Key Insights

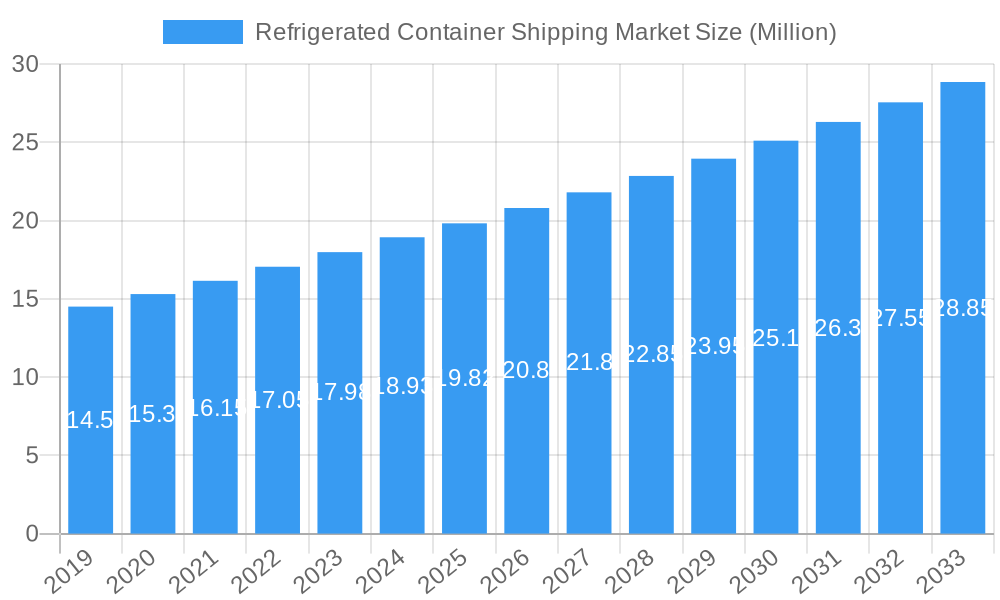

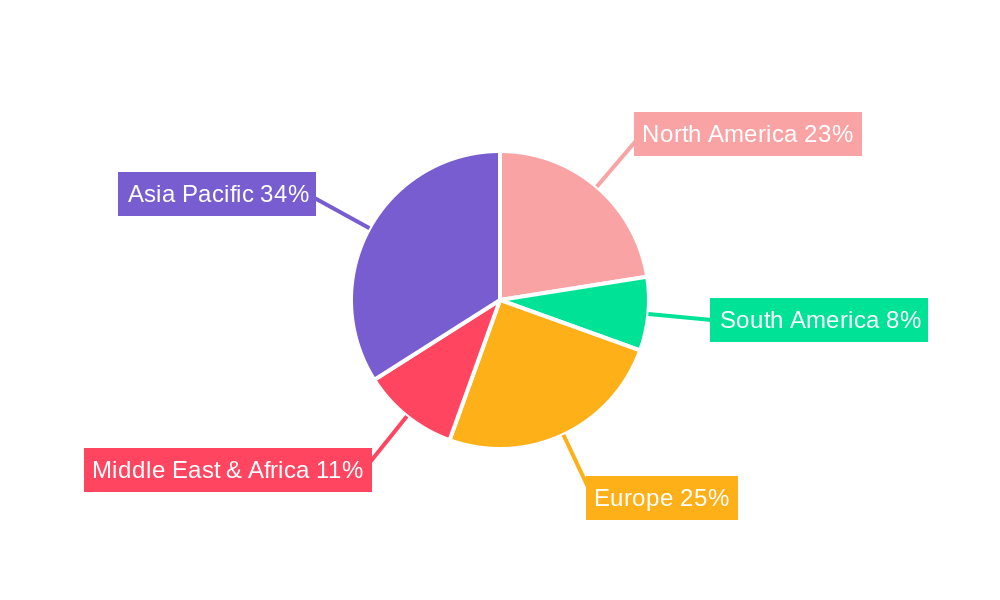

The global refrigerated container shipping market is poised for robust expansion, projected to reach a substantial USD 19.82 billion by 2025. This growth is fueled by an estimated Compound Annual Growth Rate (CAGR) of 5.98% from 2019 to 2033. The increasing demand for temperature-sensitive goods, particularly perishables like fruits and vegetables, meat products, and dairy, is a primary driver. Furthermore, the expanding pharmaceutical sector and the critical need for the safe and efficient transportation of vaccines and biologicals, especially in the wake of global health events, are significantly contributing to market momentum. The advancements in reefer container technology, including enhanced energy efficiency, remote monitoring, and sophisticated climate control systems, are also playing a crucial role in meeting stringent regulatory requirements and ensuring product integrity throughout the supply chain. The Asia Pacific region is expected to emerge as a dominant force, driven by its large population, burgeoning middle class, and increasing consumption of chilled and frozen foods.

Refrigerated Container Shipping Market Market Size (In Million)

However, the market faces certain headwinds. Fluctuations in fuel prices, geopolitical instability impacting trade routes, and the high capital expenditure required for modern reefer fleets can pose significant challenges. Additionally, the complexity of cold chain logistics, requiring specialized infrastructure and stringent adherence to international standards, can limit accessibility for smaller players. Despite these restraints, the continuous innovation in reefer technology, coupled with the growing global emphasis on food safety and the pharmaceutical cold chain, is expected to propel the market forward. Key players like A P Moller - Maersk A/S, MSC Mediterranean Shipping Company S.A., and Ocean Network Express Pte. Ltd. are actively investing in expanding their reefer fleets and enhancing their cold chain capabilities to cater to the evolving demands of global trade. The expanding application segments, beyond traditional perishables to include pharmaceuticals and chemicals, highlight the versatility and critical importance of refrigerated container shipping in modern commerce.

Refrigerated Container Shipping Market Company Market Share

Refrigerated Container Shipping Market: Global Outlook & Strategic Insights 2025-2033

Unlock critical insights into the dynamic global Refrigerated Container Shipping Market, a pivotal sector for temperature-sensitive cargo. This comprehensive report delves deep into market dynamics, industry trends, leading segments, and strategic opportunities shaping the future of cold chain logistics. With a meticulous study period spanning from 2019 to 2033, a base year of 2025, and a forecast period of 2025–2033, this analysis provides actionable intelligence for stakeholders in reefer shipping, perishable goods transportation, and pharmaceutical logistics. Explore market growth drivers, technological advancements, competitive landscapes, and emerging trends to inform your business strategies and capitalize on the expanding global cold chain market.

Refrigerated Container Shipping Market Market Dynamics & Concentration

The Refrigerated Container Shipping Market exhibits a moderate to high level of concentration, with key players dominating global trade routes. Innovation drivers are primarily focused on energy efficiency, advanced temperature monitoring technologies, and the development of sustainable reefer container solutions. Regulatory frameworks, such as international food safety standards and greenhouse gas emission targets, significantly influence operational practices and investment decisions in cold chain transport. Product substitutes, while limited for highly perishable goods, include alternative transportation methods for less sensitive items, impacting demand for specialized reefer services. End-user trends highlight a growing demand for ethically sourced and transparently transported goods, pushing for enhanced traceability within the cold chain. Mergers and acquisitions (M&A) are a significant feature, with companies consolidating to achieve economies of scale and expand service portfolios. Notable M&A activities have seen major shipping lines acquire or merge with container leasing companies and logistics providers, driving consolidation. The market share for leading players continues to be influenced by fleet size, technological adoption, and global network reach. M&A deal counts indicate a steady stream of strategic consolidations aimed at strengthening market position and expanding service offerings in the temperature-controlled shipping sector.

Refrigerated Container Shipping Market Industry Trends & Analysis

The Refrigerated Container Shipping Market is poised for robust growth, driven by a confluence of escalating global demand for perishable goods, increasing pharmaceutical exports, and advancements in cold chain technology. The projected Compound Annual Growth Rate (CAGR) for the forecast period is estimated at 6.8%, reflecting a sustained upward trajectory. Market penetration is deepening across developed and developing economies as infrastructure for cold chain logistics improves. Key growth drivers include the expanding middle class in emerging markets, leading to higher consumption of fruits, vegetables, and meat products. Furthermore, the burgeoning pharmaceutical industry, with its increasing reliance on temperature-sensitive vaccines and biologics, represents a significant and rapidly growing segment for reefer cargo. Technological disruptions are paramount, with the adoption of Internet of Things (IoT) enabled reefer containers offering real-time monitoring of temperature, humidity, and cargo condition, thereby minimizing spoilage and enhancing supply chain efficiency. Advancements in insulation materials and refrigeration units are also contributing to reduced energy consumption and environmental impact. Consumer preferences are shifting towards greater awareness of food safety and quality, demanding more sophisticated cold chain solutions that ensure product integrity from origin to destination. The competitive dynamics are characterized by intense rivalry among established shipping lines, specialized reefer container operators, and integrated logistics providers, all vying for market share through service innovation, competitive pricing, and network expansion. The increasing volume of e-commerce for groceries and pharmaceuticals further fuels the demand for efficient and reliable cold chain shipping services.

Leading Markets & Segments in Refrigerated Container Shipping Market

The Seaways transportation mode remains the dominant force in the global Refrigerated Container Shipping Market, accounting for approximately 85% of the total market share. This dominance is attributed to its cost-effectiveness and capacity for handling large volumes of cargo over long distances, crucial for international trade in perishable goods.

- Dominant Regions: Asia-Pacific, particularly China, holds a significant share due to its extensive manufacturing base for reefer containers and its role as a major exporter of fruits, vegetables, and seafood. North America and Europe are also key markets, driven by strong domestic consumption of refrigerated products and advanced logistics infrastructure.

- Key Drivers for Seaways Dominance:

- Economies of scale offered by large container vessels.

- Established global port infrastructure and shipping networks.

- Cost efficiency for bulk transportation of temperature-sensitive goods.

- Government policies supporting international trade and maritime transport.

Within the Application segment, Fruits and Vegetables and Meat Products collectively represent the largest market share, driven by global dietary trends and increasing consumer demand. The Pharmaceuticals and Vaccines and Biologicals segments, while smaller in volume, represent high-value markets with stringent temperature control requirements.

Application Segment Dominance:

- Fruits and Vegetables: Driven by increasing global consumption, year-round availability through international trade, and growing demand for exotic produce. Economic policies promoting agricultural exports and imports contribute to this growth.

- Meat Products: Fueled by rising disposable incomes and changing dietary habits in developing economies. Stringent regulations regarding food safety and traceability in this segment also necessitate reliable cold chain solutions.

- Pharmaceuticals & Vaccines and Biologicals: This segment is experiencing rapid growth due to the increasing production of biologics, vaccines, and temperature-sensitive medications. Advancements in healthcare, coupled with global health initiatives, are significant growth catalysts. Government investments in healthcare infrastructure and research play a crucial role.

Transportation Mode Analysis:

- Seaways: Continues to be the backbone of reefer container shipping, facilitating intercontinental trade.

- Roadways: Crucial for last-mile delivery and intra-continental transport, connecting ports and distribution centers to end consumers. Infrastructure development and the growth of e-commerce are driving its importance.

- Railways: Offers a sustainable and cost-effective alternative for long-haul land transport, complementing seaway and roadway networks, especially in regions with developed rail infrastructure.

Refrigerated Container Shipping Market Product Developments

Product innovations in the Refrigerated Container Shipping Market are primarily focused on enhancing energy efficiency, improving temperature precision, and increasing cargo visibility. Advanced insulation materials, like vacuum insulated panels, are being integrated into reefer containers to reduce power consumption and maintain stable internal temperatures. Smart container technology, leveraging IoT sensors, provides real-time data on temperature, humidity, and even potential impacts, offering unparalleled cargo monitoring and proactive issue resolution. These developments are crucial for minimizing spoilage in sensitive cargo such as fruits and vegetables, meat products, and critically, vaccines and biologicals and pharmaceuticals. The competitive advantage lies in offering more reliable, sustainable, and data-driven cold chain solutions that meet the stringent demands of global supply chains.

Key Drivers of Refrigerated Container Shipping Market Growth

The Refrigerated Container Shipping Market is propelled by several key drivers. The increasing global demand for perishable goods, fueled by population growth and evolving dietary preferences, is a primary catalyst. Technological advancements in reefer container technology, including smart sensors and energy-efficient refrigeration systems, are enhancing operational efficiency and cargo integrity. Growing pharmaceutical and healthcare sectors, with their increasing reliance on temperature-sensitive medicines and vaccines, represent a significant growth avenue. Furthermore, government initiatives promoting international trade and stricter food safety regulations worldwide are compelling businesses to invest in robust cold chain logistics. The expansion of e-commerce for groceries and pharmaceuticals also necessitates more sophisticated and widespread cold chain shipping capabilities.

Challenges in the Refrigerated Container Shipping Market Market

Despite its growth potential, the Refrigerated Container Shipping Market faces several challenges. High initial investment costs for reefer containers and supporting infrastructure can be a barrier for smaller players. The complex and fragmented nature of the global supply chain, coupled with potential disruptions from geopolitical events or natural disasters, poses significant risks to timely delivery and cargo integrity. Strict and varying international regulations concerning food safety, emissions, and hazardous materials can create compliance hurdles. Fierce competition among a multitude of providers leads to price pressures, impacting profitability. Moreover, the need for specialized maintenance and skilled personnel for operating and managing reefer units adds to operational complexity.

Emerging Opportunities in Refrigerated Container Shipping Market

Emerging opportunities in the Refrigerated Container Shipping Market lie in leveraging technological breakthroughs and expanding into underserved markets. The rise of precision agriculture and the increasing demand for organic and specialty produce are creating niche markets for specialized cold chain solutions. The growing pharmaceutical market in developing economies, coupled with the global push for vaccine distribution, presents significant expansion opportunities. Strategic partnerships between container leasing companies, shipping lines, and technology providers can foster innovation and offer integrated cold chain services. Furthermore, the development of greener and more sustainable refrigeration technologies, aligned with global environmental goals, will unlock new market potential and appeal to environmentally conscious stakeholders. The increasing adoption of digitalization and big data analytics within the cold chain offers opportunities for optimizing routes, predicting potential issues, and improving overall supply chain visibility.

Leading Players in the Refrigerated Container Shipping Market Sector

- Seaco Srl

- Hapag-Lloyd AG

- Singamas Container Holdings Ltd

- SeaCube Container Leasing Ltd

- China International Marine Containers (Group) Co Ltd

- ZIM Integrated Shipping Services Ltd

- Ocean Network Express Pte Ltd

- MSC Mediterranean Shipping Company S A

- BSL Containers Ltd

- Almar Container Group

- Triton International Ltd

- A P Moller - Maersk A/S

- 6 3 Other Companies

Key Milestones in Refrigerated Container Shipping Market Industry

- November 2023: Maersk initiated the construction of its expansive cold storage facility in Rotterdam, The Netherlands. This state-of-the-art warehouse, strategically positioned adjacent to the APM Terminals (Maasvlakte) II terminal, is designed for the storage of temperature-sensitive or frozen goods such as pharmaceuticals, fruits, meats, and fish. Anticipated to be completed in Q4 2024, the facility will boast an impressive annual flow throughput capacity exceeding 43,000 ftf (40 feet equivalent units). It will play a crucial role in Maersk's integrated logistics solution, catering to the needs of its customers in North-Western Europe.

- January 2023: A.P. Moller-Maersk (Maersk) successfully concluded the acquisition of Martin Bencher Group, a Danish Project Logistics specialist with exceptional capabilities in non-containerized project logistics and global operations. The transaction, valued at approximately USD 61 million on a post-IFRS16 basis, was announced on 5 August 2022, assuming a constant foreign exchange rate. This valuation corresponds to an EV/EBITDA multiple of 7.1, based on the estimated post-IFRS16 EBITDA for the full year 2021. The acquisition reinforces Maersk's commitment to expanding its expertise and global presence in project logistics.

Strategic Outlook for Refrigerated Container Shipping Market Market

The strategic outlook for the Refrigerated Container Shipping Market is overwhelmingly positive, driven by sustained global demand for temperature-controlled goods and ongoing technological advancements. Future growth accelerators include the continued expansion of e-commerce for groceries and pharmaceuticals, requiring more sophisticated and accessible cold chain logistics. Investments in smart technologies, such as IoT and AI for route optimization and predictive maintenance, will be critical for competitive advantage. Furthermore, the increasing focus on sustainability will drive demand for energy-efficient reefer containers and greener logistics solutions. Strategic partnerships and potential consolidation will continue to shape the market, enabling players to offer end-to-end cold chain management services. The growing importance of vaccines and biologicals transportation will also present significant long-term growth opportunities, demanding specialized expertise and stringent adherence to quality standards.

Refrigerated Container Shipping Market Segmentation

-

1. Transportation Mode

- 1.1. Seaways

- 1.2. Roadways

- 1.3. Railways

-

2. Application

- 2.1. Fruits and Vegetables

- 2.2. Meat Products

- 2.3. Dairy Products

- 2.4. Vaccines and Biologicals

- 2.5. Pharmaceuticals

- 2.6. Chemicals

- 2.7. Other Applications

Refrigerated Container Shipping Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Refrigerated Container Shipping Market Regional Market Share

Geographic Coverage of Refrigerated Container Shipping Market

Refrigerated Container Shipping Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. Rising demand for pharmaceutical market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Refrigerated Container Shipping Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 5.1.1. Seaways

- 5.1.2. Roadways

- 5.1.3. Railways

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Fruits and Vegetables

- 5.2.2. Meat Products

- 5.2.3. Dairy Products

- 5.2.4. Vaccines and Biologicals

- 5.2.5. Pharmaceuticals

- 5.2.6. Chemicals

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 6. North America Refrigerated Container Shipping Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 6.1.1. Seaways

- 6.1.2. Roadways

- 6.1.3. Railways

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Fruits and Vegetables

- 6.2.2. Meat Products

- 6.2.3. Dairy Products

- 6.2.4. Vaccines and Biologicals

- 6.2.5. Pharmaceuticals

- 6.2.6. Chemicals

- 6.2.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 7. South America Refrigerated Container Shipping Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 7.1.1. Seaways

- 7.1.2. Roadways

- 7.1.3. Railways

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Fruits and Vegetables

- 7.2.2. Meat Products

- 7.2.3. Dairy Products

- 7.2.4. Vaccines and Biologicals

- 7.2.5. Pharmaceuticals

- 7.2.6. Chemicals

- 7.2.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 8. Europe Refrigerated Container Shipping Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 8.1.1. Seaways

- 8.1.2. Roadways

- 8.1.3. Railways

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Fruits and Vegetables

- 8.2.2. Meat Products

- 8.2.3. Dairy Products

- 8.2.4. Vaccines and Biologicals

- 8.2.5. Pharmaceuticals

- 8.2.6. Chemicals

- 8.2.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 9. Middle East & Africa Refrigerated Container Shipping Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 9.1.1. Seaways

- 9.1.2. Roadways

- 9.1.3. Railways

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Fruits and Vegetables

- 9.2.2. Meat Products

- 9.2.3. Dairy Products

- 9.2.4. Vaccines and Biologicals

- 9.2.5. Pharmaceuticals

- 9.2.6. Chemicals

- 9.2.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 10. Asia Pacific Refrigerated Container Shipping Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 10.1.1. Seaways

- 10.1.2. Roadways

- 10.1.3. Railways

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Fruits and Vegetables

- 10.2.2. Meat Products

- 10.2.3. Dairy Products

- 10.2.4. Vaccines and Biologicals

- 10.2.5. Pharmaceuticals

- 10.2.6. Chemicals

- 10.2.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Seaco Srl

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hapag-Lloyd AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Singamas Container Holdings Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SeaCube Container Leasing Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 China International Marine Containers (Group) Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ZIM Integrated Shipping Services Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ocean Network Express Pte Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 MSC Mediterranean Shipping Company S A

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BSL Containers Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Almar Container Group**List Not Exhaustive 6 3 Other Companie

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Triton International Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 A P Moller - Maersk A/S

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Seaco Srl

List of Figures

- Figure 1: Global Refrigerated Container Shipping Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Refrigerated Container Shipping Market Revenue (Million), by Transportation Mode 2025 & 2033

- Figure 3: North America Refrigerated Container Shipping Market Revenue Share (%), by Transportation Mode 2025 & 2033

- Figure 4: North America Refrigerated Container Shipping Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Refrigerated Container Shipping Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Refrigerated Container Shipping Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Refrigerated Container Shipping Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Refrigerated Container Shipping Market Revenue (Million), by Transportation Mode 2025 & 2033

- Figure 9: South America Refrigerated Container Shipping Market Revenue Share (%), by Transportation Mode 2025 & 2033

- Figure 10: South America Refrigerated Container Shipping Market Revenue (Million), by Application 2025 & 2033

- Figure 11: South America Refrigerated Container Shipping Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: South America Refrigerated Container Shipping Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Refrigerated Container Shipping Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Refrigerated Container Shipping Market Revenue (Million), by Transportation Mode 2025 & 2033

- Figure 15: Europe Refrigerated Container Shipping Market Revenue Share (%), by Transportation Mode 2025 & 2033

- Figure 16: Europe Refrigerated Container Shipping Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Refrigerated Container Shipping Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Refrigerated Container Shipping Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Refrigerated Container Shipping Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Refrigerated Container Shipping Market Revenue (Million), by Transportation Mode 2025 & 2033

- Figure 21: Middle East & Africa Refrigerated Container Shipping Market Revenue Share (%), by Transportation Mode 2025 & 2033

- Figure 22: Middle East & Africa Refrigerated Container Shipping Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Middle East & Africa Refrigerated Container Shipping Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East & Africa Refrigerated Container Shipping Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Refrigerated Container Shipping Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Refrigerated Container Shipping Market Revenue (Million), by Transportation Mode 2025 & 2033

- Figure 27: Asia Pacific Refrigerated Container Shipping Market Revenue Share (%), by Transportation Mode 2025 & 2033

- Figure 28: Asia Pacific Refrigerated Container Shipping Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Asia Pacific Refrigerated Container Shipping Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Refrigerated Container Shipping Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Refrigerated Container Shipping Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Refrigerated Container Shipping Market Revenue Million Forecast, by Transportation Mode 2020 & 2033

- Table 2: Global Refrigerated Container Shipping Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Refrigerated Container Shipping Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Refrigerated Container Shipping Market Revenue Million Forecast, by Transportation Mode 2020 & 2033

- Table 5: Global Refrigerated Container Shipping Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Refrigerated Container Shipping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Refrigerated Container Shipping Market Revenue Million Forecast, by Transportation Mode 2020 & 2033

- Table 11: Global Refrigerated Container Shipping Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Refrigerated Container Shipping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Refrigerated Container Shipping Market Revenue Million Forecast, by Transportation Mode 2020 & 2033

- Table 17: Global Refrigerated Container Shipping Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Refrigerated Container Shipping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Refrigerated Container Shipping Market Revenue Million Forecast, by Transportation Mode 2020 & 2033

- Table 29: Global Refrigerated Container Shipping Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Refrigerated Container Shipping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Refrigerated Container Shipping Market Revenue Million Forecast, by Transportation Mode 2020 & 2033

- Table 38: Global Refrigerated Container Shipping Market Revenue Million Forecast, by Application 2020 & 2033

- Table 39: Global Refrigerated Container Shipping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Refrigerated Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Refrigerated Container Shipping Market?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the Refrigerated Container Shipping Market?

Key companies in the market include Seaco Srl, Hapag-Lloyd AG, Singamas Container Holdings Ltd, SeaCube Container Leasing Ltd, China International Marine Containers (Group) Co Ltd, ZIM Integrated Shipping Services Ltd, Ocean Network Express Pte Ltd, MSC Mediterranean Shipping Company S A, BSL Containers Ltd, Almar Container Group**List Not Exhaustive 6 3 Other Companie, Triton International Ltd, A P Moller - Maersk A/S.

3. What are the main segments of the Refrigerated Container Shipping Market?

The market segments include Transportation Mode, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

Rising demand for pharmaceutical market.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

November 2023: Maersk initiated the construction of its expansive cold storage facility in Rotterdam, The Netherlands. This state-of-the-art warehouse, strategically positioned adjacent to the APM Terminals (Maasvlakte) II terminal, is designed for the storage of temperature-sensitive or frozen goods such as pharmaceuticals, fruits, meats, and fish. Anticipated to be completed in Q4 2024, the facility will boast an impressive annual flow throughput capacity exceeding 43,000 ftf (40 feet equivalent units). It will play a crucial role in Maersk's integrated logistics solution, catering to the needs of its customers in North-Western Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Refrigerated Container Shipping Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Refrigerated Container Shipping Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Refrigerated Container Shipping Market?

To stay informed about further developments, trends, and reports in the Refrigerated Container Shipping Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence