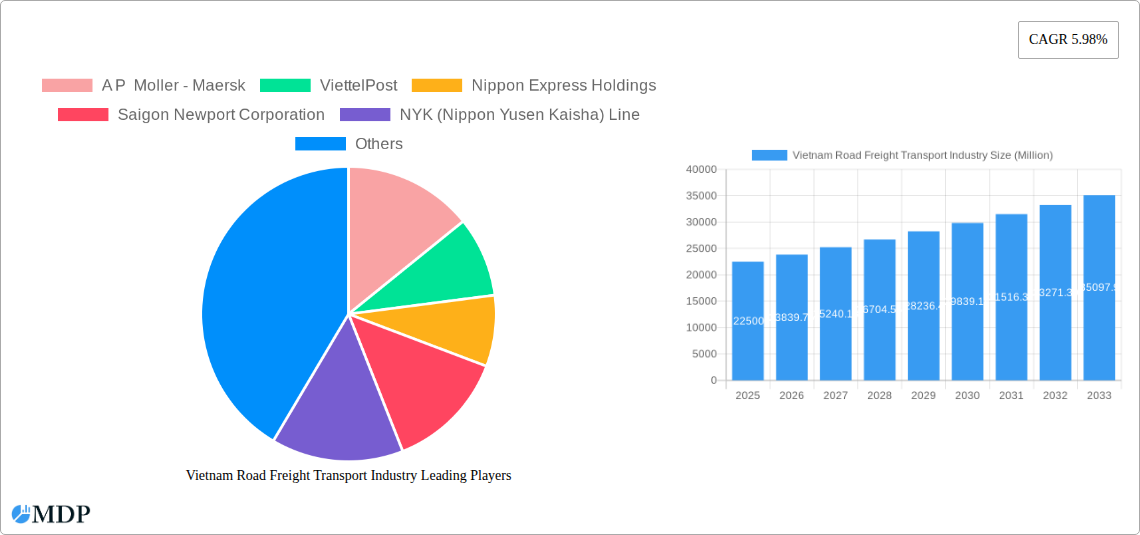

The Vietnam Road Freight Transport Industry is poised for significant growth, with a projected market size of $22.5 billion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 5.91% through 2033. This robust expansion is propelled by a dynamic economic landscape in Vietnam, characterized by increasing industrialization, a booming manufacturing sector, and a growing emphasis on both domestic and international trade. The rising demand for efficient logistics solutions across diverse end-user industries, including construction, manufacturing, and retail, serves as a primary driver. Furthermore, the government's continued investment in infrastructure development, such as road networks and logistics hubs, is expected to facilitate smoother and more cost-effective road freight operations, thereby enhancing market accessibility and efficiency. The growing adoption of advanced logistics technologies and the increasing preference for optimized supply chain management are also contributing to this upward trajectory.

Vietnam Road Freight Transport Industry Market Size (In Billion)

Key trends shaping the Vietnam Road Freight Transport Industry include the growing preference for containerized freight, especially for international trade, and the increasing demand for specialized services like temperature-controlled transport for perishables and pharmaceuticals. While the market benefits from strong drivers, it also faces certain restraints. These include potential infrastructure bottlenecks in certain regions, fluctuating fuel prices that can impact operational costs, and a growing need for skilled labor within the logistics sector to manage increasingly complex supply chains. Despite these challenges, the industry's inherent resilience, coupled with ongoing technological advancements and strategic investments by major players like A P Moller - Maersk, Nippon Express Holdings, and DHL Group, positions it for sustained and substantial growth. The market's segmentation, covering various truckload specifications, goods configurations, and distances, indicates a diverse and evolving demand landscape.

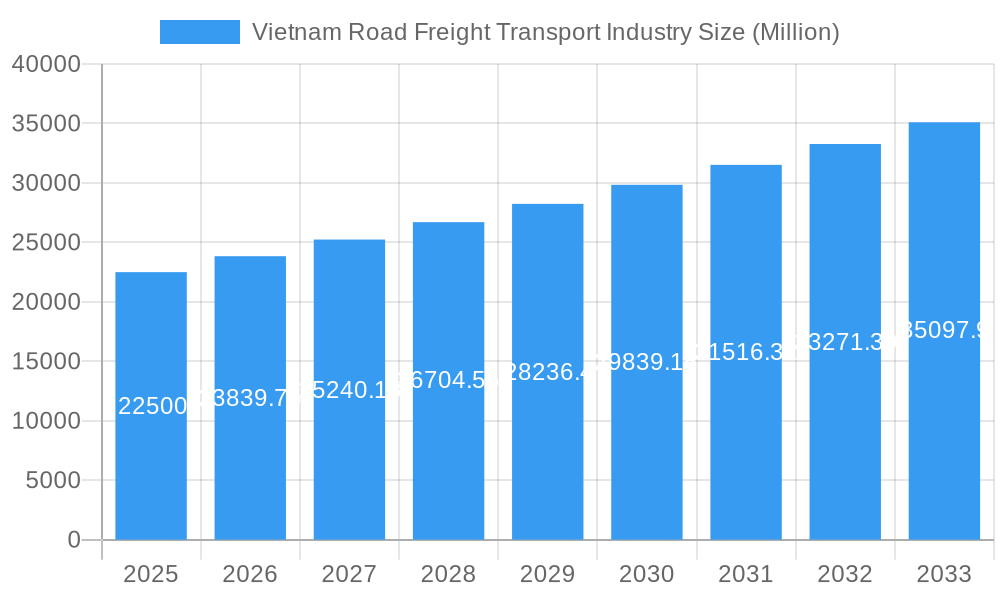

Vietnam Road Freight Transport Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Vietnam Road Freight Transport Industry, offering crucial insights for industry stakeholders, investors, and logistics professionals. Covering the historical period of 2019–2024 and forecasting through 2033, with a base and estimated year of 2025, this report delves into market dynamics, segmentation, technological advancements, and key players shaping the future of freight movement in Vietnam. Discover the expansive market size, projected to reach billions, driven by a robust economy and increasing trade volumes.

Vietnam Road Freight Transport Industry Market Dynamics & Concentration

The Vietnam road freight transport market, valued in the billions, is experiencing dynamic shifts characterized by moderate concentration. Major players like A P Moller - Maersk and ViettelPost command significant market share, driven by extensive networks and strategic investments. Innovation is a key differentiator, with companies focusing on digitalizing operations, enhancing route optimization, and improving fleet management. Regulatory frameworks, while evolving to support trade, can present both opportunities and challenges, particularly concerning cross-border logistics and environmental standards. Product substitutes, such as rail and sea freight, are increasingly integrated into multimodal solutions, influencing demand for road transport services. End-user trends reveal a strong demand from Manufacturing, Wholesale and Retail Trade, and Construction sectors, which are expanding rapidly. Mergers and acquisitions (M&A) activities are on the rise, indicating a consolidation phase with approximately 5–10 significant M&A deals anticipated within the forecast period, aimed at expanding service offerings and geographic reach.

- Market Concentration: Moderate, with key players holding substantial market share.

- Innovation Drivers: Digitalization, route optimization, fleet management, sustainable practices.

- Regulatory Frameworks: Evolving policies supporting trade, with potential for increased compliance requirements.

- Product Substitutes: Rail, sea freight, and integrated multimodal solutions.

- End-User Trends: High demand from Manufacturing, Wholesale & Retail Trade, and Construction.

- M&A Activities: Increasing consolidation, with an estimated xx–xx deals annually in the forecast period.

Vietnam Road Freight Transport Industry Industry Trends & Analysis

The Vietnam road freight transport industry is poised for significant growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 7%–9% over the forecast period (2025–2033). This expansion is fueled by Vietnam's robust economic performance, increasing international trade activities, and substantial foreign direct investment flowing into the manufacturing sector. Technological disruptions are playing a pivotal role, with the adoption of AI-powered route planning, real-time tracking systems, and the integration of IoT devices for fleet management enhancing operational efficiency and transparency. Consumer preferences are shifting towards faster, more reliable, and environmentally conscious logistics solutions, pushing service providers to invest in greener fleets and optimized delivery networks. The competitive dynamics are intensifying, marked by strategic partnerships and service diversification. Market penetration is expected to deepen as smaller logistics providers are acquired or collaborate with larger entities to leverage advanced technologies and expand their service portfolios. The growth of e-commerce and the burgeoning manufacturing hub status of Vietnam are foundational pillars supporting this upward trajectory, ensuring sustained demand for efficient road freight solutions.

Leading Markets & Segments in Vietnam Road Freight Transport Industry

The Domestic segment of the Vietnam road freight transport industry holds a dominant position, driven by extensive intra-country trade and the growth of various end-user industries. Within end-user industries, Manufacturing represents the largest contributor to freight volumes, accounting for an estimated 30%–35% of the market, followed closely by Wholesale and Retail Trade at 25%–30%. The Construction sector also contributes significantly, fueled by ongoing infrastructure development and urbanization.

- Dominant Destination: Domestic freight movement is a key driver due to internal economic activity and supply chain requirements.

- Key End User Industries:

- Manufacturing: Strong demand for raw material transport and finished goods distribution, comprising 30%–35% of the market share.

- Wholesale and Retail Trade: Extensive movement of consumer goods, accounting for 25%–30%.

- Construction: Demand for building materials and equipment, representing an estimated 15%–20%.

- Agriculture, Fishing, and Forestry: Significant volumes, particularly for raw produce and processed goods.

- Oil and Gas: Specialized transport needs for exploration and distribution.

- Mining and Quarrying: Heavy haulage requirements for raw materials.

- Others: Encompassing a range of specialized logistics needs.

In terms of Truckload Specification, Full-Truck-Load (FTL) services are prevalent for bulk shipments, while Less than-Truck-Load (LTL) options cater to smaller, consolidated shipments, offering cost-effectiveness. Containerization is a critical aspect, with Containerized freight dominating international trade and increasingly utilized for domestic long-haul movements, estimated at 60%–70% of total containerized cargo moved by road. Non-Containerized transport remains crucial for oversized or specialized goods. The Distance segmentation sees Long Haul routes connecting major economic centers and ports, while Short Haul is vital for last-mile delivery and regional distribution. Goods Configuration is diverse, with Solid Goods constituting the majority, but Fluid Goods requiring specialized tanker transport. Non-Temperature Controlled transport is the norm for most commodities, though a growing segment requires Temperature Controlled solutions for perishable and sensitive goods.

- Truckload Specification: FTL for bulk, LTL for consolidated shipments.

- Containerization: Containerized freight leads for international and long-haul domestic, with an estimated 60%–70% share.

- Distance: Long Haul connects major hubs, Short Haul for regional and last-mile delivery.

- Goods Configuration: Solid Goods dominate, with increasing demand for Fluid Goods transport.

- Temperature Control: Non-Temperature Controlled is standard, with a growing niche for Temperature Controlled services.

Vietnam Road Freight Transport Industry Product Developments

Recent product developments in the Vietnam road freight transport industry focus on enhancing efficiency, visibility, and sustainability. Companies are investing in advanced telematics and IoT solutions for real-time fleet monitoring, predictive maintenance, and optimized fuel consumption. The integration of digital platforms for booking, tracking, and payment is streamlining operations and improving customer experience. Furthermore, there's a growing emphasis on the development of multimodal solutions, linking road transport with other modes for seamless end-to-end logistics. Innovations in specialized vehicle design, such as fuel-efficient trucks and those equipped for specific cargo types, are also gaining traction, offering competitive advantages.

Key Drivers of Vietnam Road Freight Transport Industry Growth

The growth of the Vietnam road freight transport industry is primarily driven by the nation's robust economic expansion and its increasing role as a global manufacturing and export hub. Favorable government policies promoting trade and infrastructure development, such as the expansion of highways and logistics centers, are crucial enablers. The burgeoning e-commerce sector and a growing middle class with increasing purchasing power further stimulate demand for efficient and timely delivery services. Technological advancements in logistics management software and fleet optimization are enhancing operational efficiency and cost-effectiveness.

- Economic Growth: Vietnam's sustained GDP growth fuels increased production and consumption.

- Trade Expansion: Growing exports and imports necessitate efficient freight movement.

- Infrastructure Development: Government investments in roads and logistics facilities improve connectivity.

- E-commerce Boom: Rapid growth in online retail drives demand for last-mile delivery.

- Technological Adoption: Digitalization and automation enhance operational capabilities.

Challenges in the Vietnam Road Freight Transport Industry Market

Despite its growth, the Vietnam road freight transport industry faces several challenges. Inadequate road infrastructure in certain regions, coupled with traffic congestion, can lead to delays and increased operational costs. A shortage of skilled truck drivers and logistics professionals poses a significant labor challenge. Regulatory hurdles, including complex customs procedures for international freight and evolving environmental regulations, can create compliance burdens. Intense competition among a fragmented market of logistics providers also puts pressure on profit margins, making it difficult for smaller players to invest in necessary upgrades and technology.

- Infrastructure Limitations: Congestion and underdeveloped road networks in some areas.

- Skilled Labor Shortage: Difficulty in recruiting and retaining qualified drivers and logistics staff.

- Regulatory Complexity: Navigating diverse and evolving compliance requirements.

- Intense Competition: Price pressures and market fragmentation.

Emerging Opportunities in Vietnam Road Freight Transport Industry

Emerging opportunities in the Vietnam road freight transport industry lie in the continued digitalization and integration of supply chains. The expansion of cross-border e-commerce presents a significant avenue for growth, requiring specialized logistics solutions for international shipments. Investments in green logistics, including the adoption of electric vehicles and sustainable warehousing practices, are becoming increasingly important as environmental consciousness rises. Strategic partnerships between logistics providers, technology companies, and end-user industries can unlock new efficiencies and service offerings. The development of advanced logistics hubs and smart city initiatives will further streamline freight movement and create new demand for innovative transport solutions.

Leading Players in the Vietnam Road Freight Transport Industry Sector

A P Moller - Maersk ViettelPost Nippon Express Holdings Saigon Newport Corporation NYK (Nippon Yusen Kaisha) Line ASG Corporation DHL Group Nguyen Ngoc Logistics Corporation GEODIS Gemadept Rhenus Group Hop Nhat International Joint Stock Company VNT Logistic Macs Shipping Corporation MP Logistics Linfox Pty Ltd PetroVietnam Transport Corporation Kintetsu Group Holdings Co Ltd Vinatrans Indo Trans Logistics Corporation Transimex Corporation Bee Logistics Corporation U&I Logistics Corporation Bolloré Group Aviation Logistics Corporation (ALS) Royal Cargo Expeditors International of Washington Inc Viet Total Logistics Co Ltd

Key Milestones in Vietnam Road Freight Transport Industry Industry

- August 2023: Viettel Post and KOIMA signed a strategic cooperation agreement in logistics, investment, and trade, aligning with Viettel Post's goal of establishing national logistics infrastructure and promoting cross-border commerce.

- August 2023: GEODIS launched its expanded Road Network from Southeast Asia to China, offering secure, day-definite, and environmentally friendly solutions connecting Singapore, Malaysia, Thailand, Vietnam, and China, integrated with major air and sea ports for multimodal options.

- July 2023: Nippon Express (Vietnam) opened its NX Yen Phong Logistics Center in Bac Ninh province, enhancing inventory control, sorting, packing for apparel and electronics, and serving as a distribution center with bonded inventory management services.

Strategic Outlook for Vietnam Road Freight Transport Industry Market

The strategic outlook for the Vietnam road freight transport industry is exceptionally positive, driven by ongoing economic growth and the nation's strategic position in global supply chains. Continued investments in infrastructure, coupled with the adoption of cutting-edge logistics technologies like AI and blockchain, will be crucial for service providers to enhance efficiency, transparency, and sustainability. Strategic partnerships and collaborations will enable companies to expand their service portfolios and geographic reach, catering to the evolving demands of sectors like manufacturing and e-commerce. The industry's ability to adapt to evolving regulatory landscapes and embrace greener logistics practices will be key to unlocking long-term, sustainable growth and maintaining a competitive edge in the dynamic Vietnamese market.

Vietnam Road Freight Transport Industry Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

Vietnam Road Freight Transport Industry Segmentation By Geography

- 1. Vietnam

Vietnam Road Freight Transport Industry Regional Market Share

Geographic Coverage of Vietnam Road Freight Transport Industry

Vietnam Road Freight Transport Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Road Freight Transport Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 A P Moller - Maersk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ViettelPost

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nippon Express Holdings

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Saigon Newport Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NYK (Nippon Yusen Kaisha) Line

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ASG Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DHL Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nguyen Ngoc Logistics Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GEODIS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Gemadept

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rhenus Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hop Nhat International Joint Stock Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 VNT Logistic

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Macs Shipping Corporation

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 MP Logistics

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Linfox Pty Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 PetroVietnam Transport Corporation

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Kintetsu Group Holdings Co Ltd

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Vinatrans

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Indo Trans Logistics Corporation

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Transimex Corporation

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 Bee Logistics Corporation

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 U&I Logistics Corporation

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.24 Bolloré Group

- 6.2.24.1. Overview

- 6.2.24.2. Products

- 6.2.24.3. SWOT Analysis

- 6.2.24.4. Recent Developments

- 6.2.24.5. Financials (Based on Availability)

- 6.2.25 Aviation Logistics Corporation (ALS)

- 6.2.25.1. Overview

- 6.2.25.2. Products

- 6.2.25.3. SWOT Analysis

- 6.2.25.4. Recent Developments

- 6.2.25.5. Financials (Based on Availability)

- 6.2.26 Royal Cargo

- 6.2.26.1. Overview

- 6.2.26.2. Products

- 6.2.26.3. SWOT Analysis

- 6.2.26.4. Recent Developments

- 6.2.26.5. Financials (Based on Availability)

- 6.2.27 Expeditors International of Washington Inc

- 6.2.27.1. Overview

- 6.2.27.2. Products

- 6.2.27.3. SWOT Analysis

- 6.2.27.4. Recent Developments

- 6.2.27.5. Financials (Based on Availability)

- 6.2.28 Viet Total Logistics Co Ltd

- 6.2.28.1. Overview

- 6.2.28.2. Products

- 6.2.28.3. SWOT Analysis

- 6.2.28.4. Recent Developments

- 6.2.28.5. Financials (Based on Availability)

- 6.2.1 A P Moller - Maersk

List of Figures

- Figure 1: Vietnam Road Freight Transport Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Vietnam Road Freight Transport Industry Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 2: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Destination 2020 & 2033

- Table 3: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Truckload Specification 2020 & 2033

- Table 4: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Containerization 2020 & 2033

- Table 5: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Distance 2020 & 2033

- Table 6: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Goods Configuration 2020 & 2033

- Table 7: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Temperature Control 2020 & 2033

- Table 8: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 9: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 10: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Destination 2020 & 2033

- Table 11: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Truckload Specification 2020 & 2033

- Table 12: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Containerization 2020 & 2033

- Table 13: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Distance 2020 & 2033

- Table 14: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Goods Configuration 2020 & 2033

- Table 15: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Temperature Control 2020 & 2033

- Table 16: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Road Freight Transport Industry?

The projected CAGR is approximately 5.91%.

2. Which companies are prominent players in the Vietnam Road Freight Transport Industry?

Key companies in the market include A P Moller - Maersk, ViettelPost, Nippon Express Holdings, Saigon Newport Corporation, NYK (Nippon Yusen Kaisha) Line, ASG Corporation, DHL Group, Nguyen Ngoc Logistics Corporation, GEODIS, Gemadept, Rhenus Group, Hop Nhat International Joint Stock Company, VNT Logistic, Macs Shipping Corporation, MP Logistics, Linfox Pty Ltd, PetroVietnam Transport Corporation, Kintetsu Group Holdings Co Ltd, Vinatrans, Indo Trans Logistics Corporation, Transimex Corporation, Bee Logistics Corporation, U&I Logistics Corporation, Bolloré Group, Aviation Logistics Corporation (ALS), Royal Cargo, Expeditors International of Washington Inc, Viet Total Logistics Co Ltd.

3. What are the main segments of the Vietnam Road Freight Transport Industry?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

August 2023: Viettel Post and KOIMA also signed a strategic cooperation agreement in the fields of logistics, investment, and trade. This initiative is aligned with Viettel Post's strategy to establish a national logistics infrastructure and promote cross-border commerce.August 2023: GEODIS has expanded its Road Network from Southeast Asia (SEA) to China providing secure day-definite, and environmentally friendly solutions connecting Singapore, Malaysia, Thailand, Vietnam, and China. GEODIS Road Network is integrated with major air and sea ports and offers multimodal options to meet customer needs. Road network has offically launched on August 2023.July 2023: Nippon Express (Vietnam) has opened its NX Yen Phong Logistics Center in the northern province of Bac Ninh. The warehouse will perform tasks such as inventory control, sorting, and packing of apparel and electrical/electronic equipment. It will also serve as a distribution center for Hanoi and other parts of northern Vietnam and provide bonded inventory management services for Export Processing Enterprises (EPEs).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Road Freight Transport Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Road Freight Transport Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Road Freight Transport Industry?

To stay informed about further developments, trends, and reports in the Vietnam Road Freight Transport Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence