Key Insights

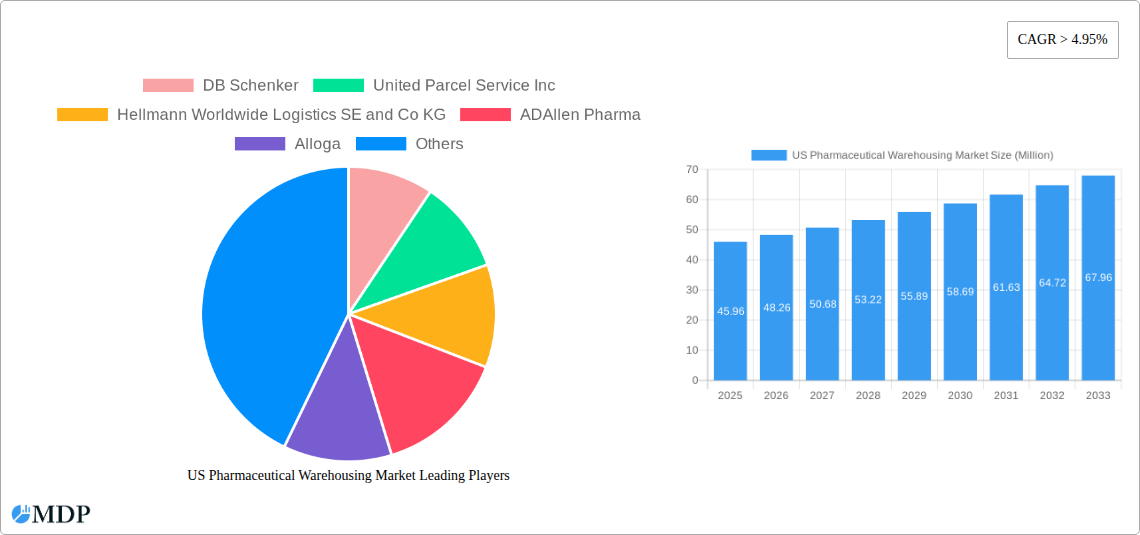

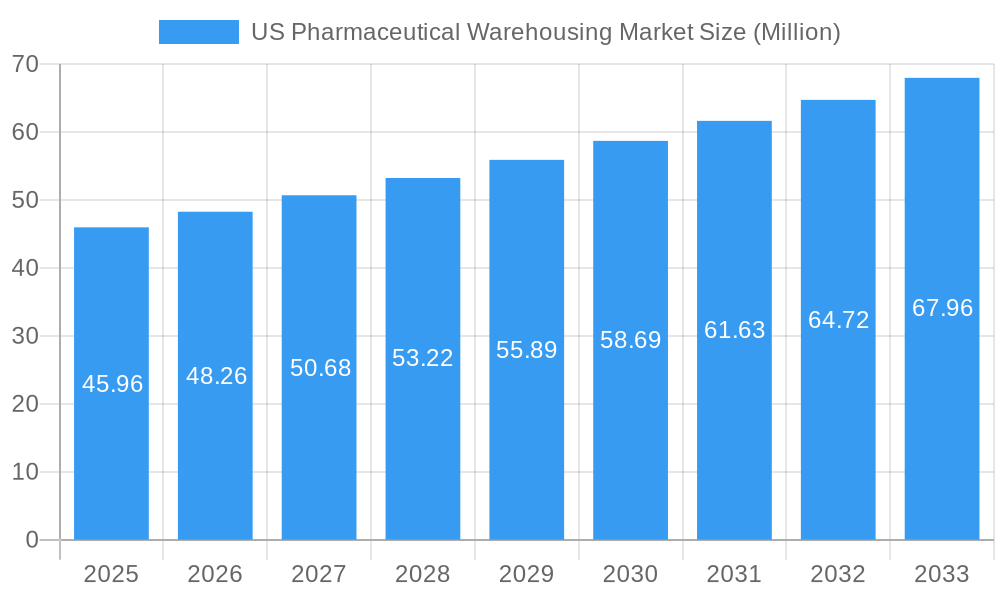

The US Pharmaceutical Warehousing Market is poised for significant expansion, projecting a market size of $45.96 million by 2025, with a robust CAGR exceeding 4.95% over the forecast period of 2025-2033. This growth is primarily propelled by the increasing complexity of pharmaceutical supply chains, the escalating demand for temperature-sensitive biologics and vaccines, and stringent regulatory requirements that necessitate specialized warehousing infrastructure. The "drivers" such as advancements in cold chain technology, the growing global pharmaceutical market, and the rise of e-commerce in healthcare are fueling this upward trajectory. Furthermore, the "trends" of increasing outsourcing of logistics by pharmaceutical companies, the adoption of advanced technologies like IoT for real-time monitoring, and the expansion of specialized warehousing facilities for niche drug categories are shaping the market landscape. The market is segmented into Cold Chain Warehouses and Non-Cold Chain Warehouses, with applications spanning pharmaceutical factories, pharmacies, hospitals, and other healthcare-related entities. Major players like DB Schenker, United Parcel Service Inc., and FedEx Corp. are actively investing in expanding their capacities and technological capabilities to cater to the evolving needs of the pharmaceutical industry.

US Pharmaceutical Warehousing Market Market Size (In Million)

The "restrains" such as the high cost associated with establishing and maintaining state-of-the-art pharmaceutical warehousing, particularly cold chain facilities, and the potential for supply chain disruptions due to unforeseen events, present challenges to the market's uninhibited growth. However, the inherent necessity of secure and compliant storage for pharmaceuticals, coupled with the continuous innovation in logistics solutions, is expected to outweigh these limitations. The focus on optimizing inventory management, reducing lead times, and ensuring product integrity throughout the supply chain remains paramount. The competitive landscape is characterized by strategic partnerships, mergers, and acquisitions as companies strive to enhance their service offerings and geographical reach. The US pharmaceutical warehousing sector is thus a dynamic and critical component of the broader healthcare ecosystem, vital for the timely and safe delivery of essential medicines.

US Pharmaceutical Warehousing Market Company Market Share

Unlock critical insights into the dynamic US Pharmaceutical Warehousing Market with this in-depth report, covering the period from 2019 to 2033. This analysis provides a granular view of market dynamics, industry trends, leading segments, and key players, offering actionable intelligence for stakeholders in the pharmaceutical logistics sector. With an estimated market size projected to reach XX Million by 2033, this report delves into the essential factors shaping the future of pharmaceutical storage and distribution across the United States.

US Pharmaceutical Warehousing Market Market Dynamics & Concentration

The US pharmaceutical warehousing market is characterized by a moderately concentrated landscape, with a few dominant players holding significant market share. Key players like DB Schenker, United Parcel Service Inc., FedEx Corp., and Kuehne Nagel Management AG are at the forefront, offering extensive networks and specialized services. Innovation is primarily driven by the increasing demand for sophisticated cold chain logistics and the need for temperature-controlled storage solutions to preserve the efficacy of high-value biologics and vaccines. Regulatory frameworks, particularly stringent Good Distribution Practices (GDP) and evolving FDA guidelines, play a crucial role in shaping operational standards and investment decisions. Product substitutes are limited due to the highly specialized nature of pharmaceutical warehousing, but advancements in temperature-controlled transportation technology offer some alternatives. End-user trends highlight a growing preference for outsourced logistics solutions, enabling pharmaceutical companies to focus on core competencies. Mergers and acquisitions (M&A) activities are strategic moves to expand geographical reach, enhance service offerings, and consolidate market presence. For instance, the past few years have seen a steady number of M&A deals, averaging around 3-5 significant transactions annually, aimed at acquiring specialized capabilities or expanding into key pharmaceutical hubs.

US Pharmaceutical Warehousing Market Industry Trends & Analysis

The US pharmaceutical warehousing market is experiencing robust growth, propelled by several converging industry trends. The escalating demand for biopharmaceuticals, vaccines, and temperature-sensitive drugs is a primary growth driver, necessitating specialized cold chain warehousing solutions. Technological advancements, including the integration of Internet of Things (IoT) for real-time temperature monitoring, advanced Warehouse Management Systems (WMS), and automation in handling processes, are significantly enhancing operational efficiency and reducing the risk of product spoilage. Consumer preferences are shifting towards faster delivery times and greater transparency in the supply chain, pushing logistics providers to invest in agile and responsive warehousing infrastructure. Competitive dynamics are intensifying, with a focus on value-added services such as kitting, packaging, and reverse logistics. The market penetration of specialized pharmaceutical warehousing services is steadily increasing, with an estimated CAGR of 7.5% between 2025 and 2033. The increasing complexity of drug manufacturing and the growing number of smaller, specialized pharmaceutical companies contribute to a rising reliance on third-party logistics (3PL) providers. Furthermore, the expanding healthcare sector and aging population globally are contributing to a sustained increase in the volume of pharmaceutical products requiring secure and compliant storage. The adoption of sustainable warehousing practices, including energy-efficient designs and waste reduction initiatives, is also becoming a key differentiator and a focus for industry leaders.

Leading Markets & Segments in US Pharmaceutical Warehousing Market

Dominant Region: The United States itself is the leading market for pharmaceutical warehousing due to its vast pharmaceutical manufacturing base, extensive distribution network, and high consumption of pharmaceutical products.

- Key Drivers of Dominance:

- Robust Pharmaceutical Industry: Home to a significant number of global pharmaceutical and biotechnology companies.

- Advanced Healthcare Infrastructure: A well-developed healthcare system with numerous hospitals and pharmacies driving demand.

- Technological Adoption: High propensity for adopting advanced warehousing technologies and automation.

- Favorable Regulatory Environment: While stringent, it also fosters a mature and compliant logistics sector.

Dominant Segment by Type: Cold Chain Warehouse commands a significant and growing share within the US pharmaceutical warehousing market. The increasing prevalence of biologics, vaccines, and specialized therapies that require precise temperature control at all stages of storage and transit is the primary driver. The global cold chain logistics market is projected to reach over $400 Billion by 2030, with the US being a substantial contributor.

- Detailed Dominance Analysis:

- The development and distribution of temperature-sensitive pharmaceuticals, including mRNA vaccines, monoclonal antibodies, and gene therapies, necessitate sophisticated cold chain infrastructure. This includes controlled room temperature (20-25 degrees Celsius), refrigerated (2-8 degrees Celsius), frozen (-20 degrees Celsius), and ultra-low temperature (-80 degrees Celsius and below) storage capabilities.

- Investments in advanced refrigeration systems, real-time temperature monitoring, and validation services are critical for compliance and product integrity, thus driving demand for specialized cold chain warehousing.

- The expansion of biopharmaceutical manufacturing facilities and the growing pipeline of biologic drugs further solidify the dominance of cold chain warehousing.

Dominant Segment by Application: Pharmaceutical Factory warehouses are crucial for initial storage and staging of manufactured drugs before distribution. However, the growth in direct-to-patient models and specialized dispensing through Pharmacies and Hospitals is increasingly influencing warehousing strategies.

- Detailed Dominance Analysis:

- Pharmaceutical Factories: Essential for large-scale storage of finished products, raw materials, and active pharmaceutical ingredients (APIs). These facilities often integrate with manufacturing operations.

- Pharmacies: With the rise of specialty pharmacies and mail-order services, dedicated pharmaceutical warehousing supporting pharmacy fulfillment is experiencing significant growth. This includes the handling of high-value, temperature-sensitive medications.

- Hospitals: Require efficient warehousing for onsite inventory management, emergency stock, and distribution to various hospital departments. The increasing complexity of hospital supply chains drives demand for optimized pharmaceutical storage solutions.

- Others (including Distribution Centers and Wholesalers): These segments are fundamental to the overall supply chain, acting as intermediaries and playing a vital role in regional and national distribution networks. The trend towards centralized distribution centers is gaining momentum.

US Pharmaceutical Warehousing Market Product Developments

Product developments in the US pharmaceutical warehousing market are primarily focused on enhancing temperature control, ensuring regulatory compliance, and improving operational efficiency. Innovations in ultra-low temperature storage solutions, advancements in passive and active temperature-controlled packaging, and the integration of AI-powered WMS for predictive analytics are key trends. The development of modular and scalable warehousing solutions allows companies to adapt to fluctuating inventory needs. Furthermore, there's a growing emphasis on eco-friendly warehousing designs, incorporating renewable energy sources and sustainable materials to reduce the environmental footprint. These developments aim to provide greater product integrity, streamline supply chain operations, and meet the evolving demands of the pharmaceutical industry for secure and compliant storage.

Key Drivers of US Pharmaceutical Warehousing Market Growth

The US pharmaceutical warehousing market's growth is propelled by several key factors. The escalating demand for biologics, vaccines, and specialty drugs, which often require stringent temperature control, is a primary driver. Technological advancements, including the adoption of IoT for real-time monitoring, automation, and advanced WMS, enhance efficiency and product safety. Evolving regulatory landscapes, such as strict GDP compliance, necessitate specialized warehousing capabilities. The increasing outsourcing of logistics by pharmaceutical manufacturers to 3PL providers seeking cost-effectiveness and expertise further fuels market expansion. Additionally, the growing prevalence of chronic diseases and an aging population contribute to higher drug consumption, thereby increasing the need for robust warehousing infrastructure.

Challenges in the US Pharmaceutical Warehousing Market Market

Despite its growth, the US pharmaceutical warehousing market faces several challenges. Stringent and ever-evolving regulatory requirements, including those from the FDA and international bodies, demand continuous investment in compliance and specialized infrastructure, such as cold chain capabilities. High operational costs associated with maintaining temperature-controlled environments, energy consumption, and specialized equipment pose a significant hurdle. A shortage of skilled labor trained in handling pharmaceutical products and adhering to strict safety protocols is another concern. Furthermore, supply chain disruptions, whether from natural disasters, geopolitical events, or pandemics, can severely impact the availability and integrity of pharmaceutical products, necessitating resilient and flexible warehousing solutions. Intense competition among logistics providers also pressures profit margins.

Emerging Opportunities in US Pharmaceutical Warehousing Market

Emerging opportunities in the US pharmaceutical warehousing market are ripe for strategic exploitation. The burgeoning demand for cell and gene therapies, which require highly specialized ultra-low temperature storage and handling, presents a significant growth avenue. The increasing adoption of direct-to-patient (DTP) and direct-to-consumer (DTC) models for pharmaceuticals and medical supplies is creating new warehousing and last-mile delivery requirements. Strategic partnerships between pharmaceutical manufacturers and 3PL providers are deepening, leading to more integrated and customized warehousing solutions. Furthermore, the expansion of e-commerce for prescription drugs and over-the-counter medications will drive the need for sophisticated order fulfillment and warehousing capabilities. Investment in sustainable warehousing practices and green logistics solutions also presents an opportunity to enhance brand reputation and attract environmentally conscious clients.

Leading Players in the US Pharmaceutical Warehousing Market Sector

- DB Schenker

- United Parcel Service Inc.

- Hellmann Worldwide Logistics SE and Co KG

- ADAllen Pharma

- Alloga

- FedEx Corp.

- Rhenus SE and Co KG

- CEVA Logistics

- Bio Pharma Logistics

- Kuehne Nagel Management AG

- XPO Logistics Inc.

- GEODIS SA

- KRC Logistics

Key Milestones in US Pharmaceutical Warehousing Market Industry

- April 2023: MD Logistics LLC, a group company of NIPPON EXPRESS HOLDINGS, INC., opened the Garner 2000 Pharmaceutical Logistics Center, a dedicated pharmaceutical warehouse in Garner, North Carolina (US). North Carolina is a key hub for the pharmaceutical industry in the United States (US), with numerous major pharmaceutical manufacturers and life science companies expanding into the state. It is also home to many research institutes and universities with amassed significant medical knowledge and technologies. MD includes four warehouses in Indiana and one in Nevada. It located its sixth US warehouse in North Carolina, where pharmaceutical logistics needs are high and expected to grow further. This expansion bolsters NIPPON EXPRESS's presence in a critical pharmaceutical hub.

- February 2023: Langham Logistics, one of the leading third-party logistics and freight management companies, opened its third warehouse in Whiteland, Indiana. This latest warehouse boasts 500,000 sq ft of dedicated space. It is designed to maintain storage environments by temperature zone: controlled room temperature (20-25 degrees Celsius), refrigerated (2-8 degrees Celsius), frozen (-20 degrees Celsius), and an ultra-low temperature freezer farm. The new facility will provide access to the ocean, air, freight, truckload, expedited, less than truckload, intermodal, and cGDP transport capabilities. It features an environmentally friendly design, including solar energy capture, HVLS fans, LED lights with motion detection, and battery-operated fork trucks. This development highlights advancements in sustainable and temperature-controlled warehousing.

Strategic Outlook for US Pharmaceutical Warehousing Market Market

The strategic outlook for the US pharmaceutical warehousing market is characterized by continued innovation and expansion. Growth accelerators include the increasing demand for specialized cold chain solutions, driven by advancements in biologics and vaccines. The adoption of advanced technologies like AI, IoT, and automation will be crucial for enhancing efficiency, ensuring compliance, and providing real-time visibility across the supply chain. Strategic partnerships and consolidations are expected to continue as companies seek to expand their service portfolios and geographical reach. Furthermore, the growing emphasis on sustainability and green logistics will shape future warehousing designs and operational strategies. The market is poised for sustained growth, driven by an aging population, evolving healthcare needs, and the continuous development of new pharmaceutical therapies.

US Pharmaceutical Warehousing Market Segmentation

-

1. Type

- 1.1. Cold Chain Warehouse

- 1.2. Non-Cold Chain Warehouse

-

2. Application

- 2.1. Pharmaceutical Factory

- 2.2. Pharmacy

- 2.3. Hospital

- 2.4. Others

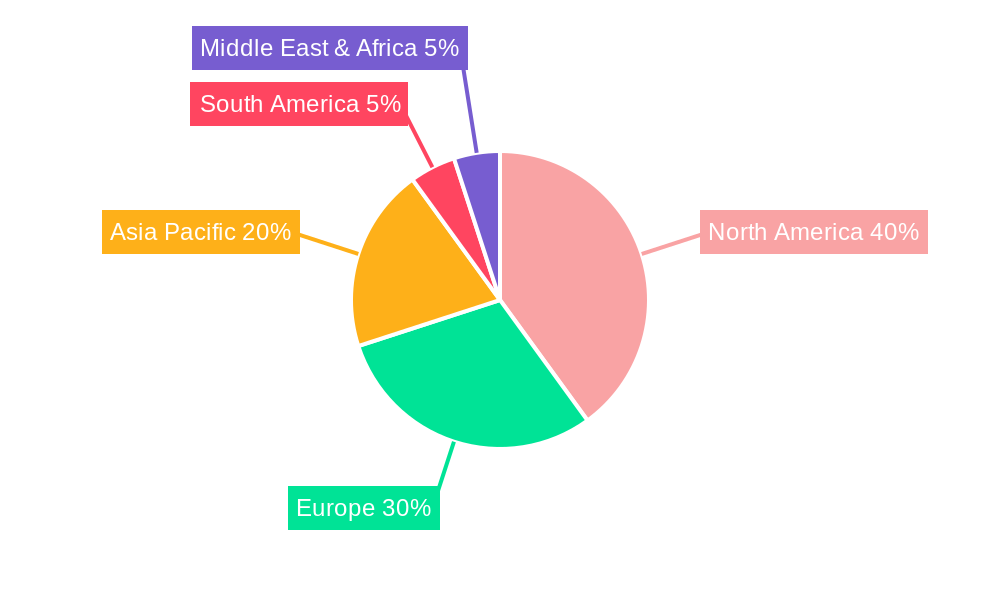

US Pharmaceutical Warehousing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Pharmaceutical Warehousing Market Regional Market Share

Geographic Coverage of US Pharmaceutical Warehousing Market

US Pharmaceutical Warehousing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased focus on quality and product sensitivity in the pharma industry; Automation at warehouses to increase efficiency and accuracy

- 3.3. Market Restrains

- 3.3.1. Stringent FDA rules & regulations towards Pharmaceutical Warehousing

- 3.4. Market Trends

- 3.4.1. Increase in need of pharmaceutical products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cold Chain Warehouse

- 5.1.2. Non-Cold Chain Warehouse

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pharmaceutical Factory

- 5.2.2. Pharmacy

- 5.2.3. Hospital

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America US Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cold Chain Warehouse

- 6.1.2. Non-Cold Chain Warehouse

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Pharmaceutical Factory

- 6.2.2. Pharmacy

- 6.2.3. Hospital

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America US Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cold Chain Warehouse

- 7.1.2. Non-Cold Chain Warehouse

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Pharmaceutical Factory

- 7.2.2. Pharmacy

- 7.2.3. Hospital

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe US Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cold Chain Warehouse

- 8.1.2. Non-Cold Chain Warehouse

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Pharmaceutical Factory

- 8.2.2. Pharmacy

- 8.2.3. Hospital

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa US Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cold Chain Warehouse

- 9.1.2. Non-Cold Chain Warehouse

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Pharmaceutical Factory

- 9.2.2. Pharmacy

- 9.2.3. Hospital

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific US Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cold Chain Warehouse

- 10.1.2. Non-Cold Chain Warehouse

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Pharmaceutical Factory

- 10.2.2. Pharmacy

- 10.2.3. Hospital

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 United Parcel Service Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hellmann Worldwide Logistics SE and Co KG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ADAllen Pharma

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alloga

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 FedEx Corp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rhenus SE and Co KG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CEVA Logistics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bio Pharma Logistics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kuehne Nagel Management AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 XPO Logistics Inc **List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 GEODIS SA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 KRC Logistics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global US Pharmaceutical Warehousing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Pharmaceutical Warehousing Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America US Pharmaceutical Warehousing Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America US Pharmaceutical Warehousing Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America US Pharmaceutical Warehousing Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America US Pharmaceutical Warehousing Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America US Pharmaceutical Warehousing Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America US Pharmaceutical Warehousing Market Revenue (Million), by Type 2025 & 2033

- Figure 9: South America US Pharmaceutical Warehousing Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America US Pharmaceutical Warehousing Market Revenue (Million), by Application 2025 & 2033

- Figure 11: South America US Pharmaceutical Warehousing Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: South America US Pharmaceutical Warehousing Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America US Pharmaceutical Warehousing Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe US Pharmaceutical Warehousing Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe US Pharmaceutical Warehousing Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe US Pharmaceutical Warehousing Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe US Pharmaceutical Warehousing Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe US Pharmaceutical Warehousing Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe US Pharmaceutical Warehousing Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa US Pharmaceutical Warehousing Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa US Pharmaceutical Warehousing Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa US Pharmaceutical Warehousing Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Middle East & Africa US Pharmaceutical Warehousing Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East & Africa US Pharmaceutical Warehousing Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa US Pharmaceutical Warehousing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific US Pharmaceutical Warehousing Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific US Pharmaceutical Warehousing Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific US Pharmaceutical Warehousing Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Asia Pacific US Pharmaceutical Warehousing Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific US Pharmaceutical Warehousing Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific US Pharmaceutical Warehousing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Pharmaceutical Warehousing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global US Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global US Pharmaceutical Warehousing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global US Pharmaceutical Warehousing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global US Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global US Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global US Pharmaceutical Warehousing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global US Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global US Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global US Pharmaceutical Warehousing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global US Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global US Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global US Pharmaceutical Warehousing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global US Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global US Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global US Pharmaceutical Warehousing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global US Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 39: Global US Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific US Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Pharmaceutical Warehousing Market?

The projected CAGR is approximately > 4.95%.

2. Which companies are prominent players in the US Pharmaceutical Warehousing Market?

Key companies in the market include DB Schenker, United Parcel Service Inc, Hellmann Worldwide Logistics SE and Co KG, ADAllen Pharma, Alloga, FedEx Corp, Rhenus SE and Co KG, CEVA Logistics, Bio Pharma Logistics, Kuehne Nagel Management AG, XPO Logistics Inc **List Not Exhaustive, GEODIS SA, KRC Logistics.

3. What are the main segments of the US Pharmaceutical Warehousing Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 45.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased focus on quality and product sensitivity in the pharma industry; Automation at warehouses to increase efficiency and accuracy.

6. What are the notable trends driving market growth?

Increase in need of pharmaceutical products.

7. Are there any restraints impacting market growth?

Stringent FDA rules & regulations towards Pharmaceutical Warehousing.

8. Can you provide examples of recent developments in the market?

April 2023: MD Logistics LLC, a group company of NIPPON EXPRESS HOLDINGS, INC., opened the Garner 2000 Pharmaceutical Logistics Center, a dedicated pharmaceutical warehouse in Garner, North Carolina (US). North Carolina is a key hub for the pharmaceutical industry in the United States (US), with numerous major pharmaceutical manufacturers and life science companies expanding into the state. It is also home to many research institutes and universities with amassed significant medical knowledge and technologies. MD includes four warehouses in Indiana and one in Nevada. It located its sixth US warehouse in North Carolina, where pharmaceutical logistics needs are high and expected to grow further.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Pharmaceutical Warehousing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Pharmaceutical Warehousing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Pharmaceutical Warehousing Market?

To stay informed about further developments, trends, and reports in the US Pharmaceutical Warehousing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence