Key Insights

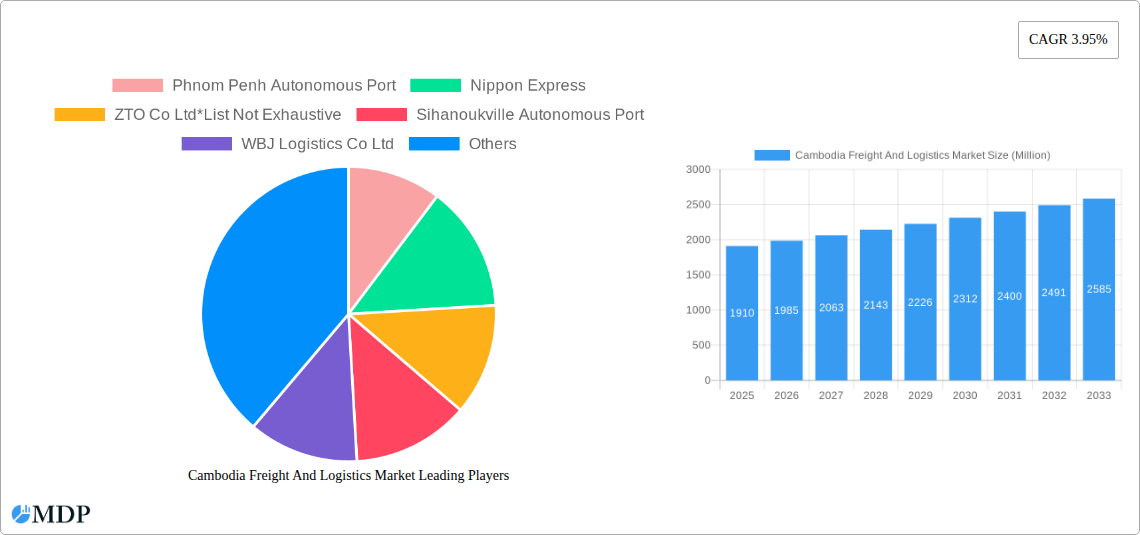

The Cambodia Freight and Logistics Market is poised for significant expansion, projected to reach an estimated USD 1.91 billion by 2025. This robust growth is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 3.95% over the forecast period of 2025-2033. Key drivers fueling this upward trajectory include Cambodia's increasing integration into global supply chains, a burgeoning manufacturing sector, and substantial investments in infrastructure development, particularly in road and port facilities. The government's commitment to improving logistics efficiency and attracting foreign direct investment further bolsters market prospects. As e-commerce continues its rapid adoption, the demand for efficient warehousing and freight forwarding services is expected to surge, creating new opportunities for logistics providers.

Cambodia Freight And Logistics Market Market Size (In Billion)

The market is segmented across diverse functions, with Freight Transport, encompassing road, inland water, air, and rail, anticipated to remain the dominant segment. Freight Forwarding and Warehousing services are also critical components, experiencing steady growth in response to the increasing complexity of trade and the need for optimized inventory management. Value-added services, such as customs brokerage and specialized cargo handling, are gaining traction as businesses seek comprehensive logistics solutions. The Manufacturing and Automotive sectors, along with Oil and Gas, Mining, and Quarrying, are expected to be the primary end-users, leveraging these services to facilitate their expanding operations. Strategic partnerships and technological advancements, including digitalization and automation within logistics operations, will be crucial for companies to maintain a competitive edge in this dynamic market.

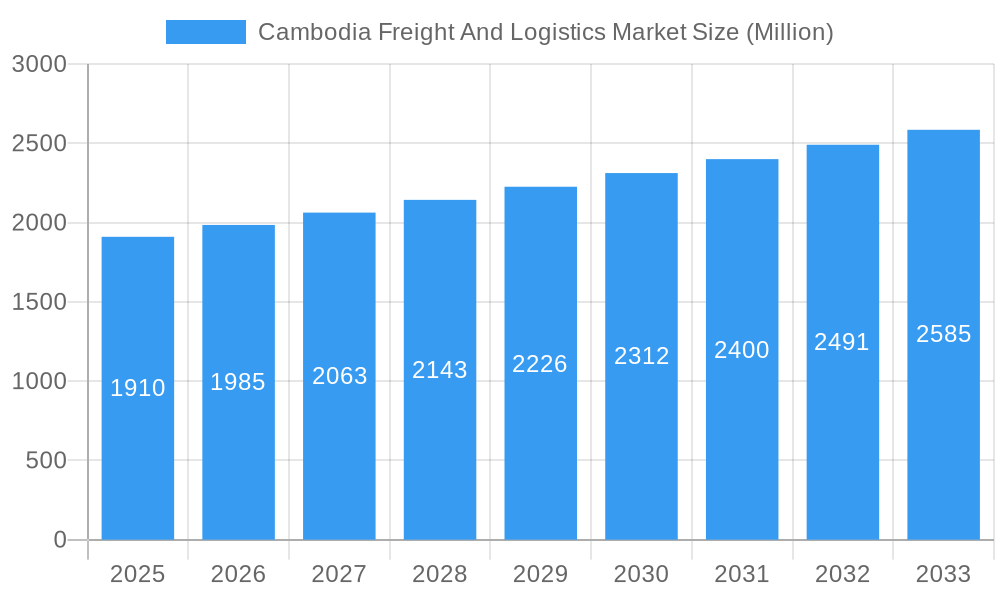

Cambodia Freight And Logistics Market Company Market Share

Unlock the strategic insights into Cambodia's burgeoning freight and logistics market. This in-depth report provides a detailed analysis of market dynamics, industry trends, leading segments, and key players. From freight transport and warehousing to value-added services, explore the growth drivers, challenges, and emerging opportunities shaping Cambodia's supply chain landscape. Packed with actionable intelligence for stakeholders, this report covers the study period 2019–2033, with 2025 as the base and estimated year.

Cambodia Freight And Logistics Market Market Dynamics & Concentration

The Cambodian freight and logistics market exhibits a moderate concentration, driven by evolving infrastructure and increasing foreign investment. Key innovation drivers include the adoption of digital technologies for supply chain visibility and efficiency, alongside a growing demand for specialized logistics services. Regulatory frameworks, particularly those pertaining to trade facilitation and customs procedures, are continually being refined to attract more international trade. Product substitutes are limited in core freight transport functions, but alternative logistics solutions are emerging, particularly in last-mile delivery. End-user trends highlight a significant shift towards efficient and cost-effective supply chains, influenced by the growth of manufacturing, e-commerce, and the agricultural sector. Mergers and acquisitions (M&A) activities, though nascent, are expected to increase as larger players seek to consolidate market share and expand service offerings. The market is poised for growth, with M&A deal counts projected to rise in the coming years.

Cambodia Freight And Logistics Market Industry Trends & Analysis

The Cambodian freight and logistics market is on a robust growth trajectory, driven by its strategic geographical location and increasing integration into global supply chains. The market is experiencing significant expansion fueled by robust economic policies aimed at boosting international trade and foreign direct investment. A projected Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period underscores this strong upward trend. Technological disruptions are playing a pivotal role, with the increasing adoption of digitalization in warehousing, fleet management, and freight tracking enhancing operational efficiency and transparency. This technological integration is crucial for improving market penetration for advanced logistics solutions. Consumer preferences are evolving, with a greater emphasis on faster delivery times, reduced transit costs, and improved shipment reliability. This is compelling logistics providers to invest in modern infrastructure and advanced IT systems. Competitive dynamics are intensifying, with both established domestic players and international logistics giants vying for market share. The growing demand for integrated logistics solutions, encompassing freight transport, warehousing, and value-added services, is shaping the competitive landscape, pushing companies to innovate and diversify their service portfolios to meet the dynamic needs of businesses operating within and through Cambodia.

Leading Markets & Segments in Cambodia Freight And Logistics Market

The Cambodian freight and logistics market is characterized by the dominance of Freight Transport, particularly Road Freight, which constitutes a significant portion of the overall market share. This dominance is driven by the country's developing infrastructure and the extensive network of roads connecting key economic hubs. The Manufacturing and Automotive sector, along with Agriculture, Fishing, and Forestry, are the primary end-users driving demand for these transport services.

- Freight Transport (Road): This segment benefits immensely from government initiatives focused on improving road connectivity and trade facilitation. The expansion of industrial zones and increased cross-border trade further solidify its leading position. Economic policies promoting export-oriented manufacturing directly translate into higher demand for road freight services for both raw material import and finished goods export.

- Warehousing: As trade volumes grow, the demand for modern warehousing facilities, including cold storage solutions, is escalating. This segment's growth is intrinsically linked to the expansion of the manufacturing and agricultural sectors, requiring efficient storage and inventory management.

- Freight Forwarding: This segment plays a crucial role in coordinating complex supply chains, offering services that streamline international trade processes. The increasing involvement of Cambodia in regional and global trade agreements necessitates sophisticated freight forwarding capabilities.

- Manufacturing and Automotive End User: This sector is a primary driver of logistics demand due to its requirement for the timely and secure movement of raw materials, components, and finished products. The growth of manufacturing facilities, particularly in Special Economic Zones, directly fuels the need for comprehensive logistics solutions.

- Agriculture, Fishing, and Forestry End User: This sector's logistical needs are expanding with improved processing capabilities and export opportunities. The demand for specialized logistics, including temperature-controlled transport for perishable goods, is a key growth catalyst.

Cambodia Freight And Logistics Market Product Developments

Product developments in the Cambodia freight and logistics market are increasingly focused on enhancing efficiency, transparency, and sustainability. Technology integration is at the forefront, with advancements in supply chain visibility platforms, route optimization software, and the adoption of IoT devices for real-time shipment tracking. Companies are also investing in modern warehousing solutions, including automated systems and specialized storage for temperature-sensitive goods, catering to the evolving needs of the manufacturing and agricultural sectors. Furthermore, there's a growing emphasis on developing eco-friendly logistics solutions, such as optimizing fuel consumption and exploring alternative transportation modes, reflecting a commitment to sustainable practices and gaining a competitive advantage in the market.

Key Drivers of Cambodia Freight And Logistics Market Growth

Several key factors are propelling the growth of the Cambodia freight and logistics market. Economic Liberalization and Trade Agreements, such as RCEP, are significantly boosting import and export activities, thereby increasing the demand for logistics services. Government Investment in Infrastructure Development, including ports, roads, and special economic zones, is crucial for enhancing connectivity and reducing transit times. The rapid expansion of the Manufacturing Sector, particularly in garment, footwear, and electronics, is a major demand generator. Furthermore, Increasing Foreign Direct Investment brings with it sophisticated supply chain requirements. The growing adoption of Digital Technologies in logistics is also driving efficiency and creating new service opportunities.

Challenges in the Cambodia Freight And Logistics Market Market

Despite its growth potential, the Cambodia freight and logistics market faces several challenges. Inadequate Infrastructure, particularly in rural areas and for certain transport modes like rail and inland waterways, can lead to higher operational costs and longer transit times. Bureaucratic Hurdles and Customs Delays continue to impact efficiency and increase the cost of doing business. Limited Availability of Skilled Workforce in specialized logistics functions poses a constraint on service quality and adoption of advanced technologies. Intense Competition from both local and international players can put pressure on profit margins. Furthermore, Fluctuating Fuel Prices and global supply chain disruptions can significantly impact operational costs and service reliability.

Emerging Opportunities in Cambodia Freight And Logistics Market

The Cambodia freight and logistics market presents significant emerging opportunities. The Development of Multi-modal Transportation Networks, integrating road, rail, and water transport, holds immense potential for efficiency gains and cost reduction. The Growth of E-commerce and Digitalization is creating a surge in demand for last-mile delivery solutions and specialized fulfillment services. Expansion of Cold Chain Logistics is critical for supporting the growing agricultural and food processing sectors, as well as increasing the export of perishable goods. Investment in Smart Warehousing and Automation offers opportunities to enhance operational efficiency and accuracy. Furthermore, the Strategic Location of Cambodia as a gateway to ASEAN markets provides opportunities for developing regional logistics hubs.

Leading Players in the Cambodia Freight And Logistics Market Sector

- Phnom Penh Autonomous Port

- Nippon Express

- ZTO Co Ltd

- Sihanoukville Autonomous Port

- WBJ Logistics Co Ltd

- NHL Import Export Co Ltd

- CBG Logistics

- Shipco Transport Co Ltd

- Union Import Export & Transport Company Limited

- Damco Ltd

- Soon Soon Import Export Co Ltd

- QM Express Co Ltd

Key Milestones in Cambodia Freight And Logistics Market Industry

- June 2023: Kuehne+Nagel signed an agreement to acquire Morgan Cargo, a leading South African, UK, and Kenyan freight forwarder specializing in the transport and handling of perishable goods. During 2022, the company handled more than 40,000 tonnes of air freight and more than 20,000 TEU of sea freight globally, managed by approximately 450 logistics experts. The acquisition of Morgan Cargo ideally complements Kuehne+Nagel's perishables logistics service offering while improving connectivity for customers to and from South Africa, the UK, and Kenya, which includes state-of-the-art cold chain facilities.

- March 2023: Yusen Logistics, a leading global supply chain provider, announced that it has acquired ownership of Taylored Services, a U.S. multichannel 3PL fulfillment organization. The deal expands Yusen Logistics' Contract Logistics Group's warehouse network in key distribution areas of the United States. Further, it strengthens its end-to-end supply chain portfolio with specialized services, such as omnichannel retail, wholesale, and e-commerce fulfillment.

Strategic Outlook for Cambodia Freight And Logistics Market Market

The strategic outlook for the Cambodia freight and logistics market is highly positive, driven by sustained economic growth and increasing trade integration. Future market potential lies in the continued development of modern logistics infrastructure, including deeper port capacities and enhanced intermodal connectivity. Strategic opportunities include the adoption of advanced digital solutions for end-to-end supply chain management, thereby improving transparency and efficiency. Companies that focus on offering specialized services, such as cold chain logistics and e-commerce fulfillment, are well-positioned for growth. Furthermore, exploring partnerships and collaborations to leverage technological advancements and expand service offerings will be crucial for navigating the evolving market landscape and capitalizing on the increasing demand for reliable and efficient logistics solutions in Cambodia.

Cambodia Freight And Logistics Market Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Inland Water

- 1.1.3. Air

- 1.1.4. Rail

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services and Others

-

1.1. Freight Transport

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distribu

- 2.6. Other En

Cambodia Freight And Logistics Market Segmentation By Geography

- 1. Cambodia

Cambodia Freight And Logistics Market Regional Market Share

Geographic Coverage of Cambodia Freight And Logistics Market

Cambodia Freight And Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in trade activities boosting the market; Increase in infrastructure development and increasing foreign investments

- 3.3. Market Restrains

- 3.3.1. Inadequate transportation infrastructure affecting the market; Regulatory challenges affecting the market

- 3.4. Market Trends

- 3.4.1. Surge in import and exports boosting the logistics market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Cambodia Freight And Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Inland Water

- 5.1.1.3. Air

- 5.1.1.4. Rail

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services and Others

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distribu

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Cambodia

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Phnom Penh Autonomous Port

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nippon Express

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ZTO Co Ltd*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sihanoukville Autonomous Port

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 WBJ Logistics Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NHL Import Export Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CBG Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shipco Transport Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Union Import Export & Transport Company Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Damco Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Soon Soon Import Export Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 QM Express Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Phnom Penh Autonomous Port

List of Figures

- Figure 1: Cambodia Freight And Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Cambodia Freight And Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Cambodia Freight And Logistics Market Revenue Million Forecast, by Function 2020 & 2033

- Table 2: Cambodia Freight And Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Cambodia Freight And Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Cambodia Freight And Logistics Market Revenue Million Forecast, by Function 2020 & 2033

- Table 5: Cambodia Freight And Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Cambodia Freight And Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cambodia Freight And Logistics Market?

The projected CAGR is approximately 3.95%.

2. Which companies are prominent players in the Cambodia Freight And Logistics Market?

Key companies in the market include Phnom Penh Autonomous Port, Nippon Express, ZTO Co Ltd*List Not Exhaustive, Sihanoukville Autonomous Port, WBJ Logistics Co Ltd, NHL Import Export Co Ltd, CBG Logistics, Shipco Transport Co Ltd, Union Import Export & Transport Company Limited, Damco Ltd, Soon Soon Import Export Co Ltd, QM Express Co Ltd.

3. What are the main segments of the Cambodia Freight And Logistics Market?

The market segments include Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Surge in trade activities boosting the market; Increase in infrastructure development and increasing foreign investments.

6. What are the notable trends driving market growth?

Surge in import and exports boosting the logistics market.

7. Are there any restraints impacting market growth?

Inadequate transportation infrastructure affecting the market; Regulatory challenges affecting the market.

8. Can you provide examples of recent developments in the market?

June 2023: Kuehne+Nagel signed an agreement to acquire Morgan Cargo, a leading South African, UK, and Kenyan freight forwarder specializing in the transport and handling of perishable goods. During 2022, the company handled more than 40,000 tonnes of air freight and more than 20,000 TEU of sea freight globally, managed by approximately 450 logistics experts. The acquisition of Morgan Cargo ideally complements Kuehne+Nagel's perishables logistics service offering while improving connectivity for customers to and from South Africa, the UK, and Kenya, which includes state-of-the-art cold chain facilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cambodia Freight And Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cambodia Freight And Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cambodia Freight And Logistics Market?

To stay informed about further developments, trends, and reports in the Cambodia Freight And Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence